Potassium Bicarbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436611 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Potassium Bicarbonate Market Size

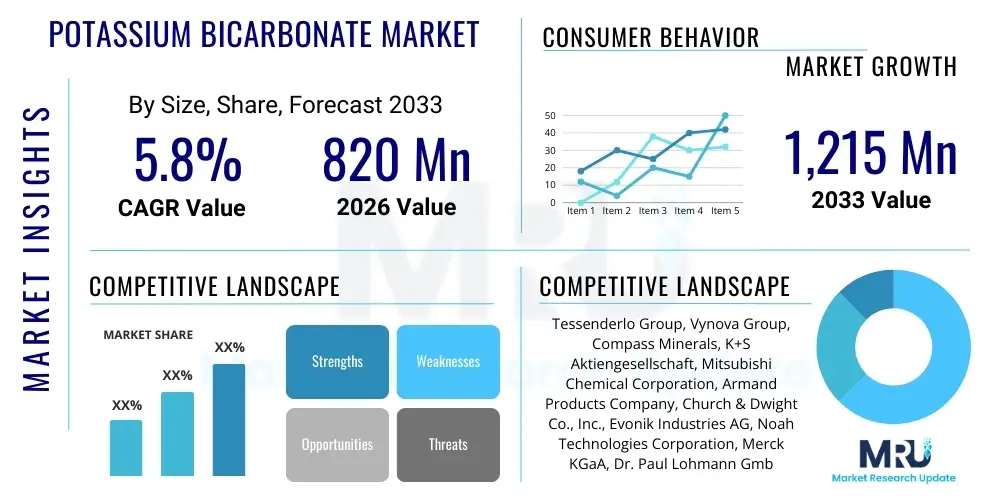

The Potassium Bicarbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 820 million in 2026 and is projected to reach USD 1,215 million by the end of the forecast period in 2033.

Potassium Bicarbonate Market introduction

Potassium Bicarbonate (KHCO3) is an odorless, white crystalline compound known for its strong buffering capabilities, high solubility, and low toxicity profile, making it a highly versatile chemical essential across diverse industrial sectors. Primarily recognized as a crucial source of potassium, it plays a vital role in agricultural applications, particularly as a mild yet effective fungicide and a highly soluble component in foliar fertilizers. Its primary chemical function across all applications is to act as a pH modifier or leavening agent. The increasing global focus on sustainable and organic farming practices significantly accelerates its demand, positioning it as an environmentally friendly alternative to traditional synthetic chemicals. Furthermore, its efficacy in fire suppression systems, where it is used in dry chemical agents (often referred to as Purple-K), cements its importance in industrial safety and infrastructure.

The major applications of potassium bicarbonate span agriculture, food and beverage processing, pharmaceuticals, and industrial chemicals. In the food industry, it serves as a raising agent in baking, a pH stabilizer, and an effervescent source in carbonated beverages, benefiting from its "Generally Recognized As Safe" (GRAS) status by regulatory bodies. In the pharmaceutical sector, it is incorporated into antacids and effervescent tablets due to its neutralizing properties and its role in delivering essential potassium minerals. The fundamental driving factors supporting market expansion include stringent regulations promoting safer food additives, the burgeoning demand for high-potency, water-soluble fertilizers to enhance crop yield, and the need for non-toxic pH regulators in water treatment and specialized chemical processes. Its inherent characteristics of being non-toxic and biodegradable offer a significant competitive advantage over competing compounds, particularly in consumer-facing and ecologically sensitive domains.

The demand trajectory is strongly influenced by demographic shifts and evolving consumer preferences. As the global population grows, the pressure on agricultural efficiency increases, driving the adoption of specialized micronutrients and pest control agents like potassium bicarbonate. Simultaneously, health-conscious trends are prompting food manufacturers to seek potassium-rich, sodium-reduced ingredients, where KHCO3 serves as an effective salt substitute. The compound’s utility extends beyond primary uses into niche areas such as laboratory reagents and textiles, ensuring sustained, diversified demand growth over the forecast period. This diversified application base acts as a risk mitigant for the market, insulating it from potential slowdowns in any single end-use sector, thus guaranteeing stable market expansion.

Potassium Bicarbonate Market Executive Summary

The Potassium Bicarbonate Market is characterized by steady, application-driven growth, underpinned by strong regulatory support favoring sustainable and food-grade chemicals. Key business trends indicate a significant push toward product purity and granulation standardization, primarily driven by the precision agriculture sector which demands highly soluble and low-residue formulations for fertigation systems. Strategic mergers and acquisitions are observed among leading producers aiming to secure raw material supply chains and expand their geographical footprint, particularly into high-growth regions like Southeast Asia and Latin America, where agricultural modernization is rapidly progressing. Furthermore, innovation centers around developing specialized coatings and microencapsulation techniques to improve the handling, storage stability, and targeted release efficiency of potassium bicarbonate in harsh environmental conditions.

Segment trends highlight the dominance of the agricultural segment, particularly the fungicide and foliar fertilizer sub-segments, due to the recognized effectiveness of potassium bicarbonate against powdery mildew and other fungal diseases, coupled with its nutritional benefits. The food and beverage sector exhibits robust, steady growth, fueled by its application as a clean-label raising agent and a strategic mineral fortifier in functional foods. Geographically, Asia Pacific (APAC) stands out as the primary engine of market expansion, attributable to its vast agricultural base, increasing industrialization, and rapid adoption of advanced food processing technologies. North America and Europe maintain stable demand, driven primarily by mature food safety standards and the widespread utilization of potassium bicarbonate in organic certified farming systems.

The competitive landscape is moderately fragmented, with large multinational chemical companies competing against specialized regional players. Differentiation often hinges on the quality (purity level) and physical form (powder, granular, or solution) offered. A critical regional trend involves the shift of manufacturing capabilities toward regions with lower energy costs and readily available raw materials, specifically potash. The overarching theme for market participants is integration—integrating high-purity production with efficient logistics to capitalize on the time-sensitive agricultural demand cycles and the stringent quality requirements of the pharmaceutical industry. The market’s resilience is demonstrated by its consistent performance, regardless of minor fluctuations in global commodity prices, confirming its status as an essential input material across core industries.

AI Impact Analysis on Potassium Bicarbonate Market

User queries regarding AI's impact on the Potassium Bicarbonate Market frequently center on optimizing agricultural application rates, enhancing production process efficiency, and forecasting raw material stability. Users are particularly concerned with how AI-driven precision farming platforms will integrate data regarding soil pH, weather patterns, and fungal infection levels to recommend optimal, just-in-time dosing of potassium bicarbonate fungicides and fertilizers. Another key theme revolves around utilizing predictive analytics within chemical manufacturing to minimize waste, manage exothermic reactions during synthesis more safely, and forecast demand volatility to adjust inventory levels effectively. Expectations are high that AI will lead to customized KHCO3 formulations tailored for specific crop types or regional soil deficiencies, moving beyond standardized bulk products.

While potassium bicarbonate itself is a foundational chemical compound, AI’s influence is profound within its adjacent ecosystems. In agriculture, AI systems utilizing drone imagery and sensor networks can pinpoint localized fungal outbreaks, ensuring that KHCO3 is applied precisely where needed, dramatically reducing overall consumption while maximizing efficacy. This shift from blanket treatment to pinpoint intervention requires suppliers to adapt their packaging and logistics capabilities to support smaller, highly customized batch orders. Furthermore, in the context of food manufacturing, AI algorithms are beginning to optimize blending processes where KHCO3 acts as a leavening agent or pH buffer, ensuring consistent product quality in large-scale baking and beverage production, reducing batch failures associated with incorrect additive ratios.

The integration of machine learning and sensor technology is also transforming quality control within the production facilities. AI models trained on spectroscopic data can rapidly and accurately assess the purity levels, particle size distribution, and moisture content of manufactured potassium bicarbonate, exceeding the speed and consistency of traditional manual laboratory testing. This high-speed quality assurance is vital for products destined for the pharmaceutical and high-end food sectors, where minute variations in composition are unacceptable. Consequently, the primary impact of AI is not on replacing the chemical substance but on optimizing its supply chain, application efficiency, and ensuring stringent quality compliance across all high-value end-user markets, indirectly boosting demand by validating the product’s reliability.

- AI-driven Precision Agriculture: Optimization of fungicide application rates using predictive models, reducing overall waste and improving efficacy.

- Supply Chain Forecasting: Utilization of machine learning for robust demand forecasting, minimizing inventory holding costs and ensuring timely supply to seasonal agricultural markets.

- Manufacturing Optimization: AI implementation in chemical plants to control crystallization parameters, enhancing product purity (especially for pharmaceutical grade KHCO3).

- Quality Control Enhancement: Real-time assessment of particle size and purity through AI-powered sensors, ensuring compliance with strict food and pharmaceutical standards.

- Custom Formulation Development: Leveraging computational chemistry and AI to design potassium bicarbonate formulations with enhanced stability or targeted release mechanisms.

DRO & Impact Forces Of Potassium Bicarbonate Market

The Potassium Bicarbonate Market is primarily driven by the escalating global shift towards sustainable and organic farming practices, where KHCO3 serves as a critical, permitted input for both nutritional supplementation and disease control. Simultaneously, the robust demand from the food industry, which utilizes the compound as a leavening agent, pH regulator, and a low-sodium mineral source, provides essential market stability. However, the market faces restraints primarily related to the volatility and high cost of raw materials, chiefly potash (potassium chloride), which directly impacts manufacturing profitability and final product pricing, making it susceptible to geopolitical supply chain disruptions. Opportunities are abundant in the emerging economies, particularly for developing specialized, high-purity grades required for the rapidly expanding pharmaceutical and nutraceutical sectors, alongside the potential for integrating KHCO3 into next-generation fire suppression technologies and environmental remediation applications.

The key market drivers include rigorous health-conscious consumer trends promoting reduced sodium intake, necessitating the use of potassium salts as replacements, and regulatory pressure in developed nations to phase out certain synthetic pesticides, creating a necessity for softer, biological alternatives like potassium bicarbonate. Furthermore, the increasing global consumption of convenience foods and effervescent medicinal products ensures persistent demand from the food processing and pharmaceutical segments. Conversely, significant restraints include the technical challenge of handling and storage, as KHCO3 is hygroscopic and tends to cake, requiring specialized packaging and warehousing, particularly in humid climates. Moreover, competition from alternative buffering agents and potassium sources, such as potassium carbonate or potassium hydroxide, places downward pressure on pricing in large industrial applications where cost is the primary selection criterion.

The primary impact forces acting on the market are the substitution threat and shifts in environmental policy. The threat of substitution is moderated by the unique combination of low toxicity, efficacy against specific pathogens (like powdery mildew), and nutritional value offered by potassium bicarbonate, making a direct, comprehensive replacement difficult, especially in organic agriculture. Environmental policies, particularly those governing water quality and agricultural runoff, strongly favor the use of benign chemicals, positioning KHCO3 favorably compared to harsher nitrogen or phosphate-based compounds. The market benefits significantly from the macro-economic force of population growth, which intrinsically boosts demand for food production and, consequently, agricultural inputs. Strategic opportunities lie in exploiting underdeveloped markets in Africa and specific parts of Asia where agricultural intensification is just beginning, requiring basic, reliable, and cost-effective inputs like potassium bicarbonate to improve soil health and crop resilience.

Segmentation Analysis

The Potassium Bicarbonate Market segmentation provides a granular view of market dynamics, classified primarily by Grade, Application, and Physical Form. The Grade segmentation, encompassing Food Grade, Industrial Grade, and Pharmaceutical Grade, dictates the purity requirements and pricing structure, with Pharmaceutical Grade commanding the highest premium due to stringent regulatory compliance and quality control. Application analysis reveals the agricultural sector as the dominant consumer, leveraging KHCO3 for its dual functionality as a potassium nutrient source and a contact fungicide. The Food & Beverage sector follows, driven by its roles as a raising agent, buffering agent, and sodium reduction substitute. Segmentation by Physical Form (Powder, Granular, and Liquid Solution) is crucial for logistics and end-user efficiency, as granular forms are often preferred for bulk industrial mixing, while high-purity powder is standard for pharmaceutical tablet pressing.

This structure allows market players to focus their manufacturing and marketing strategies on specific high-value segments. For instance, companies specializing in high-purity production target the highly profitable pharmaceutical and specialized nutraceutical segments, where demand elasticity is lower. Conversely, bulk producers focus on the industrial and agricultural sectors, emphasizing cost leadership and supply chain efficiency. The interdependence between Grade and Application is critical; for example, while Industrial Grade is suitable for water treatment, only Food Grade or higher is acceptable for direct use in beverage carbonation. Analyzing these segments helps in understanding the disparate regional consumption patterns and regulatory environments that dictate product adoption rates.

- By Grade:

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- By Application:

- Agriculture (Fungicide, Fertilizer, Soil Amendment)

- Food and Beverage (Leavening Agent, pH Stabilizer, Sodium Reduction)

- Pharmaceuticals (Antacids, Effervescent Tablets)

- Fire Extinguishers (Dry Chemical Agent)

- Industrial (Water Treatment, Chemical Manufacturing)

- By Physical Form:

- Powder

- Granular

- Liquid Solution

Value Chain Analysis For Potassium Bicarbonate Market

The value chain for the Potassium Bicarbonate Market begins with the upstream procurement of key raw materials, primarily potassium chloride (potash) and carbon dioxide. Potash mining and refining constitute a high-cost component of the chain, often concentrated geographically in areas like Canada, Russia, and Belarus, leading to inherent geopolitical risks and commodity price volatility. Manufacturers convert these raw materials through reaction processes, such as the dissolution of potassium carbonate in water followed by saturation with CO2, requiring significant energy inputs. Efficiency at this stage—managing energy costs and achieving high purity—is critical for downstream profitability. Due to the requirement for specific high-purity grades for certain end-use applications, internal quality control and refining capacity are substantial differentiators among manufacturers.

Midstream activities involve processing and formulation, where manufacturers refine the base chemical into various physical forms, including micronized powder, free-flowing granules, or concentrated aqueous solutions. Packaging is a vital element in the midstream, as potassium bicarbonate is hygroscopic; specialized moisture-resistant packaging is essential to maintain product integrity, particularly for export. The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for large industrial buyers, such as major fertilizer producers or specialized pharmaceutical companies, facilitating bulk delivery and customized purity specifications. Indirect distribution relies heavily on regional distributors and specialized chemical brokers who manage smaller quantities and provide localized inventory services to agriculture retailers and smaller food processors, particularly in fragmented markets.

Downstream analysis focuses on end-user integration and application. In agriculture, distribution channels include agri-input retailers and cooperatives, emphasizing technical support and product knowledge regarding fungicidal application timing and dosage. For the food and pharmaceutical sectors, stringent audit trails and certification (like ISO, GMP, and Kosher/Halal certification) are prerequisite for market entry, placing substantial responsibility on distributors and manufacturers to ensure compliance. The efficiency of the entire value chain hinges on minimizing logistics costs, given that KHCO3 is a medium-volume commodity, and optimizing inventory management to match highly seasonal agricultural demand peaks. Successful market players excel in optimizing upstream procurement contracts while simultaneously providing sophisticated technical support to downstream end-users to maximize application efficiency.

Potassium Bicarbonate Market Potential Customers

The primary consumers of the Potassium Bicarbonate Market are diversified across three major industrial ecosystems: industrial agriculture, packaged food and beverage manufacturing, and the global pharmaceutical and nutraceutical industry. Within agriculture, the key customers include large-scale commercial farming operations focused on high-value crops (grapes, berries, tomatoes) where mildew control is paramount, and fertilizer blending companies that incorporate highly soluble potassium sources into specialized NPK blends and liquid feeds. These customers prioritize efficacy, purity, and solubility, driven by the desire to maximize yield while adhering to stringent residue limits required by export markets. The shift toward hydroponics and precision irrigation systems further cements this demand for high-grade, soluble KHCO3.

In the food and beverage sector, potential customers range from major multinational confectionary and baking companies utilizing KHCO3 as a reliable leavening agent, to leading beverage manufacturers that use it as a buffering and effervescent agent in sports drinks, carbonated waters, and dietary supplements. A rapidly growing segment involves companies specializing in sodium reduction strategies, where potassium bicarbonate is used extensively as a salt substitute in packaged savory foods and condiments to meet evolving public health guidelines. These customers demand consistent granular size and certified food-grade purity, requiring robust supply chain documentation and adherence to global food safety standards like HACCP and GFSI.

Pharmaceutical and healthcare customers represent the highest-value segment, purchasing specialized Pharmaceutical Grade potassium bicarbonate for use in antacid formulations, potassium supplements, and excipients in effervescent dosage forms. These customers include Contract Development and Manufacturing Organizations (CDMOs) and proprietary drug manufacturers. Furthermore, a stable customer base exists in the industrial safety sector, comprising fire equipment manufacturers who integrate KHCO3 (Purple-K) into fire suppression systems, particularly for applications involving flammable liquids and gases (Class B and C fires). These diverse customer bases ensure market stability, with demand fluctuations in one sector often offset by growth in others, underpinning the compound's critical industrial status.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 820 million |

| Market Forecast in 2033 | USD 1,215 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tessenderlo Group, Vynova Group, Compass Minerals, K+S Aktiengesellschaft, Mitsubishi Chemical Corporation, Armand Products Company, Church & Dwight Co., Inc., Evonik Industries AG, Noah Technologies Corporation, Merck KGaA, Dr. Paul Lohmann GmbH KG, GFS Chemicals, Inc., Shandong Taihe Chemicals Co., Ltd., Zouping Jingcheng Chemical Co., Ltd., Innophos Holdings, Inc., Jost Chemical Co., Spectrum Chemical Mfg. Corp., Hawkins, Inc., Hefei TNJ Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Potassium Bicarbonate Market Key Technology Landscape

The manufacturing process for potassium bicarbonate primarily relies on the reaction between potassium carbonate or potassium hydroxide and carbon dioxide, necessitating precise control over temperature and pressure to achieve desired purity and particle size distribution. The key technological developments in this landscape are centered not on radically altering the core chemical synthesis, which is mature, but rather on process intensification and downstream product refinement. Modern facilities incorporate advanced crystallization technologies, such as reactive crystallization coupled with continuous cooling, to produce highly uniform, non-caking, and free-flowing granular products. This technological improvement is crucial for satisfying the precision requirements of the agricultural sector, particularly for mechanical spreading and injection into fertigation lines, where uniform solubility is paramount.

Another significant area of technological focus is the purification and drying processes, especially for pharmaceutical and food-grade materials. High-efficiency filtration and drying systems, including vacuum drum dryers and fluid bed dryers, are employed to achieve purity levels exceeding 99.8% and minimize residual moisture, which is vital for extending shelf life and preventing agglomeration. Companies are also investing heavily in advanced sensor technologies and process analytical technology (PAT) to monitor reaction kinetics and crystallization morphology in real-time. This continuous monitoring enables instantaneous adjustments to process variables, ensuring batch-to-batch consistency, a non-negotiable requirement for regulatory compliance in high-stakes industries.

Furthermore, technology related to packaging and handling is evolving rapidly. Given the hygroscopic nature of potassium bicarbonate, innovation in multilayer barrier packaging (e.g., specialized liners and humidity-controlled sacks) is essential to maintain product integrity during long-distance shipping and storage in diverse climates, particularly in the humid coastal regions of Asia. Additionally, companies are exploring microencapsulation techniques to formulate KHCO3 for controlled release applications in complex soil environments, potentially enhancing its efficacy as a fungicide by ensuring a sustained protective presence on the plant surface. These technological advancements ensure that potassium bicarbonate remains competitive against newer, more complex chemical alternatives by offering reliable performance and high quality standardized across various grades.

Regional Highlights

The global Potassium Bicarbonate Market exhibits significant regional variations in consumption patterns, driven primarily by differences in agricultural practices, population density, and regulatory stringency. Asia Pacific (APAC) currently dominates the global market share and is projected to register the fastest growth throughout the forecast period. This dominance is attributed to the presence of vast agricultural lands, particularly in China, India, and Southeast Asia, coupled with rapid urbanization that fuels the processed food and beverage industry. Government initiatives in countries like China to promote high-efficiency, water-soluble fertilizers and reduce synthetic pesticide use are major drivers for KHCO3 adoption in this region. Furthermore, the burgeoning middle class in APAC creates high demand for specialized health supplements and nutraceuticals, boosting the requirement for pharmaceutical-grade potassium bicarbonate.

North America and Europe represent mature markets characterized by steady, stable demand, highly influenced by stringent regulatory standards and the established organic farming sector. In North America, the primary consumption lies in the fire suppression industry, specialized agricultural applications (especially vineyards and citrus groves), and the expansive processed food sector where sodium reduction is a key mandate. European demand is bolstered by the robust regulatory framework (such as the EU’s emphasis on reducing copper-based fungicides) which favors benign alternatives like potassium bicarbonate, particularly within the EU organic certification system. Growth in these regions is modest but high-value, focusing on premium, certified grades and specialized formulations rather than bulk commodity volumes.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential growth markets. In LATAM, agricultural intensification, particularly in Brazil and Argentina, drives demand for advanced fertilizers and crop protection agents, capitalizing on the dual benefit of KHCO3. The MEA region is witnessing growing investments in modern agriculture techniques to ensure food security, especially in Gulf Cooperation Council (GCC) countries utilizing controlled environment agriculture (CEA) and hydroponics, where potassium bicarbonate is critical for pH buffering in nutrient solutions. Challenges in these regions include underdeveloped distribution infrastructure and localized price sensitivity, necessitating strategic partnerships and efficient logistics management by global market participants.

- Asia Pacific (APAC): Market leader and fastest growing; driven by intensive agriculture, population growth, and booming food processing industries in China and India.

- North America: Stable demand centered on food safety, organic farming inputs, and extensive use in professional fire suppression systems (Purple-K).

- Europe: Growth sustained by strict environmental regulations and high adoption rates in the organic sector as a preferred fungicide and soil conditioner.

- Latin America (LATAM): High growth potential fueled by agricultural expansion and modernization projects in Brazil, Argentina, and Mexico.

- Middle East and Africa (MEA): Emerging market focused on food security initiatives, requiring KHCO3 for hydroponic systems and water treatment applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Potassium Bicarbonate Market.- Tessenderlo Group

- Vynova Group

- Compass Minerals

- K+S Aktiengesellschaft

- Mitsubishi Chemical Corporation

- Armand Products Company

- Church & Dwight Co., Inc.

- Evonik Industries AG

- Noah Technologies Corporation

- Merck KGaA

- Dr. Paul Lohmann GmbH KG

- GFS Chemicals, Inc.

- Shandong Taihe Chemicals Co., Ltd.

- Zouping Jingcheng Chemical Co., Ltd.

- Innophos Holdings, Inc.

- Jost Chemical Co.

- Spectrum Chemical Mfg. Corp.

- Hawkins, Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- Nippon Chemical Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Potassium Bicarbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of potassium bicarbonate in agriculture?

Potassium bicarbonate serves a dual function in agriculture: it is an essential, highly soluble source of potassium nutrient for improved crop yield and health, and it acts as an effective, low-toxicity contact fungicide, primarily used to control powdery mildew and other fungal diseases in sensitive crops.

How does the use of potassium bicarbonate contribute to sodium reduction in food products?

In the food and beverage industry, potassium bicarbonate is extensively utilized as a functional salt substitute. By replacing sodium chloride (table salt) in formulations, particularly in baked goods and processed foods, it helps manufacturers meet consumer and regulatory demands for lower sodium content while maintaining taste and texture profiles.

Which grade of potassium bicarbonate commands the highest market premium?

The Pharmaceutical Grade potassium bicarbonate commands the highest market premium. This is due to the extremely stringent purity standards, mandatory regulatory certifications (such as GMP), and specialized processing required to ensure safety and efficacy for use in effervescent tablets, antacids, and intravenous solutions.

What are the key driving factors for market growth in the Asia Pacific region?

The key drivers in the Asia Pacific region are high population density leading to increased food production demand, the rapid adoption of intensive and precision agricultural techniques, and government support for the use of sustainable and non-toxic crop protection agents over synthetic chemicals.

What raw materials are essential for the production of potassium bicarbonate and how does their cost impact the market?

The primary raw materials are potassium chloride (potash) and carbon dioxide. The high cost and inherent price volatility of potash significantly influence the upstream manufacturing costs of potassium bicarbonate, which directly affects the final product pricing and profitability margins across all grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager