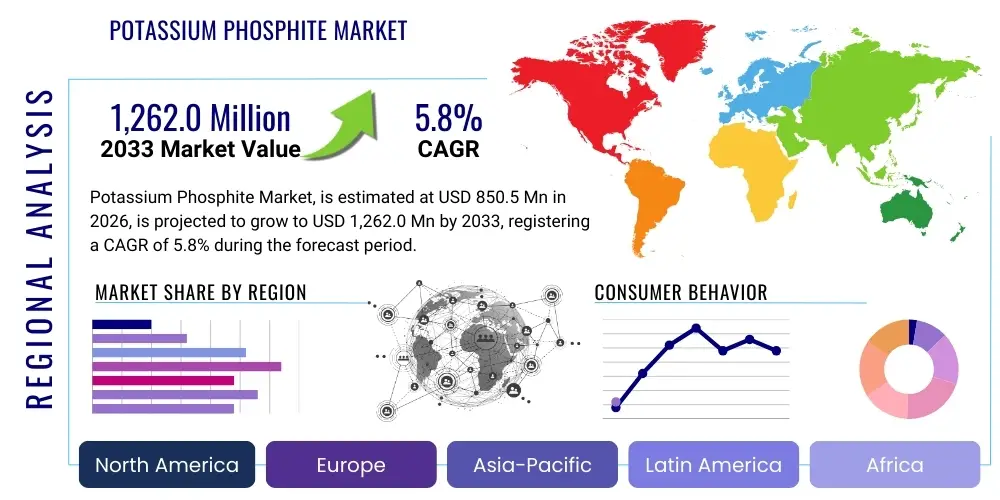

Potassium Phosphite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438145 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Potassium Phosphite Market Size

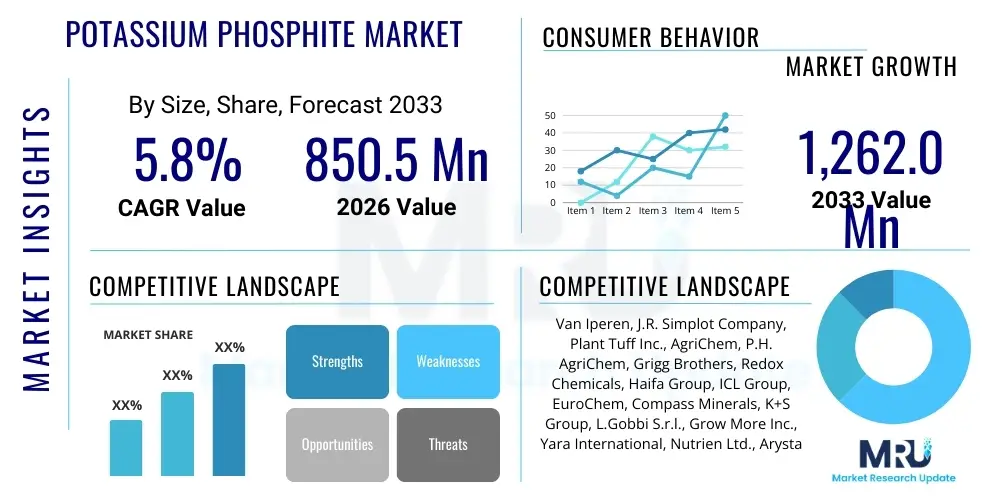

The Potassium Phosphite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,262.0 Million by the end of the forecast period in 2033.

Potassium Phosphite Market introduction

Potassium phosphite, often utilized in agriculture as a plant nutrient source and a disease management tool, represents a specialized segment within the broader crop protection and fertilizer industry. Chemically, it is derived from phosphorous acid (H3PO3), distinct from traditional phosphate fertilizers. This unique chemical structure allows it to function both as an effective source of easily absorbable potassium and phosphorus (in the phosphite form) and, critically, as a systemic acquired resistance (SAR) inducer in plants. Its dual role in nutrition and disease defense is a core driver of its increasing adoption across high-value crops globally. The substance is typically manufactured as a liquid concentrate or a crystalline solid, offering flexibility in application methods such as foliar sprays, soil drenching, or incorporation into irrigation systems (fertigation).

Major applications of potassium phosphite center around the management of oomycete-related diseases, particularly those caused by pathogens like Phytophthora and Pythium, which pose severe threats to crops such as citrus, grapes, potatoes, and various fruits and vegetables. By strengthening the plant's natural defense mechanisms, potassium phosphite reduces the reliance on traditional, sometimes environmentally challenging, chemical fungicides. Furthermore, its nutritional benefits, especially the provision of highly bioavailable potassium, contribute significantly to improved fruit set, better quality harvest, enhanced stress tolerance, and overall yield optimization, thereby providing comprehensive agronomic advantages.

The market growth is primarily fueled by the escalating demand for sustainable agriculture practices, stricter environmental regulations pushing for safer crop protection alternatives, and the continuous innovation in formulation chemistry to enhance efficacy and compatibility. Key driving factors include the global shift towards high-intensity horticulture, the need to manage increasing pathogen resistance to conventional treatments, and the expanding cultivated area under protected agriculture, where precision nutrition and disease management are paramount. These factors collectively establish potassium phosphite as a critical input for modern, sustainable farming systems aiming for high productivity and reduced environmental impact.

Potassium Phosphite Market Executive Summary

The global Potassium Phosphite market is experiencing robust expansion driven by pronounced secular trends in sustainable agriculture and advanced crop nutrition. Business trends indicate a strong move toward concentrated liquid formulations due to ease of application and enhanced efficiency in fertigation and foliar treatments. Major manufacturers are focusing on integrating phosphites with biostimulants and micronutrients to create synergistic products that offer integrated crop management solutions. Furthermore, the rising awareness among growers regarding the systemic benefits of phosphites in inducing plant immunity, especially in dealing with pervasive root and crown rot diseases, is bolstering adoption rates across cash crops. Strategic acquisitions and collaborations aimed at expanding distribution networks in emerging agricultural economies, particularly in Asia Pacific and Latin America, characterize current competitive strategies.

Regionally, the market trajectory is segmented yet uniformly positive. North America and Europe lead in terms of regulatory maturity and adoption of high-value formulations, driven by stringent environmental standards that favor low-residue inputs. Conversely, the Asia Pacific region, led by China and India, presents the highest growth potential, characterized by massive agricultural land area, increasing mechanization, and rapid adoption of high-tech horticulture methods, particularly in protected environments. Latin America, with its extensive production of grapes, citrus, and avocados, is a critical consumer base, leveraging potassium phosphite to manage high-pressure oomycete diseases endemic to tropical and subtropical climates. These regional dynamics necessitate tailored marketing and distribution strategies focusing on crop-specific formulations and local regulatory compliance.

Segment trends reveal that the Fungicides application segment maintains the largest market share due to the undeniable efficacy of potassium phosphite against Phytophthora species. However, the Foliar Fertilizers and Plant Stimulants segments are projected to register the fastest growth, reflecting the growing understanding of phosphite’s nutritional and biostimulatory effects beyond mere disease suppression. By form, the liquid segment dominates due to its superior handling properties and suitability for precise dose delivery via modern irrigation infrastructure. The shift towards specialty crop cultivation, including berries, nuts, and ornamental plants, further emphasizes the demand for highly soluble and effective phosphite solutions that minimize phytotoxicity risks while maximizing nutrient uptake and disease defense capabilities.

AI Impact Analysis on Potassium Phosphite Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the application and development of potassium phosphite products, focusing on precision agriculture, disease prediction, and formulation efficiency. Key themes center on leveraging AI-driven predictive modeling to determine the optimal timing and dosage of phosphite application based on real-time environmental data, pathogen pressure, and crop health metrics. Growers seek AI tools that can interpret complex data from sensors (drones, satellites, soil probes) to accurately diagnose early-stage oomycete infections, ensuring potassium phosphite is used proactively rather than reactively. Another major area of inquiry revolves around utilizing machine learning algorithms in R&D to accelerate the discovery of synergistic phosphite combinations with other active ingredients or biostimulants, improving formulation stability and efficacy against resistant strains.

AI's influence in the potassium phosphite supply chain will primarily focus on demand forecasting and inventory management. By analyzing historical consumption patterns, weather variability, and agricultural commodity prices, AI models can significantly improve the accuracy of production planning for phosphite manufacturers, reducing wastage and ensuring timely supply to key farming regions during critical application windows. Furthermore, generative AI tools are beginning to assist in creating highly personalized agronomic recommendations for farmers, integrating phosphite usage instructions directly into broader farm management systems. This integration minimizes application errors and maximizes the economic return on investment for the specialized input.

The long-term expectation is that AI will transform potassium phosphite from a generalized preventative treatment into a component of highly targeted, variable-rate prescription applications. This evolution requires developing robust data infrastructure within the agricultural sector to feed AI models with high-resolution input data (e.g., leaf wetness duration, specific soil chemical profiles, pathogen load). While concerns remain regarding data privacy and the accessibility of complex AI technology to smallholder farmers, the demonstrated capability of machine learning in optimizing inputs aligns directly with global sustainability goals, driving efficiency and minimizing environmental load associated with crop protection usage.

- AI-driven predictive modeling optimizes potassium phosphite application timing based on real-time pathogen risk assessment.

- Machine learning algorithms enhance formulation R&D, identifying synergistic blends with biostimulants for increased efficacy.

- Precision agriculture platforms utilize AI to create variable-rate application maps, ensuring targeted delivery and reduced input usage.

- Computer vision systems integrated with drones detect early signs of Phytophthora infection, triggering preventative phosphite sprays.

- AI improves supply chain resilience by forecasting regional demand fluctuations based on climatic and regulatory shifts.

- Generative AI assists in developing tailored, crop-specific phosphite usage protocols for complex farming systems.

DRO & Impact Forces Of Potassium Phosphite Market

The Potassium Phosphite market dynamics are fundamentally shaped by a confluence of strong drivers rooted in sustainable agriculture, offset by certain constraints, and underpinned by significant opportunities arising from technological advancements and regulatory shifts. The primary driver is the unique functionality of phosphite as both a nutrient source and a plant defense inducer, addressing the twin challenges of crop productivity and disease resistance simultaneously. Restraints typically involve regulatory complexity regarding its classification (fertilizer versus fungicide) and the lingering perception among some growers that it is merely a nutritional supplement rather than a potent disease management tool. Opportunities largely emerge from expanding research into novel phosphite formulations, focusing on enhanced systemic movement and compatibility with integrated pest management (IPM) programs, especially for high-value specialty crops.

Impact forces currently exerting the strongest influence include the regulatory landscape and consumer demand for sustainably produced food. Regulatory agencies, particularly in Europe and North America, are increasingly scrutinizing traditional chemical inputs, which favors the adoption of alternatives like potassium phosphite, which generally possess lower toxicity profiles. Simultaneously, consumer preference for organic or low-residue produce puts direct pressure on large-scale producers to adopt safer crop protection methods. The inherent impact forces such as Porter’s five forces analysis reveal moderate bargaining power of suppliers (due to reliance on phosphorous acid supply) and increasing bargaining power of buyers (large cooperative farms demanding competitive pricing and customized blends). The threat of substitutes, primarily conventional fungicides and other biostimulants, remains significant but is often mitigated by phosphite’s unique dual-action mechanism.

Specific market factors driving adoption include the continuous emergence of fungicide-resistant pathogen strains, necessitating rotation and diversification of control chemistries, where potassium phosphite plays a crucial non-fungicide role. Conversely, one significant restraint is the initial higher cost compared to basic macro-fertilizers, requiring robust educational outreach to demonstrate the long-term return on investment derived from reduced crop losses and improved yield quality. The greatest opportunity lies in geographical expansion into untapped markets in Southeast Asia and Africa, coupled with product differentiation through advanced nanotechnology encapsulation techniques that improve bioavailability and prolong efficacy under varied environmental conditions, thereby solidifying its indispensable role in sophisticated crop management strategies.

Segmentation Analysis

The Potassium Phosphite market is comprehensively segmented based on its physical form, the specific agricultural application, and the diverse crop types where it is utilized, allowing for detailed analysis of consumption patterns and strategic market positioning. Segmentation by form—liquid versus solid—is crucial, as liquid products dominate due to ease of handling, rapid solubility, and suitability for precision delivery systems like fertigation. Application segmentation provides insights into the primary utility, distinguishing between its use as a systemic fungicide (dominant volume driver) and its growing role as a foliar fertilizer and plant biostimulant. Analyzing segments allows manufacturers to tailor marketing messages and develop targeted formulations that maximize efficacy for specific end-use requirements, ranging from high-pressure disease control in perennial crops to general nutritional enhancement in broadacre agriculture.

- By Form:

- Liquid

- Solid (Powder/Crystalline)

- By Application:

- Fungicides (Disease Control)

- Foliar Fertilizers

- Plant Stimulants/Biostimulants

- Others (Seed Treatment, Soil Drench, Post-harvest dips)

- By Crop Type:

- Fruits and Vegetables (e.g., Citrus, Grapes, Potatoes, Tomatoes)

- Grains and Cereals (e.g., Wheat, Rice, Corn)

- Oilseeds and Pulses

- Ornamentals and Turf

- Other Specialty Crops (e.g., Nuts, Coffee, Tea)

Value Chain Analysis For Potassium Phosphite Market

The value chain for the Potassium Phosphite market begins with the upstream sourcing and manufacturing of critical raw materials, primarily phosphorous acid (H3PO3) and potassium hydroxide or carbonate. The quality and purity of the technical-grade phosphorous acid are paramount, directly influencing the final product's stability and efficacy. Upstream activities involve stringent quality control and efficient chemical synthesis processes (neutralization/reaction) to produce the potassium phosphite salt, often customized into liquid concentrates or soluble powders. This stage is characterized by moderate capital intensity and requires specialized chemical handling due to the nature of the reactants. Supply chain stability, especially regarding phosphorous acid, is a key risk factor that influences downstream pricing and availability.

Midstream activities encompass formulation, blending, and primary distribution. Manufacturers often blend the basic potassium phosphite with chelating agents, buffering agents, and sometimes micronutrients to improve stability, leaf penetration, and overall plant uptake (bioavailability). The distribution channel is multifaceted, relying heavily on both direct and indirect routes. Direct distribution is common for large agricultural cooperatives and key institutional buyers, allowing for customized bulk orders and technical support. Indirect distribution utilizes a network of regional distributors, agricultural retailers, and specialized input dealers, who play a crucial role in providing logistical support and localized agronomic advice to diverse farming communities, particularly small and medium-sized operations.

Downstream analysis focuses on the end-user application and market access. The success of potassium phosphite products relies heavily on effective education and technical field support provided through the distribution network, ensuring correct usage rates and application timing relative to crop growth stages and disease pressure cycles. The end consumers—farmers, plantation managers, and turf specialists—drive demand based on demonstrated field performance, regulatory acceptance, and integration into existing IPM programs. The effectiveness of the product at this stage feeds back into the value chain, influencing research and development efforts toward next-generation, high-performance formulations tailored to overcome specific regional phytotoxicity or efficacy challenges.

Potassium Phosphite Market Potential Customers

The primary potential customers and end-users of potassium phosphite are agricultural entities engaged in high-value, intensive cropping systems where disease management and nutritional optimization yield significant economic returns. These customers fall into several categories, including large-scale commercial farms specializing in fruits, vegetables, and perennial crops (like vineyards, orchards, and citrus groves) where oomycete diseases cause devastating losses. These operations are sophisticated buyers, often integrating detailed soil and plant tissue analysis, demanding high-concentration, systemically effective products suitable for automated application via drip irrigation or aerial spraying. They prioritize products with demonstrated low environmental impact and official approval for residue management programs.

A rapidly growing segment of potential customers includes greenhouse and controlled environment agriculture (CEA) operators. These high-tech facilities cultivate premium crops (e.g., leafy greens, herbs, high-end tomatoes) year-round and require precise, fast-acting, and residue-free inputs to manage high-density plantings susceptible to root pathogens like Pythium. For these buyers, compatibility with closed-loop hydroponic or aeroponic systems is essential. Furthermore, professional turf and ornamental managers—including those overseeing golf courses, sports fields, and public landscaping—constitute a vital customer base, utilizing potassium phosphite to manage crown and root diseases while promoting turf vigor and stress tolerance, adhering to high aesthetic standards.

Finally, small to medium-sized growers in developing regions, increasingly moving towards cash crop production for export markets, represent substantial potential. While they may require smaller, more affordable package sizes and greater accessibility through localized distribution channels, their demand for reliable disease control and yield enhancement remains high. Government agricultural programs and farmer cooperatives often act as major procurement channels in these regions, aggregating demand and facilitating the adoption of proven technologies like potassium phosphite to improve national food security and export competitiveness. Educational materials translating complex phosphite science into practical, easy-to-implement application guides are critical for penetrating this segment effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,262.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Van Iperen, J.R. Simplot Company, Plant Tuff Inc., AgriChem, P.H. AgriChem, Grigg Brothers, Redox Chemicals, Haifa Group, ICL Group, EuroChem, Compass Minerals, K+S Group, L.Gobbi S.r.l., Grow More Inc., Yara International, Nutrien Ltd., Arysta LifeScience (UPL), Brandt Consolidated, Inc., Wilmar International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Potassium Phosphite Market Key Technology Landscape

The technological landscape surrounding the potassium phosphite market is focused intensely on enhancing product efficacy, improving delivery systems, and ensuring greater systemic mobility within the plant structure. A major area of innovation involves chelation and buffering technology. Manufacturers utilize specialized chelating agents (such as polyamines or organic acids) to stabilize the phosphite ion in solution, preventing its precipitation when mixed with other fertilizers or hard water, thereby maximizing nutrient availability and reducing the risk of clogging in micro-irrigation systems. Advanced buffering technologies ensure the product maintains an optimal pH upon application, which is crucial for maximizing leaf absorption (foliar uptake) and maintaining biological activity against pathogens.

Another crucial technological advancement is the application of nanotechnology and microencapsulation. Nano-formulations involve packaging the potassium phosphite into ultrafine particles or micelles, significantly increasing the surface area and facilitating more rapid and uniform absorption through the cuticle and stomata of the leaf surface. This controlled-release technology not only minimizes the required dosage but also potentially prolongs the duration of the phosphite’s systemic protective effect against diseases. Furthermore, these microencapsulated products often exhibit improved rainfastness, reducing loss and maximizing the economic value of the treatment, positioning them as premium offerings in the market.

The integration of phosphite products into sophisticated fertigation systems and smart delivery platforms represents the final key technological frontier. Modern agricultural technology utilizes sensors and software to monitor soil moisture, nutrient levels, and plant health, automatically adjusting the concentration and timing of phosphite injection via drip systems. This allows for highly precise, targeted nutritional and defense applications throughout the growing season, moving away from calendar-based spraying. These technological advancements, coupled with ongoing research into the synergistic effects of phosphite with beneficial microorganisms (microbial biostimulants), are continually pushing the boundaries of integrated crop management efficiency and performance.

Regional Highlights

The global consumption profile of potassium phosphite demonstrates distinct regional variations driven by climate, regulatory requirements, and crop cultivation intensity. North America, particularly the U.S. and Canada, represents a mature market characterized by high adoption rates in specialty crop cultivation (e.g., avocados, citrus, nuts) and professional turf management. Strict pesticide regulations favor the systemic, low-residue nature of phosphites. Europe is highly restricted by stringent chemical regulations but shows strong demand within the biostimulant segment, where phosphite is valued for its nutritional contribution and plant health benefits in high-value greenhouse crops. The European market emphasizes organic-compatible or highly sustainable formulations, pushing innovation toward cleaner manufacturing processes.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid intensification of agriculture, increasing focus on export-quality fruits and vegetables, and significant investment in protected cultivation infrastructure (greenhouses and polyhouses) in countries like China, India, and Australia. Demand is high for managing root rot in rice and horticulture crops.

- North America: A significant revenue generator, driven by extensive specialty crop acreage in California and Florida, coupled with high usage in professional turf and ornamental markets. Focuses on premium, high-concentration liquid formulations and strong technical support.

- Europe: Characterized by high environmental standards and sophisticated growers. Consumption is channeled heavily into improving nutrient efficiency and plant vigor in line with the European Green Deal objectives, particularly in grape and potato production.

- Latin America (LATAM): A critical market, particularly Brazil, Chile, and Mexico, due to vast tropical and subtropical environments highly susceptible to oomycete diseases like late blight and root rots in perennial crops (e.g., cocoa, coffee, bananas, and citrus). Economic drivers favor effective, systemic disease control methods.

- Middle East and Africa (MEA): Emerging market with increasing adoption in irrigated, high-value desert agriculture and intensive horticulture in regions like South Africa and Egypt, driven by the necessity for effective water and nutrient use efficiency under stressful climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Potassium Phosphite Market.- Van Iperen

- J.R. Simplot Company

- Plant Tuff Inc.

- AgriChem

- P.H. AgriChem

- Grigg Brothers

- Redox Chemicals

- Haifa Group

- ICL Group

- EuroChem

- Compass Minerals

- K+S Group

- L.Gobbi S.r.l.

- Grow More Inc.

- Yara International

- Nutrien Ltd.

- Arysta LifeScience (UPL)

- Brandt Consolidated, Inc.

- Wilmar International

- Miller Chemical & Fertilizer, LLC

Frequently Asked Questions

Analyze common user questions about the Potassium Phosphite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between potassium phosphite and traditional potassium phosphate fertilizers?

The primary difference lies in the chemical valence of phosphorus. Phosphites contain phosphorus in the +3 oxidation state (H2PO3-), while traditional phosphates have phosphorus in the +5 oxidation state (PO43-). Phosphite, due to its unique structure, exhibits powerful systemic fungicidal properties and induces plant defense mechanisms (SAR), functions traditional phosphate does not possess. It provides phosphorus nutrition but is chiefly utilized for its biostimulatory and disease management capabilities, making it a specialized input.

Is potassium phosphite classified strictly as a fungicide or a fertilizer in major agricultural markets?

The classification of potassium phosphite is complex and varies regionally, often impacting its regulatory status and labeling. In many markets, particularly the US (EPA) and parts of Europe, it is registered under both categories or as a supplemental nutritional product with biological activity. Its dual role means some formulations are explicitly registered as fungicides for systemic disease control (e.g., Phytophthora), while others are marketed primarily as foliar fertilizers to enhance potassium and phosphorus availability, capitalizing on its nutritional benefits.

Which specific plant diseases are most effectively controlled by using potassium phosphite?

Potassium phosphite is highly effective against diseases caused by oomycetes, a class of destructive pathogens often referred to as water molds. Key targets include Late Blight (Phytophthora infestans) in potatoes and tomatoes, various types of root and crown rot (caused by Phytophthora and Pythium species) in citrus, avocados, berries, and ornamental plants. It controls these pathogens not by direct toxicity but by stimulating the plant's own systemic defenses and inhibiting pathogen metabolism.

What are the typical application methods for potassium phosphite products in large-scale commercial farming?

The most common application methods include foliar spraying, which ensures rapid uptake and systemic movement within the plant canopy; soil drenching or shank injection, targeting root and crown diseases; and fertigation, where it is injected directly into irrigation systems (drip or micro-sprinkler) for precise and continuous delivery to the root zone. Selection depends on the target crop, the specific disease pressure, and the existing farm infrastructure, with liquid formulations being preferred for large-scale precision systems.

How does the adoption of sustainable farming practices influence the demand trajectory for potassium phosphite?

Sustainable farming practices are a major positive driver for potassium phosphite demand. As growers prioritize Integrated Pest Management (IPM) strategies and seek inputs with favorable toxicological profiles, potassium phosphite is increasingly preferred over broad-spectrum conventional fungicides. Its low environmental impact, reduced risk of residue buildup, and dual nutritional/defensive function align perfectly with global sustainability mandates and consumer demand for "greener" crop protection solutions, thereby securing its market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager