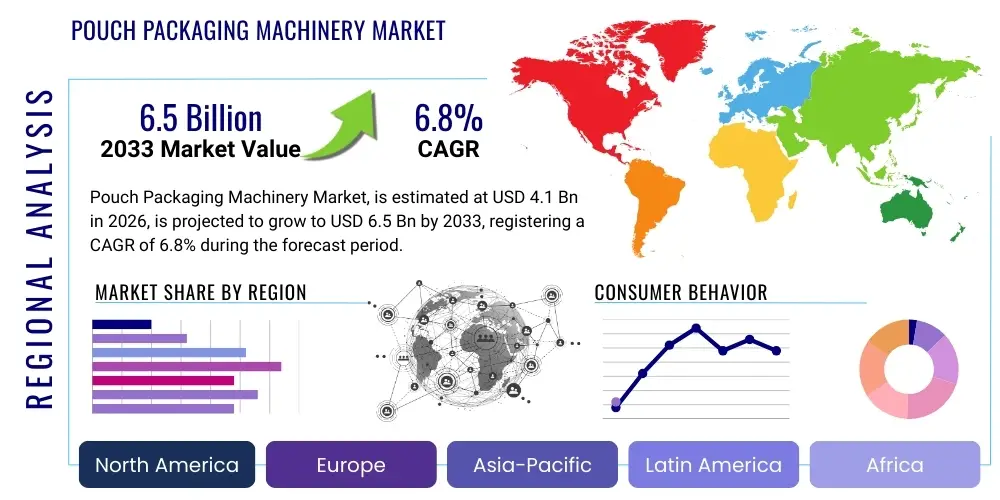

Pouch Packaging Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437942 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Pouch Packaging Machinery Market Size

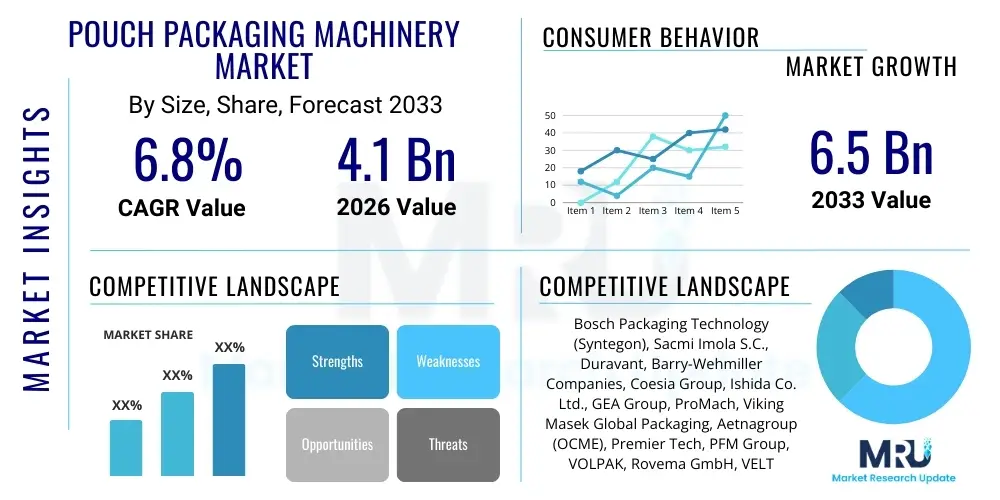

The Pouch Packaging Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Pouch Packaging Machinery Market introduction

The Pouch Packaging Machinery Market encompasses equipment designed for the automated formation, filling, and sealing of flexible pouches, catering to a vast array of consumer and industrial goods. These machines, essential components of modern high-speed production lines, utilize various technologies such as Vertical Form-Fill-Seal (VFFS), Horizontal Form-Fill-Seal (HFFS), and pre-made pouch handling systems to deliver flexible, sustainable, and convenient packaging solutions. The core product offering includes equipment tailored for handling specific product forms—ranging from free-flowing liquids and viscous pastes to powders, granules, and solid items—thereby providing manufacturers with versatile tools to meet diverse market demands while significantly improving throughput and minimizing material waste. The flexibility inherent in pouch packaging, coupled with its lower material costs compared to rigid containers, solidifies the machinery’s critical role across multiple high-volume sectors, specifically fast-moving consumer goods (FMCG).

Major applications of pouch packaging machinery span key end-use industries including food and beverage, where items like snacks, sauces, and pet food are extensively packaged; pharmaceuticals, requiring high precision and sterility for unit doses and medical devices; and cosmetics and personal care products, where stand-up pouches offer excellent shelf appeal and consumer convenience. The inherent benefits of utilizing flexible pouch systems are manifold, encompassing enhanced product preservation through specialized barrier films, reduced transportation costs due to lower package weight, and increased sustainability credentials owing to reduced material usage. These machinery systems are increasingly integrated with sophisticated controls, enabling quick changeovers between different pouch formats and sizes, ensuring high operational efficiency and responsiveness to evolving consumer preferences.

The principal driving factors accelerating market expansion revolve around the global shift toward flexible packaging formats driven by consumer demand for convenience, portability, and single-serve portions. Furthermore, stringent regulatory requirements concerning food safety and hygiene mandate the adoption of advanced, reliable, and easily sanitizable packaging machinery. Technological advancements, particularly in automation, sensing capabilities, and the integration of sustainable packaging materials such as biodegradable and compostable films, also serve as powerful drivers, compelling manufacturers to upgrade legacy systems to maintain competitive advantage and meet corporate environmental goals. The ongoing expansion of the organized retail sector and e-commerce further necessitates robust, high-volume pouch packaging capabilities, ensuring market stability and continued investment.

Pouch Packaging Machinery Market Executive Summary

The Pouch Packaging Machinery Market is characterized by robust growth, primarily propelled by pervasive business trends focusing on operational efficiency, supply chain optimization, and sustainability adoption across global manufacturing hubs. Key business trends include the consolidation of machinery manufacturers, leading to integrated solution providers capable of offering complete, end-to-end packaging lines, and the rapid adoption of modular machine designs that facilitate easier maintenance, faster format changes, and scalability in response to fluctuating demand. The integration of Industry 4.0 elements, such as the Industrial Internet of Things (IIoT) and advanced sensors, is becoming standard, offering predictive maintenance capabilities and real-time performance monitoring, which directly contributes to higher uptime and reduced total cost of ownership (TCO) for end-users operating in competitive sectors like processed food and pharmaceuticals.

Regionally, the market exhibits divergent maturity levels and growth trajectories. Asia Pacific (APAC) dominates in terms of overall market growth potential, fueled by expanding populations, rising disposable incomes, and the massive scale-up of local food and beverage manufacturing capabilities in countries such as China, India, and Southeast Asia. North America and Europe, while mature, demonstrate steady growth driven by the continuous need for machinery replacement and technological upgrades focused on advanced automation, high-speed capability, and strict adherence to food contact safety regulations, particularly concerning handling sustainable and bio-based packaging materials. These developed regions are the primary adopters of high-precision, premium machinery designed for highly specialized applications, such as aseptic packaging and sensitive pharmaceutical powders, leading to sustained investment in high-value machinery segments.

Segmentation trends reveal strong performance in the Vertical Form-Fill-Seal (VFFS) machinery segment, largely due to its versatility and cost-efficiency in handling granular products, powders, and snacks, dominating high-volume staple food production. However, the pre-made pouch filling segment is experiencing the fastest acceleration, driven by the increasing consumer preference for stand-up pouches (SUPs), which offer superior shelf stability, reclosable features, and greater aesthetic appeal for premium products in the cosmetic and liquid food sectors. Furthermore, the End-Use segmentation highlights the Food and Beverage industry as the undisputed major revenue contributor, closely followed by the Pharmaceutical segment, which demands highly specialized, compliant, and integrated machinery solutions capable of precise dosing and validation protocols, thereby driving demand for sophisticated control systems and material handling mechanisms across all geographical markets.

AI Impact Analysis on Pouch Packaging Machinery Market

Common user questions regarding AI's influence on the Pouch Packaging Machinery Market frequently center on its practical application in enhancing operational efficiency, reducing material waste, and ensuring predictive quality control. Users are keen to understand how AI-driven algorithms can optimize machine performance parameters, such as seal temperature, fill volume accuracy, and sealing pressure, in real-time, thereby maximizing output and minimizing product rejection rates. Key concerns also revolve around the implementation cost of integrating AI into existing legacy systems and the required skill upgrade for maintenance personnel to handle complex data analytics generated by these smart systems. Users fundamentally expect AI to transform reactive maintenance into proactive failure prediction, significantly lowering downtime, and enabling greater customization for short-run production batches without compromising speed or efficiency, particularly when handling novel or sustainable films with variable mechanical properties.

The introduction of Artificial Intelligence (AI) and machine learning (ML) is fundamentally altering the operational dynamics of pouch packaging lines by moving beyond simple automation toward intelligent manufacturing. AI systems are increasingly being deployed to analyze vast datasets collected from sensors, cameras, and production logs to detect subtle anomalies that precursors equipment failure. This ability to perform continuous condition monitoring allows maintenance schedules to be optimized based on actual wear and tear rather than generalized time intervals, maximizing machine life and throughput. Furthermore, ML algorithms are proving indispensable in quality control, capable of identifying microscopic defects in packaging seals, film lamination, or print registration faster and more accurately than traditional vision systems, thereby upholding stringent product safety and branding standards, especially critical in pharmaceutical and infant nutrition sectors.

AI's impact also extends significantly into optimizing material consumption, addressing a major cost driver and sustainability challenge for manufacturers. Machine learning models can predict the exact requirements for film length and tension based on product characteristics and environmental conditions (like humidity), dynamically adjusting the machinery settings to ensure minimal overage and scrap material generation during the formation-fill-seal process. This optimized resource utilization translates directly into cost savings and improved environmental performance. Additionally, AI facilitates advanced customization capabilities; by quickly processing order specifications and materials data, intelligent systems can automatically recalibrate machine settings for product changeovers in mere seconds, drastically reducing the unproductive time traditionally associated with shifting production from one SKU to another, thus enabling true flexibility in high-mix, low-volume manufacturing environments prevalent in many specialized food and medical packaging operations.

- Enhanced Predictive Maintenance: AI analyzes sensor data to forecast potential component failures, reducing unscheduled downtime by up to 30%.

- Optimized Quality Control: ML-driven vision systems achieve near-perfect seal integrity inspection and print verification in high-speed operations.

- Dynamic Parameter Adjustment: Real-time optimization of sealing temperatures, pressure, and fill rates based on material variability and environmental factors.

- Reduced Material Waste: Algorithms minimize film scrap and product giveaway through highly accurate dosing and material usage prediction.

- Automated Changeovers: AI accelerates setup times for different pouch formats, enabling efficient production of customized, smaller batches.

- Supply Chain Visibility: Integration with upstream logistics systems provides forecasts for raw material needs (films, valves, zippers).

DRO & Impact Forces Of Pouch Packaging Machinery Market

The Pouch Packaging Machinery Market is driven by the escalating global consumer demand for flexible packaging formats that prioritize convenience, portability, and reduced packaging weight, aligning with modern lifestyle changes and the expansion of on-the-go consumption habits. The mandatory need for automation in manufacturing processes, especially in regions facing labor shortages and requiring increased output efficiency, further accelerates machinery adoption. Concurrently, the primary restraint challenging market growth is the substantial initial capital investment required for high-speed, technically sophisticated packaging lines, which often proves prohibitive for small and medium-sized enterprises (SMEs), particularly in developing economies. Furthermore, the complexities associated with handling and sealing novel sustainable films, which can be less thermally stable or consistent than traditional plastics, pose technical challenges that restrain rapid adoption across all machinery types. Opportunities, however, abound, particularly in the rapid development of machinery specialized for handling compostable and recyclable mono-materials, and the integration of advanced track-and-trace serialization technologies crucial for pharmaceutical packaging compliance and enhanced brand security across multiple global jurisdictions.

Segmentation Analysis

The Pouch Packaging Machinery Market is highly diversified, segmented based on machinery type, product form handled, and the specific end-use industry. This granular segmentation allows manufacturers to tailor solutions precisely to the varying operational needs, volume requirements, and regulatory compliance standards of different sectors. The key differentiation lies between machines handling pre-made pouches versus those performing the forming function in-line (F-F-S). The market structure is highly dependent on the velocity and consistency of the product being packaged, necessitating specialized handling mechanisms, such as auger fillers for powders, pump fillers for liquids, and multi-head weighers for solid items. Analyzing these segments is crucial for identifying pockets of high growth, particularly the accelerating demand for stand-up pouches in premium markets and the sustained demand for VFFS systems in emerging markets focusing on staple food items like rice, flour, and snack foods, thereby providing a clear roadmap for investment and product development strategies.

From a technological standpoint, the segmentation into VFFS and HFFS determines the speed, flexibility, and suitability for various product types. VFFS systems excel in high-speed applications for powders and granules where vertical drops aid filling, whereas HFFS machines offer greater control over pouch size, shape, and suitability for complex features like fitments, spouts, and zippers, making them ideal for liquid and high-value solid products. The performance of these machines is often benchmarked against their operational capabilities, including speed (pouches per minute), changeover efficiency, and sanitation features, particularly in the dairy and pharmaceutical sectors where rigorous cleaning protocols are mandatory. The ongoing trend toward modular machinery design further allows end-users to invest strategically, adding modules for features like gas flushing or cap application as their product requirements evolve, rather than replacing entire lines, which supports sustained market growth within technologically advanced regions.

The dominant application remains the Food and Beverage sector due to the sheer volume and diversity of products requiring flexible packaging, ranging from coffee and confectionery to processed meat and dairy products. Within this sector, the demand for single-serve and family-size pouches continues to dictate machinery specifications. In contrast, the Pharmaceutical segment, while smaller in volume, drives innovation in precision engineering, serialization capabilities, and validation services, as these machines must adhere to Good Manufacturing Practice (GMP) guidelines and ensure the integrity and sterility of highly sensitive contents. The shift towards unit-dose packaging and blister-in-pouch solutions represents a lucrative niche, demanding extremely high accuracy and low contamination risk, driving demand for specialized, high-cost machinery that incorporates advanced robotics and non-contact filling techniques. These stringent requirements ensure that pharmaceutical machinery segments maintain a higher average selling price (ASP) than mass-market food packaging equipment.

- By Type:

- Vertical Form-Fill-Seal (VFFS) Machines

- Horizontal Form-Fill-Seal (HFFS) Machines

- Pre-made Pouch Filling & Sealing Machines (Rotary/Linear)

- Automated Pouch Systems (Including Spouted and Zipper Pouch Applicators)

- By Product Form:

- Solids (Snacks, Confectionery, Parts)

- Liquids (Beverages, Sauces, Oils)

- Powders (Flour, Coffee, Pharmaceutical Powders)

- Granules (Sugar, Grains, Fertilizer)

- By End-Use Industry:

- Food and Beverage (F&B)

- Pharmaceutical

- Cosmetics and Personal Care

- Chemical and Industrial

- Pet Food

Value Chain Analysis For Pouch Packaging Machinery Market

The value chain for the Pouch Packaging Machinery Market begins with upstream activities centered on the procurement and manufacturing of highly specialized components, followed by the complex processes of machinery assembly, integration, and final distribution to end-users. Upstream analysis involves key suppliers of precision parts, including servo motors and drives (critical for high-speed accuracy), programmable logic controllers (PLCs), vision systems, advanced sensor technologies, and specialized metallurgy required for components in contact with food or medical products. Key raw materials include high-grade stainless steel for sanitary design and advanced composites. Suppliers of sophisticated control software and human-machine interface (HMI) systems also occupy a vital position, as these elements define the machine's operational flexibility and integration capabilities within a smart factory environment. The quality and reliability of these upstream inputs directly influence the final machinery performance, longevity, and adherence to stringent industry standards like FDA compliance.

The midstream stage is dominated by the Original Equipment Manufacturers (OEMs) who design, assemble, and rigorously test the final pouch packaging systems. This stage involves intense research and development to innovate on sealing technology (ultrasonic, heat-sealing), improve energy efficiency, and ensure compatibility with evolving sustainable packaging materials. Distribution channels are typically a mix of direct and indirect sales models. Direct sales are preferred for large, customized, or highly complex integrated lines, particularly to major multinational food and pharmaceutical corporations where extensive after-sales support, installation, and validation services are required. Indirect channels, involving regional distributors, agents, and system integrators, are more common for standardized, lower-cost machinery targeting smaller enterprises or specific regional markets, often providing localized maintenance and parts supply, which is critical for maximizing customer proximity and service responsiveness.

Downstream analysis focuses on the end-users—the various manufacturing companies across F&B, Pharma, and Cosmetics—who purchase and operate this machinery. The success of the machinery in the downstream market is measured by factors such as efficiency (pouches per minute), total cost of ownership, and flexibility in handling multiple SKUs. Crucially, the downstream market also includes the suppliers of the flexible packaging materials (films, laminates, zippers, spouts) who must collaborate closely with the machinery OEMs to ensure optimal performance of the film on the machinery, particularly concerning seal integrity and machinability. Feedback from end-users regarding machine reliability, cleanability, and integration with existing factory infrastructure is vital for driving future machinery design and innovation, thereby ensuring a highly cyclical relationship between the OEMs and their expansive customer base demanding continuous performance improvements and customized solutions.

Pouch Packaging Machinery Market Potential Customers

The primary consumers, or potential customers, in the Pouch Packaging Machinery Market are high-volume manufacturers operating within the Fast-Moving Consumer Goods (FMCG) sectors globally, particularly those involved in the production of food, beverages, and personal care items. These customers, ranging from large multinational corporations (MNCs) to mid-sized regional processors, prioritize machinery that offers exceptional speed, reliability, and the ability to handle various product formats and packaging designs with minimal downtime. The demand drivers for this segment include the constant pressure to reduce packaging material costs, enhance product shelf life, and meet the dynamic retail demands for aesthetically pleasing, convenient, and environmentally responsible packaging formats, such as reclosable stand-up pouches and single-serve stick packs. Their investment decisions are heavily weighted by factors such as machine TCO, energy efficiency, and the availability of responsive, comprehensive service contracts.

A second critical customer segment is the highly regulated Pharmaceutical and Nutraceutical industry. These end-users demand machinery that adheres strictly to current Good Manufacturing Practices (cGMP) and validation protocols, requiring specialized features such as sterile construction, precision dosing mechanisms for powders and liquids, and integrated serialization and track-and-trace capabilities to meet global regulatory requirements for drug authenticity and patient safety. Investment in this segment is driven less by volume maximization and more by precision, contamination avoidance, and the ability to provide extensive documentation and compliance support for regulatory audits. Machinery purchases are often tied to major capacity expansions or the launch of new unit-dose drug formats requiring advanced aseptic or controlled environment packaging solutions, making these customers prime targets for high-specification, premium machinery OEMs.

Furthermore, chemical and industrial manufacturers represent a growing segment, utilizing pouch packaging for products ranging from automotive fluids and cleaning supplies to seeds and construction materials. While the volume requirements might be lower or more specialized compared to food, the machinery must be robust enough to handle corrosive, abrasive, or highly viscous materials, often requiring specialized sealing and filling technologies. Pet food manufacturers also form a significant and rapidly growing sub-segment, driven by consumer willingness to pay a premium for high-quality pet nutrition, often packaged in large, durable, reclosable pouches. These customers seek high-output VFFS systems capable of handling large pouch sizes and incorporating features like integrated degassing valves and high barrier films to preserve product freshness and nutritional value, ensuring sustained demand for durable, industrial-grade packaging equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Packaging Technology (Syntegon), Sacmi Imola S.C., Duravant, Barry-Wehmiller Companies, Coesia Group, Ishida Co. Ltd., GEA Group, ProMach, Viking Masek Global Packaging, Aetnagroup (OCME), Premier Tech, PFM Group, VOLPAK, Rovema GmbH, VELTEKO, TMI, Winpak Ltd., KHS GmbH, Omag Srl, Fuji Machinery Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pouch Packaging Machinery Market Key Technology Landscape

The technological landscape of the Pouch Packaging Machinery Market is rapidly evolving, driven primarily by the need for increased speed, precision, and flexibility, coupled with rising sustainability mandates. A foundational advancement is the widespread adoption of servo drive technology, which replaces traditional mechanical linkages. Servo motors offer superior control over machine movements, enabling precise indexing, minimal mechanical wear, and faster, more reliable operation, particularly beneficial for accurate pouch registration and sealing consistency, significantly reducing reject rates associated with high-speed lines. This technology is critical for minimizing energy consumption compared to older pneumatic or purely mechanical systems, aligning machinery performance with corporate environmental goals. Furthermore, the development of specialized sealing techniques, such as ultrasonic welding, is gaining traction, especially for handling delicate materials or achieving tamper-evident seals without relying solely on intense heat, which is often unsuitable for biodegradable films.

Connectivity and smart manufacturing integration constitute another major technological shift. Modern pouch packaging machinery is increasingly equipped with sophisticated sensors and IoT (Internet of Things) platforms, enabling real-time data acquisition and remote monitoring. This facilitates the implementation of comprehensive cloud-based predictive maintenance programs, allowing manufacturers to schedule interventions based on actual component degradation rather than fixed timeframes, maximizing operational uptime. Human-Machine Interfaces (HMIs) are also becoming more intuitive, utilizing touchscreens and augmented reality (AR) guidance for troubleshooting and format changeovers, significantly reducing the dependence on highly specialized, on-site technical expertise and simplifying training for local operators, a key advantage in geographically dispersed manufacturing operations across developing markets.

Crucially, the technological focus is heavily concentrated on facilitating sustainable packaging initiatives. This includes developing machinery capable of efficiently running mono-material films (e.g., all polyethylene or all polypropylene structures) which are easier to recycle than multi-layer laminates, without compromising seal integrity or speed. There is substantial investment in specialized dosing and filling technologies, such as magnetic flow meters and Coriolis mass flow meters, to ensure highly accurate filling of valuable liquids or powders, thus minimizing product giveaway and maximizing profitability. Furthermore, advancements in aseptic and ultra-clean filling systems, incorporating technologies like pulsed light and hydrogen peroxide sterilization, are becoming standard for dairy, extended shelf-life beverages, and pharmaceutical applications, ensuring the highest standards of product safety and shelf stability demanded by modern retail environments.

Regional Highlights

- North America: This region is characterized by high adoption rates of advanced, fully automated, and high-speed HFFS and pre-made pouch machinery, driven by high labor costs and stringent regulatory demands for food safety and traceability. The market is mature, with growth primarily fueled by the replacement of aging infrastructure and the strong demand for premium, reclosable stand-up pouches, particularly in the pet food, snack, and ready-to-eat meal sectors. Investment often targets machinery integrated with advanced IIoT capabilities and specialized serialization features crucial for the pharmaceutical industry.

- Europe: The European market maintains a robust focus on innovation, particularly driven by strict mandates regarding environmental sustainability and recyclable packaging materials. Machinery adoption here is highly influenced by the ability to run novel bio-based and recyclable mono-materials efficiently. Western European countries emphasize precision engineering, rapid changeover capability, and energy efficiency. Germany and Italy remain leading hubs for machinery manufacturing, often exporting high-specification systems globally, prioritizing sophisticated aseptic and ultra-clean packaging solutions for the dairy and liquid food sectors.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, underpinned by vast population growth, rapid urbanization, increasing disposable incomes, and the massive expansion of the domestic manufacturing and organized retail sectors in China and India. The demand is diverse, encompassing both cost-effective VFFS machinery for staple goods and highly automated, high-end equipment imported to service the rapidly expanding high-value consumer goods market. Governments are investing heavily in infrastructure, leading to massive scale-up requirements, making this region critical for volume sales and localization efforts by major global OEMs.

- Latin America (LATAM): Growth in LATAM is driven by improving economic stability and increasing foreign investment in the food processing industry, particularly in countries like Brazil and Mexico. The market is transitioning from semi-automatic to fully automated systems to enhance competitive advantage against global imports. Demand focuses on versatile, robust machinery capable of handling basic consumer goods, with an increasing trend towards utilizing stand-up pouches for beverages and sauces to improve shelf appeal.

- Middle East and Africa (MEA): This region exhibits burgeoning demand, driven by population expansion, reliance on imported food products, and local initiatives to establish self-sufficiency in food processing. Investment is concentrated in packaged food and beverage production, often requiring machinery suitable for harsh environmental conditions (heat/humidity) and focused on extending product shelf life through high-barrier and gas-flushing capabilities, especially within the Saudi Arabian and UAE markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pouch Packaging Machinery Market.- Bosch Packaging Technology (Syntegon)

- Sacmi Imola S.C.

- Duravant

- Barry-Wehmiller Companies (BW Packaging Systems)

- Coesia Group

- Ishida Co. Ltd.

- GEA Group

- ProMach

- Viking Masek Global Packaging

- Aetnagroup (OCME)

- Premier Tech

- PFM Group

- VOLPAK (A Coesia Company)

- Rovema GmbH

- VELTEKO

- TMI (Theegarten-PacTec GmbH & Co. KG)

- Winpak Ltd.

- KHS GmbH

- Omag Srl

- Fuji Machinery Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Pouch Packaging Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Pouch Packaging Machinery Market?

The primary factor driving growth is the pervasive global shift towards flexible packaging formats, particularly stand-up pouches (SUPs) and reclosable pouches, fueled by consumer preference for convenience, portability, and sustainability advantages over rigid packaging. This trend necessitates continuous investment in high-speed, flexible forming, filling, and sealing machinery, especially in emerging economies and the highly competitive snack food sector globally.

How is Industry 4.0 influencing the design and functionality of modern pouch packaging equipment?

Industry 4.0, encompassing IoT, AI, and advanced sensor technology, is leading to smarter machinery that offers predictive maintenance, real-time performance optimization, and enhanced remote diagnostics. This integration minimizes unplanned downtime, ensures greater operational efficiency, and facilitates rapid, automated changeovers between different product sizes and film specifications, addressing the critical manufacturing need for agility.

Which machinery type dominates the market, and what is the fastest-growing segment?

Vertical Form-Fill-Seal (VFFS) machines currently dominate the market volume, particularly for high-speed packaging of powders, granules, and snack foods due to their efficiency and versatility. However, the pre-made pouch filling and sealing segment, which handles stand-up pouches (SUPs), is experiencing the fastest growth rate, driven by demand for premium products requiring superior shelf appeal and added features like zippers or spouts.

What are the key technological challenges machinery manufacturers face regarding sustainable packaging materials?

Manufacturers face significant challenges in adapting machinery to reliably handle new sustainable materials, such as compostable or mono-material films, which often possess narrow temperature windows for sealing and less consistent mechanical properties than traditional multi-layer plastics. Overcoming these limitations requires continuous R&D into specialized sealing technologies (like ultrasonic) and precise temperature control systems to maintain high-speed integrity.

Which geographical region offers the highest growth potential for pouch packaging machinery sales?

The Asia Pacific (APAC) region offers the highest growth potential, driven by rapid urbanization, massive expansion in the domestic food and beverage manufacturing sector, and increasing consumer adoption of packaged goods across highly populated nations like China and India. The sustained need for large-scale production capacity and improved automation infrastructure ensures robust, double-digit growth prospects for equipment suppliers in this area.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager