Poultry Opening Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439562 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Poultry Opening Machine Market Size

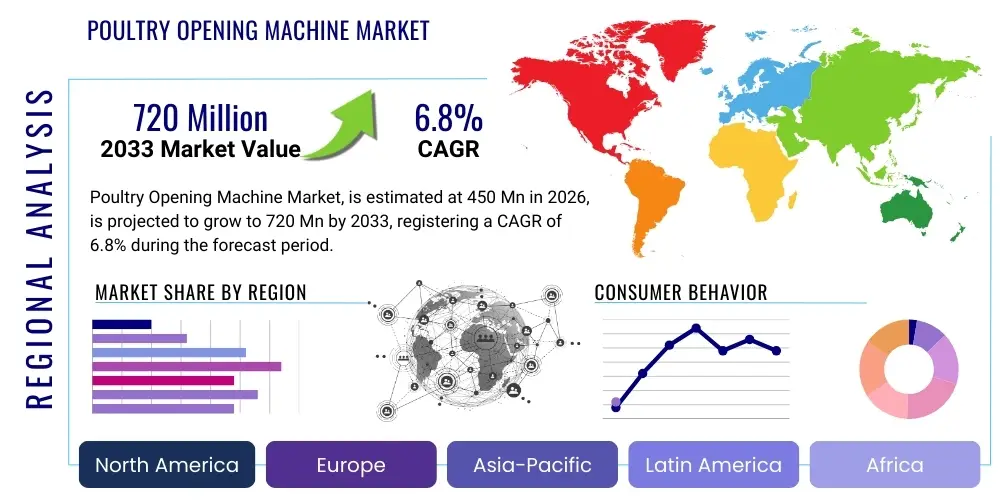

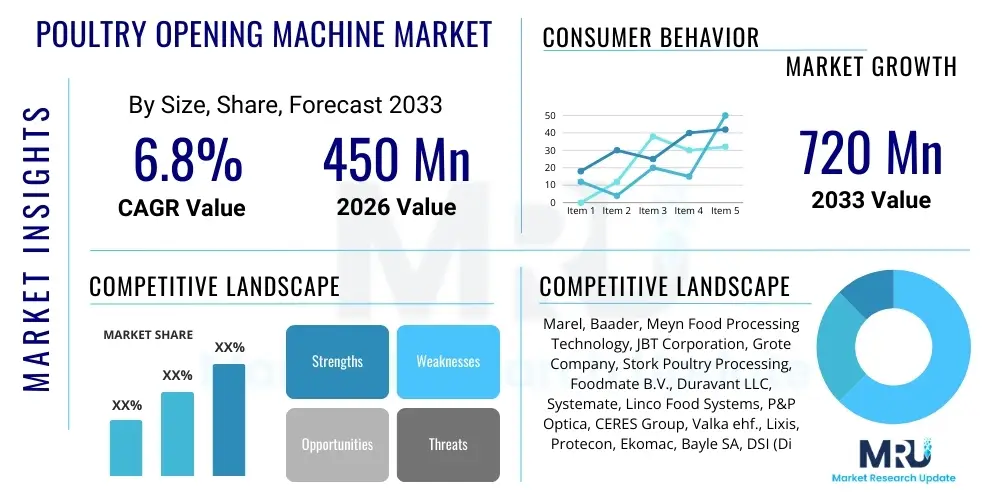

The Poultry Opening Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033. This growth is primarily driven by increasing demand for automated and efficient poultry processing solutions across the globe, aiming to enhance productivity, ensure food safety, and reduce labor costs in the burgeoning meat industry. The market expansion is further supported by technological advancements that lead to more sophisticated and versatile opening machines capable of handling various poultry types and sizes with greater precision and speed.

Poultry Opening Machine Market introduction

The Poultry Opening Machine Market encompasses the global industry dedicated to the manufacturing, distribution, and utilization of specialized machinery designed to automate the initial processing stages of poultry carcasses. These machines are crucial for opening poultry to allow for evisceration and further processing, ensuring hygiene, consistency, and efficiency in high-volume production environments. The core product involves mechanical systems that precisely cut and open poultry carcasses, replacing manual labor that is often prone to inconsistencies and higher risks of contamination. Key applications span a wide range of poultry processing facilities, including large-scale industrial plants, medium-sized operations, and specialized meat packers, all seeking to streamline their production lines and meet stringent food safety standards.

The primary benefits of adopting poultry opening machines include significant reductions in processing time and labor costs, improved product quality through consistent cuts, and enhanced food safety by minimizing human contact and cross-contamination risks. These machines contribute directly to operational efficiency, allowing processors to handle larger volumes of poultry with fewer resources while maintaining high hygiene standards. Driving factors for market growth are multifaceted, rooted in the global increase in poultry consumption, which necessitates higher production capacities and faster processing speeds. Furthermore, rising labor costs and a shortage of skilled labor in many regions compel processors to invest in automation. Stringent food safety regulations worldwide also play a pivotal role, pushing the industry towards automated solutions that offer greater control over hygiene and product integrity. Continuous innovation in machine design, material science, and control systems further fuels this market's expansion, making these machines more robust, efficient, and adaptable to diverse operational requirements.

Poultry Opening Machine Market Executive Summary

The Poultry Opening Machine Market is experiencing robust growth, propelled by significant business trends such as increasing automation in the food processing industry, a global surge in poultry consumption, and heightened focus on food safety and operational efficiency. Processors are increasingly investing in advanced machinery to counteract rising labor costs and improve throughput, transforming traditional manual operations into high-speed, automated lines. This shift is also driven by the need for greater precision and consistency in processing, which manual methods often fail to deliver at scale. Emerging business models focused on service and maintenance contracts, along with customizable machine solutions, are also gaining traction, offering long-term value to end-users and fostering strong partnerships between manufacturers and processors. The competitive landscape is characterized by innovation in machine design, integration of smart technologies, and a strategic emphasis on expanding global distribution networks to cater to diverse market needs.

Regional trends indicate significant growth opportunities across various geographies. Asia Pacific, driven by populous countries like China and India, is witnessing a massive expansion in poultry production and processing, making it a lucrative market for opening machines. North America and Europe, already mature markets, are focusing on upgrading existing facilities with more advanced, energy-efficient, and intelligent machines to maintain competitive advantages and adhere to stringent environmental regulations. Latin America and the Middle East & Africa regions are emerging as high-growth markets, fueled by increasing per capita poultry consumption, urbanization, and investments in modern food processing infrastructure. Each region presents unique market dynamics influenced by local economic conditions, consumer preferences, and regulatory frameworks, dictating specific demands for machine capacity, automation levels, and technical features. Companies are therefore tailoring their product offerings and market entry strategies to align with these distinct regional requirements.

Segmentation trends within the market highlight a growing preference for fully automatic poultry opening machines over semi-automatic or manual variants, primarily due to their superior efficiency, speed, and consistency. The demand for machines capable of processing higher capacities is also on the rise, reflecting the increasing scale of poultry operations globally. In terms of poultry type, machines optimized for chicken processing dominate the market, given chicken's widespread consumption, but there is also a steady demand for adaptable machines that can handle turkeys, ducks, and other poultry. End-user segmentation shows that large-scale industrial poultry processors remain the primary buyers, although medium-sized enterprises are increasingly adopting these technologies to scale up their operations. The market is also seeing trends in modular designs, allowing for easier integration into existing processing lines and offering flexibility for future upgrades, catering to a broad spectrum of operational needs and investment capacities.

AI Impact Analysis on Poultry Opening Machine Market

Users commonly inquire about how Artificial Intelligence (AI) can revolutionize the efficiency, precision, and safety of poultry opening processes, particularly regarding real-time carcass analysis, defect detection, and adaptive machine operation. There is a strong interest in AI's ability to optimize machine performance, reduce waste, and enhance product quality, moving beyond traditional automation to truly intelligent systems. Concerns often revolve around the initial investment costs, complexity of integration, and the need for skilled personnel to manage these advanced AI-powered systems. Expectations include AI leading to more autonomous and error-free processing lines, with improved yield and traceability throughout the poultry supply chain, ultimately transforming the industry into a more data-driven and responsive sector.

- AI-driven vision systems enable real-time analysis of poultry carcasses, detecting abnormalities and ensuring precise cuts, significantly reducing human error and improving consistency.

- Predictive maintenance algorithms powered by AI analyze machine performance data to forecast potential failures, allowing for proactive maintenance and minimizing costly downtime.

- Machine learning models optimize machine parameters (e.g., cut depth, speed) based on real-time feedback and variations in poultry size or condition, maximizing yield and efficiency.

- AI integration enhances food safety by identifying contamination risks or unhygienic conditions on the processing line with higher accuracy than human inspection.

- Robotics combined with AI allows for more adaptive and flexible handling of diverse poultry types and sizes, leading to increased versatility in processing operations.

- Data analytics from AI systems provide valuable insights into production bottlenecks, operational efficiency, and quality control, supporting informed decision-making for plant managers.

- Automated quality control leveraging AI can sort and grade poultry based on predefined criteria, ensuring a consistent product output and reducing manual labor for inspection tasks.

- AI can facilitate improved traceability by recording detailed processing data for each carcass, aiding in compliance and recall management.

- Resource optimization through AI helps in reducing water and energy consumption by fine-tuning machine operation based on actual processing needs.

- Enhanced worker safety by automating dangerous or repetitive tasks, allowing human operators to focus on supervisory roles and complex problem-solving.

DRO & Impact Forces Of Poultry Opening Machine Market

The Poultry Opening Machine Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping its trajectory. Key drivers include the escalating global demand for poultry products, necessitating higher processing capacities and automation to meet consumer needs efficiently. The increasing focus on food safety and hygiene standards worldwide is another powerful driver, pushing processors towards automated solutions that reduce human contact and potential contamination. Furthermore, rising labor costs and a persistent shortage of manual labor in many developed and developing economies compel investments in advanced machinery to maintain profitability and operational continuity. The continuous pursuit of operational efficiency and consistency in product quality also acts as a primary driving force, as automated opening machines deliver uniform cuts and faster throughput compared to traditional methods. These drivers collectively create a compelling business case for the adoption of poultry opening machines across the industry.

Conversely, several restraints impede the market's growth. The high initial capital investment required for acquiring and installing advanced poultry opening machines can be a significant barrier for small and medium-sized processors, particularly in developing regions with limited access to financing. The complexity of integrating these sophisticated machines into existing processing lines, along with the need for specialized technical expertise for operation and maintenance, also poses challenges. Furthermore, the market can be susceptible to fluctuations in poultry production cycles and raw material costs, which might impact investment decisions. Despite these restraints, considerable opportunities exist, particularly in emerging markets where poultry consumption is rapidly growing and processing infrastructure is still developing. The ongoing technological advancements, including the integration of AI, robotics, and advanced sensor technologies, present avenues for innovation and expansion into more versatile and efficient machine designs. Moreover, the increasing global emphasis on sustainable and ethical food production practices creates opportunities for machines that optimize yield and minimize waste. These opportunities, when strategically leveraged, can mitigate the impact of restraints and accelerate market growth.

Segmentation Analysis

The Poultry Opening Machine Market is comprehensively segmented to provide a detailed understanding of its various facets, enabling targeted market strategies and product development. This segmentation helps in identifying key market characteristics, consumer preferences, and competitive landscapes across different dimensions. The primary segmentation criteria typically include machine type, capacity, poultry type processed, and end-user applications. Each segment showcases unique growth dynamics and market potential, influenced by technological advancements, regional economic conditions, and shifts in consumer demand patterns.

- By Type:

- Manual Poultry Opening Machines

- Semi-Automatic Poultry Opening Machines

- Fully Automatic Poultry Opening Machines

- By Capacity:

- Small Capacity (e.g., up to 2,000 birds/hour)

- Medium Capacity (e.g., 2,001 - 6,000 birds/hour)

- Large Capacity (e.g., over 6,000 birds/hour)

- By Poultry Type:

- Chicken Opening Machines

- Turkey Opening Machines

- Duck Opening Machines

- Other Poultry (e.g., Quail, Guinea Fowl)

- By End-User:

- Industrial Poultry Processors

- Meat Packing Plants

- Food Service Providers (Large Scale)

- Retail Food Chains (with in-house processing)

Value Chain Analysis For Poultry Opening Machine Market

The value chain for the Poultry Opening Machine Market begins with the upstream analysis, which involves the sourcing of raw materials and components critical for machine manufacturing. This stage includes suppliers of high-grade stainless steel, precision mechanical parts, electronic components such as sensors and control systems, and specialized cutting tools. Relationships with these suppliers are crucial for ensuring the quality, cost-effectiveness, and timely delivery of materials, directly impacting the final product's reliability and performance. Research and development activities also play a significant upstream role, focusing on innovations in design, automation technologies, and material science to enhance machine efficiency, durability, and compliance with food safety standards. Strong partnerships with research institutions and technology providers are often fostered at this stage to drive continuous product improvement and differentiation.

Moving downstream, the value chain encompasses the manufacturing, assembly, and testing of poultry opening machines, followed by their distribution to end-users. Manufacturers often employ advanced production techniques and quality control measures to ensure that each machine meets stringent industry standards and client specifications. The distribution channel is multifaceted, including direct sales from manufacturers to large industrial poultry processors, as well as indirect channels involving distributors, agents, and system integrators who serve a broader range of customers, including smaller processors and those in remote regions. Direct distribution allows for closer customer relationships and customized solutions, while indirect channels provide wider market reach and specialized local support. Post-sales services, such as installation, training, maintenance, and spare parts supply, form a critical part of the downstream value chain, ensuring optimal machine performance and customer satisfaction throughout the product lifecycle. These services are often provided directly by manufacturers or through authorized service partners, contributing significantly to customer loyalty and brand reputation.

Poultry Opening Machine Market Potential Customers

The primary potential customers for Poultry Opening Machines are entities involved in the large-scale processing of poultry for commercial distribution and consumption. These end-users are characterized by their need for high throughput, consistent product quality, stringent hygiene standards, and operational efficiency. The market is primarily driven by organizations aiming to automate and streamline their evisceration and preparation lines to meet escalating consumer demand for poultry products while also complying with evolving food safety regulations. These customers often seek solutions that can reduce reliance on manual labor, minimize operational costs, and maximize yield from each processed bird. Their investment decisions are influenced by factors such as machine capacity, automation level, precision, ease of maintenance, and the total cost of ownership, including energy consumption and spare parts availability. Furthermore, the ability of the machine to integrate seamlessly into existing processing lines and its adaptability to various poultry sizes and types are crucial considerations for these professional buyers.

Specifically, the largest segment of potential customers comprises industrial poultry processors that operate at a national or international scale, handling millions of birds annually. These establishments, including major brands and contract processors, continually invest in state-of-the-art machinery to maintain competitive advantage, expand production capacity, and enhance product quality. Another significant group includes meat packing plants that process a variety of meats, where poultry processing often forms a substantial part of their operations. These plants are increasingly seeking specialized poultry equipment to improve efficiency and adhere to specific processing requirements. Furthermore, large-scale food service providers, such as institutional caterers or food manufacturers that process raw poultry in-house before preparing ready-to-eat meals, represent a growing segment. Even retail food chains with their own in-house processing capabilities, aimed at offering fresh, prepared poultry products, constitute potential buyers. These diverse end-users all share the common objective of optimizing their poultry processing operations through reliable, efficient, and hygienic opening solutions, ensuring profitability and consumer satisfaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marel, Baader, Meyn Food Processing Technology, JBT Corporation, Grote Company, Stork Poultry Processing, Foodmate B.V., Duravant LLC, Systemate, Linco Food Systems, P&P Optica, CERES Group, Valka ehf., Lixis, Protecon, Ekomac, Bayle SA, DSI (Div of JBT Corporation), GEA Group, Prime Equipment Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Poultry Opening Machine Market Key Technology Landscape

The technological landscape of the Poultry Opening Machine Market is characterized by a relentless pursuit of enhanced automation, precision, and hygiene, leveraging advanced engineering and digital innovations. Central to this evolution are sophisticated mechanical designs that enable high-speed and accurate opening of carcasses with minimal damage, often incorporating specialized cutting mechanisms and positioning systems. Material science plays a crucial role, with an emphasis on food-grade stainless steel and other corrosion-resistant, easy-to-clean materials that meet stringent food safety and sanitation requirements. Furthermore, modular designs are becoming prevalent, allowing processors to easily integrate opening machines into existing lines, scale operations, and perform maintenance with greater efficiency, offering flexibility and cost-effectiveness in diverse operational environments.

Beyond mechanical prowess, the market is increasingly integrating advanced sensor technologies and control systems. High-resolution vision systems, often coupled with artificial intelligence and machine learning algorithms, are used for real-time carcass analysis, precise measurement, and defect detection, ensuring optimal cutting and consistent product quality. Robotics and advanced automation are transforming handling processes, providing greater adaptability for varying poultry sizes and conditions, reducing manual labor, and improving overall throughput. Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) enable intuitive operation, monitoring, and data collection, allowing for fine-tuning of processes and predictive maintenance. These technological advancements not only boost efficiency and reduce operational costs but also significantly elevate food safety standards by minimizing human intervention and ensuring consistent hygienic practices throughout the poultry opening process.

Regional Highlights

- North America: A mature market characterized by high adoption of automation, driven by increasing labor costs, stringent food safety regulations, and a strong focus on processing efficiency. The United States and Canada are leading adopters of advanced poultry opening machines.

- Europe: Similar to North America, European countries such as Germany, Netherlands, and France exhibit high demand for automated solutions due to strict hygiene standards, sustainability goals, and the need for precision processing to cater to diverse consumer preferences.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapidly increasing poultry consumption, expanding middle-class populations, and significant investments in modernizing processing infrastructure, particularly in China, India, and Southeast Asian nations.

- Latin America: An emerging market with substantial growth potential, driven by rising domestic poultry consumption, growing export markets, and increasing investments in automation to enhance competitiveness and meet international quality standards, with Brazil being a key player.

- Middle East and Africa (MEA): Experiencing steady growth due to increasing urbanization, dietary diversification, and government initiatives to boost local food production and processing capabilities, leading to greater adoption of poultry processing technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Poultry Opening Machine Market.- Marel

- Baader

- Meyn Food Processing Technology

- JBT Corporation

- Grote Company

- Stork Poultry Processing

- Foodmate B.V.

- Duravant LLC

- Systemate

- Linco Food Systems

- P&P Optica

- CERES Group

- Valka ehf.

- Lixis

- Protecon

- Ekomac

- Bayle SA

- DSI (Div of JBT Corporation)

- GEA Group

- Prime Equipment Group

Frequently Asked Questions

What is a Poultry Opening Machine?

A Poultry Opening Machine is a specialized piece of equipment designed to automate the process of making a precise cut on poultry carcasses, typically along the ventral line, to prepare them for evisceration and further processing, ensuring hygiene and efficiency in high-volume operations.

Why is automation critical in the Poultry Opening Machine Market?

Automation is critical due to its ability to significantly increase processing speed, ensure consistent cuts, enhance food safety by reducing human contact, mitigate rising labor costs, and improve overall operational efficiency and yield in large-scale poultry processing plants.

What are the key drivers for growth in this market?

Key drivers include the global rise in poultry consumption, increasing demand for processed food products, stringent food safety regulations, and the need for poultry processors to reduce labor dependency and improve production efficiency through advanced automation.

How does AI impact Poultry Opening Machines?

AI impacts poultry opening machines by integrating advanced vision systems for real-time carcass analysis and precise cutting, enabling predictive maintenance, optimizing machine parameters for varied poultry sizes, and enhancing overall quality control and food safety protocols.

Which regions offer the most significant growth opportunities?

Asia Pacific offers the most significant growth opportunities due to its expanding poultry production and consumption, coupled with increasing investments in modernizing processing infrastructure. Latin America and MEA are also emerging as high-growth markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager