Power Battery Trays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434347 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Power Battery Trays Market Size

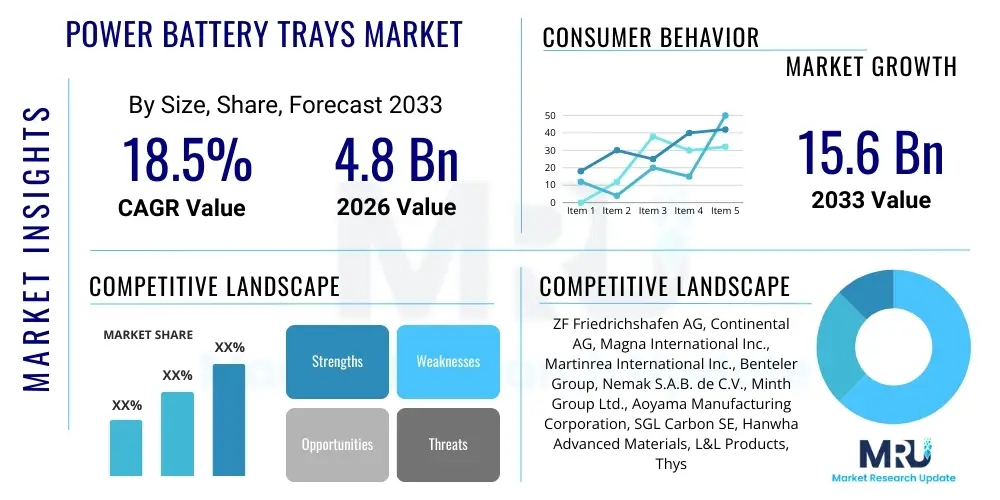

The Power Battery Trays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 billion in 2026 and is projected to reach USD 15.6 billion by the end of the forecast period in 2033.

Power Battery Trays Market introduction

The Power Battery Trays Market encompasses the design, manufacturing, and supply of protective enclosures essential for housing battery modules and packs in electric vehicles (EVs). These trays serve multiple critical functions, including structural support, thermal management integration, protection against environmental and mechanical hazards (such as crashes and road debris), and maintaining the electrical isolation of the high-voltage battery system. Driven primarily by the accelerating global transition towards electromobility, the demand for sophisticated, lightweight, and highly durable battery trays is surging. Original Equipment Manufacturers (OEMs) are increasingly focused on material science innovations, particularly utilizing aluminum alloys and advanced composites, to enhance energy density, maximize crash safety ratings, and reduce overall vehicle weight, directly impacting EV range and performance.

Product descriptions typically revolve around compliance with stringent safety standards (like ECE R100 and various regional crash tests) and thermal performance requirements. Modern battery trays are not merely passive enclosures; they are engineered systems that integrate complex cooling circuits, high-voltage wiring harnesses, and sophisticated sealing mechanisms. Major applications are predominantly found across Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and, increasingly, in heavy-duty electric commercial vehicles and buses. The market’s dynamism is characterized by continuous material substitution—moving from traditional steel toward high-strength aluminum extrusions, castings, and fiber-reinforced polymers—to achieve the twin goals of lightweighting and improved thermal conductivity.

The principal driving factors include favorable government policies, such as subsidies and stringent emission regulations globally, that mandate or encourage EV adoption. Furthermore, significant advancements in battery technology, which require more specialized and robust packaging solutions, fuel market growth. Benefits derived from optimized battery trays include extended battery life due to better thermal regulation, enhanced occupant safety during collisions by absorbing significant impact energy, and increased vehicle operational efficiency stemming from weight reduction. The market structure involves specialized automotive component suppliers, material providers, and collaborative partnerships between Tier 1 suppliers and EV manufacturers to co-develop platform-specific battery housing solutions.

Power Battery Trays Market Executive Summary

The Power Battery Trays Market is experiencing robust expansion, anchored by the rapid scaling of electric vehicle production globally and the concurrent technological evolution of battery pack architectures. Key business trends indicate a strategic pivot among suppliers towards vertical integration, encompassing design, prototyping, material sourcing (especially for specialty aluminum and carbon fiber), and manufacturing processes like high-pressure die casting and friction stir welding. Suppliers are heavily investing in localized production capabilities across major EV manufacturing hubs to mitigate supply chain risks and meet just-in-time delivery requirements. Furthermore, sustainability is becoming a paramount trend, driving research into recyclable materials and energy-efficient manufacturing processes, aligning with broader automotive industry circular economy goals.

Regional trends highlight Asia Pacific (APAC), led by China, as the dominant market due to massive domestic EV demand, favorable governmental support, and the presence of major battery and EV manufacturers. Europe is demonstrating exceptionally high growth rates, driven by stringent CO2 emission targets and significant investments in Gigafactories, fostering localized supply chain development, particularly in Germany and Scandinavia. North America is accelerating its adoption phase, propelled by supportive legislation like the Inflation Reduction Act (IRA), which incentivizes domestic manufacturing of critical EV components, including battery trays, thus attracting significant foreign direct investment into regional production facilities.

Segmentation trends show that the aluminum segment maintains market leadership due to its superior strength-to-weight ratio and excellent thermal dissipation properties, particularly for high-power BEVs. However, the composites segment, utilizing materials such as Glass Fiber Reinforced Polymers (GFRP) and Carbon Fiber Reinforced Polymers (CFRP), is witnessing the highest growth trajectory, primarily in premium or performance EV segments where maximum weight saving is crucial. By end-user, the passenger vehicle segment commands the largest market share, though the commercial vehicle segment (e-buses and e-trucks) is expanding rapidly, demanding larger, more complex, and heavier-duty battery enclosures capable of supporting higher energy loads and longer operational cycles.

AI Impact Analysis on Power Battery Trays Market

User queries regarding AI's impact on the Power Battery Trays Market often center on how Artificial Intelligence can optimize complex manufacturing processes, enhance material simulation capabilities, and accelerate the design cycle for improved crash safety and thermal performance. Common concerns include the deployment of predictive maintenance within battery enclosure production lines and leveraging AI for real-time quality control to ensure weld integrity and sealing precision. Users are primarily interested in AI’s role in managing the immense complexity introduced by multi-material battery trays and its potential to significantly reduce design-to-production timeframes, thereby lowering overall component costs in the highly competitive EV supply chain. AI promises transformative benefits in simulation accuracy and automated quality assurance.

- AI-driven topology optimization rapidly generates lightweight battery tray designs that meet specific stiffness and crash requirements, significantly reducing material consumption.

- Predictive maintenance algorithms use sensor data from production machinery (e.g., casting and stamping machines) to forecast equipment failures, minimizing downtime in high-volume manufacturing lines.

- Machine learning models enhance material property prediction for advanced composites and aluminum alloys, optimizing the blend and structural application for optimal thermal management.

- AI-powered visual inspection systems perform real-time quality assurance of complex welds, adhesive joints, and surface defects during the assembly process, exceeding human inspection capabilities.

- Generative design tools, fueled by AI, automate the creation of hundreds of design iterations based on safety constraints, cost targets, and thermal performance parameters.

- AI optimizes supply chain logistics for raw materials (aluminum billets, specialized resins) by predicting fluctuating demand from major EV OEMs, ensuring efficient inventory management.

- Simulation refinement using neural networks allows faster and more accurate virtual crash testing and thermal runaway analysis of the battery enclosure structure.

DRO & Impact Forces Of Power Battery Trays Market

The market dynamics are fundamentally shaped by the confluence of powerful drivers stemming from regulatory mandates and consumer demand, restrained by significant material and manufacturing complexities, while vast opportunities arise from technological shifts toward structural battery integration and multi-material systems. The primary driver is the governmental push for emission reduction and mass EV adoption, supported by massive public and private sector investments in the charging infrastructure. Restraints largely center on the high initial capital investment required for dedicated manufacturing facilities for high-precision components, coupled with fluctuating raw material prices, particularly for primary aluminum, which heavily influences production costs and profitability margins. The necessity for these trays to handle extreme operating conditions—thermal cycling, vibration, and severe impact protection—imposes highly demanding engineering specifications that restrict easy entry into the market for new players.

Opportunities are predominantly rooted in developing next-generation battery architectures. The shift toward cell-to-pack (CTP) and cell-to-chassis (CTC) designs necessitates integrating the battery tray directly into the vehicle structure, transforming it from a mere container into a primary load-bearing component. This structural integration opens avenues for innovative materials, such as hybrid steel and composite structures, and advanced bonding techniques. Furthermore, the burgeoning demand for standardized, modular battery platforms that can accommodate various EV models offers significant scaling opportunities for specialized suppliers who can deliver flexibility and cost efficiencies across diverse vehicle platforms.

The overall impact forces are high, characterized by rapid technological obsolescence and intense competitive pressure to deliver components that are simultaneously lighter, stronger, safer, and cheaper. The key impact forces driving supplier behavior are stringent safety regulations (UN ECE R100, FMVSS 305) which continuously elevate the required standards for fire resistance and crashworthiness. Furthermore, the push for weight reduction is a non-negotiable force, compelling continuous material science innovation. The market is defined by a high degree of integration between Tier 1 suppliers and OEMs, often resulting in long-term contracts and proprietary technology development, establishing significant barriers to entry for smaller or less technologically advanced firms.

Segmentation Analysis

The Power Battery Trays Market is comprehensively segmented based on material type, design methodology, end-user application, and battery capacity, allowing for a detailed analysis of specific market niches and growth vectors. Material segmentation is crucial as it dictates key performance attributes such as thermal conductivity, crash resistance, and weight. Design methodologies reflect the sophistication of modern manufacturing, ranging from traditional stamping to advanced high-pressure die casting (HPDC) and large-scale composite molding. Understanding these segments is vital for suppliers to align their manufacturing capabilities with OEM requirements for lightweighting and structural integrity, crucial for optimizing EV range and safety profiles across different vehicle classes.

The dominance of the passenger vehicle segment reflects the current market volume, but the fastest growth rate is observed within commercial vehicle applications due to global efforts to electrify logistics and public transport fleets. Furthermore, capacity segmentation differentiates between trays optimized for smaller, lower-voltage PHEV batteries and robust, high-voltage BEV platforms, which demand far more complex thermal management and structural reinforcement. This multifaceted segmentation framework aids in strategic planning, identifying where R&D efforts should be concentrated—for instance, focusing on high-volume aluminum HPDC for standard BEVs or specialized composite molding for premium, lightweight sports cars or long-haul trucks.

- By Material Type:

- Aluminum (Extrusions, Castings, Sheets)

- Composites (GFRP, CFRP, Sheet Molding Compound - SMC)

- Steel (High-Strength, Ultra High-Strength Steel - UHSS)

- Hybrid/Multi-Material Trays

- By Design Methodology:

- High-Pressure Die Casting (HPDC)

- Extrusion and Fabrication (Welded Structures)

- Stamping and Joining

- Composite Molding (Compression Molding)

- By End-User:

- Passenger Electric Vehicles (BEVs, PHEVs)

- Commercial Electric Vehicles (Buses, Trucks, Vans)

- By Battery Capacity:

- Below 100 kWh

- Above 100 kWh

Value Chain Analysis For Power Battery Trays Market

The value chain for the Power Battery Trays Market is characterized by highly specialized stages, beginning with upstream material providers and culminating in integration into the final EV assembly. Upstream analysis focuses on key material suppliers, including primary aluminum producers, specialized alloy manufacturers, and chemical companies supplying resins and fibers for composite construction. Price volatility and supply security of these raw materials, particularly aluminum billets and specialized high-strength steel sheets, directly impact the cost structure of the entire value chain. The initial manufacturing phase involves forming, casting, or molding the basic tray structure, demanding high capital expenditure and precision tooling.

Midstream activities involve Tier 1 automotive suppliers who take the raw structure and perform complex fabrication processes, including machining, thermal management integration (welding cooling plates), applying specialized coatings (for corrosion and fire resistance), and incorporating high-precision sealing gaskets. This stage requires rigorous quality control and often involves collaborative design partnerships with OEMs. Distribution channels are predominantly direct, with Tier 1 suppliers delivering large components on a just-in-time (JIT) basis directly to the OEM’s vehicle assembly lines. The physical size and specific nature of battery trays make inventory holding costly, mandating extremely efficient logistics and strong geographical proximity between supplier facilities and EV assembly plants.

Downstream analysis involves the EV OEMs and, subsequently, the end-users. The performance and safety of the battery tray are critical factors influencing the OEM’s brand reputation and regulatory compliance. Indirect distribution is minimal, primarily involving aftermarket replacements or specialized service centers, though the long lifespan of EVs means the primary focus remains on the initial supply to manufacturing lines. The trend toward cell-to-chassis (CTC) designs further tightens the integration between the battery tray manufacturer and the OEM vehicle platform designer, blurring the lines between component supply and structural vehicle manufacturing, emphasizing the need for robust direct partnerships.

Power Battery Trays Market Potential Customers

The primary customers for power battery trays are the major global Original Equipment Manufacturers (OEMs) specializing in electric vehicle production. These buyers demand sophisticated, structurally sound, and thermally efficient components that integrate seamlessly into their proprietary electric platforms. Given the safety-critical nature of battery enclosures, purchasing decisions are based heavily on supplier capability in advanced material science, manufacturing consistency, adherence to strict automotive quality standards (IATF 16949), and proven crashworthiness performance. Customers include established automotive giants rapidly electrifying their fleets and specialized pure-play EV manufacturers who often pioneer new structural designs.

A secondary, rapidly growing customer segment includes specialized manufacturers of electric commercial vehicles, such as electric bus and truck manufacturers. These end-users require custom-designed, heavy-duty trays optimized for high payloads, long operational cycles, and modularity to accommodate varying battery capacities. Furthermore, leading independent battery pack assemblers, who supply modules to smaller OEMs or convert conventional vehicles, also represent a significant, though often volume-constrained, customer base. The trend is moving towards larger, multi-year contracts with suppliers capable of supporting global production footprint scaling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Continental AG, Magna International Inc., Martinrea International Inc., Benteler Group, Nemak S.A.B. de C.V., Minth Group Ltd., Aoyama Manufacturing Corporation, SGL Carbon SE, Hanwha Advanced Materials, L&L Products, ThyssenKrupp AG, Webasto Group, Hitachi Metals Ltd., Hydro Extruded Solutions, Constellium SE, CIE Automotive S.A., KIRCHHOFF Automotive GmbH, Montaplast GmbH, Trelleborg AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Battery Trays Market Key Technology Landscape

The technology landscape for power battery trays is rapidly evolving, driven by the need to meet stringent lightweighting targets while significantly improving safety metrics, particularly protection against mechanical intrusion and thermal runaway propagation. A primary technological focus is on advanced joining techniques, moving beyond conventional welding to sophisticated methods like friction stir welding (FSW) for aluminum structures, which ensures higher structural integrity and reduces heat-affected zones, critical for maintaining the mechanical properties of specialized aluminum alloys. Furthermore, the use of structural adhesives and advanced bonding agents in multi-material trays is crucial for joining dissimilar materials (e.g., aluminum and composites) to achieve optimal hybrid performance.

Another major technological area involves advanced material processing. For aluminum components, high-pressure die casting (HPDC) is gaining traction, enabling the production of large, highly complex, single-piece tray structures that minimize assembly steps, reduce potential leak paths, and improve overall stiffness. For composite trays, automated compression molding (ACM) techniques using SMC or carbon fiber reinforced thermoplastics are essential for achieving the required tolerances and surface quality at high volumes. These technologies are integral to the industry’s push toward simplified battery architectures like cell-to-pack, which rely on the tray performing multiple structural and containment roles.

Thermal management integration constitutes a critical technological component. Battery trays increasingly incorporate complex internal channels or dedicated cooling plates (often manufactured using cold-plate technology) directly into the housing design to manage heat effectively. Fire protection is also a rapidly advancing field, employing intumescent coatings, ceramic barriers, and specialized fire-resistant polymers integrated within the tray structure to delay or prevent thermal runaway propagation between cells or from the battery pack to the vehicle cabin. Continuous digital twins and simulation technologies are essential tools used by manufacturers to validate the performance of these complex technologies before physical prototyping.

Regional Highlights

Regional variations in the Power Battery Trays Market reflect disparities in EV adoption rates, local manufacturing capabilities, and regulatory environments, influencing supplier strategies and technology deployment. Asia Pacific dominates the global market, primarily propelled by aggressive EV targets set by China, which boasts the world's largest EV production capacity and a substantial domestic supply chain for battery components and materials. The region benefits from high manufacturing efficiency and scale, leading to competitive pricing structures for power battery trays. Countries like South Korea and Japan, while smaller in volume, contribute significantly through technological leadership, particularly in advanced materials and high-precision casting techniques.

Europe represents the fastest-growing market, driven by mandatory phase-outs of internal combustion engines and significant infrastructure investments. German automotive giants and emerging Nordic EV manufacturers require highly localized, technologically advanced supply chains. The demand here is skewed towards premium, high-performance battery trays, often incorporating sophisticated lightweight composite materials or large-scale aluminum castings to meet demanding European safety standards and weight specifications. Government initiatives supporting Gigafactory development further solidify Europe's position as a critical future manufacturing hub for these components.

North America (NA) is undergoing a significant transformation, fueled by policy support like the US Inflation Reduction Act (IRA), which emphasizes domestic content and localized manufacturing. This legislation is rapidly attracting investment from both domestic and international Tier 1 suppliers to establish new battery tray production facilities across the United States, Canada, and Mexico. The market demand in NA is focusing on high-volume production for large SUV and truck platforms transitioning to electrification, requiring robust, larger-format battery enclosures designed for long-range, high-capacity BEVs. Latin America and the Middle East & Africa (MEA) remain nascent markets but show potential, driven by regional policy shifts favoring sustainable transport solutions, primarily focused on electric public transportation initially.

- Asia Pacific (APAC): Market leader driven by China's colossal EV production; focus on cost efficiency, scale, and established aluminum processing capabilities.

- Europe: Highest growth region fueled by stringent emission standards; strong emphasis on premium materials, lightweighting (composites), and localized supply chain development near Gigafactories.

- North America (NA): Rapidly expanding due to IRA incentives; investment in domestic high-volume manufacturing tailored for large EV platforms (trucks/SUVs); demand for robust safety features.

- Latin America & MEA: Emerging markets concentrating initial electrification efforts on public transport fleets, driving demand for heavy-duty, often modular, battery tray systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Battery Trays Market.- ZF Friedrichshafen AG

- Continental AG

- Magna International Inc.

- Martinrea International Inc.

- Benteler Group

- Nemak S.A.B. de C.V.

- Minth Group Ltd.

- Aoyama Manufacturing Corporation

- SGL Carbon SE

- Hanwha Advanced Materials

- L&L Products

- ThyssenKrupp AG

- Webasto Group

- Hitachi Metals Ltd.

- Hydro Extruded Solutions

- Constellium SE

- CIE Automotive S.A.

- KIRCHHOFF Automotive GmbH

- Montaplast GmbH

- Trelleborg AB

Frequently Asked Questions

Analyze common user questions about the Power Battery Trays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used for modern power battery trays?

The primary materials are aluminum (used widely for its lightweight and thermal properties, often via casting or extrusion), advanced composites (like CFRP and GFRP for maximum weight reduction in premium vehicles), and high-strength steel (used primarily in structural components or less demanding applications). Multi-material hybrid structures are also increasingly common to optimize performance and cost.

How does the shift to cell-to-pack (CTP) architecture impact battery tray design?

The CTP shift integrates the battery tray more closely with the vehicle structure, requiring the tray to handle significant structural loads rather than acting solely as an enclosure. This demands larger, more complex single-piece castings or high-strength composite designs, focusing heavily on enhanced stiffness, crash energy absorption, and thermal management integration within the structural component itself.

What are the key safety requirements driving innovation in power battery trays?

Innovation is primarily driven by mandates for enhanced crash protection (minimizing intrusion and ensuring component integrity during impact) and strict thermal runaway mitigation. Trays must integrate fire barriers, specialized coatings, and robust sealing systems to prevent heat propagation between cells and isolate the battery system from the vehicle cabin and external environment.

Which geographic region holds the largest market share for battery trays?

Asia Pacific (APAC), particularly China, currently holds the largest market share due to its overwhelming dominance in global electric vehicle manufacturing volume and established supply chain infrastructure. However, Europe and North America are projected to exhibit the highest growth rates over the forecast period driven by rapid electrification mandates and localized production incentives.

What role does High-Pressure Die Casting (HPDC) play in battery tray manufacturing?

HPDC is a critical manufacturing process, especially for large aluminum battery trays, as it allows for the production of highly complex, monolithic (single-piece) structures. This method minimizes welding points, improves dimensional accuracy, enhances structural rigidity, and is essential for achieving the leak-tightness and safety requirements demanded by modern high-voltage battery systems in mass-produced EVs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager