Power Converter and Inverter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436150 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Power Converter and Inverter Market Size

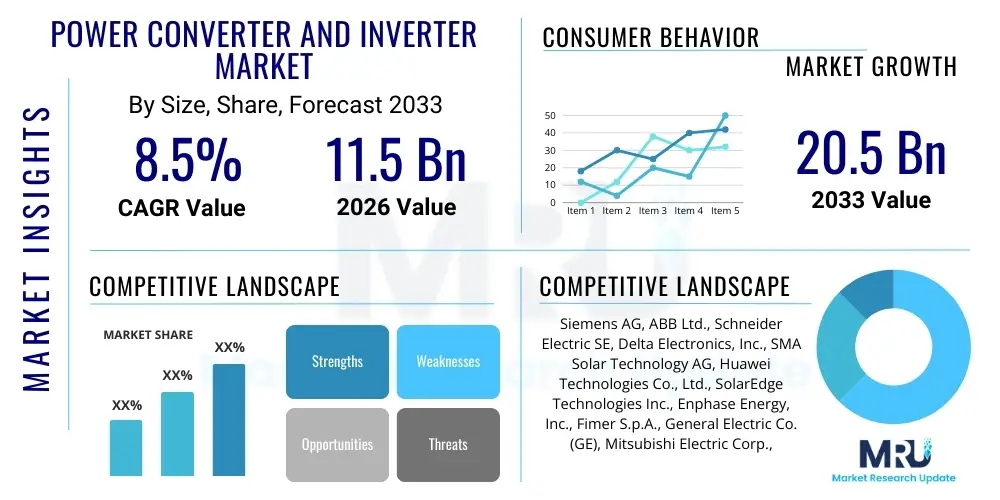

The Power Converter and Inverter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 20.5 billion by the end of the forecast period in 2033.

Power Converter and Inverter Market introduction

The Power Converter and Inverter Market encompasses devices essential for managing electrical power flow by converting DC power to AC power (inverters) or changing the voltage and frequency characteristics of AC or DC power (converters). These systems are fundamental components in renewable energy infrastructure, electric vehicle charging stations, uninterrupted power supplies (UPS), and various industrial motor drive applications. The primary benefits include enhancing energy efficiency, ensuring stable power delivery, and enabling the integration of diverse power sources, particularly intermittent sources like solar and wind. Key driving factors fueling market expansion include stringent government mandates promoting decarbonization, rapid urbanization leading to increased power demand, and significant technological advancements focused on developing high-efficiency, compact, and reliable silicon carbide (SiC) and gallium nitride (GaN) based power electronics.

Power Converter and Inverter Market Executive Summary

Global business trends indicate a robust pivot toward distributed power generation, heavily influencing the demand for smart, grid-tied inverters capable of sophisticated communication and fault detection. Technological innovation, particularly in wide-bandgap semiconductors, is defining the competitive landscape, leading to higher power density and reduced system losses. Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, exhibits the fastest growth due to massive investments in utility-scale solar farms and EV manufacturing infrastructure. North America and Europe maintain strong market shares driven by grid modernization projects and favorable policies supporting residential solar adoption. Segment trends show that the solar PV segment dominates the inverter market, while the high-voltage direct current (HVDC) converter segment is experiencing accelerated growth due to long-distance bulk power transmission requirements, emphasizing efficiency and stability across the entire power grid architecture.

AI Impact Analysis on Power Converter and Inverter Market

User inquiries frequently center on how artificial intelligence can optimize the operational performance and predictive maintenance of power conversion systems. Key themes highlight the expectation that AI and machine learning (ML) algorithms will revolutionize fault detection, improve grid synchronization, and enhance the overall efficiency curves of inverters, especially under dynamic load conditions. Concerns often revolve around the computational resources required for real-time data processing and the cybersecurity vulnerabilities associated with integrating smart, AI-driven components into critical energy infrastructure. Users anticipate that AI integration will lead to more intelligent energy management systems capable of adapting autonomously to supply fluctuations, thereby increasing the lifespan and reliability of high-cost power electronics and optimizing renewable energy harvesting across different climatic zones.

- Enhanced Predictive Maintenance: AI analyzes operational data (temperature, voltage, current harmonics) to anticipate component failures, reducing downtime.

- Optimized Power Flow Management: ML algorithms dynamically adjust switching frequencies and phase angles for maximum efficiency and reduced harmonic distortion.

- Improved Grid Integration: AI-driven inverters provide sophisticated grid-forming capabilities, managing stability in high-penetration renewable energy grids.

- Automated Fault Diagnosis: Rapid and precise identification of transient faults, minimizing cascading failures within complex power systems.

- Design Optimization: AI tools accelerate the development cycle by simulating complex thermal and electrical stress profiles for new converter architectures.

DRO & Impact Forces Of Power Converter and Inverter Market

The market is primarily driven by the escalating global shift towards sustainable energy sources, necessitating efficient power conversion for renewable integration. Restraints include the high initial capital investment required for implementing advanced power electronics, particularly those using wide-bandgap materials, and the need for standardized regulatory frameworks across diverse geographies. Opportunities arise from the rapidly expanding electric vehicle ecosystem, which demands specialized high-power DC-DC and DC-AC converters for battery management and charging infrastructure. Impact forces are predominantly shaped by technological innovation, regulatory compliance surrounding grid codes, and volatile raw material pricing for semiconductor components. The cumulative impact of these forces strongly favors market growth, contingent upon continued cost reduction through mass production and advancements in semiconductor material science.

Segmentation Analysis

The Power Converter and Inverter Market is extensively segmented based on the product type, power rating, end-user industry, and technology implemented. This granular segmentation allows manufacturers to target specific high-growth areas, such as modular inverters for distributed solar applications or specialized high-frequency DC-DC converters required for data center power supplies. Understanding these segments is crucial as market dynamics vary significantly; for instance, the industrial sector demands high reliability and robust thermal management, while the renewable sector prioritizes efficiency and low maintenance costs. The increasing complexity of power grids and the proliferation of IoT devices further necessitate the development of highly customized conversion solutions tailored to specific voltage and frequency requirements across various operating environments.

- Product Type:

- DC-AC Inverters

- AC-DC Converters

- DC-DC Converters

- AC-AC Converters (Cycloconverters)

- Power Rating:

- Low Power (< 10 kW)

- Medium Power (10 kW – 100 kW)

- High Power (> 100 kW)

- Technology:

- Silicon (Si) Based

- Silicon Carbide (SiC) Based

- Gallium Nitride (GaN) Based

- End-User Industry:

- Renewable Energy (Solar, Wind)

- Automotive (Electric Vehicles, Charging Infrastructure)

- Consumer Electronics

- Industrial (Motor Drives, Robotics)

- Utility and Infrastructure (HVDC, Smart Grids, UPS)

Value Chain Analysis For Power Converter and Inverter Market

The value chain for power converters and inverters is complex, spanning from fundamental semiconductor manufacturing to final system integration and post-sales maintenance. Upstream activities are dominated by the procurement of key raw materials, primarily silicon wafers, wide-bandgap substrates (SiC, GaN), high-performance capacitors, and magnetic components. The efficiency and cost structure of the final product are heavily dependent on the quality and availability of these components, making reliable sourcing a critical competitive factor. Semiconductor fabrication, involving intricate lithography and doping processes, represents the highest capital-intensive stage upstream. Manufacturers often engage in strategic partnerships with specialized component suppliers to ensure stable supply chains and leverage scale effects for cost optimization.

Midstream activities involve the design, assembly, and testing of the converter/inverter modules. This stage is characterized by intense intellectual property development related to control algorithms, thermal management systems, and packaging technologies. Firms focus heavily on designing compact systems that maximize power density while minimizing electromagnetic interference (EMI). The integration of cooling systems, often employing liquid or advanced air cooling, is crucial for high-power applications, particularly in the automotive and utility segments. Quality assurance and compliance testing against international standards (e.g., IEC, UL) are rigorous requirements at this stage, ensuring product reliability and safety for grid connection and consumer use.

Downstream activities center on distribution, installation, and after-sales services. Distribution channels are highly varied; large utility-scale inverters are often sold directly to EPC (Engineering, Procurement, and Construction) firms, while residential inverters are frequently distributed through wholesale electrical distributors or specialized solar installers. Indirect channels, such as authorized resellers and value-added distributors, play a crucial role in providing local support and system integration expertise. After-sales service, including remote monitoring, firmware updates, and predictive maintenance programs utilizing IoT connectivity, is becoming increasingly vital, transforming the business model from product sales to comprehensive energy management solutions. This shift necessitates robust digital infrastructure and a highly trained technical service workforce.

The entire value chain is characterized by a high degree of specialization and globalization. The trend towards modularity and standardization in component interfaces, although challenging given the custom nature of high-power systems, is aimed at improving supply chain resilience. Manufacturers are increasingly vertically integrating critical steps, such as developing proprietary power modules (e.g., SiC modules), to gain a cost advantage and maintain control over performance characteristics. Furthermore, circular economy principles are beginning to influence the downstream end, with growing emphasis on the repairability and eventual recycling of expensive components, driven both by regulatory pressure and corporate sustainability goals. The interconnectedness of the supply chain means disruptions in semiconductor manufacturing, often concentrated geographically, have immediate and profound impacts on the price and availability of finished converter products globally. Effective risk management across the entire value chain is paramount for sustained market participation and competitive advantage in this dynamic sector.

The rise of customized power solutions for specialized environments, such as marine propulsion systems or high-altitude aerospace applications, introduces further complexity into the value chain. These niche applications require exceptionally rigorous testing protocols and adherence to unique certification standards, often leading to smaller production runs but higher margins. The integration of advanced diagnostics into the converter firmware, enabled by microcontrollers and digital signal processors (DSPs), enhances the value proposition at the final consumer level by providing real-time performance feedback and facilitating remote commissioning. This necessitates strong collaboration between the semiconductor providers and the system integrators, ensuring seamless hardware-software compatibility. This collaborative approach minimizes integration risk and accelerates time-to-market for complex, high-reliability products essential for critical infrastructure operations.

The competitive landscape within the value chain is also shaped by intellectual property battles, particularly concerning patented switching topologies and modulation techniques designed to maximize efficiency under partial load conditions. Companies that invest heavily in R&D to develop novel high-frequency switching strategies often gain a distinct advantage in terms of power density and reduced component size, which is critical in space-constrained applications like electric vehicles. Furthermore, the selection of distribution channels heavily influences brand visibility and customer trust; direct sales models are favored for large utility purchases where technical consultation is essential, while established electrical wholesalers are leveraged for high-volume, standardized commercial and residential products. The optimization of logistics, especially for large, heavy high-power converter units, adds another layer of cost consideration to the downstream activities, requiring specialized handling and transport infrastructure, particularly for global shipments across continents, thus impacting the final installation cost for end-users.

Power Converter and Inverter Market Potential Customers

Potential customers for power converters and inverters span a wide array of high-growth industries focused on electrification and energy efficiency. These customers include large utility companies investing in grid modernization and HVDC transmission links, renewable energy project developers requiring maximum power point tracking (MPPT) inverters for solar and wind farms, and global automotive OEMs rapidly transitioning their fleets to electric vehicles. Furthermore, the industrial sector, encompassing manufacturers relying on variable frequency drives (VFDs) for motor control and automation, represents a stable and high-volume customer base. Crucially, the burgeoning data center industry is a major consumer, demanding highly efficient, redundant UPS systems utilizing advanced power converters to ensure continuous operation and minimize energy waste in critical cooling and computing infrastructure.

The primary purchasing drivers for these diverse customer segments are centered around reliability, system efficiency, and total cost of ownership (TCO). Utility companies prioritize highly durable, modular converters that offer long operational lifespans and stringent grid compliance features to ensure national power stability. Renewable project developers, driven by LCOE (Levelized Cost of Electricity) targets, seek high-efficiency inverters that maximize energy harvest from intermittent sources, making conversion losses a critical purchasing criterion. Conversely, automotive manufacturers prioritize power density, size, weight, and thermal performance, as these factors directly impact vehicle range and charging speed. The decision-making process often involves long-term evaluation of supplier track records, availability of localized technical support, and the adherence to regional safety and environmental standards, particularly within highly regulated markets such as the European Union and North America.

Furthermore, residential customers, although purchasing lower-power units, constitute a massive and increasingly sophisticated customer base, particularly in regions with high electricity tariffs and strong solar incentive programs. Their purchasing decisions are heavily influenced by ease of installation, integration with smart home ecosystems, and aesthetically pleasing designs, moving beyond purely technical specifications. System integrators and EPC contractors act as significant intermediaries, influencing component selection based on ease of integration and warranty coverage offered by the converter manufacturer. This emphasizes the importance of providing comprehensive, modular solutions that simplify the commissioning process. The growing emphasis on energy resilience also drives demand from commercial and industrial (C&I) customers for robust backup power solutions (e.g., microgrids and battery energy storage systems), where the bidirectional power conversion capabilities of advanced inverters are indispensable for managing complex load profiles and seamless islanding operations during grid outages.

Specific sub-segments within the industrial market, such as heavy machinery manufacturing and metallurgical processing, demand exceptionally robust and high-current converters capable of handling transient overloads and operating reliably in harsh environments characterized by dust, vibration, and extreme temperatures. These demanding applications necessitate specialized converter designs with enhanced protective features and superior thermal dissipation capabilities, making them distinct from the requirements of the consumer or typical commercial segment. The longevity of components and the availability of replacement parts over decades are key considerations for industrial buyers, leading to strong vendor loyalty when product performance is proven. Moreover, the military and aerospace sectors represent niche but high-value customer groups, demanding ultra-lightweight, high-reliability, and radiation-tolerant power conversion systems that comply with stringent defense and flight safety specifications. These customers often drive innovation in miniaturization and wide-bandgap technology, setting high benchmarks for the entire industry regarding component quality and operational assurance in extreme conditions.

Governmental and public infrastructure customers, including municipal transit systems utilizing electric buses or rail networks, also constitute a major segment. These entities require high-reliability charging infrastructure and robust wayside power supplies, characterized by long-term procurement cycles and meticulous adherence to public tendering processes. Their focus is often on securing competitive lifetime maintenance contracts alongside the product purchase, favoring suppliers who can guarantee extended operational support and compatibility with legacy systems. The proliferation of battery energy storage systems (BESS) across utility and commercial scales further solidifies BESS integrators as a critical customer group. These integrators specifically require bidirectional inverters (BMS and PCS) optimized for battery chemistry and charging cycles, capable of rapid response to grid frequency fluctuations, and providing ancillary services to the grid operator. Their purchasing decisions are uniquely driven by the inverter's ability to efficiently manage energy flow between the grid, the storage medium, and the load, maximizing the financial return on the substantial BESS investment.

In the telecommunications sector, the relentless expansion of 5G infrastructure necessitates dense deployments of remote radio heads (RRHs) and base stations, all requiring compact, highly efficient DC-DC converters for stable power supply. Telecom operators prioritize systems with minimal footprint, high tolerance for fluctuating input voltage, and remote monitoring capabilities to reduce operational expenditures associated with maintaining geographically dispersed sites. This continuous demand cycle in telecoms provides a consistent market for low-to-medium power density converters. Furthermore, the specialized field of medical imaging, including MRI and CT scanners, demands highly stable, precision power supplies to ensure imaging accuracy and patient safety. These medical device manufacturers are a customer segment where regulatory approval and absolute power quality trump cost, driving demand for converters with extremely low ripple and noise characteristics, requiring suppliers to meet rigorous regulatory compliance, such as ISO 13485. This illustrates the market's diversity, where different customer needs dictate fundamentally different product specifications and purchasing priorities, reinforcing the need for highly specialized product portfolios across the major market vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 20.5 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Schneider Electric SE, Delta Electronics, Inc., SMA Solar Technology AG, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Enphase Energy, Inc., Fimer S.p.A., General Electric Co. (GE), Mitsubishi Electric Corp., Danfoss A/S, V-Guard Industries Ltd., Toshiba Corporation, TMEIC Corporation, Hitachi, Ltd., Vertiv Holdings Co, Sensata Technologies, Inc., TDK Corporation, Bel Fuse Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Converter and Inverter Market Key Technology Landscape

The technological landscape of the power converter and inverter market is undergoing a profound transformation driven primarily by the shift from traditional silicon (Si) insulated-gate bipolar transistors (IGBTs) and metal-oxide-semiconductor field-effect transistors (MOSFETs) to wide-bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC technology is rapidly gaining traction in high-power, high-voltage applications such as electric vehicle traction inverters and utility-scale solar inverters due to its superior switching speed, lower switching losses, and ability to operate effectively at higher temperatures. These characteristics significantly improve overall system efficiency, reduce the size and weight of passive components (like inductors and capacitors), and ultimately enhance power density, which is critical for compact installations.

GaN technology, while newer to the mass market, is making significant inroads in low-to-medium power applications, particularly in consumer electronics, data center power supplies, and onboard chargers for EVs. GaN offers even higher switching speeds than SiC, enabling ultra-compact designs and higher power density in the lower voltage ranges (typically below 650V). The concurrent maturation of digital control technologies, including advanced Digital Signal Processors (DSPs) and Field-Programmable Gate Arrays (FPGAs), allows for more sophisticated control algorithms. These algorithms enable complex functions like Maximum Power Point Tracking (MPPT), sophisticated grid synchronization (Grid-Forming Inverters), and enhanced harmonic mitigation, optimizing the system performance under real-world, fluctuating operating conditions and ensuring seamless integration with modern smart grids.

Furthermore, innovations in topology design, such as multilevel inverters (e.g., Neutral Point Clamped - NPC, Flying Capacitor - FC) and modular multilevel converters (MMCs), are crucial for handling extremely high voltages in HVDC transmission systems and large industrial motor drives. MMCs, in particular, offer high reliability and modularity, simplifying maintenance while reducing the total harmonic distortion injected into the grid. Beyond semiconductor and topology advancements, the focus is increasingly turning towards thermal management and packaging technologies. Advanced liquid cooling systems and robust power module packaging are essential for extracting the full performance benefits from SiC and GaN devices, enabling higher current densities without compromising device reliability or thermal lifespan. This holistic technological approach—combining advanced materials, complex digital controls, and effective thermal solutions—is defining the next generation of highly efficient and reliable power conversion systems necessary for the global energy transition.

A critical area of development involves battery energy storage system (BESS) inverters, which are inherently bidirectional. These systems require sophisticated algorithms not only for efficient DC-AC conversion but also for managing the health and lifespan of the attached battery bank through precise charging and discharging cycles. Research focuses on optimizing the pulse width modulation (PWM) techniques to minimize ripple current and maximize battery longevity while offering fast response times essential for ancillary grid services like frequency regulation. The interoperability challenge, ensuring that inverters from different vendors can communicate and coordinate effectively within a microgrid environment, is being addressed through open standards and communication protocols. This standardization effort is vital for facilitating scalable and decentralized power generation and storage infrastructure.

Another emerging technology gaining traction is the use of high-frequency transformers and resonant topologies, which dramatically reduce the size and weight of passive magnetic components within the converter structure. By increasing the switching frequency well into the megahertz range, especially utilizing GaN switches, manufacturers can create power bricks that are significantly smaller and lighter than their Si-based predecessors. This is particularly relevant for consumer electronics and aerospace applications where size and weight are critically constrained parameters. The technological race is also accelerating in the area of reliability engineering. Advanced techniques, including embedding sensors within the power modules themselves and using machine learning models to analyze the degradation of key components, are being deployed. This predictive reliability technology promises to extend the operational life of converters and shift maintenance strategies from reactive to proactive, resulting in lower TCO for utility and industrial end-users globally and reinforcing the confidence in next-generation power electronics.

The push for grid-forming capabilities represents a major technological pivot. Traditional inverters were designed to be 'grid-following,' relying on the existing grid signal for synchronization. However, with high penetration of renewables, the grid is losing inertia, prompting the need for 'grid-forming' inverters. These advanced inverters utilize sophisticated virtual synchronous machine (VSM) algorithms to actively regulate voltage and frequency, acting as a synthetic source of inertia and supporting grid stability even when isolated or forming a microgrid. This VSM technology is crucial for achieving high renewable energy targets without destabilizing legacy transmission infrastructure. Furthermore, cybersecurity is now treated as a core technological requirement rather than an afterthought. As inverters become connected IoT devices communicating with utility operators and cloud platforms, advanced encryption, secure boot processes, and intrusion detection systems are being integrated at the hardware and firmware level to protect the energy infrastructure from malicious attacks, reflecting the growing regulatory scrutiny on critical power assets.

Regional Highlights

The Asia Pacific (APAC) region stands as the dominant and fastest-growing market for power converters and inverters, driven by unprecedented investments in renewable energy and the massive scale of electric vehicle manufacturing, particularly in China and India. China's ambitious national goals for carbon neutrality and its dominance in solar PV panel production necessitate enormous corresponding demand for high-efficiency string and central inverters. Furthermore, government policies supporting rapid industrialization and urbanization in Southeast Asian nations are fueling demand for reliable power conditioning equipment in the industrial and utility sectors. The region benefits from lower manufacturing costs and substantial governmental support for electrification projects, making it the primary hub for both production and consumption of power electronics globally.

North America maintains a robust market share, characterized by high adoption rates of residential and commercial rooftop solar and significant expenditures on grid modernization initiatives. The market in the United States, propelled by regulatory incentives like the Inflation Reduction Act (IRA), is witnessing a surge in domestic manufacturing and deployment of battery energy storage systems (BESS), which heavily rely on bidirectional inverters. Key market activities focus on integrating smart inverter technology to comply with evolving state-level grid codes (e.g., IEEE 1547 standards), ensuring enhanced grid resilience and stability. Canada's sustained investment in utility-scale wind and hydro projects also drives significant demand for specialized high-power converters tailored for these large infrastructure projects.

Europe represents a mature yet highly dynamic market, strongly supported by the European Union's aggressive climate targets and comprehensive renewable energy directives. The region is a leader in adopting advanced power electronics, particularly SiC-based inverters for high-end automotive applications and sophisticated DC-DC converters for data center power optimization, driven by strict energy efficiency mandates. Germany, Italy, and Spain are leading the deployment of solar and wind energy, creating consistent demand for high-performance string and central inverters. Furthermore, the expansion of transnational HVDC links across Northern and Southern Europe to balance renewable generation requires substantial deployment of modular multilevel converters (MMCs), positioning the region at the forefront of high-voltage conversion technology and market growth.

Latin America (LATAM) shows promising growth, primarily led by utility-scale solar projects in Brazil, Chile, and Mexico, regions endowed with excellent solar irradiation resources. Market penetration remains constrained by economic volatility and infrastructure development challenges, yet the long-term trend favors expansion as countries seek to diversify their energy mix away from fossil fuels. The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) countries, are making substantial commitments to diversify their economies and energy production through large-scale solar power complexes, such as the Mohammed bin Rashid Al Maktoum Solar Park in the UAE. These massive utility projects generate demand for robust, high-temperature tolerant converters and inverters capable of enduring the harsh desert climate, often incorporating advanced cooling solutions and specialized packaging to ensure long-term reliability under extreme operating conditions.

Specific regional nuances also influence technology selection. In regions prone to grid instability, such as parts of India and Southeast Asia, the reliability and fault-tolerance of the inverter are prioritized over marginal efficiency gains. This leads to strong demand for robust, sometimes oversized, power electronics designed for harsh electrical environments. Conversely, in the highly regulated and stable European grid, the focus shifts to maximizing efficiency and sophisticated grid support functions, where the financial incentives for providing ancillary services justify the higher cost of advanced wide-bandgap components. The competitive environment also varies; APAC is characterized by intense price competition among local and international players, whereas North America and Europe often prioritize established brand reputations and compliance certifications, leading to a more consolidated supply base dominated by key global manufacturers with proven track records in reliability and safety standards adherence. This global diversity necessitates that manufacturers tailor their product portfolio, offering cost-optimized solutions for emerging markets and high-performance, feature-rich products for established, premium markets to capture the full spectrum of global demand and maintain diversified revenue streams across all major continents. The localized grid codes and interconnection requirements further segment the market, compelling firms to invest in regional compliance testing and certification teams.

- North America: Focus on grid resilience, residential BESS, and compliance with IEEE 1547 smart inverter standards. Key markets: USA, Canada.

- Europe: High adoption of SiC technology for EVs, emphasis on HVDC transmission, and aggressive decarbonization targets. Key markets: Germany, UK, Spain.

- Asia Pacific (APAC): Dominant market volume driven by utility-scale solar, massive EV production, and industrial growth. Key markets: China, India, Japan.

- Latin America (LATAM): Emerging market potential driven by large solar PV projects, particularly in Brazil and Chile.

- Middle East and Africa (MEA): High demand for robust, high-temperature tolerant inverters for large-scale solar parks in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Converter and Inverter Market.- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Delta Electronics, Inc.

- SMA Solar Technology AG

- Huawei Technologies Co., Ltd.

- SolarEdge Technologies Inc.

- Enphase Energy, Inc.

- Fimer S.p.A.

- General Electric Co. (GE)

- Mitsubishi Electric Corp.

- Danfoss A/S

- Toshiba Corporation

- TMEIC Corporation

- Hitachi, Ltd.

- Vertiv Holdings Co

- Sensata Technologies, Inc.

- TDK Corporation

- Bel Fuse Inc.

- Luminous Power Technologies (Pvt) Ltd.

Frequently Asked Questions

What is the projected growth rate (CAGR) for the Power Converter and Inverter Market?

The Power Converter and Inverter Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8.5% over the forecast period spanning from 2026 to 2033, driven primarily by renewable energy integration and EV adoption.

How are Wide-Bandgap semiconductors, like SiC and GaN, impacting the market?

SiC and GaN semiconductors are significantly increasing inverter efficiency, enabling higher power density, and reducing system losses. This technological shift allows for smaller, lighter, and more reliable converters crucial for electric vehicles and high-voltage grid applications.

Which end-user segment drives the highest demand for power converters and inverters?

The Renewable Energy segment, particularly utility-scale solar PV and wind power generation, currently drives the highest volume of demand for high-efficiency, grid-tied inverters and power conditioning systems globally.

What role does AI play in optimizing power conversion systems?

AI is used for enhanced predictive maintenance, analyzing operational data to anticipate failures, and optimizing control algorithms for power flow management, leading to improved efficiency and increased grid stability in smart inverters.

Which geographical region holds the largest market share in power conversion?

The Asia Pacific (APAC) region currently holds the largest market share and is expected to maintain the highest growth trajectory, fueled by rapid infrastructure development and extensive government investments in green energy projects in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager