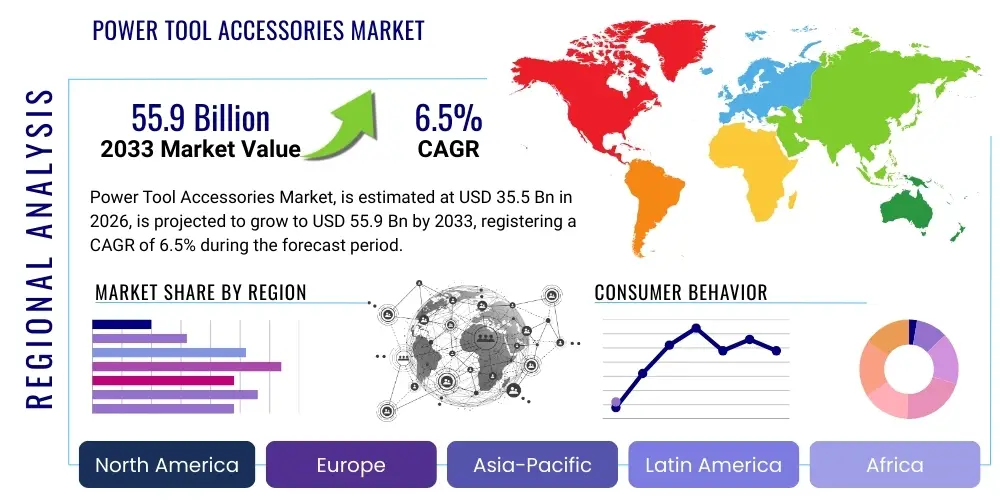

Power Tool Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436075 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Power Tool Accessories Market Size

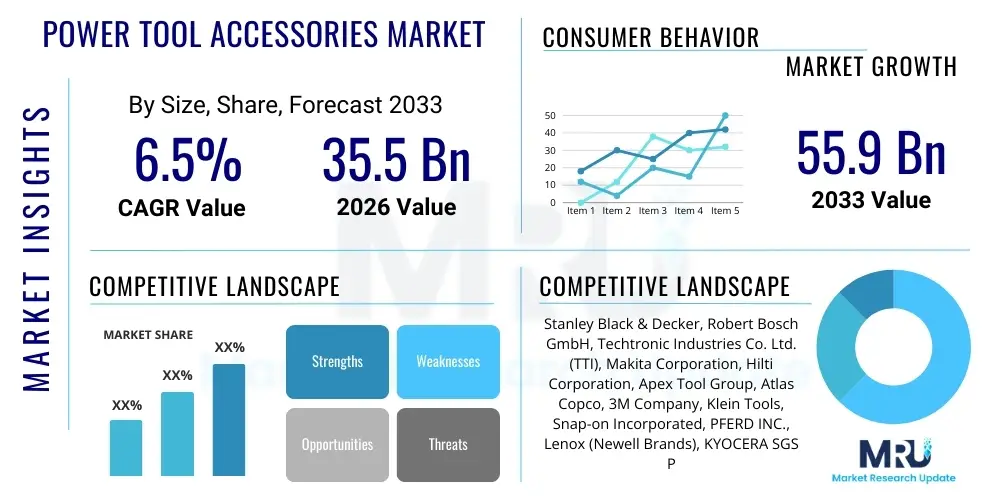

The Power Tool Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $35.5 Billion USD in 2026 and is projected to reach $55.9 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the robust growth in global construction activities, coupled with increasing consumer interest in Do-It-Yourself (DIY) projects and home renovation across developed and rapidly developing economies. The professional segment, including industries such as automotive, aerospace, and general manufacturing, consistently demands high-quality, durable, and precision-engineered accessories, thereby propelling market valuation significantly.

Power Tool Accessories Market introduction

The Power Tool Accessories Market encompasses essential consumables and attachments designed to enhance the functionality, precision, and longevity of power tools, ranging from professional-grade equipment used in heavy industry to consumer-grade devices utilized for domestic repairs. These accessories, including drilling bits, saw blades, grinding wheels, sanding pads, and battery systems, are crucial components that determine the efficiency and output quality of the underlying power tool. The continuous innovation in materials science, particularly the use of specialized coatings like diamond and carbide, ensures improved performance and reduced wear rates, catering to rigorous industry demands and increasing the replacement cycle frequency, which boosts market revenue.

Major applications for power tool accessories span several verticals, primarily focusing on construction, woodworking, metalworking, automotive maintenance, and general fabrication. Benefits derived from utilizing high-quality accessories include enhanced operational safety, significant improvements in task completion time, higher precision finishes, and extended tool lifespan. Furthermore, the trend toward cordless power tools necessitates the development of advanced, long-lasting battery accessories and efficient charging systems, further diversifying the market portfolio. These advancements are instrumental in meeting the increasing demand for portability and operational freedom on various job sites.

The driving factors shaping this market are multifaceted, anchored by rapid urbanization leading to massive infrastructure projects worldwide, particularly in Asia Pacific and the Middle East. Simultaneously, the consumer segment is experiencing growth due to readily available affordable tools and a rise in DIY content platforms, stimulating demand for residential-grade accessories. Technological drivers, such as the introduction of impact-rated accessories tailored for heavy-duty applications and intelligent accessories that integrate sensors for performance monitoring, are creating significant growth avenues. The focus on specialized applications, like the shift towards sustainable materials requiring specific cutting and fastening solutions, also acts as a primary market catalyst.

Power Tool Accessories Market Executive Summary

The Power Tool Accessories Market is characterized by intense competition and rapid technological evolution, primarily focusing on improving durability, material composition, and multi-functionality. Current business trends indicate a strong move toward consolidated product offerings, where tool manufacturers are increasingly bundling proprietary accessory sets with core tools to ensure optimal system performance and customer loyalty. The rise of e-commerce platforms has fundamentally altered distribution channels, allowing smaller, specialized accessory manufacturers to reach global markets directly. Furthermore, sustainability is becoming a critical business focus, with companies exploring recyclable materials and energy-efficient manufacturing processes to meet stringent environmental regulations and consumer preferences.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market due to massive investment in infrastructure and manufacturing base expansion, particularly in China and India. North America and Europe, characterized by mature construction sectors and high labor costs, prioritize premium, high-performance accessories that minimize downtime and maximize operational efficiency. The adoption of smart construction technologies in these regions, necessitating compatible, digitally-enabled accessories, further solidifies their market share. Conversely, Latin America and MEA are experiencing growth tied to resource extraction and initial urbanization phases, focusing on general-purpose, robust accessories.

Segmentation trends highlight the increasing dominance of cordless accessories, specifically high-capacity lithium-ion battery packs, driven by the global shift away from corded tools for enhanced mobility. By product type, drilling and fastening accessories maintain the largest share, reflecting their pervasive use across construction and general assembly. However, specialized cutting and abrasive accessories, particularly those incorporating advanced materials like industrial diamonds and ceramic grains, are projected to witness the highest growth rate, driven by demand from aerospace and high-precision manufacturing sectors where material hardness requires specialized tooling solutions. The residential/DIY segment is growing faster than industrial applications in unit volume, though industrial applications maintain dominance in terms of value due to the higher pricing of professional-grade products.

AI Impact Analysis on Power Tool Accessories Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Power Tool Accessories Market frequently center on predictive maintenance, the development of intelligent accessories, automated quality control in manufacturing, and optimizing the accessory lifespan. Users are keen to understand how AI algorithms can monitor tool usage patterns to recommend optimal accessory changes, thereby preventing catastrophic failures and maximizing efficiency. Key themes identified include the integration of micro-sensors into accessories for data collection, the use of Machine Learning (ML) to refine material composition for enhanced durability based on real-world usage data, and the automation of supply chain logistics to ensure accessories are available precisely when and where they are needed. Concerns often involve the cost of integrating such smart technology into traditionally low-margin consumables and the complexity of ensuring interoperability across different tool brands. Expectations are high regarding significant reductions in operational waste and downtime due to AI-driven predictive insights.

- AI-driven Predictive Maintenance: ML algorithms analyze sensor data from tools (vibration, temperature, current draw) to predict the end-of-life cycle for specific accessories (e.g., drill bits, saw blades), enabling timely replacement and preventing tool damage.

- Smart Accessory Development: Integration of miniature embedded systems and sensors within high-value accessories, allowing them to communicate usage metrics and condition status back to the tool or a centralized maintenance platform.

- Manufacturing Optimization: AI and computer vision systems enhance quality control during accessory production, automatically detecting microscopic defects in carbide tips or abrasive grain placement, ensuring superior consistency and performance.

- Inventory and Demand Forecasting: ML models analyze construction schedules, regional sales data, and economic indicators to accurately forecast demand for specific accessory types, significantly optimizing inventory levels for distributors and reducing stockouts.

- Design and Material Innovation: AI simulates material stress tests and identifies optimal geometries and coatings for enhanced durability (e.g., specialized coatings for high-strength steel cutting), drastically reducing R&D cycles.

- Customization at Scale: AI facilitates mass customization of specialized accessories for niche applications (e.g., unique blade tooth configuration for specific composite materials), improving performance beyond standard off-the-shelf products.

- Augmented Reality (AR) Training: AI-powered AR applications guide users on selecting and correctly installing specialized accessories, reducing errors and improving safety on job sites.

DRO & Impact Forces Of Power Tool Accessories Market

The market dynamics for Power Tool Accessories are governed by a robust interplay of growth drivers, constraining factors, emerging opportunities, and competitive impact forces. Primary drivers include the global resurgence in construction and infrastructure spending, the accelerated replacement cycles in industrial environments due to safety standards, and the strong consumer adoption of DIY culture, bolstered by easily accessible online resources and tutorials. The continued transition towards high-performance cordless tools also acts as a significant catalyst, compelling users to purchase compatible high-capacity battery packs and specialized impact-rated accessories designed to withstand higher torque outputs. These drivers collectively ensure consistent baseline demand, even during economic fluctuations, due to the consumable nature of the products.

However, market growth faces notable restraints, chiefly including the volatility in raw material prices, particularly steel, carbide, and cobalt, which are essential for producing high-durability cutting and drilling tools. Counterfeit products, often prevalent in emerging markets, pose a serious challenge by diluting market share for legitimate manufacturers and potentially compromising user safety and tool integrity. Furthermore, the standardization challenges across different tool brands can occasionally restrict cross-compatibility, forcing users into specific ecosystems, although this is mitigated somewhat by the growing acceptance of universal fitting systems for common accessories like saw blades.

Significant opportunities exist in the development of "smart" accessories that integrate IoT capabilities for performance monitoring, enabling real-time feedback on wear and tear. The burgeoning focus on sustainable and recyclable accessory materials aligns with corporate social responsibility goals and opens up new product lines addressing environmentally conscious consumers. The expansion into developing economies through localized manufacturing and robust distribution networks presents substantial untapped market potential. The impact forces are characterized by high substitution threat, driven by advancements in tool technology (e.g., self-fastening tools reducing the need for traditional drilling), moderate bargaining power of buyers due to highly fragmented offerings, and intense rivalry among major established players who compete heavily on material innovation and brand loyalty. The threat of new entrants is moderate due to high capital requirements for precision manufacturing and established distribution channels.

Segmentation Analysis

The Power Tool Accessories Market is meticulously segmented based on product type, tool technology, application, and end-user, providing a granular view of market dynamics and specialized demand centers. This comprehensive segmentation allows manufacturers to target specific industrial needs, ranging from high-precision aerospace component fabrication to general residential maintenance tasks. The segmentation based on product type, such as drilling, cutting, and fastening accessories, helps in understanding where the bulk of expenditure occurs, reflecting the foundational needs of most fabrication and construction tasks. Geographic segmentation further highlights the varying maturity levels and regulatory environments influencing accessory demand globally, with advanced economies focusing on precision and safety, while emerging economies prioritize volume and cost-effectiveness.

Segmentation by tool technology, primarily differentiating between corded and cordless tools, reveals the significant shift towards battery-powered ecosystems. This shift is not just limited to the tool itself but extends critically to the accessories, requiring specialized designs for battery optimization and high-impact resistance. Furthermore, the segmentation by end-user, differentiating between professional industrial users and residential/DIY consumers, dictates material choice, durability specifications, and pricing strategies. Industrial users demand certified, premium accessories capable of continuous, heavy-duty operation, whereas the residential segment seeks cost-effective, easily interchangeable, multi-purpose solutions. Understanding these distinctions is crucial for effective product development and market positioning, ensuring that product specifications align accurately with the operational demands of the target segment.

- By Product Type:

- Drilling and Fastening Accessories (Drill bits, Drivers, Impact sockets)

- Cutting and Sawing Accessories (Saw blades, Reciprocating blades, Jigsaw blades)

- Grinding, Polishing, and Abrading Accessories (Abrasive wheels, Sanding pads, Wire brushes)

- Routing and Milling Accessories (Router bits, Planer blades)

- Batteries and Chargers (Li-ion battery packs, Charging stations)

- Others (Jigs, Clamps, Dust extraction systems)

- By Tool Type:

- Corded Tool Accessories

- Cordless Tool Accessories

- By Application:

- Woodworking

- Metalworking

- Construction

- Automotive

- Others (Gardening, MRO)

- By End User:

- Industrial/Professional

- Residential/DIY

- By Distribution Channel:

- Offline (Specialty Stores, Hardware Stores)

- Online (E-commerce platforms)

Value Chain Analysis For Power Tool Accessories Market

The value chain for the Power Tool Accessories Market begins with upstream activities focused heavily on raw material procurement, encompassing specialized alloys (e.g., tungsten carbide, high-speed steel), industrial diamonds, and high-performance plastics for casings and battery components. Raw material quality is paramount, as it directly determines the lifespan and efficiency of the final accessory, making strong supplier relationships and effective negotiation critical. This stage is followed by advanced manufacturing processes, which involve complex techniques such as precision forging, heat treatment, specialized coating (e.g., titanium nitride, diamond coatings), and assembly. Investment in highly automated manufacturing facilities and quality control is essential to maintain the necessary precision required for professional-grade accessories, distinguishing industry leaders from smaller competitors.

Midstream activities involve sophisticated warehousing, inventory management, and marketing strategies. Given the vast range of accessories available, effective inventory management is crucial to minimize carrying costs while ensuring high availability across global markets. Direct and indirect distribution channels define the path to the end-user. Indirect channels, which include wholesalers, large retailers (big-box stores like Home Depot or specialized industrial suppliers), and authorized distributors, account for the majority of sales volume, offering broad market reach and localized service. Direct sales channels are increasingly utilized by major original equipment manufacturers (OEMs) for large industrial contracts and through proprietary online stores, ensuring closer control over pricing and customer relationship management.

Downstream activities center on aftermarket services, technical support, and end-user engagement. Customer feedback regarding accessory performance, wear rates, and compatibility issues is highly valuable for iterative product improvement and material science innovation. The market's shift toward cordless technology has amplified the importance of the downstream segment related to battery accessory recycling and lifecycle management, driven by increasing regulatory scrutiny on lithium-ion disposal. Successful companies excel by optimizing logistics for high-volume, small-unit shipments, ensuring product traceability, and leveraging digital platforms to offer rich product information and comparison tools, significantly influencing the purchasing decisions of both professional tradesmen and DIY enthusiasts.

Power Tool Accessories Market Potential Customers

The potential customer base for the Power Tool Accessories Market is highly diversified, spanning multiple industries and consumer demographics, broadly categorized into professional users and residential consumers. Professional end-users, who represent the highest value segment, include large construction companies requiring drilling and cutting accessories for steel and concrete, automotive repair shops demanding specialized sockets and sanding equipment, and aerospace and defense manufacturers needing high-precision tooling for composite materials and exotic metals. These industrial buyers prioritize durability, certification, consistency, and specific performance metrics such as resistance to high temperatures or capacity for continuous operation. Procurement decisions are often centralized, relying on bulk purchasing agreements and long-term supplier relationships based on verified product performance.

The residential or Do-It-Yourself (DIY) segment constitutes the second major customer group. These buyers are typically individuals engaging in home renovation, repair, maintenance, or hobbyist woodworking projects. Their purchasing criteria are centered on ease of use, general compatibility, availability through retail channels, and price competitiveness. This segment drives high volume for common accessories like basic drill bit sets, sanding paper, and standard saw blades. E-commerce platforms play a pivotal role in serving this segment by offering broad selection, competitive pricing, and detailed product reviews, influencing decision-making. The increasing complexity of modern home repairs often pushes DIY enthusiasts toward slightly higher quality, specialized accessories, bridging the gap between basic residential tools and professional equipment.

Other significant buyers include Maintenance, Repair, and Operations (MRO) departments in various institutional settings (schools, hospitals, utilities) and specialized service providers such as plumbers, electricians, and landscapers. These customers require accessories that are reliable under varying conditions and often need portable power solutions, emphasizing the demand for advanced battery accessories and ergonomic carrying cases. Understanding the specific application environment—whether it is controlled manufacturing floor, an extreme outdoor construction site, or a simple residential garage—is paramount for manufacturers when tailoring their product offerings and marketing messages to these diverse potential customer groups, ensuring maximum market penetration across all user levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $35.5 Billion USD |

| Market Forecast in 2033 | $55.9 Billion USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Robert Bosch GmbH, Techtronic Industries Co. Ltd. (TTI), Makita Corporation, Hilti Corporation, Apex Tool Group, Atlas Copco, 3M Company, Klein Tools, Snap-on Incorporated, PFERD INC., Lenox (Newell Brands), KYOCERA SGS Precision Tools, Fein GmbH, Starrett, Tyrolit Group, Sandvik AB, Kennametal Inc., Milwaukee Tool (TTI), DEWALT (Stanley Black & Decker). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Tool Accessories Market Key Technology Landscape

The technology landscape within the Power Tool Accessories Market is defined by continuous innovation focused on material science and digital integration, aiming to maximize durability and performance metrics. A critical technological advancement is the widespread adoption of specialized material coatings, such as PVD (Physical Vapor Deposition) coatings like Titanium Nitride (TiN) and Aluminum Titanium Nitride (AlTiN), which significantly reduce friction and heat buildup during high-speed operations, thereby extending the life of drill bits and saw blades. Similarly, the refinement of carbide manufacturing processes, including sintering techniques for superior grain structure, has allowed for the creation of tougher, sharper cutting edges capable of handling modern, high-strength construction materials and advanced composites increasingly used in aerospace and automotive industries. These material innovations represent the core competitive advantage for premium accessory manufacturers.

Beyond material composition, the accessory market is being transformed by advancements in battery technology, fundamentally driven by the proliferation of cordless power tools. Lithium-ion (Li-ion) battery packs have evolved considerably, incorporating intelligent battery management systems (BMS) that monitor cell health, temperature, and charging cycles to prevent overheating and maximize cycle life. Newer battery chemistries and advanced cooling technologies are enabling higher power output and quicker recharge times, making cordless tools viable for heavy-duty, sustained industrial applications previously reserved for corded equipment. This technology focus extends to chargers, with rapid-charging stations and multi-bay systems becoming standard accessories, crucial for professional efficiency on site.

Furthermore, digital technologies, although nascent, are beginning to play a role, particularly in high-value accessories. The integration of RFID tags or miniature IoT sensors into accessories like high-end cutting discs or specialized bits allows for automated inventory tracking, usage monitoring, and confirmation of genuine parts. This data connectivity facilitates better tool fleet management for large industrial users, enabling automated reordering and performance analysis. Technology in manufacturing, particularly the use of additive manufacturing (3D printing) for prototyping specialized jigs and fixtures, also speeds up product development cycles, ensuring that accessory design can keep pace with the rapidly evolving demands of specialized materials and new power tool platforms, positioning technology as a key differentiator in market success.

Regional Highlights

The global Power Tool Accessories Market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced heavily by infrastructure development levels, labor costs, and prevailing industry practices. North America, encompassing the U.S. and Canada, represents a mature but highly valuable market segment, characterized by high disposable incomes, stringent safety regulations, and a substantial focus on home improvement and professional construction. Demand in this region leans heavily towards premium, high-performance accessories, especially those compatible with the latest cordless platforms, and there is high adoption of specialized fastening and drilling systems due to the widespread use of wood and light-gauge steel framing in residential construction. The established presence of major market leaders and the rapid integration of smart technology solutions further solidify North America's position as a critical revenue generator.

Europe mirrors North America in terms of maturity and emphasis on quality, but with a specific regional focus driven by diverse industrial heritage, particularly in Germany and the UK. The European market places a strong emphasis on energy efficiency, ergonomic design, and compliance with EU safety standards, leading to high demand for specialized precision tools for metalworking and complex fabrication tasks. Western Europe shows stable, high-value growth, while Central and Eastern European countries are demonstrating faster growth rates due to ongoing infrastructure modernization and increasing foreign direct investment in manufacturing sectors. The regulatory push towards sustainability and responsible battery recycling also significantly impacts the type of battery accessories developed and marketed across the continent.

Asia Pacific (APAC) stands out as the engine of future market growth, primarily fueled by exponential urbanization, rapid industrialization across China, India, and Southeast Asia, and massive government investment in infrastructure projects like high-speed rail and utility modernization. This region demands accessories across the entire price spectrum, from high-volume, cost-effective consumables for general construction to high-precision tools for burgeoning electronics and automotive manufacturing hubs. APAC's sheer population size and the escalating rate of DIY adoption among a rising middle class ensure sustained high-unit volume growth. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, with growth tightly correlated to commodity prices (oil, mining) and initial phase urbanization projects, driving demand primarily for robust, general-purpose accessories suitable for challenging working environments and demanding high levels of reliability over advanced features.

- North America (U.S., Canada): Focus on premium, cordless-compatible, specialized accessories for professional residential and commercial construction. High adoption rate of intelligent tool fleet management systems.

- Europe (Germany, UK, France): Emphasis on precision engineering, compliance with strict environmental and safety standards (CE Mark), driving demand for high-quality metalworking and grinding tools.

- Asia Pacific (China, India, Japan): Highest growth region driven by mass infrastructure development, booming manufacturing output, and expansion of the middle-class DIY consumer base. High-volume demand across all price points.

- Latin America (Brazil, Mexico): Market growth linked to mining, oil & gas, and urbanization projects; demand centers on durable, cost-effective accessories for heavy-duty, general applications.

- Middle East & Africa (MEA): Growth stimulated by large-scale construction projects (e.g., hospitality, commercial centers) and resource extraction activities, favoring robust tools and efficient dust management accessories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Tool Accessories Market.- Stanley Black & Decker

- Robert Bosch GmbH

- Techtronic Industries Co. Ltd. (TTI)

- Makita Corporation

- Hilti Corporation

- Apex Tool Group

- Atlas Copco

- 3M Company

- Klein Tools

- Snap-on Incorporated

- PFERD INC.

- Lenox (Newell Brands)

- KYOCERA SGS Precision Tools

- Fein GmbH

- Starrett

- Tyrolit Group

- Sandvik AB

- Kennametal Inc.

- Milwaukee Tool (TTI)

- DEWALT (Stanley Black & Decker)

- ITW (Illinois Tool Works)

- Dormer Pramet

Frequently Asked Questions

Analyze common user questions about the Power Tool Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the cordless power tool accessories segment?

The primary driver is the demand for portability, efficiency, and safety on job sites. Technological advancements in Lithium-ion battery capacity, coupled with intelligent charging systems, have made cordless tools powerful enough for industrial applications, necessitating the corresponding high-capacity battery and impact-rated accessories.

How is material science impacting the performance of drilling accessories?

Material science is crucial, particularly through the use of specialized coatings like diamond or AlTiN (Aluminum Titanium Nitride) on carbide tips. These coatings significantly reduce friction, resist heat buildup, and enhance hardness, allowing accessories to maintain sharpness and durability when working with challenging materials like hardened steel or composites, drastically extending product lifespan.

Which geographical region is expected to exhibit the fastest market growth?

Asia Pacific (APAC) is projected to be the fastest-growing region. This acceleration is due to unprecedented levels of infrastructure development, rapid urbanization, massive manufacturing expansion, and increasing penetration of both professional and residential power tool usage across key economies like China and India.

What are "smart accessories" and how will AI influence their adoption?

Smart accessories incorporate IoT sensors or RFID chips to monitor performance, usage data, and wear status in real-time. AI and Machine Learning (ML) analyze this data to provide predictive maintenance alerts, optimize usage recommendations, and automate inventory management for large industrial fleets, maximizing operational uptime.

What challenges do manufacturers face regarding raw material supply?

Manufacturers face significant challenges due to price volatility and supply chain instability of critical raw materials, notably tungsten carbide, cobalt, and specialized steel alloys, which are essential for producing high-durability cutting and drilling consumables. Geopolitical factors affecting mining and processing contribute to this uncertainty.

What role do distribution channels play in market competitive advantage?

Distribution channels are critical for market penetration and customer reach. While traditional hardware stores remain vital for professional users, the rapid expansion of e-commerce platforms is providing a competitive edge by offering wider product selections, direct manufacturer access, and detailed comparison tools, particularly appealing to the DIY segment and improving global market accessibility.

How do professional and DIY end-users differ in their accessory purchasing criteria?

Professional users prioritize durability, precision, specific performance certifications, and long-term cost-effectiveness (minimizing downtime), often leading to high-value bulk purchases. DIY users prioritize general compatibility, ease of use, immediate availability through retail, and overall lower unit cost for general maintenance tasks.

What technological advancements are driving safety improvements in accessories?

Safety improvements are driven by features such as anti-kickback technology in saw blades, improved dust extraction systems integrated into sanding and cutting attachments, and highly robust impact-resistant casings for battery packs. These innovations reduce operational risks, comply with regulatory standards, and minimize workplace accidents.

Is standardization a concern in the Power Tool Accessories Market?

Yes, standardization remains a concern, particularly regarding proprietary interfaces for high-torque tools. While many common accessories use standardized shanks or arbors, brand-specific tool interfaces (e.g., battery systems, oscillating tool fittings) can limit cross-compatibility, forcing professionals to commit to a single brand ecosystem for certain applications.

What are the key application segments contributing most significantly to market revenue?

The construction sector remains the largest contributor to revenue due to the high volume and continuous consumption of drilling, cutting, and fastening accessories. Metalworking and automotive repair segments also contribute substantially, driven by the demand for high-precision, specialized abrasive, and routing tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager