Power Tool Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433199 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Power Tool Switches Market Size

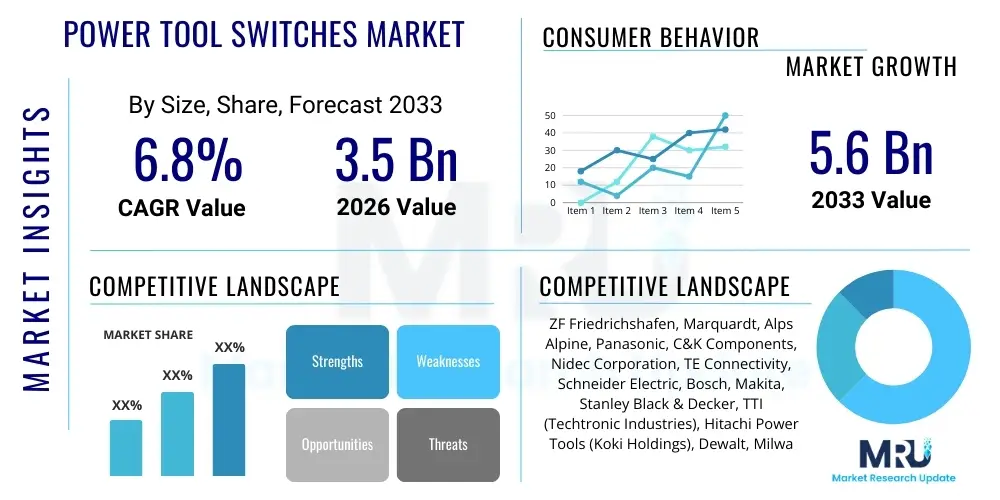

The Power Tool Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Power Tool Switches Market introduction

The Power Tool Switches Market encompasses the manufacturing and distribution of specialized switching mechanisms designed for integration into various electric power tools, including drills, saws, grinders, routers, and sanders. These switches are critical components that govern the electrical flow to the motor, enabling functions such as power activation, speed control (variable speed triggers), direction reversal, and braking mechanisms. They must meet stringent requirements for durability, ergonomic integration, high current handling capacity, and safety under demanding operating conditions typical of construction and industrial environments. The design complexity of these switches has increased significantly with the pervasive adoption of brushless DC (BLDC) motors and sophisticated battery management systems in cordless tools.

Product descriptions range from basic on/off rocker and toggle switches found in low-end tools to highly advanced electronic trigger switches that incorporate Pulse Width Modulation (PWM) circuits for precise motor speed regulation and soft-start capabilities. Major applications span professional construction, automotive repair, woodworking, residential DIY activities, and industrial maintenance operations. These switches act as the primary interface between the user and the tool’s power system, making reliability and responsiveness key performance indicators. The switch assembly often includes integrated thermal protection and overload cut-offs, particularly in high-amperage professional tools, enhancing both tool lifespan and user safety.

Key benefits driving market growth include increased emphasis on occupational safety, mandating the use of features like lock-off switches and brake functions; the continuous innovation in lithium-ion battery technology, necessitating complex electronic controls managed by advanced switches; and the overall global expansion of the construction and manufacturing sectors. Driving factors involve rising infrastructural spending, particularly in emerging economies, the consumer shift toward high-performance cordless tools that require robust electronic switches, and continuous regulatory pressure to improve power tool ergonomic design and electrical safety standards globally, pushing manufacturers towards advanced, customized switch solutions.

Power Tool Switches Market Executive Summary

The global Power Tool Switches Market is experiencing robust expansion driven primarily by key business trends centered on electrification, miniaturization, and enhanced functional integration. A major trend involves the rapid transition from corded tools to high-voltage, high-efficiency cordless battery platforms, which mandates the incorporation of intelligent electronic switches capable of handling high instantaneous currents, communicating with Battery Management Systems (BMS), and offering nuanced speed and torque control. Manufacturers are increasingly prioritizing sealed, dustproof, and moisture-resistant switch designs (meeting IP ratings) to ensure longevity in harsh professional environments, thereby increasing the average selling price of premium switch units. Consolidation among major tool manufacturers and their subsequent push for proprietary battery platforms also influences switch standardization and procurement strategies.

Regionally, the Asia Pacific (APAC) market is positioned for the most accelerated growth, fueled by massive infrastructural projects, rapid industrialization, and the burgeoning manufacturing sector, particularly in countries like China and India, which are transitioning from manual labor to mechanized processes. North America and Europe, characterized by mature markets, exhibit strong demand for high-end, professionally graded tools, focusing on ergonomic design, smart features (such as Bluetooth connectivity integrated via the switch assembly), and adherence to strict safety certifications. Latin America and the Middle East and Africa (MEA) represent substantial untapped potential, with growing construction activity driving initial demand for entry-level and mid-range switches, often prioritizing cost-effectiveness and ruggedness over advanced electronic features.

Segment trends highlight the dominance of electronic trigger switches within the product type category due to the pervasive nature of variable speed control required in modern tools. By application, the professional/industrial segment commands the largest market share, driven by the demanding operational cycles and higher replacement rates of professional-grade equipment. The cordless segment continues to cannibalize the corded market share, fundamentally reshaping switch requirements towards smaller footprints, integrated thermal management, and robust digital communication capabilities. Furthermore, there is a distinct vertical trend favoring custom-designed switches over standardized components, allowing tool OEMs to differentiate their products through unique trigger feel, enhanced safety features, and proprietary electronic interfaces.

AI Impact Analysis on Power Tool Switches Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Power Tool Switches Market frequently revolve around how AI can enhance tool precision, predictive maintenance capabilities, and user safety through smarter control systems. Users are concerned with whether AI integration will lead to entirely new switch designs that move beyond basic electrical activation, focusing instead on data aggregation and behavioral response. Key themes emerging from these inquiries include the potential for AI algorithms to optimize motor performance dynamically based on the material being cut or drilled, the ability of embedded sensors (managed by AI) to predict switch failure before it occurs, and the development of intelligent lockout mechanisms that prevent operation if improper usage is detected. Users also expect AI to drive the integration of complex diagnostic feedback systems accessible via the switch interface or associated smart tool applications, moving the switch from a simple mechanical component to a sophisticated data gateway.

- AI-Driven Predictive Maintenance: AI analyzes current draw, temperature fluctuations, and activation cycles captured through integrated switch sensors to predict component wear, significantly reducing unexpected tool downtime.

- Optimized Motor Control: AI algorithms use real-time feedback from the switch activation profile and motor load to adjust power delivery (via the electronic switch circuit board) for maximum efficiency and torque stability.

- Enhanced Safety Features: AI enables intelligent anti-kickback or anti-bind mechanisms, instantly cutting power via the switch circuit upon detecting abrupt rotational impedance, improving operator safety beyond traditional mechanical clutches.

- Automated Operational Diagnostics: AI assists in diagnosing electrical faults within the switch assembly or connected motor, facilitating quicker repair and replacement decisions in professional service centers.

- Ergonomic Personalization: AI learns operator preferences and common tasks, potentially adjusting the trigger response curve or soft-start parameters based on historical usage data, enhancing user comfort and precision.

- Integration with Smart Ecosystems: AI facilitates seamless communication between the switch (as a data source) and broader job site management systems, tracking tool usage, location, and operational metrics for fleet management.

DRO & Impact Forces Of Power Tool Switches Market

The market is predominantly driven by increasing global construction activity, particularly in residential and infrastructure development, which fuels demand for both professional and DIY-grade power tools, necessitating a corresponding supply of switches. Another significant driver is the continuous innovation in battery technology, which pushes power tool manufacturers to adopt sophisticated electronic switches capable of managing high-efficiency brushless motors and advanced battery chemistry, providing variable speed and robust thermal protection. Regulatory mandates regarding user safety, such as requirements for instantaneous braking and lock-off features, further accelerate the replacement cycle and complexity of switch designs. However, the market faces restraints, primarily high manufacturing costs associated with producing sealed, complex electronic switches, especially those requiring high IP ratings and intricate circuitry for communication with sophisticated motor controllers. Furthermore, market vulnerability to economic downturns in the construction sector poses a cyclical restraint, affecting overall tool and component sales.

Opportunities for growth are abundant in the development of smart switches featuring integrated sensors for diagnostic feedback and enhanced data logging, facilitating the rise of connected job sites and smart construction management. Miniaturization technologies offer opportunities to integrate more functionality—such as sophisticated motor controllers and safety electronics—directly into the switch housing, reducing overall tool size and complexity. The untapped potential in emerging markets for professional-grade, durable tools also presents a key avenue for market penetration. The continuous push towards eco-friendly manufacturing processes and the adoption of recycled or sustainable materials in switch enclosures align with evolving corporate sustainability goals and consumer preferences, offering a differentiating opportunity for specialized component manufacturers.

Impact forces governing the market dynamics include the high bargaining power of large power tool OEMs who demand customized, high-volume components at competitive prices, influencing pricing and margin structures for switch suppliers. The threat of substitutes is relatively low, as a switch is indispensable for electric motor control, although internal component substitution (e.g., solid-state relays replacing mechanical contacts) is a continuous technological force. Regulatory compliance acts as a critical external force, compelling mandatory adherence to international safety standards (like UL, CE, and RoHS), imposing technical barriers to entry and demanding high levels of quality assurance. Technological change remains a paramount force, particularly the rapid evolution of electronic speed control and sensor integration, forcing switch manufacturers to invest heavily in R&D to remain competitive in the fast-moving cordless tool segment.

Segmentation Analysis

The Power Tool Switches Market segmentation provides granular insights into demand patterns across various operational and technical specifications, aiding manufacturers in targeted product development. Segmentation by type differentiates between basic mechanical switches and complex electronic controls, reflecting the vast differences in pricing and functional capabilities required by various tool classes. Application segmentation distinguishes between the demanding industrial environment, where robustness and high cycle life are paramount, and the residential DIY segment, which prioritizes cost-effectiveness and ease of use. Furthermore, segmenting based on tool technology (corded versus cordless) is now foundational, as cordless tools impose unique constraints related to voltage, current management, and space limitations, fundamentally altering switch design requirements compared to traditional corded applications.

The dominant segments currently are electronic trigger switches, which enable variable speed functionality essential for modern high-precision tasks, and the professional/industrial application segment, driven by large fleet purchases and continuous operational cycles. Within the professional segment, there is a clear trend towards customized switch units integrated directly with proprietary motor controllers and communication buses (e.g., CAN bus interfaces) to maximize efficiency and capture operational data. The growth trajectory is steepest in the cordless tool category, reflecting the global consumer and professional preference for portable and unrestricted operation. Understanding these segment dynamics is crucial for strategic planning, especially concerning investments in manufacturing capabilities tailored for complex electronic assemblies required by the high-growth segments.

- By Type:

- Trigger Switches (Variable Speed, Fixed Speed)

- Push Button Switches (Momentary, Latching)

- Rocker Switches

- Toggle Switches

- Slide Switches

- Reversing Switches

- By Application:

- Industrial/Professional Use (Construction, Automotive, Aerospace)

- Residential/DIY Use

- Commercial Use (Light Repair, Maintenance)

- By Tool Type:

- Corded Tools (AC operation)

- Cordless Tools (DC operation, High Current Management)

- By Voltage Range:

- Low Voltage (Below 18V)

- Medium Voltage (18V to 40V)

- High Voltage (Above 40V, primarily professional corded)

- By Mechanism:

- Mechanical Switches

- Electronic Switches (Integrated PCB, PWM control)

Value Chain Analysis For Power Tool Switches Market

The value chain for Power Tool Switches begins with upstream analysis, focusing on the procurement of critical raw materials and specialized electronic components. Raw material suppliers provide essential commodities such as high-grade plastics (for housing and internal mechanical structures), copper alloys (for contacts and terminals), and specialized semiconductor components (for electronic speed control triggers). Key upstream activities include the sourcing of rare earth metals used in certain motor types that require high-precision electronic switches, and the manufacturing of custom PCBs designed to fit into extremely tight tolerances within the tool handle. The quality and stable pricing of these foundational electronic and material inputs are crucial, as fluctuations directly impact the cost of the final switch assembly, particularly the complex electronic units used in high-end cordless tools.

Midstream activities involve core manufacturing, including stamping, molding, assembly, and rigorous quality testing. Switch manufacturers specialize in high-precision plastic injection molding for ergonomic housing and automated assembly lines for integrating mechanical and electronic components, ensuring consistent quality and cycle life. Customization is a key feature in the midstream, where major power tool OEMs demand proprietary designs regarding trigger geometry, contact materials, and integrated electronics tailored specifically to their motor and battery architecture. Strict quality control, including environmental testing (dust, moisture) and electrical endurance testing (millions of cycles), is necessary to meet industry standards and OEM specifications before components are delivered for final tool assembly.

Downstream analysis covers distribution channels and end-user engagement. Distribution is multifaceted, involving both direct supply agreements between switch manufacturers and major power tool OEMs (the dominant channel) and indirect sales through specialized industrial distributors and electronic component suppliers for smaller tool manufacturers or aftermarket replacement services. The indirect channel often handles standardized components, while the direct channel manages bespoke, high-volume orders. End-users—professional contractors, industrial operators, and residential consumers—ultimately drive demand, but the purchasing decision is primarily dictated by the tool manufacturer who selects the switch. Effective sales strategies focus on technical consulting and proving the switch component’s reliability and longevity to the OEM engineering teams, emphasizing its role in overall tool performance and safety compliance.

Power Tool Switches Market Potential Customers

The primary customers in the Power Tool Switches Market are the global Original Equipment Manufacturers (OEMs) of electric power tools. These companies, ranging from multinational conglomerates specializing in professional construction equipment to smaller niche producers of specialized woodworking or automotive tools, represent the largest volume of purchasers. Their purchasing decisions are highly influenced by factors such as component quality, reliability under extreme conditions, integration capability with proprietary motor controllers (especially brushless DC motors), competitive pricing for high volumes, and the switch supplier's ability to provide customized ergonomic designs and integrated safety electronics. These OEMs view the switch as a critical brand differentiator, impacting the user experience through trigger feel and precision control.

Secondary potential customers include professional repair and maintenance service providers, independent electrical component distributors, and industrial maintenance departments that require replacement switches for tool longevity. This aftermarket segment, while smaller in volume than OEM supply, often demands rapid availability of standardized or compatible replacement parts. Specialized distributors cater to this need, stocking a wide array of switches compatible with legacy and current tool models. These end-users prioritize accessibility and compatibility, often seeking components that meet or exceed the original equipment specification to ensure continued safe operation.

Furthermore, emerging markets with burgeoning domestic tool manufacturing industries represent significant future potential. As countries in Southeast Asia and Latin America ramp up local production of entry-level and mid-range power tools, demand for cost-effective, durable, and reliable basic mechanical switches is expected to surge. Targeting these new manufacturing clusters requires strategic localization of supply chains and flexible manufacturing capabilities. Ultimately, although the consumer is the tool user, the tool manufacturer acts as the immediate buyer, making technical collaboration and long-term supply contracts the cornerstone of successful market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen, Marquardt, Alps Alpine, Panasonic, C&K Components, Nidec Corporation, TE Connectivity, Schneider Electric, Bosch, Makita, Stanley Black & Decker, TTI (Techtronic Industries), Hitachi Power Tools (Koki Holdings), Dewalt, Milwaukee Tool, Eaton, Honeywell International, Omron, Johnson Electric, Littelfuse, E-Switch, Kaihua Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Tool Switches Market Key Technology Landscape

The current technology landscape in the Power Tool Switches Market is defined by the integration of advanced electronics and materials science to meet the demands of high-performance battery-powered tools. A primary technological shift involves the transition from purely mechanical contact switches to sophisticated Electronic Speed Control (ESC) modules integrated within the trigger assembly. These electronic switches utilize Pulse Width Modulation (PWM) technology, allowing for fine-grained control over motor speed and torque, which is crucial for tasks requiring precision, such as drilling into delicate materials or driving screws accurately. The development of robust semiconductor components, particularly MOSFETs and IGBTs capable of handling high instantaneous currents associated with starting powerful brushless motors, is foundational to this technological evolution. Furthermore, miniaturization techniques allow for the incorporation of complex circuitry, including microcontrollers for smart features and communication interfaces (e.g., SMBus for battery communication), directly into the confined space of the switch housing, enhancing overall tool efficiency and diagnostic capability.

Another pivotal technology is the implementation of superior contact materials and sealing mechanisms. High-cycle professional tools necessitate contacts made from specialized silver alloys (e.g., silver cadmium oxide or silver tin oxide) to resist arcing, maintain low contact resistance, and ensure maximum durability over millions of operations. Simultaneously, manufacturers are focusing heavily on achieving high IP (Ingress Protection) ratings, utilizing ultrasonically welded housings and advanced gaskets to protect sensitive electronic components from dust, moisture, and debris prevalent on job sites. This focus on durability extends the lifespan of the tool and reduces potential safety hazards caused by environmental contamination. Moreover, sophisticated mechanisms for electromagnetic interference (EMI) suppression are increasingly being incorporated into switch design to prevent interference with other electronic systems and to comply with rigorous regulatory standards.

Emerging technologies include the integration of Hall Effect sensors and other non-contact sensing mechanisms for measuring trigger displacement, offering smoother and more reliable variable speed control compared to traditional potentiometers. This reduces mechanical wear and increases the longevity of the control mechanism. Furthermore, the push towards "smart" tool functionality is integrating wireless connectivity (such as Bluetooth Low Energy) into or near the switch module, turning the switch into a data collection point. This allows professional users to monitor tool usage statistics, battery status, and receive diagnostic alerts via connected apps. Future developments are likely to focus on solid-state switching technologies to completely eliminate mechanical wear, further improving reliability and extending the operating life of the switch mechanism in the most demanding industrial applications.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by massive investments in residential, commercial, and transportation infrastructure, particularly in China, India, and Southeast Asian nations. The region is both a massive consumer market, witnessing increasing adoption of electric power tools in industrial and residential sectors, and a global manufacturing hub for power tool OEMs. Competitive pricing strategies and rapid urbanization fuel demand, although the market remains segmented between high-end professional tools and cost-effective entry-level products.

- North America: North America holds a dominant market share in terms of value, primarily due to high consumer spending power and a strong preference for high-performance, premium-quality cordless tools. The region is characterized by stringent safety standards and a rapid uptake of technological advancements, including smart tools and integrated electronic switches offering advanced diagnostic feedback. Professional contractors drive the demand for durable, heavy-duty switches with robust electronic controls and high duty cycle ratings.

- Europe: The European market is mature and highly regulated, focusing intensely on sustainability, ergonomic design, and comprehensive safety certifications (CE marking). Demand is strong across Western Europe for professional-grade power tools, necessitating high-specification, reliable switches. Eastern Europe is experiencing growth driven by construction modernization. European manufacturers often lead in adopting advanced electronic switch designs that integrate sophisticated thermal and overload protection circuits compliant with local labor safety laws.

- Latin America (LATAM): LATAM represents a promising emerging market, characterized by increasing industrialization and residential construction activities. The market is highly price-sensitive, leading to strong demand for reliable, mid-range mechanical and basic electronic switches. Market growth is gradually shifting towards cordless technology, especially in Brazil and Mexico, creating new opportunities for suppliers offering switches suitable for 12V and 18V battery platforms.

- Middle East and Africa (MEA): Growth in MEA is primarily propelled by large-scale government-funded infrastructure and energy projects, particularly in the Gulf Cooperation Council (GCC) countries. Extreme climate conditions in this region necessitate switches with superior dust and heat resistance (high IP ratings), driving demand for specialized, environmentally sealed switch components. South Africa and the UAE are key demand centers for professional tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Tool Switches Market.- ZF Friedrichshafen AG

- Marquardt GmbH

- Alps Alpine Co. Ltd.

- Panasonic Corporation

- C&K Components, Inc.

- Nidec Corporation

- TE Connectivity Ltd.

- Schneider Electric SE

- Robert Bosch GmbH

- Makita Corporation

- Stanley Black & Decker, Inc.

- TTI (Techtronic Industries Co. Ltd.)

- Hitachi Power Tools (Koki Holdings Co. Ltd.)

- Dewalt

- Milwaukee Tool (a TTI brand)

- Eaton Corporation plc

- Honeywell International Inc.

- Omron Corporation

- Johnson Electric Holdings Limited

- Littelfuse, Inc.

- E-Switch, Inc.

- Kaihua Electronics

- NKK Switches Co., Ltd.

- CW Industries

- Grayhill, Inc.

Frequently Asked Questions

Analyze common user questions about the Power Tool Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and electronic power tool switches?

Mechanical switches use physical contacts to interrupt or complete the circuit, offering basic on/off control. Electronic switches incorporate a Printed Circuit Board (PCB) with semiconductors (like MOSFETs), enabling advanced functions such as variable speed control, soft starts, motor braking, and integrated communication with the battery management system (BMS), essential for modern cordless tools.

How does the shift to cordless tools impact the design of power tool switches?

The cordless tool shift necessitates smaller, more robust electronic switches capable of handling high DC voltage and instantaneous current peaks without overheating. Switches must integrate complex circuitry for precise Pulse Width Modulation (PWM) control to maximize battery life and motor efficiency, requiring advanced thermal management within the constrained switch housing.

Which power tool switch type is driving the highest market growth?

Electronic Trigger Switches are the dominant and fastest-growing segment. Their ability to provide variable speed control, which is critical for precision tasks, coupled with the mandatory integration of safety and smart features in high-end professional tools, ensures their rapid adoption over simpler mechanical alternatives across most tool categories.

What role do safety regulations play in the Power Tool Switches Market?

Safety regulations are a key market driver. Mandates such as the requirement for immediate motor braking upon release (e.g., in saws and grinders) and the implementation of automatic lock-off mechanisms compel switch manufacturers to integrate sophisticated electronic and mechanical safety features, increasing component complexity and replacement rates to comply with standards like UL, CE, and OSHA.

What are the key materials used in high-durability professional power tool switches?

High-durability professional switches utilize engineered thermoset plastics for robust, heat-resistant housing, and specialized silver alloy contacts (such as silver cadmium oxide or silver tin oxide) to minimize electrical erosion and ensure longevity under high current loads and numerous switching cycles, often sealed with high IP-rated materials for environmental protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager