Powered Mixer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436471 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Powered Mixer Market Size

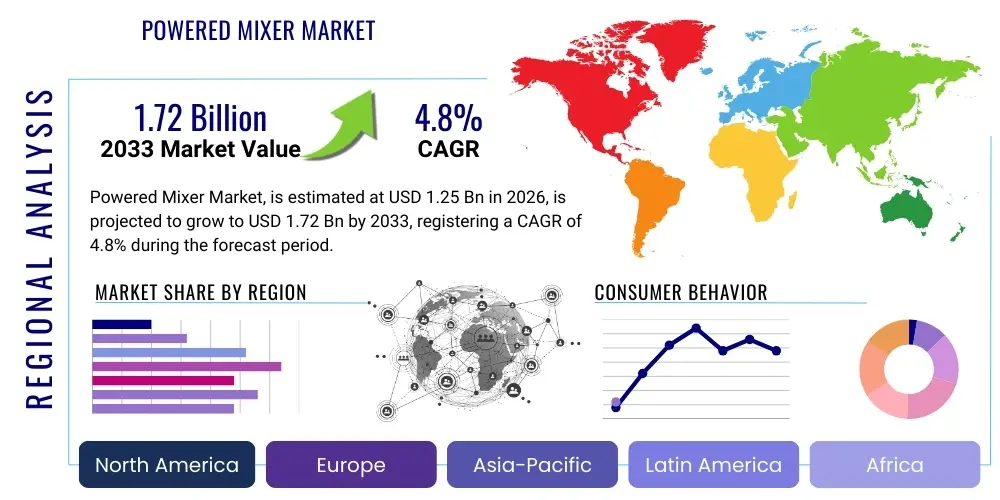

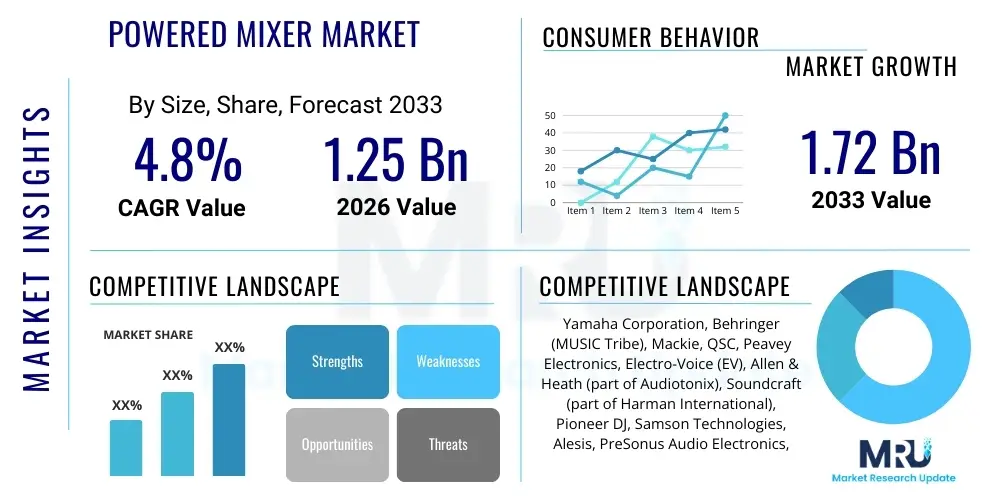

The Powered Mixer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.72 Billion by the end of the forecast period in 2033.

Powered Mixer Market introduction

The Powered Mixer Market encompasses sophisticated electronic devices integrating a mixing console and a power amplifier into a single, cohesive unit. These devices are crucial for sound reinforcement applications, eliminating the need for separate external amplifiers, which simplifies setup, reduces equipment footprint, and enhances portability, making them highly desirable for mobile DJs, small-to-medium live venues, educational institutions, and houses of worship. Product complexity ranges from small, basic units offering fundamental EQ and routing capabilities to advanced digital models featuring extensive onboard effects, sophisticated digital signal processing (DSP), network connectivity (such as Dante or AVB), and comprehensive remote control capabilities via mobile applications or dedicated software interfaces. The core function is to receive, combine, process, and amplify various audio sources (microphones, instruments, playback devices) into a unified, high-quality output delivered to passive loudspeakers.

Major applications of powered mixers span across diverse sectors, predominantly concentrated in live sound reinforcement, fixed installations in commercial spaces, and mobile entertainment events. Benefits include exceptional ease of deployment, which significantly lowers the barrier to entry for novice sound engineers, coupled with cost efficiency compared to procuring separate high-wattage amplifiers and mixing boards. Modern powered mixers often include features such as feedback suppression, automatic gain control, and integrated multi-effects processors, maximizing sound quality and operational stability. The driving factors behind market expansion include the global proliferation of live music events, increasing demand for plug-and-play audio solutions in corporate and educational settings, and technological advancements focusing on miniaturization, enhanced power efficiency, and integration of cutting-edge digital audio networking standards. These factors collectively push manufacturers toward developing more compact, powerful, and feature-rich powered mixing solutions.

The transition toward digital powered mixers is a profound trend reshaping the market, offering unparalleled flexibility and performance. Digital models facilitate preset recall, virtual soundcheck capabilities, and superior sonic fidelity through 24-bit/96kHz processing. This shift is particularly impactful in installation markets where remote management and system integration are paramount. Furthermore, the rising adoption of high-efficiency Class D amplification technology allows manufacturers to pack greater power output into lighter, cooler-running chassis, addressing crucial constraints related to heat dissipation and weight—especially important for touring applications. Continued focus on user-centric design, robust construction for road durability, and seamless integration with existing audio ecosystems solidifies the powered mixer's relevance in the evolving professional audio landscape.

Powered Mixer Market Executive Summary

The Powered Mixer Market is characterized by robust business trends driven by the convergence of portability, power density, and digital functionality. Key market players are prioritizing the development of hybrid powered mixers that combine the intuitive, tactile controls of analog interfaces with the advanced processing power and flexibility of digital systems. Consolidation among manufacturers specializing in professional audio equipment has led to strategic acquisitions, aiming to broaden product portfolios and leverage cross-platform technological expertise, particularly concerning DSP algorithms and network integration standards. The shift towards subscription-based software updates and enhanced ecosystem integration (e.g., compatibility with proprietary loudspeaker management systems) is becoming a competitive differentiator, moving the market beyond hardware sales toward comprehensive audio solutions. Furthermore, supply chain resilience, focusing on securing high-quality semiconductor components essential for digital mixers, remains a crucial operational challenge and a focal point for strategic investment.

Regionally, North America and Europe maintain dominance, attributed to mature professional entertainment industries, high disposable income allocated to professional audio equipment, and the pervasive presence of key manufacturing and technology hubs. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid infrastructure development, the explosion of entertainment and performance venues in emerging economies like India and China, and increasing consumer awareness regarding professional-grade audio quality. Governments and private entities in APAC are investing heavily in establishing modern conference centers, theaters, and mega-churches, creating substantial latent demand for integrated, reliable, and powerful sound reinforcement systems. Latin America and MEA are also showing steady growth, primarily fueled by the burgeoning live events sector and increased access to affordable, robust audio equipment imported from established manufacturing centers.

Segmentation trends highlight the increasing polarization between entry-level, highly portable analog mixers serving small venues and high-end, network-enabled digital powered mixers tailored for fixed installations and demanding touring requirements. The digital segment, particularly those offering advanced features like motorized faders and integrated Wi-Fi control, is experiencing accelerated adoption due to its superior efficiency and versatility. Within the application segment, the Live Sound category remains the largest consumer, but the Installation segment (including hospitality, corporate, and educational environments) is registering a faster CAGR, reflecting the demand for permanently installed, low-maintenance sound systems where powered mixers provide an all-in-one convenience package. Power output categorization also reflects evolving technology, with high-power (2000W+ per channel) Class D amplifiers dominating the medium-to-large venue market by offering unprecedented power-to-weight ratios.

AI Impact Analysis on Powered Mixer Market

User inquiries regarding AI's influence on the Powered Mixer Market frequently center on automation capabilities, enhanced sound optimization, and preventative maintenance features. Common user questions include: "Can AI automatically mix a live band?" "Will AI replace the sound engineer?" "How can AI reduce feedback?" and "Can powered mixers use machine learning for room correction?" This indicates a primary user concern regarding the potential for AI to automate complex audio tasks, thereby simplifying operation and improving sonic consistency across varied environments. Users anticipate AI integration to provide predictive analysis for equipment failure and sophisticated, real-time algorithms for acoustic optimization, moving beyond traditional fixed DSP presets toward adaptive, dynamic sound management. The expectation is that AI will enhance, not replace, the audio professional, by handling repetitive technical adjustments and optimizing sound quality based on live acoustic data, leading to significantly reduced setup times and superior audience experiences.

- AI-driven automated gain staging ensures optimal input levels are maintained dynamically, preventing clipping and maximizing signal-to-noise ratio without manual intervention.

- Machine learning algorithms enhance feedback suppression systems, allowing the mixer to precisely identify and notch out resonant frequencies faster and more accurately than traditional analog or fixed DSP filters.

- Predictive maintenance implemented via AI monitors internal amplifier temperatures, current draw, and component performance, alerting users to potential failures before catastrophic breakdown, thus improving equipment reliability.

- AI-based acoustic room correction automatically analyzes the frequency response characteristics of the venue in real-time and applies adaptive equalization and time alignment to optimize speaker performance.

- Generative audio effects using deep learning models offer novel and complex sound manipulation possibilities that surpass conventional digital effects libraries.

- Enhanced user interface personalization through AI analyzes engineer preferences and common workflow patterns to customize control layouts and streamline mixing processes.

DRO & Impact Forces Of Powered Mixer Market

The Powered Mixer Market is propelled by key drivers such as the burgeoning global events and entertainment sector, the persistent demand for compact and highly portable audio solutions, and continuous technological advancements, particularly in Class D amplification and integrated DSP technology. Restraints primarily involve intense competition from the trend toward separate component systems (passive mixers combined with active/powered loudspeakers), high initial capital investment required for high-end digital powered mixers, and complexity in integrating disparate network audio protocols across different brands. Opportunities are abundant in emerging markets focusing on infrastructure development, the expansion of the corporate AV sector requiring robust yet straightforward conferencing solutions, and the potential for integrating augmented reality (AR) tools for intuitive physical mixing control. The interplay of these factors, collectively known as Impact Forces, dictates the trajectory of market adoption; the convenience and portability of all-in-one systems strongly impact small-to-medium users, while the cost factor and competitive alternatives pressure high-end adoption. Successfully navigating these forces requires manufacturers to prioritize robust digital networking capabilities while simultaneously optimizing the price-to-performance ratio.

The primary driving force remains the increasing professionalization of audio requirements in non-traditional settings, such as educational, corporate, and governmental installations. These settings demand centralized control and reliable performance without requiring highly specialized audio technicians on staff. Powered mixers fulfill this niche perfectly by offering simplified operation and system integrity checks built directly into the console. Furthermore, the exponential improvement in Class D amplifier efficiency has significantly reduced the size, weight, and heat generation of powerful units, overcoming previous restraints related to portability and reliability. This efficiency allows for greater channel density and higher output capabilities within a single rack unit or compact housing, making high-power solutions accessible to a wider user base and accelerating replacement cycles for older, heavier analog equipment.

Despite these drivers, a significant restraint is the continued market preference among top-tier audio professionals and large touring companies for modular, separate component systems, particularly active loudspeakers which integrate amplification directly. This preference is based on the perceived flexibility and superior scalability of separate components. Moreover, the barrier to entry presented by the advanced technical knowledge required to fully utilize sophisticated digital powered mixers, especially those with complex network routing capabilities, can deter potential small venue operators. Addressing this requires manufacturers to focus on highly intuitive user interfaces and automated configuration tools. Opportunities reside in leveraging IoT capabilities for remote diagnostics and maintenance, further enhancing the appeal of these integrated solutions in fixed installations where minimized downtime is paramount.

Segmentation Analysis

The Powered Mixer Market segmentation offers critical insights into user requirements and technological focus across different application environments and technical specifications. The market is primarily segmented based on the type of technology (Analog, Digital, Hybrid), the power output capabilities (Low, Medium, High Wattage), and the application environment (Live Sound/Touring, Studio/Broadcast, Fixed Installation). Digital powered mixers are rapidly gaining market share due to their superior feature sets, preset memory, and network integration capabilities, pushing analog units into the budget or niche markets. Power output segmentation reflects the venue size, with high-wattage units specifically targeting outdoor events and large concert halls. The fastest-growing application segment, fixed installation, emphasizes reliability, energy efficiency, and ease of integration into existing building management systems, driving demand for specialized features like remote control and fail-safe operation modes.

- By Type:

- Analog Powered Mixers

- Digital Powered Mixers

- Hybrid Powered Mixers (Combining analog inputs with digital processing)

- By Power Output (RMS per Channel):

- Low Power (Under 500 Watts)

- Medium Power (500 Watts to 1500 Watts)

- High Power (Above 1500 Watts)

- By Application:

- Live Sound Reinforcement (Concerts, Touring, Mobile DJ)

- Fixed Installation (Churches, Corporate Halls, Educational Facilities)

- Studio and Broadcast (Post-production, Small Broadcast Sets)

Value Chain Analysis For Powered Mixer Market

The value chain for the Powered Mixer Market begins with upstream activities focused on the procurement of specialized components, including high-performance Analog-to-Digital/Digital-to-Analog converters (AD/DA), advanced semiconductor chips for DSP, high-efficiency Class D amplifier modules, and proprietary networking chips (like Dante or AES67). Key upstream suppliers are crucial for determining the quality, latency, and overall performance of the finished product. Manufacturing processes involve complex PCB design, precise soldering, assembly of robust physical chassis capable of withstanding touring demands, and rigorous quality control and stress testing to ensure amplifier reliability. The efficiency of this upstream phase directly impacts the final product’s cost and competitiveness.

Midstream activities involve core manufacturing, including research and development (R&D) focused on miniaturization, thermal management, and software development for intuitive user interfaces and remote control applications. Brand reputation and proprietary technological advancements (e.g., unique EQ algorithms or feedback suppression circuits) are established here. Downstream activities encompass the movement of finished goods through various channels. Distribution channels are bifurcated into direct sales to large integration firms for fixed installations and indirect sales through specialized audio equipment distributors, retailers (both brick-and-mortar and e-commerce platforms), and value-added resellers (VARs) who often bundle the mixers with loudspeakers and microphones. E-commerce platforms are increasingly vital for reaching the prosumer and small venue market due to their vast reach and competitive pricing.

The success in the downstream segment relies heavily on effective channel management, post-sales support, and technical training provided to end-users and installation partners. Direct channels allow manufacturers tighter control over pricing and customer feedback, essential for high-end digital products requiring complex installation support. Indirect channels, particularly specialized regional distributors, provide local market expertise and rapid inventory deployment, critical in fragmented global markets. Effective collaboration across the value chain, from component suppliers to regional installers, ensures that products meet the demanding performance and durability standards expected by professional audio users worldwide, while simultaneously managing inventory risks associated with highly technical, cyclical product releases.

Powered Mixer Market Potential Customers

Potential customers and end-users of powered mixers represent a diverse spectrum, primarily categorized by their operational scale, technical expertise, and venue type. The largest segment comprises mobile entertainers, including DJs and small touring bands, who prioritize portability, quick setup time, and an all-in-one solution that reduces the amount of gear they must transport. Houses of worship form another significant customer base, valuing the simplicity of operation, reliable performance, and often the necessity for multi-channel mixing capabilities for choirs, spoken word, and video feeds within a single console. Educational institutions, spanning from high school auditoriums to university lecture halls, seek durable, user-friendly equipment that can withstand multiple operators and diverse applications, often with fixed installation requirements and remote management capabilities.

The corporate sector, encompassing conference centers, hotel ballrooms, and convention facilities, represents a high-growth customer segment. These buyers demand sophisticated, discreet installations where the powered mixer must integrate seamlessly with video conferencing systems and be controlled intuitively by non-technical staff. Furthermore, professional audio rental companies constitute key buyers, acquiring large inventories of robust, high-wattage powered mixers specifically for short-term events and large outdoor functions where rapid deployment and durability are non-negotiable prerequisites. The key differentiating factor for high-value customers (like corporate integrators) is not just peak performance but also long-term reliability, comprehensive warranty support, and standardized networking compatibility, driving demand towards premium digital models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.72 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yamaha Corporation, Behringer (MUSIC Tribe), Mackie, QSC, Peavey Electronics, Electro-Voice (EV), Allen & Heath (part of Audiotonix), Soundcraft (part of Harman International), Pioneer DJ, Samson Technologies, Alesis, PreSonus Audio Electronics, RCF S.p.A., FBT Elettronica S.p.A., Pyle Audio, Phonic Corporation, TASCAM, Wharfedale Pro, Studiomaster, American Audio |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Powered Mixer Market Key Technology Landscape

The technological evolution of the Powered Mixer Market is primarily characterized by the shift from heavy, inefficient analog circuitry to lightweight, highly efficient digital platforms. Key technologies driving innovation include Class D amplification, which offers exceptional power efficiency (often exceeding 90%) and drastically reduces the weight and heat output compared to traditional Class A/B amplifiers. This allows manufacturers to build powerful mixers into compact, fan-less or low-noise chassis, which is critical for noise-sensitive applications like studio or broadcast environments. Furthermore, advanced Digital Signal Processing (DSP) chips are standard features in modern mixers, enabling complex functions such as sophisticated multi-band equalization, compressor/gate dynamics control on every channel, virtual effects racks, and automated mixing features, all integrated internally, streamlining the overall signal chain complexity.

The integration of high-speed digital audio networking protocols, such as Dante (developed by Audinate) and AVB (Audio Video Bridging), is transforming how powered mixers interface with the broader audio ecosystem. Network connectivity allows for streamlined signal routing, remote control, and system expansion over standard ethernet cables, significantly reducing the requirement for bulky analog cabling. This networking capability is particularly vital in large installations or complex touring setups where signal distribution needs to be flexible and robust, ensuring low latency and high channel counts. Manufacturers are actively integrating these protocols to provide interoperability with other professional audio equipment, positioning the powered mixer as a hub within a wider digital audio network.

Future technological trends are focusing on miniaturization of high-density components and enhanced user interaction. High-resolution touchscreens and dedicated control surfaces, often combined with Wi-Fi and Bluetooth connectivity, allow engineers to mix wirelessly from anywhere in the venue using tablets or smartphones, optimizing the sound experience from the audience's perspective. Moreover, the increasing adoption of 32-bit floating-point processing enhances dynamic range and audio fidelity, meeting the stringent requirements of modern high-definition audio sources. The amalgamation of powerful processing, efficient amplification, and robust connectivity defines the competitive edge in the current technology landscape, making mixers more capable, reliable, and user-friendly than previous generations.

Regional Highlights

- North America: This region holds a dominant market share, driven by a highly mature entertainment industry, substantial spending on professional audio equipment for live music venues, and a strong presence of large churches and corporate installations. Demand is heavily concentrated in high-end digital powered mixers featuring advanced networking capabilities and comprehensive software ecosystems. The U.S. market, in particular, showcases rapid adoption of new audio technology and strong consumer emphasis on brand reputation and quality, favoring key manufacturers known for reliability and customer support. The proliferation of music festivals and dedicated live event spaces ensures sustained demand for high-output, reliable mixing solutions.

- Europe: Characterized by a strong cultural affinity for live music and events, Europe represents a major market. Countries like the UK, Germany, and France are hubs for professional audio manufacturing and distribution. The European market exhibits a balanced demand across analog and digital segments, influenced by smaller venue sizes requiring compact solutions, particularly in urban areas. Regulatory emphasis on energy efficiency and standardized connectivity protocols (like AES67) further shape product development, pushing manufacturers toward energy-efficient Class D models suitable for diverse installation environments, from historic theaters to modern conference centers.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, fueled by rapid urbanization, significant government and private investment in entertainment infrastructure (new stadiums, convention centers, and theaters), and the explosive growth of the domestic music scene. Countries such as China and India are experiencing soaring demand for professional audio solutions. The market here is sensitive to price, leading to high consumption of cost-effective, high-quality mid-range powered mixers. Localization of user interfaces and robust distribution networks are critical factors for market penetration in this dynamic and rapidly expanding regional landscape.

- Latin America (LATAM): Growth in LATAM is steady, primarily driven by mobile DJs, local concert circuits, and expansion of houses of worship which favor the all-in-one convenience of powered mixers. While budget constraints often guide purchasing decisions, there is a growing interest in hybrid digital/analog models that offer advanced features without the full cost of high-end digital consoles. Brazil and Mexico are core markets, requiring durable equipment built to withstand fluctuating environmental conditions and intensive mobile use.

- Middle East and Africa (MEA): This region is characterized by substantial infrastructure projects, particularly in the UAE and Saudi Arabia, leading to increased demand for high-end fixed installations in hospitality, tourism, and massive cultural event venues. The market generally favors reliable, high-specification equipment capable of handling large-scale events. Growth in Africa is driven by emerging economies adopting affordable, robust powered mixers for community centers and small performance venues, making reliability and ease of use crucial buying criteria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Powered Mixer Market.- Yamaha Corporation

- Behringer (MUSIC Tribe)

- Mackie

- QSC

- Peavey Electronics

- Electro-Voice (EV)

- Allen & Heath (part of Audiotonix)

- Soundcraft (part of Harman International)

- Pioneer DJ

- Samson Technologies

- Alesis

- PreSonus Audio Electronics

- RCF S.p.A.

- FBT Elettronica S.p.A.

- Pyle Audio

- Phonic Corporation

- TASCAM

- Wharfedale Pro

- Studiomaster

- American Audio

Frequently Asked Questions

Analyze common user questions about the Powered Mixer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a powered mixer and an unpowered (passive) mixer?

A powered mixer integrates both the mixing console and the power amplifier into a single chassis, allowing it to directly drive passive loudspeakers without external amplification units. An unpowered (passive) mixer only processes and combines the audio signals and requires separate power amplifiers or active (self-powered) loudspeakers to produce sound.

Which is better for touring applications: analog or digital powered mixers?

Digital powered mixers are generally preferred for professional touring applications due to their exceptional portability, high channel density, ability to save and recall complex scene presets quickly, and integrated networking capabilities, which streamline setup and improve operational efficiency compared to analog counterparts.

How is Class D amplification impacting the design of modern powered mixers?

Class D amplification is critically important as it provides high power output (wattage) with significantly reduced heat generation and weight. This efficiency allows manufacturers to create much lighter, smaller, and more portable powered mixers that are easier to transport and less prone to overheating, optimizing them for mobile sound reinforcement.

What role does network technology like Dante play in high-end powered mixers?

Dante and similar protocols enable powered mixers to transmit and receive multiple channels of high-resolution, low-latency digital audio over standard ethernet cables. This simplifies complex cable runs, facilitates remote patching and control, and allows the powered mixer to integrate seamlessly with other networked audio devices, which is vital for large-scale fixed installations.

What is the expected CAGR for the Powered Mixer Market between 2026 and 2033?

The Powered Mixer Market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven by increasing adoption in emerging markets and continued technological improvements in digital integration and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager