Powered Paramotors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438866 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Powered Paramotors Market Size

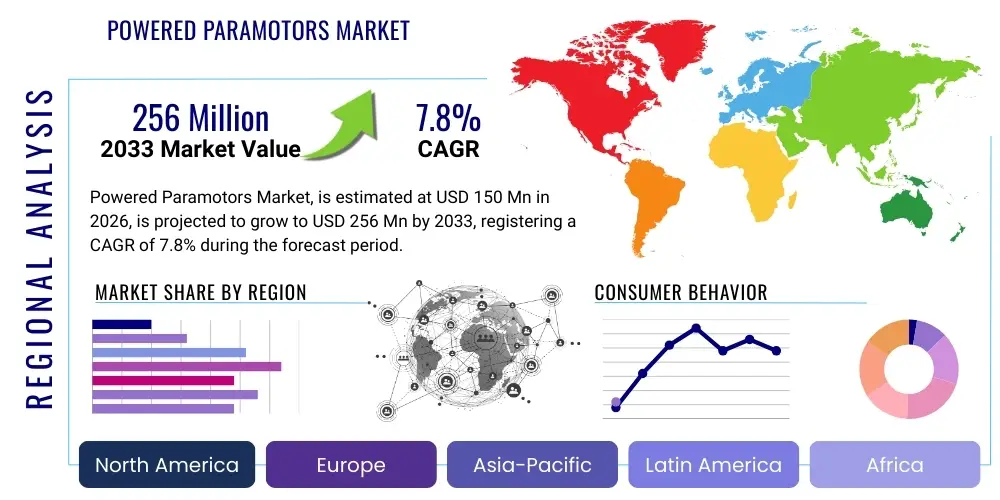

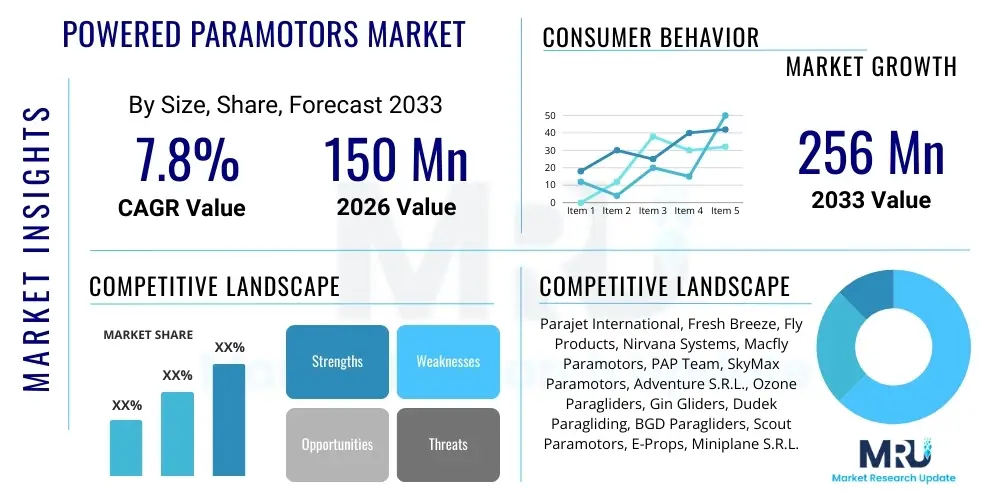

The Powered Paramotors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 256 Million by the end of the forecast period in 2033.

Powered Paramotors Market introduction

The Powered Paramotors Market, encompassing Powered Paragliding (PPG) systems, represents a niche but rapidly expanding segment within the broader light aviation and personal aerial mobility industry. A powered paramotor is essentially a paraglider wing coupled with a propulsion system—typically a two-stroke or four-stroke gasoline engine, or increasingly, an electric motor—worn by the pilot as a backpack. This system allows for foot-launched takeoff and landing, providing exceptional mobility and low-altitude flight capability without the need for traditional runways or complex infrastructure. The simplicity of operation, coupled with the relatively low barrier to entry regarding cost and training compared to fixed-wing aircraft or helicopters, positions paramotors as attractive solutions for both recreational enthusiasts and professional applications requiring rapid, localized aerial access.

The primary product differentiation within this market revolves around the engine type, power-to-weight ratio, frame construction materials (e.g., aluminum, carbon fiber), and noise reduction features. Major applications span recreational flying, aerial photography and videography, search and rescue (SAR) operations, border patrol and surveillance, and agricultural monitoring. Key benefits driving market adoption include superior maneuverability, portability (allowing transportation in standard vehicle trunks), fuel efficiency, and the ability to operate safely in confined spaces or challenging terrains. Furthermore, the inherent safety profile, relying on the high glide ratio of the paraglider wing, ensures controlled descent even in the event of engine failure, fostering user confidence and expanding the demographic of potential pilots.

Driving factors propelling the market growth include the rising popularity of adventure sports and experiential tourism, increasing demand from governmental and non-governmental organizations for cost-effective aerial surveillance platforms, and significant technological advancements in engine efficiency and battery performance (for electric models). Regulatory environments are also gradually evolving, with numerous jurisdictions implementing specific, often less stringent, regulations for ultralight vehicles like paramotors, thereby simplifying operational prerequisites and expanding operational zones. This confluence of technological innovation, regulatory accommodation, and widening application scope underscores the robust growth trajectory anticipated for the powered paramotors sector during the forecast period.

Powered Paramotors Market Executive Summary

The global Powered Paramotors Market is currently experiencing robust momentum, characterized by accelerated technological adoption, particularly the shift toward electric propulsion systems, and diversification of application areas beyond purely recreational use. Business trends indicate a strong focus among manufacturers on developing lighter, more durable frames, integrating advanced safety features such such as ballistic reserve parachutes, and improving engine reliability while reducing acoustic footprint. Key market participants are also engaging in strategic collaborations with training academies and national aviation authorities to standardize training protocols and promote safe operational practices, which in turn fosters market acceptance and reduces insurance complexities. Furthermore, the trend towards modular design allows end-users to easily swap components, enhancing maintenance flexibility and prolonging the operational lifespan of the equipment, thereby offering better return on investment for commercial operators.

Regional trends reveal that North America and Europe currently dominate the market in terms of value, driven by high disposable income, established adventure tourism infrastructure, and relatively mature regulatory frameworks supporting ultralight aviation. However, the Asia Pacific (APAC) region, particularly emerging economies like India and China, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to increasing military and border surveillance applications, coupled with growing domestic enthusiasm for extreme sports. Latin America and the Middle East and Africa (MEA) are also showing promising growth, primarily fueled by the use of paramotors in specialized roles such as large-scale farm monitoring and pipeline inspection, offering a cost-effective alternative to traditional helicopter usage in remote areas.

Segment trends highlight the increasing prominence of Electric Powered Paramotors (EPPGs). While traditional two-stroke gasoline engines still hold the largest volume share due to their high power-to-weight ratio and range capabilities, the electric segment is rapidly gaining ground. This growth is attributable to zero emissions, drastically lower maintenance requirements, and significantly reduced noise pollution, making them ideal for operations near populated areas or wildlife habitats. In terms of application, the Commercial/Utility segment is poised for the fastest expansion, driven by the integration of high-resolution camera systems and LiDAR technology for precise data acquisition in fields such as mapping, construction progress monitoring, and disaster assessment, demonstrating a clear shift from niche leisure activity to essential operational tool.

AI Impact Analysis on Powered Paramotors Market

User queries regarding AI's influence on the Powered Paramotors Market predominantly revolve around three critical themes: enhanced safety mechanisms, the potential for autonomous flight systems, and optimizing flight efficiency. Users frequently ask how AI can prevent mid-air collisions, assist novice pilots in navigating complex weather patterns, and whether AI-driven flight control will eventually lead to pilotless paramotor platforms for dangerous or routine commercial missions. Concerns also center on data privacy related to advanced onboard telemetry and the certification challenges associated with implementing AI algorithms in regulatory environments historically focused on human piloted ultralight aircraft. The general expectation is that AI will primarily serve as a powerful augmentation tool, significantly improving situational awareness and flight control stability, rather than immediately leading to fully autonomous recreational models, though commercial utility platforms are expected to incorporate deep learning for route optimization and payload management faster.

The practical application of Artificial Intelligence in the paramotoring sector is transforming flight safety and mission execution. Currently, AI algorithms are being integrated into ground control systems and onboard electronic systems to process real-time meteorological data, enabling predictive analysis of turbulence and wind shear, which is crucial for safety given the low operational altitude of paramotors. Furthermore, machine learning models are being utilized to analyze historical flight data to optimize throttle control and fuel consumption, thereby extending range and improving efficiency for long-duration missions, especially vital for surveillance and mapping tasks. This intelligent management of flight dynamics reduces pilot workload, making the activity accessible to a broader range of skilled professionals and minimizing human error during critical phases of flight, such as takeoff and landing under adverse conditions.

Looking ahead, the integration of AI-powered vision systems is poised to revolutionize automated obstacle avoidance, especially when paramotors are employed for low-level infrastructure inspection or flying in congested airspace near power lines or antennas. These systems use neural networks trained on vast datasets of aerial imagery to instantaneously identify hazards and recommend corrective flight paths, providing an additional layer of protection beyond standard human visual detection. For the commercial segment, AI is enabling sophisticated payload management, calculating optimal trim settings dynamically based on shifting weight distribution or changing atmospheric density, ensuring maximum stability and efficiency throughout the flight envelope. While fully autonomous paramotors (without a pilot) face substantial regulatory hurdles, AI is crucial in perfecting remote piloting systems used for specialized, high-risk commercial operations, demonstrating its profound role in enhancing both the safety and utility of powered paramotors.

- AI-enhanced situational awareness and predictive weather modeling for pre-flight risk assessment.

- Machine learning algorithms optimizing thrust management and fuel/battery consumption for extended operational range.

- AI-powered object recognition and avoidance systems enhancing low-altitude safety during inspection and surveillance missions.

- Integration of deep learning for automated route planning and dynamic trajectory optimization, minimizing pilot fatigue.

- Development of standardized AI flight telemetry analysis tools to rapidly identify component wear and predictive maintenance needs.

DRO & Impact Forces Of Powered Paramotors Market

The Powered Paramotors Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively dictate the momentum and directional growth of the sector. The primary drivers include the escalating global demand for affordable, ultra-portable aerial platforms for recreational purposes and professional low-altitude surveillance. This driver is powerfully complemented by ongoing technological innovations, especially in lightweight materials engineering and energy density improvements in lithium-ion batteries, which directly address the historical limitations of payload capacity and range. The market is also heavily influenced by the relative ease of acquiring necessary permits and certifications compared to traditional aviation, which significantly lowers the barrier to entry for new operators and pilots worldwide.

Conversely, the market faces significant restraints that temper its expansion. Regulatory ambiguity remains a critical challenge; while many jurisdictions are easing restrictions, the lack of globally harmonized safety standards and operational ceilings creates fragmentation and limits cross-border utility. Furthermore, the inherent noise pollution generated by gasoline-powered two-stroke engines restricts operation in environmentally sensitive areas and urban centers, prompting public resistance. Safety concerns, often magnified by high-profile recreational accidents, also impact consumer confidence and drive up liability insurance costs. These restraints necessitate substantial investment in noise mitigation research and stringent adherence to manufacturer safety guidelines to ensure sustainable market growth.

The most compelling opportunities lie in the accelerating adoption of Electric Powered Paramotors (EPPGs), which effectively address the noise and emission restraints, positioning them for widespread use in urban air mobility (UAM) logistics and highly regulated environments. There is also a substantial opportunity in developing specialized commercial payloads, such as hyperspectral sensors for precision agriculture or advanced thermal imaging for wildfire monitoring, thereby expanding the utility beyond basic photography. The emergence of standardized training simulators and virtual reality tools presents an opportunity to professionalize pilot training, reduce risk exposure, and enhance overall operational safety, creating a more professionalized and trustworthy industry ecosystem that attracts institutional investment and large-scale commercial contracts.

Segmentation Analysis

The Powered Paramotors Market is systematically segmented based on key functional and technical characteristics, allowing for detailed analysis of market behavior and future growth projections across different product categories and end-user demands. The segmentation encompasses classification by Engine Type (Two-stroke, Four-stroke, Electric), Seating Capacity (Single, Tandem), and Application (Recreation, Commercial/Utility, Military/Defense). This structured approach enables market players to tailor product development and marketing strategies precisely to the needs of specific user groups, such as focusing on high-end carbon fiber frames for the recreational enthusiast segment or emphasizing payload endurance and durability for commercial surveillance operators. Understanding these segment dynamics is crucial for investors evaluating potential entry points and for existing manufacturers prioritizing R&D expenditure toward emerging technologies, specifically electric propulsion, which is redefining performance expectations.

The Engine Type segmentation provides insight into the trade-offs between power, weight, and environmental impact. Two-stroke engines dominate legacy sales due to their exceptional power-to-weight ratio, necessary for quick, low-altitude takeoffs, but they are increasingly challenged by environmental regulations and high noise levels. Four-stroke engines offer improved fuel economy and reduced emissions but are heavier and typically more complex to maintain, appealing primarily to pilots prioritizing range and reliability over absolute portability. The electric segment, though currently representing a smaller share, is experiencing explosive growth due to zero emissions, silent operation, and decreased maintenance complexity. The Application segment further differentiates demand; the Recreation segment relies heavily on simplicity and low cost, whereas the Commercial/Utility segment demands high reliability, integrated GPS, and the capacity to carry specialized equipment like high-definition gimbal cameras or specialized measuring tools.

The Tandem seating capacity segment, while small, is strategically important as it facilitates professional training, allowing instructors to safely guide new pilots, and enables tourism operators to offer tandem flights, tapping into the experiential travel market. Conversely, the Single capacity segment forms the vast majority of the market volume, appealing to independent pilots prioritizing maximum portability and agility. Future segmentation analysis will likely incorporate factors related to automation level and material composition (e.g., carbon fiber vs. aluminum frames) as manufacturers increasingly utilize advanced composites to shed weight and enhance structural integrity. This granular market understanding is paramount for forecasting resource allocation and identifying underserved geographic markets where specific product attributes, such as maximum operational ceiling or endurance, are highly valued for mission effectiveness.

- By Engine Type:

- Two-stroke

- Four-stroke

- Electric (EPPG)

- By Seating Capacity:

- Single

- Tandem (Two-seater)

- By Application:

- Recreation and Leisure

- Commercial and Utility (Surveying, Agriculture, Inspection)

- Military and Defense (Reconnaissance, Border Patrol)

- By Components:

- Wing/Canopy

- Frame/Cage

- Engine/Motor (Propulsion System)

- Harness and Safety Equipment

Value Chain Analysis For Powered Paramotors Market

The value chain of the Powered Paramotors Market begins with the upstream activities centered on the procurement and processing of specialized raw materials and components, which are crucial for achieving the necessary power-to-weight ratios and structural integrity. Key upstream suppliers include specialized manufacturers of small, high-performance engines (often derived from drone or karting technology), advanced composite material suppliers (carbon fiber, lightweight aluminum alloys for frames), and specialized textile manufacturers producing high-tenacity nylon and polyester fabrics for the paraglider wing (canopy). The performance and reliability of the final product are highly dependent on the quality control and innovation within this upstream segment, necessitating strong, collaborative relationships between paramotor assembly companies and these component specialists to ensure material specification compliance and continuous weight reduction initiatives. Given the precision engineering required, particularly for propulsion systems, sourcing often involves global supply networks, introducing complexities related to international trade tariffs and logistics management.

The midstream involves the core manufacturing and assembly processes, where the frame, engine, harness, and wing are integrated and tested. Manufacturers typically employ highly skilled technicians for precise welding, machining, and electronic integration, especially for complex electric models incorporating sophisticated battery management systems (BMS). This stage adds significant value through proprietary design, rigorous safety testing, and brand reputation building. Distribution channels then move the finished product to the end-user. Direct channels are common, involving sales directly from the manufacturer to the pilot or commercial client, especially for highly customized professional systems, offering better margin control and direct customer feedback. Indirect channels primarily involve specialized flight schools, paramotor dealers, and adventure sports retailers who provide local sales, maintenance, and essential flight training packages, acting as critical touchpoints for market penetration, particularly in emerging recreational hubs.

Downstream activities focus on post-sale services, including maintenance, repairs, spare parts provision, and, crucially, pilot training and certification. The market relies heavily on certified flight instructors and accredited schools to ensure safe usage, which is essential for managing regulatory risk and fostering market growth. Furthermore, the downstream includes the utilization phase across various applications. For the Commercial/Utility sector, the value is captured through data acquisition services (e.g., aerial mapping data sales) or specialized operational services (e.g., infrastructure inspection contracts). The efficiency of the downstream support network, including the availability of certified maintenance technicians and readily available high-wear parts like propellers and specific engine components, significantly influences customer satisfaction and the perceived total cost of ownership, driving repeat purchases and market loyalty.

Powered Paramotors Market Potential Customers

The potential customer base for the Powered Paramotors Market is highly diversified, ranging from individual recreational enthusiasts seeking affordable personal flight experiences to sophisticated governmental and commercial organizations requiring specialized aerial platforms. The largest volumetric segment comprises private individuals, often categorized as adventure sports aficionados, who value the freedom, portability, and relatively low operational cost compared to owning conventional aircraft. These recreational buyers prioritize ease of use, aesthetic design, and maximal safety features, driving demand for single-seater models with reliable, lightweight engines and simplified controls. This segment acts as the foundational demand source, supporting the broader manufacturing ecosystem through volume sales and demand for advanced training services.

A rapidly expanding customer cohort includes commercial enterprises across diverse sectors. These end-users, or buyers, seek practical utility, viewing paramotors as indispensable tools rather than mere leisure devices. Key commercial customers include agricultural companies using paramotors for precision spraying and large-scale crop monitoring (precision agriculture), construction and infrastructure firms requiring quick, low-altitude photographic surveying of project progress, and specialized aerial filming crews seeking unique camera angles and mobility unavailable to drones or helicopters. These commercial buyers prioritize payload capacity, long endurance capabilities, the integration of advanced sensors (like LiDAR or thermal cameras), and robust, reliable four-stroke or electric propulsion systems capable of maintaining stable flight paths under varying load conditions, demonstrating a high willingness to invest in specialized, higher-cost equipment tailored for specific mission profiles.

Furthermore, significant potential lies within the governmental and defense sectors. Military, border patrol, and law enforcement agencies are increasingly adopting paramotors for cost-effective short-range reconnaissance, rapid deployment surveillance, and search and rescue (SAR) operations in challenging terrains where drone range is insufficient and helicopter operations are too expensive or impractical. These governmental buyers demand exceptional durability, secure communication systems, night-vision integration capabilities, and tandem systems for potential rapid insertion/extraction tasks. Non-governmental organizations (NGOs) involved in disaster relief and humanitarian aid also represent a niche but crucial customer base, relying on paramotors for rapid damage assessment and logistical observation following natural catastrophes, valuing their ability to operate effectively without infrastructure support. The diversity of these end-user needs necessitates a highly modular and customizable product offering from market suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 256 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parajet International, Fresh Breeze, Fly Products, Nirvana Systems, Macfly Paramotors, PAP Team, SkyMax Paramotors, Adventure S.R.L., Ozone Paragliders, Gin Gliders, Dudek Paragliding, BGD Paragliders, Scout Paramotors, E-Props, Miniplane S.R.L., Air Conception, Vittorazi Motors, Polini Motori S.p.A., EOS Engines, Helix Propellers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Powered Paramotors Market Key Technology Landscape

The technological landscape of the Powered Paramotors Market is undergoing rapid evolution, primarily driven by three core pillars: propulsion efficiency, material science innovation, and safety system integration. In propulsion, the dominant shift involves the refinement of small, specialized two-stroke engines (like those from Vittorazi or Polini) to achieve higher power output per kilogram while simultaneously meeting stricter emission standards through advanced fuel injection and exhaust system designs. Crucially, the rise of Electric Powered Paramotors (EPPGs) necessitates sophisticated battery technology, focusing on high energy density, rapid charging cycles, and robust thermal management systems to ensure sustained performance and pilot safety during flight. The integration of proprietary Electronic Speed Controllers (ESCs) and efficient electric motors is key to maximizing thrust while managing heat and optimizing battery drain, directly impacting flight endurance, the critical performance metric for electric systems.

Material science contributes significantly through the increasing adoption of aerospace-grade carbon fiber for frames and propellers. This technology delivers substantial weight reduction—often cutting frame weight by 30-40% compared to traditional aluminum—which directly translates into lower required thrust, shorter takeoff runs, and improved fuel/battery efficiency. Advanced parachute canopy fabrics are also being developed to offer improved longevity, higher resistance to UV degradation, and optimized airfoil shapes that maximize glide ratio and stability in turbulent air. Furthermore, the development of modular frame designs utilizing quick-disconnect couplings allows for easy breakdown and portability, a significant technological advantage that enhances the paramotor’s utility for travel and rapid deployment in commercial applications, distinguishing modern systems from earlier, bulkier models.

Safety and instrumentation technologies are also seeing significant upgrades. Modern paramotors frequently incorporate integrated GPS navigation systems and altimeters with advanced digital readouts displayed directly on the throttle hand unit, providing pilots with critical real-time flight metrics. Furthermore, passive safety features, such as enhanced harness geometry for better weight distribution and impact protection, are continuously being refined. The most critical safety technology remains the emergency ballistic reserve parachute system, which uses a pyrotechnic charge to rapidly deploy a secondary parachute, requiring precise engineering to ensure reliability across varied flight conditions. Future technological focus will include the integration of basic flight assistance systems leveraging sensors for automated trim adjustments and advanced telemetry transmission capabilities for real-time remote monitoring of commercial fleets, further professionalizing the operational environment and integrating paramotors into the broader digital aerial ecosystem.

Regional Highlights

The Powered Paramotors Market exhibits distinct regional consumption patterns, influenced by regulatory climate, disposable income, and the maturity of adventure sports culture. North America, particularly the United States, holds a dominant position driven by a large base of recreational pilots, strong manufacturing presence, and generally favorable ultralight aircraft regulations (e.g., FAR 103 exemption in the US), which minimize bureaucratic hurdles. This region sees significant demand for high-end, technologically advanced models, including the early adoption of electric paramotors and integrated digital flight systems, owing to the high average purchasing power of consumers and the extensive marketing efforts aimed at the adventure tourism segment. Moreover, governmental agencies in North America are increasingly exploring paramotor use for border patrol and environmental monitoring, further solidifying the region's market value leadership.

Europe represents the second-largest market, characterized by stringent safety and environmental standards, which drive technological innovation toward noise reduction and cleaner propulsion systems. Countries such as France, Spain, and the Czech Republic have strong paramotor manufacturing bases and well-established, regulated training infrastructures, leading to a high penetration rate in both recreational and professional surveying sectors. European manufacturers are often at the forefront of developing sophisticated canopy designs and lightweight material applications. Regulatory harmonization efforts within the European Union, while slow, continue to support market accessibility and cross-border operations, encouraging tourism and professional deployment.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment. This growth is predominantly fueled by rapid urbanization and corresponding increases in infrastructure projects, demanding cost-effective aerial surveying tools, particularly in China, India, and Australia. While the recreational market is nascent in many parts of APAC, military and defense applications are significant drivers, utilizing paramotors for cost-effective reconnaissance in complex coastal and mountainous terrains. Market growth in APAC often necessitates products tailored for high-temperature and high-humidity operational environments. Latin America and the Middle East and Africa (MEA) represent emerging markets where commercial applications, such as vast agricultural land monitoring (Brazil, Argentina) and oil/gas pipeline inspection (MEA), are the primary catalysts. These regions prioritize durability, maximum payload, and operational independence in remote areas over aesthetic features or noise reduction, favoring robust gasoline models for their simplicity and range.

- North America: Market leader, strong recreational base, early adopter of EPPGs, favorable ultralight regulations (FAR 103).

- Europe: Second largest market, high manufacturing quality, strong regulatory focus on noise and emissions, robust training infrastructure.

- Asia Pacific (APAC): Highest expected CAGR, driven by military/surveillance applications and rapid expansion in commercial surveying (China, India).

- Latin America (LATAM): Growth fueled by utility applications in agriculture (precision farming) and resource management across large, inaccessible terrains.

- Middle East and Africa (MEA): Emerging market, focus on security surveillance (border patrol) and critical infrastructure inspection (oil and gas pipelines).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Powered Paramotors Market.- Parajet International

- Fresh Breeze

- Fly Products

- Nirvana Systems

- Macfly Paramotors

- PAP Team

- SkyMax Paramotors

- Adventure S.R.L.

- Ozone Paragliders

- Gin Gliders

- Dudek Paragliding

- BGD Paragliders

- Scout Paramotors

- E-Props

- Miniplane S.R.L.

- Air Conception

- Vittorazi Motors

- Polini Motori S.p.A.

- EOS Engines

- Helix Propellers

Frequently Asked Questions

Analyze common user questions about the Powered Paramotors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Electric (EPPG) and Gasoline Powered Paramotors?

Electric Powered Paramotors (EPPGs) offer silent operation, zero direct emissions, and significantly lower maintenance needs, making them preferred for environmentally sensitive areas and urban periphery use. However, current limitations include higher initial cost, limited flight endurance (range), and longer recharge times. Gasoline models (two-stroke or four-stroke) provide greater power-to-weight ratios, longer range due to high energy density of gasoline, and faster refueling, dominating the long-distance commercial and heavy-load segments, despite inherent noise and higher maintenance requirements.

What are the key regulatory hurdles affecting the expansion of the Powered Paramotors Market?

The primary hurdles are fragmented regulatory standards across countries concerning ultralight aircraft classification, flight ceilings, and required pilot licensing. While many regions like the US (under FAR 103) treat paramotors as minimally regulated foot-launched gliders, restrictions on urban airspace access and mandatory noise limits in Europe and other developed markets necessitate costly compliance measures and specialized certification, slowing widespread commercial adoption outside of designated recreational zones.

How is the Powered Paramotors Market impacting the field of precision agriculture and commercial utility?

Paramotors offer a cost-effective, highly maneuverable platform for precision agriculture by carrying multispectral and thermal sensors for monitoring crop health, irrigation efficacy, and pest infestation over vast farm areas. In commercial utility, they are invaluable for rapid, low-altitude inspection of hard-to-access infrastructure like power lines, pipelines, and construction sites, providing high-resolution aerial data significantly faster and cheaper than traditional helicopters or fixed-wing surveillance, especially for linear assets.

Which regions are currently leading the market in terms of value and technological innovation?

North America currently leads the market in terms of overall value due to high consumer spending power, established recreational infrastructure, and streamlined regulation. However, Europe is strongly driving technological innovation, particularly in sustainable materials, noise reduction technologies, and the rapid advancement of electric propulsion systems (EPPGs), responding directly to strict regional environmental and acoustic standards.

What are the most significant technological advancements contributing to enhanced paramotor safety?

The most significant safety advancements include the integration of sophisticated electronic instruments for real-time situational awareness (GPS, advanced altimeters), the widespread use of impact-resistant carbon fiber frame materials, and the critical refinement of ballistic reserve parachute systems that can be reliably deployed at low altitudes. Ongoing development focuses on AI-assisted flight planning and obstacle detection to mitigate pilot error and environmental risks during challenging flight conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager