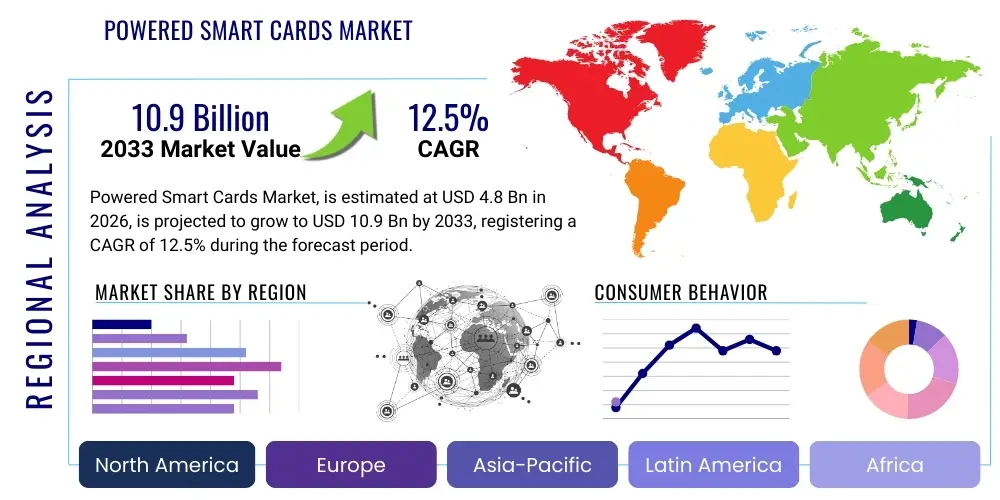

Powered Smart Cards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439099 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Powered Smart Cards Market Size

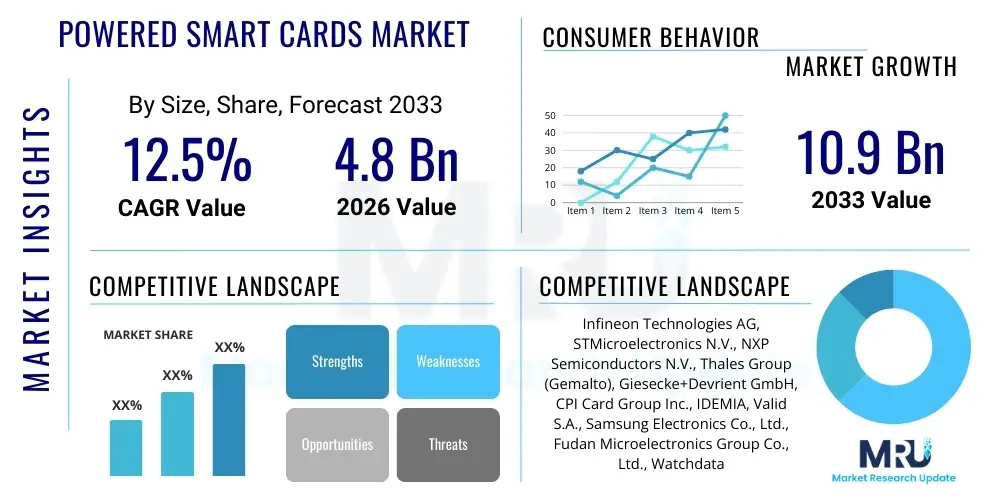

The Powered Smart Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033.

Powered Smart Cards Market introduction

The Powered Smart Cards Market encompasses advanced smart card technology integrating an internal power source, typically a thin-film battery, micro-battery, or a miniature power cell, along with embedded components such as microcontrollers, biometric sensors, dynamic display modules, and secure operating systems. Unlike traditional passive smart cards that rely solely on external readers (NFC/RFID) for power and operation, powered smart cards offer enhanced functionalities, including on-card display of dynamic security codes (Dynamic CVV/CVC), sophisticated biometric authentication for transactions, and extended operational ranges without constant physical contact with a reader. This inherent capability for independent operation and complex data processing positions them as critical instruments for high-security applications, elevating both user convenience and transactional integrity across various sectors.

Major applications for powered smart cards span critical infrastructure domains. In the Banking, Financial Services, and Insurance (BFSI) sector, they are pivotal in combating card-not-present (CNP) fraud through the use of powered display cards, which generate one-time passwords or rotating security codes directly on the card surface. Government and Healthcare industries utilize these powered solutions for secure identification, access control, and handling sensitive patient data, often integrating biometric verification directly onto the card. Furthermore, the telecommunications sector leverages them for advanced Subscriber Identity Modules (SIMs) requiring internal processing capabilities, while the logistics and supply chain sectors employ them for tracking high-value assets where active, secure data logging is mandatory, demonstrating their multifaceted utility.

The market's robust growth is fundamentally driven by the escalating demand for highly secure, multi-factor authentication mechanisms in digital and physical transactions, a necessity underscored by the global rise in sophisticated cybercrime and identity theft. Benefits include superior fraud mitigation, seamless integration of biometric features, reduced dependency on external authentication devices, and improved compliance with stringent regulatory frameworks like PSD2 and GDPR regarding data protection and transactional security. The continuous miniaturization of power sources and sensor technology, coupled with decreasing manufacturing costs for flexible display components, further accelerates their adoption across emerging economies and technologically mature markets seeking next-generation security solutions for digital commerce and physical access.

Powered Smart Cards Market Executive Summary

The global Powered Smart Cards Market is experiencing significant acceleration, fueled by pivotal business trends such as the pervasive adoption of biometric payment cards and the integration of dynamic security features (like e-ink or flexible LCD displays) into financial instruments. Technology convergence, particularly the combination of embedded power, secure elements, and near-field communication (NFC) capabilities, is reshaping the competitive landscape, pushing established semiconductor and card manufacturers to invest heavily in miniaturization and battery longevity research. Key business imperatives driving this surge include the necessity for enhanced customer experience in contactless payments and the regulatory mandate for stronger authentication methods, leading to strategic partnerships between technology providers and major issuing banks worldwide to pilot and scale deployment programs for high-security powered solutions.

Regionally, North America and Europe maintain dominance, primarily due to well-established payment infrastructures, high consumer acceptance of advanced payment technologies, and the early implementation of regulatory standards requiring stronger customer authentication. The Asia Pacific (APAC) region, however, is projected to exhibit the highest growth rate, driven by rapid digitalization, massive governmental initiatives related to national ID and healthcare digitization, and the explosion of mobile and contactless payments in countries like India, China, and Southeast Asia. The focus in APAC shifts towards mass deployment of powered identification cards alongside financial applications, capitalizing on the region's large, tech-savvy population and lower card issuance costs compared to Western counterparts, creating a fertile ground for market expansion.

Segmentation analysis reveals that the BFSI segment remains the largest consumer by application, primarily driven by the deployment of display cards and biometric cards aimed at securing high-value transactions and mitigating sophisticated card fraud. In terms of components, microcontrollers and secure elements constitute the foundation of the technology, but the highest growth trajectory is observed in the sensor and battery segments, reflecting the industry's shift towards self-sufficient, multi-functional cards. The hybrid card type, which combines powered active features with passive contact/contactless interfaces, is gaining prominence, offering maximum interoperability and flexibility across diverse reader environments, thereby appealing to issuers seeking comprehensive solutions.

AI Impact Analysis on Powered Smart Cards Market

Common user inquiries regarding the impact of Artificial Intelligence on the Powered Smart Cards Market center on two primary areas: enhancing on-card security features and optimizing manufacturing/supply chain efficiency. Users frequently ask how AI can improve biometric authentication reliability on the card, whether AI algorithms embedded within the card’s secure element can detect and prevent emerging transaction fraud patterns in real-time (edge computing security), and how generative AI tools might accelerate the design and testing of new card functionalities, especially concerning battery life optimization and sensor calibration. These questions highlight user expectations that AI will move beyond simple data processing to enable truly adaptive, self-learning security features integrated directly into the physical card infrastructure, thereby establishing a new benchmark for trust and safety in digital interaction.

AI algorithms are fundamentally transforming the operational profile of powered smart cards by integrating sophisticated anomaly detection and predictive security capabilities. On-card AI, utilized through optimized, lightweight machine learning models embedded in the secure element, allows the card to learn individual user spending habits and authentication nuances (e.g., biometric pressure sensitivity or transaction location patterns). If a transaction deviates significantly from the learned profile, the card can dynamically require a higher level of authentication, such as a biometric scan combined with a rotating security code, without needing instant communication with the central server. This crucial capability minimizes latency and significantly enhances fraud prevention in offline or intermittent connectivity environments, providing a proactive layer of defense that was previously impossible to achieve with static security protocols.

Furthermore, AI plays a crucial role in optimizing the physical lifecycle and production logistics of powered smart cards. Machine learning is being applied during the manufacturing process to analyze sensor data from battery embedding and component lamination, predicting potential failure points and optimizing material usage, thereby improving yield rates and product longevity. In the deployment phase, AI assists issuers in predicting card wear-out rates and proactively managing inventory and reissuance cycles based on usage data and environmental factors (temperature, humidity exposure) captured by the card's internal sensors. This operational efficiency translates directly into reduced cost of ownership for issuers and guarantees continuous, reliable service for the end-user, further solidifying the business case for adopting powered smart card technology.

- AI-Powered Biometrics: Enhancing accuracy and spoof detection for fingerprint and vein recognition embedded within the card.

- Edge Fraud Detection: Utilizing lightweight ML models on the secure element for real-time, behavioral anomaly detection without cloud connectivity.

- Dynamic Risk Scoring: Adjusting required authentication levels based on transactional context and historical usage patterns analyzed by embedded AI.

- Manufacturing Optimization: Using predictive analytics to improve battery integration quality, component calibration, and overall production yield.

- Personalized Card Experience: Customizing display information or access rights based on learned user profiles and context determined by AI.

DRO & Impact Forces Of Powered Smart Cards Market

The Powered Smart Cards Market is propelled by powerful Drivers, yet faces structural Restraints, while significant Opportunities emerge from technological innovation and regulatory shifts. Key Drivers include the urgent global need for robust fraud mitigation tools, especially for card-not-present transactions, and the consumer trend towards seamless, biometric-enabled payment methods. Restraints primarily revolve around the higher unit cost of powered cards compared to passive alternatives, the perceived complexity regarding the longevity and replacement cycle of embedded batteries, and the need for new infrastructure upgrades (e.g., specialized POS terminals for handling display or biometric prompts). Opportunities are abundant, specifically in integrating these cards into IoT ecosystems, expanding their use in digital identity and decentralized finance (DeFi), and developing flexible, printable battery technology to dramatically reduce manufacturing costs and increase form factor versatility. These forces collectively dictate the market trajectory, emphasizing high security and convenience as core value propositions.

The primary impact forces shaping the market involve technological advancement and stringent regulatory compliance. The rapid progress in thin-film battery technology, offering extended lifespan and reduced thickness, is directly impacting the feasibility and adoption rates of powered cards by addressing key restraints related to cost and durability. Simultaneously, evolving global security regulations, such as the Payment Services Directive 2 (PSD2) in Europe, which mandates Strong Customer Authentication (SCA), naturally favor powered smart cards that can natively perform multi-factor authentication (e.g., something you have—the card, and something you are—the biometrics, or something you know—a dynamic PIN). This regulatory pressure acts as a powerful catalyst, compelling financial institutions to phase out less secure legacy card systems and adopt more resilient powered solutions, driving large-scale market penetration, particularly within developed economies adhering to these security mandates.

Furthermore, the competitive landscape is intensely influenced by the convergence of security needs and user experience expectations. The market demands cards that are not only secure but also intuitive and reliable over a standard five-year operational cycle. The ongoing battle among key players focuses on achieving superior battery performance (charge cycles and shelf life) while maintaining the card's compliance with standard ISO 7810 dimensions. The impact of consumer perception regarding the reliability of embedded technology is crucial; any widespread reports of battery failure or functionality issues could severely dampen adoption. Therefore, manufacturers are under pressure to rigorously test and certify the durability and security integrity of the entire powered system, making product quality assurance a high-impact force governing market trust and acceptance rates.

Segmentation Analysis

The Powered Smart Cards Market is comprehensively segmented based on Type, Component, Application, and Region, reflecting the diverse technological architecture and end-use scenarios of these advanced devices. The segmentation by Type delineates the core functionality, separating hybrid cards with dual power modes from pure microprocessor-based powered cards focused on high computation. Component segmentation highlights the underlying technological reliance on microcontrollers, batteries, specialized display modules, and sophisticated operating systems. Application segmentation is crucial for understanding demand concentration, with BFSI, Government, and Telecommunications representing the foundational pillars of adoption. Analyzing these segments provides a clear framework for identifying high-growth niches, directing strategic investment, and tailoring product development efforts to meet specific industry security requirements and consumer demands across global markets.

- By Type:

- Display Cards (Dynamic CVV/CVC)

- Biometric Cards (Fingerprint/Vein Sensor Integration)

- Hybrid Powered Cards (Combining active/passive functionalities)

- By Component:

- Microcontrollers and Secure Elements

- Embedded Batteries (Thin-film, Rechargeable, Primary Cells)

- Sensors (Biometric Modules, Temperature, Environmental)

- Display Modules (E-ink, Flexible LCD, OLED)

- Operating Systems and Middleware

- By Application:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector (e-ID, Health Cards)

- Telecommunications (Advanced SIM/eSIM security)

- Retail and Loyalty Programs

- Transportation and Access Control

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Powered Smart Cards Market

The value chain for the Powered Smart Cards Market is complex, beginning with upstream suppliers of specialized components and extending through card manufacturing, personalization, distribution, and final usage by end-user organizations. Upstream activities are dominated by highly specialized semiconductor manufacturers (providing secure microcontrollers and specialized operating systems) and sophisticated battery manufacturers (producing ultra-thin, high-density power sources). The availability and cost of these crucial components significantly influence the final product price and market scalability. Midstream, card manufacturers integrate these components, requiring specialized fabrication techniques to embed the battery, display, and sensors while maintaining card flexibility and adherence to strict ISO standards. This phase involves advanced precision lamination and secure operating system integration, demanding significant capital investment and highly secure production environments compliant with schemes like Visa and Mastercard.

Downstream activities involve card personalization, which includes embedding unique user data, cryptographic keys, and specific security profiles tailored to the issuer or government entity. This process is typically performed by secure service bureaus or the card manufacturers themselves, ensuring the integrity of the data stored on the secure element. Distribution channels are highly secure and regulated, often involving direct partnerships between the manufacturer or service bureau and the issuing organization (e.g., banks or government agencies). Direct distribution ensures chain of custody security, minimizing the risk of card interception or compromise during transit, which is paramount given the high-security nature of the powered cards.

The indirect channel plays a supporting role, involving technology integrators and system providers who deploy the necessary reader infrastructure, software integration tools, and secure communication platforms that interface with the powered cards. For instance, in the transportation sector, third-party system integrators are responsible for updating ticketing barriers and validators to correctly interact with the powered functionality of transit cards. The primary power lies with the issuing banks and government entities who dictate volume, security specifications, and supplier contracts, effectively controlling demand and setting the pace for technological feature implementation. Efficiency across the value chain hinges on seamless coordination between component suppliers and card fabricators to manage the complex supply chain of fragile, high-value embedded electronics.

Powered Smart Cards Market Potential Customers

The primary consumers and end-users of Powered Smart Cards are institutions and organizations requiring the highest levels of digital identity verification, transaction security, and enhanced access control features. The largest segment remains the Banking, Financial Services, and Insurance sector, where issuing banks are the direct buyers, deploying these cards to mitigate increasing instances of online and card-present fraud, meet regulatory requirements (e.g., SCA), and differentiate their premium product offerings through advanced features like on-card biometrics or dynamic CVV displays. Government entities are another massive consumer, particularly those undertaking large-scale national ID projects, utilizing powered cards for secure citizen identification, electronic voting, passport functionality, and protected access to sensitive governmental services, where the integration of biometric identification is often a mandatory feature.

Beyond the core sectors, major telecommunication operators represent substantial potential customers, adopting advanced powered SIM cards or dedicated subscriber identification platforms that require high security and potentially integrated display functionalities for specific services. Furthermore, large enterprise organizations operating within sensitive industries, such as defense, energy, and high-tech manufacturing, are increasingly integrating powered smart cards for employee access control, logical access to network resources, and time attendance tracking, leveraging the card’s robust security architecture. The logistics and healthcare sectors also show growing potential, using powered cards for secure medical records access and high-value asset tracking, where location data or environmental conditions need to be logged securely on the card itself before synchronization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Thales Group (Gemalto), Giesecke+Devrient GmbH, CPI Card Group Inc., IDEMIA, Valid S.A., Samsung Electronics Co., Ltd., Fudan Microelectronics Group Co., Ltd., Watchdata Technologies Pte Ltd., Kona I Co., Ltd., Smartrac Technology Group (Avery Dennison), Ingenico Group (Worldline), Linxens Holding, Shenzhen Chuangxinjia Smart Card Co., Ltd., Austria Card GmbH, ELSYS America, Wuhan Tianyu Information Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Powered Smart Cards Market Key Technology Landscape

The Powered Smart Cards market is defined by a dynamic technological landscape centered on the integration of highly sophisticated, miniaturized electronic components within the constraints of a standard card form factor. The core technology involves highly secure microcontroller units (MCUs) that host the secure element (SE) and the operating system, often certified under stringent security standards such as Common Criteria EAL 5+. These MCUs manage cryptographic operations, data storage, and the communication interfaces (contact, contactless, or NFC). A critical differentiator is the embedded power source, which leverages ultra-thin, flexible batteries, typically lithium-polymer or solid-state thin films, engineered to deliver sufficient power for the operation of sensors and displays over the card's multi-year lifetime without significantly increasing card thickness or rigidity. Continuous innovation in battery density and flexibility is essential for market viability.

Furthermore, the sensor technology, particularly in biometric powered cards, is pivotal. Integration of flexible, low-power fingerprint sensors (capacitive or optical) directly into the card requires advanced packaging techniques to ensure durability and reliability when handled daily. These sensors communicate directly with the secure element, performing the matching process locally on the card to ensure user biometric data never leaves the secure environment, thereby adhering to strict privacy regulations. Display technology, utilizing E-ink or flexible LCD screens, enables dynamic visual feedback, such as displaying the one-time password, account balance, or transaction approval prompts, adding substantial value to the card's security features and user interactivity, driven by specialized low-power drivers and flexible circuit boards.

The underlying software and communication protocols also form a key technological pillar. Operating systems (OS) specifically designed for powered smart cards must be highly robust, capable of managing complex multi-application environments, power consumption optimization, and secure over-the-air (OTA) updates for firmware and security patches. Communication technology includes advanced cryptography algorithms for securing data exchange with POS terminals and backend systems, alongside optimized NFC/RFID antennae designed to function effectively despite the interference or physical presence of internal components like the battery and display module. The technological push is consistently toward greater functionality (e.g., higher capacity memory, faster processing speeds) while simultaneously achieving reduced power consumption and cost efficiency in mass production, facilitating broader deployment across diverse global markets.

Regional Highlights

- North America: This region is a leading adopter of Powered Smart Cards, driven primarily by the BFSI sector’s robust efforts to combat cyber fraud and the high market penetration of premium biometric payment cards. The U.S. and Canada benefit from advanced payment infrastructure and consumer readiness to adopt new technologies. High disposable income levels and early technology piloting by major banks ensure continuous demand, particularly for display cards offering dynamic security codes (DSC) and biometric authentication, positioning the region for sustained growth in high-security applications.

- Europe: Europe is significantly influenced by stringent regulatory mandates, particularly the Payment Services Directive 2 (PSD2) which requires Strong Customer Authentication (SCA). This regulatory environment strongly favors the deployment of biometric and display cards, making Europe a high-growth market, especially in countries like the UK, France, and Germany. Furthermore, robust governmental digitization initiatives involving powered e-ID cards and health records contribute substantially to regional market volume and technological maturity, driving innovation in secure element technology.

- Asia Pacific (APAC): APAC is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to accelerating digital transformation, expanding mobile payment ecosystems, and large-scale governmental investment in national ID schemes (e.g., India's Aadhaar ecosystem expansion). China, India, and Southeast Asian nations are prioritizing secure digital identity solutions and addressing financial inclusion challenges, creating massive opportunities for both biometric and standard powered smart card deployments at scale, although price sensitivity remains a key consideration in this region.

- Latin America (LATAM): This region presents emerging opportunities, characterized by an increasing necessity to modernize outdated banking infrastructure and combat high levels of identity and card fraud. Countries like Brazil and Mexico are witnessing pilots and initial rollouts of biometric payment cards, driven by competitive financial institutions seeking technological differentiation. Adoption is tied to improving regulatory certainty and overcoming logistical challenges related to secure card distribution across geographically diverse areas.

- Middle East and Africa (MEA): The MEA market is exhibiting strong growth, particularly in the Gulf Cooperation Council (GCC) countries where massive government investment in smart city initiatives and secure e-government services drives demand for high-security powered e-ID cards. The African sub-region focuses on leveraging these cards for financial inclusion, mobile banking authentication, and secure access to healthcare services, with growth primarily concentrated in areas with robust telecommunications infrastructure and supportive government policies focused on digital identity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Powered Smart Cards Market.- Infineon Technologies AG

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Thales Group (Gemalto)

- Giesecke+Devrient GmbH (G+D)

- CPI Card Group Inc.

- IDEMIA

- Valid S.A.

- Samsung Electronics Co., Ltd.

- Fudan Microelectronics Group Co., Ltd.

- Watchdata Technologies Pte Ltd.

- Kona I Co., Ltd.

- Smartrac Technology Group (Avery Dennison)

- Ingenico Group (Worldline)

- Linxens Holding

- Austria Card GmbH

- Wuhan Tianyu Information Industry Co., Ltd.

- Shenzhen Chuangxinjia Smart Card Co., Ltd.

- ELAN Microelectronics Corporation

- Fime SAS

Frequently Asked Questions

Analyze common user questions about the Powered Smart Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary security advantage of a Powered Smart Card over a standard contactless card?

The primary advantage is the integration of an internal power source that enables on-card processing for advanced security features, such as biometric verification (authenticating the user directly on the card) or generating Dynamic CVV/CVC codes for enhanced transaction security, making them highly effective against card fraud.

What is the typical lifespan and replacement cycle for the embedded battery in a Powered Smart Card?

Most powered smart cards are engineered with thin-film batteries designed to last for the standard card replacement cycle of three to five years. The batteries are optimized for low power consumption, enabling several hundred to thousands of biometric operations or dynamic code generations over this period, ensuring durability.

Which application segment holds the largest market share for Powered Smart Cards?

The Banking, Financial Services, and Insurance (BFSI) segment currently holds the largest market share, driven by the global imperative to deploy advanced payment security solutions like biometric payment cards and dynamic security code display cards to comply with regulations and mitigate card-not-present fraud.

Are Powered Biometric Cards compatible with existing retail Point-of-Sale (POS) terminals?

Yes, powered biometric cards are designed to be fully compliant with ISO 7816 and ISO 14443 standards (contact and contactless). Biometric authentication occurs entirely on the card, and once verified, the card transmits the standard authorized signal, ensuring seamless compatibility with existing, unmodified NFC and contact POS terminals worldwide.

What role does component miniaturization play in the future growth of this market?

Component miniaturization, particularly of the embedded battery and fingerprint sensor modules, is crucial as it reduces the card's thickness and cost, enhancing user acceptance and facilitating mass production. Advances in thin, flexible components are key to enabling multi-functional cards that maintain standard ISO dimensions and flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager