Powerline Adapter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432253 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Powerline Adapter Market Size

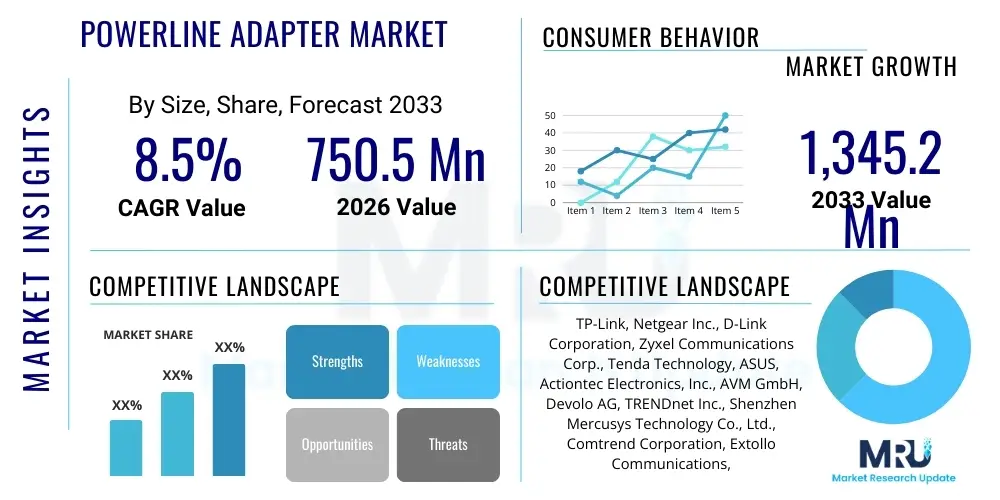

The Powerline Adapter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $750.5 Million in 2026 and is projected to reach $1,345.2 Million by the end of the forecast period in 2033.

Powerline Adapter Market introduction

Powerline adapters, also known as Powerline Communication (PLC) devices, are innovative networking solutions that utilize a building’s existing electrical wiring infrastructure to transmit data. These devices plug into standard electrical outlets, instantly creating a local area network (LAN) bridge across rooms or floors where Wi-Fi signals may be weak or unreliable. The core purpose of Powerline technology is to provide high-speed, stable internet connectivity without the complexity and cost associated with installing new Ethernet cables, making them a crucial component for modern smart homes and small office/home office (SOHO) setups demanding robust broadband access.

Major applications of Powerline adapters span several domains, including high-definition media streaming (4K/8K), online gaming requiring low latency, connecting security cameras and smart home hubs, and extending enterprise-grade networks in distributed environments. The operational principle relies on modulating data signals onto the electrical carrier, utilizing frequencies separate from standard electrical power transmission (50/60 Hz). This capability to penetrate walls and floors effectively positions Powerline adapters as superior alternatives to standard Wi-Fi extenders in environments suffering from significant signal interference or structural impediments, thereby driving their increasing adoption globally.

Key benefits driving market adoption include ease of installation (plug-and-play functionality), high data transfer rates supported by modern standards like HomePlug AV2 and G.hn, enhanced security features through mandatory encryption (typically 128-bit AES), and cost-effectiveness compared to extensive wiring projects. Furthermore, the inherent stability and reliability offered by a wired connection path, even if utilizing electrical circuits, significantly improves performance for bandwidth-intensive tasks. The escalating demand for seamless multi-device connectivity, accelerated by the proliferation of IoT devices and remote work trends, solidifies the market position of Powerline adapter technology as a foundational solution for reliable indoor networking.

Powerline Adapter Market Executive Summary

The Powerline Adapter market demonstrates robust growth, primarily fueled by the accelerating global shift towards high-bandwidth applications, the expansion of smart home ecosystems, and persistent demand for stable connectivity solutions in difficult-to-wire locations. Business trends indicate a strong focus on developing products compliant with the G.hn standard, which promises superior performance, increased reliability, and greater interoperability compared to legacy standards like HomePlug AV. Manufacturers are integrating advanced features such as MIMO (Multiple Input, Multiple Output) technology, which utilizes all three electrical wires (live, neutral, ground) to maximize throughput, thereby enhancing the user experience, particularly for streaming and gaming applications. Strategic partnerships between Powerline manufacturers and utility providers or telecommunication companies for integrated smart metering solutions also represent a significant commercial pathway.

Regional trends highlight North America and Europe as dominant markets, characterized by high disposable incomes, extensive penetration of high-speed broadband services, and mature smart home markets requiring diverse networking solutions. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the projection period, driven by rapid urbanization, massive infrastructure development, and a surge in residential construction requiring straightforward networking options. Governments and regulatory bodies in various regions are beginning to standardize power grid communications, indirectly benefiting high-performance PLC solutions like Powerline adapters for both consumer and utility-scale deployments. Competitive strategies are increasingly focused on product differentiation through enhanced security protocols and aesthetic industrial design, moving away from purely price-based competition.

Segmentation trends indicate that the residential segment maintains the largest market share, directly correlated with the rise in streaming media consumption and the expansion of residential IoT networks. However, the commercial and industrial segments, particularly those involving security surveillance and factory automation (Industrial IoT), are emerging as fast-growing niches due to the reliability and range offered by Powerline communication in electrically noisy environments. The product type segmentation shows a growing preference for adapter kits offering advanced features like integrated Wi-Fi hotspots, seamlessly combining the stability of a wired connection through power lines with the convenience of wireless access in dead zones. These integrated solutions address the full spectrum of modern connectivity demands, positioning hybrid models as key growth drivers.

AI Impact Analysis on Powerline Adapter Market

Common user and industry questions regarding AI's influence on Powerline adapters center on how Artificial Intelligence can optimize network performance, manage interference proactively, and integrate Powerline networks seamlessly into larger, self-healing smart home ecosystems. Users frequently ask if AI can predict and mitigate power grid noise that affects connection stability, whether AI algorithms can dynamically allocate bandwidth between devices using the Powerline link, and if device setup and pairing can be automated using intelligent assistants. The consensus expectation is that AI will move Powerline technology from a simple data bridge to an actively managed, highly optimized segment of the home network, enhancing reliability and reducing the necessity for manual troubleshooting, thereby significantly improving the overall customer experience and extending the operational lifespan of the connection.

- AI-driven Network Optimization: Utilizing machine learning algorithms to analyze network traffic patterns and power line noise characteristics, allowing the adapter firmware to dynamically adjust modulation schemes and frequencies for optimal throughput and resilience against interference.

- Predictive Maintenance and Diagnostics: AI models predicting potential connection drops or speed reductions based on historical power usage and environmental data, enabling proactive alerts or automated adjustments before performance degradation is noticeable to the user.

- Enhanced Security Protocols: Implementing AI for anomaly detection within the encrypted Powerline network, identifying unusual data flow or unauthorized connection attempts, thereby improving the inherent security capabilities of the physical layer.

- Smart Home Integration: Seamless interoperability with central AI hubs (like digital assistants), allowing users to monitor Powerline network health, prioritize traffic for specific devices (e.g., gaming consoles or streaming boxes), and automate pairing processes using voice commands.

- Energy Efficiency Management: AI optimizing the power consumption of the adapter itself based on usage patterns, entering low-power states when the network is idle without compromising immediate wake-up capability upon data request.

- Self-Healing Networks: Enabling adapters to autonomously reroute data or switch frequency bands when local electrical interference is detected, creating a more robust and self-managing mesh network over the existing wiring.

DRO & Impact Forces Of Powerline Adapter Market

The Powerline Adapter Market is heavily influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and internal and external impact forces. Key drivers include the exponential increase in data consumption and the rapid adoption of bandwidth-intensive applications such as 4K/8K video streaming and cloud gaming, necessitating ultra-reliable backhaul connections that Wi-Fi often struggles to provide across large or complex residences. This demand is further amplified by the shift toward hybrid work models and increased remote learning, making stable home connectivity a necessity rather than a luxury. These strong external market pressures create significant momentum for PLC solutions capable of extending high-speed connectivity seamlessly.

However, the market faces notable restraints, primarily concerning performance inconsistency and regulatory fragmentation. Powerline speeds are inherently susceptible to electrical interference (noise) generated by appliances such as vacuum cleaners, dimmer switches, and large motors, leading to unpredictable data rates that frustrate end-users. Furthermore, the maximum achievable speed, while significantly improved by technologies like G.hn, often remains below the theoretical maximums advertised, creating a gap between marketing claims and real-world performance. Regulatory challenges also exist regarding spectrum usage, as different regions impose varying standards on the frequencies permitted for data transmission over power lines, complicating global product development and standardization efforts.

Opportunities for growth are concentrated in the commercial utility sector and the emergence of the G.hn standard. G.hn, as a globally recognized standard for networking over any wire (including power lines, coaxial cables, and phone lines), offers superior performance, enhanced noise mitigation, and critical interoperability that previous standards lacked. This technological shift opens avenues for Powerline adapters to move beyond residential use and into multi-dwelling units (MDUs), hotels, and large commercial spaces where installing dedicated Ethernet cabling is cost-prohibitive. Additionally, the development of integrated smart grid infrastructure provides a massive opportunity, utilizing Powerline communication for high-speed, secure data transfer between utility providers and smart meters.

Segmentation Analysis

The Powerline Adapter Market segmentation provides a granular view of market dynamics based on factors such as product type, application, data rate, and geography. Understanding these segments is critical for manufacturers to tailor their product offerings, distribution strategies, and pricing models to specific user needs. The primary segmentation categories reflect the evolving technological capabilities (e.g., speed differentiation) and the primary user environment (residential versus commercial). The shift toward integrated Wi-Fi Powerline solutions demonstrates the market's response to the demand for comprehensive coverage solutions that address both wired backhaul reliability and wireless last-mile convenience.

Segmentation by Data Rate is particularly influential, with devices categorized into lower-speed models (up to 500 Mbps, often legacy HomePlug AV) and high-speed models (1000 Mbps and above, utilizing HomePlug AV2 or G.hn standards). The high-speed segment dominates revenue generation due to the increasing prevalence of ultra-high-definition content and latency-sensitive applications like gaming. Application segmentation remains crucial, where the residential segment drives volume, focusing on media streaming and basic network extension, while the commercial segment prioritizes robust security, reliability, and management features for large-scale deployments like security surveillance networks and specialized industrial automation tasks.

- By Product Type:

- Non-Wi-Fi Powerline Adapters (Basic Kits)

- Wi-Fi Powerline Adapters (Hybrid Solutions/Extenders)

- Powerline Switches/Routers

- By Technology Standard:

- HomePlug AV

- HomePlug AV2

- G.hn (Global Home Network Specification)

- By Data Rate (Throughput):

- Up to 500 Mbps

- 500 Mbps to 1000 Mbps

- Above 1000 Mbps (Gigabit and higher)

- By Application:

- Residential (Media Streaming, Gaming, IoT Networks)

- Commercial (Small Offices, Hotels, Security Surveillance)

- Industrial/Utility (Smart Grid, Factory Automation)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Powerline Adapter Market

The value chain for the Powerline Adapter Market begins with upstream activities focused on core component manufacturing and intellectual property development. This stage involves silicon vendors specializing in Powerline Communication (PLC) chipsets—key players like Broadcom, Qualcomm (through acquired technologies), and various Asian chipset manufacturers—who develop the fundamental technologies underpinning HomePlug and G.hn standards. Raw material sourcing (plastics, metals, PCBs) and highly specialized component manufacturing (modulators, filters, coupling circuits essential for noise isolation) are critical upstream inputs. Intellectual property licensing and rigorous electromagnetic compatibility (EMC) testing are also major cost and value additions at this stage, setting the technological boundaries for the downstream products.

Midstream activities involve the design, assembly, and integration phase, managed by Original Design Manufacturers (ODMs) and brand owners (e.g., TP-Link, Netgear). This stage focuses on firmware development, user interface design, physical product aesthetics, and ensuring compliance with regional safety and regulatory standards (e.g., FCC, CE). The efficiency of manufacturing, particularly in high-volume production facilities often located in Asia, dictates the final unit cost and scalability. Quality control is paramount here, specifically ensuring the product's resilience to power surges and its ability to maintain stable communication across different types of household wiring and electrical infrastructure.

Downstream activities are dominated by distribution and sales channels. Direct channels include manufacturers selling directly via e-commerce platforms, offering higher margins but requiring significant logistics investment. Indirect channels rely heavily on major retail outlets (e.g., consumer electronics stores, large box retailers), specialized IT distributors, and system integrators who bundle Powerline solutions with broader networking or smart home installation services. System integrators, especially those serving the commercial and utility sectors, often act as crucial gatekeepers. Effective marketing and post-sales support, focused on educating consumers about the unique benefits and limitations of PLC technology compared to traditional Wi-Fi, finalize the value delivery process to the end-user.

Powerline Adapter Market Potential Customers

The primary customer base for Powerline adapters is highly diversified but centers mainly on consumers and small businesses struggling with wireless network deficiencies. Residential end-users represent the largest and most dynamic segment, typically consisting of homeowners or renters who inhabit multi-story dwellings, older buildings with thick walls, or large homes experiencing Wi-Fi "dead zones." These consumers prioritize easy, stable connectivity for entertainment (streaming platforms, consoles) and remote productivity (video conferencing, VPN access). They are generally sensitive to ease of installation and comparative pricing against mesh Wi-Fi systems, seeking a straightforward "plug-and-play" solution to extend their network access points.

A rapidly growing segment comprises Small Office/Home Office (SOHO) users and small to medium-sized enterprises (SMEs). For these customers, reliability and security are paramount. They utilize Powerline adapters to securely connect networked printers, NAS drives, VoIP systems, and security surveillance systems where pulling new Ethernet cable is impractical or too costly. The commercial segment also includes multi-dwelling unit (MDU) operators, such as apartment complexes and dormitories, who leverage Powerline technology for rapid deployment of shared internet infrastructure without extensive structural modifications. These commercial buyers value features like centralized management capabilities, high-density performance, and advanced security encryption necessary for professional environments.

Finally, the utility and industrial sectors represent high-value potential customers, particularly those involved in developing smart grid technologies and Industrial IoT (IIoT). Utility companies use robust, high-bandwidth Powerline Communication (PLC) solutions for meter data acquisition, remote monitoring, and control of distribution infrastructure. In the industrial setting, manufacturers may use PLC for connecting sensors and control systems in environments where radio frequency interference (Wi-Fi) is high or where infrastructure needs to be highly resilient against physical damage, emphasizing the niche market for ruggedized, highly reliable Powerline devices tailored for harsh operating conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.5 Million |

| Market Forecast in 2033 | $1,345.2 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TP-Link, Netgear Inc., D-Link Corporation, Zyxel Communications Corp., Tenda Technology, ASUS, Actiontec Electronics, Inc., AVM GmbH, Devolo AG, TRENDnet Inc., Shenzhen Mercusys Technology Co., Ltd., Comtrend Corporation, Extollo Communications, Qualcomm Technologies, Inc., Broadcom Inc., Huawei Technologies Co., Ltd., Nokia Corporation, Panasonic Corporation, Cisco Systems, Inc., Aztech Global Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Powerline Adapter Market Key Technology Landscape

The technological landscape of the Powerline Adapter market is fundamentally defined by evolving communication standards that aim to maximize throughput, minimize latency, and improve resilience against environmental noise. Historically dominated by the HomePlug Alliance standards, particularly HomePlug AV and the subsequent high-speed iteration, HomePlug AV2, the industry is increasingly converging on the ITU-T G.hn standard. G.hn is engineered to be technology-agnostic concerning the physical medium, supporting data transfer over power lines, coaxial cable, twisted-pair wiring, and plastic optical fiber. This universal approach offers superior flexibility and future-proofing. G.hn utilizes advanced techniques such as Orthogonal Frequency-Division Multiplexing (OFDM) for robust data transmission and Low-Density Parity-Check (LDPC) coding for efficient error correction, leading to higher data rates (up to 2 Gbps physical layer) and significantly enhanced stability, even in electrically noisy residential environments. The adoption of G.hn is seen as critical for market growth, especially as users demand performance equivalent to dedicated Ethernet connections.

Another crucial technological advancement is the integration of Multiple-Input Multiple-Output (MIMO) technology within Powerline adapters, a feature central to the HomePlug AV2 and G.hn standards. Traditional Powerline communication typically uses only the Live and Neutral wires (SISO), but MIMO technology leverages the ground wire as an additional conductor, effectively creating multiple parallel data paths. This significantly increases physical layer throughput and improves signal robustness by exploiting spatial diversity in the electrical wiring. MIMO implementation is particularly effective in older homes where wiring quality might be inconsistent, making it a key differentiator for premium, high-speed Powerline products. Furthermore, the market is seeing a standardization of integrated Wi-Fi functionality, where the Powerline link provides the stable backhaul, and a high-performance 802.11ac or 802.11ax (Wi-Fi 6) access point is built directly into the remote adapter unit, simplifying the expansion of high-speed wireless coverage.

Security and power management technologies are also central to the competitive technology landscape. All modern Powerline adapters incorporate mandatory 128-bit AES encryption to secure data transmitted over the power grid, providing a crucial layer of protection against eavesdropping within the electrical circuit environment. Energy conservation features, such as automatic power-saving modes that reduce consumption when no data traffic is detected, comply with growing consumer environmental expectations and regulatory requirements like the European Union's Energy-related Products (ErP) Directive. The continuous development in chipset fabrication, aiming for smaller footprints and lower heat generation while maintaining high processing capabilities, ensures that future Powerline adapters will offer even greater speed and reliability, further consolidating their role as essential components in modern heterogeneous networking environments.

Regional Highlights

The global Powerline Adapter market exhibits distinct regional dynamics driven by varying levels of broadband penetration, smart home adoption rates, and electrical infrastructure age. North America holds a significant share of the market, primarily due to the widespread consumer demand for seamless, high-definition content delivery (4K/8K streaming) and the high penetration of smart home devices that require stable backhaul connectivity. The existence of many large, multi-story single-family homes in the US and Canada, where traditional Wi-Fi often struggles with range and obstacles, provides an ideal market scenario for Powerline solutions. This region also benefits from early adoption of advanced standards like HomePlug AV2 and a mature consumer electronics retail ecosystem, ensuring high product availability and consumer awareness. The competitive landscape focuses heavily on brand loyalty and integration with other home networking gear.

Europe represents another dominant region, characterized by its dense population centers, older building stock, and high regulatory standards (CE marking, WEEE directives). Countries like Germany and the UK show high market maturity, driven by strong players like Devolo and AVM (Fritz!Powerline). The European market often sees stronger integration between Powerline adapters and Internet Service Provider (ISP) equipment, frequently bundled as part of high-speed broadband packages to guarantee coverage throughout multi-floor apartments or older stone buildings. Demand is robust across both residential and small commercial segments, with increasing interest stemming from utilities utilizing PLC for Advanced Metering Infrastructure (AMI) and smart grid applications, providing a dual revenue stream opportunity for manufacturers.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive urbanization, rapidly expanding middle-class populations, and large-scale government investments in digital infrastructure, particularly in countries like China, India, and Southeast Asian nations. Although high-rise apartments often rely on fiber-to-the-home (FTTH) solutions, the complexity of wiring in vast, newly constructed residential complexes makes plug-and-play solutions highly attractive. The intense competition among local manufacturers drives down prices, making Powerline adapters highly accessible. Furthermore, the APAC region is a manufacturing hub for these devices, giving local companies a significant logistical and cost advantage. The market is witnessing accelerated adoption of G.hn technology here due to its versatility across different wiring types found in the region, including older telecommunications infrastructure.

- North America: Market leader, driven by high demand for 4K streaming and smart home IoT devices in large residential properties; focus on premium, high-speed HomePlug AV2/G.hn products.

- Europe: High maturity, strong presence in countries with older, structurally complex buildings; significant uptake in bundled ISP offerings and utility sector PLC applications.

- Asia Pacific (APAC): Highest growth potential due to rapid urbanization, increasing broadband penetration, and large-scale manufacturing capacity; strong focus on price-competitive and versatile G.hn compliant devices.

- Latin America (LATAM): Emerging market with potential in urban centers where infrastructure updates are lagging and reliable wired extension solutions are needed; growth constrained by lower average broadband speeds but poised for expansion as infrastructure improves.

- Middle East & Africa (MEA): Nascent market, primarily focused on high-end commercial installations (hotels, corporate offices) and utility modernization projects utilizing Powerline communication for smart grid implementation in major cities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Powerline Adapter Market.- TP-Link

- Netgear Inc.

- D-Link Corporation

- Zyxel Communications Corp.

- Tenda Technology

- ASUS

- Actiontec Electronics, Inc.

- AVM GmbH

- Devolo AG

- TRENDnet Inc.

- Shenzhen Mercusys Technology Co., Ltd.

- Comtrend Corporation

- Extollo Communications

- Qualcomm Technologies, Inc. (Chipset Provider)

- Broadcom Inc. (Chipset Provider)

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Panasonic Corporation

- Cisco Systems, Inc.

- Aztech Global Ltd.

Frequently Asked Questions

Analyze common user questions about the Powerline Adapter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Powerline Adapter and how does it work to extend a network?

A Powerline Adapter uses a building's existing electrical wiring to transmit network data. It works by modulating high-frequency data signals onto the electrical current, effectively turning any standard electrical outlet into a potential Ethernet port, overcoming Wi-Fi range limitations by creating a stable wired connection bridge.

Are Powerline Adapters safe and secure for transmitting sensitive data?

Yes, modern Powerline adapters are designed with robust security features. They typically utilize 128-bit Advanced Encryption Standard (AES) encryption, ensuring that the data transmitted across the power lines is secure and cannot be accessed by unauthorized devices outside the paired Powerline network.

How do G.hn standards compare to older HomePlug technology, and why is this important for performance?

G.hn (Global Home Network Specification) is the latest standard, offering superior performance, higher throughput (up to 2 Gbps physical layer), and better noise resilience than older HomePlug standards (like HomePlug AV/AV2). G.hn’s importance lies in its ability to provide stable, gigabit-level speeds critical for 4K/8K streaming and high-demand applications over inconsistent electrical wiring.

What factors commonly reduce the speed or stability of a Powerline connection?

Powerline speed and stability are primarily reduced by electrical interference (noise) generated by household appliances (e.g., HVAC units, dimmer switches, treadmills), connecting adapters across different electrical phases, or using surge protectors/uninterruptible power supplies between the adapter and the wall outlet, which often filter out the data signal.

Can Powerline Adapters replace a Mesh Wi-Fi system for whole-home coverage?

Powerline adapters are often complementary to Mesh Wi-Fi. While Powerline provides the stable, high-speed wired backbone (backhaul) through the electrical system, Mesh Wi-Fi (especially hybrid Powerline models) utilizes this stability to broadcast a strong wireless signal from multiple points, offering a highly reliable solution for full, wall-to-wall coverage in large or architecturally challenging homes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager