PPC Bid Management Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431876 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

PPC Bid Management Tools Market Size

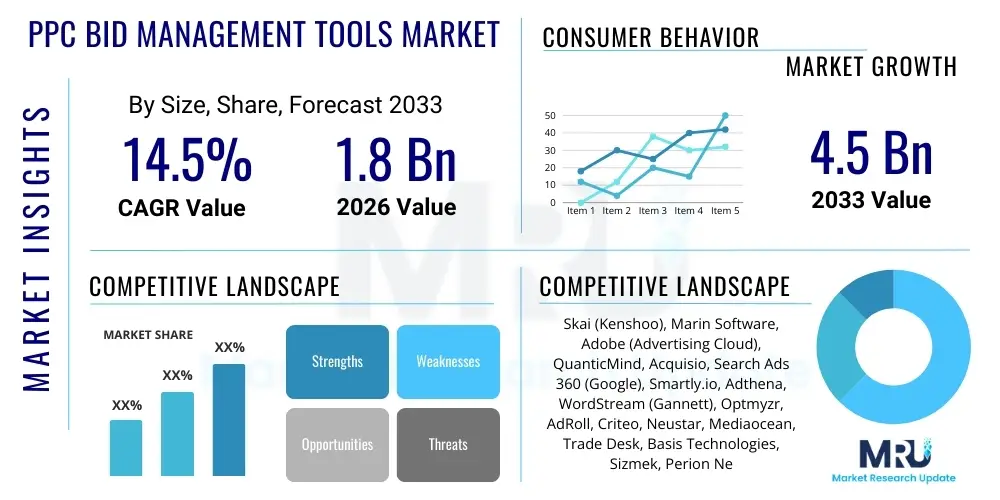

The PPC Bid Management Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

PPC Bid Management Tools Market introduction

The PPC Bid Management Tools Market encompasses sophisticated software solutions designed to automate, optimize, and execute bidding strategies across various Pay-Per-Click advertising platforms, including Google Ads, Microsoft Advertising, and social media channels. These platforms are crucial for businesses seeking to maximize their Return on Investment (ROI) from digital advertising campaigns by ensuring optimal budget allocation and competitive positioning. The core functionality revolves around algorithmic adjustments of keyword bids based on predefined goals, performance data, conversion rates, and competitive intelligence, moving far beyond manual static bidding to dynamic, real-time optimization. These tools utilize advanced data analytics and machine learning capabilities to process vast amounts of data points, determining the precise bid required to secure a favorable ad position while adhering strictly to specific Cost Per Acquisition (CPA) or Return On Ad Spend (ROAS) targets.

Product descriptions within this category span from enterprise-level, all-in-one marketing platforms that offer integrated bidding, reporting, and attribution features, to specialized, niche tools focusing purely on specific aspects like algorithmic hourly adjustments or negative keyword management. Major applications for PPC Bid Management Tools are found across diverse industries, predominantly in e-commerce, where inventory-level bidding precision is vital; digital marketing agencies managing thousands of client campaigns; and large enterprises seeking centralized control over complex, multi-regional advertising budgets. The necessity for these tools arises directly from the increasing complexity and fragmentation of the digital advertising ecosystem, coupled with the sheer volume of data generated by high-frequency auctions.

Key benefits derived from adopting professional PPC bid management solutions include significantly improved operational efficiency, reduced human error associated with manual adjustments, and enhanced campaign performance leading to superior ROI. Driving factors propelling this market forward include the exponential growth in global digital advertising spending, particularly in mobile and video formats, the continuous evolution of search engine algorithms favoring dynamic optimization, and the critical requirement for cross-channel synchronization. Furthermore, the persistent competitive pressure across major auction platforms necessitates the use of automated, intelligent systems to maintain cost-effectiveness and market share, ensuring that advertisers are always bidding accurately against sophisticated, AI-driven competitors.

PPC Bid Management Tools Market Executive Summary

The PPC Bid Management Tools Market is currently characterized by robust growth, driven primarily by the escalating sophistication of machine learning algorithms and the massive scale of digital transformation across global economies. Business trends indicate a strong shift towards unified marketing intelligence platforms that integrate bidding capabilities with creative optimization, audience segmentation, and deep attribution modeling, moving away from siloed tools. The necessity for real-time adjustments to maintain relevance and cost-efficiency in increasingly competitive ad auctions is boosting demand for tools offering predictive analytics and instant API integration with major platforms. Furthermore, vendor consolidation and strategic partnerships aimed at broadening geographic reach and enhancing cross-channel functionality represent significant developments in the competitive landscape, signaling a maturation of the tool ecosystem while simultaneously raising the barrier to entry for smaller developers focused on rudimentary optimization.

Regionally, North America remains the dominant market, attributable to the early and extensive adoption of digital advertising technologies, high advertising expenditure by leading technology and e-commerce giants, and the presence of major technology providers and digital agencies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid digitalization, the surge in mobile internet penetration, and the emergence of massive domestic e-commerce markets, particularly in China and India. European growth is steady, but often influenced by stringent data privacy regulations like GDPR, which mandate high levels of transparency and compliance in data usage for bidding algorithms. These varied regional dynamics necessitate that global vendors offer customizable solutions that align with local regulatory frameworks and unique platform ecosystems, such as domestic search engines prevalent in certain APAC territories.

Segmentation trends highlight the increasing preference for Software-as-a-Service (SaaS) deployment models due to lower upfront costs, scalability, and ease of maintenance, especially among Small and Medium Enterprises (SMEs). While large enterprises historically favored on-premise or custom-built solutions for maximum data control, the flexibility and powerful features of modern cloud-based solutions are accelerating cloud adoption across all enterprise sizes. Application-wise, performance marketing and e-commerce remain the largest consumers of advanced bidding tools, yet specialized applications focusing on localized retail promotion and lead generation in the B2B sector are experiencing significant expansion. The segment focused on cross-platform functionality, allowing simultaneous management of search, social, and programmatic bids, is projected to command the largest market share due to inherent operational efficiencies.

AI Impact Analysis on PPC Bid Management Tools Market

Common user questions regarding AI’s impact on PPC Bid Management often center on the dichotomy between automation efficiency and human control: users frequently ask if AI will completely replace the role of the PPC manager, how specific algorithms handle unexpected market shifts or highly nuanced campaign goals, and what level of transparency and explainability (XAI) these black-box models provide. There is significant concern about data dependency, specifically how the quality and volume of historical data directly influence the effectiveness of AI bids, and the fear of algorithmic runaway where bids spiral out of control due to unforeseen variables. These concerns underscore the key themes of the AI influence: massive efficiency gains through hyper-optimization, increased technical complexity requiring specialized staff, and a persistent demand for tools that offer actionable insights and strategic oversight rather than purely opaque automation. Expectations are high regarding predictive capabilities, particularly demand forecasting and real-time budget reallocation across channels.

The integration of sophisticated Artificial Intelligence and Machine Learning (ML) has fundamentally transformed the PPC bid management landscape, moving the focus from rules-based automation to predictive, goal-oriented optimization. AI algorithms, particularly deep learning models, now analyze signals far beyond traditional keyword performance, incorporating external factors such as competitor bid patterns, macroeconomic shifts, real-time weather conditions, seasonal fluctuations, and user intent signals derived from vast datasets. This enables tools to make millions of micro-adjustments daily, optimizing bids not just for conversion likelihood but for the projected lifetime value (LTV) of the customer, offering a dramatically improved level of precision that human managers cannot achieve manually or through rudimentary scripting. This paradigm shift has elevated the role of the PPC professional from an implementer of bids to a strategic overseer of highly complex, automated systems, focusing on creative strategy, audience alignment, and defining the overall AI optimization objective.

Crucially, the next phase of AI impact is focusing heavily on Generative AI capabilities for creative optimization and automated campaign construction. While current ML models excel at numerical bid adjustment, emerging tools are leveraging large language models (LLMs) to dynamically generate relevant ad copy, headlines, and descriptions tailored to specific auction moments and user search context. This linkage between automated bidding and dynamic creative optimization (DCO) ensures maximum quality score relevance, further reducing Cost Per Click (CPC) and improving conversion rates. However, this advancement also necessitates robust governance frameworks to ensure brand safety and regulatory compliance, addressing user concerns regarding the ethical deployment and transparency of these powerful, autonomous systems. The market is evolving towards 'co-pilot' AI, where human expertise guides the strategic direction while the AI handles the execution complexity.

- Enhanced Predictive Bidding: AI utilizes historical and real-time data to forecast conversion probability and adjust bids for maximum LTV.

- Dynamic Creative Optimization (DCO): Integration of generative AI for tailoring ad copy and creatives automatically based on auction context.

- Cross-Channel Synchronization: AI facilitates holistic budget management and bidding strategies across search, social, and display networks simultaneously.

- Increased Operational Efficiency: Automation of routine tasks allows PPC managers to focus on strategic insights and high-level goal setting.

- Explainable AI (XAI) Demand: Growing necessity for tools to provide transparency regarding algorithmic decision-making processes for auditing and trust.

- Fraud Detection and Prevention: AI algorithms are highly effective at identifying and blocking fraudulent click patterns, optimizing ad spend quality.

DRO & Impact Forces Of PPC Bid Management Tools Market

The dynamic trajectory of the PPC Bid Management Tools market is shaped by a confluence of powerful Drivers, strategic Restraints, abundant Opportunities, and persistent Impact Forces. Key drivers include the ever-increasing complexity of digital marketing campaigns, driven by fragmented consumer journeys across multiple devices and platforms, making manual optimization practically obsolete. The fundamental necessity for advertisers to achieve higher ROI under shrinking margins compels rapid adoption of sophisticated tools capable of granular, real-time optimization. Furthermore, the inherent limitations of native platform bidding tools (like those offered by Google or Meta) often push large-scale advertisers toward third-party enterprise solutions offering superior cross-platform visibility and customizable algorithmic control. However, growth is tempered by critical restraints, primarily surrounding data privacy regulations, such as GDPR and CCPA, which introduce friction in data aggregation and utilization necessary for advanced AI models. High subscription costs and the steep learning curve associated with implementing complex enterprise platforms pose significant barriers to entry for smaller market players and SMEs with limited technical resources, thereby concentrating market power among established organizations.

Significant opportunities are emerging from the shift towards retail media networks and connected TV (CTV) advertising, extending the scope of bid management beyond traditional search and social platforms. Developing tools capable of seamlessly integrating bidding strategies across these emerging, high-growth channels presents a major avenue for market expansion. Furthermore, the rising demand for predictive analytics, which moves beyond reactive optimization to proactive forecasting of market fluctuations and competitive responses, offers lucrative development pathways. Addressing the persistent demand for greater algorithmic transparency (Explainable AI or XAI) and providing robust governance features for budget control will unlock further adoption, particularly within regulated industries that require strict auditing capabilities. The convergence of PPC bid management with broader Customer Data Platforms (CDPs) allows for unparalleled personalization and bid accuracy based on unified customer profiles, representing a substantial growth catalyst.

Impact forces exert constant pressure on market participants, dictating the speed and direction of technological change. The intense competitive rivalry among tool providers—including established enterprise vendors, agile startups, and native platform offerings—forces continuous innovation in optimization algorithms and integration capabilities. Technological obsolescence is a major factor; algorithms that are highly effective today may become outdated rapidly as search engine and social media platforms frequently update their APIs and underlying auction mechanisms. Data governance and security requirements act as critical impact forces, demanding substantial investment in compliance infrastructure to ensure secure handling of sensitive campaign and consumer data. Ultimately, the cyclical nature of digital advertising budgets, tied closely to global economic performance, represents a macroeconomic impact force that influences demand for high-cost, advanced solutions, often favoring cost-effective, scaled solutions during downturns and premium platforms during expansionary phases.

Segmentation Analysis

The PPC Bid Management Tools Market is segmented based on several critical dimensions, including Deployment Type, Enterprise Size, Platform Type, and End-User Application. This segmentation is vital for understanding market dynamics as the needs and constraints of different user groups dictate the features and pricing models required. Cloud-based (SaaS) deployment dominates the landscape due to its accessibility, rapid deployment, and inherent scalability, contrasting sharply with the smaller, though still significant, on-premise segment preferred by large corporations requiring maximum data sovereignty. Enterprise size is crucial, differentiating between comprehensive, customized enterprise solutions for large organizations that handle massive budgets and streamlined, user-friendly packages tailored for the limited resources and specific needs of Small and Medium Enterprises (SMEs). Platform Type segmentation addresses the shift from single-channel focus (e.g., search-only) to cross-channel platforms that manage bidding across search engines, social media platforms, and programmatic display networks, reflecting the multi-touchpoint reality of modern marketing.

- Deployment Type:

- Cloud-Based (SaaS)

- On-Premise

- Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Platform Type:

- Search Engine Bidding Tools (Google Ads, Microsoft Advertising)

- Social Media Bidding Tools (Meta, LinkedIn, X)

- Cross-Channel/Unified Bidding Platforms

- Application/End-User:

- E-commerce and Retail

- Digital Marketing Agencies

- BFSI (Banking, Financial Services, and Insurance)

- Media and Entertainment

- Others (Telecom, Healthcare)

Value Chain Analysis For PPC Bid Management Tools Market

The value chain of the PPC Bid Management Tools market begins with the Upstream component, which involves core technology development, including sophisticated data collection infrastructure, proprietary machine learning model training, and continuous algorithm refinement. This stage is dominated by specialized data scientists and engineering teams focused on creating high-speed, predictive bidding engines and ensuring robust API integration capabilities with major ad platforms. Midstream activities focus on the delivery and configuration of the tool, encompassing the Software-as-a-Service (SaaS) delivery mechanism, platform customization for specific client needs (e.g., compliance, custom goal setting), and ongoing customer success and technical support. Distribution channels are predominantly Direct, leveraging internal sales teams and online subscription models, especially for large enterprise contracts. Indirect channels, such as partnerships with major cloud providers (AWS, Azure) or referrals from management consultants and independent digital agencies, also play a role in market penetration. The Downstream phase involves the end-user adoption and utilization, where digital marketing managers, performance specialists, and media buyers deploy the tools to execute their bidding strategies, generating crucial feedback that fuels further upstream algorithmic improvements and feature development, thereby closing the continuous optimization loop within the value chain.

PPC Bid Management Tools Market Potential Customers

Potential customers for PPC Bid Management Tools span a diverse range of organizations characterized by high volumes of digital advertising spend and a critical dependence on performance marketing metrics. The primary end-users or buyers are large e-commerce retailers and direct-to-consumer (D2C) brands, which require inventory-level bidding precision across tens of thousands of products to manage profitability and seasonality effectively. Digital marketing and advertising agencies constitute another major customer segment, relying on these tools to efficiently manage hundreds or even thousands of client campaigns, seeking cross-client reporting and streamlined workflow capabilities to maintain high service levels and cost-efficiency. Additionally, organizations in the BFSI sector, which often allocate massive budgets to competitive keyword bidding (e.g., mortgages, insurance), utilize these tools to navigate highly regulated environments while maximizing lead generation quality. Finally, large B2B technology companies and SaaS providers leverage advanced bidding platforms to optimize complex sales funnel conversions and manage global demand generation campaigns, where the focus shifts from transactional ROI to maximizing high-value lead quality and optimizing for post-click customer lifecycle events.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Skai (Kenshoo), Marin Software, Adobe (Advertising Cloud), QuanticMind, Acquisio, Search Ads 360 (Google), Smartly.io, Adthena, WordStream (Gannett), Optmyzr, AdRoll, Criteo, Neustar, Mediaocean, Trade Desk, Basis Technologies, Sizmek, Perion Network, DataFeedWatch, Channable |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PPC Bid Management Tools Market Key Technology Landscape

The core technological landscape of the PPC Bid Management Tools market is anchored in advanced Machine Learning (ML) algorithms, forming the foundation of modern algorithmic bidding. These technologies move beyond simple linear regression models to employ complex neural networks and deep reinforcement learning, enabling the systems to learn dynamically from millions of real-time auction data points. Key ML components include predictive modeling for conversion likelihood and customer lifetime value (LTV), which allows the tool to place bids that reflect the expected value of a specific impression rather than just the immediate click cost. Furthermore, these systems heavily utilize advanced time series analysis to detect seasonality, trends, and anomalies within performance data, ensuring that bidding strategies are optimally adjusted for micro-moments and macroeconomic shifts. This algorithmic sophistication is critical for maintaining competitiveness, especially in highly contested sectors where bid differentials are minimal.

A crucial technological element is the robust integration infrastructure, primarily relying on high-speed, scalable Application Programming Interfaces (APIs) provided by major advertising platforms like Google, Meta, and Amazon. The performance of a bid management tool is directly correlated with its ability to maintain stable, real-time API connections, ensuring instantaneous data transmission and bid execution with minimal latency. Beyond basic data transfer, the latest tools utilize sophisticated API management layers that incorporate proprietary data warehousing solutions and cloud elasticity (e.g., leveraging AWS Lambda or Google Cloud Functions) to handle massive computational loads required for hourly or sub-hourly bid optimization across thousands of campaigns simultaneously. This real-time synchronization capability is what distinguishes market leaders, allowing them to react to competition and traffic changes far quicker than legacy systems.

The emerging technological focus centers on cross-channel intelligence and unified data attribution. Modern platforms are integrating technologies that unify data signals originating from search, social, display, and even offline sources to create a holistic view of the customer journey. This requires sophisticated data mapping, identity resolution techniques, and attribution modeling (often multi-touch or fractional attribution) to accurately assign value to each ad impression and click. Technology providers are also increasingly incorporating natural language processing (NLP) for automated keyword research, sentiment analysis of competitor ads, and integration of generative AI for dynamic ad copy creation, further expanding the technological footprint beyond purely numerical optimization and solidifying the shift towards fully integrated marketing performance suites.

Regional Highlights

The global PPC Bid Management Tools Market exhibits distinct characteristics and growth patterns across key regions, influenced by varying levels of digital maturity, regulatory environments, and the scale of local advertising spending.

- North America (NA): North America represents the largest and most mature market for PPC Bid Management Tools, primarily driven by the colossal digital advertising expenditures in the United States, home to headquarters of major technology giants and the largest e-commerce retailers globally. The high level of technical sophistication and the prevalent use of data-intensive performance marketing necessitate advanced, AI-driven bidding solutions. Adoption rates for enterprise-level, cross-channel platforms are highest here, focusing heavily on integrating LTV modeling and complex attribution solutions. The market is highly competitive, dominated by established vendors offering cutting-edge predictive capabilities and extensive integration ecosystems. Sustained growth is fueled by continuous technological advancement and a strong venture capital interest in specialized ad tech startups. The demand centers around solutions that offer granular control over billion-dollar budgets and seamless integration with existing marketing stacks (CDPs, CRMs).

- Europe: The European market shows steady, regulated growth, with adoption rates varying significantly between Western and Eastern Europe. Western Europe, particularly the UK, Germany, and France, is characterized by high digital adoption but operates under the stringent regulatory framework of the General Data Protection Regulation (GDPR). This regulation significantly impacts data collection and utilization for bidding algorithms, necessitating tools that prioritize privacy compliance, consent management, and transparent data processing. European customers prioritize platforms that offer robust data governance features and localized language support. Eastern Europe is experiencing rapid growth, driven by increasing internet penetration and burgeoning e-commerce sectors, although budget sizes remain smaller compared to the US, driving demand for cost-effective, scalable SaaS solutions suitable for SMEs.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, propelled by rapidly expanding digital populations, high mobile internet penetration, and the emergence of enormous regional e-commerce powerhouses (e.g., China, India, Southeast Asia). Market dynamics are complex due to the fragmentation of advertising platforms (e.g., Baidu, Naver, local social platforms alongside global giants) and diverse language requirements. Consequently, there is high demand for vendor tools that offer specific localization and deep API connectivity with regional proprietary ad networks. The shift towards mobile-first and video advertising campaigns in this region necessitates highly optimized bidding strategies tailored to these formats, encouraging investment in solutions that excel in non-traditional search bidding environments and address high volumes of mobile traffic efficiently.

- Latin America (LATAM): The LATAM market is experiencing solid growth, driven by increasing digitalization, particularly in Brazil and Mexico. The market is still developing, often characterized by price sensitivity and a preference for flexible, scalable SaaS solutions. Local currencies and economic volatility require bid management tools that can quickly adapt to changing budget constraints and market risks. Adoption is primarily concentrated among major regional e-commerce players and global brands seeking to expand their local footprint. The need for efficient, automated tools is high given the limited specialized ad tech talent pool in many LATAM countries.

- Middle East and Africa (MEA): The MEA region is at an emergent stage, with growth concentrated primarily in the Gulf Cooperation Council (GCC) countries due to high disposable income and advanced digital infrastructure investment. Digital marketing spend is accelerating, particularly in mobile and social media channels. Demand focuses on solutions that handle Arabic language complexities and manage campaigns across diverse consumer segments. Challenges include regulatory variability and lower overall market maturity, though significant future potential exists as governments push for digital economic transformation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PPC Bid Management Tools Market.- Skai (formerly Kenshoo)

- Marin Software

- Adobe (Advertising Cloud)

- QuanticMind

- Acquisio

- Search Ads 360 (Google Marketing Platform)

- Smartly.io

- Adthena

- WordStream (Gannett)

- Optmyzr

- AdRoll

- Criteo

- Neustar

- Mediaocean

- Trade Desk

- Basis Technologies

- Sizmek

- Perion Network

- DataFeedWatch

- Channable

Frequently Asked Questions

Analyze common user questions about the PPC Bid Management Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using third-party PPC bid management tools over native platform tools?

Third-party tools offer enhanced functionality, critically including cross-channel optimization capabilities (managing bids across Google, Meta, Amazon simultaneously), highly customizable proprietary algorithms (beyond platform-default settings), and superior data integration with CRM and attribution systems for LTV-based bidding. They provide a unified view and centralized control essential for complex advertising portfolios.

How does AI impact the required skill set for PPC managers utilizing these tools?

AI shifts the PPC manager's role from manual execution to strategic oversight. The new required skill set emphasizes defining sophisticated business objectives, interpreting algorithmic outputs, validating data integrity, and conducting high-level creative and audience strategy, rather than daily bid optimization.

Which market segment is expected to show the fastest growth rate?

The Cross-Channel/Unified Bidding Platforms segment is projected to show the fastest growth. As consumer journeys become fragmented, advertisers require holistic solutions that synchronize bidding strategies across search, social, and programmatic display to maximize campaign efficiency and accurately attribute conversions.

What are the main technical challenges facing the adoption of advanced bidding algorithms?

Key technical challenges include maintaining real-time API latency with rapidly evolving ad platforms, ensuring data quality and volume to effectively train AI models, and navigating complex data privacy restrictions (like GDPR and CCPA) that limit the scope of user tracking necessary for hyper-personalized bidding.

Is the PPC Bid Management Tools market dominated by a specific deployment type?

Yes, the market is overwhelmingly dominated by the Cloud-Based (SaaS) deployment model. This preference stems from the inherent advantages of SaaS, including lower upfront investment, rapid deployment, superior scalability to handle fluctuating ad volume, and automatic real-time software updates necessary for API compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager