PPS Monofilament Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434729 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

PPS Monofilament Market Size

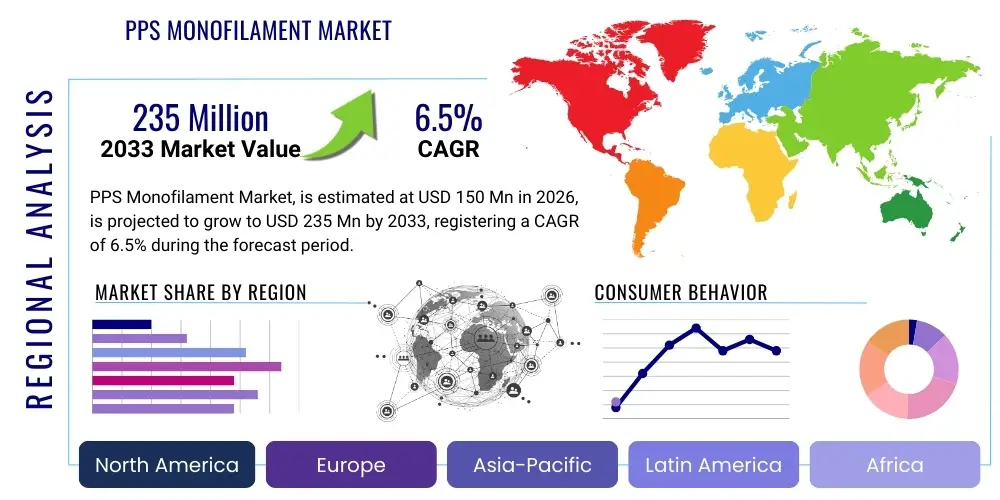

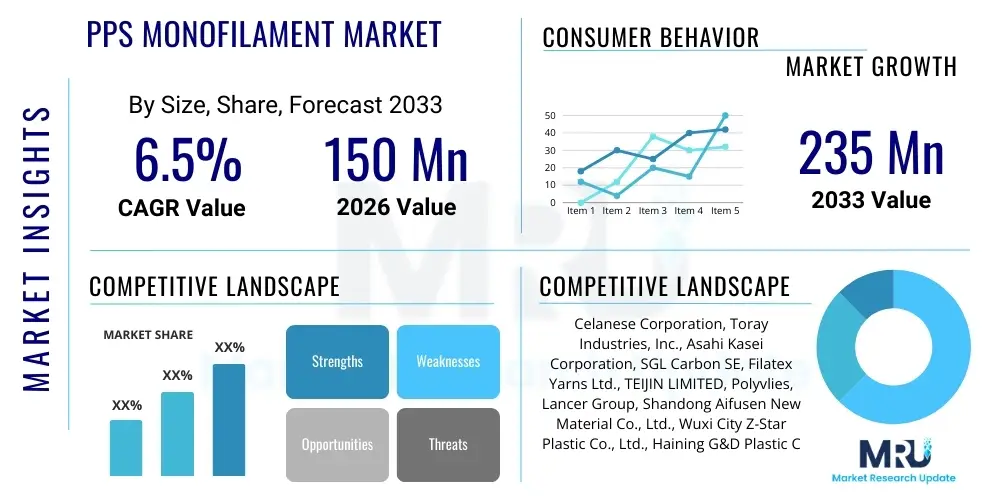

The PPS Monofilament Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 235 Million by the end of the forecast period in 2033.

PPS Monofilament Market introduction

The PPS Monofilament Market encompasses the production and utilization of extruded threads made from Polyphenylene Sulfide (PPS) polymer. PPS is a high-performance thermoplastic characterized by exceptional thermal stability, inherent flame retardancy, chemical resistance, and high mechanical strength, making it ideal for demanding industrial applications. PPS monofilaments are differentiated from multifilaments by their single, continuous strand structure, offering superior stiffness, abrasion resistance, and dimensional stability, which are critical factors in end-use industries like industrial filtration and technical textiles.

Major applications of PPS monofilaments include use in filter media for hot gas and chemical filtration, production of paper machine clothing (forming fabrics and dryer screens), and various technical textiles requiring high durability under extreme operating conditions. The inherent resistance of PPS to harsh chemicals and elevated temperatures (with a continuous service temperature often exceeding 200°C) provides a significant competitive advantage over standard polymers such as polyester or nylon, particularly in applications exposed to flue gases from coal-fired boilers or waste incinerators.

Market growth is primarily driven by the escalating demand for high-efficiency filtration systems necessitated by stringent environmental regulations, particularly in emerging economies undergoing rapid industrialization. Furthermore, the longevity and reduced downtime associated with PPS components in complex machinery, such as paper manufacturing equipment, contribute significantly to their adoption. The ongoing trend toward lightweighting and performance enhancement in industrial processes further fuels the innovation in PPS formulations and extrusion techniques, maintaining a robust trajectory for market expansion.

PPS Monofilament Market Executive Summary

The PPS Monofilament Market is positioned for stable growth, fueled primarily by sustained investment in industrial air pollution control measures and advancements in specialized technical textiles. Business trends indicate a strong regional shift towards Asia Pacific, which dominates both production capacity and consumption due to concentrated heavy industries and expanding infrastructure projects. Key manufacturers are focusing on capacity expansion and vertical integration to secure raw material supply (PPS resin) and optimize costs, leading to moderate consolidation activity within the specialty extrusion sector. Innovation is concentrated on developing finer denier monofilaments with enhanced surface finishes to improve flow characteristics and filtration efficiency in demanding applications.

Regional trends highlight that North America and Europe remain crucial markets, characterized by high-value applications in advanced manufacturing, medical devices, and high-temperature waste management. These regions prioritize performance over cost, driving demand for premium, custom-engineered PPS products. Conversely, the APAC market, led by China and India, exhibits explosive growth in volume terms, driven by large-scale filtration requirements in cement, power generation, and metal processing industries. Segmentation trends indicate that the filtration segment, particularly high-temperature baghouse filters, retains the largest market share due to global mandates on particulate matter emissions.

The overall market trajectory is influenced by geopolitical stability affecting global trade routes for raw materials and fluctuating energy costs, which directly impact the energy-intensive polymerization and extrusion processes. Sustainability efforts are also beginning to influence the market, with increasing interest in recycling post-industrial PPS monofilament waste and developing bio-based or recycled content additives, although these technologies are currently nascent. Despite challenges related to the high initial cost of PPS resin, the superior total cost of ownership (TCO) offered by PPS monofilaments due to their long service life ensures their continued dominance in critical industrial niches.

AI Impact Analysis on PPS Monofilament Market

User queries regarding AI's influence typically revolve around optimizing complex manufacturing processes, predicting material failure in extreme environments, and enhancing supply chain resilience. Users are keen to understand how AI-driven predictive maintenance can reduce costly industrial downtime associated with monofilament-based components like filter bags or conveyor belts, and how machine learning can fine-tune extrusion parameters for optimal tensile strength and diameter uniformity. Concerns also focus on whether AI can democratize access to high-performance material formulation data, potentially accelerating the development of new PPS blends tailored for specific chemical exposures.

AI's primary impact on the PPS Monofilament market centers on operational efficiency and product quality enhancement. In manufacturing, AI algorithms process massive datasets from extrusion lines—including temperature profiles, melt pressure, and drawing speeds—to establish dynamic optimal parameters, minimizing defects, and maximizing throughput. This data-intensive approach allows manufacturers to maintain extremely tight tolerances required for high-precision end-products, such as medical mesh or ultra-fine filtration media, which are otherwise difficult to achieve consistently through traditional process control methods.

Furthermore, AI is transformative in material science R&D. Machine learning models analyze structure-property relationships in different PPS formulations, predicting the impact of new additives or polymer blending ratios on thermal, chemical, and mechanical performance. This speeds up the innovation cycle for developing next-generation monofilaments with even higher performance characteristics, tailored specifically for emerging challenges in industries like environmental remediation or advanced battery manufacturing where PPS usage is being explored. The predictive modeling capabilities extend to forecasting demand shifts and optimizing inventory levels, leading to a leaner, more responsive supply chain.

- AI-driven optimization of extrusion parameters leading to superior filament uniformity and reduced waste.

- Predictive maintenance analytics for filter media and technical textiles, maximizing component lifespan.

- Accelerated R&D via Machine Learning for novel PPS compound formulation and performance prediction.

- Enhanced quality control through automated vision systems identifying minute surface defects in real-time.

- Supply chain optimization using AI to forecast raw material demand and mitigate procurement risks.

DRO & Impact Forces Of PPS Monofilament Market

The PPS Monofilament Market is fundamentally driven by strict global environmental standards mandating industrial emission control, which necessitates high-performance filtration media capable of withstanding corrosive environments and elevated temperatures. Restraints predominantly involve the volatile pricing and availability of the primary raw material, PPS resin, coupled with the high capital investment required for precision extrusion machinery and the subsequent high cost of the final product, which often deters adoption in highly price-sensitive, low-temperature applications. Opportunities arise from technological advancements focusing on reducing fiber diameter for micro-filtration efficiency and exploring new applications in emerging sectors like electric vehicle battery components and advanced composite reinforcement.

Driving forces for market expansion are strongly linked to the expansion of industrial capacity across Asia, particularly in coal-fired power plants, cement production, and chemical processing facilities, all of which are major consumers of hot gas filtration systems. The inherent durability and long service life of PPS monofilaments translate into lower operational expenditure (OPEX) for end-users compared to polymers requiring frequent replacement, reinforcing the value proposition despite the higher initial investment. Furthermore, the versatility of PPS allows penetration into niche markets such such as specialized offshore oil and gas industry filters and medical device manufacturing.

Impact forces govern how external pressures translate into market dynamics. The regulatory force, driven by agencies like the EPA and equivalent global bodies, is perhaps the most significant, dictating minimum filtration standards. Economic forces, particularly the global GDP trajectory and manufacturing output, determine the overall demand for industrial components. Technology forces, involving innovations in polymer modification and extrusion technology, influence product performance ceilings and cost structures, while sustainability forces are slowly pushing manufacturers to address end-of-life recycling challenges associated with high-performance specialty polymers like PPS.

Segmentation Analysis

The PPS Monofilament market is systematically segmented based on product characteristics, primarily diameter, and by core application fields, which reflect the divergent needs of the end-user industries. Analyzing the market through these segments provides critical insights into areas of highest growth potential and technological requirements. Diameter segmentation (Fine Denier and Coarse Denier) dictates the suitability for specific filtration or mechanical applications, while the application segmentation (Filtration, Technical Textiles, Paper Machine Clothing) directly correlates with industrial demand cycles and regulatory environments. The dominance of the Filtration segment highlights the market's reliance on industrial emission control needs, whereas segments like Paper Machine Clothing represent highly specialized, oligopolistic procurement landscapes demanding bespoke material properties.

- By Diameter:

- Fine Denier Monofilaments (e.g., <0.3 mm)

- Coarse Denier Monofilaments (e.g., >0.3 mm)

- By Application:

- Filtration (Hot Gas Filtration, Liquid Filtration, Chemical Filtration)

- Technical Textiles (Mesh, Screening Media, Industrial Conveyors)

- Paper Machine Clothing (Forming Fabrics, Dryer Screens)

- Other Applications (Medical Devices, Composite Reinforcement, Ropes/Cordage)

Value Chain Analysis For PPS Monofilament Market

The value chain for PPS Monofilaments begins with upstream activities dominated by major chemical companies specializing in the synthesis of PPS polymer resin, often relying on global petrochemical supply chains for key precursors like benzene and sulfur. The high cost of raw PPS resin makes this upstream segment a critical determinant of final product pricing and market competition. Procurement efficiency and securing long-term supply agreements with primary resin producers are paramount for monofilament manufacturers to maintain cost competitiveness and stable production schedules. Quality control at this stage, particularly polymer molecular weight and thermal stability, directly impacts the extrudability and performance characteristics of the final monofilament.

The midstream involves the core manufacturing process: melt extrusion, precision drawing, and winding. Specialized monofilament extruders process the PPS pellets into continuous single strands. Drawing is a highly technical process involving controlled heating and stretching to orient the polymer chains, thereby enhancing tensile strength, reducing elongation, and ensuring precise diameter tolerance, which is vital for applications like filter mesh. This stage requires significant technological expertise and capital investment. Efficient waste management and process automation are key focus areas for reducing operational costs in the midstream.

Downstream activities focus on converting the finished monofilaments into end-use products, primarily conducted by specialized fabricators (weaving and knitting companies) who produce filter bags, filter screens, paper machine fabrics, and industrial meshes. Distribution channels are varied, incorporating both direct sales models for large, highly customized orders (e.g., paper machine clothing manufacturers) and indirect distribution through specialized industrial distributors serving smaller MRO (Maintenance, Repair, and Operations) buyers or regional textile converters. The effectiveness of the sales network in providing technical support and customized sizing solutions significantly influences market penetration and customer retention in this highly technical industrial market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 235 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Celanese Corporation, Toray Industries, Inc., Asahi Kasei Corporation, SGL Carbon SE, Filatex Yarns Ltd., TEIJIN LIMITED, Polyvlies, Lancer Group, Shandong Aifusen New Material Co., Ltd., Wuxi City Z-Star Plastic Co., Ltd., Haining G&D Plastic Co., Ltd., Jinsanmonofilament, Jiangsu Huaxing Special Textile Co., Ltd., Sichuan Deyang Co., Ltd., Huizhou Jinsheng Plastic Monofilament, Jiangsu Xinghe Special Textile Co., Ltd., SWM International, Inc., Freudenberg Group, Nippon Paper Industries Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PPS Monofilament Market Potential Customers

Potential customers for PPS monofilaments are specialized industrial entities that operate machinery under conditions involving high temperatures, corrosive chemicals, or extreme mechanical stress, prioritizing durability and performance over marginal cost savings. The primary customer base comprises industrial filter bag manufacturers and weavers specializing in high-temperature filtration systems utilized in coal-fired power plants, municipal waste incinerators, and cement kilns. These buyers require PPS monofilaments for their exceptional chemical resistance and thermal stability, ensuring compliance with stringent air quality standards and minimizing costly system shutdowns for replacement.

Another significant segment includes major global Paper Machine Clothing (PMC) manufacturers. These customers integrate PPS monofilaments into forming fabrics and dryer screens due to the material's hydrolysis resistance and dimensional stability in humid, hot, and chemically aggressive paper production environments. The high mechanical load and continuous operation demand PPS for ensuring sheet quality and machine longevity. Procurement decisions in this sector are driven by long-term performance guarantees and technical specifications that directly influence the efficiency of paper production lines.

Furthermore, chemical processing and refining companies, along with specialized technical textile converters, represent robust potential buyers. These entities utilize PPS monofilament mesh and screening media for critical liquid and solid separation processes where contact with aggressive solvents or acids is unavoidable. Emerging customer segments include medical device manufacturers requiring inert, high-strength suture material or mesh, and advanced materials companies exploring PPS monofilaments for lightweight, high-performance composite reinforcement in aerospace and automotive applications where chemical resistance is essential.

PPS Monofilament Market Key Technology Landscape

The technological landscape of the PPS Monofilament market is defined by the ongoing pursuit of optimizing extrusion, drawing, and post-treatment processes to enhance mechanical, thermal, and surface properties. A core technological focus is precision high-speed extrusion, which manages the high melt temperature and low viscosity inherent to PPS, ensuring consistent melt flow without degradation. Advanced temperature control systems and specialized screw designs are employed to maintain polymer homogeneity and prevent oxidative breakdown, resulting in a cleaner, stronger initial strand before drawing.

The most critical technological differentiator lies in the precision drawing and orientation processes. Manufacturers utilize sophisticated multi-stage drawing systems to achieve the desired molecular orientation necessary for maximizing tensile strength and modulus while precisely controlling the filament diameter, especially for fine denier monofilaments (often less than 0.2 mm). Innovations include inline monitoring systems utilizing laser or optical sensors for real-time diameter feedback, allowing automated adjustments to drawing speeds to maintain extremely tight dimensional tolerances essential for high-quality woven filter media and paper machine clothing.

Furthermore, surface modification and post-treatment technologies are gaining importance. These include plasma treatment, specialized coating applications, and annealing processes designed to improve specific characteristics such as UV resistance, antistatic properties, or enhanced adhesion for subsequent weaving or lamination steps. Composite monofilament technology, involving co-extrusion or blending PPS with other high-performance polymers or reinforcing agents (like carbon nanotubes or glass fibers), represents an emerging frontier aimed at creating hybrid fibers that combine PPS benefits with specific desired attributes, such as enhanced wear resistance or electrical conductivity, thus broadening application potential into smart textiles and extreme environment sensors.

Continuous investment in recycling technology for high-performance polymers is another critical area. Developing economically viable methods to depolymerize or mechanically recycle end-of-life PPS monofilaments from filter bags presents a substantial technological challenge due to the harsh conditions the material endures during service, often involving heavy particulate contamination. Companies focusing on closed-loop systems and developing robust chemical cleaning processes for recycled PPS polymer inputs are gaining competitive ground in sustainability-conscious markets.

Regional Highlights

Regional dynamics in the PPS Monofilament Market are characterized by a consumption shift towards developing economies while high-value manufacturing and R&D activities remain concentrated in established industrial hubs. Asia Pacific (APAC) stands out as the dominant region, commanding the largest market share both in terms of production volume and consumption value. This is directly attributable to the region's expansive industrial base, particularly in China and India, involving vast numbers of coal-fired power plants, cement factories, and chemical manufacturing units, all requiring high volumes of PPS-based hot gas filtration media to meet escalating domestic environmental compliance requirements. Government infrastructure spending and capacity expansion across Southeast Asia further solidify APAC's leading position, driving demand for raw materials and finished technical textiles.

North America and Europe represent mature markets focused on premium, specialized, and highly technical applications. While volume growth is slower compared to APAC, the value realized per unit product is significantly higher due to strict specifications in aerospace, medical, and advanced manufacturing sectors. These regions are primary centers for innovation, driving demand for ultra-fine denier monofilaments and composite PPS fibers. Regulatory pressures, especially the EU's Industrial Emissions Directive, necessitate continuous upgrades to filtration and separation technology, ensuring sustained, albeit measured, demand for high-end PPS solutions. Furthermore, established paper and pulp industries in Northern Europe and North America are major, consistent buyers of high-quality PPS paper machine clothing.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting considerable potential, primarily driven by investments in refining, petrochemicals, and mineral processing sectors. The growth in MEA is closely linked to large-scale infrastructure projects and sustained investment in hydrocarbon processing facilities, where PPS monofilaments find critical use in process filtration under challenging climatic and chemical conditions. Market penetration in these regions often involves navigating complex logistics and establishing robust distribution partnerships, but the underlying industrial growth trajectory points toward increasing PPS adoption rates throughout the forecast period.

- Asia Pacific (APAC): Dominates market volume due to high industrial capacity in China and India; significant consumer of hot gas filtration media in power generation and cement industries.

- North America: High-value market focused on advanced manufacturing, medical devices, and stringent filtration standards; strong presence of R&D focused on next-generation PPS applications.

- Europe: Mature market characterized by premium demand in the paper and pulp industry and adherence to strict EU environmental directives, necessitating continuous technology upgrades.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging growth regions driven by expansion in petrochemical, refining, and basic materials processing industries; increasing adoption in specialized industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PPS Monofilament Market.- Celanese Corporation

- Toray Industries, Inc.

- Asahi Kasei Corporation

- SGL Carbon SE

- Filatex Yarns Ltd.

- TEIJIN LIMITED

- Polyvlies

- Lancer Group

- Shandong Aifusen New Material Co., Ltd.

- Wuxi City Z-Star Plastic Co., Ltd.

- Haining G&D Plastic Co., Ltd.

- Jinsanmonofilament

- Jiangsu Huaxing Special Textile Co., Ltd.

- Sichuan Deyang Co., Ltd.

- Huizhou Jinsheng Plastic Monofilament

- Jiangsu Xinghe Special Textile Co., Ltd.

- SWM International, Inc.

- Freudenberg Group

- Nippon Paper Industries Co., Ltd.

- DuPont de Nemours, Inc.

Frequently Asked Questions

Analyze common user questions about the PPS Monofilament market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of PPS Monofilaments over standard industrial fibers?

PPS monofilaments offer superior resistance to high temperatures (continuous use up to 200°C), exceptional chemical inertness against a wide range of acids and bases, inherent flame retardancy, and high mechanical strength and dimensional stability, making them ideal for extreme industrial environments like hot gas filtration.

Which industry segment holds the largest share in the PPS Monofilament Market?

The Filtration segment, particularly for high-temperature and harsh-chemical industrial applications such as baghouse filters in power generation, cement, and waste incineration plants, holds the largest market share due to stringent global environmental regulations mandating efficient emission control.

What major factors restrain the growth of the PPS Monofilament Market?

The primary restraints include the high production cost of the specialized PPS polymer resin and the necessity for significant capital investment in highly specialized, precision extrusion and drawing equipment, which results in a high cost of the final product compared to commodity polymers.

How does the value chain complexity impact the market price of PPS Monofilaments?

The value chain is complex, starting with high-cost PPS resin synthesis (upstream). The subsequent specialized, capital-intensive precision extrusion and drawing (midstream) add substantial value. The tight tolerances required for end-user applications mean quality control costs are high, directly inflating the final market price relative to simpler fiber products.

Which regional market is expected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the fastest growth rate due to ongoing rapid industrialization, large-scale infrastructure development, and increasing governmental enforcement of air pollution control standards in major economies like China and India, driving mass consumption in industrial filtration applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager