PPTC and CPTC Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440356 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

PPTC and CPTC Market Size

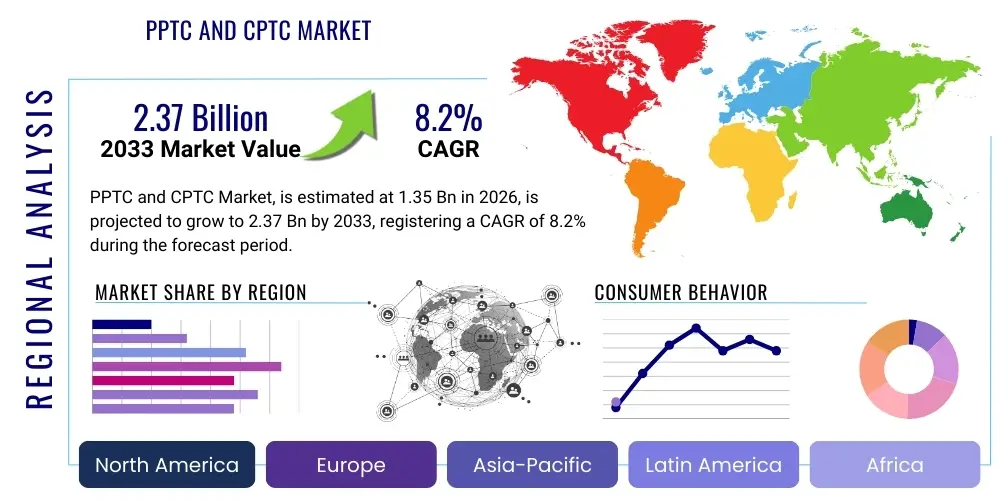

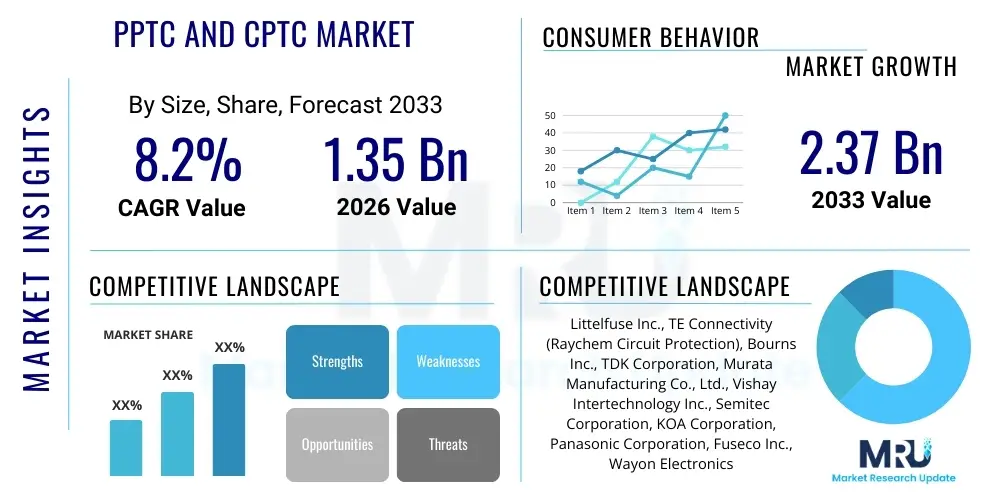

The PPTC and CPTC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.37 Billion by the end of the forecast period in 2033.

PPTC and CPTC Market introduction

The PPTC (Polymeric Positive Temperature Coefficient) and CPTC (Ceramic Positive Temperature Coefficient) market encompasses advanced passive electronic components primarily used for resettable overcurrent and overtemperature protection in a wide array of electronic circuits. PPTC devices are made from a composite of crystalline polymer and conductive particles, exhibiting a sharp increase in resistance when current or temperature thresholds are exceeded, then returning to a low resistance state once the fault is cleared. CPTC devices, conversely, utilize ceramic materials that also display a positive temperature coefficient of resistance, often employed in applications requiring precise temperature sensing or heating, although their primary use in this market context is for self-regulating heaters and thermal protection circuits, typically in lower voltage, high current scenarios or for specific temperature control.

Major applications for both PPTC and CPTC components span consumer electronics, automotive systems, industrial control, telecommunications infrastructure, and medical devices. In consumer electronics, they protect batteries, USB ports, and power adapters from overcurrent faults. Within the automotive sector, they are crucial for safeguarding electronic control units (ECUs), infotainment systems, and increasingly, electric vehicle (EV) battery management systems. Industrial applications include protecting motor control, power supplies, and process automation equipment. The core benefits include their resettable nature, compactness, fast response times, and compliance with various safety standards. The market is significantly driven by the accelerating demand for circuit protection in miniaturized and high-density electronic designs, the proliferation of IoT devices, the global push for vehicle electrification, and the increasing complexity of electronic systems requiring robust and reliable protection solutions against transient events.

PPTC and CPTC Market Executive Summary

The PPTC and CPTC market is experiencing dynamic shifts driven by technological advancements and evolving end-user demands, positioning itself for substantial growth through the forecast period. Key business trends include the ongoing miniaturization of electronic components, which mandates more compact and efficient circuit protection solutions, and the increasing adoption of advanced materials to enhance performance characteristics such as faster trip times and higher voltage ratings. Furthermore, there is a rising emphasis on integrated protection solutions that combine multiple functionalities, alongside a strategic focus on expanding manufacturing capabilities in regions with high electronics production. Companies are investing in R&D to develop custom-tailored solutions for specific high-growth applications, such as high-voltage protection for electric vehicles and precise thermal management for 5G telecommunications infrastructure.

Regional trends indicate that the Asia Pacific (APAC) region continues to dominate the market, primarily due to its robust electronics manufacturing base, rapid industrialization, and significant consumer electronics production. However, North America and Europe are showing strong growth, propelled by the increasing demand from the automotive industry (especially EVs), the expansion of data centers, and the adoption of industrial automation. Latin America and the Middle East & Africa are emerging as promising markets, driven by infrastructure development and increasing penetration of smart devices. In terms of segment trends, the surface mount device (SMD) category for PPTC and CPTC is projected to exhibit the fastest growth, largely attributable to its compatibility with automated assembly processes and its suitability for compact electronic designs. The automotive segment, particularly for EV battery protection and onboard electronics, is poised for significant expansion, closely followed by the telecommunications and industrial sectors, reflecting the broader trends of digitalization and electrification across industries.

AI Impact Analysis on PPTC and CPTC Market

The integration of Artificial Intelligence (AI) across various industries, while not directly consuming PPTC and CPTC devices, significantly influences the market indirectly by shaping the design, complexity, and performance requirements of the electronic systems that utilize these components. Common user questions revolve around how AI impacts the need for advanced circuit protection in increasingly intelligent and autonomous systems, whether AI can optimize the placement or selection of such components, and if AI-driven diagnostics will reduce the reliance on traditional protection methods. The prevailing themes suggest that AI's influence is primarily through the proliferation of more complex, power-dense, and mission-critical electronics, which inherently demand more sophisticated and reliable overcurrent and overtemperature protection. Users anticipate that AI will lead to smarter, more resilient systems, thereby increasing the demand for high-performance and customized PPTC and CPTC solutions capable of operating within stringent thermal and electrical envelopes.

- AI-powered systems (e.g., autonomous vehicles, industrial robots) require highly robust and reliable circuit protection, increasing demand for high-performance PPTC/CPTC.

- The development of AI hardware (GPUs, NPUs, specialized accelerators) generates significant heat and power density, necessitating advanced thermal management and overcurrent protection, driving PPTC/CPTC innovation.

- AI-driven predictive maintenance systems can optimize the operational lifespan of electronic components, potentially reducing catastrophic failures but demanding more precise and responsive protection against transient faults.

- AI in smart grid applications and IoT devices increases the complexity and interconnectedness of electrical systems, thereby escalating the need for distributed and intelligent overcurrent protection.

- AI algorithms can be used in the design phase to simulate thermal profiles and current paths, leading to optimized placement and specification of PPTC and CPTC devices for enhanced system reliability.

- The increasing adoption of AI in critical infrastructure and medical devices elevates safety standards, pushing for higher quality and more rigorously tested PPTC and CPTC components.

DRO & Impact Forces Of PPTC and CPTC Market

The PPTC and CPTC market is shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the relentless trend towards miniaturization in electronic devices, which necessitates compact and efficient circuit protection; the booming electric vehicle (EV) market, demanding high-voltage and high-current protection for battery management systems and power electronics; and the widespread deployment of IoT devices, 5G infrastructure, and industrial automation, all requiring reliable overcurrent and overtemperature protection. These factors collectively create a strong and continuous demand for advanced resettable protection solutions, pushing manufacturers to innovate in material science and component design to meet evolving performance requirements.

However, the market also faces several restraints. Price sensitivity, particularly in high-volume consumer electronics segments, can limit the adoption of premium PPTC/CPTC solutions. Competition from alternative protection devices like traditional fuses, bimetallic thermal cutoffs, and NTC thermistors, each with specific advantages and cost profiles, poses a challenge. Furthermore, the inherent performance limitations of PPTC and CPTC devices, such as temperature derating, relatively slower trip times compared to fast-blow fuses, and voltage/current limitations in certain extreme applications, can restrict their use. Manufacturing complexities related to achieving consistent performance across a wide range of operating conditions and the need for specialized materials also contribute to these limitations.

Opportunities within the market are significant and diverse. The burgeoning market for renewable energy systems, including solar inverters and energy storage, presents a growing need for robust circuit protection. The medical device sector, with its stringent safety and reliability requirements, offers high-value opportunities for specialized PPTC/CPTC solutions. Furthermore, the development of advanced materials, such as improved conductive polymers and ceramic composites, holds the potential to overcome existing performance limitations and expand the application range. Strategic collaborations between component manufacturers and original equipment manufacturers (OEMs) to develop customized protection solutions for emerging applications are also key avenues for growth, enabling the creation of tailored components that precisely meet specific industry needs and integrate seamlessly into new designs.

Segmentation Analysis

The PPTC and CPTC market is extensively segmented to provide a detailed understanding of its diverse applications, technological variations, and end-user demands. This segmentation allows for a granular analysis of market trends, growth drivers, and competitive landscapes across different product types, form factors, and industry verticals. By dissecting the market into these specific categories, stakeholders can identify niche opportunities, understand product adoption patterns, and formulate targeted strategies for development and market penetration. Each segment reflects unique technical requirements and market dynamics, contributing to the overall complexity and potential of the circuit protection industry.

- By Type:

- Radial Leaded Devices

- Surface Mount Devices (SMD)

- Chip Devices

- Disc/Wafer Devices

- Strapped/Specialty Devices

- By Material (for PPTC):

- Polymer-Based (e.g., PE, HDPE, PTFE)

- Carbon Black Composites

- Other Conductive Fillers

- By Application:

- Consumer Electronics (e.g., PCs, Mobile Devices, Wearables, Gaming Consoles)

- Automotive Electronics (e.g., Infotainment, Engine Control, EV Battery Management, ADAS)

- Industrial Equipment (e.g., Motor Drives, Power Supplies, Industrial Automation, Test & Measurement)

- Telecommunications (e.g., Base Stations, Network Infrastructure, Data Centers)

- Medical Devices (e.g., Diagnostic Equipment, Portable Medical Devices, Patient Monitoring)

- LED Lighting

- Battery Protection (General purpose)

- HVAC Systems

- Home Appliances

- Aerospace & Defense

- By Voltage Rating:

- Low Voltage (e.g., < 30V)

- Medium Voltage (e.g., 30V-60V)

- High Voltage (e.g., > 60V)

- By Current Rating:

- Low Current (e.g., < 1A)

- Medium Current (e.g., 1A-10A)

- High Current (e.g., > 10A)

Value Chain Analysis For PPTC and CPTC Market

The value chain for the PPTC and CPTC market commences with upstream activities centered on the procurement and processing of raw materials. This includes suppliers of specialized polymers (such as polyethylene, high-density polyethylene, and polytetrafluoroethylene) and conductive fillers like carbon black for PPTC devices, as well as ceramic materials (like barium titanate) and dopants for CPTC components. Other crucial upstream elements involve manufacturers of conductive metals for electrodes and lead wires, and advanced chemical suppliers providing specific additives to enhance material properties. The quality and availability of these raw materials directly impact the performance, cost, and manufacturability of the final PPTC and CPTC products, emphasizing the importance of robust supplier relationships and supply chain management.

Midstream in the value chain, component manufacturers undertake the intricate processes of material formulation, molding, sintering (for CPTC), and assembly. This stage involves significant R&D investment in material science and processing technologies to achieve desired electrical and thermal characteristics, such as precise trip times, holding current, and resettability. Following manufacturing, products move through various distribution channels, which can be broadly categorized into direct and indirect channels. Direct sales often involve large OEMs who purchase in bulk directly from manufacturers, allowing for custom specifications and close technical collaboration. Indirect channels include a network of global and regional distributors, catalog houses, and online marketplaces that serve a broader customer base, including smaller manufacturers, repair shops, and hobbyists, providing accessibility and logistical support across diverse geographies. The effectiveness of these channels is crucial for market penetration and timely delivery.

Downstream activities involve the integration of PPTC and CPTC devices into a vast array of end-products across different industries. Original equipment manufacturers (OEMs) in sectors such as consumer electronics, automotive, industrial, and telecommunications are the primary consumers, incorporating these protection components into their circuit boards and finished goods. The final stage involves the end-users who utilize these products, benefiting from the enhanced safety and reliability provided by the embedded PPTC and CPTC devices. Post-sales support, technical assistance for integration, and product lifecycle management also form a critical part of the downstream activities, ensuring customer satisfaction and continuous product improvement based on real-world application feedback.

PPTC and CPTC Market Potential Customers

Potential customers for PPTC and CPTC devices encompass a broad spectrum of industries and manufacturers, all requiring reliable and resettable overcurrent and overtemperature protection for their electronic systems. These end-users, or buyers, are typically Original Equipment Manufacturers (OEMs) that integrate these components into their final products, as well as Electronic Manufacturing Service (EMS) providers who build assemblies for various clients. The diverse application areas mean that virtually any industry utilizing electronic circuits, from simple appliances to complex industrial machinery, represents a potential customer segment. The critical need for safeguarding sensitive electronics against damage from fault conditions and ensuring product longevity drives demand from these varied buyer groups.

Key segments of potential customers include prominent manufacturers in the consumer electronics sector, ranging from smartphone and laptop producers to wearable device innovators and smart home appliance companies. The automotive industry, particularly manufacturers of electric vehicles (EVs), hybrid electric vehicles (HEVs), and advanced driver-assistance systems (ADAS), represents a rapidly growing customer base due to the increasing electronic content and high-voltage requirements. Industrial equipment manufacturers, including those producing motor controls, power supplies, factory automation systems, and test and measurement devices, also form a significant customer segment. Telecommunications companies, involved in building 5G infrastructure, data centers, and network equipment, similarly rely on these components. Furthermore, medical device manufacturers, demanding high reliability and safety for diagnostic, therapeutic, and patient monitoring equipment, represent a high-value customer group. These customers seek not just components but integrated solutions that meet stringent performance, size, and safety standards, often leading to custom development collaborations with PPTC and CPTC manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.37 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Littelfuse Inc., TE Connectivity (Raychem Circuit Protection), Bourns Inc., TDK Corporation, Murata Manufacturing Co., Ltd., Vishay Intertechnology Inc., Semitec Corporation, KOA Corporation, Panasonic Corporation, Fuseco Inc., Wayon Electronics Co., Ltd., Fuzetec Technology Co., Ltd., Brightking Electronics Technology Co., Ltd., Polytronics Technology Corp., Changzhou Umei Electronic Co., Ltd., Xiamen Set Electronics Co., Ltd., BetterFuse, PPTC Electronics (HK) Limited, ESI North America, Ohizumi Mfg. Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PPTC and CPTC Market Key Technology Landscape

The technology landscape for the PPTC and CPTC market is characterized by ongoing advancements in material science, component design, and manufacturing processes aimed at enhancing performance, reliability, and cost-effectiveness. For PPTC devices, the core technology revolves around specialized polymer composites, typically crystalline polymers mixed with conductive fillers like carbon black. Innovations focus on developing new polymer matrices and conductive materials that offer lower resistance in the "on" state, faster trip times, higher voltage and current ratings, and improved stability across wider temperature ranges. This includes research into optimizing the polymer's crystalline structure and the dispersion of conductive particles to achieve more predictable and repeatable switching characteristics. Surface mount technology (SMT) packaging is another critical area, enabling smaller footprints and compatibility with automated assembly, which is essential for miniaturized electronic devices.

In the CPTC segment, the key technology lies in advanced ceramic formulations, predominantly based on barium titanate, doped with various elements to achieve specific positive temperature coefficient characteristics. Technological advancements here involve optimizing the ceramic sintering process to control grain size and density, thereby fine-tuning the resistance-temperature curve for precise thermal sensing or self-regulating heating applications. The development of thin-film CPTC thermistors also represents a significant technological trend, allowing for ultra-miniature sensors and heaters with faster response times. Furthermore, advancements in electrode materials and passivation layers are crucial for improving the long-term stability and reliability of both PPTC and CPTC devices, especially in harsh operating environments prevalent in automotive and industrial applications. The push for higher operating temperatures and voltage capabilities is continuously driving innovation in both material composition and component architecture.

Beyond the core materials, manufacturing techniques such as extrusion, injection molding, and screen printing are continuously refined for PPTC devices, ensuring high precision and repeatability. For CPTC, advanced ceramic processing techniques like tape casting and multilayer co-firing are vital for producing complex geometries and integrated solutions. There is also a growing trend towards integrating these protection devices into multi-functional modules, often alongside other passive components, to offer complete circuit protection solutions in a more compact form factor. This integration requires sophisticated packaging technologies and careful thermal management design to ensure optimal performance. The use of advanced simulation and modeling tools during the design phase is becoming increasingly prevalent, allowing manufacturers to predict device behavior under various fault conditions and accelerate product development cycles, further contributing to the evolving technological landscape.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share, primarily driven by its extensive electronics manufacturing ecosystem, particularly in China, South Korea, Japan, Taiwan, and India. Rapid industrialization, increasing disposable income, and the large-scale production of consumer electronics, automotive components, and telecommunications infrastructure fuel significant demand for PPTC and CPTC devices. The region also benefits from a robust supply chain and competitive manufacturing costs.

- North America: Exhibits strong growth, propelled by the burgeoning electric vehicle (EV) market, advancements in industrial automation, the expansion of data centers, and a significant presence of medical device manufacturers. The emphasis on high-reliability and high-performance components for critical applications drives innovation and adoption in this region.

- Europe: A mature market experiencing steady growth, largely due to stringent safety regulations, increasing adoption of industrial IoT, and the strong automotive industry, particularly in Germany for premium and EV sectors. Investments in renewable energy infrastructure and smart grid technologies also contribute to demand.

- Latin America: An emerging market with growth driven by increasing foreign investment in manufacturing, infrastructure development, and rising consumer electronics penetration. Brazil and Mexico are key countries, benefiting from their manufacturing capabilities and growing domestic demand.

- Middle East & Africa (MEA): Shows promising growth potential due to ongoing urbanization, government initiatives in digitalization, and diversification of economies away from oil. Investments in telecommunications, renewable energy projects, and basic consumer electronics manufacturing are creating new opportunities for PPTC and CPTC applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PPTC and CPTC Market.- Littelfuse Inc.

- TE Connectivity (Raychem Circuit Protection)

- Bourns Inc.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Vishay Intertechnology Inc.

- Semitec Corporation

- KOA Corporation

- Panasonic Corporation

- Fuseco Inc.

- Wayon Electronics Co., Ltd.

- Fuzetec Technology Co., Ltd.

- Brightking Electronics Technology Co., Ltd.

- Polytronics Technology Corp.

- Changzhou Umei Electronic Co., Ltd.

- Xiamen Set Electronics Co., Ltd.

- BetterFuse

- PPTC Electronics (HK) Limited

- ESI North America

- Ohizumi Mfg. Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PPTC and CPTC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are PPTC and CPTC devices, and how do they function?

PPTC (Polymeric Positive Temperature Coefficient) and CPTC (Ceramic Positive Temperature Coefficient) devices are resettable electronic components used for overcurrent and overtemperature protection. They operate by increasing their resistance significantly when a fault current or excessive temperature causes them to heat up, effectively limiting current flow. Once the fault is removed and the device cools, its resistance returns to a low state, allowing normal operation without manual replacement.

What are the primary differences between PPTC and CPTC thermistors?

The main difference lies in their material composition and typical applications. PPTC devices use a polymer composite and are widely employed for resettable overcurrent protection in various electronics. CPTC devices, made from ceramic materials, often find use in self-regulating heaters, precise thermal sensing, or specific thermal protection circuits, typically excelling in lower voltage, higher current scenarios or precise temperature control applications, sometimes also acting as current limiters.

In which applications are PPTC and CPTC devices most commonly used?

PPTC and CPTC devices are extensively used across numerous industries. Common applications include consumer electronics (e.g., battery packs, USB ports, power adapters), automotive systems (e.g., ECU protection, EV battery management), industrial equipment (e.g., motor controls, power supplies), telecommunications (e.g., network equipment, base stations), and medical devices (e.g., portable patient monitors, diagnostic tools).

What drives the growth of the PPTC and CPTC market?

Market growth is primarily driven by the ongoing miniaturization of electronic devices, the rapid expansion of the electric vehicle (EV) sector, the widespread adoption of IoT devices and 5G infrastructure, and increasing demands for robust circuit protection in complex electronic systems. The need for reliable, resettable protection against overcurrents and overtemperatures across diverse applications fuels sustained demand.

What are the key technological trends influencing the PPTC and CPTC market?

Key trends include advancements in material science to achieve higher voltage/current ratings and faster response times, the development of smaller surface mount device (SMD) packages for compact designs, improved stability across wider operating temperatures, and integration into multi-functional protection modules. There's also a focus on customized solutions for high-growth areas like EV battery protection and high-power industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager