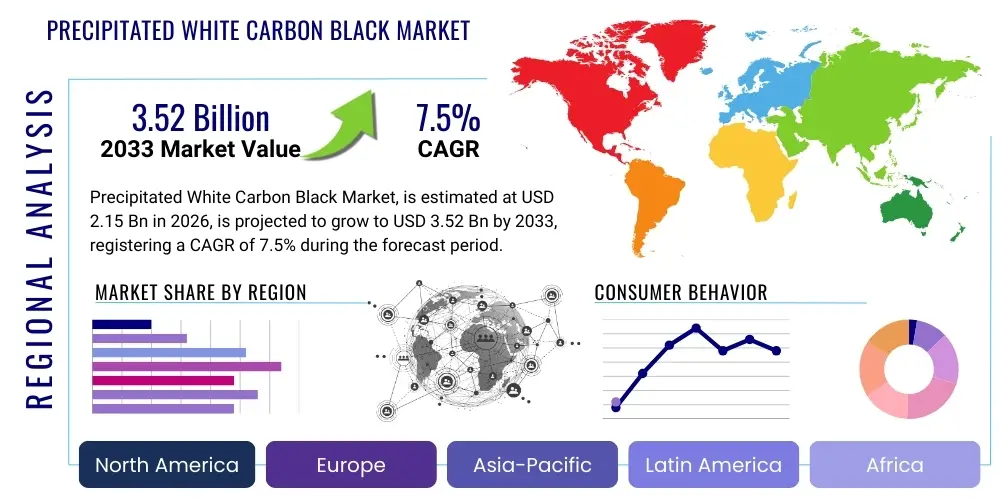

Precipitated White Carbon Black Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432670 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Precipitated White Carbon Black Market Size

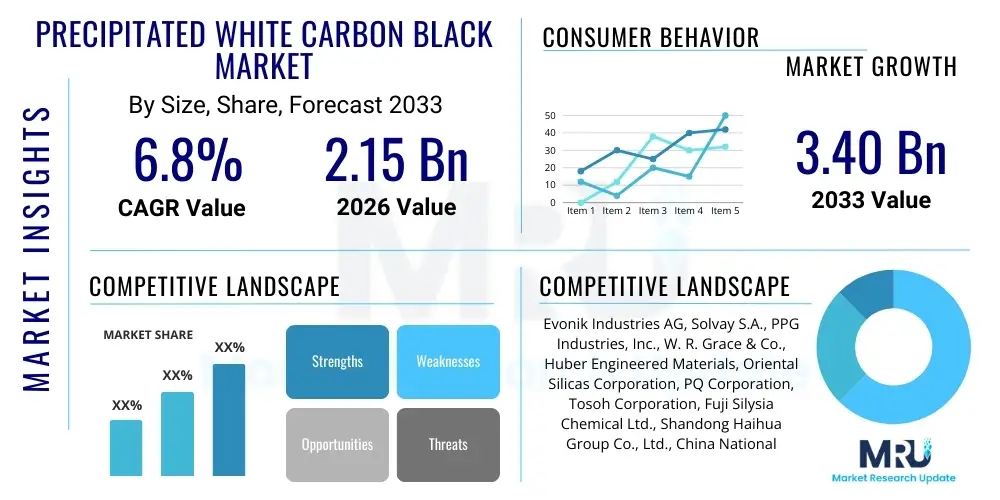

The Precipitated White Carbon Black Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $3.40 Billion by the end of the forecast period in 2033.

Precipitated White Carbon Black Market introduction

Precipitated White Carbon Black, commercially known as precipitated silica, is a synthetic, amorphous form of silicon dioxide (). It is produced through the precipitation process by reacting sodium silicate solution with a mineral acid, such as sulfuric acid. This manufacturing process allows for precise control over the physiochemical properties, including surface area, particle size, and porosity, which are crucial for its diverse industrial applications. Unlike carbon black, which is derived from the incomplete combustion of heavy petroleum products, precipitated silica is white and non-abrasive, making it indispensable in sectors where coloration and high reinforcement are required simultaneously.

The primary applications of Precipitated White Carbon Black span across the rubber industry, particularly in green tire manufacturing, where Highly Dispersible Silica (HDS) significantly improves wet grip, rolling resistance, and fuel efficiency. Beyond tires, it serves as a critical reinforcing filler in industrial rubber goods, footwear components, and silicone rubber products. Furthermore, its unique properties—such as thickening, anti-settling, and matting capabilities—make it vital in coatings, paints, and printing inks. In the food and feed sector, it functions effectively as an anti-caking agent, carrier, and flow aid, meeting stringent regulatory standards for direct contact applications.

Market growth is predominantly driven by stringent environmental regulations, particularly in the automotive industry, which mandates the adoption of low-rolling-resistance tires to reduce carbon emissions. The shift toward Electric Vehicles (EVs), which require specialized, durable tires, further accelerates the demand for high-performance precipitated silica. Additionally, increasing consumption of packaged food requiring anti-caking additives and expansion in the thriving cosmetics and personal care sectors contribute substantially to the upward trajectory of the Precipitated White Carbon Black market globally, making it a critical material for enhancing performance across various end-user segments.

Precipitated White Carbon Black Market Executive Summary

The Precipitated White Carbon Black market is characterized by robust growth, driven by the indispensable role of highly engineered silica in enhancing the performance characteristics of modern materials, particularly tires and advanced rubber compounds. Current business trends indicate a significant focus on developing Highly Dispersible Silica (HDS) grades, which offer superior compatibility with polymers, leading to reduced energy consumption and improved product durability. Strategic mergers, acquisitions, and capacity expansions, particularly in the Asia Pacific region, define the competitive landscape, as established players seek to optimize supply chains and capture burgeoning demand from the rapidly industrializing automotive and construction sectors. Sustainability and regulatory compliance, especially regarding emissions reduction and the use of eco-friendly reinforcing agents, remain pivotal drivers influencing product innovation and market positioning.

Regionally, the Asia Pacific (APAC) dominates the market share, fueled by the massive scale of tire production in countries like China, India, and Southeast Asia, coupled with expansive infrastructure development necessitating performance coatings and robust industrial rubber goods. North America and Europe, while mature, exhibit strong growth in high-value, specialized segments such as performance coatings, high-end footwear, and pharmaceutical excipients, propelled by strict environmental policies favoring green technologies. Segmentation trends highlight the superiority of the Tire application segment, which accounts for the largest revenue share due to the global mandate for green tires (EU Tire Labeling Regulation, US CAFE standards). Furthermore, the highly specialized Precipitated Silica sub-segment continues to expand its lead over other forms due to its tailored physical properties crucial for high-performance end-uses.

In terms of segment performance, the Highly Dispersible Silica (HDS) product type is registering the fastest CAGR, reflecting its premium pricing and superior functionality in fuel-efficient tire manufacturing. Conversely, standard precipitated silica maintains a foundational role in conventional rubber products and general industrial applications, providing stability to the overall market. The market structure emphasizes backward integration among key manufacturers who aim to secure raw material (sodium silicate) supply and maintain quality control. Overall, the market outlook is overwhelmingly positive, underpinned by continuous research and development efforts aimed at optimizing particle morphology and surface chemistry to unlock new application areas in polymers, batteries, and advanced materials engineering.

AI Impact Analysis on Precipitated White Carbon Black Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Precipitated White Carbon Black market frequently center on how AI can optimize manufacturing efficiency, enhance material properties through predictive analytics, and improve supply chain resilience. Key concerns revolve around the integration cost of AI-driven systems and the requisite data infrastructure needed to leverage advanced algorithms for synthesis control. Users commonly expect AI to revolutionize quality control by predicting deviations in particle size distribution and surface area during the precipitation process, thereby reducing batch inconsistency and minimizing waste. Furthermore, there is significant interest in using machine learning to simulate and predict the performance of novel silica formulations in complex matrices (like tire compounds) before expensive physical trials, accelerating the material innovation pipeline and shortening time-to-market for specialized HDS grades.

- AI-powered process optimization leads to tighter control over reaction parameters (pH, temperature, concentration), enhancing the consistency and quality of precipitated silica.

- Predictive maintenance using AI minimizes unplanned downtime in high-volume production facilities, optimizing overall equipment effectiveness (OEE).

- Machine learning accelerates R&D by simulating the interaction between silica fillers and polymer matrices, leading to faster development of customized HDS for specific tire performance requirements.

- AI-driven supply chain management optimizes raw material procurement (sodium silicate, acid) and logistics planning, mitigating risks associated with supply volatility.

- Enhanced quality assurance through computer vision and sensor fusion detects microscopic defects in batch samples, ensuring stringent compliance with automotive and food-grade specifications.

DRO & Impact Forces Of Precipitated White Carbon Black Market

The Precipitated White Carbon Black market growth is primarily propelled by stringent global regulations mandating improved energy efficiency in vehicles, specifically the transition to "green tires," which heavily rely on Highly Dispersible Silica (HDS) to reduce rolling resistance. This demand is further amplified by the expanding adoption of Electric Vehicles (EVs), requiring highly durable and low-abrasion tire components. However, the market faces significant restraints, chiefly volatility in raw material prices, particularly sodium silicate and sulfuric acid, which directly impacts manufacturing costs and profit margins. Additionally, the intensive energy consumption required for the drying and grinding stages of production poses sustainability challenges and operational constraints, pressuring manufacturers to invest in energy-efficient technologies.

Opportunities for market expansion are substantial, stemming from the increasing utilization of precipitated silica as a thickening and reinforcing agent in specialized high-value applications, including advanced batteries, personal care products, and pharmaceutical excipients. Developing regions, especially in Asia Pacific, present untapped potential due to rapid urbanization, increasing per capita income, and subsequent growth in packaged goods consumption and automotive production. Strategic investments in capacity expansion for HDS production and the exploration of bio-based or recycled raw materials offer pathways for sustained, resilient growth, addressing both cost volatility and environmental concerns simultaneously.

Impact forces within this market are high, driven by the interplay between regulatory pressures (a strong external driver) and competitive pricing dynamics (an internal restraint). The ability of key players to innovate and produce tailored silica grades with enhanced dispersibility and functionality directly influences their competitive advantage and market share. Technological advancements in precipitation and functionalization techniques represent a pivotal impact force, enabling the creation of specialized products that command premium pricing and meet the evolving high-performance requirements of the tire and specialty chemicals industries. Overall, the market forces favor innovation and geographical diversification, compelling manufacturers to operate efficiently while adhering to increasingly stringent performance and environmental criteria.

Segmentation Analysis

The Precipitated White Carbon Black market is comprehensively segmented based on product type, application, and geography, reflecting the highly specialized nature of the material and its diverse end-use industries. The fundamental categorization by type differentiates between Highly Dispersible Silica (HDS), which offers superior reinforcing capabilities vital for green tires, and Conventional Precipitated Silica, which serves broader industrial needs like basic rubber filling, toothpaste, and simple anti-caking applications. The sophistication level of the end-use often determines the required silica grade, impacting pricing and technological requirements. Understanding these segments is crucial for strategic market penetration, as the demand dynamics, regulatory landscape, and profitability vary significantly between segments like advanced tire compounds and basic commodity uses.

Application segmentation reveals the dominance of the rubber industry, which is further split into tire and non-tire sectors. The tire application segment remains the largest volume consumer due to regulatory drivers and the sheer size of the automotive market. Non-tire rubber applications include footwear, industrial belts, hoses, and molded goods, where silica provides excellent abrasion resistance and tear strength. Outside the rubber domain, the market thrives in high-margin sectors such as coatings and inks, where it acts as a thickening agent and matting additive, and in the food and feed industry, capitalizing on its role as an effective flow agent and carrier, ensuring product stability and shelf life, thereby contributing significantly to market heterogeneity and revenue diversification across regions.

- By Product Type:

- Conventional Precipitated Silica

- Highly Dispersible Silica (HDS)

- By Application:

- Tire (Passenger Car Tires, Truck and Bus Tires, Off-The-Road Tires)

- Non-Tire Rubber (Footwear, Industrial Rubber Goods, Belts, Hoses)

- Coatings and Inks (Matting Agents, Thickeners, Anti-settling agents)

- Food and Feed (Anti-caking Agent, Carrier for Liquids, Flow Agent)

- Others (Personal Care, Adsorbents, Pharmaceutical Excipients)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Precipitated White Carbon Black Market

The value chain for Precipitated White Carbon Black commences with the upstream segment, which involves the sourcing and processing of core raw materials: sand (quartz), sodium carbonate, and sulfuric acid. Sand is processed into sodium silicate, often referred to as water glass, which is the primary precursor. Since raw material cost volatility significantly impacts the final product price, establishing stable, long-term procurement contracts or engaging in backward integration to secure sodium silicate production capacity is a critical strategy for major market players. The capital-intensive nature of chemical synthesis, requiring large-scale reactors, filtration equipment, and drying facilities, characterizes this upstream phase.

The manufacturing process itself represents the central stage, where leading global manufacturers utilize specialized precipitation technologies to control particle size, surface area, and porosity, crucial for yielding high-performance grades like Highly Dispersible Silica (HDS). Distribution channels are diverse, ranging from direct sales to large-volume customers, such as major tire manufacturers (direct channel), to indirect distribution through specialized chemical distributors and agents who serve smaller industrial users, particularly in the coatings, food, and personal care segments. Effective logistics and warehousing capabilities are vital due to the bulky nature of the product, necessitating optimized packaging and transport solutions to maintain product integrity and minimize costs.

The downstream analysis focuses on the end-use industries. Key buyers include large multinational tire corporations, specialty rubber product manufacturers, and global food and consumer goods conglomerates. The demand is highly inelastic in the automotive sector once a specific silica grade is validated for tire compounds, emphasizing the importance of technical service and application support. This specialized nature often mandates direct technical collaboration between the silica producer and the end-user, ensuring the functional properties of the white carbon black are perfectly optimized for the final product's performance specifications, thus maximizing value capture throughout the chain.

Precipitated White Carbon Black Market Potential Customers

Potential customers for Precipitated White Carbon Black are predominantly concentrated in industrial sectors requiring high-performance reinforcing fillers, specialized adsorbents, and effective flow control agents. The largest buying segment is the global tire industry, including original equipment manufacturers (OEMs) and replacement market producers such as Michelin, Bridgestone, Goodyear, and Continental. These companies are continually seeking advanced Highly Dispersible Silica (HDS) grades to meet evolving regulatory standards for rolling resistance and safety, making them high-volume, strategically important clients who often negotiate large, long-term supply contracts directly with major silica producers.

A second major customer cluster resides in the non-tire rubber sector, encompassing manufacturers of specialized industrial rubber goods like conveyor belts, seals, hoses, and premium footwear brands. For these buyers, precipitated silica is valued for its ability to impart high tear strength, elongation at break, and non-marking characteristics, which carbon black cannot provide. Furthermore, the specialized chemical industry and consumer goods sector represent critical customers, including paint and coating manufacturers using silica as a matting or thixotropic agent, and large food and pharmaceutical companies requiring high-purity, food-grade or excipient-grade silica for use as anti-caking agents, tablet disintegrants, and carriers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $3.40 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Solvay S.A., PPG Industries, Inc., W. R. Grace & Co., Huber Engineered Materials, Oriental Silicas Corporation, PQ Corporation, Tosoh Corporation, Fuji Silysia Chemical Ltd., Shandong Haihua Group Co., Ltd., China National Bluestar (Group) Co, Ltd., Wuxi Micro-Nano Material Technology Co., Ltd., Quechen Silicon Chemical Co., Ltd., K.C. Industries, Madhu Silica Private Limited, AkzoNobel N.V., Nouryon, Hematech Group, Crosspoint Chemicals, Brisil. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precipitated White Carbon Black Market Key Technology Landscape

The technological landscape of the Precipitated White Carbon Black market is fundamentally centered on optimizing the chemical precipitation reaction to precisely control the morphological and surface properties of the silica particles, ensuring enhanced functionality for specific end-use applications, particularly in tire reinforcement. Key advancements involve sophisticated reactor design, such as continuous flow reactors, which offer better control over reaction kinetics, temperature gradients, and mixing intensity compared to traditional batch processes. This level of control is essential for mass-producing highly dispersible silica (HDS) grades characterized by high surface area and minimal aggregation, leading to superior reinforcement and lower rolling resistance in rubber compounds. Furthermore, modern filtration and drying technologies, including spray drying and rotary vacuum drying, are constantly being refined to reduce energy consumption while preserving the desirable loose structure and dispersibility of the silica powder, minimizing post-processing challenges for end-users.

A crucial technological trend involves surface modification and functionalization techniques. While raw precipitated silica has hydrophilic surfaces (silanol groups), the most advanced applications require the filler to be chemically compatible with hydrophobic organic polymers, especially those used in rubber manufacturing. This necessitates the use of coupling agents, such as silanes, either added externally during compounding or applied directly to the silica surface during production (pre-functionalization). Research focuses on developing novel, efficient coupling mechanisms and agents that maximize the chemical interaction between the silica and the polymer matrix, thereby unlocking the full performance potential of the rubber compound, leading to improved dynamic stiffness and reduced hysteresis losses, critical for green tire performance metrics.

Beyond traditional synthesis, sustainability-driven innovation is becoming a cornerstone of the technology landscape. Manufacturers are exploring advanced methods to utilize alternative, sustainable raw materials, such as rice husk ash (RHA) or municipal waste incineration ash, as a source of high-purity silica. Although challenging due to purification requirements, these processes offer a circular economy advantage and help mitigate dependence on mineral-derived sodium silicate. Additionally, the integration of advanced process control systems (APCS), often leveraging AI and IoT sensors, allows for real-time monitoring and adaptive control of the synthesis parameters, ensuring batch-to-batch consistency, reducing chemical consumption, and optimizing the yield of premium, specialty precipitated silica products.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, led by China and India, holds the largest market share and exhibits the highest growth rate. This dominance is attributed to the massive scale of automotive manufacturing, particularly tire production, driven by increasing vehicle ownership and replacement tire demand. Robust infrastructure development in the region also fuels demand for performance coatings and industrial rubber components. Furthermore, the region benefits from low manufacturing costs and significant capacity expansion undertaken by both local and international players seeking proximity to major end-user markets.

- Europe’s Focus on Sustainability: Europe is a mature market characterized by stringent environmental regulations, particularly the EU Tire Labeling Regulation, which heavily favors the use of Highly Dispersible Silica (HDS) for fuel efficiency and reduced emissions. This regulatory push sustains high demand for premium, specialized silica grades. Key markets like Germany and France are central to advanced automotive R&D and specialized chemical manufacturing, driving innovation in surface functionalization and green synthesis methods.

- North American Specialty Markets: North America represents a stable market with strong demand in high-value non-tire applications, including premium coatings, personal care, and specialized rubber sectors like aerospace and industrial belts. Although tire production is significant, growth is increasingly driven by sophisticated product requirements and the shift toward electric vehicle tires, demanding tailored silica solutions that offer superior wear resistance and thermal management properties.

- Latin America (LATAM) Potential: LATAM is an emerging market characterized by fluctuating economic conditions but possessing long-term growth potential, particularly in Brazil and Mexico, due to expanding domestic automotive production and increasing industrialization. The demand profile is currently skewed towards conventional precipitated silica but is gradually transitioning toward HDS as international tire manufacturers expand their regional footprint and local standards rise.

- Middle East and Africa (MEA) Growth: MEA represents the smallest but rapidly developing regional market. Growth is tied to investments in infrastructure, which boosts the consumption of coatings, sealants, and construction-related rubber goods. The region's reliance on imported high-grade silica provides local opportunity for new entrants or strategic distributors looking to capture market share in specialized industrial and consumer segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precipitated White Carbon Black Market.- Evonik Industries AG

- Solvay S.A.

- PPG Industries, Inc.

- W. R. Grace & Co.

- Huber Engineered Materials

- Oriental Silicas Corporation

- PQ Corporation

- Tosoh Corporation

- Fuji Silysia Chemical Ltd.

- Shandong Haihua Group Co., Ltd.

- China National Bluestar (Group) Co, Ltd.

- Wuxi Micro-Nano Material Technology Co., Ltd.

- Quechen Silicon Chemical Co., Ltd.

- K.C. Industries

- Madhu Silica Private Limited

- AkzoNobel N.V. (Sikkens)

- Nouryon

- Hematech Group

- Crosspoint Chemicals

- Brisil

Frequently Asked Questions

Analyze common user questions about the Precipitated White Carbon Black market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Precipitated White Carbon Black (Silica) and traditional Carbon Black?

Precipitated White Carbon Black (silica) is synthetic, white, and amorphous silicon dioxide used primarily for reinforcement in applications requiring non-black color or lower rolling resistance (green tires). Traditional carbon black is derived from petroleum, is black, and provides high reinforcement but leads to higher rolling resistance in tires.

Which application segment drives the highest demand for Precipitated White Carbon Black?

The Tire application segment is the largest driver, specifically the manufacturing of ‘green tires’ using Highly Dispersible Silica (HDS). This demand is mandated by global regulations aiming to improve vehicle fuel efficiency and reduce carbon emissions by lowering tire rolling resistance.

How does the volatility of raw material prices affect the market?

Raw material price volatility, particularly for sodium silicate and sulfuric acid, directly impacts the production cost structure and profitability of Precipitated White Carbon Black manufacturers. Fluctuations necessitate robust hedging strategies and supply chain resilience measures among key players.

What role does Highly Dispersible Silica (HDS) play in the market?

HDS is a premium, high-growth segment essential for high-performance applications, especially green tires. It offers superior reinforcement and dispersion within rubber compounds, critically lowering the hysteresis and thus reducing fuel consumption, commanding a higher price point than conventional grades.

Which region shows the most significant growth potential for this market?

The Asia Pacific (APAC) region demonstrates the highest growth potential, driven by rapid industrialization, massive automotive production (especially in China and India), and expanding end-use applications across the rubber, coatings, and consumer goods sectors, attracting significant investment in manufacturing capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager