Precision Agriculture Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434287 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Precision Agriculture Robot Market Size

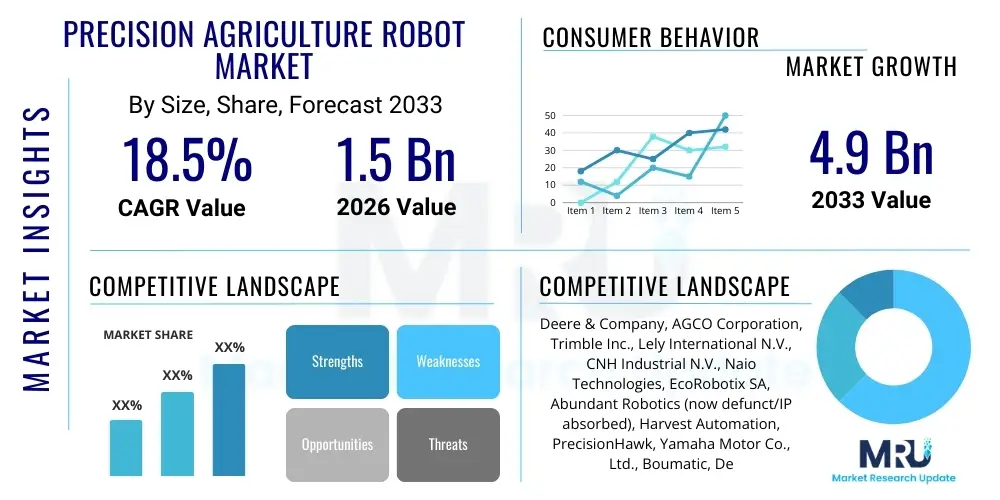

The Precision Agriculture Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.5 Billion in 2026 and is projected to reach $4.9 Billion by the end of the forecast period in 2033.

Precision Agriculture Robot Market introduction

Precision agriculture robots are specialized autonomous or semi-autonomous machines designed to perform various farming tasks with high accuracy and minimal human intervention. These systems utilize advanced technologies, including Global Navigation Satellite Systems (GNSS), sophisticated sensor arrays, computer vision, and machine learning algorithms, to optimize farm management practices. The core objective of deploying these robots is to enhance operational efficiency, reduce labor dependency and associated costs, minimize environmental impact through precise resource allocation (such as water, fertilizers, and pesticides), and ultimately maximize crop yield quality and quantity. Applications span the entire agricultural cycle, from soil preparation and planting to crop monitoring, harvesting, and sorting, positioning robotics as a fundamental disruptive force in modern agricultural paradigms.

The product portfolio within this market is diverse, encompassing weeding robots, seeding and planting robots, monitoring and sensing drones, autonomous tractors, and specialized harvesting systems. Each category addresses specific challenges faced by contemporary farming operations, often providing task-specific solutions that surpass the efficiency and precision achievable by traditional machinery or manual labor. For instance, selective weeding robots use camera systems to differentiate weeds from crops and apply micro-doses of herbicide or utilize mechanical removal methods, drastically lowering chemical use and cultivation costs. Furthermore, the interoperability of these systems with broader farm management software platforms facilitates data-driven decision-making, transforming farming from an experience-based practice into a data science-driven enterprise.

Key market benefits driving adoption include significant improvements in resource use efficiency, which is critical in regions facing water scarcity or strict environmental regulations regarding nutrient runoff. The ability of robots to operate 24/7, regardless of weather or daylight conditions, mitigates the severe and pervasive labor shortage issues plaguing industrialized agriculture globally. Major driving factors include escalating global food demand fueled by population growth, continuous advancements in sensor technology making robotic systems more reliable and affordable, and substantial government investments and subsidies promoting sustainable and mechanized farming techniques across developed economies in North America and Europe.

Precision Agriculture Robot Market Executive Summary

The Precision Agriculture Robot Market is undergoing rapid transformation, characterized by significant technological convergence, heightened investment activity, and shifting deployment models. Business trends emphasize the move towards ‘Robot-as-a-Service’ (RaaS) models, lowering the high initial capital expenditure barrier for smaller farming operations, thereby accelerating market penetration. The trend is also focused on the development of smaller, swarming autonomous units over large, monolithic autonomous tractors, driven by the need for increased operational flexibility and specialized crop management tasks. Strategic alliances between technology developers, traditional farm equipment manufacturers, and AI specialists are becoming crucial to integrate complex algorithms and robust hardware, ensuring seamless performance in varying field conditions. Furthermore, intellectual property protection around proprietary sensing and computer vision algorithms is a key competitive differentiator, driving rapid innovation cycles, particularly in areas like crop disease identification and yield prediction.

Regionally, North America maintains its dominance due to the presence of large-scale commercial farms that benefit significantly from automation’s scale and efficiency gains, coupled with strong venture capital funding directed toward agritech startups. Europe follows closely, primarily motivated by stringent environmental mandates under the Common Agricultural Policy (CAP) and public demand for sustainable food production, which necessitates the use of precision tools to reduce chemical inputs. The Asia Pacific region, though slower in initial mass adoption, is projected to be the fastest-growing market segment, fueled by governmental support in countries like China and India to modernize highly fragmented and labor-intensive agricultural systems. These emerging markets represent immense untapped potential for specialized robots addressing unique challenges such as rice paddy cultivation and small landholdings, requiring tailored, cost-effective robotic solutions rather than systems designed for vast monocultures.

Segment trends reveal that the use of Unmanned Aerial Vehicles (UAVs) or drones remains dominant for monitoring and spraying applications due to their cost-effectiveness and scalability across different farm sizes. However, ground-based autonomous vehicles (AGVs) are capturing increasing market share, particularly for precision weeding and harvesting, tasks that require greater torque and stability. The component segment is seeing explosive growth in advanced sensor and software components, particularly multispectral and hyperspectral cameras, Lidar systems, and integrated Artificial Intelligence/Machine Learning (AI/ML) platforms. The shift toward AI-driven data processing is transforming robots from merely automated machines into intelligent decision-making agents, enabling truly autonomous operation and predictive maintenance capabilities, which are highly valued by commercial growers focused on optimizing every input dollar.

AI Impact Analysis on Precision Agriculture Robot Market

User inquiries concerning AI's role in precision agriculture robotics overwhelmingly revolve around its capability to enhance real-time decision-making, the reliability of autonomous operations, and the complexity of data interpretation. Common concerns address the accuracy of machine learning models in unpredictable environments (e.g., varying light, soil, or crop maturity), the need for vast, high-quality training datasets, and how AI integration affects the total cost of ownership (TCO) for farmers. Users expect AI to fundamentally shift robot functionality from programmed automation to contextual intelligence, enabling robots to identify nuanced problems such as early-stage pest infestation or nutrient deficiencies and execute variable-rate tasks with unprecedented precision. The core theme is the expectation that AI will unlock the robot's potential to provide actionable, granular insights that directly translate into higher yields and operational sustainability.

The integration of deep learning and computer vision frameworks has allowed precision agriculture robots to process visual data streams from cameras and sensors in real-time, enabling highly accurate tasks like spot-spraying or selective harvesting. This intelligence layer allows the robot to dynamically adjust its trajectory, speed, and functional parameters based on the immediate environment, moving beyond rigid pre-programmed routes. Furthermore, predictive maintenance models, powered by AI, monitor robot component health and operational efficiency, minimizing unexpected downtime during critical growing seasons, which is a significant factor in maximizing farm productivity.

Moreover, AI facilitates the sophisticated amalgamation of diverse data sets—including historical yield data, weather patterns, soil moisture readings, and aerial imagery—to generate highly prescriptive action plans. These plans are then executed autonomously by the robotic fleet. This capability supports truly precise farming by ensuring that inputs are applied only where and when needed, contributing significantly to sustainability goals and regulatory compliance. The continuous learning loop characteristic of AI ensures that the robotic system improves its performance over time, adapting to regional idiosyncrasies and evolving crop genetics, solidifying AI as the indispensable core technology driving the next generation of precision agriculture robotics.

- AI enables real-time, accurate identification of crops, weeds, and pathogens using advanced computer vision.

- Predictive analytics optimize resource application (fertilizer, water) based on forecasted needs and environmental conditions.

- Deep learning models facilitate the autonomous navigation (SLAM) and obstacle avoidance in complex field environments.

- AI-driven optimization algorithms maximize harvesting efficiency and minimize crop damage during automated picking.

- Machine learning improves yield forecasting accuracy by integrating multi-source environmental and biological data.

- Continuous learning feedback loops enhance robot performance and operational consistency across different seasons and terrains.

- AI supports sophisticated data fusion from multispectral and hyperspectral sensors for superior crop health monitoring.

DRO & Impact Forces Of Precision Agriculture Robot Market

The market for precision agriculture robots is shaped by a confluence of powerful drivers, significant restraining factors, compelling opportunities, and overriding external impact forces. A primary driver is the accelerating scarcity and rising cost of skilled agricultural labor globally, forcing farm operators to seek highly efficient automation solutions. Simultaneously, the persistent demand for increased global food production, coupled with the need for sustainability (reducing carbon footprint and chemical use), necessitates the precision and consistency that robotic systems provide. However, significant restraints impede widespread adoption, notably the high initial capital investment required for robotic fleets and sophisticated sensor technology, making adoption challenging for small to medium-sized farms. Furthermore, issues related to field connectivity, standardization, and the lack of robust regulatory frameworks for fully autonomous operation across all jurisdictions present ongoing barriers to seamless market growth.

Opportunities for growth are vast, particularly in emerging applications such as vertical farming and indoor controlled environment agriculture (CEA), where robots can perform specialized tasks (e.g., nutrient delivery, LED lighting management) in confined and optimized spaces. Additionally, the proliferation of 5G networks and improved satellite communication infrastructure promises to mitigate current connectivity restraints, enabling more sophisticated cloud-based real-time processing and coordination of robotic swarms. Furthermore, the development of affordable, modular, and open-source robotic platforms presents a substantial opportunity to lower entry barriers and encourage innovation among localized solution providers tailored for specific regional crops and farming practices, expanding the total addressable market beyond large industrial farms.

The overall impact forces exerting pressure on this market include climate change, which increases the volatility and complexity of farming, thereby necessitating resilient and adaptive precision tools. Government policies, particularly environmental subsidies and technology grants in regions like the European Union and North America, strongly favor the adoption of technologies that promote sustainable intensification. Technology diffusion from adjacent sectors, such as the automotive industry's advancements in Lidar and sensor fusion, rapidly lowers component costs and enhances robotic reliability. These forces collectively push the market toward mandatory technological adoption, where precision robotics moves from being a competitive advantage to a necessary tool for maintaining economic viability and environmental compliance in modern agriculture.

Segmentation Analysis

The Precision Agriculture Robot Market is systematically segmented based on Type, Application, Component, and Geography, providing granular insights into demand patterns and growth vectors across various operational facets of agriculture. Segmentation by Type includes categories such as Unmanned Aerial Vehicles (UAVs) primarily used for scouting and mapping, Ground-Based Robots (AGVs) which cover autonomous tractors and robotic implements for heavy fieldwork, and specialized Milking Robots, catering specifically to the dairy industry. The Application segmentation delineates the end-use functionality, with categories like Field Monitoring, Harvesting Management, Weeding & Spraying, and Soil Management, reflecting the specialized tasks robots are deployed to address. Component segmentation highlights the technological ecosystem supporting these robots, dissecting the market into Hardware (sensors, actuators, motors, GPS systems) and Software (AI/ML platforms, guidance systems, farm management systems), where the latter is rapidly growing due to the increasing value placed on data intelligence and prescriptive analytics. This structured segmentation allows stakeholders to target investment and development efforts toward the most promising and technologically active sub-sectors within the broader market landscape.

- By Type:

- Unmanned Aerial Vehicles (UAVs)/Drones

- Ground-Based Robots (Autonomous Tractors and Robotic Implements)

- Milking Robots

- Automated Harvesting Systems

- By Component:

- Hardware (Sensors, Navigation Systems (GNSS/RTK), Control Systems, Actuators)

- Software (Data Analytics, Guidance Systems, Cloud Services, Farm Management Systems)

- Services (Consulting, Maintenance, RaaS)

- By Application:

- Field Mapping and Monitoring (Scouting, Yield Monitoring)

- Planting and Seeding

- Weeding and Spraying (Spot Spraying, Mechanical Weeding)

- Harvesting Management (Robotic Pickers and Sorters)

- Soil Management (Fertilization, Tilling)

- Dairy and Livestock Management

- By Farm Type:

- Large Commercial Farms

- Small and Medium Farms (SMEs)

- Vertical and Indoor Farms (CEA)

- By Crop Type:

- Row Crops (Corn, Wheat, Soybeans)

- Specialty Crops (Fruits, Vegetables, Vineyards)

Value Chain Analysis For Precision Agriculture Robot Market

The value chain for precision agriculture robots is complex, involving numerous specialized actors across three main stages: upstream (component and intellectual property providers), midstream (robot manufacturing and integration), and downstream (distribution, deployment, and end-user services). The upstream segment is critical, dominated by high-tech firms specializing in advanced sensor technology (LiDAR, multispectral cameras), high-precision navigation components (RTK-GPS, inertial measurement units), and foundational software components, including computer vision libraries and AI/ML frameworks. The quality and cost of these proprietary technologies fundamentally dictate the capabilities and pricing of the final robotic system. Suppliers in this segment focus heavily on research and development to maintain technological superiority, as their innovations drive the intelligence and autonomy level of the end product.

The midstream segment involves the transformation of these components into functional robotic systems. This includes traditional agricultural equipment manufacturers (OEMs) who are rapidly integrating robotics into their product lines (e.g., autonomous tractors), as well as dedicated robotics startups focused on niche applications like automated weeding or fruit picking. This stage involves complex mechanical engineering, software integration, system testing, and compliance with agricultural safety and performance standards. Original Equipment Manufacturers (OEMs) often leverage their extensive dealer networks for widespread physical distribution, while startups frequently employ direct sales or partnership models to access early adopters, especially for highly innovative, specialized machinery.

The downstream activities involve distribution channels, deployment, maintenance, and ongoing data services delivered directly to the end-users (farmers). Distribution typically occurs through specialized agricultural dealers (indirect channel) who provide localized sales support, financing, and technical maintenance. Direct channels, often used for subscription-based RaaS models, allow manufacturers to maintain a closer relationship with the farmer, gathering crucial performance data for product improvement. The service element, particularly in providing analytical insights derived from the robot-collected data (precision mapping, predictive maintenance alerts), is a rapidly growing revenue stream and a key differentiator in the market, ensuring continuous engagement and maximizing the return on investment for the agricultural operator.

Precision Agriculture Robot Market Potential Customers

The primary consumers of precision agriculture robots are diverse, ranging from large-scale commercial farming operations to specialized crop producers and research institutions, each driven by distinct imperatives for automation. Large commercial farms, particularly those cultivating row crops (corn, soy, wheat) across vast acreage in North America, South America, and Eastern Europe, represent the largest immediate market segment. These customers prioritize efficiency, large-scale task execution (e.g., autonomous tilling and seeding), and solutions that directly mitigate high labor costs. For them, autonomous tractors and large robotic implements offer the highest return on investment by maximizing operational hours and reducing input waste across thousands of hectares, often necessitating high-throughput, integrated fleet management systems.

A rapidly growing segment of potential customers includes producers of specialty crops, such as fruits, vegetables, and grapes, who require highly accurate, delicate, and often repetitive tasks. These growers are the key buyers for highly specialized robotic pickers, pruners, and selective weeding robots, as these technologies directly address the acute labor shortage and quality control issues inherent in manual specialty crop harvesting. Precision is paramount in this sector, meaning these customers demand advanced computer vision and end-effector technology to minimize crop damage, which significantly impacts the marketability and price of their produce. Their investment focuses less on scale and more on precise execution and maximizing yield quality.

Furthermore, controlled environment agriculture (CEA) operators, including vertical farms and greenhouses, are becoming critical consumers. These controlled environments require robots capable of navigating tight spaces, managing light and nutrient delivery, and performing continuous monitoring in a hyper-efficient manner. Academic and corporate research institutions also constitute a stable customer base, utilizing these robots for advanced field testing, genetic data collection, and developing the next generation of precision farming protocols. For all potential customers, the ultimate buying decision is increasingly influenced by the total lifecycle cost, ease of integration with existing farm management systems, and the verifiable data proving the robot's contribution to sustainability and profitability metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion |

| Market Forecast in 2033 | $4.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, AGCO Corporation, Trimble Inc., Lely International N.V., CNH Industrial N.V., Naio Technologies, EcoRobotix SA, Abundant Robotics (now defunct/IP absorbed), Harvest Automation, PrecisionHawk, Yamaha Motor Co., Ltd., Boumatic, DeLaval, Gaussian Robotics, Monarch Tractor, Kubota Corporation, Iron Ox, FJDynamics, Blue River Technology (acquired by Deere), Vitirover. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Agriculture Robot Market Key Technology Landscape

The technological landscape of precision agriculture robotics is defined by the synergistic integration of advanced sensing, high-precision navigation, and sophisticated computational intelligence. Central to autonomous operation is the use of Real-Time Kinematic Global Navigation Satellite Systems (RTK-GNSS), which offer centimeter-level positional accuracy, crucial for tasks like row planting and nutrient application to avoid damaging crops. Coupled with this are sophisticated Inertial Measurement Units (IMUs) and Sensor Fusion algorithms that maintain accuracy even when GNSS signals are momentarily blocked. The reliance on accurate localization enables variable rate applications, where robots apply inputs differentially across the field based on specific need zones identified by scouting data, moving beyond blanket treatments and driving resource optimization.

Computer vision is arguably the most transformative technology, providing the "eyes" and subsequent "intelligence" for robotic systems. This involves using various camera types—RGB, multispectral, and hyperspectral—alongside deep learning models to identify objects, assess crop health, detect weeds, and localize fruit for harvesting. Simultaneous Localization and Mapping (SLAM) algorithms are increasingly used in complex, unstructured environments like orchards or vineyards, allowing smaller robots to build real-time maps while navigating, which is vital where high-precision GNSS might be unreliable. The rapid evolution of Graphics Processing Units (GPUs) and specialized edge computing hardware has made it feasible to run these complex AI algorithms directly on the robot, enabling immediate decision-making without constant reliance on cloud connectivity, thereby improving operational robustness.

Furthermore, the market relies heavily on the Internet of Things (IoT) infrastructure and secure connectivity platforms. IoT sensors deployed across the farm collect environmental data (soil moisture, temperature) which feed into the robot’s decision-making system. The coordination of multi-robot systems, or "swarm robotics," is a nascent but high-potential technology requiring robust peer-to-peer communication and centralized fleet management software to coordinate simultaneous tasks efficiently across a large area. The focus is increasingly shifting towards modular robotics, allowing farmers to quickly interchange specialized tools (end-effectors) for tasks like spraying, pruning, or picking onto a common autonomous base platform, enhancing the versatility and overall utility of the investment and future-proofing the robotic assets against evolving agricultural needs.

Regional Highlights

- North America (NA): Dominates the market share due to the large size of commercial farms, high labor costs, and robust governmental support for agricultural technology adoption. The U.S. and Canada benefit from significant venture capital investment in agritech startups and possess advanced infrastructure for GPS and high-speed data transmission, facilitating the deployment of large-scale autonomous tractors and heavy-duty robotic implements for row crops like corn and soybeans. Early adoption rates and favorable regulatory environments for testing autonomous vehicles solidify this region's leadership in both development and application of precision robotics.

- Europe: Exhibits rapid growth driven by stringent environmental regulations, particularly the European Union’s push to reduce pesticide and fertilizer use, creating a strong demand for small, precise, selective weeding and spraying robots. Countries like the Netherlands, Germany, and France are leaders in adopting specialized robotics for high-value crops and dairy farming (milking robots). High subsidies under the Common Agricultural Policy (CAP) incentivize farmers to invest in sustainable precision technologies, fostering a market focused on specialization, sustainability, and data privacy compliance.

- Asia Pacific (APAC): Expected to register the highest growth rate during the forecast period. While farm sizes are generally smaller and more fragmented than in the West, massive modernization initiatives in countries like China, India, Japan, and Australia are accelerating adoption. Governments are heavily investing in mechanization to improve food security and counter aging farming populations. Unique market opportunities exist for tailored solutions addressing labor-intensive crops like rice, tea, and specialized fruits, often involving smaller, simpler, and more affordable autonomous machines than their Western counterparts, focusing on yield improvement per unit area.

- Latin America (LATAM): A major consumer of large autonomous machinery, particularly in agricultural powerhouses like Brazil and Argentina, which boast vast expanses of land dedicated to row crops and soybean production. The adoption is driven by the need for efficiency and scale. However, infrastructure deficits, particularly regarding reliable rural internet connectivity and RTK base station coverage, pose significant challenges that must be addressed to unlock full robotic potential. Focus is largely on large-scale autonomous tractors and field preparation equipment.

- Middle East and Africa (MEA): Represents a nascent market with significant potential, particularly in regions facing acute water scarcity (e.g., Israel, UAE). Precision robotics, especially those focused on water efficiency (drip irrigation coupled with robotic monitoring), controlled environment agriculture, and specialized sensor deployment, are vital for desert farming and improving output in arid climates. Growth is heavily reliant on government mega-projects and technological transfer initiatives aimed at sustainable agriculture development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Agriculture Robot Market.- Deere & Company

- AGCO Corporation

- Trimble Inc.

- Lely International N.V.

- CNH Industrial N.V.

- Naio Technologies

- EcoRobotix SA

- Harvest Automation

- PrecisionHawk

- Yamaha Motor Co., Ltd.

- Boumatic

- DeLaval

- Monarch Tractor

- Kubota Corporation

- Vitirover

- Deveron Corp

- Raven Industries (now part of CNH)

- Robotics Plus Ltd.

- Iron Ox

- FJDynamics

Frequently Asked Questions

Analyze common user questions about the Precision Agriculture Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary barriers to the mass adoption of precision agriculture robots?

The main barriers include the high initial capital investment required for robotic systems, which limits access for small and medium-sized farms, the lack of ubiquitous high-speed internet connectivity in rural areas necessary for real-time data transfer, and persistent challenges related to system interoperability and standardization between different hardware and software platforms.

How do autonomous farming robots contribute to environmental sustainability?

Robots enhance sustainability by enabling hyper-precise resource management, specifically through spot spraying (reducing herbicide use by up to 90%), variable rate fertilization, and optimized water use. Their ability to minimize soil compaction and nutrient runoff aligns with global ecological goals and stringent regulatory mandates.

What is the 'Robot-as-a-Service' (RaaS) model and how is it impacting the market?

RaaS is a subscription-based business model where farmers pay a fee for the robotic service (e.g., weeding, monitoring) without purchasing the equipment outright. This model significantly lowers the upfront financial barrier, democratizes access to advanced technology, and transfers maintenance and upgrade responsibilities from the farmer to the service provider, thereby accelerating market penetration, especially among SMEs.

Which technology is most crucial for the real-time decision-making capabilities of precision agriculture robots?

The most crucial technology is computer vision integrated with Artificial Intelligence (AI) and Machine Learning (ML). This synergy allows robots to analyze real-time visual data (from RGB, multispectral, and LiDAR sensors) to accurately identify specific objects, assess crop health, and execute precise tasks immediately without human command, forming the basis of true field autonomy.

Between UAVs and Ground-Based Vehicles, which segment is expected to show faster long-term growth?

While UAVs currently dominate in monitoring and scouting applications due to lower cost, Ground-Based Autonomous Vehicles (AGVs) are expected to show faster long-term value growth. This is because AGVs are essential for heavy, high-value tasks requiring torque and persistence, such as precision weeding, complex harvesting, and continuous tilling, which directly address the critical labor shortage in large-scale commercial farming operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager