Precision Casting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435303 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Precision Casting Market Size

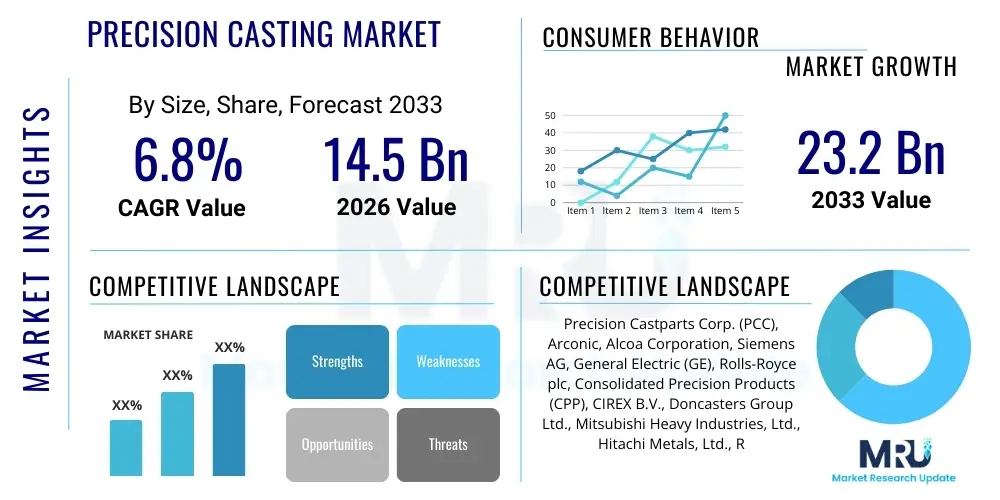

The Precision Casting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $23.2 Billion by the end of the forecast period in 2033.

Precision Casting Market introduction

Precision casting, often synonymously referred to as investment casting or lost-wax casting, is a critical manufacturing process renowned for producing complex, near-net-shape components with exceptional dimensional accuracy and superior surface finishes. This technology facilitates the creation of parts from almost any alloy, including nickel-based superalloys, high-performance stainless steels, and various light alloys, making it indispensable for industries where performance under extreme stress, temperature, or corrosive environments is mandatory. The core principle involves creating a wax pattern, coating it with a ceramic shell, melting out the wax, and pouring molten metal into the resultant cavity, thereby achieving intricate internal geometries that traditional machining or forging processes cannot replicate efficiently.

The primary applications of precision casting span highly demanding sectors, predominantly aerospace, defense, automotive, energy, and medical devices. In aerospace, these components are essential for turbine engine blades, vanes, and structural airframe parts, critical for enhancing fuel efficiency and maximizing operational lifespan. For the automotive industry, precision casting delivers complex turbocharger components, valve bodies, and structural parts necessary for lightweighting initiatives and improving engine performance. The inherent benefit of this process is the minimization of material waste and post-processing requirements, leading to significant cost savings in mass production scenarios involving high-specification metals.

Market growth is substantially driven by the relentless expansion of the global aerospace sector, particularly the rising demand for next-generation, high-thrust turbofan engines that utilize advanced superalloys requiring precision forming. Furthermore, the increasing adoption of electric and hybrid vehicles necessitates precision-cast components for lightweight battery housings, cooling systems, and specialized transmission parts. Technological advancements, such as the integration of 3D printing for rapid tooling and pattern creation, are further enhancing the efficiency and responsiveness of the precision casting supply chain, positioning it as a foundational technology for advanced manufacturing worldwide. The process guarantees superior metallurgical properties and repeatability, which are paramount in regulated industries like medical implants and power generation.

Precision Casting Market Executive Summary

The global Precision Casting Market is undergoing a rapid evolution characterized by significant business trends focused on optimizing material usage and enhancing operational efficiency through automation. A major trend involves the consolidation of the supply chain, as large aerospace and defense contractors seek to acquire or partner with specialized foundries to secure critical production capabilities for turbine components. Furthermore, environmental regulatory pressures are driving demand for precision casting techniques that can handle lighter materials, particularly aluminum and magnesium alloys, for weight reduction in transportation sectors, directly impacting foundry technology investment toward vacuum melting and rapid cooling processes to maintain material integrity.

Regionally, the Asia Pacific (APAC) market is exhibiting the highest growth trajectory, fueled primarily by massive investments in infrastructure development, increasing domestic aerospace manufacturing capabilities in China and India, and the burgeoning demand from the regional automotive market. While North America and Europe remain mature markets, they continue to dominate in terms of technological innovation and high-value component production, especially those requiring complex superalloys for advanced defense and civilian aviation projects. The market dynamics reflect a shift in manufacturing focus, with APAC capitalizing on cost-effective production scaling and Western markets maintaining dominance in advanced R&D and materials science related to casting.

Segment trends highlight the sustained dominance of the investment casting process due to its unparalleled ability to handle intricate geometries and high-performance alloys. However, the market is also witnessing increasing adoption of ceramic shell casting for larger, non-aerospace components. Application-wise, the Aerospace and Defense segment remains the largest revenue generator, demanding increasingly stringent specifications for heat resistance and fatigue life. Concurrently, the Medical segment is demonstrating robust growth, driven by the need for high-quality, biocompatible precision-cast implants and surgical instrumentation, where dimensional accuracy and surface finish are crucial for patient safety and device efficacy.

AI Impact Analysis on Precision Casting Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Precision Casting Market frequently center on themes of quality assurance, operational efficiency, and the potential for predictive failure analysis. Users are particularly keen to understand how AI-driven machine vision systems can eliminate human error in defect detection, moving beyond traditional X-ray inspection to real-time analysis of surface defects and internal porosities during the casting process. A primary concern revolves around the high initial investment required for implementing sophisticated AI algorithms and sensor infrastructure, and whether the technology can successfully manage the inherent variability of metal solidification and cooling processes across diverse alloys and component designs. Furthermore, questions arise about AI’s role in optimizing the complex simulation phase, often replacing traditional trial-and-error methods with iterative, data-driven optimization of gating systems and runner designs before physical production begins.

The integration of AI and Machine Learning (ML) is fundamentally transforming the design and production cycles within precision casting foundries. AI algorithms are now deployed to analyze vast datasets pertaining to temperature profiles, cooling rates, mold integrity, and alloy composition. This data-driven approach allows foundries to accurately predict potential casting defects, such as shrinkage porosity or hot tears, significantly earlier in the process, thus drastically reducing scrap rates and improving overall yield. The optimization extends to energy consumption; ML models can fine-tune furnace operation schedules and melting parameters based on real-time load demands and material characteristics, contributing to sustainability targets and lower operational expenditures.

Moreover, AI is playing a critical role in enhancing supply chain resilience and throughput predictability. Predictive maintenance models analyze sensor data from expensive foundry equipment—such as vacuum furnaces, robotics, and ceramic production units—to forecast equipment failure long before it occurs, ensuring minimal unplanned downtime. In the post-casting phase, deep learning algorithms are being trained to automate inspection tasks. These systems are capable of identifying micro-defects invisible to the human eye, establishing unprecedented levels of quality consistency. While implementation requires specialized expertise and substantial data infrastructure, the long-term benefits in terms of efficiency, reduced cycle time, and heightened quality control are driving rapid adoption among Tier 1 precision casting providers targeting the aerospace and energy sectors where failure tolerance is zero.

- AI optimizes gating and feeding system design through advanced computational fluid dynamics analysis, reducing trial-and-error costs.

- Machine Vision Systems (MVS) use deep learning for automated, real-time defect detection during inspection, enhancing quality control consistency.

- Predictive Maintenance (PdM) algorithms monitor foundry machinery health, minimizing unplanned downtime of capital-intensive equipment.

- AI-driven process control ensures consistent temperature and pressure parameters throughout the pouring and solidification phases.

- Data synthesis capabilities aid in optimizing material consumption and predicting optimal alloy mixing ratios for specific application requirements.

DRO & Impact Forces Of Precision Casting Market

The Precision Casting Market is governed by a robust interplay of driving factors (D), significant restraints (R), and compelling opportunities (O), collectively shaping its growth trajectory and competitive landscape. Key drivers include the escalating global production rates for commercial aircraft, which mandate a steady supply of high-performance turbine components made from precision-cast superalloys. Furthermore, the global push toward energy efficiency and stricter emission standards compels manufacturers in the automotive and power generation sectors to adopt lightweight, intricately designed precision-cast components. These drivers are underpinned by the intrinsic advantage of precision casting: its ability to achieve complex geometries and superior material properties often unattainable by alternative manufacturing methods.

However, the market faces considerable restraints, primarily the inherently high initial capital investment required for setting up and maintaining a precision casting foundry. This includes the cost of specialized equipment, such as vacuum furnaces for reactive alloys, sophisticated robotics for pattern handling, and rigorous quality control infrastructure like CT scanning and advanced NDT equipment. Additionally, the process is heavily reliant on highly skilled labor for pattern assembly, shell building, and post-casting treatment, leading to high operational costs and vulnerability to labor market fluctuations. Regulatory complexity and the need for extensive certification (especially in aerospace) also act as significant barriers to entry and expansion.

The principal opportunities reside in leveraging additive manufacturing (3D printing) technologies for rapid prototyping of wax patterns and complex ceramic cores, thereby drastically reducing lead times and enabling quick iteration of designs. Furthermore, the expanding medical device sector, particularly orthopedics and dental implants, offers a high-margin opportunity for specialized precision casters due to the need for biocompatible materials and highly precise surface finishes. The adoption of Industry 4.0 principles, including sensor integration, big data analytics, and digital twinning, presents a significant avenue for foundries to optimize their complex multi-stage processes, moving towards fully autonomous smart manufacturing environments. These forces collectively dictate market expansion, favoring established players capable of continuous technological investment and specialization.

Segmentation Analysis

The Precision Casting Market is comprehensively segmented based on the casting process, material type, and critical end-use application. Analysis across these dimensions provides a granular view of market dynamics, revealing varying growth rates and technological demands within specific niches. The process segmentation differentiates between investment casting (lost wax) and ceramic shell casting, recognizing the former's dominance for small, high-precision, and complex parts, and the latter's suitability for larger components. Material-based segmentation is crucial as it reflects technology intensity, with superalloys driving premium revenue and aluminum/steel alloys commanding volume. Finally, end-use application segmentation confirms the market’s primary dependency on high-reliability sectors such as aerospace and power generation.

- By Casting Process:

- Investment Casting (Lost-Wax Process)

- Ceramic Shell Casting

- By Material Type:

- Superalloys (Nickel, Cobalt, Iron-based)

- Steel Alloys (Stainless Steel, Carbon Steel)

- Aluminum Alloys

- Titanium Alloys

- Others (e.g., Magnesium, Zinc)

- By End-Use Application:

- Aerospace and Defense

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Industrial Gas Turbines (IGT) and Power Generation

- Medical and Dental

- General Industrial (Machinery, Pumps, Valves)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Precision Casting Market

The precision casting value chain is characterized by several distinct and highly specialized stages, beginning with upstream raw material sourcing. Upstream activities primarily involve securing high-purity metals, particularly specialty superalloys (such as high-performance nickel-based alloys for turbine blades) and refractory materials necessary for ceramic shell formation (e.g., fused silica, zircon). The quality and consistency of these raw materials directly impact the final mechanical and metallurgical properties of the cast component, necessitating rigorous supplier vetting and quality control protocols. Procurement logistics are complex, particularly for strategic materials like cobalt and nickel, which face price volatility and geopolitical supply risks.

The core manufacturing process, or midstream segment, involves complex, multi-stage operations: pattern making (often incorporating 3D printing), investment (building the ceramic shell through dipping and stuccoing), dewaxing, melting, pouring, and finally, post-casting finishing (including cutting, grinding, and heat treatment). This stage is highly capital and technology-intensive. Major precision casting firms often integrate advanced simulation software (e.g., solidification modeling) to optimize mold design and minimize defects before commencing production. Efficiency in the midstream depends heavily on automation and adherence to stringent industry standards like AS9100 for aerospace components, adding layers of cost and complexity.

Downstream activities focus on distribution and direct sales to end-user segments. Precision casting products are predominantly distributed directly to Original Equipment Manufacturers (OEMs) in specialized sectors like aerospace and power generation, or to Tier 1 suppliers in the automotive sector. Distribution channels are largely direct due to the customized nature and high value of the components, requiring strong, long-term relationships and technical collaboration between the foundry and the client. The process often involves comprehensive non-destructive testing (NDT) and certification, making the downstream phase critical for ensuring product traceability and regulatory compliance before the part is integrated into final assemblies.

Precision Casting Market Potential Customers

The primary consumers, or potential customers, of precision casting services are large-scale global manufacturers operating in sectors demanding exceptionally high reliability, material integrity, and complex geometric design capability. The largest and most demanding customer base resides within the Aerospace and Defense sector. Aircraft engine manufacturers (e.g., GE Aviation, Rolls-Royce, Pratt & Whitney) and airframe producers rely heavily on precision casting for turbine blades, vanes, combustion liners, and critical structural components that must withstand extreme thermal and mechanical stresses. These customers seek highly specialized foundries capable of working with exotic superalloys and maintaining zero-defect production standards, making long-term qualification a significant barrier to entry for new suppliers.

Another rapidly expanding customer segment is the Automotive industry, especially as OEMs transition towards electric vehicles (EVs) and focus intensively on lightweighting internal combustion engine components. Automotive manufacturers require precision-cast parts for turbochargers, common rail systems, transmission components, and increasingly, specialized thermal management systems for EV batteries. While the volume is high, the automotive segment typically demands lower cost per unit compared to aerospace, driving foundries to focus on high-volume automation and rapid tooling techniques to maintain competitiveness and meet stringent supply schedules for global platforms.

Furthermore, the Industrial Gas Turbine (IGT) and Medical Device manufacturing sectors represent critical high-value customer groups. IGT operators require precision-cast hot-section components for power generation turbines, which mirror the material complexity of aircraft engines. Medical device manufacturers, particularly those specializing in orthopedic implants (hip, knee replacements) and surgical instruments, rely on precision casting for biocompatible materials (like titanium and medical-grade stainless steel) where exact dimensional specifications and pristine surface finishes are mandatory for regulatory approval and patient safety. These customers prioritize quality assurance, traceability, and compliance with standards such as ISO 13485.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $23.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Precision Castparts Corp. (PCC), Arconic, Alcoa Corporation, Siemens AG, General Electric (GE), Rolls-Royce plc, Consolidated Precision Products (CPP), CIREX B.V., Doncasters Group Ltd., Mitsubishi Heavy Industries, Ltd., Hitachi Metals, Ltd., Retech Systems LLC, Vesuvius plc, Impro Group, ZOLLERN GmbH & Co. KG, Metaltek International, Dynacast, Rheinmetall AG, Milwaukee Precision Casting Inc., HTCI Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Casting Market Key Technology Landscape

The technological landscape of the Precision Casting Market is undergoing continuous innovation driven by the imperative to produce components with increasingly demanding material specifications and tighter dimensional tolerances. A core technological focus remains on refining the investment casting process itself, particularly through advancements in ceramic shell slurry formulations and stuccoing techniques to achieve superior surface quality and minimize shell cracking during high-temperature metal pouring. Foundries are heavily investing in specialized melting technologies, such as Vacuum Induction Melting (VIM) and Vacuum Arc Remelting (VAR), which are essential for processing reactive and high-performance superalloys like those used in modern jet engines, ensuring minimal impurity inclusion and optimal microstructural integrity. Furthermore, specialized cooling technologies, including directional solidification (DS) and single-crystal (SC) casting, are utilized to control grain structure and significantly enhance the high-temperature creep resistance and fatigue life of critical components.

A transformational element in the current technology landscape is the integration of Additive Manufacturing (AM), specifically 3D printing. While 3D printing does not replace the casting process, it revolutionizes the upstream pattern and tooling creation stages. Foundries are now utilizing technologies like Stereolithography (SLA) and Digital Light Processing (DLP) to rapidly print intricate wax patterns or expendable ceramic cores directly from CAD data. This rapid prototyping capability drastically reduces the lead time associated with traditional metal tooling fabrication, allowing for faster design iterations and making short-run or highly complex component production economically viable. This convergence of traditional casting mastery with digital additive techniques represents a significant competitive differentiator for technologically advanced market players.

Moreover, the adoption of sophisticated digital tools—integral to Industry 4.0—is paramount for process control and quality assurance. This includes the widespread use of advanced Computer-Aided Engineering (CAE) and simulation software packages, which allow engineers to digitally simulate mold filling, solidification behavior, and residual stress development. These predictive tools enable the optimization of complex runner and riser systems prior to physical production, drastically reducing costly pilot runs and scrap rates. Post-casting, the technology focus shifts to advanced Non-Destructive Testing (NDT) methods, such as industrial Computed Tomography (CT) scanning and automated ultrasonic testing, enabling highly precise internal defect detection necessary for regulatory compliance in sensitive applications like aerospace and medical implants.

Regional Highlights

- North America: The region maintains dominance in the global Precision Casting Market, primarily driven by the massive presence of the Aerospace and Defense sector, particularly in the United States. Demand is characterized by a requirement for high-specification components made from superalloys for next-generation military and commercial aircraft programs. Significant R&D investment is channeled toward advanced metallurgical processes and the integration of automation technologies to enhance domestic manufacturing competitiveness.

- Europe: Europe is a mature market distinguished by strong demand from the automotive premium segment (particularly in Germany and Italy) and the industrial gas turbine (IGT) sector. Regulatory requirements regarding emissions and fuel efficiency in the EU drive innovation in lightweighting technologies and complex component design, supporting steady growth in precision casting applications, especially in countries like the UK and France which have strong aerospace supply chains.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid industrialization, increasing domestic defense spending (China, India), and significant expansion in commercial aviation maintenance, repair, and overhaul (MRO) activities. Lower operating costs and rising infrastructure investments are attracting global manufacturers, leading to increased volume demand, particularly for steel and aluminum precision castings used in general industrial and mass-market automotive applications.

- Latin America: This region exhibits modest growth, primarily centered on Brazil and Mexico, which serve as regional manufacturing hubs for the automotive and general industrial machinery sectors. Market expansion is dependent on global trade dynamics and foreign direct investment in manufacturing infrastructure, though specialized high-value segment growth remains limited.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states, driven by oil and gas infrastructure development requiring precision-cast components for valves, pumps, and specialized piping. The region also shows nascent growth potential linked to defense expenditure and localized aerospace MRO development initiatives, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Casting Market.- Precision Castparts Corp. (PCC)

- Arconic

- Alcoa Corporation

- Siemens AG

- General Electric (GE)

- Rolls-Royce plc

- Consolidated Precision Products (CPP)

- CIREX B.V.

- Doncasters Group Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Hitachi Metals, Ltd.

- Retech Systems LLC

- Vesuvius plc

- Impro Group

- ZOLLERN GmbH & Co. KG

- Metaltek International

- Dynacast

- Rheinmetall AG

- Milwaukee Precision Casting Inc.

- HTCI Global

Frequently Asked Questions

Analyze common user questions about the Precision Casting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between precision casting and traditional sand casting?

Precision casting, particularly investment casting, offers vastly superior dimensional accuracy, finer surface finish, and the ability to cast intricate geometries and complex internal features without significant post-machining. Sand casting is generally suitable for larger components requiring less precision.

Which industry is the primary revenue driver for the Precision Casting Market?

The Aerospace and Defense industry is the primary revenue driver, demanding high volumes of precision-cast components, especially turbine blades and vanes made from advanced superalloys, which require the high integrity and geometric complexity achievable only through investment casting.

How does 3D printing impact the precision casting value chain?

3D printing primarily impacts the upstream segment by facilitating rapid production of complex wax patterns and ceramic cores. This significantly reduces tooling lead times, lowers costs for prototyping, and makes customized, short-run production more feasible without traditional metal dies.

What are the primary restraints affecting market growth?

The key restraints include the high initial capital investment required for foundry setup and specialized equipment (e.g., vacuum furnaces), the substantial operational costs associated with specialized labor, and the stringent, time-consuming regulatory certification processes required for critical end-use applications like aerospace.

What role do Superalloys play in the Precision Casting Market?

Superalloys (nickel, cobalt, and iron-based) are critical materials used to manufacture components that must operate under extreme conditions, such as high temperatures and corrosive environments, predominantly found in jet engines and industrial gas turbines. Precision casting is the preferred method for forming these alloys due to its ability to maintain mechanical properties and achieve complex geometries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager