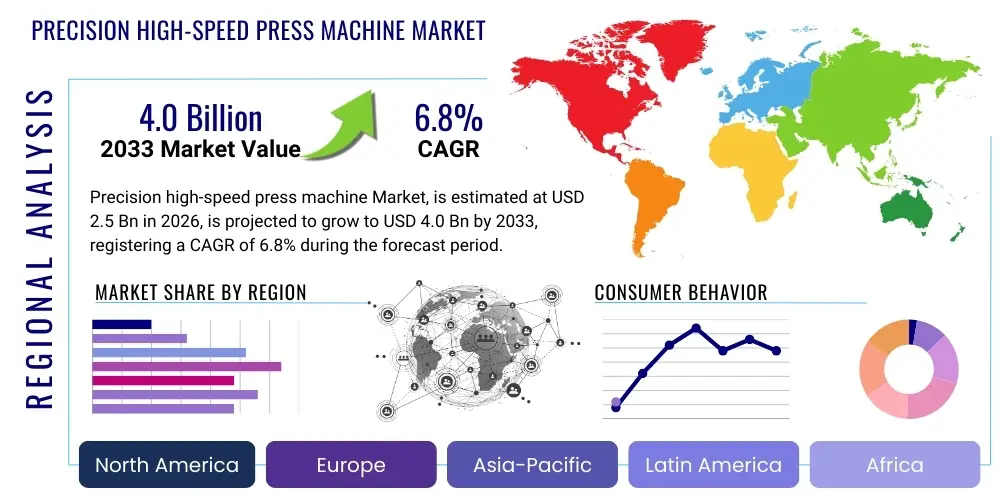

Precision high-speed press machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439070 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Precision high-speed press machine Market Size

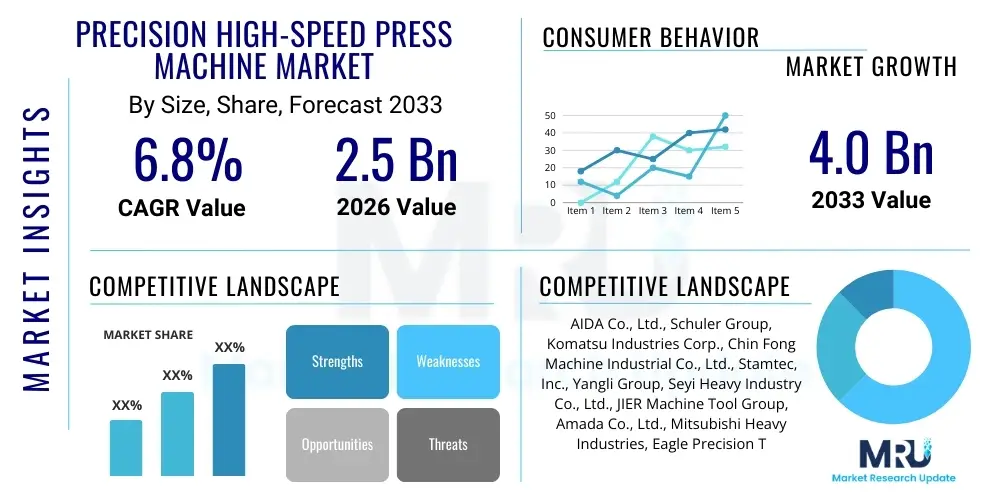

The Precision high-speed press machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Precision high-speed press machine Market introduction

Precision high-speed press machines are specialized industrial equipment designed for rapid, accurate stamping and forming of small to medium-sized components, typically requiring high dimensional tolerance and superior surface finish. These machines operate at very high strokes per minute (SPM), often exceeding 500 SPM, making them indispensable in mass production environments where efficiency and repeatability are paramount. The core product description involves highly rigid frame structures, advanced servo control systems, and specialized feeding mechanisms capable of handling thin, delicate materials while maintaining precise alignment. Key components often include high-performance clutches and brakes, dynamic balancing systems, and sophisticated die protection systems to ensure prolonged tooling life and uninterrupted operation. The operational precision allows manufacturers to achieve narrow tolerance specifications crucial for sophisticated end-products.

Major applications of these machines span critical sectors globally, predominantly including the manufacturing of electrical connectors, terminals, motor laminations, intricate components for automotive sensors, and parts for consumer electronics like smartphones and computers. Their high speed drastically reduces the unit manufacturing cost, a significant benefit driving their adoption across Asian manufacturing hubs and advanced industrial economies. The primary benefit derived by end-users is the unparalleled combination of speed, accuracy, and efficiency, enabling high-volume production of complex parts with minimal material waste. Furthermore, modern precision presses integrate sophisticated monitoring and diagnostics capabilities, enhancing predictive maintenance and reducing costly downtime, thereby optimizing overall equipment effectiveness (OEE).

Driving factors for market expansion are closely tied to the global surge in electric vehicle (EV) production, which requires vast quantities of precise battery components and motor laminations, and the ongoing miniaturization trend in the electronics industry, demanding increasingly smaller and more intricate stamped parts. Additionally, the increasing focus on automation and industrial digitalization (Industry 4.0) encourages manufacturers to replace older, less efficient mechanical presses with modern, servo-driven high-speed alternatives that offer superior control over the stamping cycle. Government incentives promoting domestic manufacturing capability and significant investments in advanced production technologies across emerging economies further accelerate market growth and technological adoption.

Precision high-speed press machine Market Executive Summary

The global Precision high-speed press machine market is characterized by robust growth driven by significant advancements in servo technology and the increasing demand from high-growth industries, primarily automotive electrification and 5G infrastructure development. Business trends indicate a strong focus on integration capabilities, where press machines are bundled with automated feeding, transfer, and quality inspection systems to form fully integrated stamping lines, enhancing productivity and traceability. Manufacturers are shifting towards offering customizable, modular presses capable of adapting to various material types (e.g., high-strength steel, aluminum, copper alloys) and stamping complexity, emphasizing energy efficiency and reduced noise levels to meet stringent environmental regulations. The competitive landscape is intensely focused on patenting advanced control algorithms and developing predictive maintenance services based on cloud connectivity and real-time data analysis.

Regional trends reveal Asia Pacific (APAC) as the undisputed leader in market consumption and production, spearheaded by intensive industrialization in China, South Korea, and Japan, which serve as global manufacturing bases for electronics and automotive components. North America and Europe demonstrate mature market characteristics, focusing primarily on replacing aging fleets with advanced servo-driven models that comply with stricter safety and energy efficiency standards. The adoption rate of Industry 4.0 technologies is notably higher in Europe, driving demand for intelligent, network-enabled presses. Furthermore, emerging markets in Latin America and the Middle East are beginning to show increased procurement of mid-range precision presses to support domestic manufacturing initiatives aimed at reducing reliance on imports.

Segment trends underscore the rising dominance of servo-driven high-speed presses over traditional mechanical systems due to their superior stroke control, variable speed capabilities, and optimized energy consumption profiles, offering significant production flexibility. The application segment remains heavily skewed towards the electronics and automotive industries, though the medical device sector is emerging as a niche high-value segment due requiring ultra-precise micro-stamped components. In terms of tonnage, the 100-300 Ton category holds the largest market share, representing the sweet spot for general precision stamping operations, while machines under 100 Tons are seeing explosive growth due to the demand for micro-components in connectivity devices.

AI Impact Analysis on Precision high-speed press machine Market

Common user questions regarding AI's impact on the precision high-speed press machine market revolve around how machine learning can enhance operational predictability, improve die life, and optimize stamping parameters for defect reduction. Users are keenly interested in predictive maintenance models powered by AI that can analyze complex vibration, temperature, and current consumption data streams to anticipate equipment failure before production stops. Furthermore, significant curiosity exists about AI-driven quality control systems, specifically algorithms that can process high-speed camera images of stamped parts in real-time, instantly flagging microscopic defects that human inspectors or traditional vision systems might miss. The key themes summarized from this user engagement indicate high expectations for AI to dramatically increase OEE, reduce material scrap, and facilitate true lights-out manufacturing operations in precision stamping.

The integration of artificial intelligence and machine learning algorithms into press machine control systems is fundamentally transforming the maintenance and operational efficiency paradigms within the precision stamping industry. AI enables the transition from reactive or scheduled maintenance to highly accurate predictive maintenance, drastically minimizing unscheduled downtime. By analyzing massive datasets collected from sensors on parameters such as slide velocity profiles, forming forces, and bearing temperatures, AI models can identify subtle anomalies indicative of future failures, allowing for timely intervention and significantly extending the lifespan of critical components like dies and bearings. This capability is crucial in high-speed environments where a few minutes of downtime can result in thousands of lost components.

Beyond maintenance, AI is being deployed to optimize the stamping process itself. Machine learning algorithms can automatically adjust complex stamping parameters, such as cushion pressure, material feeding length, and stroke profile, in real-time based on variations in material properties or ambient conditions, ensuring consistent part quality throughout long production runs. This level of dynamic optimization is practically impossible for human operators or traditional static control systems to achieve. The implementation of AI-enhanced quality inspection using deep learning for pattern recognition is leading to near-zero defect rates, as these systems can learn to distinguish between acceptable process variations and critical structural flaws instantaneously, solidifying AI's role as a cornerstone of future high-precision manufacturing.

- AI-powered Predictive Maintenance: Real-time analysis of machine sensor data to anticipate and prevent critical component failures, maximizing uptime.

- Real-time Quality Control: Deployment of deep learning vision systems for instantaneous defect detection and classification on high-speed stamped parts.

- Parameter Optimization: Machine learning algorithms dynamically adjust stamping parameters (e.g., speed, force) based on material feedback to maintain consistent quality.

- Energy Efficiency Management: AI systems optimize press cycling profiles to minimize energy consumption without compromising production speed or accuracy.

- Tool Wear Prediction: Advanced analytics predict the remaining useful life of stamping dies, enabling proactive servicing and extending tool longevity.

DRO & Impact Forces Of Precision high-speed press machine Market

The market dynamics are primarily driven by the imperative for automation and high-volume, high-precision production across the electronics and automotive sectors. The shift towards electric vehicles necessitates specialized stamping for motor cores and battery components, requiring faster, more precise machines. However, the market faces significant restraints, chiefly the exceptionally high initial capital investment required for these sophisticated machines and the lack of highly skilled technicians capable of operating and maintaining advanced servo-press technology. Opportunities abound in expanding into niche high-tolerance sectors like medical devices and aerospace, coupled with integrating Industry 4.0 elements like cloud connectivity and AI-driven predictive maintenance. These four factors—Drivers, Restraints, Opportunities, and Impact Forces—collectively shape the competitive strategies and technological roadmap of the market.

Key drivers include the global expansion of the 5G ecosystem, demanding billions of precision-stamped connectors and shielding components, and the ongoing push for efficiency improvement in traditional manufacturing processes. The economic incentive to reduce unit manufacturing cost through higher throughput is a powerful driver, pushing companies to invest in equipment operating at 1000+ SPM. The technological evolution towards servo-driven presses offers unmatched control over the press motion profile, enabling complex deep drawing and forming processes previously impossible at high speeds. These capabilities position the precision press market favorably for meeting the stringent specifications of next-generation product designs, particularly those involving advanced high-strength materials that require controlled deformation rates.

Restraints are deeply rooted in financial and human capital challenges. The specialized nature and high complexity of precision high-speed press machines result in steep procurement costs, often acting as a barrier to entry for smaller manufacturers or those in developing economies. Furthermore, the reliance on highly sophisticated control systems and intricate tooling demands a specialized workforce trained not just in mechanics but also in advanced digital diagnostics and programming, creating a shortage of skilled labor globally. Impact forces are strong and multifaceted; the increasing stringency of global quality standards (especially in medical and automotive safety parts) necessitates flawless component production, while volatile raw material costs influence the adoption rate of presses capable of minimizing scrap and maximizing material utilization. The pressure for shorter product lifecycles also compels manufacturers to seek highly flexible and rapidly reconfigurable stamping lines.

Segmentation Analysis

The Precision high-speed press machine market is broadly segmented based on product type, tonnage capacity, application, and control technology. This segmentation provides a granular view of market demand tailored to specific manufacturing requirements. Product types generally distinguish between C-Frame (offering easier access for complex dies and material handling) and Straight-Side presses (providing greater rigidity and stability for higher tonnage and deeper draw applications). Tonnage classification dictates the scale of operations, ranging from micro-stamping for electronics (below 100 tons) to heavier gauge material processing (above 300 tons). The critical differentiating factor, Control Technology, highlights the increasing dominance of servo technology, which offers superior customization and energy savings compared to traditional mechanical and hydraulic variants. Understanding these segments is vital for strategic market entry and product development, as demands vary significantly across user industries and geographical regions.

Segmentation by application remains the most influential factor, dictating volume demand and required machine specifications. The Automotive sector requires high-tonnage machines for structural components, as well as mid-tonnage presses for complex motor laminations and electronic control unit (ECU) casings, emphasizing reliability and long production cycles. Conversely, the Electronics & Electrical segment focuses intensely on high SPM (strokes per minute) and ultra-precision for manufacturing connectors, semiconductor lead frames, and battery cell components, favoring machines under 100 tons with exceptional positioning accuracy. The distinct needs regarding required materials, cycle speed, and lifetime maintenance schedules contribute to varied purchasing patterns across these core application segments. This divergence ensures that press manufacturers must maintain a diverse portfolio to cater effectively to the specialized needs of each industry vertical, often requiring customized feed systems and tooling protection mechanisms.

Geographically, market segmentation reflects the distribution of global manufacturing powerhouses. Asia Pacific leads due to its expansive consumer electronics and automotive supply chains, driving demand for all machine types but predominantly high-volume straight-side presses. North America and Europe, while slower in sheer volume growth, represent high-value markets demanding advanced servo presses integrated with sophisticated automation systems compliant with stringent safety regulations. Analyzing the intersection of technology and region reveals that high-end servo presses are seeing fastest adoption in technologically advanced regions, whereas mechanical and hydraulic presses still dominate certain mid-range and general-purpose stamping operations in emerging economies, driven by cost sensitivity. This layered segmentation approach allows for precise forecasting and targeted sales strategies based on local industrial maturity and specific regulatory environments.

- By Tonnage Capacity:

- Less than 100 Tons

- 100 Tons to 300 Tons

- Above 300 Tons

- By Product Type:

- C-Frame Press

- Straight-Side Press

- Arch Frame Press

- By Control Technology:

- Mechanical Press

- Hydraulic Press

- Servo Press

- By Application:

- Automotive Industry (EV Components, Body Parts, Motor Cores)

- Electronics & Electrical Industry (Connectors, Lead Frames, Terminals)

- Aerospace & Defense

- Industrial Machinery and Equipment

- Consumer Goods and Appliances

- Medical Devices

Value Chain Analysis For Precision high-speed press machine Market

The value chain for the Precision high-speed press machine market begins with upstream activities, involving raw material suppliers and specialized component manufacturers. This includes high-grade steel and cast iron producers for the machine frame, and high-precision component specialists supplying servo motors, advanced control systems (PLCs), high-speed clutches, dynamic balancing mechanisms, and sophisticated sensor packages. The quality and reliability of these upstream inputs—particularly the highly customized controllers and high-performance motors—are critical determinants of the final press machine's precision and lifespan. Strong partnerships between press machine builders and specialized component suppliers are essential for innovation and maintaining supply chain stability, especially regarding proprietary servo technologies and advanced sensor integration required for Industry 4.0 readiness.

The core manufacturing stage involves the design, assembly, and testing of the press machines. This is where intellectual property related to frame rigidity, ram guidance systems, and vibration dampening technology is concentrated. Manufacturers often engage in direct sourcing of critical components while retaining control over specialized assembly and rigorous quality assurance processes. Distribution channels in this capital-intensive market are typically bifurcated. Direct sales are common for large, customized, high-tonnage machines, particularly when dealing with Tier 1 automotive suppliers or major electronics conglomerates who require extensive pre-sale consultation, installation, and post-sale training from the Original Equipment Manufacturer (OEM) itself. This direct channel facilitates the necessary technical dialogue and customization.

Indirect distribution involves specialized distributors and local agents who manage sales, installation, and localized maintenance services for standard or mid-range press models, especially in geographically fragmented markets or regions where the OEM does not maintain a large local presence. Downstream activities involve post-sale services, including highly specialized maintenance contracts, spare parts supply, tooling consulting, and software updates for the control systems. The complexity of these machines makes after-sales support a significant revenue generator and a critical element of competitive differentiation. End-users rely heavily on prompt and skilled technical support to minimize production downtime, thereby linking aftermarket service quality directly to customer loyalty and repeat business in this high-stakes capital equipment sector.

Precision high-speed press machine Market Potential Customers

The primary potential customers and buyers of precision high-speed press machines are large-scale manufacturing enterprises requiring mass production of intricate metal components with extremely tight tolerances. The End-Users/Buyers are predominantly categorized within the high-volume, quality-critical industrial sectors, most notably Tier 1 and Tier 2 suppliers to the global Automotive industry. These customers purchase machines for stamping components essential for powertrain systems, electric vehicle battery packaging, motor laminations, and advanced safety systems, demanding durability and consistency over billions of cycles. The ongoing electrification of vehicles is creating a massive new segment of customers focused solely on producing highly precise magnetic cores and terminals.

Another dominant customer segment is the Electronics and Electrical Manufacturing sector, including producers of electronic connectors, lead frames for integrated circuits, computer hardware components, and housing for telecommunication devices. These buyers prioritize ultra-high speed (often above 1,200 SPM) and microscopic precision, often utilizing specialized machines for micro-stamping processes involving extremely thin materials. The demand in this sector is characterized by rapid technological refresh cycles, leading to a constant need for upgrading equipment to handle new materials and geometries associated with miniaturization trends in smartphones, tablets, and wearable technology. Therefore, flexibility and rapid changeover capabilities are paramount purchase criteria for these customers.

Finally, other significant potential customers include specialized stamping houses that operate as contract manufacturers for various industries, often serving the Industrial Machinery, HVAC, and Medical Device markets. While the volume requirements may be lower than those of major automotive or electronics players, the precision demands in medical devices (e.g., surgical staples, hearing aid components) are often the most stringent, commanding premium machine features and dedicated service support. These customers often seek versatile servo presses that can handle smaller batch sizes and complex material forming requirements, relying heavily on the OEM for application-specific tooling and process optimization consulting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIDA Co., Ltd., Schuler Group, Komatsu Industries Corp., Chin Fong Machine Industrial Co., Ltd., Stamtec, Inc., Yangli Group, Seyi Heavy Industry Co., Ltd., JIER Machine Tool Group, Amada Co., Ltd., Mitsubishi Heavy Industries, Eagle Precision Technologies, Heilongjiang Forging Group, Erfurt Inc., Vamco International, Sangiacomo Presse S.r.l., H&F Group, Simpac Co., Ltd., SMTCL, Fagor Arrasate, AP&T Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision high-speed press machine Market Key Technology Landscape

The technological landscape of the precision high-speed press machine market is fundamentally defined by the transition towards advanced servo control systems, displacing traditional mechanical press mechanisms due to their superior flexibility, precision, and energy efficiency. Servo presses utilize a direct-drive motor connected to the eccentric gear, allowing precise manipulation of the slide movement profile throughout the entire stroke. This capability enables manufacturers to optimize the forming speed specific to the material being stamped, reducing shock, vibration, and noise while significantly extending die life. Furthermore, modern presses are increasingly incorporating high-resolution encoders and feedback loops to ensure repeatability of press depth within microns, a non-negotiable requirement for critical components in electronics and automotive safety systems. The integration of advanced computational fluid dynamics (CFD) and finite element analysis (FEA) during the design phase ensures maximum frame rigidity and minimizes deflection, which is crucial for high-speed operation.

Another major technological trend is the pervasive adoption of Industry 4.0 and the Industrial Internet of Things (IIoT). Modern press machines are equipped with hundreds of sensors monitoring everything from hydraulic pressure and lubrication levels to vibration signatures and motor current draw. These data streams are aggregated and transmitted via secure cloud platforms, enabling remote diagnostics, real-time performance monitoring (KPIs like OEE), and sophisticated predictive maintenance algorithms. This connectivity transforms the press from a standalone piece of equipment into an intelligent node within a larger automated manufacturing ecosystem. IIoT integration is crucial for global manufacturers who manage geographically dispersed facilities, allowing centralized oversight and standardized process management, thereby significantly enhancing operational consistency and responsiveness to market demands.

The focus on auxiliary systems and automation integration is also key. High-speed stamping requires equally high-speed, reliable material feeding and component removal systems. The latest technologies include high-precision roller feeders and gripper transfer systems optimized for rapid indexing and minimal mechanical backlash, ensuring material integrity at high speeds. Furthermore, sophisticated die protection and monitoring systems, utilizing highly sensitive force sensors and proximity detectors, are essential to prevent catastrophic die damage, which can cost hundreds of thousands of dollars and result in extensive downtime. The convergence of highly refined mechanics, advanced servo control, and integrated digital intelligence characterizes the cutting edge of precision high-speed press machine technology, yielding unmatched throughput and quality standards essential for competitive manufacturing.

Regional Highlights

Regional dynamics are crucial in understanding the demand and supply centers for precision high-speed press machines, reflecting differences in industrial maturity, labor costs, and technological adoption rates across the globe.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by the colossal manufacturing bases in China, Japan, South Korea, and Taiwan. These nations dominate the production of consumer electronics, automotive components (both traditional and EV), and semiconductor equipment, generating immense volume demand for high-speed, high-precision stamping solutions. Japan and Taiwan remain global leaders in press machine manufacturing technology, while China represents the largest consumption market, fueling demand for both domestic and imported high-end servo presses to upgrade and automate factories in line with "Made in China 2025" objectives. The region's growth is heavily influenced by the expansion of EV infrastructure and the relentless pace of electronics miniaturization.

- North America: This region constitutes a mature market focusing heavily on replacing older mechanical infrastructure with advanced, energy-efficient servo technology, particularly within the Tier 1 automotive supply chain and specialized aerospace and medical stamping operations. Demand is centered on high-automation integration, requiring sophisticated presses capable of interfacing seamlessly with robotics and enterprise resource planning (ERP) systems. The emphasis is on quality, regulatory compliance, and reducing lifecycle operational costs, driving strong demand for US- and European-made high-reliability machines.

- Europe: Characterized by a strong focus on advanced manufacturing, regulatory compliance (especially safety and noise reduction), and sustainable production, Europe demonstrates high demand for top-tier servo presses that offer maximum flexibility and minimal environmental impact. Countries like Germany, Italy, and Switzerland are major producers and consumers, driving innovation in press design, tooling technology, and complete automated stamping lines. The rapid transition of European automotive giants towards electric mobility accelerates the procurement of specialized presses for lamination and battery casing production.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets with increasing industrialization, particularly in Mexico (automotive) and Brazil (industrial machinery). Demand is currently moderate but growing, driven by foreign direct investment and initiatives to establish localized manufacturing hubs. While cost sensitivity remains a factor, leading to higher proportional demand for standard mechanical and hydraulic presses, investments in high-speed precision equipment are increasing as local firms aim to meet international quality standards required for export-oriented production, especially in the automotive sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision high-speed press machine Market.- AIDA Co., Ltd.

- Schuler Group GmbH

- Komatsu Industries Corp.

- Chin Fong Machine Industrial Co., Ltd.

- Stamtec, Inc.

- Yangli Group

- Seyi Heavy Industry Co., Ltd.

- JIER Machine Tool Group

- Amada Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Eagle Precision Technologies

- Heilongjiang Forging Group

- Erfurt Inc.

- Vamco International

- Sangiacomo Presse S.r.l.

- H&F Group

- Simpac Co., Ltd.

- SMTCL (Shenyang Machine Tool Co., Ltd.)

- Fagor Arrasate S. Coop.

- AP&T Group

Frequently Asked Questions

Analyze common user questions about the Precision high-speed press machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-speed precision press machines?

The primary factor is the rapid expansion and technological advancement in the automotive electrification sector, specifically the mass production requirement for highly precise motor laminations, coupled with the miniaturization trend in the consumer electronics industry demanding intricate connectors and components.

How does servo technology enhance the performance of precision high-speed presses?

Servo technology allows for precise, programmable control over the ram motion profile (slide movement), enabling variable speeds throughout the stroke, optimized forming rates for different materials, significant reduction in noise/vibration, and improved energy efficiency compared to traditional mechanical presses.

Which industry application segment holds the largest market share globally?

The Electronics & Electrical segment historically held a dominant share due to high-volume component production, but the Automotive industry, driven by global EV adoption, is rapidly increasing its share and is projected to become the largest application segment by the end of the forecast period.

What role does Industry 4.0 play in the future of the press machine market?

Industry 4.0 integration, through IIoT and AI, enables predictive maintenance, real-time remote diagnostics, and automated process optimization. This is crucial for maximizing Overall Equipment Effectiveness (OEE) and minimizing costly downtime in high-speed, automated production environments.

Why is the Asia Pacific region considered the leader in this market?

APAC leads the market due to its concentration of global electronics and automotive manufacturing supply chains, particularly in China, Japan, and South Korea, which drives the highest volume demand for high-throughput, precision stamping machinery necessary for mass production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager