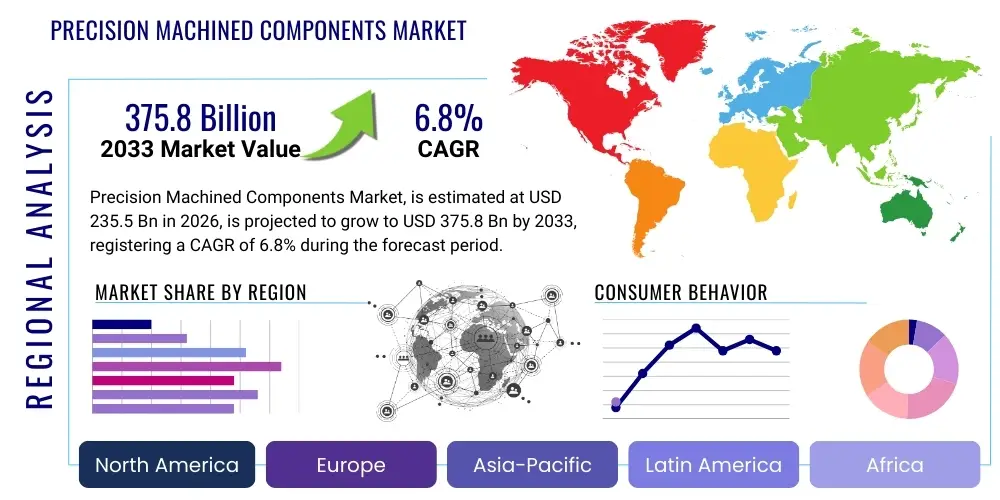

Precision Machined Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437973 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Precision Machined Components Market Size

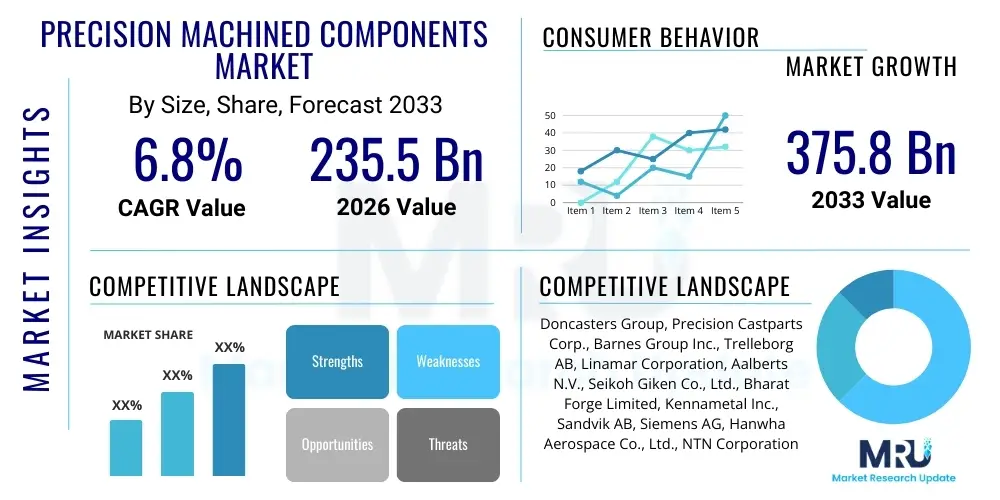

The Precision Machined Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $235.5 Billion in 2026 and is projected to reach $375.8 Billion by the end of the forecast period in 2033.

Precision Machined Components Market introduction

The Precision Machined Components Market encompasses the design, engineering, and manufacturing of highly accurate parts and components using advanced fabrication techniques such as Computer Numerical Control (CNC) machining, turning, milling, grinding, and electrical discharge machining (EDM). These components are characterized by extremely tight tolerances, superior surface finish, and complex geometries, making them indispensable for critical applications across high-reliability industries. The demand is intrinsically linked to the performance and reliability requirements of sophisticated end products, where failure is not permissible, such driving segments like aerospace, medical devices, and high-performance automotive sectors. The shift toward miniaturization and complexity in modern electronics and mechanical systems further fuels the need for specialized precision machining capabilities.

Product descriptions within this market include intricate parts made from various materials, including high-strength alloys (titanium, nickel-based superalloys), advanced plastics, ceramics, and standard metals (aluminum, stainless steel). Major applications span across industrial automation, defense systems, surgical instruments, aircraft engines, and complex consumer electronics assemblies. The crucial benefits derived from using precision components include enhanced operational efficiency, reduced friction and wear, extended equipment lifespan, and guaranteed product consistency, which directly contributes to overall system performance and safety standards compliance. The high barrier to entry, requiring significant investment in state-of-the-art machinery and highly skilled labor, solidifies the specialized nature of this industry.

Key driving factors accelerating market expansion include the burgeoning adoption of Industry 4.0 standards, which integrate machining processes with advanced sensing and data analytics, enabling real-time quality control and predictive maintenance. Furthermore, the sustained growth in the global aerospace industry, coupled with increasing governmental defense spending and the rapid technological advancements in the medical device sector—particularly in implantable devices and minimally invasive surgical tools—are primary catalysts. The transition of the automotive industry toward electric vehicles (EVs) also necessitates new generations of highly precise gears, battery housing components, and specialized motor parts, maintaining robust momentum for market participants focused on innovative manufacturing solutions and supply chain resilience.

Precision Machined Components Market Executive Summary

The Precision Machined Components Market is undergoing a significant transformation driven by technological integration and shifting global manufacturing footprints. Business trends indicate a strong move towards automated production lines, leveraging multi-axis CNC machines and robotic handling systems to maximize throughput and maintain stringent quality controls. Companies are increasingly focusing on vertical integration and developing highly specialized niche capabilities, particularly in additive manufacturing integration (hybrid machining) to tackle geometric limitations of traditional subtractive methods. Sustainability and supply chain resilience have become paramount, leading manufacturers to adopt localized production models and invest in energy-efficient machinery to meet client demands for ethical sourcing and reduced carbon footprints. Consolidation through strategic mergers and acquisitions is also evident as larger players seek to acquire specific technological expertise or expand geographical reach, particularly into high-growth Asia-Pacific markets.

Regionally, Asia Pacific maintains its dominance, primarily fueled by massive industrial expansion in countries like China, India, and South Korea, which are major hubs for automotive, electronics, and contract manufacturing. North America and Europe, while representing mature markets, are characterized by high-value, specialized production, focusing heavily on aerospace, defense, and sophisticated medical components where quality assurance standards are exceptionally high. These regions lead in the adoption of advanced technologies such as 5-axis machining and advanced metrology. The current macroeconomic environment, including inflationary pressures and geopolitical instability, introduces temporary volatility in raw material costs, necessitating flexible pricing strategies and strategic inventory management across all operating regions, yet the long-term structural demand remains robust due to non-discretionary applications.

Segment trends highlight the dominance of the CNC Milling segment due to its versatility and ability to produce complex parts efficiently. Material-wise, high-performance alloys are registering the fastest growth, primarily due to their increasing use in lightweighting applications across aviation and high-speed transportation. End-use segmentation reveals the aerospace and defense sector as the leading revenue generator, driven by long-lifecycle projects and stringent safety regulations demanding continuous component replacement and upgrades. However, the medical devices segment is expected to show the highest CAGR, spurred by aging global populations and rapid innovation in surgical robotics and diagnostics equipment, necessitating ultra-precision, biocompatible components. The market structure emphasizes outsourcing to specialized contract manufacturers who can achieve economies of scale and expertise unattainable by captive operations.

AI Impact Analysis on Precision Machined Components Market

User inquiries regarding AI's impact on the Precision Machined Components Market frequently center on productivity enhancement, predictive maintenance capabilities, and automated quality inspection. Key themes involve understanding how AI algorithms can optimize machining parameters (e.g., feed rate, spindle speed) in real-time to minimize tool wear and maximize material removal rates, particularly in complex, high-tolerance operations. Concerns often relate to the initial investment cost for integrating AI-driven monitoring systems and the need for a skilled workforce capable of managing and interpreting complex data generated by these systems. Users expect AI to reduce waste, shorten lead times, and significantly elevate the consistency of output quality, transitioning the manufacturing process from reactive control to proactive optimization across the entire production lifecycle, including supply chain forecasting and capacity planning.

- AI-driven optimization of CNC toolpaths reduces cycle times by up to 15%.

- Predictive maintenance analytics minimize unplanned machine downtime by forecasting component failure.

- Automated visual inspection using machine vision and deep learning drastically improves quality control and defect detection accuracy.

- Generative Design algorithms assist engineers in creating optimized part geometries suitable for precision machining.

- Supply chain risk management enhanced through AI forecasting of material availability and pricing volatility.

- Real-time process control adapts machining parameters based on sensor feedback, ensuring consistent dimensional accuracy.

- Autonomous scheduling and resource allocation optimizes factory floor efficiency and order fulfillment.

DRO & Impact Forces Of Precision Machined Components Market

The market is fundamentally driven by escalating demand from high-growth, high-value end-user industries such as aerospace, medical, and defense, coupled with ongoing global efforts toward product miniaturization and complexity in design. These factors necessitate increasingly stringent manufacturing tolerances, pushing machine shops to adopt advanced multi-axis CNC technology and sophisticated metrology solutions. However, the market faces significant restraints, primarily stemming from the severe global shortage of highly skilled machinists and engineers capable of programming, operating, and maintaining advanced precision equipment. Furthermore, the substantial capital expenditure required for acquiring top-tier CNC machines, along with the high energy consumption associated with long machining cycles, poses financial barriers, particularly for smaller and medium-sized enterprises (SMEs).

Opportunities within the market are abundant, particularly in the expansion of hybrid manufacturing, which combines additive and subtractive techniques to produce parts with previously unattainable internal features and optimized material usage. The growing emphasis on electric vehicle (EV) component manufacturing, requiring precision-machined thermal management and transmission components, presents a lucrative diversification path. Moreover, the integration of Industrial Internet of Things (IIoT) sensors and cloud-based data platforms allows manufacturers to offer value-added services focused on operational efficiency and predictive failure analysis to their clients. Embracing sustainability by machining lighter, stronger alternative materials also opens doors to new, environmentally conscious clients and specialized projects in green energy infrastructure.

The impact forces influencing the market are multifaceted, balancing technological progress against operational constraints. The force of technological evolution, specifically 5-axis and 9-axis machining adoption, significantly enhances the market's capability and complexity offering. Conversely, the powerful impact of regulatory compliance, particularly in regulated industries like medical devices (FDA standards) and aerospace (AS9100), acts as a driving force for quality investment but simultaneously elevates operational overhead and time-to-market. Economic cycles exert considerable force, as industrial capital expenditure often tracks closely with GDP growth and business confidence, impacting order volumes for new machinery and outsourced components. Lastly, the impact of skilled labor availability acts as a powerful brake on rapid scaling, forcing companies to invest heavily in automation and internal training programs to mitigate this constraint.

Segmentation Analysis

The Precision Machined Components Market is extensively segmented based on the technology utilized, the material processed, the type of component manufactured, and the end-use application. This segmentation reflects the highly specialized nature of the industry, where capabilities are often tied directly to specific material expertise or machining processes, such as high-speed milling for aerospace alloys versus high-precision grinding for medical implants. Understanding these segments is crucial for market participants to identify niche opportunities and allocate resources effectively, moving beyond standardized operations to specialized, high-margin manufacturing contracts. The shift toward specialized component types, such as micro-components and complex assemblies, drives segmentation differentiation, moving away from simple commodity part production.

- By Technology:

- CNC Machining (Milling, Turning, Grinding)

- Electrical Discharge Machining (EDM)

- Laser Processing

- Others (Jig boring, Lapping, Honing)

- By Material:

- Metals and Alloys (Steel, Aluminum, Titanium, Nickel-Based Alloys)

- Plastics and Polymers

- Ceramics

- Composites

- By Component Type:

- Shafts and Gears

- Fittings and Valves

- Casings and Housings

- Fasteners and Connectors

- Micro-Components

- Others

- By End-Use Industry:

- Aerospace and Defense

- Automotive (ICE and EV)

- Medical and Healthcare

- Industrial Machinery and Automation

- Electronics and Semiconductors

- Oil and Gas

- Others

Value Chain Analysis For Precision Machined Components Market

The value chain for precision machined components starts with upstream activities involving raw material procurement and machine tool suppliers. Raw material providers, including metal foundries and specialty alloy manufacturers, play a critical role, as the quality and consistency of the feedstock directly dictate the final component's integrity. Machine tool suppliers, encompassing CNC machine manufacturers, tooling specialists, and metrology equipment providers, represent the foundational technological layer, investing heavily in R&D to deliver faster, more accurate, and versatile equipment. Strategic partnerships at this stage ensure continuous access to high-quality materials and the latest manufacturing technologies, which is essential for maintaining a competitive edge in precision manufacturing.

The core of the value chain is the manufacturing process itself, executed by contract manufacturers, captive units, and specialized job shops. This midstream segment involves rigorous design validation, sophisticated programming, complex multi-axis machining operations, heat treatment, surface finishing, and stringent quality inspection (metrology). Distribution channels involve both direct and indirect routes. Direct distribution is common for high-value, bespoke components destined for Tier 1 suppliers or original equipment manufacturers (OEMs) in aerospace and medical sectors, requiring close technical collaboration and dedicated supply agreements. Indirect distribution utilizes specialized industrial distributors and trading houses, typically for standardized or lower-complexity components, providing inventory management and localized logistics support.

Downstream activities involve component assembly, integration into complex systems, and final delivery to the end-use customer. Service providers, including those offering post-sales maintenance, repair, and operational support (MRO), further extend the value chain. Direct sales are prevalent when the manufacturer provides a complete solution, including design for manufacturability (DFM) input and long-term service contracts. The trend toward digitalization requires seamless data integration across the chain, from design software (CAD/CAM) used upstream to monitoring and quality assurance systems deployed midstream, ensuring traceability and compliance throughout the entire component lifecycle. Optimization of the distribution network reduces lead times, a critical performance metric in the just-in-time manufacturing environments of end-users.

Precision Machined Components Market Potential Customers

The potential customer base for precision machined components is highly diverse yet concentrated within sectors demanding high reliability, longevity, and adherence to severe performance standards. Primary customers include Original Equipment Manufacturers (OEMs) across the aerospace and defense sectors, who require complex, lightweight, and heat-resistant parts for engines, airframes, and guidance systems. Within the medical field, major buyers are manufacturers of sophisticated surgical robotics, prosthetic devices, implantable cardiovascular components, and diagnostic imaging equipment, all requiring components made from biocompatible materials with micro-level precision. These customers prioritize quality accreditations (e.g., ISO 13485, AS9100) and robust process control documentation above almost all other factors, including minor cost variances.

In the automotive industry, particularly the high-performance and electric vehicle segments, buyers include manufacturers of advanced powertrain components, specialized thermal management systems, and precision gears requiring highly accurate surface finishes to minimize noise, vibration, and harshness (NVH). Industrial machinery and automation companies, encompassing manufacturers of robots, semiconductor processing equipment, and heavy construction equipment, are also major buyers, seeking components that guarantee long operating life under extreme load and continuous operation. The purchasing decision process for these customers is typically technical, involving extensive auditing of supplier manufacturing capabilities, quality management systems, and financial stability, often leading to multi-year contractual relationships based on demonstrated performance and reliability rather than transactional pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $235.5 Billion |

| Market Forecast in 2033 | $375.8 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Doncasters Group, Precision Castparts Corp., Barnes Group Inc., Trelleborg AB, Linamar Corporation, Aalberts N.V., Seikoh Giken Co., Ltd., Bharat Forge Limited, Kennametal Inc., Sandvik AB, Siemens AG, Hanwha Aerospace Co., Ltd., NTN Corporation, JTEKT Corporation, Yamazaki Mazak Corporation, DMG MORI, GF Machining Solutions, Makino Milling Machine Co., Ltd., FANUC Corporation, Haas Automation, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Machined Components Market Key Technology Landscape

The current technology landscape in the Precision Machined Components Market is defined by a relentless pursuit of higher accuracy, speed, and automation, driven largely by the integration of sophisticated digital tools. Multi-axis CNC machines (5-axis and above) are now standard, allowing for the simultaneous machining of complex contours and reduced setup times, which is critical for intricate components used in gas turbines and medical implants. This evolution is supported by advanced tooling and cutting materials, such as polycrystalline diamond (PCD) and specialized ceramic inserts, enabling efficient machining of hard and exotic materials like titanium and Inconel. Further technological advancement focuses on enhancing the stiffness and thermal stability of machine tools to mitigate precision errors over long operational cycles.

A significant trend is the adoption of advanced metrology and quality assurance systems, moving from post-process inspection to in-process verification. Coordinate Measuring Machines (CMMs), non-contact laser scanning systems, and integrated machine tool probes provide real-time dimensional feedback, which is essential for maintaining tight tolerances below 10 micrometers. Furthermore, the convergence of additive manufacturing (AM) with traditional subtractive techniques is creating "hybrid manufacturing systems." These systems allow manufacturers to build complex near-net shapes via AM and then use precision machining to achieve the necessary surface finish and high accuracy on critical features, optimizing material use and reducing lead times, especially for prototypes and low-volume, highly complex parts.

The implementation of Industry 4.0 principles is fundamentally reshaping factory floor operations. This includes the widespread deployment of the Industrial Internet of Things (IIoT) sensors on machinery to collect data on vibration, temperature, and power consumption, feeding into AI-driven analytics platforms. These platforms enable predictive maintenance, optimizing scheduling and preventing costly unplanned downtime. Furthermore, advanced simulation software and digital twin technology are being used extensively for virtual prototyping and process optimization before a single piece of material is cut. This comprehensive technological ecosystem not only improves operational efficiency but also ensures unprecedented traceability and quality documentation, which is non-negotiable for high-stakes industries like aerospace and medical device manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by massive manufacturing output in China, India, and Southeast Asia. The region benefits from lower labor costs, robust governmental support for industrialization, and high foreign direct investment in electronics, automotive (including EV battery components), and industrial machinery sectors. China, in particular, dominates the volume manufacturing segment, while countries like Japan and South Korea focus on ultra-precision components for semiconductors and robotics.

- North America: Characterized by high-value manufacturing, North America focuses heavily on the aerospace and defense (A&D) and medical device markets, segments requiring the highest levels of material expertise and certification. The United States leads in R&D investment for advanced machining technologies, including AI integration and hybrid manufacturing, maintaining a technological leadership edge despite higher operating costs. Demand is stable, driven by ongoing modernization of military assets and rapid growth in complex surgical instruments.

- Europe: Europe, particularly Germany, Switzerland, and Italy, is renowned for technological excellence and specialization in high-end industrial machinery, luxury automotive components, and medical technology. The region leads in environmental sustainability mandates, driving demand for precision components used in renewable energy systems (e.g., wind turbines, hydrogen power). Strict quality standards and established supply chains for high-quality machine tools underpin the market strength in this region.

- Latin America (LATAM): The market in LATAM is comparatively smaller, focusing primarily on meeting the needs of regional automotive assembly and domestic industrial machinery production. Brazil and Mexico are key markets, heavily influenced by global automotive OEMs establishing local manufacturing bases. Growth is dependent on macroeconomic stability and increased foreign investment in infrastructure and energy sectors, driving demand for heavy-duty precision parts.

- Middle East and Africa (MEA): Growth in MEA is largely fueled by significant investments in the oil and gas sector, requiring robust, precision-machined parts for drilling, extraction, and processing equipment capable of handling harsh environments. Saudi Arabia and the UAE are also diversifying into defense manufacturing and infrastructure projects (e.g., NEOM), creating emerging demand for high-specification components, though the market remains highly fragmented and import-reliant for specialized machining capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Machined Components Market.- Doncasters Group

- Precision Castparts Corp.

- Barnes Group Inc.

- Trelleborg AB

- Linamar Corporation

- Aalberts N.V.

- Seikoh Giken Co., Ltd.

- Bharat Forge Limited

- Kennametal Inc.

- Sandvik AB

- Siemens AG

- Hanwha Aerospace Co., Ltd.

- NTN Corporation

- JTEKT Corporation

- Yamazaki Mazak Corporation

- DMG MORI

- GF Machining Solutions

- Makino Milling Machine Co., Ltd.

- FANUC Corporation

- Haas Automation, Inc.

Frequently Asked Questions

Analyze common user questions about the Precision Machined Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Precision Machined Components Market?

The primary driver is the stringent demand for high-reliability, complex components from non-discretionary sectors, particularly Aerospace and Defense, and Medical Devices, which mandate superior quality, tight tolerances, and long operational lifespans for critical systems.

Which technology segment holds the largest market share in precision machining?

CNC Machining, encompassing multi-axis milling and turning, holds the largest market share due to its versatility, automation potential, and ability to handle a wide range of materials and complex geometries with high accuracy.

How is the market addressing the shortage of skilled labor?

The market is mitigating labor shortages by significantly increasing investment in advanced automation, including robotics, AI-driven process control, and self-regulating machinery, thereby reducing reliance on manual oversight and highly specialized operators.

What role does the transition to Electric Vehicles (EVs) play in this market?

The EV transition is a significant opportunity, generating high demand for precision machined components related to battery thermal management systems, lightweight motor housings, specialized gears, and complex power electronics components required for efficiency and durability.

Which geographic region is projected to experience the fastest growth rate?

Asia Pacific (APAC) is projected to exhibit the fastest growth rate, fueled by robust industrial expansion, increasing domestic manufacturing capabilities across multiple sectors, and growing technological sophistication, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager