Precision Medical Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431380 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Precision Medical Coating Market Size

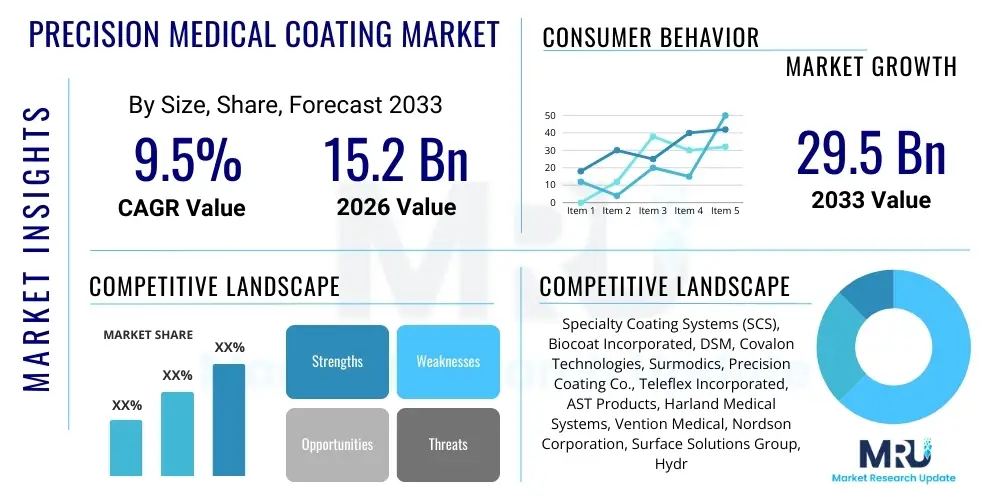

The Precision Medical Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This robust growth is fueled by the escalating demand for minimally invasive surgical procedures and stringent regulatory requirements mandating enhanced performance and biocompatibility of medical devices. The industry is currently undergoing significant transformation, prioritizing specialized coating solutions that offer superior lubricity, infection resistance, and durability, directly impacting patient safety and device efficacy across numerous clinical applications.

The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033. This upward trajectory reflects major investments by leading medical device manufacturers (OEMs) in advanced coating technologies such as nanocoatings and bio-active coatings. Furthermore, the rising incidence of chronic cardiovascular, neurological, and orthopedic conditions globally necessitates a continuous supply of high-performance coated implants and catheters, solidifying the long-term commercial viability and expansion of this specialized segment of the healthcare industry.

Precision Medical Coating Market introduction

Precision medical coatings are specialized thin film layers applied to the surface of medical devices, implants, and surgical instruments. Their primary function is to enhance the device's interaction with the biological environment, ensuring biocompatibility, improving mechanical performance (such as lubricity and abrasion resistance), and often providing therapeutic functionalities like drug elution or antimicrobial protection. These coatings are indispensable in modern medicine, particularly for critical applications such as coronary stents, urinary catheters, joint replacements, and neurological probes, where device failure or adverse biological reactions could be catastrophic.

The product portfolio within this market spans various chemical compositions and functional properties, including hydrophilic coatings designed to reduce friction during insertion, anti-microbial coatings crucial for preventing Hospital-Acquired Infections (HAIs), and inert barrier coatings like Parylene which provide electrical insulation and moisture protection. Major applications encompass cardiovascular intervention devices (catheters, guidewires, stents), orthopedic implants (wear reduction), and minimally invasive surgical tools. The selection of a coating material and deposition technique is highly dependent on the substrate material, the intended application, and the required duration of functionality within the human body.

Key benefits derived from precision medical coatings include improved patient outcomes through reduced procedural complications, extended device lifespan, and enhanced diagnostic accuracy. The market is fundamentally driven by the global aging population, which requires more complex and frequent medical interventions, coupled with the rapid adoption of advanced, minimally invasive surgical techniques that rely heavily on highly lubricious and precise instrument coatings. Ongoing innovation in material science, particularly concerning bioresorbable and smart coatings, continues to propel the market forward, addressing unmet clinical needs related to localized drug delivery and long-term implant stability.

Precision Medical Coating Market Executive Summary

The global Precision Medical Coating Market is characterized by robust growth, primarily driven by strong business trends focusing on risk mitigation, device miniaturization, and enhanced functional integration. Medical device OEMs are increasingly outsourcing complex coating processes to specialized vendors to leverage proprietary technology and ensure strict regulatory compliance, leading to higher consolidation and strategic partnerships within the coating supply chain. Regional trends indicate North America maintaining market dominance due to high healthcare expenditure and advanced infrastructure, while the Asia Pacific region is projected to register the fastest growth, fueled by expanding access to advanced medical treatment and significant growth in medical device manufacturing hubs.

Segment trends highlight the critical importance of functional coatings. The anti-microbial coating segment is experiencing accelerated adoption globally, spurred by global initiatives to combat antibiotic resistance and reduce Surgical Site Infections (SSIs) and HAIs. Simultaneously, hydrophilic coatings continue to command a significant market share, remaining essential for almost all interventional cardiology and urology devices where extremely low friction is paramount. Device manufacturers are also exploring multi-functional coatings—combining lubricity with drug-eluting capabilities—to simplify device design and improve therapeutic efficacy.

Overall market evolution is characterized by stringent quality control and regulatory oversight, particularly following the implementation of stricter guidelines like the EU Medical Device Regulation (MDR). This regulatory environment acts as a barrier to entry for smaller players but ensures high quality and reliability from established vendors. Strategic investments are centered on automation, precision deposition techniques (such as Atomic Layer Deposition or ALD), and developing coatings suitable for increasingly complex and smaller-diameter devices, ensuring the market's long-term sustainability and technological advancement.

AI Impact Analysis on Precision Medical Coating Market

User queries regarding AI's influence in the precision medical coating domain predominantly revolve around how artificial intelligence and machine learning (ML) can optimize material discovery, enhance process quality control, and accelerate regulatory approval timelines. Common concerns focus on the cost implications of integrating AI-driven predictive maintenance systems into specialized cleanroom manufacturing environments and the potential for AI to personalize coating characteristics for patient-specific implants. The core expectation is that AI will move the industry beyond traditional trial-and-error methods, enabling faster identification of novel, biocompatible polymers and perfecting complex deposition parameters (like temperature, pressure, and flow rates in PVD or CVD processes) to achieve zero-defect production, thereby guaranteeing the performance and longevity of critical medical devices.

The primary impact of AI is centered on optimizing the manufacturing workflow and material science research. AI algorithms can analyze vast libraries of chemical structures and biological interaction data, predicting the performance, biocompatibility, and degradation profile of potential coating materials before laboratory synthesis even begins. This predictive capability drastically reduces R&D cycles and expenditure. Furthermore, in the production phase, ML models analyze real-time sensor data from coating machinery—such as plasma monitors in vacuum chambers or thickness sensors in dip coating baths—to instantly adjust parameters, ensuring uniform film thickness, adhesion, and desired surface morphology across every batch, which is critical for precision components like drug-eluting stents.

Beyond material and process optimization, AI systems are instrumental in advanced quality assurance and compliance tracking. Computer vision systems powered by deep learning analyze microscopic images of coated surfaces far more accurately and rapidly than human inspectors, identifying minute defects, pinholes, or inconsistencies that could compromise device function. This enhanced quality control not only improves device safety but also streamlines documentation required for regulatory bodies like the FDA and EMA. The implementation of AI-driven predictive maintenance also minimizes equipment downtime, ensuring high utilization rates in capital-intensive coating facilities, thereby improving overall operational efficiency and supply chain reliability for critical medical components.

- AI accelerates the discovery and screening of novel, biocompatible coating materials (e.g., polymers, ceramics).

- Machine Learning optimizes complex coating deposition processes (PVD, CVD, dip coating) for precise thickness and uniformity.

- Deep learning models enhance real-time quality control (QC) by analyzing surface images for microscopic defects (Computer Vision QA).

- Predictive maintenance systems utilize AI to reduce equipment downtime and improve efficiency in specialized cleanrooms.

- AI assists in standardizing documentation and performance data analysis for faster regulatory compliance and submission.

DRO & Impact Forces Of Precision Medical Coating Market

The trajectory of the Precision Medical Coating Market is shaped by a powerful confluence of drivers, restraints, and opportunities. Primary drivers include the increasing global incidence of chronic diseases, necessitating more complex and higher volumes of interventional procedures, coupled with the mandatory shift towards Minimally Invasive Surgery (MIS). MIS procedures require highly lubricious, small-diameter devices, making functional coatings non-negotiable for smooth navigation within the body. These drivers create a foundational demand floor that supports steady market growth. Conversely, significant restraints include the exceptionally high capital expenditure required for establishing and maintaining ISO Class coating facilities (cleanrooms), the high operational costs associated with specialized coating materials, and the increasingly complex and time-consuming regulatory approval processes mandated by global health authorities, which delays market entry for novel coating solutions.

Opportunities are emerging predominantly in the realm of advanced material science and application customization. The growing research into nanocoatings, bioresorbable polymers, and stimuli-responsive or ‘smart’ coatings presents pathways for creating next-generation therapeutic devices capable of localized drug delivery or providing feedback on physiological conditions. Furthermore, the expansion of the healthcare sector in developing economies offers untapped potential for companies capable of scaling production efficiently. The immediate impact forces on the market are dominated by regulatory shifts (MDR adoption forcing reformulation) and technological advancements (e.g., shift from conventional PTFE to high-performance hydrophilic or drug-eluting polymer blends), compelling established players to innovate continuously to maintain market relevance and competitive advantage.

These forces interact dynamically: while high regulatory barriers restrain smaller entrants, they simultaneously drive established companies toward developing superior, globally compliant products, thereby ensuring quality but potentially inflating production costs. The increasing demand for advanced coatings (Driver) pushes innovation toward nanocoatings and bioactives (Opportunity), but the high cost of integrating these novel technologies (Restraint) limits immediate mass adoption. Successfully navigating this environment requires firms to possess strong intellectual property portfolios, robust quality management systems, and strategic partnerships with leading medical device OEMs to mitigate risks and capitalize on high-growth segments such as cardiovascular and neurovascular interventions where coating performance is absolutely critical for clinical success.

Segmentation Analysis

The Precision Medical Coating Market is comprehensively segmented based on coating type, application, substrate material, and end-user, reflecting the diverse requirements of the medical device industry. Analysis reveals that segmentation by type, particularly focusing on functional outcome, is the most crucial differentiator, with hydrophilic and anti-microbial coatings dominating the market share due to their direct impact on surgical outcomes and infection prevention. Segmentation allows manufacturers to tailor coating solutions precisely to the clinical environment, ensuring optimal performance—for example, selecting a Parylene coating for insulating neurological probes versus a robust fluoropolymer coating for high-wear orthopedic components. The increasing complexity of interventional devices necessitates specialized multi-layer coatings, further driving differentiation across these defined segments.

By application, the cardiovascular segment holds the largest share, driven by the high volume of catheter-based procedures, balloon angioplasty, and stent implantation, all of which critically depend on low-friction and sometimes drug-eluting coatings. However, the orthopedics segment is experiencing accelerating growth due to the rising demand for enhanced biocompatibility and wear resistance in joint replacement implants, often utilizing specialized ceramic or metal oxide coatings. Understanding these application-specific requirements is vital for market participants to focus their R&D and manufacturing capabilities effectively. Substrate differentiation, whether metal (stainless steel, Nitinol), polymer (PEEK, polyurethane), or ceramic, dictates the chosen deposition technology, impacting cost and complexity.

The market’s segmentation profile confirms a trend towards highly customized solutions over generic offerings. End-user analysis indicates that medical device manufacturers are the primary and most influential consumers, driving demand for high-volume, consistent coating application. The move toward advanced segments, such as biocompatible and specialized barrier coatings, signifies a maturing market where safety, efficacy, and regulatory compliance are prioritized above initial cost considerations. This detailed segmentation analysis is key for stakeholders formulating targeted marketing strategies and product development roadmaps tailored to niche clinical needs within the vast medical technology landscape.

- By Coating Type: Hydrophilic Coatings, Anti-microbial Coatings, Anti-thrombogenic Coatings, Drug-eluting Coatings, PTFE/Fluoropolymer Coatings, Parylene Coatings, Ceramic Coatings.

- By Application: Cardiovascular Devices, Orthopedic Implants, Neurovascular Devices, Gastrointestinal Devices, Urology Devices, General Surgery Instruments, Dental Devices.

- By Substrate: Metals (Stainless Steel, Nitinol, Titanium), Polymers (PEEK, Polyurethane), Glass, Ceramics.

- By End-User: Medical Device Manufacturers, Hospitals and Clinics, Diagnostic Centers, Ambulatory Surgical Centers (ASCs).

Value Chain Analysis For Precision Medical Coating Market

The value chain for precision medical coatings begins with the upstream suppliers responsible for raw material procurement, encompassing specialized polymers (e.g., hydrogels, fluoropolymers, silicones), high-purity solvents, and active pharmaceutical ingredients (APIs) for drug-eluting applications. This upstream phase requires stringent quality control, as the purity and consistency of raw materials directly determine the performance and regulatory compliance of the final coating. Key challenges at this stage include securing specialized materials that meet rigorous biocompatibility standards and managing supply chain volatility, particularly for proprietary chemical precursors. Successful companies often maintain close, vetted relationships with specialized chemical manufacturers to ensure material provenance and consistency.

The core manufacturing process involves highly specialized coating service providers, often operating in ISO Class 7 or Class 8 cleanroom environments. This midstream phase includes sophisticated deposition techniques such as plasma polymerization, vapor deposition (CVD/PVD/ALD), spray coating, and dip coating. Value addition here is high, driven by intellectual property related to proprietary formulations, validated process parameters, and highly skilled technical labor necessary for microscopic precision. Outsourced coating services are preferred by many OEMs due to the enormous capital investment required for in-house capabilities and the need for specialized expertise in surface chemistry, adhesion science, and process validation necessary for regulatory submissions.

Downstream distribution channels primarily involve direct sales from the specialized coating service provider to the Medical Device Original Equipment Manufacturer (OEM). These are often high-volume, business-to-business transactions based on long-term contracts and strict quality agreements. Indirect channels involve a minimal number of highly specialized distributors focused on niche markets or geographical regions where the coating provider lacks a direct presence. The ultimate end-users—hospitals and patients—receive the benefit through the superior performance of the coated medical device. The value chain is heavily influenced by strict adherence to ISO 13485 standards and cGMP guidelines throughout all stages, with regulatory validation being a critical component of every step, adding significant value and assuring product integrity.

Precision Medical Coating Market Potential Customers

The primary and largest segment of potential customers for precision medical coatings consists of global Medical Device Original Equipment Manufacturers (OEMs). These companies, ranging from multinational giants (e.g., Medtronic, Boston Scientific, Abbott) to specialized niche developers, require coatings for their extensive product portfolios, including cardiovascular catheters, orthopedic implants, neurovascular guidewires, and drug-delivery systems. OEMs prioritize suppliers who can offer consistency, scalability, strict quality documentation, and support during the arduous regulatory approval process, often seeking specialized functional coatings that provide a competitive edge in device performance and patient safety.

A secondary, yet significant, customer base includes smaller, specialized medical device innovators and startups focusing on novel therapeutic areas or diagnostic tools. These entities usually lack the capital or expertise for in-house coating operations and rely entirely on external coating service providers. They seek flexible contract manufacturing arrangements and quick turnaround times for prototyping and clinical trials. Their purchasing decision is heavily influenced by the coating vendor’s ability to develop customized, low-volume, high-precision solutions that meet unique material compatibility challenges specific to their emerging technologies.

Furthermore, large hospital systems, particularly those with high-volume interventional labs or surgical centers, sometimes function as indirect customers by influencing the purchasing decisions of the devices themselves. While they do not purchase the coatings directly, their demand for devices with superior performance—such as highly lubricious catheters that reduce procedural trauma or antimicrobial implants that lower readmission rates due to infection—drives the requirements placed upon the OEMs. High-volume buyers of consumables often specify performance criteria that implicitly necessitate the use of premium precision coatings, making the end-user clinical environment a critical factor in market demand creation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialty Coating Systems (SCS), Biocoat Incorporated, DSM, Covalon Technologies, Surmodics, Precision Coating Co., Teleflex Incorporated, AST Products, Harland Medical Systems, Vention Medical, Nordson Corporation, Surface Solutions Group, Hydromer, PPG Industries, Momentive Performance Materials, AdvanSource Biomaterials, Aculon, Europlaz Technologies, Henkel AG & Co. KGaA, Vancive Medical Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Medical Coating Market Key Technology Landscape

The technological landscape for precision medical coatings is diverse and highly specialized, relying on advanced surface engineering techniques to achieve the required microscopic film characteristics. The dominant technologies include various methods of thin-film deposition, such as Dip Coating and Spray Coating, which are cost-effective and widely used for applying hydrophilic or fluoropolymer coatings to high-volume products like catheters and guidewires. However, for applications demanding ultra-thin, highly conformal, and pinhole-free layers—such as insulation for neurological devices or stents—Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD), particularly Plasma Enhanced CVD (PECVD), are the preferred methods. PECVD is crucial for applying Parylene coatings, which offer exceptional barrier protection and dielectric strength, integral to implantable electronic devices.

An emerging and critical technology is Atomic Layer Deposition (ALD), which allows for the creation of coatings one atomic layer at a time. ALD offers unprecedented control over film thickness and uniformity, making it highly valuable for creating functional nanocoatings, applying bio-active agents precisely, and ensuring superior adhesion even on substrates with complex geometries. While ALD is currently more costly, its ability to produce highly consistent, ultra-thin films (<10 nm) is vital for miniaturized, high-performance implants where even minimal coating thickness variation can compromise function. Additionally, ultraviolet (UV) curing technology is widely utilized, especially for polymer-based coatings, offering rapid processing times and enhanced film properties compared to traditional thermal curing methods, speeding up high-throughput manufacturing lines.

Further technological innovation focuses on developing surface modification techniques that integrate the coating's function directly into the substrate's material structure, reducing the risk of delamination. This includes techniques like plasma treatment or specialized etching prior to deposition to enhance chemical bonding. The integration of advanced diagnostics, often powered by AI (as discussed previously), such as spectroscopic ellipsometry and electron microscopy, ensures that these sophisticated deposition processes meet the stringent quality standards required for patient-contact devices. The current technology landscape is characterized by a strong push toward multi-layering capabilities, combining barrier layers with functional topcoats (e.g., Parylene followed by a lubricious hydrophilic layer) to achieve complex performance specifications demanded by next-generation interventional devices.

Regional Highlights

Regional analysis of the Precision Medical Coating Market reveals distinct patterns of growth, regulation, and technological adoption across key geographical areas. North America currently dominates the market share, driven by several factors: the presence of major global medical device manufacturers (OEMs), high levels of healthcare expenditure, sophisticated surgical infrastructure, and robust governmental funding for medical research and development. The US market, in particular, sets the global benchmark for innovation in cardiovascular and orthopedic implants, requiring continuous technological advancements in coating efficacy and durability, thus ensuring sustained demand for high-end precision coating services.

Europe represents the second-largest market, characterized by stringent regulatory oversight under the Medical Device Regulation (MDR). While MDR compliance poses challenges, it also drives demand for validated, high-quality, and robust coating solutions, particularly those offering long-term stability and comprehensive performance data. Major economies like Germany, France, and the UK are strong adopters of advanced medical technologies, especially in neurological and orthopedic segments. The emphasis in Europe is placed heavily on minimizing infection rates, propelling the growth of sophisticated antimicrobial and anti-thrombogenic coating segments across the continent.

The Asia Pacific (APAC) region is projected to be the fastest-growing market throughout the forecast period. This exponential growth is attributed to improving healthcare access, rising medical tourism, large aging populations, and increasing government investment in local medical device manufacturing hubs (especially in China, India, and Japan). While initially focused on cost-effective coating solutions, APAC is rapidly transitioning to adopt advanced technologies, driven by increasing patient expectations and the influx of Western-trained medical professionals. This region offers significant expansion opportunities for international coating service providers seeking to establish manufacturing footprints closer to emerging OEM markets.

- North America: Market leader due to advanced infrastructure, high R&D spending, and concentration of key medical device OEMs (especially in cardiovascular and neurovascular devices).

- Europe: Strong growth underpinned by stringent regulatory standards (MDR) and high demand for infection-resistant and bio-compatible implants across major economies.

- Asia Pacific (APAC): Highest CAGR expected, driven by expanding healthcare expenditure, increasing surgical volumes, and the emergence of regional manufacturing centers.

- Latin America & MEA: Developing markets showing steady demand growth, primarily focused on essential functional coatings for high-volume consumables like catheters and basic surgical tools, increasingly importing coated devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Medical Coating Market.- Specialty Coating Systems (SCS)

- Biocoat Incorporated

- DSM

- Covalon Technologies

- Surmodics

- Precision Coating Co.

- Teleflex Incorporated

- AST Products

- Harland Medical Systems

- Vention Medical (Acquired by Nordson Corporation)

- Nordson Corporation

- Surface Solutions Group

- Hydromer

- PPG Industries

- Momentive Performance Materials

- AdvanSource Biomaterials

- Aculon

- Europlaz Technologies

- Henkel AG & Co. KGaA

- Vancive Medical Technologies (An Avery Dennison Business)

Frequently Asked Questions

Analyze common user questions about the Precision Medical Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for precision medical coatings?

The primary driver is the accelerating global shift towards Minimally Invasive Surgical (MIS) procedures. MIS necessitates high-performance, small-diameter devices that require specialized lubricious (hydrophilic) and barrier coatings to ensure smooth navigation, minimize friction, and guarantee long-term device function within the body.

Which coating type currently holds the largest market share and why?

Hydrophilic coatings hold the largest market share due to their essential role in interventional devices like catheters and guidewires. These coatings become extremely slippery when wet, drastically reducing friction during insertion and use, thereby minimizing trauma to tissues and improving patient safety during complex procedures.

What are the most significant regulatory hurdles affecting coating manufacturers?

The most significant hurdle is compliance with increasingly strict global standards, particularly the EU Medical Device Regulation (MDR) and enhanced FDA scrutiny. Compliance requires extensive testing, detailed documentation, and rigorous validation of coating processes and material biocompatibility, significantly extending time-to-market for new products.

How is nanotechnology transforming the medical coating landscape?

Nanotechnology enables the development of ultra-thin, highly functional coatings, often using techniques like Atomic Layer Deposition (ALD). Nanocoatings improve drug loading efficiency in drug-eluting stents, enhance mechanical properties without adding bulk, and create surfaces with inherent antimicrobial or anti-fouling characteristics at the molecular level.

Which end-user segment is the primary consumer of precision coating services?

Medical Device Original Equipment Manufacturers (OEMs) constitute the primary end-user segment. OEMs require specialized coating services to integrate advanced functionality into their mass-produced devices, relying on coating vendors for consistent quality, scalability, and technical expertise in complex surface modification techniques.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager