Precision Metal Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434917 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Precision Metal Parts Market Size

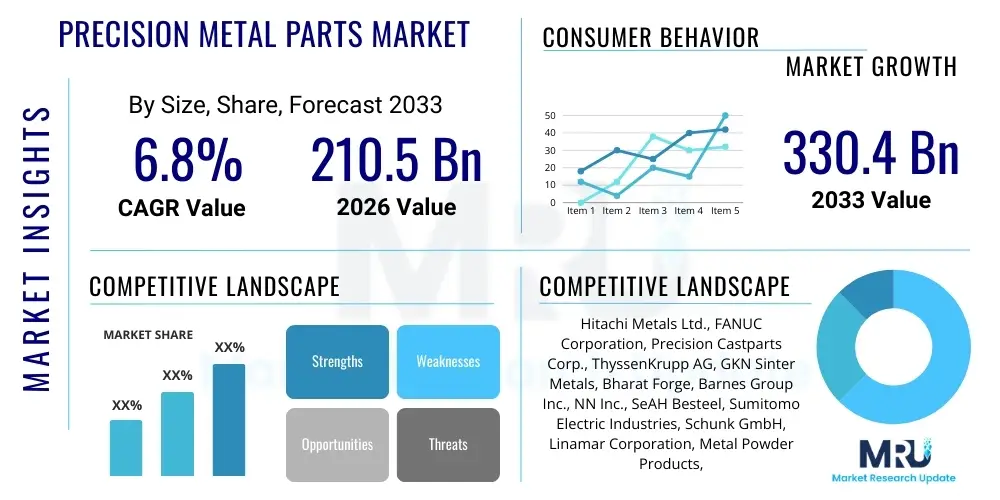

The Precision Metal Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 210.5 billion in 2026 and is projected to reach USD 330.4 billion by the end of the forecast period in 2033.

Precision Metal Parts Market introduction

The Precision Metal Parts Market encompasses the manufacturing and supply of components that meet extremely tight tolerance specifications, often involving complex geometries and high-performance material requirements. These components are critical structural or functional elements in advanced machinery and products across high-tech industries. The manufacturing processes utilized—such as CNC machining, stamping, metal injection molding (MIM), and additive manufacturing (AM)—are sophisticated, requiring specialized equipment and advanced quality control systems to ensure micron-level accuracy and repeatability.

Product descriptions typically include miniature gears, complex shafts, surgical instruments, fuel injection nozzles, and aerospace fasteners, all characterized by their flawless finish, exceptional durability, and consistency. Major applications span the automotive sector, driven by the shift towards electric vehicles (EVs) requiring precise battery cooling components and powertrain parts; the aerospace and defense industry, demanding lightweight, high-strength parts for jet engines and avionics; and the medical sector, where miniaturization and biocompatibility are paramount for implants and robotic surgery tools. The inherent benefits of these parts include enhanced product reliability, improved efficiency in end-use applications, and the ability to withstand extreme operating conditions, such as high temperatures or corrosive environments.

The market is primarily driven by the continuous trend of miniaturization across consumer electronics and medical devices, the increasing complexity of modern machinery demanding tighter tolerances, and massive investment in infrastructure and defense capabilities globally. Furthermore, the proliferation of automation technologies and the transition to high-mix, low-volume production paradigms necessitate reliance on highly precise manufacturing techniques. Geopolitical stability and supply chain resilience also play a crucial role, pushing manufacturers toward advanced, localized production capabilities utilizing sophisticated tools and materials.

Precision Metal Parts Market Executive Summary

The Precision Metal Parts Market is experiencing robust growth fueled by technological convergence and increased demand for high-performance components across industrial ecosystems. Key business trends include the adoption of Industry 4.0 methodologies, integrating IoT, AI, and cloud computing into manufacturing operations to enhance predictive maintenance and optimize production throughput. There is a strong movement towards specialized, high-nickel alloys and ceramics, particularly in demanding applications like turbine blades and medical devices, pushing material science innovation. Consolidation among smaller, specialized machine shops and larger contract manufacturers is also notable, aiming to achieve economies of scale and integrate diverse process capabilities, such as combining CNC machining with 3D printing for hybrid parts production.

Regionally, Asia Pacific (APAC) continues its dominance, driven by rapid industrialization, massive automotive production bases in China and India, and significant investments in electronics manufacturing in Southeast Asia. North America and Europe are focusing heavily on advanced manufacturing techniques, quality control standards, and sustainability in materials sourcing. The stringent regulatory environments in these developed regions, particularly in aerospace (FAA/EASA) and medical (FDA), ensure high barriers to entry but promise premium pricing for compliant, high-quality components. Latin America and MEA are emerging markets, primarily driven by infrastructure development and increasing demand in the oil and gas sector, though these regions still rely heavily on imports of highly complex precision parts.

Segmentation trends highlight the increasing share of Metal Injection Molding (MIM) due to its cost-effectiveness in mass production of small, complex components, especially in consumer electronics. The Automotive segment remains the largest application area, rapidly shifting focus from traditional powertrain components to sensor housings, high-precision braking systems, and lightweight structural parts for electric vehicles. Additionally, the process segment is witnessing a surge in Additive Manufacturing (AM) adoption, which, while currently niche, is increasingly used for rapid prototyping and the production of geometrically optimized parts that conventional methods cannot achieve, signaling a long-term shift in production paradigms toward design freedom and material efficiency.

AI Impact Analysis on Precision Metal Parts Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Precision Metal Parts Market predominantly revolve around three core themes: operational efficiency, design optimization, and quality assurance. Users frequently ask how AI can reduce scrap rates and minimize the need for manual inspection, seeking concrete examples of AI-driven predictive maintenance systems that decrease unexpected downtime. Another major concern is the integration of Generative Design tools, with users querying how AI algorithms can rapidly generate topologically optimized designs that maximize material efficiency and strength while adhering to manufacturing constraints. Finally, supply chain management is a hot topic, focusing on AI's role in optimizing inventory levels for specialized, high-value materials and predicting demand fluctuations to maintain precise production scheduling in high-mix environments.

AI's integration fundamentally alters the economics and technical feasibility of precision parts manufacturing. Machine learning algorithms analyze vast datasets generated by IoT-enabled CNC machines—such as vibration, temperature, and torque—to predict tool wear with high accuracy, enabling proactive replacement and virtually eliminating defects caused by worn tools. This shift from reactive maintenance to predictive scheduling dramatically improves uptime and consistency, which is vital when producing parts requiring tolerances measured in microns. Furthermore, deep learning techniques are being deployed in visual inspection systems, surpassing human capability in identifying microscopic surface defects or material flaws instantaneously.

The strategic deployment of AI extends beyond the factory floor into the initial stages of product development. Generative AI tools allow engineers to input performance parameters, material specifications, and manufacturing process constraints, yielding optimized part designs in minutes rather than weeks. This capability accelerates time-to-market for complex products (like new medical implants or aerospace components) and ensures that the final design is inherently optimized for the chosen precision manufacturing process, whether it be five-axis machining or metal 3D printing, thus minimizing post-processing and iterative adjustments. This level of optimization translates directly into reduced material usage and overall production costs, positioning AI as a critical competitive differentiator.

- AI-Driven Predictive Maintenance (PdM): Reduces machine downtime by forecasting tool wear and equipment failure, minimizing costly production interruptions.

- Generative Design Optimization: Accelerates R&D cycles by using algorithms to create topologically optimized, lightweight, and high-performance part geometries.

- Automated Quality Control (AQC): Enhances inspection speed and accuracy using machine vision and deep learning to detect minute surface defects and dimensional inaccuracies.

- Process Parameter Optimization: ML algorithms tune complex variables (e.g., feed rate, cutting speed, pressure) in real-time to maintain consistent tolerances and reduce scrap rates.

- Smart Supply Chain Management: Predicts demand fluctuations for specialized raw materials, optimizing inventory and ensuring timely procurement of critical alloys.

DRO & Impact Forces Of Precision Metal Parts Market

The dynamics of the Precision Metal Parts Market are defined by powerful driving forces, significant capital investment constraints, and untapped opportunities presented by technological advancements. The primary drivers include the stringent requirements for miniaturization and performance enhancement in end-user industries, particularly the escalating production volume of electric vehicles (EVs), which require thousands of specialized, highly precise parts (e.g., motor components, battery management sensors) to manage thermal efficiency and power delivery. Simultaneously, rapid growth in minimally invasive surgery techniques drives demand for extremely small, biocompatible, and high-precision instruments and implants, mandating zero-defect manufacturing standards. These drivers are amplified by global defense spending cycles that demand next-generation materials and precision components for aerospace and naval systems.

Restraints largely center on the intense capital expenditure required to acquire and maintain advanced manufacturing technologies, such as five-axis CNC machines and industrial metal 3D printers, making scale-up challenging for small and medium enterprises (SMEs). Furthermore, the volatility and rising cost of key raw materials, including specialized stainless steels, titanium, and nickel superalloys, introduce significant supply chain risks and cost pressures. A critical, enduring restraint is the global shortage of skilled labor—specifically, highly trained machinists, metallurgists, and quality control engineers capable of operating and programming these complex, high-tolerance systems. Manufacturing high-precision components requires intellectual capital that is scarce and expensive to retain.

Opportunities are predominantly found in the integration of Additive Manufacturing (AM) processes, particularly Powder Bed Fusion (PBF) and Binder Jetting, which allow for the creation of previously impossible geometries, reducing component counts and assembly complexity. The development of advanced, high-performance alloys and composite materials tailored for specific extreme environments presents a substantial market differentiator. Furthermore, leveraging big data analytics and AI for enhanced process control and predictive maintenance provides a pathway for manufacturers to significantly increase operational efficiency and gain competitive advantage. The burgeoning market for customized, low-volume, high-value components, especially in satellite technology and advanced diagnostics, offers significant growth potential for specialized providers.

Segmentation Analysis

The Precision Metal Parts Market is comprehensively segmented based on the primary manufacturing process used, the material composition of the final component, the specific application or end-user industry, and the geographic region. Process segmentation is crucial as it dictates achievable tolerances, cost structure, and production volume capabilities. Material segmentation reflects the performance requirements of the end product, distinguishing between common alloys and highly specialized, expensive superalloys. Application segmentation provides insights into major demand drivers, market maturity, and regulatory constraints across diverse sectors like Automotive, Aerospace, and Medical.

- By Manufacturing Process:

- CNC Machining (Turning, Milling, Grinding)

- Stamping and Fine Blanking

- Casting (Investment Casting, Die Casting)

- Metal Injection Molding (MIM)

- Additive Manufacturing (3D Printing)

- By Material:

- Steel (Stainless Steel, Carbon Steel)

- Aluminum and Aluminum Alloys

- Titanium and Titanium Alloys

- Nickel Superalloys

- Brass and Copper

- By Application:

- Automotive

- Aerospace and Defense

- Medical and Healthcare (Implants, Instruments)

- Electronics and Consumer Goods

- Industrial Machinery and Robotics

- Others (Oil & Gas, Telecommunications)

Value Chain Analysis For Precision Metal Parts Market

The value chain for precision metal parts begins with upstream analysis, focusing on the sourcing and preparation of specialized raw materials. This stage is dominated by large mining corporations and specialized alloy producers that supply high-grade materials such as medical-grade titanium, high-strength stainless steel, and nickel-based superalloys. Material quality and certification (e.g., adherence to ASTM or ISO standards) are paramount here, significantly impacting the downstream precision manufacturing process. Suppliers who can offer consistent quality, material traceability, and metallurgical expertise hold substantial leverage in the initial phase of the value chain. Procurement contracts often focus on long-term supply agreements due to the specialized nature and fluctuating costs of these metals.

Midstream activities involve the precision manufacturing and processing phase, encompassing specialized equipment providers (e.g., DMG Mori, Mazak for CNC; EOS, GE Additive for AM) and contract manufacturers. This phase adds the most value through high-skill operations like complex multi-axis machining, heat treatment, surface finishing, and rigorous metrology (measurement and inspection). Direct distribution often occurs for custom, high-value components where the original equipment manufacturer (OEM) directly purchases from the precision parts manufacturer under strict contracts. Indirect channels utilize specialized industrial distributors or sales agents, particularly for standard components or lower-volume industrial applications. The complexity and criticality of the parts largely dictate whether a direct or indirect channel is utilized.

Downstream analysis focuses on the integration of the precision parts into final products by Original Equipment Manufacturers (OEMs) across target industries (Automotive, Aerospace, Medical). Customer feedback loops are critical at this stage, influencing design revisions and process improvements. The final link involves service and maintenance, where the long-term reliability of the precision parts affects the overall lifespan and operational cost of the end product. Traceability and documentation are essential throughout the entire chain, linking the final product back to the specific batch of raw material and the exact manufacturing parameters used, which is non-negotiable in highly regulated sectors like aerospace and medical devices.

Precision Metal Parts Market Potential Customers

The potential customers for the Precision Metal Parts Market are primarily Original Equipment Manufacturers (OEMs) and large Tier 1 suppliers operating in technology-intensive, quality-sensitive sectors that require components with minimal defect rates and high durability. The Automotive industry is a massive consumer, particularly customers engaged in the production of electric vehicles (EVs), hybrid systems, advanced driver-assistance systems (ADAS), and complex engine management components. These buyers prioritize lightweight materials, tight tolerances, and high-volume consistency, driving demand for MIM and CNC-machined parts used in battery enclosures and power electronics.

A second major customer base resides within the Aerospace and Defense sectors, including commercial aircraft manufacturers (e.g., Boeing, Airbus), jet engine producers (e.g., Rolls-Royce, GE Aviation), and defense contractors. These customers demand parts made from superalloys and titanium, requiring high-temperature resistance, fatigue strength, and stringent certification (AS9100). Buyers in this segment often require long-term partnership agreements and necessitate capabilities in exotic materials and complex geometries often best achieved through five-axis machining or directed energy deposition (DED) 3D printing.

The third critical group includes medical device manufacturers and pharmaceutical equipment producers. Customers here are focused on components for surgical robotics, orthopedic and dental implants, and drug delivery systems. Biocompatibility, sterile manufacturing environments, and extreme precision are prerequisites, favoring materials like medical-grade titanium and stainless steel. These customers seek suppliers with ISO 13485 certification and robust quality management systems. Furthermore, high-tech industrial machinery manufacturers and major players in consumer electronics (for miniaturized connectors and enclosures) also constitute significant and growing customer segments, emphasizing volume scalability and cost-effective precision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 210.5 billion |

| Market Forecast in 2033 | USD 330.4 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd., FANUC Corporation, Precision Castparts Corp., ThyssenKrupp AG, GKN Sinter Metals, Bharat Forge, Barnes Group Inc., NN Inc., SeAH Besteel, Sumitomo Electric Industries, Schunk GmbH, Linamar Corporation, Metal Powder Products, Inc., Precision Engineering Inc., Custom Metal Fabrication. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Metal Parts Market Key Technology Landscape

The technological landscape of the Precision Metal Parts Market is characterized by the convergence of traditional high-precision machining with advanced digital and additive manufacturing techniques. Computer Numerical Control (CNC) remains the foundational technology, but it is evolving rapidly. Modern CNC systems incorporate five-axis and multi-tasking capabilities, allowing for the simultaneous completion of complex parts with exceptional surface finish and sub-micron tolerances, minimizing fixturing errors and part handling. Crucially, these machines are now highly connected through IoT sensors, enabling real-time performance monitoring and data feedback critical for process control and quality assurance, forming the core of smart factory initiatives.

Additive Manufacturing (AM), particularly Metal Powder Bed Fusion (PBF) and Binder Jetting, represents a disruptive technological shift. While AM currently holds a smaller market share, its importance is growing due to its ability to produce parts with complex internal structures (e.g., internal cooling channels) and customized geometries that minimize material waste. Hybrid manufacturing systems, combining AM with CNC machining within a single platform, are emerging to address the common challenge of surface finish in 3D-printed parts. This allows manufacturers to leverage AM's geometric freedom while using high-precision subtractive methods for critical interface features, ensuring the final part meets the required tolerance specifications without extensive post-processing steps.

Furthermore, metrology and inspection technologies are integral to the precision metal parts landscape. Non-contact measurement systems, such as advanced Coordinate Measuring Machines (CMMs) with optical scanners and X-ray computed tomography (CT) scanning, are essential for verifying the internal structure and dimensional accuracy of complex parts without destruction. Coupled with advanced statistical process control (SPC) software, these technologies ensure zero-defect manufacturing standards required by aerospace and medical industries. The ongoing push involves integrating these measurement systems directly into the production line, utilizing AI to interpret real-time data and provide instantaneous compensation adjustments to the machining processes, thereby closing the loop on manufacturing quality control.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by large-scale manufacturing activities in China, India, Japan, and South Korea. China’s massive electronics and automotive production base, coupled with government initiatives promoting advanced manufacturing (e.g., Made in China 2025), ensures sustained high demand. Japan and South Korea lead in adopting advanced processes like Metal Injection Molding (MIM) for consumer electronics and high-end automotive components. The region benefits from lower operating costs and robust supply chain networks, positioning it as the global hub for high-volume precision parts manufacturing.

- North America: North America, particularly the United States, focuses on high-value, high-technology segments, notably Aerospace & Defense and Medical Devices. Growth here is characterized by heavy investment in Additive Manufacturing technologies and smart factory integration to enhance domestic production resilience. The stringent regulatory environment necessitates superior quality control and material traceability, leading to a premium market structure. Demand is further solidified by significant federal spending on defense modernization and strong R&D activities in specialized superalloys and complex machining techniques.

- Europe: Europe holds a strong position, particularly in the premium Automotive (Germany, Italy), Industrial Machinery, and Medical sectors. The region is driven by strict environmental regulations and a focus on sustainable manufacturing practices, pushing innovation in lightweight materials and energy-efficient production processes. Germany, the manufacturing powerhouse, is a leader in high-end CNC machining and specialized tooling. The implementation of Industry 4.0 concepts is highly advanced, utilizing connectivity and automation to maintain global competitiveness despite higher labor costs.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, is growing steadily, primarily driven by automotive assembly (Mexico) and infrastructure investment (Brazil). While highly specialized parts are often imported, there is increasing domestic capability in standardized precision stamping and basic machining. Market growth is closely tied to foreign direct investment in local manufacturing plants and shifts in commodity pricing impacting the industrial sector.

- Middle East and Africa (MEA): Growth in MEA is concentrated in sectors related to Oil & Gas, infrastructure development, and defense modernization. Demand for high-precision components often involves specialized parts resistant to extreme heat and corrosion, crucial for energy exploration and refining. The UAE and Saudi Arabia are investing in developing localized defense and aerospace manufacturing capabilities, creating pockets of high-demand for sophisticated machining processes, though the region remains a net importer of complex precision parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Metal Parts Market.- Precision Castparts Corp. (PCC)

- GKN Sinter Metals (Melrose Industries)

- Hitachi Metals Ltd.

- ThyssenKrupp AG

- Metal Powder Products, Inc. (MPP)

- MIM-Tech Asia Co. Ltd.

- Bharat Forge

- Linamar Corporation

- Schunk GmbH

- NN Inc.

- FANUC Corporation

- Sumitomo Electric Industries

- SeAH Besteel

- Barnes Group Inc.

- Bumatech AG

- Dongguan Mentech Optical & Magnetic Co., Ltd.

- Kennametal Inc.

- Custom Metal Fabrication

- Precision Engineering Inc.

- ARC Group Worldwide

Frequently Asked Questions

Analyze common user questions about the Precision Metal Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Precision Metal Parts Market?

The market growth is primarily driven by the exponential demand from the electric vehicle (EV) sector, the increasing need for miniaturization and high-performance components in medical devices (implants and surgical robotics), and global defense modernization requiring lightweight, complex superalloy parts.

Which manufacturing technology is showing the fastest growth rate in the market?

Additive Manufacturing (3D Printing), particularly Metal Powder Bed Fusion (PBF) and Binder Jetting, is exhibiting the highest growth rate, offering unparalleled geometric complexity and customization for prototyping and low-volume, high-value applications in aerospace and medical sectors.

How does the shift to electric vehicles (EVs) impact the demand for precision metal components?

The EV transition increases demand for precision components used in battery thermal management systems, power electronics, motor stators, and complex braking systems. While powertrain parts change, EVs require more high-precision, corrosion-resistant components for optimal energy efficiency and weight reduction compared to internal combustion engines.

What role does AI play in modern precision metal parts manufacturing?

AI integrates through Generative Design tools to optimize part geometry, machine learning for predictive maintenance to minimize downtime, and automated visual inspection systems to ensure zero-defect quality control, fundamentally improving efficiency and reducing scrap rates in high-tolerance operations.

Which region dominates the global Precision Metal Parts Market, and why?

The Asia Pacific (APAC) region dominates the market due to its large-scale electronics and automotive manufacturing bases, rapid industrialization, lower operating costs, and significant governmental investment in advanced manufacturing technologies, particularly in China and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager