Precision Reduction Gears Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433584 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Precision Reduction Gears Market Size

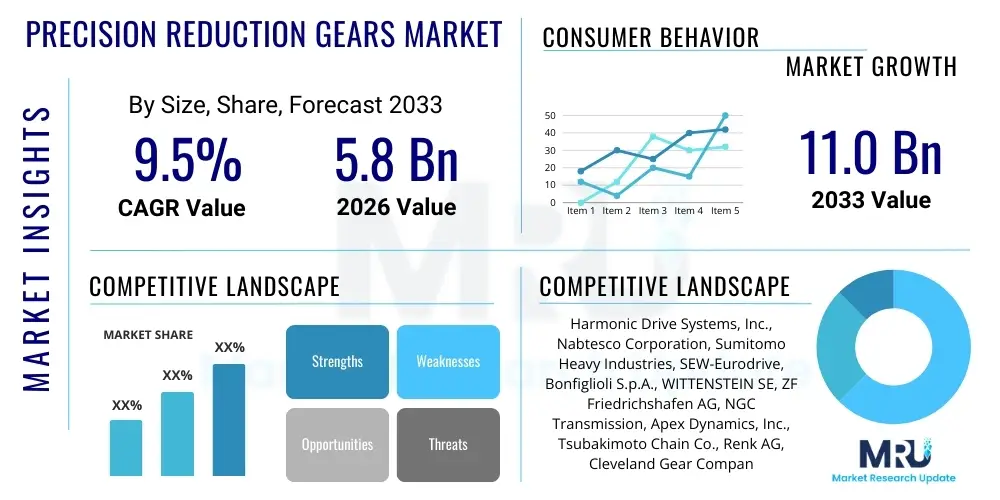

The Precision Reduction Gears Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $11.0 Billion by the end of the forecast period in 2033.

Precision Reduction Gears Market introduction

Precision reduction gears are highly sophisticated mechanical components engineered to provide high torque density, exceptional accuracy, and minimal backlash, primarily serving as the critical interface between high-speed motors and the application mechanism. These components are indispensable in demanding environments such as industrial robotics, aerospace systems, high-precision machine tools, and specialized medical devices where positional accuracy and reliable speed reduction are paramount. The design complexity, often involving specialized gear geometries like cycloidal or harmonic drive systems, differentiates them significantly from standard industrial gearboxes, enabling them to achieve reduction ratios that are crucial for modern automation applications requiring precise control over motion profiles.

The primary function of these gear systems is to convert the high rotational speed and low torque output of electric motors into the necessary low speed and significantly high torque required to move large loads or execute delicate, accurate maneuvers. Key applications across the industrial spectrum include the joint actuators in articulated robots, the rotational stages in semiconductor manufacturing equipment, and the drive mechanisms in CNC machining centers. The increasing global push toward full automation, driven by competitive manufacturing pressures and the need for higher throughput, establishes a foundational demand for these precise motion control solutions, emphasizing durability and long operational lifetimes under constant load conditions.

Major driving factors fueling the expansion of this market include the relentless growth of the industrial robotics sector, particularly in Asia Pacific, the accelerated adoption of automated material handling systems in logistics and e-commerce warehouses, and the technological advancements in surgical and collaborative robotics. The benefits offered by precision reduction gears—specifically, their compact size relative to the torque they transmit, coupled with outstanding repeatability—are non-negotiable requirements for next-generation automated systems. Furthermore, ongoing innovation in gear materials, heat treatment processes, and lubrication technologies continuously enhances performance parameters, making these gears lighter, stronger, and more energy-efficient, thereby reinforcing their critical role in the architecture of Industry 4.0 infrastructure worldwide.

Precision Reduction Gears Market Executive Summary

The global precision reduction gears market is experiencing dynamic shifts, characterized by strong vertical integration among key players striving to control the specialized manufacturing processes necessary for achieving ultra-low backlash specifications. Business trends indicate a heightened focus on modular design and customization, catering specifically to the rapidly evolving needs of collaborative robots (cobots) which require lighter, quieter, and safer drive systems. Furthermore, there is a distinct competitive trend involving the optimization of supply chain resilience, moving away from geographically concentrated manufacturing hubs to mitigate geopolitical risks and ensure stable component availability for major robotic and machine tool manufacturers globally. This strategic adjustment aims to solidify long-term partnerships between gear manufacturers and original equipment manufacturers (OEMs), providing sustained revenue growth based on reliable component supply and technological co-development.

Regionally, the market exhibits pronounced disparity, with the Asia Pacific (APAC) region maintaining its dominance, fueled primarily by the robust expansion of manufacturing automation in China, South Korea, and Japan. These economies are massive consumers and developers of industrial robotics and high-speed CNC machinery, establishing APAC as the epicenter for both demand and innovation in precision gear technology. Meanwhile, North America and Europe demonstrate steady, quality-driven growth, emphasizing high-end, niche applications such as aerospace, medical robotics, and advanced electric vehicle production lines, where the stringent requirements for reliability and longevity justify the higher initial investment in premium gear solutions. Emerging markets in Latin America and the Middle East, though smaller, are showing accelerated adoption rates, especially in sectors aiming to modernize oil and gas processing and general manufacturing infrastructure.

Segmentation trends highlight the increasing polarization between different precision gear types. Harmonic drives are witnessing exceptionally high growth, driven by their unmatched accuracy and compact nature, making them ideal for the smaller, more articulate joints of modern collaborative robots. Conversely, cycloidal drives maintain a strong foothold in high-load, high-impact applications such as heavy-duty industrial manipulators and large machine tools, valued for their intrinsic rigidity and overload capacity. Planetary gears, offering a balance of performance and cost-effectiveness, continue to dominate in applications requiring moderate precision and high throughput. The overall market trajectory is defined by the synergistic relationship between the proliferation of automation technologies and the continuous engineering refinements aimed at improving gear efficiency, reducing total cost of ownership, and extending maintenance cycles across all major product categories.

AI Impact Analysis on Precision Reduction Gears Market

Common user questions regarding AI's impact on the precision reduction gears market center around optimizing gear design parameters, predicting failure modes accurately, and enhancing the overall efficiency of integrated robotic systems. Users are keenly interested in how Artificial Intelligence can move maintenance practices from reactive or scheduled intervention to truly predictive strategies, maximizing gear operational uptime. Specifically, there is high anticipation concerning the use of machine learning algorithms to analyze massive datasets generated by sensors embedded in gearboxes, allowing engineers to identify minute acoustic, vibration, or thermal anomalies that precede catastrophic failure. This capability promises significant reductions in maintenance costs and substantial improvements in manufacturing line continuity, directly addressing core concerns about reliability and total ownership cost in high-precision environments.

The integration of AI is fundamentally transforming both the design phase and the operational lifetime management of precision reduction gears. In design, Generative AI models are utilized to explore complex design spaces far beyond traditional simulation capabilities, optimizing parameters such as tooth profile, material selection, and housing geometry simultaneously to minimize backlash and maximize torque density while reducing weight. Operationally, AI-driven diagnostics are becoming standard, where algorithms continuously monitor gear performance signatures in real-time. By comparing current operating data against historical failure patterns and optimal performance benchmarks, the AI system can issue highly specific and actionable alerts, predicting not just that a failure might occur, but precisely which component within the gear train is likely to degrade first.

Furthermore, AI plays a crucial role in optimizing the integration of the gear system within the broader robotic or machine architecture. Machine learning techniques are applied to motion control algorithms to compensate dynamically for minor inherent gear imperfections (like residual backlash or torsional stiffness variations) during complex motion paths. This level of dynamic compensation allows the robot or machine tool to achieve higher levels of absolute positional accuracy than the hardware alone could deliver, thereby raising the performance ceiling for automated systems. This AI-enhanced precision is increasingly critical for applications in semiconductor fabrication, micro-assembly, and complex surgical procedures, driving a new wave of demand for 'smart' gear systems equipped with embedded processing and communication capabilities.

- AI-driven predictive maintenance optimizes gear operational lifespan and minimizes unplanned downtime.

- Generative Design algorithms accelerate the creation of lighter, stronger, and backlash-optimized gear geometries.

- Machine learning enhances real-time motion control by compensating for mechanical tolerances and imperfections.

- AI facilitates defect detection in manufacturing through automated optical inspection and acoustic analysis of gear testing.

- Integration of smart sensors and edge computing enables localized data processing for immediate condition monitoring.

DRO & Impact Forces Of Precision Reduction Gears Market

The market for precision reduction gears is strongly propelled by the escalating global trend of industrial automation (Drivers), particularly in emerging economies seeking efficiency gains and quality consistency in their manufacturing output. However, this growth is significantly tempered by the inherent complexity and substantial capital investment required for high-precision manufacturing processes (Restraints), leading to high component costs and limited scalability for smaller manufacturers. Opportunities arise from untapped sectors, such as the increasing commercialization of service robotics, advancements in high-throughput satellite communication systems, and the shift towards fully automated electric vehicle assembly lines, which demand robust, high-torque density solutions. These internal and external pressures collectively constitute the Impact Forces shaping strategic decisions, necessitating continuous investment in specialized machining and material science to maintain competitive advantages and satisfy stringent application requirements.

Key drivers include the proliferation of Industry 4.0 initiatives, which mandates highly reliable and networked machinery, and the rapid deployment of collaborative robots across various industries, necessitating compact and low-backlash actuators. The demographic shift towards aging populations in developed nations also drives investment in automation to mitigate labor shortages, further stimulating demand. Coupled with this is the continuous decline in the price of electric motors and control electronics, making the adoption of sophisticated automated systems financially viable for a broader range of industrial users. The convergence of these factors creates a sustained, foundational demand curve for precision mechanical components capable of handling continuous, high-duty cycles with unwavering accuracy.

Restraints primarily revolve around the severe technical challenges associated with maintaining micron-level tolerances during gear manufacturing, which requires specialized climate-controlled environments and extremely expensive, dedicated machine tools. The long lead times for custom orders, coupled with dependency on specialized raw materials (e.g., high-grade alloy steels), can also pose supply chain bottlenecks, particularly during periods of high global demand volatility. Nevertheless, significant opportunities exist in developing hybrid gear designs that combine the strengths of different types (e.g., planetary-harmonic combinations) to achieve optimal performance footprints for specific applications like drone propulsion systems or advanced defense mechanisms. Furthermore, the push towards miniaturization in medical devices and wearable robotics opens lucrative, high-margin avenues for ultra-compact precision gear systems.

Segmentation Analysis

The precision reduction gears market is comprehensively segmented based on Type, Application, and End-Use Industry, reflecting the diverse technical requirements across the manufacturing landscape. Segmentation by Type differentiates between the core technologies: Harmonic Drive (Strain Wave Gearing), Cycloidal Drive, and Planetary Gear Systems. Harmonic drives command a premium due to their superior zero-backlash characteristics, favoring intricate robotic joints and high-accuracy positioning systems. Cycloidal drives are recognized for their exceptional durability and high overload capacity, commonly applied in heavy-duty machinery. Planetary gears provide a modular, scalable solution, dominating segments where cost-performance balance is key, such as general industrial automation and standard machine tool applications.

Analyzing the market by Application reveals the distribution of demand across major industrial verticals. Robotics remains the most significant application, encompassing both industrial articulated robots and the fast-growing segment of collaborative robotics, which imposes rigorous demands for lightweight and low-noise gears. Machine Tools, particularly high-speed CNC centers and precision grinding equipment, represent another critical segment, demanding high stiffness and rotational accuracy to ensure surface finish quality. Other applications include semiconductor manufacturing equipment, demanding ultra-clean and highly repetitive performance, and specialized systems in the aerospace and defense sectors, where reliability under extreme conditions is non-negotiable.

The End-Use Industry segmentation further refines the understanding of market consumption patterns, distinguishing between automotive, electronics and semiconductor, aerospace and defense, and heavy machinery sectors. The automotive industry, driven by the shift towards electric vehicle production and automation of assembly lines, is a major consumer. The electronics sector, particularly in the production of smartphones and complex circuit boards, relies heavily on high-speed, high-precision robotic arms powered by compact reduction gears. This detailed segmentation allows manufacturers to tailor their product offerings, R&D investments, and market strategies to address the distinct technical specifications and purchasing dynamics of each specific industry vertical.

- By Type:

- Harmonic Drive (Strain Wave Gearing)

- Cycloidal Drive

- Planetary Gear

- Other Specialized Gear Systems (e.g., Hypoid, Worm)

- By Application:

- Industrial Robotics

- Collaborative Robotics (Cobots)

- Machine Tools (CNC Machining Centers)

- Semiconductor Manufacturing Equipment

- Aerospace and Defense Systems

- Medical and Surgical Robotics

- Automation Equipment and Material Handling

- By End-Use Industry:

- Automotive Manufacturing

- Electronics and Semiconductor

- Aerospace and Defense

- Heavy Machinery and Construction

- Food and Beverage Processing

- Pharmaceutical and Medical Devices

Value Chain Analysis For Precision Reduction Gears Market

The value chain for the precision reduction gears market is highly specialized and generally spans from the sourcing of high-grade raw materials to complex, multi-stage manufacturing, culminating in distribution and extensive after-sales support. The upstream segment involves the procurement of specialized alloy steels, often requiring precise chemical compositions and metallurgical treatments, along with high-performance lubricants and specialized bearing components. Due to the high-tolerance requirements, raw material quality significantly dictates the final product performance, leading to strong reliance on certified suppliers capable of delivering consistent, traceable materials. Strategic partnerships at this stage are crucial for controlling costs and ensuring the integrity of the finished gear units.

The midstream phase, encompassing manufacturing and assembly, represents the most complex and value-adding step. This involves highly specialized processes such as sophisticated CNC gear cutting (hobbing and shaping), precision grinding, heat treatment (carburizing, nitriding), and final superfinishing techniques to achieve the required surface roughness and geometrical accuracy. Quality control, including non-contact metrology and specialized backlash testing, is critical to certify the gear performance before integration. Distribution channels are bifurcated, involving direct sales to major OEMs (Original Equipment Manufacturers) who integrate the gears into their robotics or machine tools, and indirect sales through specialized industrial distributors and system integrators who cater to smaller manufacturers and the maintenance, repair, and overhaul (MRO) market.

The downstream activities focus heavily on installation support, maintenance training, and the provision of replacement parts, especially for mission-critical applications like semiconductor fabrication or surgical robotics. Direct distribution to OEMs is often preferred due to the customized nature of high-precision gears, allowing for technical collaboration and optimization during the design phase of the end product. Indirect channels leverage specialized knowledge networks to provide regional access and timely MRO services. The effectiveness of the value chain is highly dependent on managing intellectual property related to proprietary gear designs and maintaining extremely tight control over the precision manufacturing environment to guarantee component reliability and performance consistency.

Precision Reduction Gears Market Potential Customers

The core customer base for precision reduction gears comprises entities heavily invested in advanced manufacturing, where automation and positional accuracy are key competitive differentiators. Industrial automation companies, particularly those specializing in the design and production of multi-axis articulated robotic arms, constitute the largest end-user segment. These customers require gearboxes that offer the highest torque-to-weight ratio and minimal backlash to ensure the robot can execute complex, repetitive tasks, such as welding, painting, or component picking, with unwavering repeatability over millions of cycles. The buying criteria here prioritize technical specifications, long-term reliability metrics, and the ability of the supplier to handle high-volume orders with consistent quality control.

A secondary, yet rapidly expanding, customer cluster includes manufacturers of high-end machine tools and specialized semiconductor processing equipment. Machine tool builders need exceptionally rigid and accurate gears for the feed axes and indexing tables of CNC machines, as gear performance directly impacts the dimensional accuracy and surface finish quality of the parts being produced. Semiconductor fabrication equipment manufacturers require gears with ultra-low vibration and particulate generation (essential for cleanroom environments) for precise wafer handling and positioning systems. These sectors are characterized by extremely stringent quality audits and long qualification periods, emphasizing technological leadership and certified compliance over marginal cost savings.

Furthermore, emerging and high-growth sectors such as medical device manufacturing and aerospace engineering represent high-value potential customers. Medical device companies purchasing gears for surgical robots and diagnostic imaging systems demand flawless safety records, compact size, and biocompatible material consideration where applicable. Aerospace and defense contractors require gears certified for extreme environmental conditions (temperature, vibration, vacuum), utilizing them in satellite mechanisms, missile guidance systems, and complex actuation systems. These customers typically engage in long-term procurement contracts, placing immense value on material traceability, component longevity, and adherence to regulatory standards like ISO and AS9100, driving manufacturers toward continual innovation in specialized materials and verifiable testing protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $11.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harmonic Drive Systems, Inc., Nabtesco Corporation, Sumitomo Heavy Industries, SEW-Eurodrive, Bonfiglioli S.p.A., WITTENSTEIN SE, ZF Friedrichshafen AG, NGC Transmission, Apex Dynamics, Inc., Tsubakimoto Chain Co., Renk AG, Cleveland Gear Company, KHK Gears, GAM Enterprises, Rexroth (Bosch), Ewellix, Cone Drive, Ochiai Co., Ltd., SPINEA s.r.l., Shimpo Nidec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Reduction Gears Market Key Technology Landscape

The technological landscape of the precision reduction gears market is continuously evolving, driven primarily by the necessity for greater precision, higher torque density, and improved durability within smaller form factors. A key area of innovation involves advanced manufacturing processes, specifically focusing on ultra-precision machining techniques such such as superfinishing and lapping, which are employed after initial gear cutting to reduce surface irregularities to sub-micron levels. This surface refinement is crucial for minimizing friction, reducing operational noise, and extending the fatigue life of the gear components under high-stress cyclical loading. Furthermore, innovations in specialized heat treatment methods, like proprietary vacuum carburizing, are essential for creating an extremely hard surface layer while maintaining a tough, ductile core, ensuring the gear can handle both surface wear and high internal stresses.

Material science represents another crucial technological frontier, with manufacturers increasingly utilizing advanced alloy steels, often doped with elements like chromium, molybdenum, and vanadium, to achieve superior mechanical properties. There is also growing interest in incorporating non-traditional materials, such as ceramic compounds or high-performance polymers, particularly in applications requiring reduced weight, improved corrosion resistance, or non-magnetic properties, such as in highly specialized defense or medical imaging equipment. Furthermore, the development of new synthetic lubricants specifically formulated for high-contact stress and wide temperature ranges is critical to maintaining peak efficiency and preventing premature wear in these tightly constrained mechanical systems, addressing the stringent performance expectations of modern robotics.

The integration of smart technology constitutes a rapidly developing trend, transitioning precision reduction gears from passive mechanical components to active, networked systems. This involves embedding miniature sensors—such as accelerometers for vibration analysis, temperature probes, and acoustic emission sensors—directly within the gear housing or mounting structure. These sensors enable continuous condition monitoring, providing the raw data necessary for AI-driven predictive maintenance algorithms. The ability of the gear unit to communicate its operational health status via integrated I/O links is becoming standard practice, enabling seamless integration into factory management and SCADA systems, thus supporting the broader goals of connected manufacturing infrastructure under Industry 4.0 protocols.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market segment, primarily driven by the colossal manufacturing bases in China, Japan, and South Korea, which lead in the deployment of industrial robotics and high-volume factory automation. China’s "Made in China 2025" strategy and significant government investment in smart manufacturing ensure sustained, aggressive growth in the consumption of high-precision components, especially cycloidal and planetary gears for assembly lines and machine tools. Japan and South Korea, being technological hubs, focus on premium, compact harmonic drives for next-generation collaborative robotics and high-accuracy semiconductor fabrication. The region serves as both the largest consumer and a critical global production center for these gears.

- North America: North America represents a mature, high-value market characterized by a strong emphasis on technological sophistication, particularly in aerospace, medical robotics, and advanced electric vehicle manufacturing. The demand here is less focused on volume and more on ultra-high performance, specialized materials, and compliance with rigorous regulatory standards. Investment in R&D, coupled with the rising defense expenditure, drives robust demand for custom-engineered precision gear systems capable of operating reliably in extreme and mission-critical environments. Key growth areas include surgical robots and advanced industrial automation for complex, low-volume manufacturing.

- Europe: Europe, particularly Germany and Italy, holds a significant market share due to its established leadership in advanced machine tools, specialized automotive production, and general industrial machinery engineering. European manufacturers place a high priority on energy efficiency, precision, and longevity, often leading to early adoption of integrated smart gearboxes equipped with diagnostic features. Regulations promoting worker safety and high-efficiency manufacturing systems further accelerate the demand for precise and reliable drive technology. The region is a key exporter of high-quality industrial machinery containing precision gear units.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets showing gradual but steady growth, primarily focused on modernizing existing industrial infrastructure, particularly in oil and gas, mining, and general consumer goods manufacturing. Adoption rates are currently lower than in developed regions, constrained by capital investment readiness, but the strategic shift towards automation to improve operational safety and efficiency is projected to drive increasing demand for standard planetary and cycloidal gear solutions over the forecast period, supported by localized system integration partners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Reduction Gears Market.- Harmonic Drive Systems, Inc.

- Nabtesco Corporation

- Sumitomo Heavy Industries

- SEW-Eurodrive

- WITTENSTEIN SE

- Bonfiglioli S.p.A.

- ZF Friedrichshafen AG

- NGC Transmission

- Apex Dynamics, Inc.

- Tsubakimoto Chain Co.

- Renk AG

- Cleveland Gear Company

- KHK Gears

- GAM Enterprises

- Rexroth (Bosch)

- Ewellix

- Cone Drive

- Ochiai Co., Ltd.

- SPINEA s.r.l.

- Shimpo Nidec

Frequently Asked Questions

Analyze common user questions about the Precision Reduction Gears market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Harmonic Drive and Cycloidal Drive precision gears?

The primary difference lies in design and application focus. Harmonic Drives (Strain Wave Gearing) offer near-zero backlash, extremely high reduction ratios in a single stage, and a very compact form factor, making them ideal for articulated robotic joints demanding superior positional accuracy. Cycloidal Drives are favored for applications requiring high rigidity, exceptional shock load resistance, and durability, typically utilized in heavier industrial machinery and large manipulators due to their robust design and overload tolerance.

How does the shift towards Collaborative Robotics (Cobots) influence precision gear requirements?

The growth of Collaborative Robotics necessitates precision gears that prioritize small size, low weight, and quiet operation, often demanding higher efficiency and inherent safety features compared to traditional industrial robots. Cobots primarily rely on highly compact Harmonic Drives and specific planetary gear designs to ensure the required smooth motion, low heat generation, and zero-backlash control crucial for safe human-robot interaction within shared workspaces.

Which technological factors are most critical for reducing backlash in high-precision gears?

Backlash reduction is achieved through a combination of ultra-precision manufacturing and specialized design. Critical factors include using advanced CNC gear grinding and honing techniques to achieve sub-micron tolerances on tooth profiles, applying pre-loaded bearing arrangements, and implementing unique design geometries such as those found in strain wave or zero-backlash planetary systems. Material rigidity and thermal stability are also crucial in maintaining precision under operational load variations.

What role does the automotive industry play in driving market demand for precision reduction gears?

The automotive industry is a key driver due to the rapid automation of high-volume assembly lines and the substantial investment in electric vehicle (EV) manufacturing. Precision gears are indispensable in robot arms performing welding, painting, and high-tolerance component placement, and increasingly, they are utilized within specialized testing equipment and battery assembly systems that require repeatable, high-speed motion control to maintain quality and production throughput.

What are the typical lifespan and maintenance considerations for precision reduction gears?

Precision reduction gears typically offer very long operational lifespans, often rated for tens of thousands of operating hours or millions of cycles, depending on the application and load profile. Maintenance is minimized in modern sealed units, which often use lifetime lubrication. The primary maintenance consideration revolves around continuous condition monitoring (often via embedded sensors and AI analytics) to detect early signs of bearing wear or lubricant degradation, facilitating predictive replacement rather than traditional scheduled maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager