Precision Ultrasonic Flaw Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436023 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Precision Ultrasonic Flaw Detector Market Size

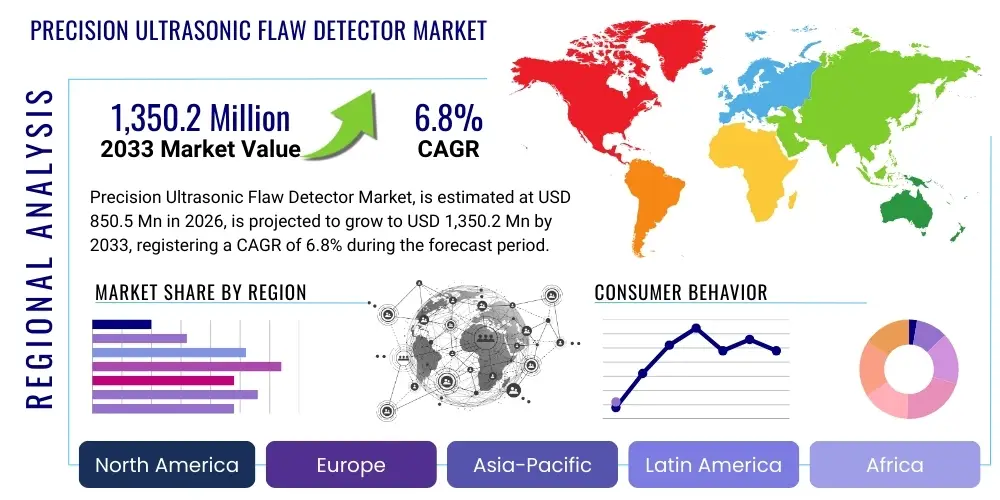

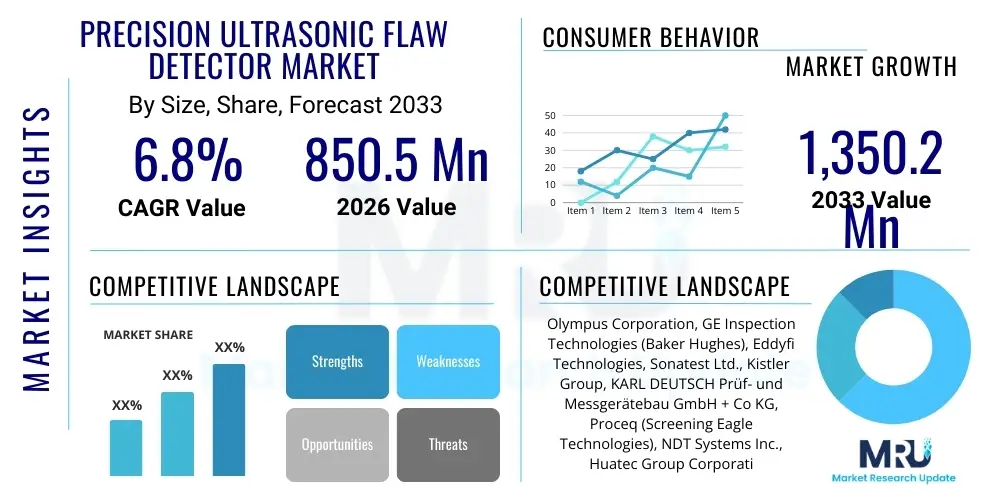

The Precision Ultrasonic Flaw Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,350.2 Million by the end of the forecast period in 2033.

Precision Ultrasonic Flaw Detector Market introduction

The Precision Ultrasonic Flaw Detector Market encompasses devices utilizing high-frequency sound waves (ultrasound) to perform non-destructive testing (NDT) on materials, components, and structures. These detectors are engineered for high-resolution inspection, primarily used to identify internal flaws such as cracks, voids, inclusions, and discontinuities, as well as to measure material thickness and assess bond integrity. Their precision capabilities—often involving advanced techniques like phased array, time-of-flight diffraction (TOFD), and automated scanning systems—are crucial for ensuring the structural integrity and quality assurance in mission-critical applications where failure is unacceptable.

Major applications driving the demand for these precision instruments include the rigorous inspection of welds in pipelines, pressure vessels, and shipbuilding structures, quality control in aerospace component manufacturing (e.g., turbine blades and composite materials), and ongoing monitoring within the oil and gas infrastructure. The primary benefit of using precision ultrasonic flaw detectors is their ability to provide instantaneous, accurate, and reproducible results without causing damage to the material under test, significantly enhancing safety, extending asset lifespan, and reducing operational costs associated with material failure. Furthermore, the portability and digital data acquisition capabilities of modern detectors enhance their utility across diverse field and laboratory environments.

The market growth is fundamentally driven by the escalating global focus on industrial safety standards, stringent regulatory mandates across sectors like nuclear energy and aviation, and the increasing need for predictive maintenance strategies. The continuous introduction of advanced materials, such as complex composites and high-strength alloys, necessitates more sophisticated and precise NDT tools, propelling innovation in detector technology, software integration, and data interpretation, thereby solidifying the market’s expansion trajectory throughout the forecast period.

Precision Ultrasonic Flaw Detector Market Executive Summary

The Precision Ultrasonic Flaw Detector Market exhibits robust growth, catalyzed by mandatory safety regulations and the aging infrastructure across developed and developing economies, necessitating routine and highly accurate non-destructive testing. Business trends indicate a strong shift towards automated and semi-automated inspection solutions, particularly those leveraging Phased Array Ultrasonic Testing (PAUT) and Full Matrix Capture (FMC)/Total Focusing Method (TFM) technologies, which offer superior volumetric inspection capabilities and detailed imaging. Key strategic moves by market leaders include developing cloud-integrated NDT systems for remote monitoring and implementing user-friendly interfaces to address the skilled labor shortage in inspection services. This focus on connectivity and digitalization is transforming traditional inspection workflows into integrated digital asset management processes, creating significant value for end-users seeking operational efficiency and comprehensive data traceability.

Regionally, Asia Pacific is forecasted to be the fastest-growing market, primarily due to massive infrastructure projects, burgeoning manufacturing sectors in countries like China and India, and significant investments in shipbuilding and petrochemical refining capacity. North America and Europe remain mature markets, characterized by high adoption rates of advanced, highly precise detection systems, driven by strict aerospace and automotive quality assurance standards and the ongoing maintenance and modernization of critical energy pipelines and power generation facilities. Segment-wise, the Phased Array segment dominates due to its versatility and speed in complex geometries, while the Oil & Gas and Aerospace sectors continue to be the largest revenue contributors, emphasizing the demand for high-reliability components and infrastructure integrity management.

Overall, the market is characterized by technological convergence, where hardware precision is increasingly complemented by sophisticated analytical software and integration with artificial intelligence for enhanced defect recognition and reporting. This convergence addresses the industry's demand for faster inspection times, higher data quality, and reduced human error, positioning precision ultrasonic flaw detection as an indispensable tool in modern industrial quality control and asset integrity management, ensuring sustainable growth across all major end-user verticals globally.

AI Impact Analysis on Precision Ultrasonic Flaw Detector Market

Common user questions regarding AI’s influence on the Precision Ultrasonic Flaw Detector Market center around automation of defect classification, the reliability of AI-driven interpretation compared to human expertise, the integration cost of AI software, and its role in handling the massive datasets generated by advanced techniques like PAUT and TFM. Users are primarily concerned about whether AI can reduce the subjectivity inherent in manual interpretation, thereby accelerating inspection throughput while maintaining or even exceeding accuracy standards. The key themes revolve around how machine learning algorithms can be trained to recognize subtle, complex defect patterns in various materials, and whether these systems can be seamlessly deployed in field environments, ensuring immediate, actionable insights for maintenance decisions without requiring constant human oversight, ultimately striving for a fully autonomous NDT process.

- AI algorithms enable rapid, automated defect detection and classification, significantly reducing inspection time and minimizing human fatigue errors.

- Machine learning enhances signal processing and noise reduction, improving the precision and clarity of complex ultrasonic data (e.g., TFM and FMC scans).

- Predictive maintenance schedules are optimized through AI analysis of historical NDT data, correlating flaw growth rates with operational parameters.

- AI assists in generating comprehensive, standardized inspection reports, improving data traceability and regulatory compliance across global operations.

- The development of AI-powered digital twins allows for virtual simulation of inspection procedures, optimizing probe setup and material characterization.

- Deep learning models facilitate the automated calibration and verification of ultrasonic equipment, ensuring consistent measurement accuracy throughout service life.

- AI integration supports remote monitoring and diagnostics, allowing expert analysts to oversee multiple inspection sites simultaneously, enhancing resource efficiency.

DRO & Impact Forces Of Precision Ultrasonic Flaw Detector Market

The market for Precision Ultrasonic Flaw Detectors is substantially propelled by stringent regulatory frameworks mandating periodic inspection of critical infrastructure, particularly in the energy, aerospace, and nuclear sectors, creating a stable, continuous demand base. However, the complexity and high initial investment required for advanced systems like phased array and TFM act as primary restraints, especially for smaller inspection service providers or industrial facilities operating on tight budgets. Significant opportunities emerge from the increasing adoption of composite materials in automotive and aerospace manufacturing, which demand specialized ultrasonic solutions capable of detecting subtle subsurface delaminations and defects specific to anisotropic structures. These forces collectively exert a considerable impact, pushing manufacturers toward developing more cost-effective, portable, and user-friendly systems while maintaining the high precision required for advanced NDT applications globally.

The core impact forces shaping market growth include the globalization of manufacturing standards, which necessitates consistent quality control across supply chains, thereby driving the demand for standardized, precision detection equipment. Furthermore, the persistent threat of aging infrastructure failures (e.g., oil pipelines, power plant components) mandates proactive, high-resolution inspection protocols, favoring technologies that provide superior volumetric coverage and clear visualization of internal flaws. The necessity for predictive maintenance strategies over reactive repairs further amplifies the need for high-frequency, reliable precision ultrasonic testing, compelling industries to invest in advanced digital flaw detectors capable of long-term data logging and sophisticated trending analysis.

Technological advancement, characterized by higher resolution probes, integrated software platforms, and improved battery life for field operations, acts as an accelerating impact force. Conversely, the restraint posed by the shortage of skilled NDT technicians who can effectively interpret complex TFM or PAUT data subtly decelerates market expansion. Manufacturers are mitigating this restraint by designing highly intuitive interfaces and integrating AI-driven interpretation tools, striving to democratize the use of advanced precision ultrasonic technology, ensuring the sustained upward trajectory of the market.

Segmentation Analysis

The Precision Ultrasonic Flaw Detector Market is comprehensively segmented based on technology type, form factor, application, and end-user industry, allowing for targeted product development and market penetration strategies. Technology segmentation is critical, differentiating standard conventional ultrasonic testing (UT) from advanced methods like Phased Array Ultrasonic Testing (PAUT) and Time-of-Flight Diffraction (TOFD), which offer varying degrees of speed, accuracy, and complexity handling. Form factor segmentation addresses operational needs, classifying detectors as portable, benchtop, or integrated automated systems, directly correlating with inspection volume and mobility requirements. Analyzing these segments provides a nuanced understanding of industry preferences, highlighting the rapid transition toward advanced digital solutions capable of high data throughput and complex inspection scenarios.

The fastest-growing segments are typically those that offer improved inspection efficiency and higher data resolution, such as the Phased Array technology segment, driven by its ability to steer the beam electronically and inspect large areas quickly. Conversely, conventional UT remains essential due to its lower cost and simplicity for basic thickness gauging and manual weld inspection in less regulated environments. Geographically, segmentation highlights disparities in technological maturity and regulatory compliance; while developed regions focus on upgrading existing infrastructure with automated solutions, emerging economies prioritize deploying precision detectors for new construction and large-scale manufacturing quality control, demonstrating diverse needs across the value chain.

End-user segmentation reveals key consumption patterns, with the aerospace and oil & gas industries being primary adopters of the highest precision and most advanced detectors due to zero-tolerance defect policies. In contrast, the automotive and general manufacturing sectors increasingly utilize semi-automated systems for high-volume component inspection. This detailed segmentation analysis is crucial for stakeholders to tailor their product offerings, focusing on features like ruggedness for field use (Oil & Gas) or superior resolution for material analysis (Aerospace), thereby maximizing market relevance and capital efficiency.

- By Technology:

- Conventional Ultrasonic Testing (UT)

- Phased Array Ultrasonic Testing (PAUT)

- Time-of-Flight Diffraction (TOFD)

- Full Matrix Capture (FMC)/Total Focusing Method (TFM)

- By Form Factor:

- Portable/Handheld Detectors

- Benchtop/Stationary Detectors

- Integrated/Automated Systems

- By Application:

- Weld Inspection

- Corrosion Mapping

- Flaw Sizing and Location

- Thickness Measurement

- Bond Testing

- By End-User Industry:

- Oil and Gas

- Aerospace and Defense

- Power Generation (Nuclear, Thermal, Hydro)

- Automotive

- Manufacturing and Metal Fabrication

- Marine and Shipbuilding

Value Chain Analysis For Precision Ultrasonic Flaw Detector Market

The value chain for the Precision Ultrasonic Flaw Detector Market begins with upstream activities focusing on the procurement of specialized components, including high-frequency transducers (probes), advanced microprocessors, digital signal processors (DSPs), and specialized display technology. Key upstream suppliers include manufacturers of piezoelectric ceramics and high-performance computing chipsets, where technological differentiation in probe design (e.g., composite probes for better signal-to-noise ratio) is crucial. The core manufacturing stage involves the assembly, integration of proprietary software, calibration, and rigorous testing of the flaw detection units. Efficiency in this stage dictates the overall product quality and precision capability, with vertical integration being a competitive advantage for major OEMs.

The distribution channel plays a vital role in market reach. Precision ultrasonic flaw detectors are often high-capital expenditure items requiring significant technical support and training, favoring a hybrid distribution model. Direct sales channels are frequently employed for large government contracts, aerospace procurement, and major integrated NDT service providers, ensuring tailored solutions and direct technical liaison. Conversely, indirect distribution through specialized regional distributors, value-added resellers (VARs), and authorized rental companies is essential for reaching smaller enterprises and providing localized support, especially in geographically dispersed markets like Asia Pacific and Latin America.

Downstream activities center on the end-user adoption and post-sale service ecosystem. This includes NDT service companies that purchase the equipment and provide outsourced inspection services, and large industrial asset owners (e.g., petrochemical plants, airframe manufacturers) who maintain in-house NDT capabilities. Key downstream requirements involve ongoing technical support, software updates (especially for AI and TFM platforms), calibration services, and training programs to ensure end-users maximize the precision capabilities of the equipment. The performance and reliability of the device in demanding operational environments ultimately determine the success and repeat business across the entire value chain.

Precision Ultrasonic Flaw Detector Market Potential Customers

The primary consumers and end-users of Precision Ultrasonic Flaw Detectors span industries where material integrity and structural reliability are paramount, and where failure could result in catastrophic consequences, significant financial loss, or major regulatory penalties. These buyers typically include asset owners who operate critical infrastructure, such as national oil companies, major pipeline operators, nuclear power facility managers, and aerospace manufacturers requiring adherence to extremely strict quality assurance protocols like AS9100. Their purchasing decisions are heavily influenced by equipment certifications, compliance with international standards (e.g., ASTM, ISO), measurement resolution, and the detector’s capability to handle complex geometries and advanced materials like carbon fiber composites.

A secondary, yet crucial, segment of potential customers comprises Non-Destructive Testing (NDT) service companies. These firms purchase high-end precision detectors to offer third-party inspection, consulting, and certification services to various industrial clients who lack internal NDT expertise or equipment. These customers prioritize versatility, ruggedness, portability, and the ability of the detector to integrate seamlessly with various probes and automated scanning systems, maximizing utilization across diverse client sites. For NDT service providers, the total cost of ownership, including calibration and maintenance simplicity, is a significant determinant in procurement.

Furthermore, educational institutions, research laboratories, and material science centers constitute a specialized segment. These buyers utilize precision flaw detectors for academic study, material research, and quality control protocol development, focusing on the detector's diagnostic capabilities, high-speed data acquisition, and ability to facilitate custom experimental setups. Regardless of the end-user category, the consistent underlying demand is for equipment that delivers highly accurate, repeatable results, supporting both predictive maintenance strategies and zero-defect manufacturing mandates across global operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,350.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, GE Inspection Technologies (Baker Hughes), Eddyfi Technologies, Sonatest Ltd., Kistler Group, KARL DEUTSCH Prüf- und Messgerätebau GmbH + Co KG, Proceq (Screening Eagle Technologies), NDT Systems Inc., Huatec Group Corporation, Danatronics Corporation, Nova Instruments LLC, MISTRAS Group, Ashtead Technology, Modsonic Instruments, Fujifilm NDT Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precision Ultrasonic Flaw Detector Market Key Technology Landscape

The technological landscape of the Precision Ultrasonic Flaw Detector Market is rapidly evolving, driven by the need for enhanced resolution, faster inspection speeds, and improved data handling capabilities. The major shift involves moving beyond conventional single-element probes toward highly sophisticated array technologies. Phased Array Ultrasonic Testing (PAUT) remains central, utilizing multiple transducers in a single probe to steer, focus, and sweep the ultrasonic beam electronically without mechanical manipulation. This enables faster volumetric scanning and the ability to inspect complex geometries, making it a critical technology standard in pipeline integrity management and aircraft component inspection where high speed and coverage are non-negotiable requirements. Integration of advanced signal processing software is paramount to managing the complexity of PAUT data and accurately generating cross-sectional visualizations.

Further innovation is concentrated in Full Matrix Capture (FMC) and the resulting analysis technique, the Total Focusing Method (TFM). TFM represents a step-change in precision, capturing a complete dataset from all element combinations and applying sophisticated algorithms to focus the energy everywhere within the inspected volume. This results in incredibly high-resolution imaging, significantly improving the accuracy of flaw sizing and characterization, especially for small or complex defects near the surface. While computationally intensive, the increasing power and portability of modern detector electronics are making TFM a standard requirement for demanding applications, such as identifying stress corrosion cracking and hydrogen-induced cracking in critical assets.

Beyond the core ultrasonic methodologies, the market is characterized by digitalization and connectivity. New detectors are equipped with advanced Wi-Fi and cloud integration capabilities, facilitating seamless data transfer for remote analysis and centralized reporting, crucial for global enterprises managing dispersed assets. Furthermore, there is a strong trend toward incorporating artificial intelligence (AI) and machine learning (ML) algorithms directly into the detector’s operating software. These embedded AI tools automatically analyze A-scans and C-scans, assisting technicians in real-time defect classification and reducing interpretation variability, solidifying the transition towards automated, high-precision NDT workflows that enhance both speed and reliability.

Regional Highlights

- North America: North America maintains a leading position in the precision ultrasonic flaw detector market, primarily driven by stringent regulatory requirements imposed by bodies such as the Federal Aviation Administration (FAA) and the Pipeline and Hazardous Materials Safety Administration (PHMSA). The region is a major early adopter of advanced technologies, including FMC/TFM and automated PAUT systems, particularly within the aging oil and gas pipeline infrastructure and the robust aerospace and defense manufacturing sectors. Investments in maintaining the integrity of energy transmission assets, coupled with the high demand for zero-defect standards in manufacturing, ensure continuous high-value procurement of the latest high-precision detectors. The presence of major NDT equipment manufacturers and sophisticated NDT service providers further accelerates market maturity and the adoption cycle for new product innovations.

- Europe: Europe represents a mature market characterized by strong regulatory compliance frameworks focused heavily on safety and environmental protection, particularly in the nuclear power, automotive, and shipbuilding industries. Countries like Germany, France, and the UK demonstrate high expenditure on predictive maintenance programs utilizing high-precision ultrasonic equipment. The automotive sector, especially in developing electric vehicle platforms and advanced structural components, necessitates detailed inspection for quality control, bolstering demand for automated inspection solutions. The European market emphasizes standardized training and certification, reinforcing the need for reliable, calibrated, and traceable precision detectors that meet CEN and ISO standards, ensuring steady growth fueled by infrastructure modernization and regulatory adherence.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by unparalleled infrastructure development, rapid industrialization, and massive investments in manufacturing capacity across China, India, Japan, and South Korea. The expansion of pipeline networks, the construction of new power generation facilities (including nuclear), and the massive growth in marine and shipbuilding activities create an immense, expanding demand for precision flaw detection equipment. While price sensitivity exists in some sub-regions, the move toward higher quality standards in manufacturing, supported by foreign direct investment and increasingly stringent local quality regulations, is driving significant adoption of PAUT and portable digital detectors. China and India, in particular, are key growth engines, focusing on scaling up NDT capabilities to match their escalating production volume.

- Latin America: The Latin American market exhibits moderate growth, primarily centered around the robust oil and gas sector (especially Brazil and Mexico) and mining operations. Demand is largely focused on maintaining existing exploration and production infrastructure, necessitating portable and rugged ultrasonic detectors suitable for remote field work and harsh environments. While the adoption rate of cutting-edge technologies like TFM is slower compared to North America, there is increasing investment in standard digital UT and PAUT systems to meet growing internal inspection standards and manage corrosion issues in aging petrochemical facilities. Economic stability and governmental emphasis on asset integrity are key factors determining market growth fluctuations.

- Middle East and Africa (MEA): The MEA region’s market growth is almost entirely dominated by massive investments in the oil and gas infrastructure, including refineries, petrochemical plants, and large-scale export pipelines. National oil companies in Saudi Arabia, UAE, and Qatar are significant purchasers of high-precision ultrasonic equipment, prioritizing systems capable of high-temperature inspection and corrosion mapping to ensure pipeline longevity and operational safety. Due to the high value and criticality of these energy assets, procurement leans toward the most reliable and advanced portable PAUT and TOFD systems. The African sub-region shows nascent growth, focused primarily on mining and emergent energy projects, where ruggedized, dependable equipment is prioritized for challenging operational conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precision Ultrasonic Flaw Detector Market.- Olympus Corporation

- GE Inspection Technologies (Baker Hughes)

- Eddyfi Technologies

- Sonatest Ltd.

- Kistler Group

- KARL DEUTSCH Prüf- und Messgerätebau GmbH + Co KG

- Proceq (Screening Eagle Technologies)

- NDT Systems Inc.

- Huatec Group Corporation

- Danatronics Corporation

- Nova Instruments LLC

- MISTRAS Group

- Ashtead Technology

- Modsonic Instruments

- FujiFilm NDT Systems

- Sonotron NDT

- Zetec, Inc.

- Silverwing UK Ltd.

- Yingkou Time Non-Destructive Testing Technology Co., Ltd.

- Hitachi Power Solutions Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Precision Ultrasonic Flaw Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between conventional UT and Phased Array UT (PAUT) in precision flaw detection?

Conventional Ultrasonic Testing (UT) uses a single crystal element to send and receive sound waves at a fixed angle and focus, limiting inspection flexibility. Precision Phased Array UT (PAUT), conversely, uses multiple elements in a single probe, allowing the ultrasonic beam to be electronically steered and focused without physically moving the probe. This enables rapid scanning, improved coverage over complex geometries, and superior electronic visualization of defects, making PAUT significantly more efficient and precise for detailed volumetric inspection in critical applications like aerospace and weld inspection.

How is the Total Focusing Method (TFM) enhancing the precision capabilities of ultrasonic flaw detectors?

The Total Focusing Method (TFM) significantly enhances precision by utilizing Full Matrix Capture (FMC) data acquisition, recording the interaction between every element combination in the array probe. TFM algorithms then process this complete data set to synthesize a focused ultrasonic beam at every single pixel within the region of interest. This technique provides unparalleled image resolution and superior signal-to-noise ratio, enabling highly accurate sizing and characterization of very small or complex defects, particularly those near the surface, which is critical for material science and advanced manufacturing quality control.

Which end-user industries drive the highest demand for advanced, high-precision ultrasonic flaw detectors?

The highest demand for advanced, high-precision ultrasonic flaw detectors is consistently driven by the Oil and Gas and the Aerospace and Defense industries. These sectors mandate the highest level of non-destructive testing accuracy due to zero-tolerance defect policies and the extreme consequences of material failure in pipelines, pressure vessels, and airframe structures. The need for precise corrosion mapping, critical weld inspection (using PAUT/TFM), and composite material analysis fuels continuous investment in the most sophisticated and automated detection systems available in the market.

What impact does the integration of Artificial Intelligence (AI) have on the future efficiency of precision NDT inspections?

AI integration fundamentally transforms NDT efficiency by automating the complex processes of defect recognition, classification, and data interpretation, tasks historically reliant on highly skilled human technicians. AI algorithms, trained on vast ultrasonic datasets, can rapidly analyze A-scans, B-scans, and C-scans to flag anomalies and provide reliable preliminary assessments, reducing subjective interpretation errors. This enhances inspection throughput, accelerates report generation, and allows NDT personnel to focus on advanced analysis rather than routine screening, leading to faster, more reliable, and standardized inspection cycles globally.

What are the main market challenges restraining the widespread adoption of high-end ultrasonic flaw detection technology?

The primary challenges restraining widespread adoption include the substantial initial capital investment required for advanced equipment (especially integrated TFM and automated PAUT systems), making it cost-prohibitive for smaller enterprises. Furthermore, a significant restraint is the global shortage of highly skilled and certified NDT technicians capable of effectively setting up, executing, and interpreting the complex data generated by high-resolution array technology. Market players are addressing this by focusing on modular, cost-effective solutions and developing AI-assisted software interfaces to lower the barrier to entry for precise inspections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager