Preclinical CRO Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431357 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Preclinical CRO Treatment Market Size

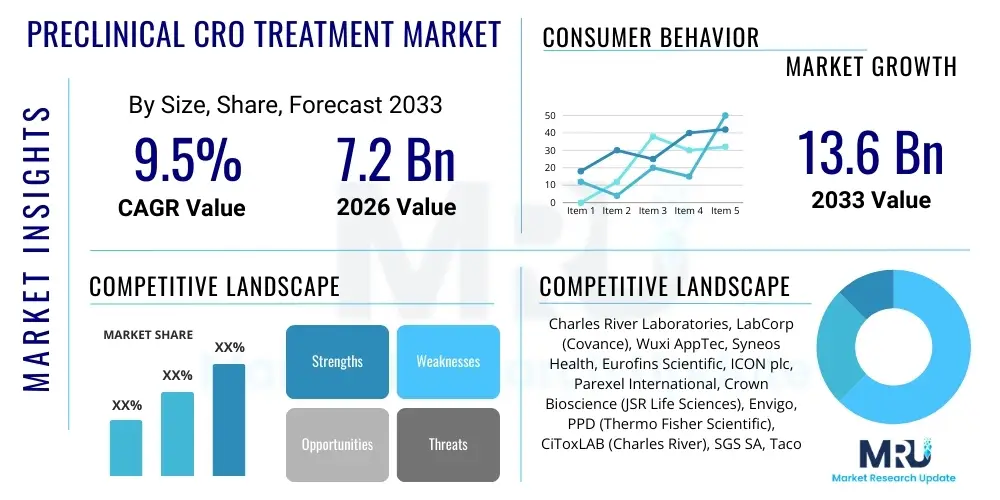

The Preclinical CRO Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 7.2 Billion in 2026 and is projected to reach USD 13.6 Billion by the end of the forecast period in 2033.

The consistent growth trajectory is primarily fueled by the increasing complexity of drug discovery processes and the stringent regulatory requirements imposed by global health authorities. Pharmaceutical and biotechnology companies are increasingly outsourcing their early-stage R&D activities, particularly toxicology testing, pharmacokinetics, and pharmacodynamics studies, to specialized Contract Research Organizations (CROs). This strategic shift allows drug developers to optimize costs, access niche expertise, and accelerate the progression of candidates from the laboratory bench to clinical trials, thereby driving market valuation significantly over the forecast timeline.

Preclinical CRO Treatment Market introduction

The Preclinical Contract Research Organization (CRO) Treatment Market encompasses a range of specialized research services provided to the pharmaceutical, biotechnology, and medical device industries for the evaluation of drug candidates before human trials. These services are crucial for assessing the safety, efficacy, and biological activity of novel therapeutic agents, including small molecules, biologics, and gene therapies. The core product offering involves complex in vivo and in vitro studies, encompassing toxicological assessments, ADME (Absorption, Distribution, Metabolism, and Excretion) analysis, and preclinical efficacy modeling tailored to specific disease areas, such as oncology, central nervous system disorders, and infectious diseases.

Major applications of preclinical CRO services revolve around Investigative New Drug (IND) enabling studies, which are mandatory submissions to regulatory bodies like the FDA and EMA. The benefits of leveraging these CROs are substantial, including accelerated timelines due to specialized operational efficiency, reduced capital expenditure for in-house laboratory infrastructure, and access to highly specialized scientific talent and proprietary animal models. Furthermore, CROs offer global operational scalability, enabling simultaneous testing across multiple jurisdictions, which is critical for multinational drug development programs. This outsourcing model transforms fixed R&D costs into variable expenses, enhancing financial agility for drug sponsors.

The primary driving factors sustaining market expansion include the exponential increase in global R&D spending, particularly in personalized medicine and complex biological drugs, which require sophisticated preclinical validation. Additionally, the high rate of attrition in late-stage clinical trials compels companies to invest heavily in robust, predictive preclinical models to de-risk their pipelines. Regulatory harmonization efforts across major markets, demanding high-quality and consistent data standards, further necessitates the involvement of accredited, experienced CROs, thereby solidifying the market's strong foundational demand profile.

Preclinical CRO Treatment Market Executive Summary

The Preclinical CRO Treatment Market is characterized by robust business trends centered on consolidation, technological integration, and specialized service offerings. Large, multinational CROs are actively pursuing mergers and acquisitions to expand their geographic footprint and enhance niche capabilities, particularly in areas like advanced biopsy services and gene therapy safety assessments. Simultaneously, there is a distinct trend towards strategic partnerships between mid-sized biotechnology firms and CROs, shifting from transactional relationships to long-term collaborative R&D agreements, ensuring stable revenue streams and knowledge sharing critical for complex therapeutic development.

Regional trends indicate significant growth momentum shifting towards the Asia Pacific (APAC) region. While North America and Europe remain dominant in terms of market share due to established pharmaceutical ecosystems and high R&D intensity, APAC countries, notably China and India, are emerging as cost-effective locations for routine toxicology and early-phase discovery services. This is supported by governmental initiatives encouraging pharmaceutical investment and the availability of large, treatment-naive patient populations for eventual clinical translation. This geographic expansion is leading to increased competition and diversification of service portfolios globally.

Segment trends highlight the dominance of toxicology testing, which remains the single largest service category, driven by mandatory safety assessments required prior to human exposure. However, the fastest-growing segment is expected to be ADME testing and bioanalysis, critical for understanding drug disposition and necessary for the development of new small-molecule drugs and increasingly complex biologics. The market structure is evolving towards specialized therapeutic segments, with CROs investing heavily in infrastructure dedicated to oncology, cardiovascular, and neuroscience research, reflecting the prevalent disease burden and the associated pharmaceutical pipeline focus.

AI Impact Analysis on Preclinical CRO Treatment Market

Common user questions regarding AI's influence on the Preclinical CRO Treatment Market primarily revolve around how Artificial Intelligence (AI) and Machine Learning (ML) can improve the predictive accuracy of preclinical models, reduce the reliance on traditional animal testing, and accelerate the identification of toxicology signals that often lead to drug failure. Users are concerned with the necessary integration costs, the validation of AI-driven models against established regulatory standards, and the potential for AI to displace manual laboratory work, simultaneously seeking reassurance about data security and intellectual property protection when leveraging AI platforms offered by CROs.

The overall impact of AI is transformative, shifting the focus of preclinical research from reactive testing to proactive, predictive modeling. AI tools are being utilized to analyze vast datasets from historical drug failures, genomic profiles, and high-throughput screening results, identifying subtle patterns indicative of toxicity or efficacy. This capability significantly enhances the efficiency of hit-to-lead optimization and drastically cuts down the time required for compound selection. Furthermore, AI facilitates the development of sophisticated in silico models and Digital Twins of biological systems, supporting the "3Rs" principles (Replacement, Reduction, Refinement) in animal testing, thereby modernizing preclinical safety evaluations and offering a competitive advantage to CROs that successfully deploy validated AI platforms.

- Accelerated candidate selection through predictive toxicology modeling.

- Enhanced precision in efficacy studies using advanced image analysis and omics data integration.

- Optimization of study design and resource allocation, minimizing experimental error.

- Development of regulatory-compliant in silico models replacing certain traditional animal tests.

- Improved data management and standardization across diverse preclinical datasets.

- Real-time monitoring and analysis of complex biological endpoints, leading to faster decision-making.

DRO & Impact Forces Of Preclinical CRO Treatment Market

The Preclinical CRO Treatment Market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. A primary driver is the financial pressure on pharmaceutical companies to curb internal R&D costs and reduce operational redundancies, making outsourcing an attractive, scalable solution. Concurrently, the increasing number of investigational new drugs entering the pipeline, particularly complex biopharmaceuticals, gene therapies, and cell therapies, demands highly specialized testing protocols that only dedicated CROs can efficiently provide, ensuring continuous market momentum.

However, significant restraints temper the market’s explosive potential. Key among these is the intense scrutiny from regulatory bodies regarding the quality and validity of outsourced data; any failure to comply can lead to costly project halts and data rejection. Furthermore, the inherent ethical constraints and evolving regulations surrounding animal testing, particularly in Europe, push the industry towards costly, complex, and sometimes less validated alternative testing methods (ATMs). The retention and recruitment of specialized scientific talent in toxicology and complex bioanalysis also pose persistent operational bottlenecks for many CROs.

Opportunities for growth are concentrated in the burgeoning fields of personalized medicine, targeted therapies, and precision oncology, where bespoke preclinical models (such as patient-derived xenografts - PDX) are essential. CROs are uniquely positioned to capitalize on the demand for advanced genomics, proteomics, and biomarker discovery services integrated into preclinical safety assessments. The impact forces indicate a net positive influence, driven by outsourcing mandates and technological advancements (like AI and automation), which outweigh the challenges of regulatory complexity and ethical constraints, ensuring sustained market expansion throughout the forecast period.

Segmentation Analysis

The Preclinical CRO Treatment Market is comprehensively segmented across several dimensions, primarily based on the type of service offered, the specific study type conducted, the application area, and the end-user profile. Service segmentation reflects the necessary phases of drug development, ranging from early-stage discovery support to formal regulatory toxicology testing. Study type segmentation addresses the methodological approach, distinguishing between in vivo and in vitro models, while application segmentation targets the major therapeutic areas where drug candidates are being developed. Understanding these segments is crucial for both CROs defining their core competencies and pharmaceutical sponsors seeking targeted expertise.

- By Service Type:

- Toxicology Testing (e.g., General Toxicology, Genetic Toxicology, Developmental and Reproductive Toxicology)

- Efficacy Studies (e.g., Oncology, CNS, Cardiovascular, Infectious Diseases)

- ADME (Absorption, Distribution, Metabolism, and Excretion) Testing

- Pharmacokinetics/Pharmacodynamics (PK/PD) Studies

- Bioanalysis and Drug Metabolism Studies

- Lead Identification and Optimization

- By Study Type:

- In Vivo Studies

- In Vitro Studies

- Ex Vivo Studies

- By Application:

- Oncology

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Diseases

- Respiratory Disorders

- Immunology

- By End User:

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Government & Academic Research Institutes

Value Chain Analysis For Preclinical CRO Treatment Market

The value chain for the Preclinical CRO Treatment Market begins with the Upstream Analysis, which involves the critical inputs and preparatory stages necessary for service delivery. This stage is dominated by the sourcing of high-quality biological materials, primarily specialized animal models (rodents, non-human primates, etc.) and advanced reagents, cell lines, and specialized laboratory equipment. Key upstream stakeholders include animal model suppliers, laboratory instrument manufacturers, and niche software providers (LIMS systems). Efficiency and quality control at this stage are paramount, as the integrity of the initial biological inputs directly impacts the reliability of the resulting preclinical data.

The core value creation stage is the CRO service delivery itself, encompassing study design, execution, data collection, and robust quality assurance (QA/QC). CROs leverage their scientific expertise and specialized infrastructure (e.g., certified GLP laboratories) to perform complex assays, including regulatory toxicology, pharmacokinetics analysis, and efficacy testing. Distribution channels in this market are predominantly direct, characterized by close scientific collaboration and contractual relationships between the CRO and the sponsor (pharmaceutical/biotech client). Indirect channels might involve partnerships with technology platforms or specialized consultants who facilitate the connection between sponsors and niche CROs specializing in rare disease models or specific analytical techniques.

The Downstream Analysis focuses on the output: comprehensive, regulatory-compliant reports and raw data packages delivered to the pharmaceutical sponsors. The successful completion of this stage enables the client to file an Investigational New Drug (IND) application, marking the transition from preclinical to clinical development. Key downstream activities also include post-study consultation and integration of preclinical findings into the broader clinical strategy. The efficiency of data transfer and the interpretability of the results are critical success factors, ensuring that the entire value chain is optimized for accelerating drug candidates towards market approval.

Preclinical CRO Treatment Market Potential Customers

The primary and largest segment of end-users for the Preclinical CRO Treatment Market comprises major Pharmaceutical and Biopharmaceutical Companies. These large entities possess extensive drug pipelines requiring continuous preclinical safety and efficacy validation across multiple therapeutic areas. Their demand is driven by the need for regulatory compliance, cost efficiencies gained from outsourcing non-core activities, and access to highly specialized GLP-certified facilities and complex animal models necessary for late-stage preclinical assessments, particularly in oncology, autoimmune diseases, and rare disorders.

A rapidly growing customer base includes small to medium-sized Biotechnology firms and emerging virtual pharmaceutical companies. These entities often lack the internal infrastructure, scientific personnel, and capital required to build proprietary preclinical laboratories. For them, CROs represent an essential operational extension, providing full-service R&D capabilities on a fee-for-service or functional outsourcing basis. This segment relies heavily on CROs for critical tasks like lead optimization and IND-enabling studies, making their partnerships essential for pipeline progression.

Furthermore, Academic Research Institutions and Government bodies (such as the NIH or national defense agencies involved in biodefense research) also represent significant potential customers. While their funding sources and objectives differ from commercial entities, they frequently utilize CRO services for large-scale compound screening, specialized toxicology studies, and managing proprietary research projects that necessitate stringent regulatory compliance or specialized infrastructure not readily available in academic settings. Medical Device companies also rely on CROs for biocompatibility and toxicology testing specific to device materials before human implantation trials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 13.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles River Laboratories, LabCorp (Covance), Wuxi AppTec, Syneos Health, Eurofins Scientific, ICON plc, Parexel International, Crown Bioscience (JSR Life Sciences), Envigo, PPD (Thermo Fisher Scientific), CiToxLAB (Charles River), SGS SA, Taconic Biosciences, Pharmaron, Inotiv Inc., Vivotecnia, GenScript ProBio, Altasciences, Medpace, Absorption Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Preclinical CRO Treatment Market Key Technology Landscape

The technological landscape of the Preclinical CRO Treatment Market is rapidly advancing, focusing on enhancing predictive capabilities, increasing throughput, and minimizing ethical concerns associated with traditional testing methods. A central pillar of this evolution is the implementation of advanced cellular and molecular technologies, including High-Throughput Screening (HTS) and High-Content Screening (HCS), which allow for the rapid and parallel assessment of thousands of compounds. These sophisticated automated systems are vital for lead optimization and initial toxicity profiling, significantly accelerating the early phases of drug discovery by providing robust, quantifiable data faster than conventional methods.

Furthermore, the shift towards more biologically relevant models is accelerating the adoption of Organ-on-a-Chip (OOC) and 3D organoid cultures. These cutting-edge in vitro systems mimic human physiological environments more accurately than traditional 2D cell cultures or simple animal models, offering enhanced predictive toxicity and efficacy data. CROs are heavily investing in integrating these microfluidic platforms, particularly for neurotoxicity and cardiotoxicity testing, promising a future where in vitro data can more reliably translate to human outcomes, thereby potentially reducing the need for extensive animal testing while improving overall R&D success rates.

Data science and informatics also constitute a critical technological segment. The application of sophisticated computational biology tools, Artificial Intelligence, and Machine Learning algorithms is essential for managing, analyzing, and interpreting the massive datasets generated by preclinical studies, particularly those involving genomics, proteomics, and toxicogenomics. These tools aid in identifying biomarkers for toxicity, optimizing dosage regimens, and constructing predictive algorithms that stratify compound risk early on. The integration of validated LIMS (Laboratory Information Management Systems) and Electronic Data Capture (EDC) systems ensures data integrity, compliance with regulatory standards (GLP), and seamless information exchange with pharmaceutical sponsors globally.

Regional Highlights

North America, particularly the United States, holds the dominant share in the Preclinical CRO Treatment Market, primarily due to the presence of the world's largest pharmaceutical and biotechnology companies and substantial R&D expenditure fueled by robust venture capital funding. The region benefits from stringent regulatory frameworks (FDA standards) which necessitate high-quality, GLP-compliant preclinical data, driving strong demand for specialized, accredited CRO services. Furthermore, the concentration of leading academic research institutions and the rapid adoption of cutting-edge technologies like regenerative medicine and gene therapy testing contribute significantly to the high market valuation and technological leadership of the region.

Europe represents the second largest market, characterized by significant governmental support for life science research and the presence of numerous global pharmaceutical headquarters in countries like Switzerland, Germany, and the UK. However, the European market faces unique challenges, particularly the rigorous implementation of the 3Rs principles concerning animal testing, which compels CROs in the region to prioritize and innovate in alternative testing methodologies, such as advanced in vitro and computational models. The regulatory oversight by the European Medicines Agency (EMA) ensures a continuous demand for standardized, high-quality toxicology and safety assessments across the continent.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate throughout the forecast period. This accelerated expansion is attributed to lower operational costs, favorable government policies promoting foreign investment in clinical and preclinical research, and a vast talent pool. Key drivers in APAC include the establishment of large-scale R&D centers by multinational corporations in countries like China and India, focusing particularly on high-volume standard toxicology and early discovery services. This shift is turning APAC into a global hub for cost-effective and large-scale preclinical trials, reshaping global outsourcing dynamics.

- North America: Market leader driven by high R&D spending, strong biotech sector, and rigorous regulatory compliance mandates.

- Europe: Second largest market, focused on integrating alternative testing methods (3Rs compliance) and specialized toxicology services.

- Asia Pacific (APAC): Fastest-growing region, fueled by cost advantages, increasing regulatory streamlining, and foreign investment in large contract research facilities.

- Latin America (LATAM): Emerging market, primarily serving local drug developers and providing regional access for global studies, showing steady growth in toxicology services.

- Middle East and Africa (MEA): Limited but increasing market presence, concentrating on localized clinical research support and initial academic partnerships in specialized disease areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Preclinical CRO Treatment Market.- Charles River Laboratories

- LabCorp (Covance)

- Wuxi AppTec

- Syneos Health

- Eurofins Scientific

- ICON plc

- Parexel International

- Crown Bioscience (JSR Life Sciences)

- Envigo

- PPD (Thermo Fisher Scientific)

- CiToxLAB (Charles River)

- SGS SA

- Taconic Biosciences

- Pharmaron

- Inotiv Inc.

- Vivotecnia

- GenScript ProBio

- Altasciences

- Medpace

- Absorption Systems

Frequently Asked Questions

Analyze common user questions about the Preclinical CRO Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Preclinical CRO Treatment Market?

The primary driver is the increasing complexity of drug candidates, particularly biologics and gene therapies, coupled with the persistent pressure on pharmaceutical companies to reduce internal operational costs and leverage specialized, outsourced expertise to meet stringent global regulatory requirements efficiently.

How is Artificial Intelligence (AI) being utilized in preclinical contract research services?

AI is utilized to enhance predictive toxicology modeling, analyze vast omics datasets for biomarker identification, optimize study designs, and reduce experimental variables, thereby accelerating the selection of viable drug candidates and minimizing reliance on costly conventional testing methods.

Which service segment holds the largest share in the Preclinical CRO Treatment Market?

Toxicology Testing, including general and specialized toxicology assessments, consistently holds the largest market share as it is a mandatory, non-negotiable step required by regulatory bodies globally for all new drug candidates prior to initiation of human clinical trials (IND-enabling studies).

What are the main ethical restraints impacting preclinical CRO service providers?

The main restraints involve the persistent ethical concerns and evolving regulations surrounding the use of live animal models in research, particularly in Europe, forcing CROs to invest heavily in alternative testing methodologies such as in vitro assays, organoids, and advanced computational models (the 3Rs principle).

Which geographical region is projected to show the fastest growth rate for preclinical CRO services?

The Asia Pacific (APAC) region is projected to demonstrate the fastest growth rate, driven by lower operating expenses, government incentives promoting biopharma research investment, and the strategic expansion of global CROs establishing large-scale, cost-effective research facilities in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager