Precursor Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432337 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Precursor Materials Market Size

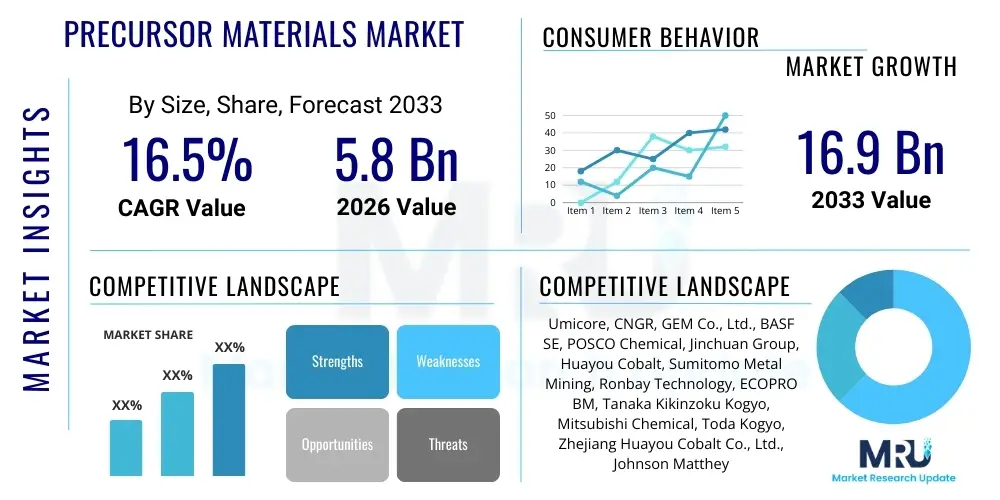

The Precursor Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 16.9 Billion by the end of the forecast period in 2033.

Precursor Materials Market introduction

Precursor materials are highly purified chemical compounds essential for manufacturing advanced technological components, particularly in the semiconductor, battery, and catalyst industries. These materials, often metal salts or specialized organic compounds, dictate the final characteristics, performance, and efficiency of the end product. In the lithium-ion battery sector, precursors like Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA) hydroxides are foundational to producing cathode active materials, driving the performance metrics of electric vehicles and consumer electronics. The increasing global focus on renewable energy storage and the rapid expansion of the electric vehicle market serve as primary catalysts for market growth.

The core application of precursor materials spans energy storage, microelectronics, thin-film deposition, and pharmaceutical synthesis. The benefits derived from high-quality precursors include enhanced product reliability, superior energy density (in batteries), and minimized defect rates (in semiconductors). Major driving factors include aggressive government subsidies for EV manufacturing, the global push for digitalization requiring high-performance semiconductor chips, and significant investments in next-generation battery technologies, such as solid-state batteries, which necessitate new classes of precursor chemicals.

Precursor Materials Market Executive Summary

The Precursor Materials Market is characterized by intense technological innovation and vertically integrated supply chains, primarily driven by the escalating demand for lithium-ion batteries and advanced semiconductor devices. Business trends show a strong shift toward high-nickel content precursors (e.g., NMC 811, 9XX) in the battery sector to achieve higher energy density, alongside rigorous purity standards mandated by semiconductor fabrication plants (Fabs). Strategic alliances and joint ventures between precursor manufacturers and battery cell producers (Gigafactories) are becoming critical to securing material flow and standardizing quality control across the value chain, minimizing geopolitical supply risks associated with raw material sourcing.

Regionally, Asia Pacific (APAC), spearheaded by China, South Korea, and Japan, dominates the market due to its established infrastructure for both battery manufacturing and semiconductor production. China maintains a significant controlling share in refining and precursor synthesis capacity. North America and Europe, however, are experiencing explosive growth, spurred by initiatives like the US Inflation Reduction Act (IRA) and the European Green Deal, which incentivize localized, resilient supply chains, shifting precursor production closer to final assembly points. This decentralization effort is poised to significantly impact global trade flows over the forecast period.

Segment trends reveal that the Lithium-ion Battery segment is the largest end-user, with a pronounced shift towards high-energy density chemistries. Within semiconductor applications, precursors for Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD) are seeing rapid adoption as feature sizes shrink and multilayer complexity increases. Nickel remains the most critical elemental component in precursor compounds, demanding continuous research into alternative raw material sourcing and sustainable processing techniques to mitigate environmental impact and price volatility.

AI Impact Analysis on Precursor Materials Market

Common user questions regarding AI's impact on the Precursor Materials Market often center on how Artificial Intelligence (AI) and Machine Learning (ML) can optimize complex synthesis processes, predict material performance, and enhance supply chain resilience. Users are concerned about the implementation costs versus the purity gains achieved and the potential for AI to accelerate the discovery of novel precursor chemistries necessary for next-generation devices. The key theme is the utilization of AI for process optimization and accelerated materials discovery. AI integration is expected to drastically reduce the R&D cycle time and improve the efficiency of existing production lines, which are often characterized by high-precision, sensitive chemical reactions requiring tight control over environmental variables. This algorithmic control minimizes batch-to-batch variability and reduces waste, addressing critical concerns related to yield maximization and sustainability in this high-cost manufacturing sector.

- AI-driven optimization of precursor synthesis parameters (temperature, pressure, pH) to maximize yield and control particle morphology.

- Machine Learning models deployed for predictive quality control and real-time defect detection in highly controlled environments, such as cleanrooms.

- Accelerated materials informatics, leveraging AI to screen millions of potential chemical combinations for novel battery or semiconductor precursor candidates.

- Enhanced supply chain risk management through AI algorithms that predict raw material price fluctuations and identify potential bottlenecks in sourcing critical metals (Nickel, Cobalt, Lithium).

- Autonomous laboratory systems for high-throughput experimentation (HTE) in R&D, significantly reducing the time required for new precursor formulation development.

- Optimization of energy consumption during precursor calcination and drying processes, leading to reduced operational expenditure (OPEX) and lower carbon footprint.

DRO & Impact Forces Of Precursor Materials Market

The Precursor Materials Market is driven primarily by the global transition to electrification, substantial growth in data centers and IoT devices necessitating advanced chips, and supportive government policies accelerating domestic manufacturing. Restraints include the high capital expenditure required for establishing high-purity production facilities, complex intellectual property landscapes, and volatile pricing of key raw materials like nickel and cobalt, often exacerbated by geopolitical instability. Opportunities lie in the commercialization of specialized precursors for solid-state batteries, establishing sustainable, circular supply chains through advanced recycling techniques, and the adoption of high-performance, cobalt-free chemistries to mitigate ethical sourcing concerns. These factors, alongside the inherent demand elasticity tied to technological advancement, create intense impact forces, driving manufacturers toward rapid scaling and continuous innovation in synthesis technology.

Segmentation Analysis

The Precursor Materials Market is broadly segmented based on the Material Type, Application, and End-Use Industry, each influencing market dynamics differently. Material types are categorized based on their primary chemical composition and intended function, ranging from high-purity metal salts to specialized organometallic compounds. Applications primarily focus on their use in cathode active materials (CAM) for batteries or thin-film deposition in microelectronics. Understanding these segmentations is vital for manufacturers to tailor production capacity and purity levels to meet stringent industry-specific requirements, especially considering the divergence in standards between the energy sector and the semiconductor industry.

- By Material Type: Nickel Sulfate, Cobalt Sulfate, Manganese Sulfate, Lithium Hydroxide, Aluminum Hydroxide, Organometallic Compounds, Metal Halides, Hydrides.

- By Chemistry: Nickel Manganese Cobalt (NMC), Nickel Cobalt Aluminum (NCA), Lithium Iron Phosphate (LFP), Lithium Manganese Oxide (LMO).

- By Application: Cathode Active Materials (CAM), Anode Materials, Thin-Film Deposition (CVD/ALD), Catalysts, Pigments and Coatings.

- By End-Use Industry: Automotive (Electric Vehicles), Consumer Electronics, Energy Storage Systems (ESS), Industrial, Aerospace and Defense, Medical Devices.

Value Chain Analysis For Precursor Materials Market

The value chain for precursor materials is highly complex, starting with the upstream sourcing and refining of critical raw materials such as nickel, cobalt, and lithium. Upstream analysis focuses on mining, extraction, and the initial chemical refinement of metals into technical-grade salts. Purity and secure sourcing are paramount in this initial stage, often involving global supply chains susceptible to geopolitical risks and environmental scrutiny. Key players at this stage include major mining companies and specialized refiners who provide the foundational chemical compounds. The subsequent manufacturing phase involves complex chemical processes, precipitation, drying, and calcination to synthesize the final precursor powder with precise particle size distribution and morphology.

The midstream involves the core precursor synthesis, where high-purity salts are converted into proprietary precursor compounds like NMC or NCA hydroxide powders. This step requires advanced technological expertise and stringent quality control, as the purity achieved here directly impacts the final battery performance or semiconductor yield. Downstream analysis focuses on the integration of precursors into final products. For batteries, the precursor is combined with lithium salts and processed to create the final cathode active material (CAM), which is then integrated into battery cells. For semiconductors, highly pure precursors are delivered directly to Fabs for use in CVD or ALD processes.

Distribution channels are categorized into direct and indirect methods. Direct distribution involves long-term contracts between major precursor manufacturers and large-scale battery cell producers (Gigafactories) or semiconductor Fabs, ensuring stable, high-volume supply with minimal intermediaries. Indirect channels involve chemical distributors and specialized logistics firms that handle smaller-volume, regional deliveries or cater to emerging R&D applications. The trend is shifting towards direct integration and co-location to reduce transportation costs, maintain cold chain integrity where necessary, and enhance security of supply, especially for high-value, sensitive organometallic precursors used in advanced electronics.

Precursor Materials Market Potential Customers

The primary consumers and buyers of precursor materials are large-scale manufacturing entities operating in high-technology, capital-intensive industries where material purity and performance consistency are non-negotiable requirements. The largest segment of potential customers includes electric vehicle battery manufacturers and energy storage system integrators, who demand metric tons of NMC, NCA, or LFP precursors monthly to feed their production lines. These customers utilize precursors to synthesize cathode active materials, forming the core electrochemical engine of their products. As battery capacity dictates vehicle range and system longevity, securing reliable, high-specification precursors is a key competitive differentiator.

Another significant customer segment is the semiconductor industry, including integrated device manufacturers (IDMs) and pure-play foundries. These customers require ultra-high purity organometallic and inorganic precursors for depositing thin films for logic, memory, and advanced packaging applications. The demands here are less volume-driven but exponentially more stringent in terms of purity (often requiring 99.999% purity or higher), as any contaminant can lead to catastrophic failure in nanoscale circuitry. Furthermore, the chemical and petrochemical sectors, particularly catalyst manufacturers utilizing complex metal precursors, represent a steady, specialized customer base. The strategic purchasing focus across all segments is shifting towards long-term, multi-year supply agreements to stabilize costs and guarantee material availability amid global supply chain volatility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 16.9 Billion |

| Growth Rate | CAGR 16.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Umicore, CNGR, GEM Co., Ltd., BASF SE, POSCO Chemical, Jinchuan Group, Huayou Cobalt, Sumitomo Metal Mining, Ronbay Technology, ECOPRO BM, Tanaka Kikinzoku Kogyo, Mitsubishi Chemical, Toda Kogyo, Zhejiang Huayou Cobalt Co., Ltd., Johnson Matthey, Showa Denko (Resonac), SK Materials, Air Liquide. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Precursor Materials Market Key Technology Landscape

The technology landscape governing the production of precursor materials is highly dependent on achieving ultra-high purity and precise particle engineering, critical for enhancing the performance of downstream applications. For lithium-ion battery precursors, the dominant technologies involve co-precipitation synthesis, which allows for tight control over the stoichiometry and morphology of layered materials like NMC. Continuous stirred-tank reactors (CSTRs) and proprietary crystal growth methods are employed to ensure uniform particle size distribution (PSD) and high tap density, which are essential for maximizing energy storage capacity and stability in the final battery cell. Further technological refinement focuses on surface modification techniques and coating processes to improve the safety and cycle life of the cathode material.

In the semiconductor sector, the technological focus shifts towards ultra-high purity synthesis and precise delivery systems for chemical precursors. Technologies such as high-purity distillation, zone refining, and advanced chromatographic purification are used to remove trace metal contaminants down to parts-per-billion (ppb) levels. Organometallic precursors for Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD) require sophisticated handling and delivery systems to maintain thermal stability and precise vapor pressure during the thin-film deposition process within the fabrication plant. Innovation here is driven by the need for precursors that are non-toxic, have low deposition temperatures, and offer excellent conformality for 3D transistor architectures like FinFETs and GAAFETs.

A burgeoning technological area involves sustainable and circular economy approaches, including hydro- and pyro-metallurgical recycling of spent batteries. These processes aim to efficiently recover high-value precursor metals (Ni, Co, Mn) and re-synthesize them into new, battery-grade precursors, significantly reducing reliance on primary raw material extraction. The development of direct precursor recycling technologies, which bypass the need for full material breakdown, represents a key disruptive innovation expected to mature during the forecast period, addressing environmental regulatory pressures and resource scarcity challenges across the global supply chain.

Regional Highlights

- Asia Pacific (APAC): APAC remains the undisputed market leader, anchored by dominant manufacturing bases in China, South Korea, and Japan. China controls the majority of the world's processing capacity for battery precursors, benefiting from governmental support and deep integration with global EV supply chains. South Korea and Japan lead in the development of cutting-edge, high-nickel chemistries and advanced semiconductor precursors, driving technological superiority and maintaining high domestic consumption rates.

- North America: This region is experiencing the fastest growth, largely attributable to the US Inflation Reduction Act (IRA) and significant investments in domestic battery and semiconductor manufacturing (Gigafactories and Fabs). The focus is on establishing resilient, localized precursor production capacity to reduce dependence on Asian supply chains, particularly for high-value NMC and NCA materials.

- Europe: Growth is robust, propelled by the European Green Deal and commitments to electric mobility. Europe is rapidly building its own "Battery Valley," focusing on environmentally sustainable precursor production and recycling infrastructure. Germany, Hungary, and Poland are emerging as critical hubs for localized precursor synthesis, catering to major European automotive OEMs.

- Latin America (LATAM): While a smaller consumer, LATAM is vital due to its vast lithium reserves (the "Lithium Triangle" – Chile, Argentina, Bolivia). Regional focus is on attracting investment to move beyond raw material extraction and establish local capacity for basic chemical refining, positioning the region higher up the precursor value chain.

- Middle East and Africa (MEA): This region is strategically important due to its reserves of key raw materials, particularly nickel and cobalt (Democratic Republic of Congo). The market is primarily focused on upstream mining and refining activities, with nascent efforts in Saudi Arabia and the UAE to develop localized chemical processing capabilities to diversify their industrial base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Precursor Materials Market.- Umicore

- CNGR Advanced Material Co., Ltd.

- GEM Co., Ltd.

- BASF SE

- POSCO Chemical Co., Ltd.

- Jinchuan Group Co., Ltd.

- Zhejiang Huayou Cobalt Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Ronbay Technology Co., Ltd.

- ECOPRO BM Co., Ltd.

- Tanaka Kikinzoku Kogyo K.K.

- Mitsubishi Chemical Corporation

- Toda Kogyo Corp.

- Johnson Matthey PLC

- Showa Denko K.K. (Resonac Group)

- SK Materials Co., Ltd.

- Air Liquide S.A.

- W-Scope Co., Ltd.

- BTR New Material Group Co., Ltd.

- LG Chem Ltd.

- Guangzhou Tinci Materials Technology Co., Ltd.

- Kemet Corporation

- Honeywell International Inc.

- Praxair (Linde PLC)

- Gelest, Inc. (Mitshubishi Chemical Group)

- SACHEM, Inc.

- Albemarle Corporation

- Livent Corporation

- Ganfeng Lithium Co., Ltd.

- Qingdao Wylton.

Frequently Asked Questions

Analyze common user questions about the Precursor Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Precursor Materials Market?

The market growth is primarily driven by the exponential global demand for electric vehicles (EVs) and grid-scale energy storage systems (ESS), which rely heavily on high-performance lithium-ion batteries. Additionally, the continuous miniaturization and advancement in semiconductor technology necessitate increasingly pure and specialized deposition precursors.

How does the shift to high-nickel content precursors impact the market?

The trend towards high-nickel content precursors, such as NMC 811 and 9XX, is crucial for achieving higher energy density in batteries, extending EV range. This shift increases the demand for battery-grade nickel sulfate but requires more sophisticated synthesis techniques to maintain thermal stability and structural integrity during manufacturing.

Which geographical region dominates the global supply chain for precursor materials?

Asia Pacific, particularly China, currently dominates the global precursor material supply chain due to its immense installed manufacturing capacity for refining critical metals and synthesizing cathode precursors. However, North America and Europe are rapidly expanding domestic production capabilities due to strategic government initiatives.

What technological innovations are shaping the future of precursor materials?

Key technological innovations include the deployment of AI and Machine Learning for optimizing co-precipitation processes and materials discovery, the development of precursors for solid-state battery chemistries, and the implementation of advanced hydrometallurgical recycling techniques to create closed-loop, sustainable material streams.

What is the main difference between precursor demands in the battery sector versus the semiconductor sector?

The battery sector demands high-volume, cost-effective precursors (e.g., metal sulfates) engineered for specific particle morphology, while the semiconductor sector requires ultra-low volume, extremely high-purity (ppb level) organometallic compounds for precise thin-film deposition (CVD/ALD), prioritizing purity over tonnage.

Are precursor manufacturers vertically integrating or relying on external suppliers for raw materials?

Many leading precursor manufacturers are increasingly pursuing backward vertical integration, securing long-term contracts or acquiring stakes in mining and refining operations to ensure a stable, cost-controlled supply of critical raw materials like nickel and cobalt, mitigating the impact of volatile commodity markets.

How do environmental regulations affect the Precursor Materials Market?

Strict environmental regulations, particularly in the EU and US, are accelerating the demand for sustainable sourcing practices, energy-efficient production processes, and the development of robust battery recycling infrastructure. This pressures manufacturers to adopt cleaner chemistries and invest heavily in reducing their carbon footprint.

What role do organometallic precursors play in advanced technology?

Organometallic precursors are indispensable in the semiconductor industry for advanced manufacturing processes such as Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD). They are utilized to deposit precise, ultra-thin films necessary for high-performance memory, logic chips, and specialized optical coatings due to their volatility and controllable decomposition properties.

Why is purity critical in precursor materials, especially for semiconductors?

Purity is paramount because trace contaminants, even at parts-per-billion levels, can severely disrupt the electrical properties of semiconductor devices, leading to decreased yields, short circuits, and poor device performance. High-purity precursors ensure the integrity and reliability of nanoscale structures.

What are the risks associated with the cobalt supply chain in precursor manufacturing?

The primary risks associated with cobalt include high price volatility, geographical concentration (mostly mined in the DRC), and ethical sourcing concerns regarding labor practices. This has led to strong industry efforts to minimize or eliminate cobalt content through the development of nickel-rich or cobalt-free LFP chemistries.

How do new battery technologies, like solid-state batteries, influence precursor demand?

Solid-state batteries (SSBs) necessitate entirely new classes of highly pure, specialized inorganic precursors for solid electrolyte materials (e.g., sulfides, oxides) and potentially different cathode architectures, opening a significant opportunity for chemical companies specializing in advanced inorganic synthesis and purification techniques.

What is the primary function of nickel sulfate in battery precursor synthesis?

Nickel sulfate is the core raw material for synthesizing nickel-containing cathode precursors (NMC and NCA). Its primary function is to supply the nickel element, which is essential for maximizing the energy density and capacity of the lithium-ion battery cell.

How are logistics handled for sensitive precursor materials?

Logistics for precursor materials, especially organometallics or hydroscopic metal salts, require specialized, temperature-controlled, and inert atmosphere packaging (often in stainless steel cylinders or drums). Strict compliance with hazardous materials transportation regulations and just-in-time delivery systems are standard practices to maintain product integrity.

What is the expected CAGR for the Precursor Materials Market during the forecast period?

The Precursor Materials Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033, driven largely by global electric vehicle penetration and the scaling of Giga-factories across major economic regions.

Which segment holds the largest market share by end-use industry?

The Automotive segment, specifically the production of Electric Vehicles (EVs), holds the largest and fastest-growing market share by end-use industry, given the massive volumes of high-performance precursors required for EV battery packs.

What is the significance of particle morphology control in precursor manufacturing?

Controlling particle morphology (size, shape, and distribution) is critical as it directly affects the tap density, processing characteristics, and ultimately the electrochemical performance of the final cathode material. Optimized morphology enhances lithium ion mobility and extends battery cycle life.

What initiatives are key manufacturers undertaking to ensure sustainable sourcing?

Key manufacturers are implementing rigorous supplier auditing programs to ensure compliance with ethical and environmental standards, investing in battery recycling R&D, and diversifying their raw material sourcing geographically to reduce reliance on conflict-prone or non-compliant regions.

How does the shift from NMC 532 to NMC 811 affect precursor production requirements?

The shift from lower-nickel (NMC 532) to higher-nickel (NMC 811) formulations necessitates higher precision in the co-precipitation process, more stringent control over environmental factors (especially oxygen and moisture), and specialized surface treatments to manage nickel's greater thermal instability.

Are LFP (Lithium Iron Phosphate) precursors gaining traction, and why?

Yes, LFP precursors are rapidly gaining traction, particularly for entry-level and commercial EVs, and grid storage solutions. This is driven by their lower cost, superior safety profile, longer cycle life, and independence from expensive and ethically sensitive nickel and cobalt materials.

What are the barriers to entry in the Precursor Materials Market?

Major barriers include the extremely high capital expenditure required for establishing ultra-high purity production lines, the necessity for deep technical expertise in chemical engineering, the complexity of securing long-term raw material supply, and overcoming strict quality certification processes required by major OEMs.

How do governments influence precursor material market dynamics?

Governments influence the market through direct subsidies and tax credits (e.g., IRA in the US), imposing localized content requirements, funding R&D into next-generation chemistries, and setting stringent environmental protection standards, all of which steer investment toward domestic and sustainable supply chains.

What specific precursors are used for Atomic Layer Deposition (ALD) in microelectronics?

ALD utilizes various precursors including metal-organic compounds (MO-ALD) such as trimethylaluminum (TMA) for Al2O3, Hf(N(CH3)2)4 for HfO2, and various silane derivatives, all requiring exceptional purity for precise, atomic-scale layer control in semiconductor devices.

What is the typical time frame for qualifying a new precursor supplier for a major battery manufacturer?

The qualification process for a new precursor supplier is extensive and typically takes 18 to 36 months, involving rigorous quality checks, electrochemical performance testing, pilot production trials, and final approval for high-volume supply, reflecting the critical nature of the material.

Beyond batteries and semiconductors, where else are precursor materials used?

Precursor materials are extensively used in catalyst manufacturing (for petrochemical and automotive applications), in specialty coatings and pigments, and in advanced pharmaceutical synthesis, where high-purity metal compounds act as crucial reaction intermediates or catalysts.

What is the role of lithium hydroxide versus lithium carbonate in the precursor value chain?

Lithium hydroxide is increasingly favored over lithium carbonate for synthesizing high-nickel cathode precursors (NMC 811, NCA) because it allows the reaction to occur at lower temperatures, producing a more stable crystalline structure that is essential for achieving optimal high-energy density performance.

How do precursor manufacturers manage intellectual property (IP) disputes?

IP management is critical due to proprietary synthesis methods and specific cathode compositions. Manufacturers invest heavily in patenting unique crystallization techniques, particle coatings, and specialized chemical formulas, leading to frequent cross-licensing and litigation activities globally, particularly in the competitive NMC sector.

What market trend indicates a focus on supply chain resilience?

The most pronounced market trend indicating a focus on supply chain resilience is the significant investment by global automotive and energy companies in establishing localized, non-Chinese precursor manufacturing facilities in North America and Europe, supported by state incentives and tax benefits.

Describe the concept of co-precipitation synthesis in the context of battery precursors.

Co-precipitation is a chemical synthesis technique where soluble metal salts (Ni, Co, Mn) are mixed in an aqueous solution and precipitated simultaneously using an alkali agent under strictly controlled pH and temperature conditions. This ensures that the resulting precursor material has a homogeneous composition and uniform spherical particle morphology.

What is the financial impact of raw material volatility on precursor pricing?

The financial impact is substantial. Since raw materials like nickel and cobalt constitute a high percentage of the precursor's final cost, volatility in these commodity markets forces precursor manufacturers to employ complex hedging strategies, often passing price fluctuations onto battery cell producers through flexible pricing agreements.

What is the projected market size of the Precursor Materials Market by 2033?

The Precursor Materials Market is projected to reach an estimated value of USD 16.9 Billion by the end of the forecast period in 2033, reflecting the accelerated adoption of electric mobility and the expansion of advanced electronic manufacturing globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager