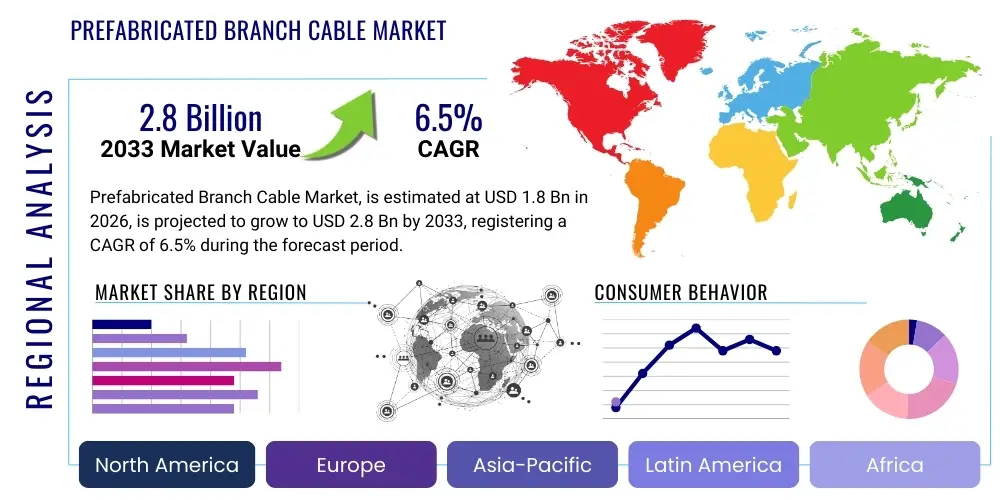

Prefabricated Branch Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437699 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Prefabricated Branch Cable Market Size

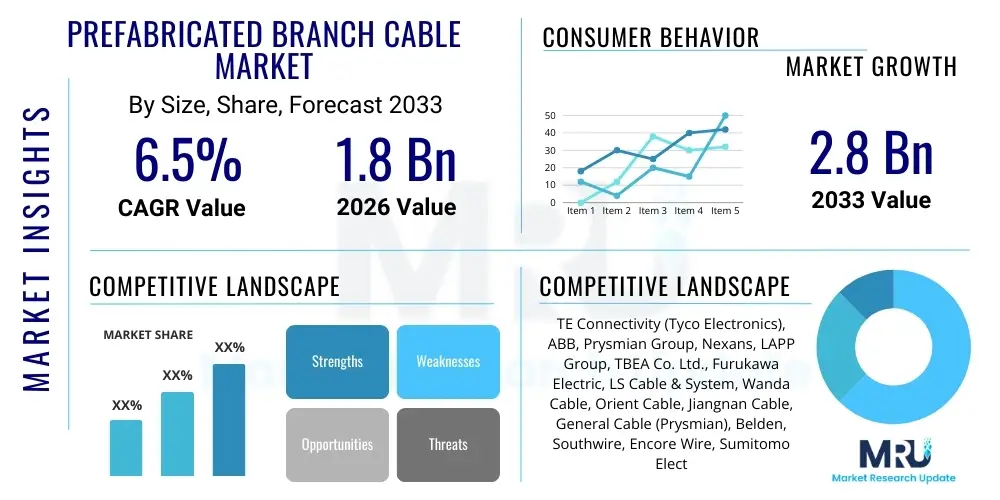

The Prefabricated Branch Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Prefabricated Branch Cable Market introduction

The Prefabricated Branch Cable Market encompasses specialized electrical distribution systems designed to streamline power supply installation, primarily in high-rise buildings, commercial complexes, and industrial facilities. These systems, often referred to as busbar trunking or proprietary cable systems, consist of factory-assembled cables with pre-installed tap-off units, eliminating the need for complex, time-consuming on-site cable cutting, splicing, and jointing. This inherent modularity and efficiency significantly reduces installation time, improves safety standards by minimizing human error during connection processes, and offers superior electrical performance compared to traditional wiring methods, making them critical components in modern, dense urban infrastructure projects requiring high reliability and flexibility.

Prefabricated branch cables (PBCs) serve as a robust alternative to conventional cable and conduit systems, primarily characterized by their highly integrated structure and standardized components. The core application areas for PBCs include the distribution of electrical power from a central riser to multiple load points across various floors or sections of a large building structure. Key applications span high-end residential towers, data centers where uptime and rapid deployment are paramount, expansive shopping malls, hospitals, and heavy industrial plants. The primary benefits driving adoption include enhanced fire safety characteristics due to specialized insulation materials, precise current distribution, high short-circuit withstand capability, and substantial long-term cost savings derived from reduced maintenance requirements and lower labor costs during the construction phase.

The market is predominantly driven by global trends in rapid urbanization and infrastructure modernization, particularly in emerging economies where large-scale construction of high-rise commercial and residential buildings is accelerating. Furthermore, stringent safety regulations concerning fire protection in densely populated urban structures are compelling developers and engineering procurement and construction (EPC) firms to adopt standardized, fire-resistant, and high-performance distribution systems like PBCs. Technological advancements focusing on lighter materials, improved connection reliability, and integration with smart building management systems are continuously bolstering the product's appeal across diverse end-use sectors globally.

Prefabricated Branch Cable Market Executive Summary

The Prefabricated Branch Cable Market is experiencing robust expansion, underpinned by fundamental business trends emphasizing construction efficiency, reliability, and safety compliance. Key business trends indicate a shift towards modular construction techniques and industrialization of construction processes, where PBC systems offer unparalleled advantages by minimizing on-site work and material waste. Market participants are heavily investing in product differentiation through proprietary connection technologies and advanced materials, such such as high-purity copper and specialized halogen-free, flame-retardant (HFFR) insulation, to meet increasing demand for safer and more sustainable building solutions. Mergers, acquisitions, and strategic alliances among core manufacturers are intensifying competition and driving geographical expansion into lucrative infrastructure development markets across Asia Pacific and the Middle East, ensuring standardization and supply chain resilience remain top strategic priorities for industry leaders.

Regionally, the market dynamics are highly heterogeneous. Asia Pacific, led by China and India, represents the largest and fastest-growing segment, propelled by massive governmental investments in smart city projects, commercial real estate expansion, and rapid industrialization. North America and Europe demonstrate mature market characteristics, focusing primarily on replacing aging infrastructure, modernizing existing grids, and enforcing stringent energy efficiency and safety standards in commercial and data center construction. Latin America and the Middle East and Africa (MEA) are emerging as high-potential regions due to accelerating infrastructure development associated with urbanization, tourism, and oil and gas sector expansions, creating significant demand for robust and reliable electrical distribution infrastructure tailored for harsh environmental conditions and large-scale industrial complexes.

Segmentation trends highlight the increasing preference for copper conductor systems in high-density, high-current applications due to their superior conductivity and reduced footprint, despite the higher initial cost. However, aluminum conductor systems are gaining traction in applications requiring longer runs and where weight reduction is a critical design factor, particularly in certain vertical infrastructure projects. By application, the commercial segment, driven by the proliferation of hyper-scale data centers and sprawling office complexes, remains the dominant revenue generator. Simultaneously, the industrial sector, including manufacturing and process plants demanding highly reliable power feeds and flexibility for layout modifications, is exhibiting accelerated adoption rates, underscoring the necessity for customizable and scalable PBC solutions tailored to specific operational requirements.

AI Impact Analysis on Prefabricated Branch Cable Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Prefabricated Branch Cable Market center on how AI can optimize manufacturing processes, enhance predictive maintenance protocols, and integrate PBC systems seamlessly within intelligent building management ecosystems (BMS). Users are concerned about the implementation costs of AI-driven quality control and whether AI can help forecast material pricing volatility, particularly copper and aluminum, to stabilize project budgeting. Furthermore, there is significant interest in how AI algorithms can model complex power loads and distribution requirements during the design phase, potentially automating the configuration and specification of complex PBC networks, thus reducing engineering overhead and minimizing sizing errors in large-scale installations. The expectation is that AI will transform PBCs from passive components into active, smart grid-ready infrastructure elements.

The integration of AI fundamentally alters the life cycle management of Prefabricated Branch Cable systems, moving beyond mere physical installation efficiency. In the manufacturing sector, AI-driven computer vision systems are being deployed for real-time quality assurance of insulation extrusion, conductor formation, and critical tap-off unit connection points, drastically improving overall product quality and reducing defect rates compared to traditional inspection methods. Furthermore, advanced machine learning models are optimizing production line scheduling and material utilization, predicting equipment failures before they occur, thus ensuring timely delivery of customized PBC segments crucial for just-in-time construction timelines. This predictive approach minimizes wastage and enhances the overall sustainability profile of PBC production.

Operationally, AI contributes significantly to the longevity and reliability of installed PBC systems. By analyzing massive datasets collected from integrated sensors (current, temperature, vibration) within smart PBC networks, AI algorithms can accurately predict potential hotspots, insulation degradation, or connection loosening before they lead to catastrophic failures. This enables facility managers to implement precise, condition-based maintenance schedules rather than relying on time-based inspections. This transition to predictive monitoring, facilitated by AI, ensures maximum system uptime, which is vital for mission-critical applications such as data centers and hospitals, thereby increasing the intrinsic value proposition of high-quality prefabricated cable solutions throughout their operational lifespan.

- AI-driven manufacturing quality control improving connection reliability and material defect detection.

- Predictive maintenance analytics optimizing the lifespan and reducing unscheduled downtime of installed PBC systems.

- Automated design configuration and load modeling utilizing machine learning to accurately specify PBC routes and capacities.

- Supply chain optimization using AI to forecast raw material costs (copper, aluminum) and inventory management.

- Integration with smart Building Management Systems (BMS) for real-time energy efficiency optimization and fault detection.

- Enhanced safety monitoring through AI analysis of thermal imaging data from operational PBC installations.

DRO & Impact Forces Of Prefabricated Branch Cable Market

The Prefabricated Branch Cable Market is characterized by strong fundamental drivers focused on construction optimization and energy infrastructure requirements, balanced against significant capital and technical barriers. The primary driver is the global surge in urbanization, necessitating the rapid and safe deployment of complex electrical networks within high-density structures, where the plug-and-play nature of PBCs offers substantial time and labor savings compared to traditional methods. Simultaneously, increasing global awareness and regulatory enforcement regarding fire safety in commercial and residential infrastructure, particularly following high-profile incidents, mandate the adoption of robust, fire-resistant distribution systems, which PBC manufacturers are adept at supplying. However, the market faces restraints primarily related to the higher initial procurement cost compared to standard conduit and wire installations, presenting a challenge for budget-sensitive projects. Furthermore, a lack of widespread standardization in tap-off unit designs across different manufacturers can create vendor lock-in and complicate inter-system compatibility.

Opportunities for market growth are vast, particularly through the ongoing integration of PBC systems with smart grid technologies and the burgeoning demand from the data center industry. As data centers expand globally, requiring ultra-reliable, high-capacity, and rapidly deployable power distribution, PBCs offer an ideal solution for modular and scalable power infrastructure. Additionally, advancements in material science, focusing on lighter, stronger, and more environmentally friendly conductor and insulation materials, present opportunities for product differentiation and appealing to sustainability-conscious clients. The major impact forces currently shaping the market include strict regulatory pressure for energy efficiency (driving demand for low-loss systems) and the fluctuating prices of base metals (copper and aluminum), which directly affect manufacturing costs and subsequent pricing stability for end-users, requiring robust hedging strategies from manufacturers to mitigate risk and ensure competitive pricing structures.

The market also benefits significantly from the general move towards digitalization and modular construction in the construction industry. As Building Information Modeling (BIM) becomes standard practice, the standardized, measurable components of PBCs integrate perfectly into digital planning and execution workflows, enabling precise material ordering and clash detection, further reducing project risk and delays. This technological synergy acts as a powerful reinforcing force for PBC adoption among large-scale EPC contractors. Conversely, a potential restraint lies in the requirement for specialized skilled labor for initial installation and maintenance, especially in regions lacking advanced technical training infrastructure, though this is mitigated over time as global training standards improve and manufacturers provide comprehensive installation certifications.

Segmentation Analysis

The Prefabricated Branch Cable Market is systematically segmented based on conductor material, application type, voltage level, and region, allowing for targeted analysis of market dynamics and demand drivers. The material segmentation (Copper vs. Aluminum) reflects key trade-offs between cost, weight, and conductivity, catering to different project specifications regarding capacity and distance. Application segmentation (Residential, Commercial, Industrial, Infrastructure) provides insight into where the highest value proposition of PBCs is realized, with commercial and industrial sectors consistently leading due to mission-critical power needs. These segmentations are crucial for manufacturers to align product development and marketing strategies with specific end-user demands, ensuring that customization capabilities—such as fire resistance ratings and specialized enclosure designs—meet stringent sector-specific regulatory requirements, particularly in healthcare and data center environments where failure is not an option.

- By Conductor Material:

- Copper Conductor

- Aluminum Conductor

- By Application:

- Residential Buildings

- Commercial Buildings (Offices, Malls, Hotels)

- Industrial Facilities (Manufacturing Plants, Process Industries)

- Infrastructure (Data Centers, Hospitals, Airports, Utilities)

- By Voltage Level:

- Low Voltage

- Medium Voltage

- By Cable Type/Structure:

- Flat Type

- Busbar Trunking Systems (Integrated Solutions)

- Standard Round Cable Bundles (with proprietary connection points)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Prefabricated Branch Cable Market

The value chain for the Prefabricated Branch Cable market initiates with upstream activities focused on the procurement and processing of core raw materials, primarily high-purity copper and aluminum, alongside specialized polymers and compounds for insulation and sheathing, such as PVC, XLPE, and Halogen-Free Flame Retardant (HFFR) materials. Given the volatile nature of global metal markets, maintaining strong, long-term relationships with metal suppliers and employing effective risk management strategies are crucial at this stage. The subsequent critical stage is manufacturing, where raw materials are transformed into specialized conductor segments and insulation layers, followed by the precise fabrication and assembly of the prefabricated tap-off units and connectors, requiring high levels of automation, stringent quality control, and specialized tooling to ensure connection integrity and performance standards are met for standardized and customized cable lengths.

Downstream activities involve logistics, distribution, and installation services. Due to the often large, non-standardized lengths and specific handling requirements of PBC segments, efficient logistics are essential to prevent damage and ensure timely arrival at construction sites, which often operate on strict schedules. The primary distribution channel involves a combination of direct sales from manufacturers to large EPC contractors and specialized electrical wholesalers who handle inventory and manage smaller, regional project demands. Direct distribution is favored for large, complex infrastructure projects where the manufacturer provides design consultation and technical support throughout the planning and installation phases, ensuring optimal system performance and warranty compliance for the end-user.

The distribution network relies heavily on both direct and indirect channels. Direct channels allow manufacturers to maintain greater control over product quality, customization, and after-sales service, establishing strong relationships with major construction developers, utility companies, and industrial plant operators. Indirect channels, involving authorized distributors and value-added resellers, are essential for penetrating regional markets, providing localized inventory, and offering smaller-scale project support. Successful engagement across both channels requires comprehensive technical training for distributor staff to ensure they can accurately specify and support the complex nature of prefabricated cable systems, maintaining the brand’s reputation for reliability and installation efficiency across various project scales and geographical locations.

Prefabricated Branch Cable Market Potential Customers

The primary consumers and buyers of Prefabricated Branch Cable systems are large-scale developers and organizations involved in constructing or modernizing high-density, power-intensive structures where reliability, speed of deployment, and safety are non-negotiable operational parameters. The core customer base includes Engineering, Procurement, and Construction (EPC) firms that prioritize solutions minimizing on-site labor and maximizing construction schedule efficiency. Furthermore, owners and operators of mission-critical facilities, such as hyperscale data center operators, healthcare systems (hospitals), and transportation hubs (airports, metros), constitute significant buyers due to the necessity for continuous, reliable power distribution and strict adherence to fire safety protocols, making the long-term cost benefits and high safety ratings of PBC systems highly appealing investments.

Utility companies and infrastructure management bodies represent another substantial segment of potential customers. These entities often require reliable, robust solutions for vertical power risers in multi-tenant buildings or municipal infrastructure projects, where modularity and ease of maintenance are critical considerations for minimizing service disruption. Real estate investment trusts (REITs) specializing in premium commercial and luxury residential properties are also key targets, as the use of high-quality PBC systems often reflects a commitment to advanced infrastructure, contributing to the building's overall market value and operational efficiency, thereby attracting high-tier tenants who demand superior infrastructure reliability and reduced operational expenditures.

The purchasing decisions of these potential customers are influenced by a holistic evaluation that extends beyond initial acquisition cost, heavily weighing factors such as installation time savings, certified fire resistance, projected maintenance costs, and system longevity (lifespan often exceeding 30 years). Manufacturers must therefore position PBC systems not merely as products, but as comprehensive engineered solutions that deliver quantifiable long-term operational advantages, safety compliance, and streamlined project execution, appealing directly to the risk management and long-term asset value preservation objectives of sophisticated developers and facility owners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity (Tyco Electronics), ABB, Prysmian Group, Nexans, LAPP Group, TBEA Co. Ltd., Furukawa Electric, LS Cable & System, Wanda Cable, Orient Cable, Jiangnan Cable, General Cable (Prysmian), Belden, Southwire, Encore Wire, Sumitomo Electric, Ducab, Eland Cables, NKT, Riyadh Cables. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prefabricated Branch Cable Market Key Technology Landscape

The technological landscape of the Prefabricated Branch Cable Market is defined by continuous innovation focused on enhancing system modularity, improving connection reliability, and achieving higher levels of fire resistance and thermal management. A key advancement involves the development of proprietary connection mechanisms, such as specialized tap-off boxes that utilize advanced locking and sealing technologies to ensure precise and highly stable electrical contacts, minimizing power loss and the risk of hot spots over the system's operational life. Furthermore, manufacturers are increasingly incorporating IoT capabilities directly into the cable system components, embedding sensors to monitor critical operational parameters like current load, temperature fluctuations, and environmental conditions, enabling real-time remote diagnostics and predictive maintenance scheduling, which significantly boosts system uptime in mission-critical environments like data centers and high-security installations.

Material science is another vital component of technological progress, particularly the refinement of insulation and jacketing compounds. The industry is moving rapidly towards the adoption of advanced polymeric materials, including cross-linked polyethylene (XLPE) and thermoset compounds, specifically formulated to be Halogen-Free, Flame Retardant (HFFR), and Low Smoke Zero Halogen (LSZH). These materials are essential for compliance with stringent international building codes, as they significantly limit the spread of fire and reduce the emission of toxic smoke in emergency situations, which is crucial for safety in high-occupancy structures. The focus here is on maintaining flexibility for installation while vastly improving fire endurance, ensuring the cables can maintain circuit integrity for longer periods under extreme heat conditions, a critical metric for life safety systems.

Moreover, the integration of PBC systems with Building Information Modeling (BIM) platforms represents a significant technological shift. Manufacturers are providing detailed digital models (BIM objects) of their entire product range, allowing engineers and architects to precisely integrate the PBC routing and components into the overall building design during the planning stage. This interoperability minimizes design errors, facilitates automated bill of materials generation, and streamlines the logistical coordination on site. Coupled with advancements in automated manufacturing processes, these technologies ensure that PBC systems remain at the forefront of highly efficient, reliable, and digitally manageable electrical distribution infrastructure for complex modern construction projects across the globe.

Regional Highlights

Regional dynamics significantly influence the adoption and growth trajectory of the Prefabricated Branch Cable Market, driven by variances in infrastructure maturity, construction activity, and regulatory frameworks.

- Asia Pacific (APAC): APAC dominates the global market and is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This dominance is attributed to aggressive infrastructure spending, particularly in urbanization, commercial real estate development, and government initiatives promoting smart cities in countries like China, India, and Southeast Asian nations. The region’s rapid expansion of metropolitan areas necessitates distribution solutions that prioritize rapid deployment and high safety standards in crowded environments.

- North America: North America is characterized by a mature market focusing on infrastructure modernization, replacement of aging electrical systems, and high demand from the specialized data center segment. Stringent safety and energy efficiency regulations, coupled with the need for resilient power systems against climatic and operational disruptions, drive the adoption of high-performance copper-based PBC systems, particularly in large commercial and institutional buildings across the United States and Canada.

- Europe: The European market maintains stable growth, primarily spurred by green building initiatives, strict adherence to fire safety standards (such as CPR – Construction Products Regulation), and substantial investment in renewable energy integration and grid decentralization projects. Western European countries emphasize sustainability and quality, driving demand for HFFR and LSZH-compliant PBC solutions tailored for historical building refurbishments and high-end commercial constructions.

- Middle East and Africa (MEA): The MEA region is experiencing rapid market penetration, fueled by mega-projects in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) related to tourism, smart city development (like NEOM), and large-scale industrialization efforts. The demand here centers on robust, customized systems capable of withstanding extreme temperatures and harsh environmental conditions while ensuring high current carrying capacity for sprawling commercial complexes and luxury high-rise towers.

- Latin America (LATAM): Growth in LATAM is gradually accelerating, supported by increasing investment in residential and commercial infrastructure, particularly in major economies like Brazil and Mexico. The market is increasingly recognizing the long-term benefits of PBCs regarding reduced labor costs and improved reliability, although market penetration remains lower than in APAC or North America due to sensitivity to initial capital expenditure and evolving regulatory harmonization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prefabricated Branch Cable Market.- TE Connectivity (Tyco Electronics)

- ABB

- Prysmian Group

- Nexans

- LAPP Group

- TBEA Co. Ltd.

- Furukawa Electric

- LS Cable & System

- Wanda Cable

- Orient Cable

- Jiangnan Cable

- General Cable (now part of Prysmian)

- Belden

- Southwire

- Encore Wire

- Sumitomo Electric

- Ducab

- Eland Cables

- NKT

- Riyadh Cables

Frequently Asked Questions

Analyze common user questions about the Prefabricated Branch Cable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using Prefabricated Branch Cables over traditional wiring?

The primary advantage is dramatically reduced installation time and labor costs on site, owing to factory-assembled components and plug-and-play tap-off units. This modularity ensures higher quality control, minimizing human error and accelerating project timelines, crucial for high-rise commercial and data center construction.

Are Prefabricated Branch Cable systems more fire-safe than conventional cable installations?

Yes, PBC systems are generally engineered for superior fire safety. Manufacturers utilize advanced, often HFFR (Halogen-Free, Flame Retardant) and LSZH materials, and the standardized factory-sealed connections inherently reduce the risk of faults and arc-flash incidents compared to vulnerable, manually spliced joints found in traditional cable installations.

How does the initial cost of PBC systems compare to conventional electrical distribution methods?

The initial procurement cost of Prefabricated Branch Cable systems is typically higher than that of raw cables and conduit. However, the total lifecycle cost is often lower due to significant savings in installation labor, faster project completion, reduced maintenance requirements, and lower system power losses during operation.

Which industry segment is driving the highest demand for Prefabricated Branch Cables globally?

The commercial segment, particularly the rapid global expansion of hyperscale and edge data centers, is currently driving the highest demand. These facilities require reliable, high-density power distribution that can be rapidly scaled and deployed, making the modular and high-performance nature of PBCs indispensable for maintaining continuous uptime.

What materials are commonly used for conductors in Prefabricated Branch Cable systems?

The two main conductor materials are copper and aluminum. Copper is preferred for high-current, low-resistance applications and confined spaces due to its superior conductivity, while aluminum is increasingly used in applications requiring longer runs or weight reduction, balancing cost effectiveness with acceptable performance parameters.

The aforementioned analysis confirms the robust growth trajectory of the Prefabricated Branch Cable Market, driven primarily by globalization of construction standards, regulatory push for advanced safety features, and the imperative for efficiency in large-scale infrastructure projects. The convergence of physical product innovation with digital integration, exemplified by AI applications in quality control and predictive maintenance, solidifies the position of PBC systems as fundamental components of resilient, future-ready electrical infrastructure worldwide. Strategic regional focus on APAC's rapid urbanization and North America's data center boom will continue to shape competitive strategies and technological advancements, emphasizing modularity, sustainability, and adherence to evolving international electrical codes and performance metrics.

The market environment mandates that key players continuously refine their supply chain management to buffer against raw material price volatility, particularly for copper and aluminum. Furthermore, investment in proprietary connection technologies and advanced material science is essential to overcome current restraints related to cost competitiveness and standardization challenges. The shift towards BIM integration and the growing acceptance of lifecycle costing over initial capital expenditure are critical factors influencing procurement decisions among major EPC firms and developers globally. Maintaining high levels of localized technical support and specialized installation training remains pivotal to ensuring effective market penetration and sustaining high levels of customer satisfaction and system performance across diverse regulatory and climatic zones.

Future market development will likely be characterized by further consolidation among key manufacturers, aiming to achieve economies of scale and extend global distribution networks. The increasing complexity of power systems, particularly those incorporating renewable energy sources and battery storage systems, will necessitate PBC solutions capable of handling bidirectional power flow and demanding transient conditions. Consequently, R&D efforts are projected to concentrate on increasing power density, reducing system footprint, and achieving seamless communication integration between the cable system and higher-level network control architectures, ensuring the Prefabricated Branch Cable market remains aligned with the accelerating demands of intelligent and sustainable urban infrastructure development well into the next decade.

The continuous evolution of construction methodologies towards greater industrialization and off-site manufacturing fundamentally aligns with the inherent strengths of prefabricated cable solutions. As labor shortages persist in many developed economies, the time-saving characteristics of PBCs become even more compelling, driving market preference away from traditional, labor-intensive installation methods. This macro trend, coupled with the non-negotiable requirement for enhanced fire safety in densely populated commercial centers and residential towers, ensures a sustained high demand trajectory for specialized, high-performance prefabricated solutions. Manufacturers who successfully leverage digital tools for design and logistics, while maintaining a commitment to advanced, sustainable materials, are strategically positioned to capitalize on the multi-billion-dollar opportunities presented by global infrastructure modernization efforts.

Furthermore, regulatory harmonization across different global regions, albeit slow, is steadily fostering a more streamlined environment for international manufacturers. As standards bodies increasingly recognize and incorporate performance specifications related to prefabricated systems into national building codes, the barrier to entry related to regulatory compliance is reduced, facilitating broader market adoption. This regulatory endorsement acts as a powerful catalyst, providing specifiers and contractors with the confidence necessary to adopt these advanced solutions across a wider spectrum of project types, ranging from small-to-medium enterprises upgrading their facilities to massive utility-scale power distribution hubs requiring maximum redundancy and reliability in their internal cabling networks. The focus remains on deliverable value rather than just initial cost.

The specialized requirements of the growing data center sector—including extremely tight tolerance specifications for power distribution uniformity, need for rapid deployment, and requirement for high-density power capacity—make it a continuous innovation engine for the PBC market. Manufacturers are developing tailored solutions, such as flexible, high-amperage systems optimized for rack-level power delivery, directly integrated with monitoring capabilities. These application-specific products, often featuring specialized fire stops and environmental seals, underscore the market's trajectory towards highly customized, engineered solutions that meet niche but high-value demand pockets. This product specialization contributes significantly to revenue stability and margin protection for industry leaders, separating them from general cable manufacturers who lack the necessary integration expertise and proprietary connection technologies required for high-reliability prefabricated systems.

In summary, the Prefabricated Branch Cable Market is transitioning from a specialized niche to a mainstream requirement in advanced construction and infrastructure projects globally. The projected CAGR of 6.5% reflects the sustained demand driven by urbanization and the critical shift towards safer, more efficient, and digitally manageable electrical distribution systems. Key strategic imperatives for market participants include maintaining technological leadership in connection design, securing stable raw material supply chains, and expanding penetration in high-growth APAC markets while simultaneously supporting modernization and compliance mandates in North America and Europe. The interplay between physical product innovation and digital ecosystem integration (AI, BIM) is set to define the competitive landscape and maximize value capture across the forecast period.

This comprehensive view of market dynamics emphasizes that the Prefabricated Branch Cable sector is not merely experiencing growth; it is undergoing a fundamental evolution driven by global macro trends in safety, efficiency, and smart infrastructure development. The intrinsic benefits associated with reduced installation errors, predictable performance metrics, and enhanced fire resistance align perfectly with the evolving demands of modern high-density environments. This strong foundational alignment ensures that the market's expansion will be resilient against short-term economic fluctuations, driven by long-term capital investments in essential urban and commercial infrastructure upgrades globally. Consequently, continuous investment in R&D and strategic market expansion are non-negotiable for maintaining competitive advantage within this expanding, technologically demanding sector.

Further analysis of the competitive environment reveals a strategic focus on acquiring or partnering with regional distributors who possess deep knowledge of local codes and construction practices. This strategy minimizes regulatory hurdles and accelerates time-to-market for complex, jurisdictionally sensitive products. Furthermore, the capacity to provide turnkey solutions, encompassing design consultation, customized fabrication, installation supervision, and long-term maintenance contracts, is increasingly becoming a critical differentiator, shifting the competitive focus from product sales to comprehensive service provision. Companies that excel in this end-to-end service delivery model are capturing larger market shares, especially in major infrastructure projects where technical risk mitigation is a paramount concern for clients.

The impact of sustainability goals is increasingly evident in the material choices and manufacturing processes. Manufacturers are investing in circular economy initiatives, exploring the recyclability of conductor materials, and minimizing waste generated during the factory prefabrication process compared to traditional on-site installation, which often results in significant cable scrap. This commitment to environmental responsibility enhances the value proposition of PBCs, particularly when bidding on publicly funded or corporate projects adhering to stringent Environmental, Social, and Governance (ESG) standards. Thus, achieving high ratings in both fire safety and environmental impact is rapidly becoming a core competency expected of leading players in the Prefabricated Branch Cable Market, ensuring alignment with global climate resilience and sustainability targets.

In conclusion, the market is poised for significant expansion, fueled by urbanization, regulatory mandates, and technological integration. The shift towards modular construction methods and the continuous proliferation of data centers globally provide powerful, inelastic demand drivers. Success in this highly competitive arena hinges on technological superiority in connection design, proactive management of raw material supply, and a strategic focus on expanding distribution channels in high-growth regions like APAC. The robust market characteristics, combined with the proven safety and efficiency benefits of PBC systems, project a sustainable and highly lucrative future for the sector.

The final consideration is the long-term geopolitical and trade dynamics affecting supply chain stability. As manufacturing footprints become increasingly globalized, resilience against regional trade barriers and geopolitical tensions is paramount. Leading Prefabricated Branch Cable manufacturers are strategically diversifying their manufacturing and assembly locations to ensure redundancy and continuity of supply, particularly for specialized components. This localization strategy not only mitigates risk but also allows for better customization of products to meet specific regional voltage standards, safety certifications, and installation preferences, thereby strengthening market presence and reducing logistical lead times, which is a critical factor in time-sensitive construction projects globally.

The evolution towards higher-voltage systems within the PBC domain, although primarily focused on low and medium voltage applications currently, also presents an emerging technological frontier. Developing safer, more reliable prefabricated solutions for medium-voltage distribution in industrial settings and utility feeders could unlock substantial new market potential. Such innovation requires significant investment in advanced insulation testing and enhanced shielding technologies to manage higher electrical stresses effectively while maintaining the inherent benefits of prefabrication. This expansion into higher-voltage applications is a key strategic opportunity for technologically advanced market leaders looking to diversify their product portfolio and target complex industrial and utility infrastructure upgrade cycles, further reinforcing the long-term growth prospects of the sector.

Furthermore, the consumer perception regarding the installation process is also evolving. While initial training for specialized installers is required, the ease, speed, and clean nature of the subsequent installation process are significant advantages noted by on-site project managers. This positive feedback loop—where reduced installation complexity translates directly into lower on-site risk and predictable scheduling—reinforces the choice of PBCs over traditional methods. Manufacturers capitalizing on these operational benefits through effective case studies and performance metrics will successfully accelerate the speed of adoption, particularly within markets where skilled labor availability is constrained or where project delivery time is a critical contractual obligation, thus cementing the market’s positive growth outlook.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager