Prefabricated Environmental Rooms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435624 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Prefabricated Environmental Rooms Market Size

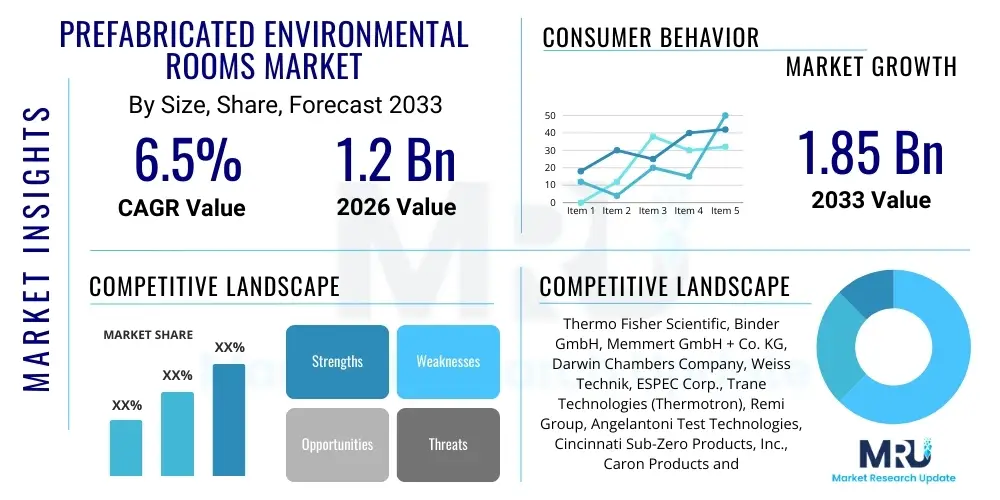

The Prefabricated Environmental Rooms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Prefabricated Environmental Rooms Market introduction

The Prefabricated Environmental Rooms Market encompasses highly specialized, modular structures designed to maintain precise atmospheric conditions, including temperature, humidity, lighting, and air quality, often exceeding the capabilities of standard laboratory environments. These rooms are essential for stability testing, product shelf-life determination, biological incubation, and critical manufacturing processes, providing controlled environments that ensure compliance with stringent regulatory standards like ICH guidelines for pharmaceuticals or ASTM standards for materials testing. The prefabricated nature allows for faster installation, scalability, and ease of relocation compared to traditional stick-built construction, driving adoption across diverse industries requiring reliable environmental control.

The primary products within this market include walk-in stability chambers, cold rooms, warm rooms, controlled temperature and humidity (CTH) rooms, and specialized cryogenic storage facilities. Major applications span critical sectors such as pharmaceuticals (drug stability testing and storage), biotechnology (cell culture and genetic material preservation), electronics (stress testing of components), and food and beverage (shelf-life studies and quality assurance). The demand is fundamentally driven by increasing global regulatory requirements for product quality, safety, and validation across the life sciences and industrial manufacturing sectors, necessitating validated and reproducible testing environments.

Key benefits of utilizing prefabricated environmental rooms include superior thermal performance, energy efficiency through optimized panel insulation, precise digital control systems, and rapid deployment capabilities that minimize downtime during facility setup or expansion. Driving factors supporting market expansion include the accelerated pace of drug discovery and clinical trials, the stringent requirements for vaccine storage (especially ultra-low temperature requirements), and the expanding use of advanced materials in industries like aerospace and automotive, which require complex environmental durability testing. Furthermore, the inherent flexibility of modular designs makes these solutions highly attractive for research institutions and Contract Research Organizations (CROs) needing adaptable testing capacity.

Prefabricated Environmental Rooms Market Executive Summary

The Prefabricated Environmental Rooms Market is experiencing robust growth, primarily fueled by the pharmaceutical and biotechnology sectors' stringent regulatory adherence requirements and the continuous expansion of R&D activities globally. Business trends indicate a strong shift towards highly integrated, IoT-enabled control systems that offer remote monitoring, predictive maintenance, and extensive data logging capabilities essential for GxP compliance. Key manufacturers are focusing on modularity, sustainable materials, and enhanced energy efficiency (e.g., using variable frequency drives and advanced refrigerants) to meet corporate environmental goals and reduce operational costs for end-users. Consolidation activities, particularly mergers and acquisitions among niche technology providers and established chamber manufacturers, are shaping the competitive landscape, aiming to offer turnkey laboratory solutions.

Regional trends highlight North America and Europe as dominant markets, characterized by high pharmaceutical R&D expenditure and established regulatory frameworks that mandate the use of validated environmental chambers. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, driven by rapid industrialization, increasing governmental investments in life sciences infrastructure in countries like China and India, and the rising presence of large-scale contract manufacturing organizations (CMOs). These regions exhibit significant demand for stability storage rooms and large-scale controlled environments to support domestic and export-oriented production, creating a necessity for readily deployable, high-quality prefabricated solutions. Investment in cold chain logistics infrastructure is further accelerating regional growth.

Segmentation trends reveal that walk-in stability rooms constitute a major revenue segment due to their high volume capacity required for ICH stability testing protocols over extended periods. Technologically, rooms featuring advanced humidity control and tight temperature uniformity are experiencing escalating demand, particularly from advanced materials testing and specialized biological research applications. In terms of end-use, the Pharmaceutical & Biotechnology segment remains the largest revenue generator, while the Food & Beverage and Electronics sectors show increasing market penetration, driven by the need for accelerated shelf-life studies and compliance with rigorous component quality standards. The trend toward customized, multi-functional environmental rooms capable of simulating diverse extreme conditions is driving premium pricing within the market.

AI Impact Analysis on Prefabricated Environmental Rooms Market

User queries regarding the intersection of AI and Prefabricated Environmental Rooms frequently center on optimizing energy consumption, enhancing predictive maintenance scheduling, and leveraging machine learning for environmental data analysis and compliance reporting. Users seek confirmation on whether AI can significantly reduce the massive energy footprint typically associated with large-scale environmental testing facilities and how AI tools can automate the complex process of maintaining GxP validation status. Common themes include the integration of sensor data with AI algorithms to anticipate refrigeration unit failures before they occur, optimizing defrost cycles based on real-time room loading, and using pattern recognition to detect deviations in stability profiles that might indicate sample degradation or chamber malfunction, thereby ensuring data integrity and minimizing costly experimental loss.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational efficiency and reliability of prefabricated environmental rooms. AI algorithms are increasingly deployed within the Room Monitoring Systems (RMS) to analyze voluminous sensor data, including temperature, humidity, pressure differentials, and air exchange rates, to establish normal operational baselines. By constantly comparing real-time performance metrics against these baselines, AI enables highly accurate predictive maintenance, shifting the operational model from reactive repairs to proactive system optimization, significantly reducing unexpected downtime which is critical for continuous stability studies.

Furthermore, AI plays a crucial role in optimizing the energy consumption of these resource-intensive units. ML models can learn patterns related to door openings, internal heat loads, and external ambient conditions to dynamically adjust compressor and heating element cycles. This granular control ensures that the required environmental set points are maintained with minimal energy expenditure, a major benefit for large facilities managing dozens of rooms. AI also streamlines the GxP compliance process by automating the generation of deviation reports and audit trails, classifying anomalous events, and ensuring that all environmental data logging adheres strictly to regulatory standards, thereby enhancing the overall data quality and integrity.

- AI-driven Predictive Maintenance: Forecasts component failure (e.g., compressor lifespan) based on acoustic and vibration data, reducing unscheduled downtime.

- Energy Optimization: Machine Learning algorithms dynamically regulate HVAC and refrigeration cycles based on real-time load and external temperature, minimizing power usage.

- Automated Compliance Reporting: AI analyzes environmental data logs, detects subtle deviations from GxP standards, and automates deviation reporting and audit trail generation.

- Enhanced Data Integrity: ML models ensure the validity and consistency of environmental monitoring data, preventing data loss or manipulation.

- Optimized Process Control: AI tunes PID controllers for faster recovery times and tighter temperature uniformity following disturbances like door openings.

DRO & Impact Forces Of Prefabricated Environmental Rooms Market

The dynamics of the Prefabricated Environmental Rooms market are shaped by several critical forces, including regulatory mandates driving mandatory stability testing (Drivers), the substantial initial investment and operational energy costs (Restraints), and the rapid expansion of biotechnology and personalized medicine necessitating specialized storage (Opportunities). These forces create an imperative for manufacturers to deliver scalable, validated, and cost-effective solutions. The necessity for strict compliance with global standards, particularly in pharmaceutical stability programs outlined by the International Council for Harmonisation (ICH), acts as a non-negotiable driver, compelling large and small organizations to invest in high-quality environmental rooms to ensure product safety and efficacy throughout their shelf life.

Key drivers include the global expansion of the pharmaceutical industry, particularly in developing nations, coupled with increasing outsourcing of clinical trials and stability studies to Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). The growing complexity of biological drugs (biologics) and gene therapies requires ultra-precise, often low-temperature, environmental control, further stimulating demand for highly specialized prefabricated solutions. However, the market faces significant restraints, notably the high capital expenditure required for purchasing and installing these specialized units, particularly larger walk-in rooms, and the substantial ongoing energy consumption associated with maintaining extreme or tightly controlled environments (e.g., -80°C freezers or large humidity chambers). These financial barriers can restrict adoption among smaller research institutions or startups.

Opportunities for market growth are abundant, centering on technological advancements such as the integration of IoT for sophisticated remote diagnostics and the development of sustainable, energy-efficient refrigeration technologies (e.g., natural refrigerants like CO2). The accelerating demand for validated cold chain infrastructure globally, driven by complex vaccine distribution requirements and the rising adoption of cell and gene therapies, represents a major avenue for market expansion. Furthermore, the modular nature of these rooms presents an opportunity for manufacturers to offer scalable, easily reconfigurable solutions that meet the evolving space and volume requirements of modern research facilities, thereby minimizing long-term facility modification costs. The primary impact force accelerating growth remains the non-discretionary regulatory requirement for product quality assurance and testing across all regulated industries.

Segmentation Analysis

The Prefabricated Environmental Rooms Market is comprehensively segmented based on the type of room, the temperature range maintained, the end-use application, and geographical region. This segmentation provides a granular view of market dynamics, revealing where investment and innovation are most concentrated. The primary segmentation by product type typically differentiates between Walk-In Stability Rooms, which dominate in terms of volume and capacity for long-term drug testing, and specialized rooms like Cryogenic Storage Rooms and Controlled Temperature/Humidity (CTH) rooms, which cater to niche, high-precision applications like vaccine storage and materials stress testing. Understanding these segments is vital for manufacturers to tailor product specifications and compliance features, especially concerning validation protocols and energy efficiency.

The end-use segmentation highlights the market's reliance on the life sciences sector, with Pharmaceuticals and Biotechnology accounting for the largest share due to mandated regulatory testing frameworks. However, non-life science sectors such as Electronics and Automotive are gaining traction. For instance, the electronics industry relies heavily on thermal shock and humidity testing rooms to ensure the reliability of components used in electric vehicles and high-performance computing. The geographical analysis further segments the market, identifying high-growth regions like APAC where regulatory standards are maturing and infrastructure investment is peaking, contrasting with the established, high-value replacement markets in North America and Europe. Continuous monitoring of these segments allows for targeted commercial strategies and R&D focused on emerging technological requirements like sustainability and connectivity.

- By Product Type:

- Walk-in Stability Chambers

- Cold Rooms (2°C to 8°C)

- Warm Rooms (30°C to 50°C)

- Controlled Temperature and Humidity (CTH) Rooms

- Cryogenic Storage Rooms (e.g., -80°C, -196°C)

- Incubators and Growth Rooms

- By Temperature Range:

- Standard Temperature Ranges (0°C to 60°C)

- Low-Temperature Ranges (below 0°C)

- Ultra-Low Temperature Ranges (below -40°C)

- By End-Use Industry:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutions

- Electronics & Semiconductor Manufacturing

- Automotive & Aerospace

- Food & Beverage Industry

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Prefabricated Environmental Rooms Market

The value chain for prefabricated environmental rooms begins with upstream suppliers, which provide critical raw materials and specialized components. Key upstream activities involve sourcing high-efficiency insulated panels (typically polyurethane or polyisocyanurate foam panels), specialized refrigeration units (compressors, condensers, evaporators), precision control systems (PLC controllers, sensors), and high-grade stainless steel or aluminum for internal structures and finishes. The reliance on energy-efficient refrigeration technology and advanced sensor manufacturing capacity makes these specialized component suppliers crucial determinants of the final product's quality and operational efficiency. Relationships with suppliers who offer sustainable refrigerants and components compliant with global environmental regulations (like the F-Gas regulation in Europe) are increasingly important for competitive advantage.

Midstream activities involve the design, manufacturing, and assembly of the modular environmental rooms. Manufacturers focus on engineering precise air flow dynamics, ensuring thermal uniformity, and achieving tight temperature and humidity tolerances necessary for regulatory compliance (e.g., ICH Q1A). The manufacturing process emphasizes modular construction techniques, quality control of the panel interlocking systems, and integration of complex monitoring and alarm systems. Direct and indirect distribution channels then facilitate market reach. Direct sales are common for large, highly customized projects, especially within the pharmaceutical sector, where manufacturers provide installation, validation (IQ/OQ/PQ), and long-term maintenance services themselves. Indirect channels involve authorized distributors, system integrators, and specialized laboratory equipment resellers who handle sales and initial setup for smaller institutions or standard product models, often broadening geographic market access.

Downstream analysis focuses on installation, validation, and post-sale services delivered to the end-users. For GxP-regulated environments, comprehensive validation services (Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ)) are mandatory and constitute a significant part of the value proposition. Post-installation support, including calibration, preventative maintenance contracts, and 24/7 remote monitoring services, ensures the long-term reliability and compliance of the chambers, generating sustained revenue streams for manufacturers. The primary downstream consumers are pharmaceutical R&D labs and manufacturing sites that rely on the validated performance of these rooms for regulatory submissions and product release. Efficiency in the downstream service phase is paramount, as equipment failure can lead to the loss of critical, time-sensitive stability study samples.

Prefabricated Environmental Rooms Market Potential Customers

The primary consumers, or potential customers, of prefabricated environmental rooms are enterprises and institutions operating under stringent regulatory mandates where environmental consistency is non-negotiable for product quality, safety, or efficacy. The largest cohort of buyers includes multinational Pharmaceutical and Biotechnology companies who require extensive capacity for stability testing of both small molecule drugs and complex biologics, often needing multiple rooms set to different ICH conditions (e.g., 25°C/60% RH, 40°C/75% RH). These customers prioritize validation services, data integrity features, redundancy in refrigeration systems, and scalable, modular designs that can adapt to rapid changes in R&D pipeline demands.

A second major customer base comprises Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). As drug development and manufacturing are increasingly outsourced, CROs and CMOs need large, flexible, and rapidly deployable environmental room infrastructure to handle diverse client projects simultaneously. Their purchasing decisions are heavily influenced by the speed of installation, energy efficiency for high utilization rates, and the ability of the chambers to maintain multi-standard compliance. Furthermore, entities in the electronics, automotive, and aerospace sectors—including R&D centers and materials testing laboratories—represent significant potential customers, particularly for rooms capable of thermal cycling, vibration testing, and highly corrosive atmosphere simulation to assess component durability under extreme operational conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Binder GmbH, Memmert GmbH + Co. KG, Darwin Chambers Company, Weiss Technik, ESPEC Corp., Trane Technologies (Thermotron), Remi Group, Angelantoni Test Technologies, Cincinnati Sub-Zero Products, Inc., Caron Products and Services, Inc., BINDER GmbH, Sheldon Manufacturing, Inc., Rusher Air Conditioning, Inc., VWR International, LLG Labware, Powers Scientific, Tenney Environmental, PERTH Scientific, CSZ Environmental Chambers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prefabricated Environmental Rooms Market Key Technology Landscape

The technological landscape of the Prefabricated Environmental Rooms market is characterized by advancements in three major areas: energy efficiency, digital integration, and advanced environmental control capabilities. Modern rooms leverage high-density, vacuum-insulated panels (VIPs) and optimized panel design to minimize thermal leakage, significantly reducing the load on refrigeration systems. Furthermore, the shift towards sustainable, low Global Warming Potential (GWP) refrigerants, such as R-290 (propane) and CO2, is gaining traction, driven by global environmental regulations and corporate sustainability mandates. The adoption of Variable Frequency Drives (VFDs) for compressors and air circulation fans allows for precise control and substantial energy savings compared to traditional, fixed-speed systems, thereby lowering the total cost of ownership for end-users.

Digital integration, centered on the Internet of Things (IoT) and centralized monitoring systems, is a defining feature of contemporary environmental rooms. These systems integrate hundreds of critical data points (temperature, humidity, pressure, power consumption) and transmit them wirelessly to cloud-based platforms. This enables real-time remote diagnostics, automated alarming, and continuous data logging necessary for GxP validation. The use of sophisticated Programmable Logic Controllers (PLCs) and touch-screen interfaces facilitates enhanced user control, highly detailed trend analysis, and simplified compliance documentation. Connectivity ensures that operational data is readily accessible and auditable, which is crucial for regulatory submissions in the life sciences sector.

Beyond standard temperature and humidity control, technological advancements focus on specialized capabilities, including photostability testing (using highly controlled UV and visible light sources), vibration simulation chambers, and extreme altitude testing capabilities for aerospace and defense applications. Advanced humidity generation and dehumidification systems utilize precise dew point sensors and modulating valves to achieve exceptionally tight humidity uniformity (e.g., +/- 1% RH). The growing demand for flexibility has also spurred innovations in modularity, allowing users to easily expand, contract, or reconfigure room sizes without compromising thermal envelopes or validation status, making these rooms valuable long-term assets for dynamically evolving research facilities.

Regional Highlights

Geographical analysis reveals stark differences in market maturity, regulatory environment, and growth trajectory across major regions. North America, particularly the United States, holds the largest market share due to its established and highly innovative pharmaceutical and biotechnology ecosystem, significant R&D spending, and the presence of major manufacturers and key end-users like large biopharmaceutical corporations and leading academic research institutions. The region’s mature regulatory landscape mandates rigorous GxP compliance and stability testing, ensuring sustained, high-value demand for validated, prefabricated rooms. Furthermore, the substantial investment in advanced cold chain storage solutions for complex biologic drugs and vaccines contributes significantly to regional market dominance.

Europe represents the second-largest market, characterized by stringent environmental and energy efficiency regulations, driving demand for technologically advanced, green environmental rooms utilizing low-GWP refrigerants. Countries such as Germany, Switzerland, and the UK host major global pharmaceutical centers and sophisticated automotive and aerospace testing facilities, creating consistent demand. The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is propelled by burgeoning investments in healthcare infrastructure, the rise of domestic pharmaceutical and biotech companies in China, India, and South Korea, and the increasing globalization of clinical trials, which necessitates the rapid deployment of compliant environmental testing and storage facilities.

- North America: Market leader driven by high pharmaceutical R&D investment, robust regulatory environment (FDA compliance), and demand for ultra-low temperature storage solutions. Key demand centers include California, Massachusetts, and North Carolina.

- Europe: Strong demand supported by stringent GxP and environmental standards; high adoption rate of sustainable refrigeration technologies and specialized chambers for materials testing (e.g., automotive sector). Germany and France are key contributors.

- Asia Pacific (APAC): Fastest-growing region; growth fueled by expansion of biotech manufacturing, increasing regulatory scrutiny, government initiatives supporting life sciences, and rapid infrastructure development in China and India.

- Latin America (LATAM): Emerging market with gradual infrastructure development; primary demand focused on basic cold rooms and stability chambers for local pharmaceutical distribution and storage, driven by domestic production needs.

- Middle East & Africa (MEA): Limited but growing market, focused primarily on essential cold chain storage for public health initiatives (vaccines) and small-scale regional pharmaceutical manufacturing, often requiring specialized climate resilience features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prefabricated Environmental Rooms Market.- Thermo Fisher Scientific

- Binder GmbH

- Memmert GmbH + Co. KG

- Darwin Chambers Company

- Weiss Technik

- ESPEC Corp.

- Trane Technologies (Thermotron)

- Remi Group

- Angelantoni Test Technologies

- Cincinnati Sub-Zero Products, Inc. (CSZ)

- Caron Products and Services, Inc.

- Sheldon Manufacturing, Inc.

- Rusher Air Conditioning, Inc.

- VWR International (part of Avantor)

- LLG Labware

- Powers Scientific

- Tenney Environmental

- PERTH Scientific

- TWS Systems

- Fujiwa Kogyo Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Prefabricated Environmental Rooms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary GxP compliance requirements for prefabricated environmental rooms?

The primary GxP (Good Practice) compliance requirements mandate adherence to strict validation protocols, specifically Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ). Rooms must maintain highly uniform temperature and humidity profiles, provide continuous data logging with tamper-proof records, and include robust alarming and monitoring systems to ensure all stored products meet regulatory stability testing standards (e.g., ICH Q1A).

How does modular design benefit end-users in the biotechnology sector?

Modular design offers biotechnology firms critical flexibility and scalability. It allows research and manufacturing facilities to rapidly deploy new environmental capacity without lengthy construction periods, adapt room sizes as project demands change, and easily relocate the validated chamber to a new facility, significantly reducing long-term capital expenditure and minimizing disruption to ongoing G&D activities.

What role do natural refrigerants play in the future of environmental room technology?

Natural refrigerants, such as CO2 (R-744) and hydrocarbons (R-290/propane), are critical for achieving long-term sustainability and compliance with global environmental regulations aimed at phasing down high Global Warming Potential (GWP) chemicals. Their adoption ensures higher energy efficiency and future-proofs the equipment against evolving refrigerant restrictions, making them a key investment criterion for environmentally conscious organizations.

Which end-use segment drives the highest demand for walk-in stability chambers?

The Pharmaceutical and Biotechnology segment drives the highest demand for walk-in stability chambers. This is due to the mandatory requirement for bulk storage and long-term stability testing of drug substances and products under various controlled climatic conditions mandated by global regulatory bodies (FDA, EMA, ICH) to determine shelf life and packaging suitability.

How do IoT and remote monitoring systems enhance the reliability of environmental rooms?

IoT and remote monitoring systems significantly enhance reliability by providing real-time data on chamber performance, enabling instant alerts for deviations, and supporting predictive maintenance. This proactive monitoring minimizes the risk of critical temperature or humidity excursions, safeguarding valuable samples, ensuring data integrity, and reducing emergency repair costs and study loss.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager