Prefabricated Medical Headwall System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432608 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Prefabricated Medical Headwall System Market Size

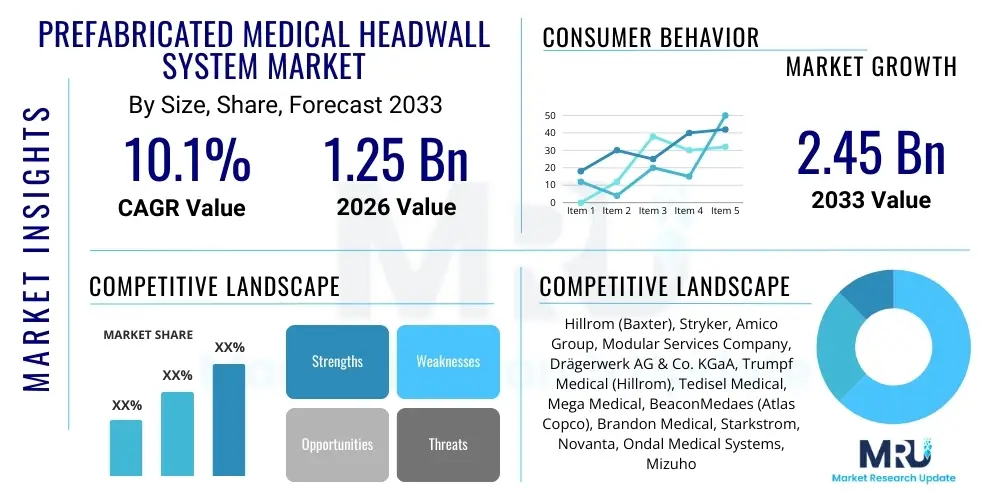

The Prefabricated Medical Headwall System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

Prefabricated Medical Headwall System Market introduction

The Prefabricated Medical Headwall System Market encompasses specialized, integrated infrastructure units designed for acute care environments, primarily in patient rooms, operating theatres, and intensive care units (ICUs). These systems consolidate essential medical services—including medical gas outlets, electrical power, data ports, and lighting controls—into a single, modular unit installed directly at the bedside. Headwalls replace traditional, time-consuming methods of installing individual components, offering enhanced safety, improved aesthetics, and superior infection control capabilities. The systems are highly customizable, available in various configurations such as vertical, horizontal, and specialty console units, catering to specific clinical requirements across different departments within a healthcare facility.

Key applications of these advanced systems are concentrated in newly constructed healthcare facilities and major renovation projects where speed of installation and standardization are critical. The inherent benefits, such as streamlined workflow, reduced installation time, and minimized disruption during construction, make them increasingly attractive alternatives to conventional construction methods. Moreover, prefabricated solutions offer flexibility for future expansion and adaptation to evolving technological standards, allowing for easier upgrades of data ports or power requirements without extensive structural modifications. This adaptability positions headwalls as crucial components in modern, patient-centric healthcare infrastructure planning.

The market growth is fundamentally driven by the global increase in healthcare infrastructure spending, particularly in developing economies, coupled with stringent regulatory standards mandating patient safety and improved clinical environments in established markets. Additionally, the rising prevalence of chronic diseases necessitating critical care services, alongside a growing focus on optimizing hospital operational efficiency and minimizing construction overheads, are accelerating the adoption of these standardized, high-quality systems. The continuous innovation in materials science and integration technology further enhances the appeal and functional lifespan of prefabricated medical headwalls.

Prefabricated Medical Headwall System Market Executive Summary

The Prefabricated Medical Headwall System Market is characterized by robust expansion, fueled primarily by major shifts toward modular construction methodologies in the healthcare sector and an intensified focus on optimizing clinical workflows within critical care settings. Business trends indicate a strong move toward highly customizable and technologically integrated solutions, where connectivity features, such as integrated nurse call systems and advanced monitoring equipment docking stations, are becoming standard requirements. Key players are increasingly focusing on strategic mergers, acquisitions, and regional partnerships to enhance their manufacturing capabilities and distribution networks, especially targeting high-growth areas in Asia Pacific and Latin America. Standardization protocols, particularly concerning medical gas piping and electrical conformity, are driving demand for certified, high-quality prefabricated units globally.

Regionally, North America maintains the largest market share due to substantial healthcare expenditure, early adoption of advanced medical technologies, and the presence of numerous large hospital systems undergoing continuous modernization. However, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), propelled by massive investments in new hospital construction to meet the demands of rapidly expanding populations and improving access to quality healthcare. Europe follows a steady growth trajectory, supported by governmental initiatives focused on updating aging hospital infrastructure and complying with stringent EU safety directives. The market dynamics are largely governed by the interplay between regulatory requirements for patient safety and the economic necessity for rapid, cost-effective hospital buildouts.

Segment trends reveal that the intensive care unit (ICU) application segment currently holds the dominant position, given the high concentration of medical services required per patient bed in these areas, making integrated headwalls indispensable for efficient emergency response and continuous monitoring. Furthermore, the horizontal headwall configuration segment is favored due to its ergonomic benefits and ability to distribute services along a wider span, though vertical systems are gaining traction in space-constrained settings like emergency departments. The materials segment is seeing a preference for durable, anti-microbial surfaces, reflecting the pervasive need for superior infection prevention in all clinical environments, thereby driving innovation in specialized coating technologies and material composition.

AI Impact Analysis on Prefabricated Medical Headwall System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Prefabricated Medical Headwall System Market typically revolve around three core themes: integration of smart monitoring capabilities, optimization of clinical environments, and predictive maintenance of critical infrastructure. Users frequently ask how AI can enhance the functionality of the headwall beyond its basic utility provision, specifically looking for features like automated environmental controls (lighting, temperature), integrated patient monitoring data analytics transmitted directly through the headwall's data ports, and predictive failure analysis for medical gas systems or power supplies connected through the unit. The consensus expectation is that AI will transform the headwall from a passive utility conduit into an active, intelligent interface for the smart hospital ecosystem, driving demand for next-generation, AI-ready physical infrastructure that supports high-bandwidth data transfer and complex analytical processing at the point of care.

The integration of AI algorithms facilitates advanced decision support systems directly accessible at the bedside via displays mounted on the headwall structure. This enhances clinical responsiveness and minimizes manual data entry errors. AI-driven systems can monitor physiological data streams routed through the headwall and alert staff to subtle changes in patient status, allowing for proactive intervention. Furthermore, AI influences the maintenance cycle by analyzing usage patterns and identifying potential component wear (e.g., gas outlet degradation or electrical load imbalances) within the headwall assembly, allowing facility management to schedule maintenance predictively rather than reactively, significantly improving system uptime and patient safety protocols.

- AI enables predictive maintenance of internal components, optimizing the longevity and reliability of medical gas and power infrastructure integrated within the headwall.

- Seamless integration of patient monitoring systems via high-speed data ports supports real-time AI analytics at the point of care, enhancing clinical decision support.

- AI optimizes environmental controls (lighting, temperature, privacy screen deployment) based on patient needs and clinical workflow phases, enhancing patient comfort and staff efficiency.

- Intelligent load balancing algorithms managed via the headwall system ensure continuous and prioritized power supply to critical life support equipment.

- AI-driven asset tracking and inventory management utilize headwall docking stations to monitor the presence and operational status of attached medical devices.

DRO & Impact Forces Of Prefabricated Medical Headwall System Market

The market for Prefabricated Medical Headwall Systems is propelled by powerful drivers centered on standardization, efficiency, and patient safety, yet faces significant restraints related to initial investment costs and complexity in integration within older facilities. The primary impact forces shaping the market trajectory include rapid technological convergence—merging utilities, data, and connectivity—and global shifts toward modular, rapid-deployment healthcare construction models. Opportunities are abundant in customization, specialized clinical applications (e.g., hybrid operating rooms), and leveraging sustainability requirements to promote energy-efficient and reusable headwall components. The overall market momentum is strongly positive, driven by the increasing global demand for high-quality critical care environments.

Drivers: A crucial driver is the necessity for streamlined hospital construction and renovation projects, where prefabricated units drastically reduce on-site labor and construction timelines, minimizing disruption to existing hospital operations. Secondly, stringent international safety and hygiene standards mandate solutions that simplify cleaning and minimize infection vectors; headwalls, particularly those made with seamless, anti-microbial materials, directly address this requirement. Furthermore, the rising global elderly population and subsequent increase in chronic diseases demand a higher volume of intensive care beds, requiring sophisticated, reliable bedside service provisioning. Finally, the growing complexity of medical devices necessitates centralized and readily accessible utility ports (power and data) that headwalls inherently provide, standardizing the connection interface for diverse equipment.

Restraints: The most significant restraint is the high initial capital expenditure associated with implementing complex, customized prefabricated systems, which can be prohibitive for smaller private hospitals or facilities in lower-income regions. Another challenge involves the lack of standardized regulatory frameworks across all geographical regions, complicating global deployment strategies for manufacturers. Moreover, integrating advanced prefabricated headwalls into existing, older hospital infrastructure often requires significant and costly modifications to structural and utility feeder lines, limiting retrofit opportunities. Finally, dependence on specialized skilled labor for the installation and specialized maintenance of these sophisticated, integrated systems poses a logistical restraint, particularly in remote or underserved areas.

Opportunities: Key market opportunities lie in developing highly modular, future-proof headwalls that can be quickly reconfigured to meet changing clinical demands, such as converting standard patient rooms into isolation or higher acuity rooms during pandemics. Significant potential exists in expanding offerings tailored for niche medical settings, including ambulatory surgical centers, psychiatric facilities, and highly specialized hybrid operating rooms requiring complex media integration. Manufacturers can also capitalize on the growing demand for sustainable construction practices by innovating materials that are recycled, environmentally friendly, and offer superior energy efficiency for lighting and power management systems. Additionally, developing smart, IoT-enabled headwalls that integrate with hospital information systems (HIS) represents a major avenue for technological advancement and market differentiation.

Segmentation Analysis

The Prefabricated Medical Headwall System Market is comprehensively segmented based on Configuration, Application, Product Type, and Material, reflecting the diverse and specialized requirements of modern healthcare facilities. Configuration segmentation—primarily vertical and horizontal—is crucial as it dictates the spatial utilization and accessibility of services at the bedside, with horizontal systems typically dominating standard patient rooms due to their spread-out service provision, while vertical systems are favored in space-constrained ICUs. Application analysis underscores the market's reliance on critical care units, where the density of required services makes prefabricated integration essential for operational efficiency and rapid response protocols. The diversity in product types, including standard, aesthetic, and specialized ceiling-mounted units, allows hospitals to select solutions that balance clinical function with patient psychological comfort.

Further granularity in segmentation involves analyzing the materials used, which is highly sensitive to infection control demands. Materials like stainless steel, anti-microbial coatings on aluminum, and high-pressure laminates are scrutinized for durability, ease of cleaning, and resistance to harsh disinfectants. This segmentation is vital for manufacturers to align their offerings with stringent regulatory requirements concerning healthcare-associated infections (HAIs). Geographically, the segmentation highlights regional differences in adoption rates, regulatory compliance, and construction standards, influencing the choice between highly advanced, fully integrated systems prevalent in North America and Western Europe, versus more cost-effective, standard solutions often utilized in emerging markets.

- By Configuration:

- Vertical Headwalls

- Horizontal Headwalls

- Ceiling-Mounted Systems (Booms)

- By Application:

- Intensive Care Units (ICU)

- Operating Rooms (OR)

- Emergency Rooms (ER)

- Standard Patient Rooms

- Neonatal Intensive Care Units (NICU)

- By Product Type:

- Aesthetic/Designer Headwalls

- Standard Utility Headwalls

- Specialty Procedure Headwalls

- By Material:

- Stainless Steel

- Aluminum

- High-Pressure Laminate (HPL)

- Anti-Microbial Surfaces

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASC)

- Specialty Clinics

Value Chain Analysis For Prefabricated Medical Headwall System Market

The value chain for the Prefabricated Medical Headwall System Market is complex, involving specialized raw material sourcing, precision manufacturing, highly regulated installation, and specialized after-market servicing. The upstream segment involves the procurement of high-grade materials, including medical-grade aluminum and stainless steel alloys, specialized medical gas tubing (copper), electrical components, and durable, infection-resistant surface laminates. This stage is crucial, as the quality and certification of these raw inputs directly influence the final product's compliance with ISO and NFPA standards for critical care equipment. Suppliers must maintain rigorous quality control and provide certified components, necessitating strong, long-term relationships between manufacturers and specialty metal and electronics providers who understand the stringent requirements of the medical sector.

The midstream (manufacturing and assembly) phase focuses on precision engineering, modular fabrication, and regulatory compliance testing. Manufacturers must invest heavily in CAD/CAM technology and clean room assembly processes to ensure components are perfectly integrated and validated before shipment. The complexity arises from integrating disparate utilities—gas, vacuum, power, and high-speed data—into a single, compact unit, requiring skilled labor and rigorous quality assurance checks to prevent potential failure points. Customization often requires a high degree of design flexibility, distinguishing standard production lines from bespoke, project-specific fabrication, which characterizes a significant portion of high-value projects.

The downstream segment encompasses distribution, installation, and after-sales service. Distribution channels include direct sales teams for large hospital systems and specialized medical equipment distributors who provide local support and manage logistics. Crucially, installation is not typical construction work; it often requires certified medical gas piping specialists and licensed electricians, acting under strict hospital construction protocols to ensure uninterrupted hospital operations. Direct and indirect channels both play vital roles, with direct sales facilitating high-value, complex projects requiring deep client consultation, while indirect channels (distributors) manage maintenance contracts, parts supply, and rapid local deployment, providing essential service continuity to ensure the long-term operational integrity of the headwall systems.

Prefabricated Medical Headwall System Market Potential Customers

The primary consumers and end-users of Prefabricated Medical Headwall Systems are institutions that provide acute and critical patient care, demanding high reliability and efficiency in utility delivery at the bedside. The largest customer segment comprises general hospitals, particularly those undergoing major expansion, structural renovations, or building new specialized wings (e.g., trauma centers, cardiovascular units). These institutions prioritize systems that offer rapid installation, conform to stringent building codes, and integrate sophisticated patient monitoring technology, leading them to favor high-end, customizable horizontal and ceiling-mounted boom systems.

Secondary, yet rapidly growing, customer segments include specialized healthcare facilities such as Ambulatory Surgical Centers (ASCs) and dedicated specialty clinics focused on areas like oncology or dialysis. ASCs value compact, efficient, and standardized headwalls that minimize footprint while ensuring compliance and accessibility for short-stay procedures. Furthermore, military and governmental healthcare facilities represent a significant segment, prioritizing robust, durable, and easily maintainable systems suitable for high-stress environments and often requiring specific features for rapid field deployment or adaptability in varying climate zones. The procurement decision for all these customers is heavily influenced by total cost of ownership, compliance track record, and the manufacturer's ability to provide comprehensive installation and maintenance support.

The increasing trend toward patient-centric design means that facilities are also focusing on the "aesthetic" qualities of headwalls, driving demand for hidden utility panels and wood-grain or designer finishes, particularly in private hospital rooms or recovery areas. Therefore, potential buyers include not only facility managers and procurement officers but also architectural design firms specializing in healthcare environments, who influence the selection and specification of these systems early in the design phase. Infection control committees also act as crucial internal customers, mandating the use of materials with proven anti-microbial properties and seamless designs, thereby impacting purchase decisions across all institutional types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 10.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hillrom (Baxter), Stryker, Amico Group, Modular Services Company, Drägerwerk AG & Co. KGaA, Trumpf Medical (Hillrom), Tedisel Medical, Mega Medical, BeaconMedaes (Atlas Copco), Brandon Medical, Starkstrom, Novanta, Ondal Medical Systems, Mizuho OSI, KwickScreen, HTM Equipment, Maxant, KLS Martin Group, Surgiris, Meditech Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prefabricated Medical Headwall System Market Key Technology Landscape

The technological evolution within the Prefabricated Medical Headwall System Market is concentrated on enhancing modularity, integration, and digital connectivity, transforming headwalls into sophisticated central hubs for patient care. A primary technological focus is on high-density data integration, necessitating the use of advanced fiber optics and Cat6a/Cat7 cabling infrastructure within the headwall structure to support bandwidth-intensive medical imaging, electronic health record (EHR) access, and real-time remote patient monitoring systems. This technological shift is essential to future-proof healthcare facilities against increasing data demands and the proliferation of connected medical devices (IoMT). Manufacturers are employing sophisticated engineering techniques to compartmentalize utilities (gases, power, data) safely within the unit, often utilizing color-coded, standardized quick-connect mechanisms that streamline installation and minimize potential errors during maintenance.

The incorporation of smart material technologies is another vital area, driven largely by infection control mandates. This includes the widespread adoption of surfaces treated with durable anti-microbial coatings (silver or copper ions) that actively inhibit bacterial growth, significantly reducing the risk of Hospital-Acquired Infections (HAIs). Furthermore, innovations in LED lighting systems integrated into the headwalls are critical, offering circadian lighting features that adjust intensity and color temperature to promote patient healing and enhance the working environment for clinical staff. These lighting solutions must be highly energy-efficient and meet strict medical photometric standards, ensuring optimal visibility during critical procedures while minimizing glare and light pollution.

Advancements in modularity and configuration flexibility, particularly in ceiling-mounted boom systems (which are technically advanced forms of headwalls), allow for dynamic positioning and utility delivery around the patient bed, optimizing space utilization in busy Operating Rooms and ICUs. Booms utilize complex robotic articulation and friction braking systems, managed electronically, providing surgeons and nurses with precise control over medical equipment placement. Moreover, power management systems within headwalls are becoming more intelligent, incorporating built-in uninterruptible power supplies (UPS) and surge protection technologies to ensure absolute reliability for life-support devices, addressing the critical necessity for continuous, clean power supply in high-acuity environments.

Regional Highlights

Regional dynamics play a crucial role in shaping the Prefabricated Medical Headwall System Market, with notable differences observed in investment patterns, regulatory compliance, and preferred product configurations. North America, encompassing the United States and Canada, currently dominates the market share due to its well-established healthcare infrastructure, high per capita healthcare expenditure, and stringent regulatory environment (NFPA standards), which promotes the adoption of high-quality, fully certified, and aesthetically integrated systems, particularly in large urban medical centers. The region's focus on acute care specialization and continuous hospital modernization cycles ensures sustained demand for advanced horizontal and specialized boom systems that support sophisticated critical care technologies.

Europe represents a mature market characterized by governmental emphasis on upgrading aging hospital infrastructure and a strong adherence to European Union directives related to medical device safety and construction norms (e.g., ISO standards for medical gas systems). Countries such as Germany, the UK, and France are primary adopters, favoring highly standardized, durable systems that offer excellent long-term operational efficiency and compliance with strict environmental regulations. Growth in this region is steady, driven mainly by replacement cycles and the increasing implementation of energy-efficient and sustainable materials in public healthcare projects, where durability and low maintenance are prioritized over purely aesthetic customizations.

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven by unprecedented investment in healthcare infrastructure expansion across countries like China, India, and Southeast Asian nations. This rapid growth is fueled by booming populations, increasing health awareness, and rising government investment aimed at improving healthcare access and quality, particularly in tier 1 and tier 2 cities. While cost sensitivity remains a factor, the increasing adoption of Western standards in new private hospitals is driving demand for both standard and mid-to-high-range prefabricated systems. Conversely, Latin America and the Middle East & Africa (MEA) present nascent markets with significant potential, constrained by fluctuating economic stability but offset by major infrastructure projects in wealthy Gulf Cooperation Council (GCC) countries and localized modernization efforts in key South American economies like Brazil and Mexico.

- North America (Dominant Market): Characterized by high technological integration, stringent safety standards (NFPA 99), and widespread adoption of premium, custom-designed horizontal and vertical headwalls in ICUs and ORs.

- Europe (Steady Growth): Driven by public sector modernization, replacement cycles, and adherence to EU regulatory compliance, favoring standardized, durable systems and focused on energy efficiency.

- Asia Pacific (Fastest Growth): Fueled by massive investments in new hospital construction, rapid urbanization, and increasing penetration of standardized critical care solutions, especially in emerging economies.

- Latin America: Growth concentrated in private healthcare sectors and major metropolitan areas, with increasing demand for affordable, reliable headwall systems in new healthcare facility developments.

- Middle East and Africa (MEA): Growth centered around large-scale government healthcare projects (e.g., Saudi Arabia, UAE) prioritizing luxury and high-technology integration, often utilizing ceiling-mounted surgical boom systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prefabricated Medical Headwall System Market.- Hillrom (Baxter)

- Stryker

- Amico Group

- Modular Services Company

- Drägerwerk AG & Co. KGaA

- Trumpf Medical (Hillrom)

- Tedisel Medical

- Mega Medical

- BeaconMedaes (Atlas Copco)

- Brandon Medical

- Starkstrom

- Novanta

- Ondal Medical Systems

- Mizuho OSI

- KwickScreen

- HTM Equipment

- Maxant

- KLS Martin Group

- Surgiris

- Meditech Systems

Frequently Asked Questions

Analyze common user questions about the Prefabricated Medical Headwall System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between horizontal and vertical medical headwall systems?

Horizontal headwalls are typically wider and distribute utilities along a patient room wall, providing easy access to multiple connection points simultaneously, making them ideal for standard patient rooms and step-down units. Vertical headwalls, conversely, utilize height to deliver services in a compact vertical column, conserving lateral space. They are preferred in confined, high-acuity areas like ICUs and ERs, often accommodating ceiling-mounted medical booms for equipment management. The choice between the two is dictated by clinical workflow requirements, space constraints, and the density of services needed at the bedside.

How do prefabricated headwalls contribute to hospital infection control standards?

Prefabricated medical headwalls significantly enhance infection control by utilizing non-porous, easy-to-clean materials, such as medical-grade stainless steel or surfaces treated with anti-microbial coatings. Their integrated, seamless design eliminates crevices and exposed piping, which are common harbor points for pathogens in traditional wall construction. Furthermore, the modular nature allows for quick maintenance or replacement of components without significant wall disruption, minimizing dust and contamination risks during repair operations, directly supporting regulatory compliance against Healthcare-Associated Infections (HAIs).

What certifications and regulatory compliance standards are essential for medical headwalls?

Medical headwalls must adhere to stringent international and regional safety and functional standards to ensure patient and staff safety. Essential certifications include compliance with NFPA 99 (Health Care Facilities Code) in North America, particularly concerning medical gas and vacuum systems, and electrical safety standards (UL or equivalent). Internationally, adherence to ISO standards (e.g., ISO 13485 for Quality Management Systems and relevant standards for medical gas piping) is critical. Buyers must verify that the headwall is certified for the specific jurisdiction where it will be installed, ensuring all electrical, gas, and structural components meet mandated performance criteria.

What is the typical lifespan and maintenance requirement for a prefabricated medical headwall?

The structural and core utility components of high-quality prefabricated medical headwalls are designed to last the typical lifespan of the healthcare facility, often exceeding 15 to 20 years with proper maintenance. Routine maintenance is crucial, focusing primarily on the periodic inspection and calibration of medical gas outlets, electrical receptacles, and data ports to ensure they maintain secure connections and proper functionality. Manufacturers recommend annual comprehensive inspections and replacement of high-wear components like quick-connect couplers and light fixtures, often managed through specialized maintenance contracts to ensure system reliability and regulatory compliance.

How are advancements in smart hospital technology influencing the design of new medical headwalls?

Smart hospital technology is transforming headwalls into intelligent interfaces. New designs emphasize high-bandwidth data capacity, facilitating seamless integration with the Internet of Medical Things (IoMT), electronic health records (EHR), and telehealth systems. This includes incorporating standardized mounting points for smart devices, integrated power charging capabilities, and internal networking architecture capable of supporting real-time data streaming. Future headwalls are designed to be "AI-ready," serving as the physical conduit for sophisticated monitoring systems and enabling predictive maintenance and automated environmental control features, thereby supporting the evolution towards fully connected, patient-centric care environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager