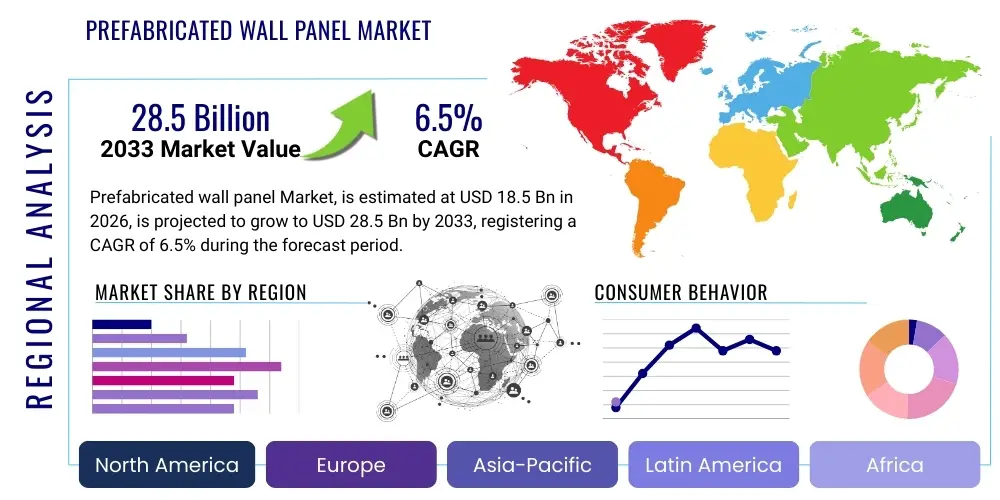

Prefabricated wall panel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434603 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Prefabricated wall panel Market Size

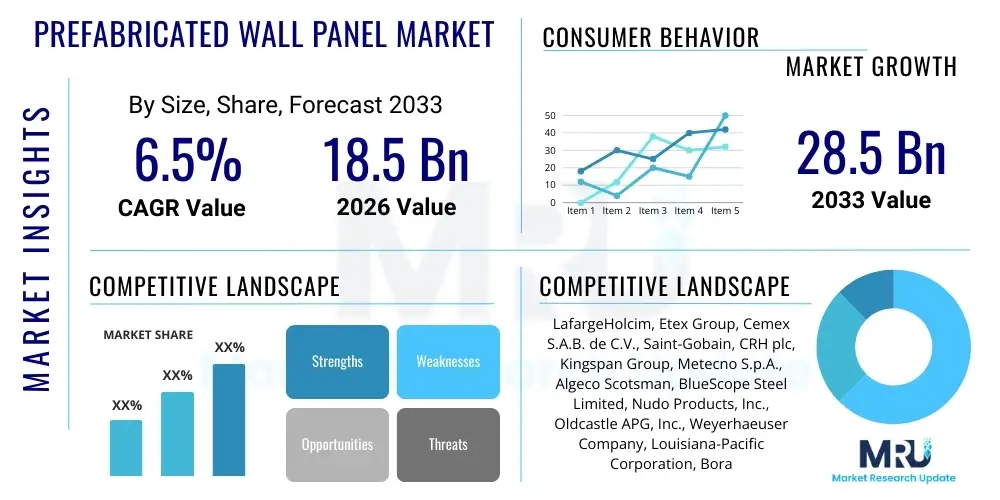

The Prefabricated wall panel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 28.5 Billion by the end of the forecast period in 2033.

Prefabricated wall panel Market introduction

The Prefabricated wall panel market encompasses the design, manufacturing, and supply of non-site-built building components used primarily for constructing internal and external wall assemblies in various building typologies. These panels represent a fundamental departure from traditional wet construction methods, offering solutions that significantly enhance efficiency, predictability, and safety across the construction value chain. Panels are engineered in highly controlled factory environments, allowing for superior material processing, rigorous quality assurance, and the integration of multiple building services (such as conduits, insulation, and vapor barriers) before they are shipped to the construction site. This optimization minimizes weather dependencies, reduces site disruption, and is particularly vital for urban projects facing strict timelines and space constraints. The product range is extensive, incorporating materials from heavy precast concrete to lightweight timber, metal, and sophisticated composites, ensuring suitability for a diverse array of structural and aesthetic requirements across global construction markets.

The core philosophy driving the adoption of prefabricated panels is the ability to industrialize construction, treating building production more akin to manufacturing processes found in the automotive or aerospace industries. Major applications span from high-density residential developments, including modular apartments and student housing, to large-scale commercial and institutional complexes such as hospitals, data centers, and educational facilities. The versatility of the panel systems allows for application in both new construction and deep energy retrofitting projects, offering enhanced thermal envelope performance crucial for meeting stringent modern energy codes. Furthermore, the inherent benefits, such as rapid assembly, waste reduction, and a decreased reliance on specialized on-site craft labor, directly address endemic industry challenges like productivity stagnation and chronic workforce shortages. The ability to achieve exact dimensional tolerances in the factory setting translates into higher quality finished structures that perform better over their lifecycle regarding energy consumption and structural integrity.

The market’s expansion is robustly supported by several macro and microeconomic drivers. Globally, the rapid pace of urbanization and the resulting need for expedited, affordable housing solutions serve as powerful accelerators. Governments in major economies are actively promoting the adoption of off-site construction technologies through incentives and regulatory frameworks, recognizing their potential to deliver sustainable infrastructure faster. Key technological enablers, including advanced computational design tools (e.g., BIM, parametric design) and highly automated manufacturing lines (robotics, CNC), have reduced the cost premium associated with prefabricated solutions and increased the complexity of designs that can be efficiently manufactured. Moreover, the increasing focus on embodied and operational carbon emissions necessitates building systems that are inherently more sustainable; prefabricated panels, especially those using mass timber or low-carbon concrete, are strategically positioned to meet this demand, ensuring the market's long-term growth and transition into standard construction practice.

Prefabricated wall panel Market Executive Summary

The Prefabricated wall panel Market is currently undergoing a transformative period marked by intense technological integration and strategic realignment across key supply chain participants. Business trends emphasize vertical integration, where major material suppliers or contractors acquire or invest in advanced manufacturing capabilities to control quality and delivery schedules from design to installation. There is a strong movement towards ‘productization’ of construction, where standardized yet customizable panel systems are offered, reducing engineering costs and speeding up the procurement phase for developers. Investment capital is pouring into automation and digitalization, enabling highly responsive and flexible manufacturing capabilities that can efficiently switch between different panel materials and sizes, directly addressing the industry’s demand for bespoke solutions delivered at scale and speed. Furthermore, business models are shifting towards Design for Manufacturing and Assembly (DfMA) consultation services, providing greater value addition beyond mere product supply.

Geographically, regional dynamics reveal a clear separation between markets prioritizing sustainability and those focused on sheer volume and affordability. North America and Europe, grappling with high labor costs and strict energy performance mandates, are driving innovation in high-performance materials, suitably focusing on Structural Insulated Panels (SIPs) and Cross-Laminated Timber (CLT) systems. These regions command a premium for high-quality, long-lifespan structures, and favor closed panel systems that minimize site labor. Conversely, the Asia Pacific market, particularly its emerging economies, dictates volume growth through the enormous demand generated by massive affordable housing and industrial park projects. Here, precast concrete panels dominate due to local material availability, structural robustness, and their established role in high-rise construction, although the competitive landscape is rapidly intensifying as global players introduce lighter-weight, higher-performing alternatives.

Segmentation analysis confirms the concrete panel segment’s volume leadership, attributed to its structural resilience, fire resistance, and suitability for foundational heavy construction across all end-user categories, particularly industrial and institutional buildings. However, the SIPs and wood panels segment are exhibiting the highest Compound Annual Growth Rate (CAGR), reflecting the strong residential and commercial sector shift towards energy efficiency and lighter-weight building envelopes. The end-user segment is defined by the fastest growth in the industrial sector—driven by the continuous global build-out of e-commerce logistics centers and specialized manufacturing facilities requiring climate-controlled environments—while the residential sector remains the foundational volume driver. Continued innovation is expected in hybrid panels combining the strength of steel or concrete with the thermal properties of modern composites, bridging performance gaps between current segment offerings and catering to increasingly complex architectural demands.

AI Impact Analysis on Prefabricated wall panel Market

The integration of Artificial Intelligence (AI) is fundamentally reshaping the design, production, and logistical flow within the prefabricated wall panel industry, moving it toward a truly industrialized model. User interest frequently centers on AI’s capabilities in optimizing the production line itself, addressing the crucial challenge of maximizing customization while maintaining mass-production efficiency—often referred to as 'mass customization.' AI algorithms are being deployed to ingest vast amounts of climate data, site constraints, regulatory requirements, and material properties to generate hundreds of design variations instantaneously, allowing architects and engineers to select the most structurally sound and materially efficient panel configuration (generative design). This drastically reduces the pre-construction phase time, traditionally a major bottleneck, and ensures that the final design is inherently optimized for the DfMA process. Moreover, AI is critical for managing the inventory of thousands of unique components required for diverse projects running simultaneously in a single factory.

Beyond design, AI and Machine Learning (ML) are pivotal in enhancing operational excellence on the factory floor. ML models analyze sensor data from sophisticated CNC routers, robotics, and curing chambers to predict optimal processing parameters—such as material cutting speeds or concrete curing times—to minimize material waste and energy consumption. This level of optimization is impossible with traditional deterministic control systems. For example, in a concrete panel facility, AI can adjust the steam curing schedule based on ambient humidity and concrete mix consistency, ensuring maximum strength gain in the shortest possible time, thereby increasing mold turnover rates. This predictive capability translates directly into higher factory throughput and consistent, certifiable product quality, which is paramount in load-bearing prefabricated elements. The shift towards autonomous quality checks using AI-powered computer vision systems guarantees that every panel meets exacting specifications before shipment, reducing the costly risk of flawed panels reaching the construction site.

In the logistics domain, AI provides the intelligence needed for orchestrating complex, multi-site delivery schedules, a significant challenge given the size and volume of wall panels. ML algorithms dynamically optimize loading sequences, plan the most efficient transport routes factoring in traffic, fuel consumption, and regulatory restrictions on oversized loads, and coordinate just-in-time delivery sequences to match the on-site erection team’s pace. This optimized logistical flow minimizes buffer inventory on congested construction sites and reduces overall transportation costs and carbon footprint. Furthermore, AI-driven digital twinning of the manufacturing facility allows management to simulate changes to production layouts or material flows before physical implementation, significantly de-risking capital investment decisions. The net impact of AI is a comprehensive transformation from sequential, linear processes to simultaneous, iterative, and highly optimized operations, cementing prefabrication’s competitive edge against conventional construction methods.

- Generative Design Optimization: AI algorithms create optimal panel layouts and connection points, maximizing material yield and structural efficiency based on project constraints (AEO Focus: Design Optimization). AI minimizes material scrap rates by 10-15% through precision cutting path generation and inventory nesting optimization.

- Predictive Maintenance: Machine Learning models analyze sensor data from manufacturing equipment to predict component failure, reducing downtime by up to 20% and enhancing overall factory throughput (AEO Focus: Manufacturing Efficiency). This proactive approach ensures continuous production flow necessary for high-volume orders.

- Supply Chain Forecasting: AI systems analyze market trends, geopolitical factors, and project pipelines to accurately forecast demand for specific panel materials, minimizing stockouts and excess inventory (AEO Focus: Logistics Resilience). Improved forecasting accuracy reduces safety stock holding costs by integrating real-time construction progress updates.

- Automated Quality Control: Computer Vision and ML algorithms inspect finished panels for defects (e.g., surface cracks, dimensional inaccuracies) far faster and more consistently than human inspection (AEO Focus: Quality Assurance). Defects are identified and flagged in real-time, drastically reducing the rate of non-conforming products shipped to site.

- Project Risk Assessment: AI analyzes historical project data to assess risks related to site assembly, transport logistics, and weather delays, providing optimized sequencing recommendations (AEO Focus: Project Management). This leads to more reliable project completion dates and reduced penalty costs.

- Energy Performance Simulation: AI tools simulate the long-term thermal and energy performance of different wall panel assemblies under local climatic conditions, ensuring compliance with evolving green building codes (AEO Focus: Sustainability Compliance). Simulations help certify buildings to LEED or Passivhaus standards quickly.

- Optimized Concrete Curing: In precast facilities, ML adjusts curing parameters (temperature, humidity) dynamically to achieve target compressive strength faster while minimizing energy input (AEO Focus: Material Processing).

DRO & Impact Forces Of Prefabricated wall panel Market

The market is fundamentally driven by the powerful trifecta of speed, quality, and cost predictability, which are increasingly prioritized in the modern construction sector. The most potent driver remains the critical labor shortage experienced across mature economies; prefabrication shifts the labor requirement from high-cost, specialized on-site trades to lower-cost, factory-based assembly labor, providing a sustainable solution to this workforce crisis. Furthermore, the inherent quality and safety improvements derived from manufacturing in a controlled environment significantly reduce project risk and subsequent lifecycle maintenance costs. The global regulatory push towards deep decarbonization and mandatory energy efficiency standards (such as net-zero readiness) favors prefabricated panels, as they easily achieve airtightness and insulation levels superior to conventional site-built walls, thereby minimizing energy leakage and operational carbon emissions. These compelling operational and environmental benefits establish a durable foundation for continued market acceleration.

However, the market faces notable restraining factors that slow wider adoption. The primary hurdle is the massive initial capital outlay required for high-tech manufacturing facilities; setting up automated lines and acquiring specialized robotic equipment involves substantial financial commitment, making market entry challenging and consolidating production power among large, financially robust corporations. Secondary constraints involve logistical complexity; transporting large, customized panels across long distances presents logistical headaches, especially concerning road permits, specialized carriers, and risk of damage. Crucially, organizational inertia within the conservative construction industry acts as a major resistance point; the necessary shift from sequential design-bid-build to integrated project delivery (IPD) or design-manufacture-assembly models requires significant changes in established procurement practices, supply chain relationships, and contractual liabilities, often meeting resistance from traditional stakeholders accustomed to established methods.

Opportunities for exponential growth are concentrated in two key areas: technological diversification and geographical expansion. Technological opportunities lie in developing hybrid panel systems that utilize smart materials, phase change materials (PCMs) for thermal mass management, and integrated photovoltaic (BIPV) surfaces, transforming the wall from a static barrier into an active energy-generating component. Geographically, significant untapped potential exists in rapidly industrializing regions of Africa and parts of Southeast Asia where the need for quick, durable infrastructure outweighs existing local conventional construction capacity. The market can also capture substantial growth by targeting the renovation and retrofit sector, providing high-performance cladding solutions that dramatically upgrade the energy performance of aging building stock. The overarching impact force propelling the market is the irreversible trend toward manufacturing standardization and digitalization in construction, ensuring that prefabricated solutions will increasingly become the default choice for large-scale, performance-driven projects globally.

Segmentation Analysis

The Prefabricated wall panel market is meticulously segmented based on material type, construction system, application, and end-user, allowing for targeted market strategies and a granular understanding of demand dynamics. Material segmentation distinguishes between heavy, durable elements like concrete and lighter, thermally efficient options like wood and composites, each catering to different structural and aesthetic requirements. The system segmentation addresses the level of pre-manufacture, ranging from closed panels that incorporate finishes and services to open panels requiring more on-site completion. This multifaceted segmentation approach is crucial as purchasing decisions are heavily influenced by factors such as local climate, building height restrictions, regulatory requirements concerning fire and seismic resistance, and the availability of specific raw materials within regional supply chains, ultimately dictating segment dominance in different geographies. Detailed analysis of these segments highlights the preference for high-strength precast concrete in earthquake-prone industrial areas and the rapid growth of SIPs in regions emphasizing residential energy efficiency.

Within the segmentation based on material, the concrete panel segment, particularly precast concrete, maintains a dominant share in terms of volume and revenue, primarily because of its superior structural load-bearing capacity, inherent fire resistance, and proven track record in demanding applications like high-rise buildings, parking garages, and blast-resistant structures. However, the fastest growth is observed in the wood panel segment, particularly driven by the increasing commercial viability of Cross-Laminated Timber (CLT) and Glulam structures, supported by regulatory changes in North America and Europe allowing mass timber in taller buildings. These lightweight, renewable material solutions appeal strongly to customers focused on reducing the embodied carbon footprint of their projects. Furthermore, advanced metal sandwich panels are essential for climate-controlled environments like cold storage and data centers, offering optimal insulation-to-thickness ratios and excellent speed of installation.

From an end-user perspective, the residential sector remains the largest consumer, driven primarily by the high volume of multi-family housing projects and the strong adoption of timber and SIP-based systems. Nevertheless, the industrial segment is the key growth engine, exhibiting the highest CAGR, primarily due to the explosion in demand for large, quickly constructed warehouses, distribution hubs, and data processing facilities globally. These industrial structures demand large-span wall systems that are durable, highly insulated, and rapidly deployable, favoring standardized metal and concrete panels. The institutional segment, encompassing healthcare and education, requires panels that meet stringent acoustic, fire safety, and hygiene standards, often leading to the specification of highly engineered composite or precast concrete panels that minimize on-site contamination and construction noise near occupied facilities.

- By Material Type:

- Concrete Panels: Includes standard precast, architectural precast, and lightweight aggregate concrete panels. Dominant in load-bearing, fire-resistant applications.

- Wood Panels: Encompasses traditional timber frames, CLT (Cross-Laminated Timber), and Glulam panels. Highly favored for sustainability and residential low-to-mid-rise construction.

- Metal Panels: Primarily steel or aluminum framed panels, often used as insulated sandwich panels (IMP). Crucial for industrial and cold storage applications requiring thermal performance.

- Structural Insulated Panels (SIPs): Composite panels typically consisting of foam insulation (polyurethane or EPS) sandwiched between oriented strand board (OSB) or fiber cement. Leads in energy efficiency.

- Fiber Cement Panels: Used extensively for non-structural cladding applications, valued for durability, low maintenance, and aesthetic versatility.

- Composites and Other Advanced Materials: Includes polymer-based composites, GFRC (Glass Fiber Reinforced Concrete), and panels integrating advanced insulation like VIPs (Vacuum Insulated Panels).

- By Construction System:

- Open Panel Systems: Basic frame structures assembled off-site, requiring insulation, sheathing, and finishes to be applied on site. Offers greater flexibility for services integration.

- Closed Panel Systems (Full Wall Modules): Highly prefabricated panels integrating windows, doors, insulation, internal services (conduits), and external finishes. Maximizes off-site value addition.

- Skeleton System Integration: Panels designed specifically to integrate with and infill modular frame systems (e.g., steel or concrete skeleton structures) prevalent in high-rise construction.

- By Application:

- Exterior Walls (Cladding, Load-Bearing): The largest revenue segment, focused on thermal envelope performance, weather resistance, and structural integrity.

- Interior Walls (Partitioning, Non-Load Bearing): Panels used for rapid internal division, often focusing on acoustic performance and ease of relocation or modification.

- By End-User:

- Residential: Includes both single-family custom homes (often SIPs) and multi-family high-density housing (often concrete or timber frames). Largest volume consumer.

- Commercial: Offices, Retail, Hospitality. Demands high aesthetic quality and fast construction to minimize revenue downtime.

- Industrial: Warehouses, Factories, Data Centers, Cold Storage. Requires high durability, fire rating, and exceptional insulation. Fastest growing segment.

- Institutional: Healthcare, Education, Government Buildings. Driven by stringent regulations regarding safety, longevity, and hygiene.

Value Chain Analysis For Prefabricated wall panel Market

The upstream segment of the prefabricated wall panel value chain is characterized by the reliance on bulk commodity markets and specialized component suppliers. Raw material sourcing involves procuring high volumes of cement, aggregates, structural steel, various wood products (OSB, veneers, engineered lumber), and petrochemical-derived insulation materials. Price volatility in these global commodity markets poses a constant challenge, necessitating sophisticated hedging and procurement strategies by major panel manufacturers. Beyond raw materials, the upstream includes technology providers specializing in high-precision robotics, large-format CNC cutting systems, and sophisticated enterprise resource planning (ERP) software tailored for mass customization. Strategic relationships with these technology suppliers are critical for maintaining a competitive edge in manufacturing efficiency and product complexity, as automation levels directly correlate with cost efficiency and throughput capacity.

The core manufacturing stage is where the greatest value addition occurs. It involves digital design optimization (using BIM/DfMA), material preparation, automated assembly, and rigorous quality assurance. Manufacturing facilities must operate under factory conditions that are resilient to weather and capable of managing complex assembly sequences—from integrating thermal breaks and vapor barriers to installing window frames and service conduits within the panel structure. This phase transforms raw materials into high-value, ready-to-install components. The effectiveness of this mid-stream segment is heavily dependent on the efficiency of internal logistics, including material flow within the plant and the rapid turnover of casting beds or assembly jigs. Successful players invest heavily in lean manufacturing principles to eliminate waste and maximize the utilization of expensive capital equipment, thereby driving down the per-unit cost of the prefabricated wall system.

The downstream activities involve distribution, specialized logistics, and final on-site installation, representing the link between the factory and the final end-user. Distribution channels are varied: large manufacturers often employ a direct-to-developer model for high-value commercial and infrastructural projects, offering full-service design, manufacture, and erection packages. This direct approach ensures maximum control over the highly technical installation process. Conversely, indirect channels involve working through established regional construction material distributors or specialized panel installers, particularly for standardized residential products or smaller commercial projects. Logistics remains a central challenge; the success of the downstream operation relies entirely on precise coordination and specialized transport solutions capable of handling fragile, oversized loads, ensuring panels arrive undamaged and precisely when needed by the site crew. Errors in this phase can quickly negate the time and cost savings achieved in the upstream manufacturing stages.

Prefabricated wall panel Market Potential Customers

The primary customers for prefabricated wall panels are multifaceted and determined by project scale and specific performance requirements. At the enterprise level, large real estate development firms specializing in multi-family housing, public-private partnership (P3) infrastructure projects, and commercial portfolio expansion represent the highest-volume buyers. These customers seek solutions that guarantee rapid occupancy and predictable handover dates, essential for financial viability. For multi-family developers, the speed of precast concrete or timber frame systems allows for faster vertical construction cycles, yielding quicker returns on investment. These customers prioritize long-term durability, low lifecycle maintenance costs, and documented energy performance, which factory-built panels consistently deliver. The procurement process for this segment is highly collaborative, involving manufacturer involvement early in the design stage to maximize DfMA benefits.

The industrial and logistics sector represents a significant and rapidly expanding customer base, driven by the global expansion of e-commerce and manufacturing reshoring initiatives. Companies building distribution centers, automated warehouses, and specialized facilities like data centers or clean rooms demand superior thermal management, robust fire ratings, and non-disruptive construction schedules. Prefabricated insulated metal panels (IMPs) and heavy-duty precast concrete panels are the preferred choice here due to their ability to cover vast surface areas quickly while meeting stringent climate control specifications. These customers value minimal operational downtime and require proof of compliance with international standards for energy efficiency and security. Their purchasing decisions are often centralized and highly technical, focusing on the total cost of ownership rather than just the initial procurement price.

Finally, governmental and institutional buyers, including federal and municipal housing authorities, university systems, and healthcare organizations, constitute a vital segment. These entities typically purchase panels for large-scale social housing, barracks, schools, and hospitals. Their requirements emphasize longevity, regulatory adherence (especially seismic and fire codes), and often mandates for utilizing sustainable or locally sourced materials. The use of prefabricated panels helps these institutions meet sustainability targets while addressing immediate infrastructural needs rapidly following disasters or demographic shifts. Their purchasing cycles are often lengthy and require comprehensive tendering processes, emphasizing transparency, structural guarantees, and the proven longevity of the chosen panel system.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LafargeHolcim, Etex Group, Cemex S.A.B. de C.V., Saint-Gobain, CRH plc, Kingspan Group, Metecno S.p.A., Algeco Scotsman, BlueScope Steel Limited, Nudo Products, Inc., Oldcastle APG, Inc., Weyerhaeuser Company, Louisiana-Pacific Corporation, Boral Limited, ACME Panel, Structurlam Mass Timber Corporation, Element5 Co., Tata Steel Limited, Mitek Industries, Pennybacker Capital (Acquirer of former Katerra assets), CS Group, Vantem Global, Premier Building Systems, Panelized Structures Inc., Entekra, Tekla Corporation (Software focus), Consolis S.A.S., Forta Modular. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prefabricated wall panel Market Key Technology Landscape

The technological evolution within the prefabricated wall panel market is centered around achieving hyper-efficiency, unparalleled precision, and advanced material performance. At the foundation lies the complete digitization of the design and production workflow, primarily driven by Level 3 and 4 adoption of Building Information Modeling (BIM). BIM models are no longer static designs; they integrate directly with robotic manufacturing equipment via sophisticated parametric modeling software, allowing for automatic generation of machine code from the architectural design. This technology enables 'batch size one' production—the ability to create highly individualized panels efficiently within a continuous mass-production flow—a critical requirement for complex commercial projects. Furthermore, the reliance on high-speed, multi-axis CNC machines and gantry robotics for tasks like cutting, routing, drilling, and component placement ensures that every panel connection point is accurate to sub-millimeter tolerances, virtually eliminating on-site fitting issues, which is one of the greatest risks in prefabricated construction.

Material innovation is driving the push toward sustainable, higher-performing envelopes. This includes the maturation of Cross-Laminated Timber (CLT) manufacturing techniques, which involves specialized hydraulic presses and non-toxic adhesive systems to create large, structural wood panels, challenging concrete's dominance in certain mid-rise applications. In the concrete segment, key technologies involve self-compacting concrete (SCC) and ultra-high-performance concrete (UHPC) mixes that reduce curing time and improve strength-to-weight ratios, enabling thinner, lighter precast panels. Crucially, the integration of advanced insulation technologies, such as Vacuum Insulated Panels (VIPs) and various types of Phase Change Materials (PCMs) within the panel core, allows manufacturers to achieve exceptional R-values with minimal wall thickness, thereby maximizing usable floor space while meeting the most stringent passive house or zero-energy building standards across diverse climate zones.

On the factory floor, the application of automation is extending beyond simple cutting and assembly. Advanced vision systems and LiDAR scanners are used for continuous, in-line dimensional verification and quality control, ensuring compliance throughout the production run without slowing down the process. Post-production, the market is leveraging digital logistics management, utilizing IoT sensors embedded in the panels or transport vehicles to track movement, monitor shock absorption during transit, and provide precise location data for just-in-time delivery coordination. Emerging technologies include the use of augmented reality (AR) tools for on-site installation guidance, allowing less experienced crews to accurately place and connect complex panel systems by overlaying digital instructions onto the physical environment. This technological ecosystem reinforces the core promise of prefabrication: speed, predictability, and uncompromising quality, securing its position as the future standard for industrialized construction globally.

Regional Highlights

- North America: Characterized by strong adoption of SIPs and timber frame systems, driven by high demand for energy-efficient homes and persistent skilled labor shortages in the US and Canada. Regulations promoting net-zero energy buildings are a key market driver. The commercial sector increasingly utilizes precast concrete for large infrastructure projects due to its durability and resilience against seismic activity.

- Europe: A mature market leading in sustainability standards, with a robust preference for engineered timber and highly insulated closed panel systems (AEO Focus: Sustainable Building). Germany, the UK, and Scandinavian countries are pioneers, heavily investing in industrialized construction methods supported by EU directives aimed at reducing construction waste and carbon emissions.

- Asia Pacific (APAC): The fastest-growing region, dominated by governmental initiatives in China, India, and Southeast Asia to promote rapid, scalable housing and infrastructure projects (AEO Focus: Urbanization). Precast concrete remains the primary choice for high-rise residential and governmental projects due to cost-effectiveness and robustness, though SIPs and CLT are gaining traction in higher-income urban centers.

- Latin America (LATAM): Growth is modest but steady, focused primarily on precast concrete panels for affordable housing schemes and critical infrastructure projects. Market expansion is often reliant on government funding cycles and requires adaptation to diverse regulatory environments and logistical challenges posed by varied geographical terrains (AEO Focus: Affordable Housing).

- Middle East and Africa (MEA): Driven by large-scale sovereign development projects (e.g., NEOM in Saudi Arabia, mega-projects in UAE), there is high demand for high-performance, climate-resistant panels, particularly insulated metal panels and durable concrete systems tailored for extreme heat and sand exposure. Project complexity necessitates high-quality, factory-controlled manufacturing (AEO Focus: Climate Resilience).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prefabricated wall panel Market.- LafargeHolcim

- Etex Group

- Cemex S.A.B. de C.V.

- Saint-Gobain

- CRH plc

- Kingspan Group

- Metecno S.p.A.

- Algeco Scotsman

- BlueScope Steel Limited

- Nudo Products, Inc.

- Oldcastle APG, Inc.

- Weyerhaeuser Company

- Louisiana-Pacific Corporation

- Boral Limited

- ACME Panel

- Structurlam Mass Timber Corporation

- Element5 Co.

- Tata Steel Limited

- Mitek Industries

- Pennybacker Capital (Acquirer of former Katerra assets)

- CS Group

- Vantem Global

- Premier Building Systems

- Panelized Structures Inc.

- Entekra

- Tekla Corporation (Software focus)

- Consolis S.A.S.

- Forta Modular

Frequently Asked Questions

Analyze common user questions about the Prefabricated wall panel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using prefabricated wall panels over traditional construction methods?

The primary benefit is significantly accelerated construction timelines, typically reducing site duration by 25% to 50%. This speed is coupled with superior quality control, reduced construction waste, and enhanced thermal performance due to factory-precise manufacturing tolerances. This leads to reduced labor costs and earlier revenue generation.

How does the integration of BIM affect the use of prefabricated wall panels?

Building Information Modeling (BIM) is essential as it facilitates precise digital design and collaboration, ensuring that the manufactured panels fit perfectly on site (Design for Manufacturing and Assembly or DfMA). BIM optimizes material use and streamlines the entire fabrication-to-assembly workflow, minimizing costly field adjustments and enhancing project predictability.

Which type of prefabricated wall panel dominates the residential market segment?

Structural Insulated Panels (SIPs) and lightweight wood-framed panels dominate the residential market, particularly in North America and Europe, due to their excellent insulation properties, speed of erection, and competitive cost efficiency for low-to-mid-rise structures. Precast concrete is heavily favored in high-rise multi-family housing projects globally.

What are the main logistical challenges associated with prefabricated construction?

The main challenges are managing the transportation of oversized panels and ensuring strict adherence to the just-in-time (JIT) delivery schedule. Disruptions can halt the entire on-site assembly process, requiring highly coordinated planning, specialized heavy-duty transport vehicles, and sophisticated tracking systems to maintain the construction rhythm.

Is the prefabricated wall panel market primarily driven by cost savings or sustainability goals?

The market is increasingly driven by a convergence of both. While labor savings, speed, and reduced project risk provide immediate cost advantages, the growing global necessity for zero-energy buildings and lower embodied carbon mandates make the superior energy performance and sustainable material options (like CLT) the critical long-term growth drivers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager