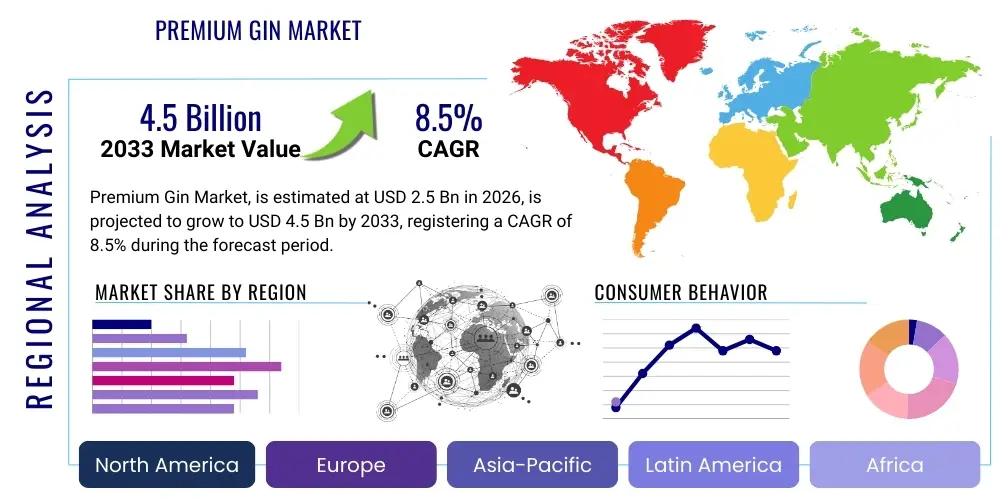

Premium Gin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431783 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Premium Gin Market Size

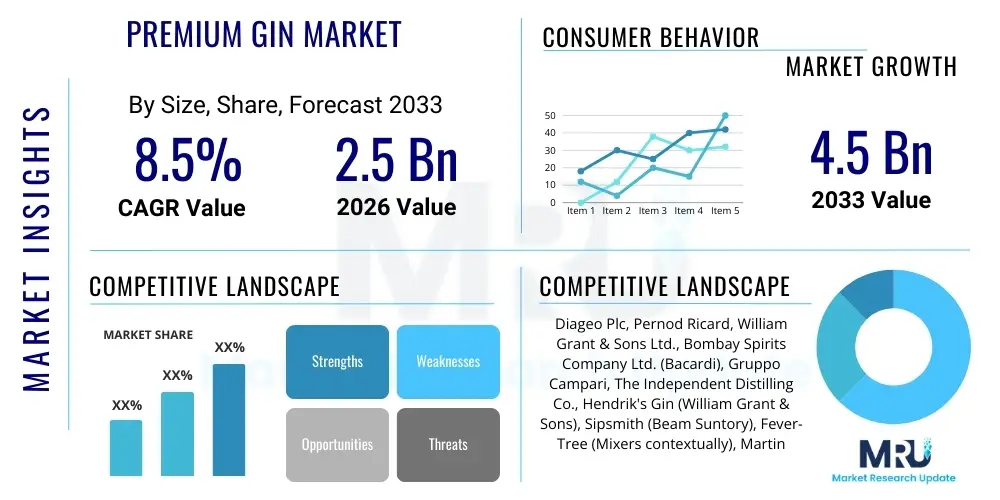

The Premium Gin Market is undergoing a significant transformation, driven by consumer preference for high-quality, craft, and artisanal spirits. This sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033, reflecting robust demand across key geographic regions, particularly Europe and North America, and rapidly expanding interest in Asia Pacific markets.

Premium Gin Market introduction

The Premium Gin Market encompasses high-end distilled juniper-based spirits characterized by superior ingredients, sophisticated distillation processes, unique botanical profiles, and elevated price points compared to standard gin offerings. The primary market driver is the global trend of premiumization in the alcoholic beverage sector, where consumers are increasingly opting for "drink less, drink better" philosophies. Major applications include consumption in high-end cocktail bars, fine dining establishments (On-Trade), and specialized retail or direct-to-consumer channels (Off-Trade/E-commerce). Benefits of the premium segment include enhanced flavor complexity, greater brand heritage, and appeal to sophisticated palates seeking unique experiences.

The product description typically involves gins that prioritize small-batch production, proprietary or locally sourced botanicals, and often feature unique aging or resting techniques. The increasing global interest in mixology and craft cocktails has propelled demand, positioning premium gin as a versatile base spirit. Driving factors also include effective marketing strategies emphasizing brand history and scarcity, coupled with rising disposable incomes in developing economies, enabling consumers to trade up to luxury spirit categories.

Furthermore, the diversification of premium gin subtypes—including flavored, barrel-aged, and unique terroir-specific expressions—contributes significantly to market expansion. The market maintains strong growth momentum due to consumer curiosity and a willingness to explore niche and specialized spirit offerings, distinguishing it from traditional beverage segments. This sustained interest guarantees continuous innovation in flavor profiles and packaging aesthetics, which are crucial differentiators in the premium segment.

Premium Gin Market Executive Summary

The Premium Gin Market Executive Summary highlights accelerated growth propelled by the shift in consumer preferences toward high-quality, artisanal spirits and the resurgence of classic cocktail culture globally. Key business trends include aggressive portfolio expansion by major beverage conglomerates to acquire successful craft distilleries, and a strong pivot towards sustainability and traceability in botanical sourcing and production methods, appealing to environmentally conscious consumers. The competitive landscape is characterized by intense innovation in flavor profiles, focusing on local, exotic, or rarely used botanicals, alongside sophisticated digital marketing aimed at millennial and Gen Z consumers.

Regionally, Europe, led by the UK and Spain, remains the dominant market due to established gin traditions and mature cocktail culture; however, the fastest growth is anticipated in Asia Pacific, particularly China and India, driven by rapid urbanization and the adoption of Western drinking habits among affluent middle and upper classes. North America continues its robust growth, fueled by the demand for American-style craft gins and the popularity of exclusive, limited-edition releases. Regional trends are also influenced by varying regulatory environments concerning alcohol distribution and taxation.

Segment trends indicate that the E-commerce distribution channel is experiencing explosive growth, benefiting from increased digital adoption and the convenience of direct-to-consumer models, which is particularly effective for niche premium brands. In terms of type, while traditional London Dry remains fundamental, the market is increasingly segmented by 'New Western' or 'Contemporary' styles, which emphasize less dominant juniper notes and complex, diverse botanical arrays. The demand for ultra-premium and exclusive small-batch offerings continues to outperform the broader segment, affirming the strength of the premiumization trend.

AI Impact Analysis on Premium Gin Market

User inquiries regarding AI's influence on the Premium Gin Market typically focus on how technology can enhance personalization, optimize the complex supply chain for exotic botanicals, and maintain the artisanal integrity of the product while scaling production. Key themes include the use of predictive analytics for inventory management in volatile global sourcing markets (especially for juniper and unique herbs), AI-driven consumer engagement tools that recommend personalized gin experiences based on purchase history and taste profiles, and the implementation of machine learning for quality control during distillation and blending processes. Consumers are concerned about whether automation might compromise the "craft" narrative, while producers are focused on leveraging AI to minimize waste and ensure consistency across small batches.

AI’s role is shifting from a background tool to a central strategic asset, particularly in enhancing market responsiveness and product development velocity. For premium gin brands, maintaining a consistent, high-quality flavor profile across varied botanical harvests is critical; AI algorithms are now deployed to analyze sensory data and adjust distillation parameters in real-time, compensating for natural variations in raw materials. This ensures brand fidelity, which is paramount in the high-value spirits category. Furthermore, AI-powered social listening helps brands rapidly identify emerging cocktail trends and flavor preferences, allowing for agile limited-edition releases.

The application extends deep into the marketing funnel, where Generative AI tools are being used to create personalized digital content, ranging from bespoke serving suggestions to unique virtual tasting experiences. This tailored approach significantly boosts consumer engagement and brand loyalty, crucial for sustaining the high price point of premium products. In logistics, predictive AI models forecast demand fluctuations based on seasonality and events, optimizing inventory holding costs for high-value stock and ensuring that limited-run premium gins are distributed efficiently to target high-net-worth individuals and exclusive retailers, thereby maximizing revenue per unit sold.

- AI-driven optimization of botanical sourcing and supply chain predictability to ensure ingredient quality and consistency.

- Predictive analytics for consumer taste profiling, enabling highly personalized marketing campaigns and new product development (NPD) strategies.

- Automated quality control systems using machine vision and sensory analysis to ensure batch-to-batch flavor consistency during distillation.

- Enhanced digital customer experience through AI chatbots and personalized virtual tasting guides, improving brand interaction.

- Optimized inventory and distribution logistics for high-value, temperature-sensitive spirits, reducing spoilage and transit time.

DRO & Impact Forces Of Premium Gin Market

The Premium Gin Market is heavily influenced by dynamic factors encapsulated by Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping its trajectory. The primary driver is the widespread consumer shift towards premiumization across all alcoholic categories, underpinned by increased disposable incomes and a preference for authentic, high-quality craft products. Opportunities lie significantly in geographical expansion into emerging economies like India, China, and Brazil, coupled with product innovation around sustainability (organic botanicals) and health (low-ABV or non-alcoholic premium alternatives). Conversely, the market faces significant restraints, including stringent regulatory barriers concerning alcohol marketing and distribution, coupled with high and variable excise duties across different jurisdictions, which directly impact the final retail price and accessibility of premium products.

Impact forces are currently trending towards strengthening the drivers. The ongoing "cocktail renaissance" globally ensures sustained demand for high-quality base spirits, and premium gin, with its diverse flavor profiles, is perfectly positioned to capitalize on this. Furthermore, the strong social media presence and effective brand storytelling employed by craft distilleries amplify consumer appeal, transforming purchasing into an experience-driven decision rather than a mere transaction. The increasing focus on traceable provenance, facilitated by technologies like blockchain, also acts as a powerful driver, reinforcing trust in the quality narrative of premium spirits.

However, the restraint posed by increasing raw material costs, particularly for unique or rare botanicals sensitive to climate change and geopolitical instability, presents an ongoing challenge to maintaining profit margins without excessively raising consumer prices. Competition from other premium white spirits, such as artisanal tequila and high-end vodka, also limits market share growth. Despite these challenges, the overwhelming opportunity presented by e-commerce platforms and global direct-to-consumer shipping capabilities offsets several restraints, allowing smaller, high-quality brands to achieve global reach without reliance on traditional, heavily regulated distribution networks. The strategic balance between maximizing opportunities for flavor innovation and mitigating the risks associated with volatile input costs defines the current market landscape.

Segmentation Analysis

The Premium Gin Market is meticulously segmented based on Type, Distribution Channel, and Geographic Region, reflecting the diverse consumer preferences and varied retail environments globally. Segmentation by Type differentiates between classic styles (like London Dry and Plymouth) and contemporary expressions (New Western, Aged Gin, Flavored Gin), with contemporary and flavored gins showing accelerated growth rates as consumers seek novelty. Segmentation by Distribution Channel highlights the traditional dominance of On-Trade (bars, restaurants) for brand advocacy and experience, juxtaposed against the rapid expansion of Off-Trade (retail stores) and E-commerce, the latter being critical for niche brands to achieve broad geographic reach efficiently.

This granular segmentation is essential for brands to tailor their product offerings and marketing efforts. For instance, the On-Trade segment demands superior quality and presentation suitable for high-end mixology, whereas the E-commerce segment requires robust digital marketing and secure, fast fulfillment capabilities. Understanding the relative market share of each segment allows producers to allocate resources effectively, ensuring optimal market penetration and profitability across different consumer touchpoints. The evolving regulatory landscape around e-commerce alcohol sales continues to influence the growth rate of this distribution channel.

Geographic segmentation remains crucial, with established markets setting premiumization trends while emerging markets offer vast potential for volume growth. The interaction between Type and Distribution Channel dictates pricing strategies and inventory management, ensuring that limited-edition or high-value aged gins are placed in the most exclusive retail environments or handled through specialized direct sales channels to maintain their premium positioning and control the consumer experience.

- By Type:

- London Dry Gin (The foundational and largest sub-segment)

- Plymouth Gin

- Old Tom Gin

- New Western/Contemporary Style Gin

- Flavored and Botanical Gin

- Aged/Barrel-Rested Gin

- By Distribution Channel:

- On-Trade (Hotels, Restaurants, Bars - HORECA)

- Off-Trade (Retail Stores, Supermarkets, Liquor Shops)

- E-commerce and Direct-to-Consumer (DTC)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Premium Gin Market

The value chain for the Premium Gin Market is highly intricate, beginning with upstream activities focused on the meticulous sourcing and cultivation of premium botanicals, particularly juniper berries, coriander, citrus peels, and numerous proprietary ingredients. Upstream analysis highlights the critical need for sustainable, ethical, and traceable sourcing, as the quality and provenance of these raw materials directly determine the premium status and flavor profile of the final product. Distillers often establish long-term relationships with specialized global suppliers or, increasingly, cultivate their own unique botanicals to maintain exclusivity and quality control, a necessary investment given the high scrutiny on premium spirit ingredients.

The midstream phase involves distillation and bottling, where proprietary techniques, unique still designs (e.g., copper pot stills), and the expertise of the Master Distiller add significant value. For premium gin, this phase emphasizes small-batch production and rigorous quality assurance rather than large-scale automation, reinforcing the craft narrative. Downstream analysis focuses on distribution and marketing. The distribution channel is bifurcated: Direct distribution is favored for high-margin, ultra-premium lines to maintain brand control, while indirect distribution through specialized wholesalers and importers is utilized for wider market reach, especially in complex international markets where localized expertise is essential.

Effective marketing, advertising the brand heritage and botanical story, is paramount in the downstream segment. The On-Trade channel (bars and restaurants) serves as a crucial marketing platform, establishing brand legitimacy through specialized cocktails and expert recommendations. Conversely, the growth of E-commerce (Direct and indirect) streamlines the link between the producer and the sophisticated end-consumer, offering transparency and convenience, ultimately enhancing the overall perceived value of the premium product by ensuring faster access to limited releases and personalized brand communication.

Premium Gin Market Potential Customers

The primary end-users and buyers of Premium Gin can be categorized into three distinct groups: sophisticated consumers (mixology enthusiasts and high-net-worth individuals), On-Trade establishments (cocktail bars, luxury hotels, and high-end restaurants), and specialized Off-Trade retailers (boutique liquor stores and duty-free shops). Sophisticated consumers are defined by their willingness to pay a premium for unique flavor profiles, brand history, and artisanal quality. They seek educational content about the gin’s production process and are often early adopters of limited-edition releases or niche botanical varieties, treating gin as a collectible item.

The On-Trade segment is vital as it acts as a primary consumption venue and a major influencer. Bars and luxury hotels purchase premium gin to curate bespoke cocktail menus, demonstrating high-quality ingredient usage to their clientele. These establishments demand consistency, reliable supply, and often require tailored training or product insights from the brand representatives. The decision-makers here are typically Head Bartenders or Beverage Directors who prioritize versatility, established reputation, and the storytelling potential of the gin brand.

Specialized retailers (Off-Trade) serve as critical points of purchase for home consumption and gifting. Their customer base is price-sensitive compared to the On-Trade but still prioritizes quality. These buyers look for aesthetic packaging, strong brand visibility, and competitive pricing within the premium bracket. E-commerce platforms aggregate all three customer types, providing direct access to product information, comparative pricing, and home delivery convenience, thereby expanding the potential customer base geographically and demographically, particularly targeting younger, digitally native consumers interested in culinary and mixology trends.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo Plc, Pernod Ricard, William Grant & Sons Ltd., Bombay Spirits Company Ltd. (Bacardi), Gruppo Campari, The Independent Distilling Co., Hendrik's Gin (William Grant & Sons), Sipsmith (Beam Suntory), Fever-Tree (Mixers contextually), Martin Miller's Gin (Zamora Company), Fords Gin (Brown-Forman), Audemus Spirits, Scapegrace Distillery, Monkey 47 (Pernod Ricard), Warner's Distillery, Four Pillars Distillery, The Botanist (Rémy Cointreau), Brockmans Gin, The Lakes Distillery, Tanqueray (Diageo). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Premium Gin Market Key Technology Landscape

The Premium Gin Market leverages several sophisticated technologies to enhance product quality, ensure provenance, and optimize customer engagement. Central to production is advanced precision distillation equipment, often utilizing vacuum or low-pressure distillation techniques to capture the delicate aromas of sensitive botanicals without thermal degradation. This technology is critical for producing the subtle, complex flavor profiles expected in the premium segment. Furthermore, sensors and IoT (Internet of Things) devices are increasingly integrated into the distillation process, allowing Master Distillers to monitor temperature, pressure, and spirit cuts with unprecedented accuracy, ensuring batch-to-batch consistency—a non-negotiable requirement for premium branding.

Beyond production, technology plays a vital role in supply chain integrity. Blockchain technology is emerging as a key tool for premium brands to provide immutable records of botanical sourcing, processing locations, and bottling dates. This ensures end-to-end traceability, allowing consumers to verify the authenticity and ethical sourcing of the high-value ingredients, directly reinforcing the brand’s premium and trust narrative, which is essential for combating counterfeiting in the luxury spirits sector. Sustainable production is supported by advanced water recycling and energy optimization technologies, appealing to the growing demographic of eco-conscious high-end consumers.

In the consumer interface, technologies like Augmented Reality (AR) are utilized via product labels and packaging to offer immersive brand storytelling, virtual tours of the distillery, or interactive cocktail recipes. Additionally, Data Analytics and AI drive dynamic pricing and personalization in the growing E-commerce channel, allowing brands to forecast local market demands precisely and target consumers with highly relevant, premium offerings. The convergence of precise production technology and transparent supply chain tools establishes a modern foundation for high-value spirit operations.

Regional Highlights

Regional dynamics significantly shape the Premium Gin Market, with established markets driving innovation and emerging economies fueling volume growth. Europe stands as the dominant region, anchored by the United Kingdom, which possesses a centuries-old gin heritage and a highly sophisticated consumer base. Spain and Germany are also critical markets, recognized for their vibrant gin and tonic culture and high per-capita consumption of premium varieties. European trends focus heavily on artisanal, hyper-local, and experimental gins, often leading global trends in low-ABV and sustainable production.

North America, particularly the United States, represents a highly lucrative market characterized by the proliferation of craft distilleries, driving demand for 'New Western Style' gins that often diverge significantly from traditional juniper-forward profiles. The high willingness of American consumers to experiment and pay high prices for limited-edition, locally sourced premium spirits ensures robust growth. E-commerce expansion and relaxation of direct-to-consumer shipping laws in various states further propel market accessibility across the region.

Asia Pacific (APAC) is projected to be the fastest-growing regional market, albeit from a smaller base. Urban centers in China, India, and Southeast Asian countries are rapidly adopting premium Western spirits as status symbols. Rising disposable income, shifting cultural acceptance of spirits, and the growth of high-end international hotel chains and cocktail bars are pivotal drivers. While still nascent, the immense scale of the consumer base ensures APAC will be the primary source of long-term volume expansion.

Latin America and the Middle East & Africa (MEA) remain emerging markets, where growth is highly localized. In LATAM, regulatory environments and economic volatility pose challenges, but large urban hubs show strong demand for imported luxury spirits. MEA exhibits strong potential in cosmopolitan centers, particularly the UAE and South Africa, driven by tourism and high-net-worth expat communities, focusing predominantly on established, globally recognized premium gin brands.

- Europe: Market leader driven by established gin culture (UK, Spain), robust craft production, and leading sustainability trends in distillation.

- North America (USA & Canada): High demand for innovative, New Western style gins; significant growth driven by craft distillery expansion and strong consumer spending power.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rapid urbanization, rising disposable incomes in China and India, and increasing social acceptance of luxury Western spirits.

- Latin America: Focused growth in urban centers (e.g., Brazil, Mexico), often preferring high-profile imported premium brands due to high duties on local production.

- Middle East & Africa (MEA): Growth concentrated in tourism-driven and economically diversified nations (UAE, South Africa), emphasizing globally recognized luxury brands and limited-edition imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Premium Gin Market.- Diageo Plc

- Pernod Ricard

- William Grant & Sons Ltd.

- Bombay Spirits Company Ltd. (Bacardi)

- Gruppo Campari

- The Independent Distilling Co.

- Hendrik's Gin (William Grant & Sons)

- Sipsmith (Beam Suntory)

- Fever-Tree (Mixers contextually)

- Martin Miller's Gin (Zamora Company)

- Fords Gin (Brown-Forman)

- Audemus Spirits

- Scapegrace Distillery

- Monkey 47 (Pernod Ricard)

- Warner's Distillery

- Four Pillars Distillery

- The Botanist (Rémy Cointreau)

- Brockmans Gin

- The Lakes Distillery

- Tanqueray (Diageo)

Frequently Asked Questions

Analyze common user questions about the Premium Gin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a gin as 'Premium' and what are the primary price determinants?

Premium gin is defined by superior ingredient quality (rare or proprietary botanicals), small-batch distillation methods, distinctive brand storytelling, and high perceived value. Price determinants include the cost of rare imported botanicals, slow, labor-intensive distillation processes, unique packaging, high regional excise taxes, and the brand's established luxury positioning.

Which geographic region currently dominates the Premium Gin Market, and where is the fastest growth expected?

Europe, particularly the UK and Spain, currently dominates the Premium Gin Market in terms of volume and value due to deeply embedded drinking culture and extensive product innovation. The fastest regional growth rate, however, is projected for the Asia Pacific (APAC) region, driven by expanding affluent consumer bases in countries like China and India.

How is the rise of low-ABV and non-alcoholic spirits affecting the Premium Gin Market?

The demand for low-ABV and non-alcoholic options presents a significant opportunity rather than a restraint. Premium gin brands are successfully introducing sophisticated, complex non-alcoholic spirit alternatives, allowing them to capture market share from health-conscious consumers who still seek sophisticated flavor profiles and an elevated drinking experience, sustaining the premium price point.

What role does the E-commerce distribution channel play in the growth of premium gin brands?

E-commerce is a pivotal growth driver, offering niche premium brands direct access to a global consumer base without relying on traditional wholesaler gatekeepers. It facilitates personalized marketing, provides robust platforms for limited-edition releases, and supports brand transparency through direct communication and detailed product storytelling, significantly reducing time-to-market.

What are the primary factors driving consumer interest away from standard gin toward premium varieties?

Consumer interest is driven primarily by the global premiumization trend, the "drink better, not more" philosophy, and the resurgence of cocktail culture demanding high-quality base spirits. Consumers value unique botanical recipes, verifiable provenance, the artisanal production narrative, and the enhanced social status associated with consuming high-end craft spirits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager