Premium Skin Care Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432785 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Premium Skin Care Market Size

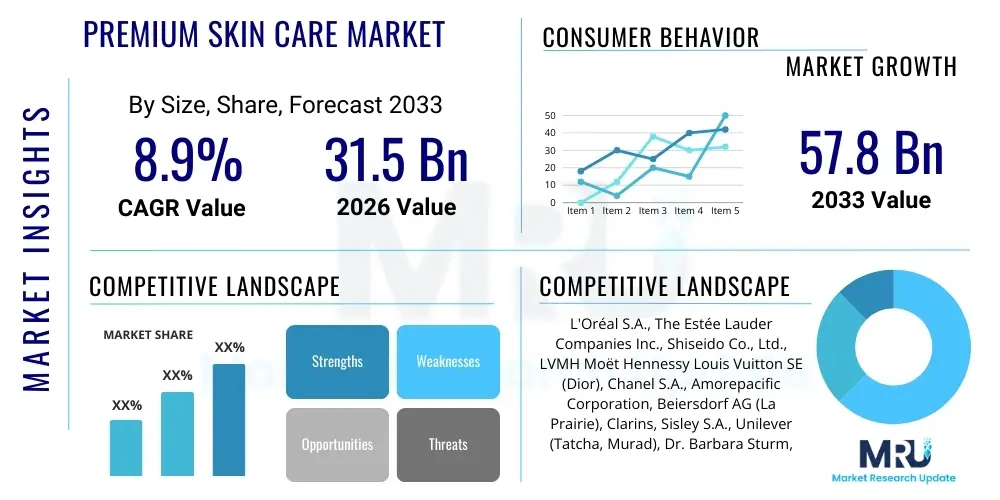

The Premium Skin Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $31.5 Billion USD in 2026 and is projected to reach $57.8 Billion USD by the end of the forecast period in 2033.

Premium Skin Care Market introduction

The Premium Skin Care Market encompasses high-end, luxury, and scientifically advanced cosmetic products designed to address specific dermatological concerns such as anti-aging, hydration, brightening, and restoration. These products are characterized by superior ingredient quality, often featuring rare extracts, highly concentrated active compounds, proprietary patented technologies, and sophisticated packaging. The segment caters to consumers seeking efficacy, experiential benefits, and brand prestige, driving significantly higher average selling prices compared to mass-market counterparts. This market segment includes various product types such as specialized serums, intensive moisturizers, high-performance masks, and professional-grade treatments, typically distributed through exclusive channels like specialty retail, high-end department stores, and direct-to-consumer online platforms.

Major applications of premium skin care products span both therapeutic and preventative domains. Key applications include sophisticated anti-aging regimens utilizing peptides, retinoids, and growth factors; specialized treatment for sensitive or compromised skin barriers; and targeted solutions for hyperpigmentation and acne scarring. The inherent benefits derived from these premium formulations include enhanced skin health, visible aesthetic improvements, long-term cellular protection, and a highly satisfying user experience, often associated with sophisticated textures and aromas. The high concentration of bio-active ingredients ensures deeper penetration and optimized bioavailability, justifying the premium price point and fostering intense consumer loyalty among affluent demographics globally.

Driving factors sustaining the robust growth of this market are multifaceted, centering on evolving consumer attitudes and rising global disposable income. A significant driver is the increasing focus on "skin longevity" and wellness, transforming skin care from a necessity into a strategic investment in self-care. Furthermore, extensive digital media influence, coupled with endorsement by dermatologists and celebrities, accelerates awareness of novel ingredients and advanced treatment methodologies. The sustained innovation pipeline within leading premium brands, emphasizing biotechnology, sustainable sourcing, and personalized formulations, further fuels market expansion, particularly in high-growth regions like Asia Pacific, where cultural emphasis on perfect skin complexion is a pervasive economic factor.

Premium Skin Care Market Executive Summary

The Premium Skin Care Market is currently experiencing robust momentum, driven by structural shifts in consumer spending prioritizing wellness and high-efficacy cosmetic science. Current business trends indicate a strong focus on clinical validation, sustainable and ethical sourcing (clean beauty), and hyper-personalization through AI-driven diagnostics and customized product recommendations. Key players are aggressively investing in biotechnology and ingredient encapsulation technology to enhance product stability and penetration, creating a significant competitive advantage over mid-range brands. Furthermore, strategic mergers and acquisitions involving established luxury conglomerates absorbing innovative indie premium brands are reshaping the competitive landscape, aiming to capture niche market segments and rapidly expand digital distribution capabilities.

Regionally, Asia Pacific (APAC) dominates the market share, led by burgeoning demand in China, Japan, and South Korea, where the comprehensive multi-step skin care routines and the desire for high-performance whitening and anti-pollution products remain paramount. North America and Europe, while mature markets, are experiencing resurgence fueled by the 'skin minimalism' movement focusing on fewer, higher-quality, multi-functional products, alongside explosive growth in male grooming and specialized medical-grade skincare lines (cosmeceuticals). These Western markets are also leading the adoption of direct-to-consumer (DTC) digital strategies, bypassing traditional department stores and leveraging influencer marketing for immediate consumer engagement and conversion.

Segment-wise, the Face Care category, specifically serums and high-potency moisturizers, retains the largest revenue share, reflecting consumer willingness to invest heavily in concentrated treatments targeting primary aging concerns. Distribution channel trends confirm the accelerating shift towards online retail and brand-owned e-commerce platforms, offering enhanced customer experience, detailed product education, and seamless subscription services. The Male segment is forecasted to exhibit the highest CAGR, spurred by changing societal norms and increased product availability tailored specifically for men's thicker skin and oilier composition, moving beyond basic hydration to incorporate advanced anti-fatigue and defense properties.

AI Impact Analysis on Premium Skin Care Market

Common user questions regarding AI's impact on the Premium Skin Care Market revolve around how artificial intelligence can deliver true product personalization, optimize the manufacturing supply chain for high-cost ingredients, and revolutionize the consumer consultation process. Users are keen to understand if AI can accurately predict individual skin responses to complex formulations (efficacy assessment), leading to truly customized, small-batch products. Concerns often center on data privacy regarding sensitive skin metrics collected via diagnostic apps and the potential for AI-driven recommendations to bias purchasing decisions based on profitability rather than genuine consumer need. The overriding expectation is that AI should enhance, not replace, the expertise inherent in luxury skincare advice, making the premium experience more precise, effective, and exclusive.

The deployment of AI and machine learning algorithms is fundamentally transforming the premium sector by enabling precision formulation and diagnostics. AI-powered diagnostic tools, often integrated into mobile applications or in-store devices, analyze high-resolution images of the skin, evaluate factors like hydration levels, melanin concentration, pore size, and wrinkle depth, and cross-reference this data with environmental factors and lifestyle choices. This allows brands to move beyond generic categories, providing a bespoke regimen that maximizes the therapeutic potential of premium active ingredients. This personalization minimizes consumer trial-and-error, enhances loyalty, and justifies the high price point by guaranteeing a targeted solution.

Furthermore, AI is crucial in optimizing the extensive supply chains necessary for sourcing rare and high-efficacy ingredients characteristic of premium skincare. Predictive analytics monitors inventory levels, anticipates regional demand fluctuations, and manages the ethical and sustainable sourcing protocols required by discerning consumers. In the R&D phase, machine learning accelerates the discovery of new active molecules and helps model the stability and interaction of complex cosmetic emulsions, drastically reducing the time and cost associated with laboratory testing. This technological integration positions premium brands as leaders in scientific innovation, reinforcing their authority and perceived value in the marketplace.

- AI-driven personalized diagnostics via mobile apps and in-store devices.

- Machine learning accelerating new ingredient discovery and formulation testing (R&D efficiency).

- Predictive supply chain analytics optimizing inventory of rare and high-cost active ingredients.

- Customized product manufacturing (small-batch production) based on individual genomic or microbiome data.

- Enhanced customer service through AI chatbots providing 24/7 personalized consultation and regimen tracking.

- Deep learning algorithms assessing environmental stress factors (e.g., pollution, UV exposure) and recommending protective strategies.

- Automated quality control systems ensuring batch consistency and ingredient integrity in high-value products.

DRO & Impact Forces Of Premium Skin Care Market

The dynamics of the Premium Skin Care Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining market trajectory. Key drivers center on demographic shifts, particularly the global aging population demanding effective anti-aging solutions and the increasing affluence in developing economies, expanding the accessible consumer base. Restraints primarily involve the high cost of raw materials and R&D, leading to premium pricing that limits mass adoption, alongside increasing regulatory scrutiny regarding ingredient safety and transparency, particularly concerning novel biotechnology-derived compounds. Opportunities abound in hyper-personalization, harnessing sustainable biotechnology (green chemistry), and expanding digital sales channels into untapped geographic regions, particularly Latin America and smaller APAC nations. These forces dictate strategic investment and product development focus within the luxury sector.

Impact forces stemming from macro-environmental factors significantly influence consumer perception and brand performance. Economic volatility can momentarily constrain luxury spending, although the premium skin care segment often proves resilient due to its classification as an "affordable luxury" or self-investment during periods of uncertainty. Social impact forces, such as the ubiquitous presence of social media and the rise of the conscious consumer, mandate that premium brands adhere not only to clinical efficacy but also to stringent ethical standards regarding ingredient origin, animal testing policies, and packaging sustainability. Failure to meet these heightened expectations can lead to swift and severe reputational damage, irrespective of product quality, thereby integrating social responsibility directly into the competitive matrix.

Technological impact forces, including advancements in genomics, microbiome research, and encapsulation delivery systems, are critical differentiators, allowing premium brands to file patents and create proprietary technology platforms that substantiate their high price points. The rapid adoption of augmented reality (AR) and virtual try-on technologies in the online retail space is fundamentally changing how consumers discover and commit to high-value purchases without physical consultation. Furthermore, regulatory alignment across major global markets (like the EU's strict ingredient bans and China's evolving animal testing requirements) introduces significant operational restraints but simultaneously provides opportunities for globally compliant brands to solidify their market access and trust. Strategic management of these complex and often conflicting forces is essential for sustaining long-term market leadership.

- Drivers:

- Increased consumer awareness regarding skin health and long-term preventative care.

- Rising disposable income, especially in emerging markets (China, India).

- Technological breakthroughs in active ingredients (e.g., bio-engineered peptides, growth factors).

- Intense influence of digital platforms and beauty influencers driving rapid product adoption.

- Growing acceptance and demand for male-specific premium skin care products.

- Restraints:

- High manufacturing and R&D costs leading to exclusionary pricing.

- Counterfeiting risks impacting brand integrity and consumer trust.

- Strict global regulatory frameworks governing cosmetic ingredients and claims substantiation.

- Economic downturns potentially impacting non-essential luxury expenditure.

- Opportunity:

- Hyper-personalization utilizing AI and consumer biometric data.

- Expansion into sustainable, "blue beauty," and refillable luxury packaging solutions.

- Tapping into specialized niches such as post-procedure recovery (dermocosmetics).

- Strategic geographic expansion into underserved markets like Latin America and the Middle East.

- Impact Forces:

- Competitive Intensity: High, due to established luxury houses, pharmaceutical giants, and well-funded indie brands.

- Substitutes Threat: Moderate, primarily from mass-tige brands improving formulations and clinical aesthetics procedures.

- Bargaining Power of Buyers: Moderate, as brand loyalty is strong, but digital transparency provides consumers with extensive price comparison data.

- Bargaining Power of Suppliers: High, due to the limited availability of high-purity, rare, and patented active ingredients.

Segmentation Analysis

The Premium Skin Care Market is comprehensively segmented across product type, distribution channel, gender, and pricing tier, reflecting the diverse consumption patterns and consumer willingness to invest in specialized treatments. Analyzing these segments is crucial for brands to refine their market positioning, target their marketing spend effectively, and ensure that product development aligns with highly profitable niches. The complexity of segmentation stems from the fact that premium consumers often shop across multiple channels and product types, seeking specialized solutions for various needs—for example, purchasing a specialized serum from a high-end department store while acquiring a dermatologist-recommended moisturizer online. This multi-channel behavior necessitates integrated marketing and supply chain strategies.

The most significant segment by revenue remains Face Care, which includes high-margin products like anti-aging serums, eye treatments, and intensive night creams, as these directly address the primary visible signs of aging that drive consumer spending. However, the fastest growth is observed in niche segments such as specialized sun care (high-SPF, anti-pollution formulas integrated into daily routines) and body contouring treatments, reflecting a holistic approach to skin health extending beyond the face. Geographic segmentation highlights the disparity in demand for specific product attributes; for instance, Asian markets prioritize brightening and clarity, whereas Western markets emphasize texture refinement and wrinkle reduction, requiring localized product adaptations.

Distribution channel segmentation confirms the ongoing digital transformation, with online retail gaining ground rapidly due to convenience and the ability of brands to tell their sophisticated scientific stories directly to the consumer. Despite this, brick-and-mortar specialty stores and high-end spas remain critical for maintaining the luxury experience, allowing consumers to engage in high-touch services, receive personalized consultations, and sample exclusive, expensive products before commitment. Strategic distribution requires a robust omnichannel approach that seamlessly integrates the digital information experience with the tangible luxury of physical retail environments.

- By Product Type:

- Face Care (Serums, Moisturizers, Masks, Cleansers, Toners, Eye Care)

- Body Care (Lotions, Creams, Oils, Specialized Treatments)

- Sun Care (High-Performance UV Protection, After-Sun Care)

- Others (Lip Care, Hand Treatments)

- By Distribution Channel:

- Online Retail (Brand Websites, E-commerce Marketplaces, Specialty E-tailers)

- Specialty Stores (Sephora, Ulta, Blue Mercury)

- Department Stores (Neiman Marcus, Harrods, Saks Fifth Avenue)

- Pharmacies/Cosmeceutical Outlets (Medical Spas, Dermatologists)

- Direct Sales/Brand Boutiques

- By Target Consumer:

- Female

- Male

- Unisex/Gender Neutral

- By Pricing Tier:

- High Premium

- Ultra-Premium (Haute-Luxe)

Value Chain Analysis For Premium Skin Care Market

The Premium Skin Care value chain is characterized by its reliance on highly specialized R&D and complex, multi-tiered distribution, which significantly inflates costs compared to mass-market segments. The chain begins with upstream activities focused heavily on sourcing rare, high-purity, and often proprietary active ingredients, sometimes requiring sustainable or ethical certifications (e.g., organic extracts, bio-fermented compounds). Significant investment is allocated to the primary manufacturing stage, focusing on precision formulation, quality assurance, and stringent clinical testing to validate efficacy claims. Intellectual property protection surrounding patented ingredient delivery systems or unique formulation processes is paramount in creating competitive differentiation at this foundational stage. This upstream emphasis on quality ensures the final product justifies its premium price point.

Downstream activities are dominated by marketing, branding, and distribution tailored specifically for the affluent consumer. Due to the high-touch nature of luxury retail, distribution channels require significant management to maintain brand image and control the consumer experience. Direct channels, such as brand-owned boutiques and proprietary e-commerce sites, offer the highest margin control and brand messaging fidelity. Indirect channels, like high-end department stores and specialty retailers, require substantial investment in highly trained beauty advisors and sophisticated merchandising displays to convey exclusivity and provide expert consultation, which is a key part of the luxury purchasing journey. Logistics must be impeccable, often involving temperature-controlled storage and discreet, luxury packaging for shipping.

The distribution landscape is shifting dramatically toward omnichannel integration. Direct distribution via the internet provides unmatched speed and global reach, minimizing intermediary costs and allowing real-time data collection on consumer behavior, which feeds back into R&D and inventory planning. However, indirect channels remain vital for accessing consumers who value the sensorial experience of sampling and the credibility conferred by prestigious retail partners. Strategic management involves optimizing the balance between direct profitability and indirect reach, ensuring that all channels uphold the brand’s rigorous standards of quality and luxury positioning, thereby maximizing customer lifetime value and maintaining pricing integrity across various global markets.

Premium Skin Care Market Potential Customers

Potential customers for the Premium Skin Care Market are defined primarily by their high disposable income, strong affinity for investing in personal wellness, and a sophisticated understanding of ingredient efficacy and scientific backing. The core demographic includes affluent individuals aged 35 and above, seeking proactive anti-aging solutions and highly specialized treatments for mature skin concerns. This group values quality and proven results over cost and is often influenced by dermatologist recommendations, specialized medical spas, and high-end lifestyle publications. They are characterized by high brand loyalty once trust is established, often engaging in continuous repurchase cycles for core regimen products.

A rapidly growing segment of potential customers includes younger millennials and Gen Z consumers who are adopting preventative skin care routines earlier in life, driven by digital awareness and the "skin positivity" movement. While not always possessing the highest income, this segment prioritizes ingredient transparency, sustainable practices, and clean beauty certifications, often purchasing smaller-sized, high-quality serums or eye treatments as 'entry points' into a premium brand. They are highly active on social media, making them influential targets for digitally native premium brands emphasizing ethical sourcing and natural biotechnology.

Furthermore, professional and medical end-users represent a vital customer segment. Dermatologists, plastic surgeons, and licensed aestheticians recommend and often sell cosmeceutical-grade premium products (e.g., post-procedure recovery creams, highly stable Vitamin C serums) to patients. These end-users prioritize clinical data, specific ingredient concentrations, and formulations designed to complement clinical treatments. Capturing this professional endorsement lends significant credibility to premium brands and acts as a powerful acquisition channel for high-value consumers seeking scientifically proven solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $31.5 Billion USD |

| Market Forecast in 2033 | $57.8 Billion USD |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., The Estée Lauder Companies Inc., Shiseido Co., Ltd., LVMH Moët Hennessy Louis Vuitton SE (Dior), Chanel S.A., Amorepacific Corporation, Beiersdorf AG (La Prairie), Clarins, Sisley S.A., Unilever (Tatcha, Murad), Dr. Barbara Sturm, Augustinus Bader, Natura & Co, Kose Corporation, Kiehl's (L'Oréal), Sunday Riley, SK-II (P&G), Sulwhasoo (Amorepacific), Rodan + Fields, Nu Skin Enterprises. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Premium Skin Care Market Key Technology Landscape

The technological landscape of the Premium Skin Care Market is defined by the quest for enhanced ingredient stability, targeted delivery deep into the epidermis, and the validation of efficacy through sophisticated biological testing. Key innovations center on advanced delivery systems such as liposomal encapsulation, micro- and nano-emulsions, and proprietary phospholipid complexes. These technologies protect highly sensitive active ingredients (like retinoids and Vitamin C) from oxidation and degradation while ensuring optimal penetration and slow-release functionality, significantly improving therapeutic outcomes compared to traditional formulations. Furthermore, the integration of bio-fermentation processes and green chemistry techniques allows brands to sustainably produce high-purity, bio-identical actives, satisfying consumer demand for both performance and ecological responsibility.

A secondary, but increasingly vital, technological front is the application of personalized bio-data. Premium brands are leveraging developments in genomics and skin microbiome research to create ingredient profiles that interact optimally with an individual's unique biological markers. This involves using diagnostic tools to analyze skin pH, bacterial diversity, and genetic predisposition to conditions like sensitivity or collagen degradation. The resulting technological framework enables the creation of highly customized treatment plans and, in some cases, the production of products tailored to the consumer's latest skin scan, moving beyond mass production toward scientific couture in cosmetics. This personalized technology platform is a crucial differentiator in the ultra-premium segment.

Digital technologies are equally transformative, especially for customer engagement and retail operations. Augmented Reality (AR) tools allow consumers to virtually assess potential results or visualize product textures, bridging the gap between online shopping and the need for sensorial proof in luxury goods. Blockchain technology is emerging as a means of ensuring supply chain transparency, allowing consumers to verify the origin and purity of high-cost active ingredients—a feature critical for building trust among highly informed premium buyers. Collectively, these biotechnological and digital innovations underscore the market's reliance on science and exclusivity, reinforcing the value proposition that drives market growth.

Regional Highlights

The global Premium Skin Care Market exhibits distinct regional consumption patterns and growth drivers, necessitating a localized strategy for brand expansion and distribution. Asia Pacific (APAC) stands as the dominant market both in terms of consumption volume and growth trajectory. This leadership is fueled primarily by the cultural emphasis on flawless skin, exemplified by the multi-step Korean and Japanese beauty routines, coupled with burgeoning middle and affluent classes in China and India. APAC consumers show intense demand for highly effective brightening, anti-pollution, and specialized mask products. The market benefits from strong indigenous premium brands alongside significant penetration by global luxury conglomerates.

North America (NA) represents a mature yet dynamic market, characterized by high adoption rates of cosmeceuticals and medical-grade skincare. Growth here is primarily driven by consumers seeking clinical validation, immediate aesthetic results, and preventative aging treatments. The regional focus is heavily skewed towards simplified, high-potency formulations (the 'skin minimalism' trend) and a strong reliance on dermatology clinics and high-end specialty retailers for consultation and product acquisition. Innovation in NA often centers around clean beauty standards, scientific transparency, and technologically advanced delivery systems, with a strong DTC presence.

Europe, driven primarily by France, Germany, and the UK, maintains its traditional stronghold in classic luxury and high-quality artisanal formulations. The market is highly regulated, prioritizing ingredient safety and strict ethical sourcing, leading to consumer trust in long-established brands. While growth is steady, it is focused on sustainable luxury (refillable and eco-friendly premium packaging) and highly targeted products aimed at specific environmental factors and dermatological concerns. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as critical high-potential growth areas, characterized by increasing luxury consumer segments and rapid urbanization, driving demand for status-symbol premium brands and products specifically formulated for varied climatic conditions.

- Asia Pacific (APAC): Dominates the market, driven by high disposable incomes in China, Japan, and South Korea, and a strong cultural focus on preventative skin health. Key demand areas include brightening, anti-pollution, and technologically advanced mask products.

- North America (NA): Significant market share defined by high expenditure on clinical-grade cosmeceuticals and anti-aging serums. Strong reliance on e-commerce, digital diagnostics, and the 'clean beauty' movement demanding ingredient transparency.

- Europe: Mature market focused on heritage luxury, sustainability, and strict regulatory compliance. Growth concentrated in Western European countries emphasizing high-quality formulations and specialized, targeted treatments.

- Middle East & Africa (MEA): Emerging market experiencing rapid growth, particularly in the GCC countries, due to high luxury spending. Demand centers on premium sun protection, hydration, and products addressing pigmentation issues common in the region.

- Latin America (LATAM): High potential growth region with increasing penetration of global premium brands. Focus on accessible luxury options and products catering to humid climates and ethnic skin concerns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Premium Skin Care Market.- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Shiseido Co., Ltd.

- LVMH Moët Hennessy Louis Vuitton SE (Dior, Guerlain)

- Chanel S.A.

- Amorepacific Corporation

- Beiersdorf AG (La Prairie)

- Clarins

- Sisley S.A.

- Unilever (Tatcha, Murad)

- Dr. Barbara Sturm

- Augustinus Bader

- Natura & Co

- Kose Corporation

- Kiehl's (L'Oréal)

- Sunday Riley

- SK-II (Procter & Gamble)

- Sulwhasoo (Amorepacific)

- Rodan + Fields

- Nu Skin Enterprises

Frequently Asked Questions

Analyze common user questions about the Premium Skin Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors differentiate premium skin care products from mass-market products?

Premium skin care products are differentiated by higher concentrations of scientifically validated active ingredients, the inclusion of proprietary or patented delivery systems (e.g., encapsulation technology), rigorous clinical testing, superior formulation textures, and high-end, sustainable packaging. These factors collectively substantiate the higher price point by offering enhanced efficacy and a luxury user experience, often developed through extensive R&D.

How is the clean beauty movement influencing premium skin care formulation and sourcing?

The clean beauty movement is fundamentally reshaping the premium sector by mandating stringent ingredient transparency, excluding potentially harmful chemicals, and emphasizing sustainable sourcing and ethical manufacturing processes. Premium brands are increasingly adopting green chemistry, bio-fermentation, and traceable supply chains to meet the sophisticated demands of conscious luxury consumers, often investing in refillable packaging solutions.

Which distribution channel is experiencing the fastest growth in the premium skin care sector?

Online retail, particularly brand-owned e-commerce platforms and specialty e-tailers, is experiencing the fastest growth. This acceleration is driven by consumer demand for convenience, the global reach of digital sales, and the ability of brands to provide deep product education, personalized AI consultation, and direct-to-consumer services, complementing the traditional high-touch experience of physical stores.

What role does Artificial Intelligence (AI) play in the future of premium skin care personalization?

AI is central to the future of premium skin care, enabling hyper-personalization through advanced diagnostic tools that analyze skin biometrics, lifestyle, and environmental exposure. This data allows for the formulation of truly bespoke product regimens, optimizing ingredient efficacy and concentration for individual needs, ultimately reducing consumer trial-and-error and enhancing consumer trust in high-cost purchases.

What are the key anti-aging ingredient trends driving innovation in the ultra-premium market?

Innovation in the ultra-premium market is centered around advanced biotechnological ingredients, including bio-engineered peptides, specific growth factors (EGF, FGF), highly stable forms of Vitamin C and Retinol delivered via encapsulation, and advanced compounds derived from microbiome research. These ingredients promise enhanced cellular regeneration, targeted repair, and visible long-term improvements in skin architecture.

How do economic fluctuations impact consumer spending in the premium skin care segment?

While major economic downturns can lead to cautious spending, the premium skin care segment often demonstrates resilience because it is categorized as an "affordable luxury" or a non-negotiable self-care investment. Consumers may downsize other luxury purchases but often maintain their core high-performance skin care routines, prioritizing consistent efficacy and brand loyalty over short-term savings on essential products.

What is the primary barrier to entry for new entrants in the premium skin care market?

The primary barrier to entry is the extensive capital required for Research and Development (R&D) and the high cost of securing proprietary, clinically tested active ingredients. Additionally, establishing consumer trust and overcoming the marketing hurdle posed by established global luxury conglomerates, which possess significant brand heritage and large clinical validation budgets, presents a formidable challenge for new entrants.

Why is the Asia Pacific region the leading consumer market for premium skin care?

APAC leads due to high levels of disposable income growth, particularly in East Asia, coupled with deep-rooted cultural values prioritizing preventative skin maintenance and flawless complexions. The market is highly sophisticated, with consumers engaging in extensive, multi-step routines, driving continuous demand for innovation in brightening, anti-pollution, and textural refinement products from both local and international luxury brands.

Do male grooming trends significantly influence the premium skin care market growth?

Yes, male grooming trends are rapidly becoming a critical growth driver. As societal perceptions evolve, men are increasingly adopting specialized premium skin care products beyond basic cleansers, focusing on anti-fatigue, anti-aging, and oil control solutions. This segment is expected to show one of the highest CAGRs, presenting a significant opportunity for unisex and male-specific product lines tailored to the unique physiological characteristics of men's skin.

How important is packaging sustainability in the ultra-premium skin care sector?

Packaging sustainability is now a non-negotiable element of the ultra-premium sector. Consumers expect luxury brands not only to use high-quality, recyclable materials but also to implement circular economy strategies, such as chic, refillable systems. Brands that fail to integrate eco-consciousness into their design risk alienating environmentally aware, affluent consumers who value ethical consumption as highly as product performance and brand prestige.

What are cosmeceuticals, and how do they fit into the premium skin care market structure?

Cosmeceuticals are cosmetic products with bioactive ingredients purported to have pharmaceutical-like benefits. They occupy the higher end of the premium market, often sold through dermatologists or medical spas, and are characterized by clinical-grade ingredient concentrations and validated therapeutic claims. They bridge the gap between traditional cosmetics and pharmaceuticals, catering to consumers seeking scientifically proven, targeted solutions, especially for post-procedure or severe aging concerns.

What is the impact of influencer marketing on high-value premium skin care purchasing decisions?

Influencer marketing, especially involving highly credible, niche experts (e.g., celebrity dermatologists, scientific aestheticians), profoundly impacts purchasing decisions. Unlike mass-market endorsements, premium brands rely on influencers who can provide detailed, science-backed reviews and demonstrations, establishing a sense of authority and trust necessary to encourage consumers to invest in high-cost serums and treatments. Digital word-of-mouth validation is crucial.

How do brands ensure the quality and purity of rare active ingredients used in premium formulations?

Brands ensure quality and purity through rigorous supplier auditing, establishing vertical integration (controlling source to shelf), employing advanced in-house analytical testing (HPLC, mass spectrometry) for purity confirmation, and increasingly utilizing blockchain technology to digitally track the ingredient origin and authenticity throughout the entire supply chain, validating ethical and sustainable claims to the end-user.

What does the trend of 'skin longevity' mean for R&D investment in the premium sector?

The 'skin longevity' trend shifts focus from simply treating wrinkles to actively supporting cellular health, metabolism, and defense mechanisms over the long term. This requires significant R&D investment into complex areas like sirtuin activators, telomere protection compounds, and targeted DNA repair enzymes, positioning premium skin care as essential preventative health investment rather than merely an aesthetic fix.

How is sensory marketing utilized to enhance the perceived value of premium skin care products?

Sensory marketing is crucial; it involves crafting products with exquisite textures, luxurious packaging, and subtle, sophisticated fragrances that evoke exclusivity and well-being. The tactile experience of application—the weight of the jar, the smoothness of the cream, the visual appeal—is carefully engineered to justify the premium price, ensuring the usage ritual is perceived as an indulgent and high-quality self-care experience.

What are the primary challenges related to the regulation of premium cosmetic claims?

The primary challenge lies in substantiating complex, high-level efficacy claims (e.g., deep cellular repair, reversing damage) without crossing the regulatory boundary into pharmaceutical claims. Regulators globally demand increasingly robust, double-blind clinical data to support assertions of anti-aging effectiveness, requiring premium brands to invest heavily in independent testing and transparent data presentation to avoid misleading advertising allegations.

Which sub-segment of Face Care currently holds the largest revenue share in the market?

Serums and concentrated treatments hold the largest revenue share within the Face Care sub-segment. Consumers are willing to pay the highest price points for these intensive products because they typically contain the highest concentrations of active, specialized ingredients (peptides, highly stable vitamins, advanced retinoids) aimed at immediate and visible improvement in texture, tone, and wrinkle reduction.

How does the shift towards ‘dermatological science’ affect brand positioning in the luxury market?

The emphasis on dermatological science shifts brand positioning away from purely aspirational marketing toward clinical authority. Luxury brands now heavily leverage white lab coat imagery, publish peer-reviewed data, and partner with renowned dermatologists to establish credibility, assuring consumers that the high cost reflects robust scientific validation and specialized expertise in ingredient selection and formulation efficacy.

What geographic regions are targeted for future expansion by global premium skin care brands?

Global premium brands are strategically targeting expansion into high-potential, underserved markets, specifically Latin America (Brazil, Mexico) due to increasing middle-class populations, and the Middle East (UAE, Saudi Arabia) driven by high per capita luxury spending. These regions require localized product development, focusing on addressing unique climate-related skin concerns and cultural preferences for brand status.

What are the technological implications of microbiome research for new premium product development?

Microbiome research is leading to the development of premium products (prebiotics, probiotics, postbiotics) that focus on balancing the skin's natural bacterial flora. This shift emphasizes barrier function restoration and defense against external aggressors. New premium products incorporate bio-fermented ingredients designed to enhance beneficial bacteria, leading to reduced sensitivity, inflammation, and improved overall skin resilience and health, catering to increasingly educated consumers.

How is the ultra-premium segment managing inventory and avoiding markdowns?

The ultra-premium segment manages inventory meticulously through sophisticated demand forecasting (often AI-assisted), prioritizing exclusivity, and employing made-to-order or small-batch manufacturing for highly volatile or expensive products. Strategic control over distribution, avoiding third-party discounters, and focusing on maximizing customer lifetime value over immediate volume ensures high-end price integrity and minimizes the necessity for value-eroding markdowns, which can damage brand prestige.

What is the significance of patented ingredient delivery systems in securing market share?

Patented ingredient delivery systems, such as advanced micro-encapsulation or targeted liposome carriers, are critical for securing market share because they provide proprietary functional superiority. These systems ensure active ingredients remain stable and are delivered optimally deep within the skin layers, translating directly into superior clinical results that competitors cannot easily replicate, thus justifying the brand's exclusivity and high investment.

What impact does the rising trend of men’s investment in grooming have on the facial serum category?

The rising investment by men in grooming is specifically boosting the facial serum category. Men are transitioning from basic moisturizing to targeted, anti-aging solutions. Premium brands are responding by launching serums with lighter textures, non-feminine packaging, and formulations focused on fast absorption and addressing concerns specific to men, such as post-shave irritation, deep lines, and environmental damage.

How are environmental concerns driving innovation in premium sun care products?

Environmental concerns are driving innovation in premium sun care through the demand for 'reef-safe' formulations, mineral-based UV filters (non-nano zinc oxide), and integrated anti-pollution technologies that defend the skin barrier against urban particulate matter. Premium sun care is moving beyond simple SPF, becoming a complex, daily preventative treatment that is lightweight, effective, and environmentally conscious, commanding a higher price point.

What role do department stores still play in the omnichannel strategy of premium brands?

Department stores, despite the rise of e-commerce, still play a vital role in the omnichannel strategy by serving as critical physical touchpoints that confer prestige and enable high-touch, personalized interactions. They provide specialized counter services, expert consultations, and the opportunity for consumers to physically experience the luxurious packaging and textures, essential for closing high-value sales that rely on sensorial validation and exclusivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager