Prepared Media Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434036 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Prepared Media Market Size

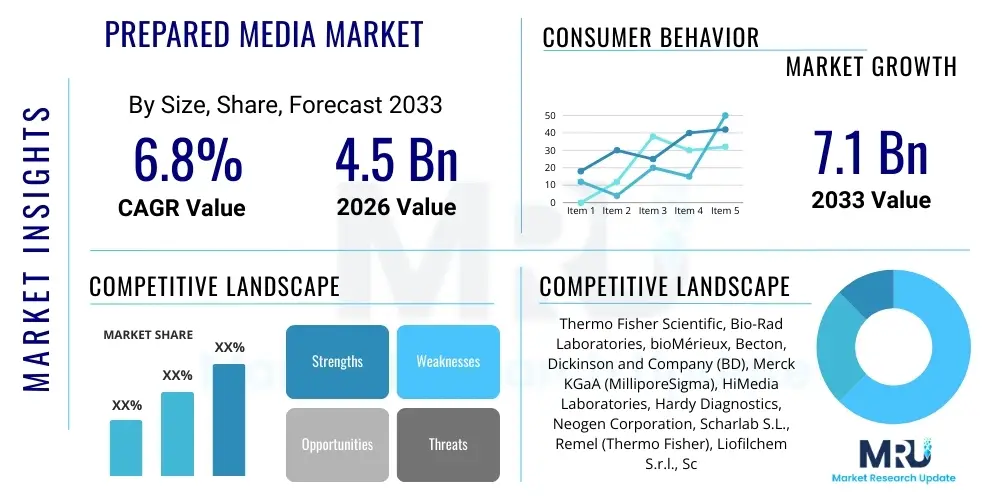

The Prepared Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating global diagnostic testing volumes, stringent pharmaceutical quality control requirements, and continuous advancements in cell culture techniques necessary for bioprocessing and personalized medicine.

Prepared Media Market introduction

The Prepared Media Market encompasses a diverse range of microbiological and cell culture consumables that are pre-mixed, sterilized, and ready-to-use, eliminating the need for in-house media preparation in clinical, academic, and industrial laboratories. These media formulations provide essential nutrients, growth factors, and selective agents necessary for the proliferation and identification of microorganisms, or the cultivation of mammalian and non-mammalian cells. Key products include agar plates, broths in tubes or bottles, pre-poured dishes, and specialized diagnostic kits. The convenience, consistency, and enhanced sterility offered by commercially prepared media significantly reduce laboratory error rates, minimize contamination risks, and streamline workflow, making them indispensable components in modern laboratory settings globally.

Major applications span clinical diagnostics, food and beverage safety testing, pharmaceutical quality assurance (QC), and advanced life science research. In clinical settings, prepared media are critical for isolating and characterizing pathogens, enabling timely and accurate disease diagnosis. For pharmaceutical companies, they are fundamental for sterility testing of injectable drugs and environmental monitoring of cleanrooms, ensuring compliance with strict regulatory standards like USP and EP guidelines. The shift towards automation in large-scale testing facilities further reinforces the demand for standardized, ready-to-use formats that integrate seamlessly with high-throughput systems, thereby minimizing manual intervention and maximizing throughput efficiency.

Key driving factors include the rising incidence of infectious diseases, leading to increased demand for diagnostic testing, particularly in developing economies. Furthermore, the burgeoning biotechnology sector, characterized by intensive research in biopharmaceuticals and regenerative medicine, requires high-quality, standardized prepared media for cell line development and protein expression. The inherent benefits, such as reduced labor costs, guaranteed quality control checks by manufacturers, and extended shelf life, strongly favor the adoption of prepared media over traditional, in-house preparation methods, positioning this market for sustained growth throughout the forecast period.

Prepared Media Market Executive Summary

The Prepared Media Market exhibits strong growth dynamics, underpinned by significant technological advancements in microbiology automation and increasing investments in biopharmaceutical production capacity globally. Business trends show a consolidation among top-tier manufacturers focusing on vertical integration and acquiring smaller specialized media providers to broaden their product portfolios, especially in specialized areas like anaerobic media and molecular diagnostics-compatible formulations. The trend of outsourcing media preparation is accelerating across small and mid-sized laboratories that prioritize core analytical activities over time-consuming preparatory tasks. Furthermore, manufacturers are heavily investing in developing enhanced formulations, including chromogenic and selective differential media, which offer faster results and higher specificity, directly addressing the pressure laboratories face regarding rapid turnaround times and resistance profiling.

Regionally, North America and Europe maintain dominance due to well-established healthcare infrastructure, high regulatory compliance standards necessitating stringent QC protocols, and extensive R&D activity in biotechnology. However, the Asia Pacific (APAC) region is poised to register the fastest growth, propelled by the massive expansion of clinical laboratories, improvements in healthcare access, and significant foreign direct investment into pharmaceutical manufacturing facilities in countries like China and India. The regional emphasis on improving food safety standards, coupled with increasing population density, also drives substantial demand for rapid microbial testing solutions, subsequently fueling the prepared media segment's expansion in emerging economies.

Segment trends highlight the dominance of the plate media segment due to its widespread use in standard culturing and colony counting techniques. However, the market is witnessing rapid adoption of specialized media formats, such as automated ready-to-use cassettes and specialized media for molecular applications (e.g., media optimized for nucleic acid preservation), reflecting the convergence of traditional microbiology with molecular techniques. By application, pharmaceutical quality control remains a critical high-value segment, driven by global regulatory pressures demanding zero-tolerance for microbial contamination in sterile drug production. The focus on quality, consistency, and traceability across all segments dictates market competition and pricing strategies, favoring established suppliers capable of maintaining robust global supply chains and stringent quality management systems.

AI Impact Analysis on Prepared Media Market

Common user questions regarding AI's influence in the Prepared Media Market revolve around how automation and machine learning can enhance quality control, optimize inventory management, and potentially alter the demand for specific media types. Users are keen to understand if AI can predict media shelf life more accurately, detect subtle contamination patterns faster than manual inspection, and streamline the complex logistical networks required for delivering temperature-sensitive, perishable products. The core expectation is that AI integration will lead to unprecedented levels of consistency and significantly reduce wastage associated with prepared media, while enabling manufacturers to predict demand fluctuations in high-stakes clinical and pharmaceutical segments. AI is expected to revolutionize production planning and quality assurance, moving beyond simple automation to predictive manufacturing models.

- Quality Control Optimization: AI-powered image recognition algorithms are enhancing automated inspection systems to detect inconsistencies, particulate matter, or microbial growth in prepared media plates with higher precision and speed than human operators.

- Predictive Inventory Management: Machine learning models analyze historical usage data, seasonal trends, and epidemiological factors to forecast demand for specific media types (e.g., specialized antibiotic sensitivity media), minimizing stockouts and reducing material spoilage.

- Formulation Optimization: AI algorithms are utilized in R&D to simulate and predict the optimal combination of nutrients, pH stabilizers, and selective agents, accelerating the development of novel, highly specific culture media for emerging pathogens or complex cell lines.

- Supply Chain Efficiency: AI analyzes real-time logistics data, including temperature monitoring and delivery routes, to ensure the cold chain integrity of temperature-sensitive prepared media, proactively identifying and mitigating potential shipment delays or temperature excursions.

- Automated Diagnostics Integration: AI facilitates the interpretation of growth patterns and colorimetric changes on chromogenic and differential media, integrating seamlessly with automated plate readers to provide rapid, objective identification of microbial species.

- Reduction in Waste: By improving forecast accuracy and optimizing batch sizes based on predicted demand, AI significantly contributes to minimizing the substantial product wastage often associated with perishable biological consumables.

- Enhanced Traceability: AI systems manage and analyze vast datasets generated during the production process, providing end-to-end traceability for every batch of prepared media, crucial for meeting stringent regulatory requirements in the clinical and pharmaceutical sectors.

- Robotics and Manufacturing Automation: AI guides advanced robotics in the precise, sterile filling and pouring of media, minimizing human contact and ensuring consistent volume and quality across high-throughput manufacturing lines.

DRO & Impact Forces Of Prepared Media Market

The Prepared Media Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. The principal drivers include the rapidly growing global focus on clinical microbiology, spurred by the continuous threat of antimicrobial resistance (AMR) and the need for accurate pathogen identification. Simultaneously, the restraints predominantly center around the short shelf life of many prepared media products, which necessitates complex, expensive cold chain logistics and results in inventory management challenges and inevitable product wastage. The primary opportunities lie in the development of specialized, highly-selective media that can support the cultivation of difficult-to-grow organisms and the integration of automated solutions for faster, high-throughput sample processing, especially within the burgeoning field of regenerative medicine and personalized diagnostics. These forces collectively dictate investment patterns and innovation trajectories, making market resilience highly dependent on technological adaptation and supply chain robustness.

The impact forces driving market adoption are heavily skewed towards regulatory compliance and standardization. Stringent guidelines from bodies such as the FDA, EMA, and ISO mandate the use of validated, high-quality prepared media for critical applications, particularly sterility testing in pharmaceutical manufacturing and clinical diagnostic validation. This regulatory pressure makes in-house media preparation an increasingly risky and non-compliant activity for many organizations, thus strongly favoring commercial prepared media solutions. Conversely, the high capital investment required for establishing advanced, sterile manufacturing facilities and managing global cold chain logistics acts as a significant barrier to entry for smaller players, intensifying competition among established market leaders who can consistently guarantee quality and reliable supply volumes worldwide.

Furthermore, the market benefits substantially from the increasing global awareness of foodborne illnesses, which necessitates routine and extensive microbiological testing in the agriculture and processed food sectors. This sustained demand, coupled with the shift towards faster molecular diagnostic methods that often still require an initial enrichment or primary culture phase using prepared media, ensures sustained growth. However, the persistent cost sensitivity in specific end-user segments, particularly academic research and public health laboratories in developing countries, poses a restraint, pushing manufacturers to continuously balance premium quality with competitive pricing strategies. Innovation in dry media format reconstitution technologies and media offering extended shelf life represent key opportunities to mitigate existing logistical and shelf-life restraints.

Segmentation Analysis

The Prepared Media Market is segmented primarily based on the type of media format, the physical state of the media, the specific application area, and the type of end-user utilizing the product. This structural breakdown helps analyze market dynamics and identify high-growth niches. Media types range from general-purpose media supporting broad microbial growth to specialized selective media formulated to isolate specific organisms. The pharmaceutical and clinical end-user segments drive demand for the highest quality and compliance, while food safety and environmental testing require robust, often high-volume, cost-effective solutions. Analyzing these segments provides critical insight into pricing strategies, quality requirements, and regional consumption patterns.

- By Type of Media:

- General Purpose Media (e.g., Tryptic Soy Agar, Nutrient Broth)

- Selective Media (e.g., MacConkey Agar, Salmonella-Shigella Agar)

- Differential Media (e.g., Blood Agar, Triple Sugar Iron Agar)

- Enriched Media

- Chromogenic Media

- Transport Media

- Custom/Specialized Media

- By Physical State:

- Solid Media (Plates, Slants, Dehydrated)

- Liquid Media (Broths, Bottled Media)

- Semi-Solid Media

- By Application:

- Clinical Diagnostics (Infectious Disease Testing, Susceptibility Testing)

- Pharmaceutical and Biotechnology (Sterility Testing, Environmental Monitoring, Bioburden Testing)

- Food and Beverage Testing (Pathogen Detection, Quality Control)

- Water and Environmental Testing

- Academic Research and Government Agencies

- By End-User:

- Hospitals and Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Food and Water Testing Laboratories

- Academic and Research Institutes

Value Chain Analysis For Prepared Media Market

The value chain for the Prepared Media Market is complex, beginning with the sourcing of highly specialized raw materials and extending through sophisticated manufacturing, strict quality assurance, and a cold-chain reliant distribution network. Upstream analysis focuses on the procurement of critical components, including peptones, hydrolysates, agar, specialized chemical salts, and purified water. The quality and purity of these raw materials are paramount, as slight variations can drastically affect the media’s performance and regulatory compliance. Suppliers must adhere to stringent quality standards, often requiring pharmaceutical-grade sourcing, which adds significant complexity and cost. Major media manufacturers often maintain tight control over raw material specifications, sometimes producing proprietary components in-house to ensure consistency and availability.

The core manufacturing process involves formulation, mixing, sterilization (typically autoclaving), and highly sterile dispensing into final containers (plates, bottles, or tubes) within cleanroom environments. Quality assurance is the most critical stage, involving extensive testing for performance characteristics, sterility, and growth promotion capability using certified reference strains. Failure at the QA stage leads to entire batch rejection, highlighting the importance of robust process control and advanced automation. Downstream analysis focuses on packaging (which must maintain sterility and humidity), warehousing (requiring strict temperature control), and distribution. Due to the perishable nature and sensitivity of the products, distribution channels rely heavily on specialized logistics providers capable of maintaining the verified cold chain from the factory floor to the end-user laboratory bench.

Distribution channels are multifaceted, utilizing both direct sales models, particularly for large pharmaceutical accounts or government tenders, and indirect channels through specialized scientific distributors. Indirect distribution through global distributors like Fisher Scientific or VWR allows manufacturers to reach a broader base of small clinical laboratories and academic institutions efficiently. Direct channels offer better margin control and specialized technical support for complex custom media orders. Ensuring rapid delivery and maintaining product integrity during transit are major challenges, often favoring local or regional manufacturing hubs to minimize transit time and temperature fluctuations. Effective management of this integrated supply chain, coupled with digital platforms for order tracking and inventory management, is crucial for market competitiveness.

Prepared Media Market Potential Customers

The primary end-users and buyers of prepared media are diverse organizations across the healthcare, biotechnology, food safety, and academic sectors, all requiring highly consistent and reliable microbiological and cell culture environments. Clinical diagnostic laboratories, ranging from large centralized reference labs to small hospital labs, represent a fundamental customer base, utilizing prepared media daily for the isolation, identification, and antibiotic susceptibility testing of infectious agents crucial for patient care and epidemiological surveillance. This segment is highly sensitive to rapid turnaround times and regulatory compliance, driving demand for ready-to-use, high-performance specialized media.

Pharmaceutical and biotechnology companies constitute another major high-value customer segment. These organizations rely on prepared media for stringent quality control protocols, including mandatory sterility testing of sterile injectable drugs, bioburden testing of raw materials, and routine environmental monitoring of Grade A and B cleanrooms. Given the zero-tolerance regulatory environment for pharmaceutical manufacturing, these customers prioritize supplier validation, robust documentation, and guaranteed product lot-to-lot consistency above all other factors, often entering into long-term supply agreements with validated manufacturers to secure supply chain integrity.

Furthermore, food and beverage processing facilities, along with dedicated food safety testing laboratories, represent a rapidly expanding customer base driven by global food safety legislation and consumer protection measures. These customers require bulk quantities of standard and selective media for the detection of critical foodborne pathogens like Salmonella, E. coli, and Listeria. Academic and governmental research institutions are consistent buyers for fundamental research, training, and surveillance programs, often purchasing a wide variety of standard formulations in smaller quantities. The overarching characteristic of all potential customers is the mandatory requirement for media products that are certified, traceable, and guaranteed to meet performance specifications set forth by international standards bodies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Bio-Rad Laboratories, bioMérieux, Becton, Dickinson and Company (BD), Merck KGaA (MilliporeSigma), HiMedia Laboratories, Hardy Diagnostics, Neogen Corporation, Scharlab S.L., Remel (Thermo Fisher), Liofilchem S.r.l., Scientific Laboratory Supplies, Conda Lab, Eurofins Scientific, Sisco Research Laboratories Pvt. Ltd., Dalynn Biologicals, VWR International (Avantor), Mast Group Ltd., Microbiology International, Inc., Lab M Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prepared Media Market Key Technology Landscape

The technology landscape in the Prepared Media Market is defined by continuous innovation aimed at enhancing sterility, extending shelf life, and improving diagnostic performance to meet the demands of modern high-throughput laboratories. A significant area of focus is on automation technologies in manufacturing, including robotic plate pouring and filling systems that operate within ISO Class 5 cleanrooms. These advanced systems minimize human contact, significantly reducing the risk of adventitious contamination and ensuring precise, repeatable media volume and consistency across millions of units annually. Furthermore, advanced sterilization techniques, such as sterile filtration and controlled heat cycles (autoclaving), are rigorously validated using biological indicators to guarantee product sterility while preserving the functional integrity of heat-sensitive media components.

In terms of product innovation, the development and adoption of chromogenic and fluorogenic media represent a major technological shift. These media incorporate specific substrates that, when metabolized by target microorganisms, release a colored or fluorescent end-product, allowing for presumptive identification within a shorter incubation time and often eliminating the need for subsequent confirmatory biochemical tests. This technology improves workflow efficiency in clinical and food safety testing environments. Another critical technological advancement is the development of specialized media optimized for compatibility with modern molecular diagnostics, such as transport and enrichment media formulated to preserve nucleic acid integrity while simultaneously inhibiting non-target organisms, bridging traditional culturing with PCR-based methods.

The integration of advanced packaging materials and modified atmosphere packaging (MAP) technologies is essential for extending the product shelf life, especially for complex or highly perishable formulations. Manufacturers are increasingly utilizing impermeable films and containers that maintain optimal humidity and restrict oxygen exposure, mitigating dehydration and degradation concerns. Traceability technologies, including integrated barcode systems and RFID tags applied at the manufacturing stage, are becoming standard, enabling seamless integration with laboratory information management systems (LIMS) and providing complete audit trails necessary for compliance in highly regulated environments like pharmaceutical QC and clinical trial settings. These technological implementations are crucial for supporting the market's trajectory towards automation and higher quality standards.

Regional Highlights

- North America: Dominates the market share due to substantial governmental and private sector investments in life science research, a mature healthcare system, and the presence of major pharmaceutical and biotechnology companies with extremely strict quality control requirements. High adoption rates of automation and advanced diagnostic technologies further cement its leading position. The US remains the largest consumer, driven by extensive infectious disease surveillance and pharmaceutical manufacturing activities.

- Europe: Represents a significant market characterized by stringent regulatory frameworks (e.g., EU Pharmacopoeia standards) that enforce high-quality requirements for microbiological testing. Key growth drivers include the well-established food safety sector and robust academic research across Germany, the UK, and France. The region is increasingly adopting rapid chromogenic media for streamlined clinical workflows.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid expansion of the healthcare infrastructure, rising incidence of chronic and infectious diseases requiring extensive diagnostics, and increasing foreign investment in pharmaceutical and food processing sectors, particularly in China, India, and Japan. Improved patient access and growing awareness of food safety standards accelerate demand.

- Latin America (LATAM): Exhibits moderate growth, primarily driven by investments in clinical laboratory modernization and efforts to combat endemic infectious diseases. Market expansion is sometimes hindered by economic volatility and reliance on imported products, but the focus on improving public health standards ensures steady demand.

- Middle East and Africa (MEA): Emerging market where growth is concentrated in the Gulf Cooperation Council (GCC) countries due to high healthcare expenditure and the establishment of advanced diagnostic centers. Challenges include fragmented regulatory environments and reliance on international suppliers, though increasing efforts in local pharmaceutical production are creating new demand pockets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prepared Media Market.- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Merck KGaA (MilliporeSigma)

- Bio-Rad Laboratories, Inc.

- HiMedia Laboratories Pvt. Ltd.

- Hardy Diagnostics

- Neogen Corporation

- Liofilchem S.r.l.

- Scharlab S.L.

- Conda Lab

- Mast Group Ltd.

- Scientific Laboratory Supplies Ltd.

- Remel (a part of Thermo Fisher)

- VWR International (Avantor)

- Dalynn Biologicals Inc.

- Sisco Research Laboratories Pvt. Ltd.

- Eurofins Scientific SE (Testing Services)

- Clyde Biosciences

- Microbiology International, Inc.

Frequently Asked Questions

Analyze common user questions about the Prepared Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Prepared Media Market?

The market is primarily driven by the increasing global prevalence of infectious diseases, demanding more diagnostic testing; stringent regulatory requirements for quality control in the pharmaceutical sector (sterility testing); and the necessity for standardized, reliable culture media in high-throughput automated laboratories.

How does AI technology affect the quality assurance process for prepared media?

AI significantly enhances quality assurance by powering automated visual inspection systems to detect contamination or formulation defects faster and more accurately than manual methods. Additionally, AI optimizes batch consistency and improves predictive maintenance in manufacturing, minimizing the risk of product non-conformity.

What are the main logistical challenges faced by manufacturers in this market?

The primary logistical challenge is maintaining the cold chain for temperature-sensitive prepared media throughout the distribution network, given the typically short shelf life of many products. This requires specialized refrigerated transport and strict inventory management to minimize product spoilage and waste, particularly in geographically expansive regions.

Which application segment holds the largest market share in Prepared Media?

The Pharmaceutical and Biotechnology Quality Control (QC) application segment typically holds a significant market share. This is due to the mandatory, high-volume testing required for sterility and bioburden assessment of drug products and environmental monitoring, where regulatory compliance necessitates the continuous use of validated, high-quality prepared media.

What is the current trend concerning the use of Chromogenic Media?

The trend shows rapid adoption of chromogenic media due to their ability to provide faster, presumptive identification of pathogens without extensive biochemical confirmation. This selectivity and ease of interpretation greatly improve workflow efficiency in clinical and food safety testing, supporting the transition towards rapid and automated diagnostic platforms.

The detailed analysis within this report underscores the Prepared Media Market's trajectory toward enhanced specialization and automation, driven by global regulatory standardization and increasing healthcare demands. Strategic investments in cold chain management and advanced manufacturing technologies remain critical differentiators for leading market players seeking to capitalize on opportunities presented by emerging diagnostic technologies and burgeoning biopharmaceutical production.

The Prepared Media Market, while mature in its core offering, demonstrates dynamic evolution driven by innovations in formulation chemistry, digital integration, and stringent quality mandates. The future landscape will be defined by manufacturers capable of delivering hyper-consistent, long shelf-life products optimized for automated laboratory systems, thereby cementing their position as critical enablers in global health and safety diagnostics.

Further expansion into specialized media for cell and gene therapies, which require highly optimized and sterile nutrient platforms, represents a high-growth frontier. Manufacturers must navigate complexities related to raw material sourcing traceability and regulatory validation in these specialized segments. The sustained investment in APAC manufacturing and distribution capabilities is essential for capturing the market potential in emerging economies, balancing cost efficiency with uncompromising quality standards required by international accreditation bodies.

End-user education regarding proper storage, handling, and quality assurance procedures for ready-to-use media remains a continuous necessity to ensure optimal performance. The transition from traditional dehydrated media preparation to ready-to-use formats continues to be a central theme, driven by the compelling economic benefits of reduced labor, guaranteed quality checks, and minimized risk of procedural contamination in laboratory environments globally.

The integration of advanced supply chain monitoring via IoT sensors and data analytics provides manufacturers with crucial insights into environmental conditions during transit, addressing one of the most significant inherent restraints of this market—product perishability. Proactive monitoring and AI-driven route optimization improve delivery reliability, a core competitive advantage when supplying critical consumables to time-sensitive diagnostic and pharmaceutical operations.

Overall, the market remains robust, highly competitive, and technology-dependent. Success hinges on a manufacturer's ability to maintain unwavering product quality, offer comprehensive product portfolios catering to diverse regulatory environments, and effectively manage the complex cold-chain logistics required for global distribution of sensitive biological products.

The focus on personalized medicine and advanced cell culture techniques necessitates continuous R&D investment in specialized, chemically defined media formulations that minimize variability and maximize cell growth efficiency. This sub-segment of the prepared media market, while smaller in volume compared to traditional microbial media, commands premium pricing due to the inherent complexity and high stakes involved in biotherapeutic production. Compliance with pharmacopeial standards across different global regions imposes a high operational burden, requiring manufacturers to maintain extensive documentation and quality management systems validated by multiple regulatory bodies.

Market sustainability is also increasingly linked to environmental factors. Customers are increasingly prioritizing suppliers who utilize sustainable packaging materials, minimize production waste, and offer efficient recycling programs for used media plates and containers. This shift towards 'green' laboratory consumables, though nascent, is expected to become a key decision-making factor in procurement tenders, particularly in publicly funded research and hospital systems across North America and Europe.

The competitive landscape is characterized by a few global conglomerates dominating the bulk supply of standard media, while smaller, specialized firms often lead in niche areas such as anaerobic culture or antibiotic susceptibility testing media. Merger and acquisition activities remain prevalent, driven by the desire of larger players to integrate niche technology, secure specialized IP, and eliminate competition, ensuring a consolidated, high-barrier entry environment for new entrants.

Technological advancement in automation is not confined to manufacturing but extends to the laboratory side, where integration of prepared media platforms with robotic sample processors and automated incubation systems is maximizing efficiency. This seamless integration ensures traceability from sample inoculation to final result reporting, significantly enhancing the reliability and speed of clinical diagnostics. The demand for media formats optimized for these automated systems, such as stackable and barcoded plates, continues to rise.

In summary, the Prepared Media Market is experiencing fundamental growth, primarily driven by critical public health needs and stringent industrial quality standards. While facing challenges related to shelf life and logistics, the market's reliance on technological innovation and adherence to global regulatory frameworks ensures its essential status within the life sciences and healthcare ecosystems globally.

The substantial investment in research and development dedicated to tackling multi-drug resistant organisms (MDROs) heavily contributes to the specialized media segment. Rapid and accurate detection of resistance mechanisms necessitates continually updated and highly selective prepared media formulations, creating a permanent innovation cycle. Manufacturers must collaborate closely with clinical microbiologists and regulatory agencies to ensure their media meet the ever-evolving standards for antimicrobial susceptibility testing (AST).

Furthermore, the digitalization of laboratory workflows (Lab 4.0) impacts procurement processes. Customers increasingly expect digital tools for managing inventory, tracking media expiry dates, and accessing batch-specific Certificates of Analysis (CoA) online. Prepared media suppliers are responding by investing in robust digital platforms that offer complete product lifecycle management integration, enhancing customer loyalty and operational transparency. This move towards digital service provision acts as a competitive differentiator beyond mere product quality.

The global pharmaceutical pipeline, particularly the growth in biosimilars and cell and gene therapies, mandates reliable, high-purity basal and complex prepared media for initial cell expansion and validation stages. The cost of failure in these therapies is astronomical, placing immense pressure on media manufacturers to deliver flawless, high-specification products, often requiring custom lot release testing and dedicated supply chains separate from commodity media.

Regulatory scrutiny regarding the manufacturing of biological media components, specifically the sourcing and processing of animal-derived ingredients (ADIs), continues to drive the demand for Animal Component-Free (ACF) and Chemically Defined (CD) prepared media. While these formulations increase initial production costs, they reduce regulatory hurdles and ensure greater batch consistency for bioprocessing clients, aligning with current pharmaceutical industry best practices.

Finally, emerging infectious disease outbreaks, such as seasonal influenzas or novel coronaviruses, generate immediate and massive surges in demand for specific diagnostic and transport media. The market’s ability to scale production rapidly and deploy emergency supplies efficiently across geographical boundaries remains a key societal function and a driver of contingency planning within the leading manufacturing firms, highlighting the strategic importance of this sector.

The ongoing globalization of food trade necessitates harmonization of testing standards and protocols, subsequently increasing the demand for standardized prepared media kits used across international supply chains. This pressure for standardization benefits large, international media suppliers capable of providing globally consistent product lines and certifications that satisfy multiple national regulatory bodies simultaneously.

The market faces increasing scrutiny over sustainability, particularly concerning the disposal of plastic petri dishes and associated biohazardous waste. Innovative packaging solutions, including recyclable components and lighter materials, are being explored to mitigate the environmental footprint associated with high-volume consumable usage, aligning with corporate sustainability goals across major healthcare systems and research institutes.

Regional economic factors significantly influence the balance between prepared and dehydrated media usage. In cost-sensitive regions, the perceived lower upfront cost of dehydrated media still holds relevance, despite the high labor and QC overheads. Consequently, manufacturers strategically tailor their product mix and pricing models based on regional economic maturity and laboratory throughput capacity, ensuring market penetration across all income levels globally.

The specialized field of veterinary diagnostics also represents an important, albeit secondary, segment. Prepared media are vital for testing animal samples for pathogens relevant to animal health and zoonotic diseases, connecting the veterinary market directly to food safety and public health agendas, ensuring a steady stream of demand for appropriate microbiological culture systems.

Advancements in rapid microbial methods (RMM) often complement, rather than replace, prepared media. Many RMM technologies, while providing faster results, still rely on an initial enrichment or primary culture phase using prepared broth or plate media to concentrate the target organisms, thus securing the ongoing demand for these foundational consumables.

In conclusion, the Prepared Media Market is characterized by indispensable demand rooted in health, safety, and regulatory compliance. Its future success depends on high-quality production, robust cold-chain logistics, and continued technological innovation in pursuit of faster, more accurate, and more specialized microbiological and cell culture consumables.

The expansion of high-throughput screening (HTS) in drug discovery and development relies heavily on standardized, miniaturized prepared media formats (e.g., in microplates), ensuring consistent growth conditions across massive compound libraries. Manufacturers must engineer media to maintain stability and performance across extended incubation times within robotic systems, demanding high technical specifications.

Furthermore, cybersecurity considerations are becoming relevant, particularly concerning the integrity of the LIMS systems and digital platforms used by prepared media manufacturers to manage batch records, quality data, and customer order fulfillment. Ensuring the security and reliability of this digital backbone is crucial for maintaining customer trust and regulatory compliance in critical infrastructure supply.

The growth in personalized medicine requires specialized media for patient-derived organoid and spheroids cultures. These systems demand chemically defined, often complex, prepared media that mimic the in vivo environment precisely. This bespoke, high-value segment requires specialized manufacturing runs and rigorous quality checks, distinguishing it significantly from bulk production of standard microbiological plates.

The rising global population and urbanization contribute to increased environmental monitoring needs (water, soil, air quality). Prepared media are fundamental tools for detecting environmental contamination, particularly concerning Legionella, coliforms, and other public health threats, solidifying a stable demand stream from municipal and environmental testing laboratories globally.

Finally, geopolitical factors and global supply chain disruptions necessitate diversification of raw material sourcing and manufacturing footprints. Prepared media manufacturers are increasingly establishing redundant production facilities across different continents to mitigate risks associated with regional political instability or natural disasters, ensuring uninterrupted supply to critical healthcare and pharmaceutical customers worldwide.

The market also benefits from ongoing training and competency assessment requirements in microbiology laboratories, where practical exercises and proficiency testing often require fresh, reliable prepared media supplies, contributing to continuous, baseline demand across academic and training institutions.

The continued vigilance against biological threats and the need for preparedness against potential pandemics drives governmental stockpiling and tender awards for essential diagnostic and transport media. This governmental demand, often managed through large contracts, stabilizes a segment of the prepared media market and encourages capacity expansion among key suppliers.

This comprehensive view confirms that the Prepared Media Market is foundational to global health, safety, and biotechnology industries, with sustained growth projected across all key segments and regions, underpinned by strict quality demands and technological evolution.

The market's ability to swiftly adapt to new testing protocols, such as those necessitated by antibiotic resistance monitoring or emerging viral threats, is crucial. This requirement necessitates flexible manufacturing lines that can quickly pivot to specialized small-batch production while maintaining massive capacity for standard media like blood agar and Tryptic Soy Broth.

Moreover, the focus on reducing laboratory variability mandates media manufacturers to invest heavily in calibration and metrology to ensure lot-to-lot consistency. This is particularly vital for highly sensitive applications such as Minimum Inhibitory Concentration (MIC) testing where even small variations in media composition can affect clinical results and treatment decisions.

In conclusion, the market analysis reinforces the integral role of prepared media, driven not merely by volume, but by the relentless pursuit of quality, precision, and efficiency in biological testing across the clinical, industrial, and research sectors globally, ensuring its indispensable position in the overall diagnostics and biopharma supply chain.

The growing preference for convenience and standardization significantly outweighs the minor cost savings associated with in-house preparation for most professional laboratories today, permanently shifting the industry dynamics towards commercially prepared, quality-assured solutions.

This enduring reliance guarantees the market's stability and sustained financial performance throughout the forecast period, positioning key players who master logistics and quality control for substantial returns.

The ongoing development of novel bioproduction systems, such as continuous bioprocessing, requires highly defined and robust media solutions that can support cell viability and productivity over extended periods, opening lucrative avenues for customized high-end prepared media suppliers.

Finally, the competitive strategy for manufacturers increasingly relies on offering comprehensive service packages that include technical support, regulatory assistance, and dedicated logistics, moving beyond a simple product sale to a full partnership model with high-volume customers.

This report provides the essential analytical foundation for stakeholders seeking to navigate the competitive and regulatory landscape of the global Prepared Media Market efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager