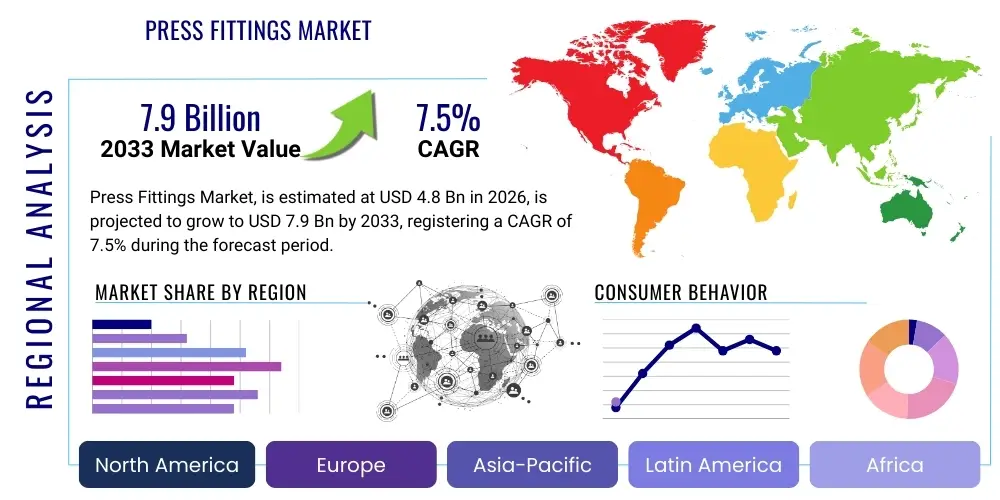

Press Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436160 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Press Fittings Market Size

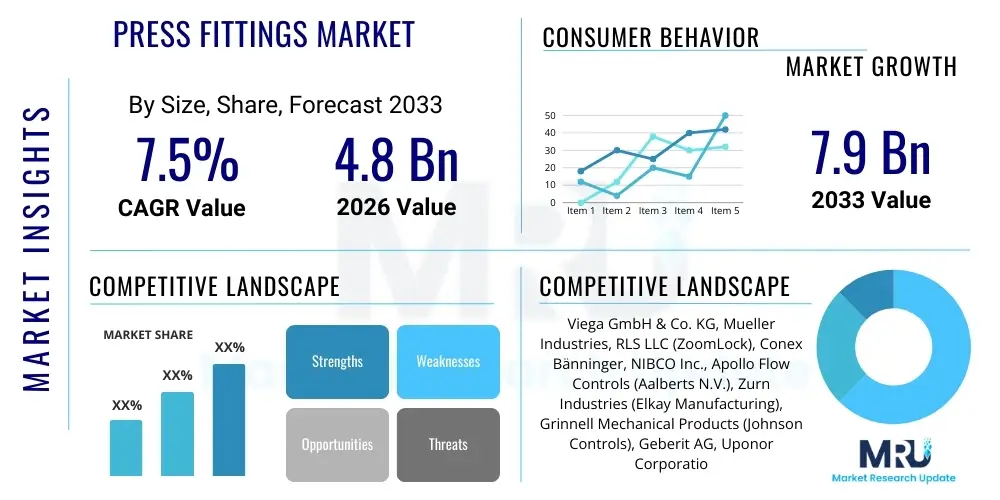

The Press Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Press Fittings Market introduction

The Press Fittings Market encompasses specialized plumbing and piping components designed for permanent, leak-proof connections in residential, commercial, and industrial fluid transfer systems. These fittings utilize mechanical pressure applied by proprietary pressing tools to compress the fitting material around the pipe, creating a reliable seal often enhanced by internal O-rings made from materials like EPDM or HNBR. Unlike traditional joining methods such as soldering, brazing, or threading, press fittings eliminate the need for heat, flame, or chemicals, significantly improving installation safety and reducing labor time on-site, which is a major benefit in high-cost labor environments.

The core product portfolio includes fittings made from materials such as copper, carbon steel, stainless steel (304 and 316), and various plastic systems like PEX and multilayer composite pipes. Major applications span potable water systems, heating and cooling installations (HVAC), compressed air lines, solar thermal systems, and non-critical gas piping. Key benefits driving adoption are the quick installation process, high joint integrity, immediate pressure testing capability, and adherence to stringent modern construction and safety standards. The market growth is fundamentally driven by the rising cost of skilled labor, the increasing pace of construction projects, and the growing demand for sustainable, efficient, and fire-safe joining technologies across developed and rapidly developing economies.

Furthermore, the push towards green building standards and enhanced water safety regulations globally favors the adoption of press fittings. Systems like stainless steel press fittings are increasingly used in aggressive environments or high-purity water applications where corrosion resistance is paramount. The continuous development of specialized O-ring materials designed to handle diverse media, including oils, chemicals, and high-temperature water, ensures that press technology maintains a competitive edge over conventional welding or threaded coupling methods, particularly in renovation projects and commercial retrofits where fire risk mitigation is essential.

Press Fittings Market Executive Summary

The global Press Fittings Market is characterized by robust growth stemming from accelerated urbanization, rigorous building safety codes, and continuous innovation in material science and pressing tool technology. Business trends indicate a strong shift towards standardized, modular building practices, where the speed and consistency offered by press technology are highly valued, particularly in large-scale commercial and multi-family residential constructions. Major manufacturers are focusing on integrating smart features into pressing tools, offering better traceability and guaranteed joint quality, thereby cementing user confidence. Supply chain stability, especially regarding copper and stainless steel sourcing, remains a crucial operational challenge and a key differentiator among leading market players, prompting diversification into multi-layer plastic systems.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, driven by massive investments in infrastructure development, modernization of existing sanitation networks, and the rapid expansion of commercial real estate in nations like China, India, and Southeast Asian countries. Europe and North America, while mature markets, continue to demonstrate steady demand fueled primarily by replacement and renovation activities, coupled with stringent environmental regulations demanding lead-free solutions and energy-efficient HVAC installations. The adoption rate of carbon steel press fittings is notably high in industrial and non-potable commercial heating applications across Europe, while copper remains dominant in potable water systems in North America.

Segment trends reveal that the metal press fittings segment, particularly stainless steel, is gaining traction due to its superior durability and suitability for high-demand industrial and healthcare sectors. By application, the residential segment holds a substantial share, but the commercial and industrial segments are poised for faster expansion due to larger pipe diameters and the critical requirement for guaranteed system uptime and longevity. Moreover, the increased availability and standardization of press fitting systems for PEX and multilayer pipes are broadening the addressable market, allowing press technology to penetrate sectors historically dominated by lower-cost polymer joining techniques, driven by the overall reduction in total installed cost compared to traditional methods.

AI Impact Analysis on Press Fittings Market

User queries regarding AI’s influence on the Press Fittings Market generally revolve around four core themes: enhanced manufacturing efficiency, predictive maintenance integration, optimized supply chain logistics, and the role of AI in design and Building Information Modeling (BIM). Users seek to understand how AI can reduce defects in complex fabrication processes, minimize material waste, and forecast equipment failure rates in critical infrastructure where press fittings are deployed. Furthermore, there is significant interest in how AI-driven demand forecasting can stabilize volatile material prices and improve the just-in-time delivery of fittings, particularly for large, staggered construction projects. The common expectation is that AI will move press fittings from a simple component industry to a smart, data-integrated part of a larger, interconnected building ecosystem, influencing everything from tooling calibration to system performance modeling.

AI’s influence extends fundamentally into the manufacturing realm, where sophisticated machine learning algorithms are utilized for real-time quality control during the pressing and O-ring insertion stages, ensuring zero-defect output and maintaining the critical tolerances necessary for a leak-proof seal. By analyzing vast datasets derived from production line sensors, AI systems can immediately detect anomalies that may compromise fitting integrity, such as minor variations in material hardness or tool pressure, leading to enhanced product reliability. This proactive quality assurance is critical, as the dependability of press fittings is directly tied to installer confidence and the overall growth trajectory of the market.

In the downstream application segment, AI is increasingly integrated with BIM software, allowing engineers to optimize piping layouts, calculate necessary material quantities with superior accuracy, and predict the optimal points for utilizing press fittings versus other joint types based on project specific constraints like labor availability or spatial limitations. Beyond design, AI-powered predictive maintenance platforms analyze sensor data from building systems (e.g., pressure drops, temperature fluctuations) to predict potential joint failures before they occur, especially in large HVAC or industrial piping networks. This shift towards smart system monitoring strengthens the value proposition of press fittings as components suitable for highly resilient, data-driven infrastructure.

- AI-driven Predictive Maintenance: Monitoring joint integrity and forecasting system component replacement cycles in large commercial and industrial installations.

- Manufacturing Quality Control: Utilizing machine learning for real-time anomaly detection during the pressing, stamping, and O-ring installation processes to ensure zero-defect production.

- Supply Chain Optimization: AI algorithms forecasting fluctuating demand and optimizing inventory levels for different materials (copper, stainless steel, carbon steel) to mitigate supply risk.

- BIM Integration and Design Optimization: Enhancing Building Information Modeling software with AI to automate complex piping route generation and precise material procurement lists.

- Tool Calibration and Traceability: AI assistance in managing battery life, tool service intervals, and ensuring correct pressing force application across thousands of installation cycles for guaranteed joint quality.

DRO & Impact Forces Of Press Fittings Market

The Press Fittings Market is propelled by significant Drivers (D), balanced by structural Restraints (R), and offers considerable Opportunities (O), all governed by powerful external Impact Forces. The primary drivers include the inherent speed and simplicity of installation, dramatically reducing labor costs and project timelines compared to welding or soldering, which is particularly attractive in regions facing skilled labor shortages. The elimination of flame and dangerous fumes enhances job site safety, making press systems the preferred choice in sensitive environments like hospitals, data centers, and occupied commercial buildings during renovation. Furthermore, the rising global mandate for sustainable, leak-proof plumbing solutions aligns perfectly with the proven reliability and longevity of press fittings, especially in potable water and high-pressure applications.

However, the market faces key restraints, most notably the higher initial component cost compared to traditional fittings, which can be a barrier to entry in budget-sensitive projects or developing regions. Additionally, press fitting installation requires specialized, proprietary tooling (press tools and jaws) which represents a significant capital investment for contractors, and the system reliability is critically dependent on the proper maintenance and calibration of these tools. Misapplication or failure to use the correct jaw profile can compromise the joint, requiring specific training and adherence to manufacturer protocols. Market growth is also constrained by the historical reliance on traditional joining techniques in certain conservative industrial sectors which are slow to adopt new technologies, requiring substantial educational outreach.

The core opportunities for market expansion lie in the massive global investment in infrastructure renewal and smart city development, particularly within water treatment, district heating, and non-residential construction sectors. The development of press fittings suitable for larger diameter pipes and higher pressure applications will open up industrial process piping markets. Moreover, stringent regulatory environments, such as those promoting lead-free components and water efficiency standards (e.g., California’s AB 1953 or European Union directives), serve as a catalyst for increased adoption. Key impact forces include fluctuating commodity prices for metals (copper and nickel), which affect manufacturing costs, continuous innovation in sealing material science (O-rings), and the rapidly evolving landscape of international safety certifications (e.g., NSF, UL, DVGW), demanding that manufacturers maintain impeccable quality assurance protocols to stay competitive.

Segmentation Analysis

The Press Fittings Market is comprehensively segmented based on material type, end-user application, and pipe diameter, reflecting the diverse requirements across the plumbing, HVAC, and industrial sectors globally. Material segmentation is crucial, distinguishing the performance characteristics and cost structures associated with copper, the traditional mainstay for residential plumbing, from stainless steel and carbon steel, which cater to commercial, industrial, and specialized high-demand applications requiring superior corrosion or pressure resistance. The segmentation by end-user, covering residential, commercial, and industrial, clearly defines the varying purchasing power, volume requirements, and regulatory adherence necessary for market penetration, with commercial construction often requiring more specialized and robust fittings than the typical residential setting.

Further granularity is achieved through the segmentation by pipe diameter, recognizing the substantial difference in manufacturing complexity and installation technique between small-bore fittings (typically used in household plumbing) and large-bore fittings (critical for industrial main lines or large-scale HVAC risers). The continued innovation in O-ring elastomers, such as EPDM for water and HNBR for gases, introduces another layer of performance-based segmentation, ensuring compatibility with specific transferred media. This layered segmentation allows manufacturers to precisely target their research and development efforts and marketing strategies towards segments exhibiting the highest growth potential, such as the increasing use of stainless steel press fittings in pharmaceutical or food and beverage facilities.

- By Material Type:

- Copper Press Fittings

- Stainless Steel Press Fittings (304, 316)

- Carbon Steel Press Fittings

- Plastic (PEX/Multi-Layer Composite) Press Fittings

- By Application:

- Potable Water Systems

- Hydronic Heating & Cooling (HVAC)

- Gas & Compressed Air Systems

- Industrial Process Piping

- Fire Protection Systems

- By End-User:

- Residential

- Commercial

- Industrial

- By Pipe Diameter:

- Small Diameter (Up to 1 Inch)

- Medium Diameter (1 Inch to 2.5 Inches)

- Large Diameter (Above 2.5 Inches)

Value Chain Analysis For Press Fittings Market

The value chain for the Press Fittings Market begins with rigorous upstream analysis focused on securing high-quality raw materials, primarily copper billets, stainless steel coils (304L and 316L), and specialized high-performance elastomers for the sealing rings (O-rings). The stability of commodity pricing, especially copper, significantly influences the final manufacturing cost, requiring manufacturers to engage in sophisticated hedging strategies or diversify their material portfolio. Specialized suppliers are critical for providing precision-engineered O-rings, which must meet exacting specifications for temperature, pressure, and chemical compatibility, often requiring strict adherence to health and safety standards like NSF/ANSI 61 for drinking water components. Manufacturing involves high-precision stamping, forging, deep drawing, and subsequent assembly, demanding substantial capital investment in highly automated machinery to ensure consistent dimensions and material integrity for a reliable press joint.

The manufacturing process also incorporates midstream activities involving strict quality control and certification processes. Given that joint reliability is paramount, fittings must undergo extensive pressure and leakage testing, often complying with multiple international certification bodies (e.g., UPC, ICC, DVGW, WRAS). Effective quality management systems are essential to maintain brand reputation and contractor trust. Distribution represents a critical bottleneck and opportunity. The channel is typically split into direct and indirect methods. Direct sales often cater to large, institutional projects or specialized industrial clients where technical support and customized sizing are necessary. However, the majority of volume moves through indirect channels, relying heavily on professional plumbing wholesale distributors and specialized HVAC suppliers who maintain vast inventories and offer localized contractor support and training.

The downstream analysis focuses on the final installation and end-user experience, where specialized training for contractors on the correct use of pressing tools is non-negotiable. Installation contractors and master plumbers are the ultimate purchasers and users, making their selection and satisfaction paramount. The efficiency of the distribution network, including e-commerce platforms focused on professional trade supplies, directly impacts project timelines. Successful market players invest heavily in educating the downstream users about the long-term benefits, such as reduced maintenance costs and system longevity, positioning press fittings as a superior total-cost-of-ownership solution, rather than just a higher initial cost component, reinforcing the importance of robust training programs provided through the distribution channel.

Press Fittings Market Potential Customers

The primary customers in the Press Fittings Market are professional mechanical contractors, plumbing and pipefitting companies, and HVAC system installers who seek efficient, reliable, and standardized joining solutions that mitigate risk and minimize labor intensity on the job site. Within the residential sector, custom home builders and large-volume tract housing developers represent significant buyers, prioritizing speed of installation for high-volume housing units where labor cost is a substantial factor. These buyers value systems that are easy to inspect and certify, reducing post-installation call-backs related to leaks. They predominantly focus on copper and PEX press systems for standard potable water and heating applications, demanding quick availability through local wholesalers.

In the commercial segment, potential customers include general contractors and specialized mechanical firms engaged in constructing hospitals, schools, hotels, and high-rise office buildings. These projects require higher specifications regarding pipe diameter, pressure ratings, and fire safety compliance, driving demand for stainless steel and carbon steel press systems, especially for larger diameter HVAC chilled water lines, fire sprinkler systems, and specialized medical gas piping. These customers often require detailed technical specifications, strong supply chain logistics to handle large, staggered orders, and robust manufacturer warranties covering potential failures, leading to a preference for Tier 1 global suppliers with established track records and comprehensive technical support services.

The industrial sector represents the most technically demanding potential customer base, including petrochemical facilities, food and beverage processing plants, pharmaceutical manufacturers, and heavy manufacturing sites. These customers utilize press fittings for specialized applications such as compressed air networks, chemical transfer lines, and steam/condensate return systems, where resistance to corrosion (316L stainless steel) and adherence to extremely high-purity standards are critical. Purchasing decisions here are highly centralized, often involving extensive engineering review, focusing less on initial material cost and more on long-term operational resilience, system uptime, and compliance with severe industry regulatory bodies such as FDA or specific hazardous environment codes, necessitating customized fittings and highly specialized sealing materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viega GmbH & Co. KG, Mueller Industries, RLS LLC (ZoomLock), Conex Bänninger, NIBCO Inc., Apollo Flow Controls (Aalberts N.V.), Zurn Industries (Elkay Manufacturing), Grinnell Mechanical Products (Johnson Controls), Geberit AG, Uponor Corporation, Reliance Worldwide Corporation (RWC), IWABUCHI (iPress), Sanha GmbH & Co. KG, Fratelli Pettinaroli S.p.A., Hilti Corporation, Kemper Valves & Fittings, Rothenberger, GF Piping Systems, Tiemme Raccorderie S.p.A., Pressac S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Press Fittings Market Key Technology Landscape

The technological landscape of the Press Fittings Market is defined by continuous advancements in material science, sealing elastomer development, and innovation in the associated installation tooling, all aimed at enhancing joint reliability and expanding application scope. Central to the technology is the design of the fitting profile and the proprietary O-ring groove geometry, which must ensure an indelible, permanent seal when the requisite pressure is applied. Manufacturers are heavily investing in developing advanced elastomers, such as specialized EPDM formulations with enhanced chlorine resistance for municipal water systems, or HNBR and FKM rings capable of handling high temperatures and aggressive media like specialized oils or industrial gases. The material composition of the metal fittings themselves is also evolving, with greater usage of high-grade, stabilized stainless steels to resist intergranular corrosion and comply with increasingly strict lead-free mandates, particularly in North American and European plumbing codes.

Tooling technology is a major competitive arena, transitioning rapidly from corded electric or manual hydraulic devices to high-capacity, lightweight, battery-powered pressing tools utilizing lithium-ion technology. Modern press tools incorporate intelligent features such as pressure monitoring sensors that ensure the correct minimum pressing force has been achieved for every joint, often providing visual or audible confirmation and digital logging capabilities. This digital traceability is critical for quality assurance, especially in highly regulated commercial projects, and aligns seamlessly with modern project management systems and BIM requirements. Further innovation focuses on universal jaw sets and interchangeable heads that can accommodate multiple pipe materials and diameters, improving contractor versatility and reducing the total investment required for proprietary equipment.

Another significant technological advancement involves the integration of features designed to enhance safety and simplify installation. This includes the implementation of "leak before press" indicators, such as a specialized unpressed profile or a temporary seal, which allows water or air pressure testing to immediately expose any joint that was forgotten or improperly pressed before the system is finalized and covered. This simple but effective feature provides an extra layer of assurance against costly system failures and reworks. Furthermore, the compatibility of press systems with multilayer and PEX piping requires specialized polymer fitting designs that utilize stainless steel sleeves or enhanced grip rings to ensure long-term mechanical stability and resistance to thermal cycling, pushing the boundaries of polymer joining technology in pressurized systems.

Regional Highlights

North America, comprising the United States and Canada, represents a mature but highly lucrative market for press fittings, characterized by high labor costs and stringent safety regulations that favor the speed and flame-free nature of press technology. The market here is heavily influenced by renovation and retrofit activities in the aging commercial infrastructure, where minimizing downtime is critical. Copper press fittings dominate the potable water segment, driven by established contractor familiarity and strict health codes regarding lead-free plumbing. However, there is accelerating growth in stainless steel systems, particularly in institutional, industrial, and high-end residential applications where long-term durability and specialized corrosion resistance are prioritized. The region also exhibits high technological adoption, with contractors readily investing in sophisticated battery-powered pressing tools featuring digital logging capabilities for quality control and documentation purposes.

Europe stands as a vanguard for press fitting adoption, possessing the highest per capita usage globally, largely driven by rigorous European standards (e.g., DIN, DVGW, WRAS) for water quality, energy efficiency, and fire safety in construction. District heating networks and hydronic HVAC systems heavily utilize both carbon steel and copper press fittings, often for large-bore applications. Germany, Italy, and the UK are primary hubs for manufacturing and consumption, with strong emphasis on sustainable building practices and the use of fittings compatible with renewable energy systems like solar thermal. The early and widespread acceptance of PEX and multilayer pipe systems, often joined using press technology, further solidified the market’s depth, allowing manufacturers to optimize systems for efficiency and material consumption.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, fueled by unprecedented rates of urbanization, industrialization, and massive government investment in modernizing water and gas utility infrastructure, particularly in China, India, and Southeast Asia. While cost sensitivity remains higher than in Western markets, the increasing demand for high-quality, reliable, and leak-proof systems in commercial high-rise construction, hospitality, and healthcare sectors is driving the strong adoption of press fittings, especially stainless steel for high-rise plumbing risers. Market expansion in APAC requires manufacturers to tailor product strategies to meet local construction practices and often involves establishing local manufacturing or assembly capabilities to manage high tariffs and logistical complexity, focusing on providing essential contractor training to bridge the gap from traditional welding practices.

- North America: High labor costs drive demand; strong adoption in renovation; dominant use of copper and increasing demand for stainless steel systems.

- Europe: High per capita usage due to strict regulations and widespread use in hydronic heating; strong market for carbon steel and standardized PEX press systems.

- Asia Pacific (APAC): Highest growth rate driven by rapid infrastructure development and urbanization; growing acceptance of stainless steel in commercial and industrial sectors.

- Latin America (LATAM): Emerging market potential driven by large-scale commercial projects and a shift away from soldering, though limited by fluctuating economic conditions.

- Middle East and Africa (MEA): Significant potential due to massive hospitality and commercial building construction (e.g., UAE, Saudi Arabia); demand focused on high-pressure, corrosion-resistant fittings due to environmental factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Press Fittings Market.- Viega GmbH & Co. KG

- Mueller Industries

- RLS LLC (ZoomLock)

- Conex Bänninger

- NIBCO Inc.

- Apollo Flow Controls (Aalberts N.V.)

- Zurn Industries (Elkay Manufacturing)

- Grinnell Mechanical Products (Johnson Controls)

- Geberit AG

- Uponor Corporation

- Reliance Worldwide Corporation (RWC)

- IWABUCHI (iPress)

- Sanha GmbH & Co. KG

- Fratelli Pettinaroli S.p.A.

- Hilti Corporation

- Kemper Valves & Fittings

- Rothenberger

- GF Piping Systems

- Tiemme Raccorderie S.p.A.

- Pressac S.p.A.

Frequently Asked Questions

Analyze common user questions about the Press Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using press fittings over traditional soldering or welding methods?

The primary benefit is significantly reduced installation time and labor cost, as press fittings eliminate the need for flame, heat, or flux. This increases job site safety, allows for immediate pressure testing, and facilitates quicker project completion, especially in commercial or renovation settings where minimizing downtime is crucial.

Are press fittings suitable for all types of pipe materials and applications?

Press fittings are available for various materials including copper, stainless steel, carbon steel, and PEX/multilayer composite pipes, covering applications such as potable water, HVAC, gas, and fire protection. However, system compatibility depends on the specific O-ring material and the fitting's pressure rating, requiring careful selection based on the media being transferred.

What certifications should contractors look for when selecting press fittings for potable water systems?

Contractors should prioritize fittings certified by recognized international and regional bodies such as NSF/ANSI 61 (for drinking water components), UPC (Uniform Plumbing Code), ICC-ES (International Code Council Evaluation Service), and specific European standards like WRAS or DVGW, ensuring the fittings meet strict health and safety requirements, including being lead-free.

What is the typical lifespan and reliability of a press fitting connection compared to soldered joints?

Properly installed press fitting connections are designed to be permanent and are generally considered as reliable as soldered or welded joints, often rated for the lifespan of the pipe system itself (50+ years). Their reliability is ensured through quality control features like the "leak before press" indicator and guaranteed pressure application from specialized, calibrated tooling.

How does the initial high cost of press fittings compare to the total installed cost over traditional piping methods?

While the component cost of a press fitting is often higher than a traditional coupling, the total installed cost (TIS) is significantly lower due to the enormous reduction in labor time, elimination of specialized hot work permits, and immediate ability to move to the next stage of construction, making the press system highly cost-effective for large-scale and time-sensitive projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager