Press Hardening Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432934 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Press Hardening Steel Market Size

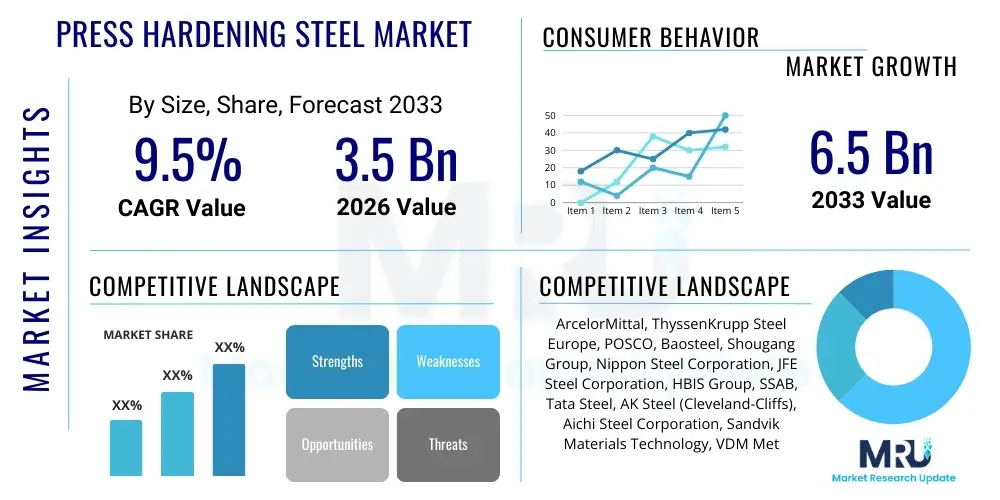

The Press Hardening Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.5 billion in 2026 and is projected to reach USD 6.5 billion by the end of the forecast period in 2033.

Press Hardening Steel Market introduction

The Press Hardening Steel (PHS) market involves the production and utilization of specialized high-strength steel sheets primarily used in the automotive industry. PHS is crucial for manufacturing structural safety components such as B-pillars, roof rails, bumper beams, and door reinforcements, where maximum strength combined with lightweighting is paramount. These steels, typically boron-alloyed (like 22MnB5), undergo a sophisticated hot stamping process that simultaneously forms the part and hardens the material through controlled cooling, resulting in tensile strengths exceeding 1500 MPa.

The core benefit of PHS lies in its ability to significantly improve vehicle crashworthiness while enabling down-gauging of material thickness, directly contributing to weight reduction and enhanced fuel efficiency or extended battery range in electric vehicles (EVs). Major applications are centered around the safety cage structure of automobiles, ensuring superior occupant protection during collisions. The necessity for advanced material solutions to meet increasingly stringent global safety standards, particularly the high ratings demanded by organizations such as Euro NCAP and IIHS, is the primary external driver for this market.

Driving factors propelling market growth include the mandatory adoption of advanced high-strength materials across new vehicle platforms globally, especially in emerging economies where regulatory frameworks are catching up to Western standards. Furthermore, the global shift towards electrification necessitates ultra-lightweight solutions to offset the heavy weight of battery packs, making PHS a foundational material in modern EV body-in-white (BIW) designs. The continuous development of tailored blanks and complex geometries achievable through hot stamping further cements PHS’s role as an indispensable material solution in modern vehicle architecture.

Press Hardening Steel Market Executive Summary

The Press Hardening Steel market is experiencing robust expansion driven by sustained regulatory pressure for enhanced vehicle safety and the irreversible automotive trend toward lightweighting and decarbonization. Business trends highlight significant capital investment in hot stamping infrastructure globally, particularly in Asia Pacific, to localize production capabilities and meet the high-volume demands of OEMs transitioning their fleets. The market is characterized by intense technological competition focused on developing new PHS grades (e.g., those offering delayed fracture properties or higher ductilities after stamping) and optimizing the hot stamping process for faster cycle times and reduced energy consumption.

Regionally, Asia Pacific, led by China and India, represents the highest growth potential due to expanding domestic automotive production and tightening safety standards, positioning it as the largest consumer base by volume. Europe and North America remain crucial markets, serving as centers for technological innovation and high-end automotive manufacturing, particularly in the premium and electric vehicle segments. These mature regions emphasize process refinement, including advanced coating technologies (e.g., Al-Si coatings) necessary for corrosion resistance during the hot stamping process, which is critical for long-term component durability.

Segment trends underscore the dominance of the 22MnB5 grade, which is the industry standard due to its excellent combination of formability and final strength. However, higher-strength grades and specialized compositions are gaining traction for niche applications requiring extremely high energy absorption. Application-wise, passenger vehicles, particularly SUVs and Crossovers, dominate demand, reflecting the global consumer preference for larger, safety-conscious vehicles. Furthermore, the increasing complexity of vehicle structures mandates the use of tailored blanks, which allow for localized strength variations within a single component, driving higher value per vehicle in the PHS application segment.

AI Impact Analysis on Press Hardening Steel Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Press Hardening Steel market typically focus on how AI can optimize the hot stamping process, predict material performance, and enhance quality control in manufacturing environments. Users are primarily concerned with whether AI integration can resolve common issues such as spring-back prediction, microstructural consistency, and real-time defect detection, which are inherent challenges in high-temperature metal forming. Key themes include leveraging machine learning for predictive maintenance of costly hot stamping tools, utilizing computer vision for immediate quality assessment of stamped parts, and employing digital twins driven by AI algorithms to simulate and optimize thermal cycles and forming pressures before physical production, thereby reducing scrap rates and time-to-market for new components.

AI's influence is transforming the PHS manufacturing ecosystem from raw material processing through final component validation. In the material sourcing and preparation phase, AI algorithms analyze complex chemistry data and historical rolling parameters to ensure optimal steel composition (specifically boron and manganese content) for press hardening. During the hot stamping cycle itself, machine learning models continuously monitor parameters like furnace temperature, die temperature, cooling rates, and stamping force. This real-time feedback loop allows for instantaneous adjustments, ensuring the microstructure transforms uniformly into martensite across the entire component, which is essential for achieving the specified strength requirements and mitigating localized weakness or fracture risks.

Furthermore, AI-powered predictive maintenance is critically important for minimizing downtime in the high-capital-intensity hot stamping environment. By analyzing vibration, acoustic, and thermal data from large presses and heating systems, AI can forecast potential equipment failures, especially concerning tooling wear and cracking. This proactive approach significantly extends die life, reduces maintenance costs, and improves overall equipment effectiveness (OEE). The integration of AI therefore moves PHS production towards a highly efficient, zero-defect manufacturing paradigm, enabling OEMs and stampers to consistently produce geometrically complex, ultra-high-strength components at scale, fulfilling the rigorous demands of modern vehicle safety structures.

- AI-driven optimization of furnace temperature profiles for consistent austenitization.

- Machine learning algorithms for predictive maintenance of hot stamping dies, extending tool life.

- Computer vision systems for real-time, non-destructive defect detection (e.g., cracks, incomplete quenching).

- Enhanced simulation accuracy using AI to predict spring-back and residual stress in complex geometries.

- Optimization of cooling channel design and parameters using generative AI for uniform quenching rates.

- Data-driven analysis of steel chemistry to minimize compositional variability and enhance final mechanical properties.

DRO & Impact Forces Of Press Hardening Steel Market

The Press Hardening Steel market is fundamentally shaped by powerful synergistic forces: the regulatory push for enhanced safety acts as the primary driver, while the high upfront investment and technical complexities of the hot stamping process impose restraining factors. The imperative for lightweighting, driven equally by fuel economy targets for internal combustion engine vehicles (ICEVs) and range extension for battery electric vehicles (BEVs), offers significant opportunities for specialized PHS grades and processes. These combined elements create strong impact forces, primarily compelling automotive manufacturers to rapidly adopt new materials that offer superior strength-to-weight ratios without compromising production efficiency or cost-effectiveness.

Key drivers include the global tightening of crash safety standards, particularly the move towards stricter pole crash and side impact tests, which require ultra-high-strength materials like PHS for effective energy absorption and intrusion prevention. The burgeoning electric vehicle market provides a massive opportunity, as PHS is essential not only for structural safety components but increasingly for battery enclosure frames to protect the critical high-voltage components from collision damage. Conversely, the market is restrained by the comparatively higher cost of PHS sheets compared to conventional mild or high-strength steels, coupled with the expensive and specialized hot stamping equipment required, creating a significant barrier to entry for smaller manufacturers.

The most compelling opportunities lie in the development of third-generation PHS with improved ductility, allowing for even more intricate part designs, and the integration of advanced coating technologies to address oxidation and corrosion issues inherent in the hot stamping process. The primary impact force remains the technological race between steel manufacturers to achieve higher strength classes (e.g., 2000 MPa PHS) and processing equipment providers to reduce cycle times and energy consumption. This competitive pressure ensures continuous innovation, cementing PHS as a foundational technology for future vehicle architectures designed for both enhanced safety and sustainable manufacturing practices.

Segmentation Analysis

The Press Hardening Steel market is systematically segmented based on the type of steel grade utilized, the primary manufacturing process employed, and the end-use application within the automotive sector. This structure allows for granular analysis of demand patterns, supply chain dynamics, and technological preferences across various regional markets. The primary segmentation criterion, material type, focuses on the specific chemical compositions that dictate the final mechanical properties achievable after the hot stamping cycle, impacting suitability for various critical safety components.

- By Type:

- 22MnB5 (Boron Steel)

- 37MnB5 and Higher Grades (e.g., grades up to 2000 MPa)

- By Process:

- Direct Hot Stamping

- Indirect Hot Stamping

- By Application (End-Use):

- Passenger Vehicles (Sedans, Hatchbacks, SUVs, Crossovers)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Trucks)

- By Coating Type:

- Aluminium-Silicon (Al-Si) Coated PHS

- Uncoated PHS

- Galvanized PHS (Emerging)

Value Chain Analysis For Press Hardening Steel Market

The Press Hardening Steel value chain is highly integrated, beginning with the complex upstream mining and steelmaking processes, and culminating in the highly specialized hot stamping operations performed by Tier 1 suppliers or OEMs. The upstream phase involves extracting iron ore, coking coal, and alloying elements (such as boron and manganese), followed by basic oxygen or electric arc furnace processing to produce the specialized steel slabs. Critical activities in this phase include precise alloying and continuous casting to ensure the chemical homogeneity and microstructural integrity necessary for successful press hardening.

Midstream activities involve the flat rolling of these slabs into coils and sheets, often including specific coating applications, predominantly Aluminium-Silicon (Al-Si), to prevent decarburization and oxidation during the subsequent high-temperature heating stages. These specialized steel producers then supply the materials either directly to large Original Equipment Manufacturers (OEMs) or, more commonly, to Tier 1 stamping suppliers who specialize in the hot stamping process. The efficiency of the distribution channel is paramount, demanding precise logistics to handle large, heavy steel coils and sheets, often relying on specialized rail and road transport networks.

The downstream segment is dominated by the hot stamping houses, which invest heavily in advanced furnaces, rapid stamping presses, and controlled cooling dies. These entities convert the PHS sheets into finished structural components (e.g., B-pillars, sill reinforcements). Distribution to the final customer—the vehicle assembly plant—is direct (B2B). Indirect sales primarily occur when the PHS component manufacturer sells sub-assemblies to another Tier 1 supplier for integration before final delivery to the OEM. This structure necessitates close collaboration and long-term contracts between steel producers, stampers, and OEMs to ensure seamless quality control and supply stability for safety-critical components.

Press Hardening Steel Market Potential Customers

The primary end-users and buyers of Press Hardening Steel are large, multinational Original Equipment Manufacturers (OEMs) in the automotive industry and their associated Tier 1 suppliers specializing in body-in-white (BIW) components and metal forming. These customers require materials that meet extremely rigorous specifications concerning strength, dimensional stability, and crash energy absorption capabilities. The shift towards modular vehicle architectures and global production platforms necessitates standardized, high-performance PHS components that can be deployed across various vehicle models, from mass-market sedans to high-end luxury SUVs.

Specifically, the core buying group consists of automotive engineering and procurement departments that focus intensely on achieving lightweighting targets mandated by regulatory bodies and internal efficiency goals. Key customers include established automotive giants in Europe, North America, and Japan, alongside rapidly expanding electric vehicle manufacturers and high-volume producers in China. These customers prioritize suppliers who can deliver PHS material in advanced forms, such as laser-welded tailored blanks (LWTBs), which optimize material usage and further reduce the weight and complexity of the final assembled component. The purchasing decision is heavily influenced by material cost, supply reliability, and the supplier's capability to provide technical support regarding material behavior during the complex hot stamping process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 billion |

| Market Forecast in 2033 | USD 6.5 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, ThyssenKrupp Steel Europe, POSCO, Baosteel, Shougang Group, Nippon Steel Corporation, JFE Steel Corporation, HBIS Group, SSAB, Tata Steel, AK Steel (Cleveland-Cliffs), Aichi Steel Corporation, Sandvik Materials Technology, VDM Metals, Acerinox, Daido Steel, Gerdau S.A., Nucor Corporation, China Baowu Steel Group, Schuler Group (Technology Provider focus) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Press Hardening Steel Market Key Technology Landscape

The technological landscape of the Press Hardening Steel market is defined by innovations across two major domains: the metallurgy of the steel itself and the advanced manufacturing processes used for hot stamping. Metallurgically, the focus is on developing new steel grades that push the boundary of achievable tensile strength while maintaining adequate ductility and managing issues related to hydrogen embrittlement. This involves precise control over boron, manganese, and carbon contents, and the introduction of secondary alloying elements to influence microstructural evolution during the cooling phase, leading to specialized high-ductility PHS (HD PHS) for complex parts requiring high energy absorption capacity.

In terms of processing technology, the industry is moving rapidly towards improving the efficiency and quality of the hot stamping line. Key technological advancements include the deployment of sophisticated furnace systems, such as roller hearth furnaces, that ensure uniform and precise austenitization temperatures across the blanks, which is vital for subsequent successful hardening. Furthermore, the development of advanced tooling materials and highly efficient internal cooling channels within the stamping dies allows for extremely rapid and controlled quenching, minimizing cycle times and ensuring martensitic transformation consistency across the component's geometry.

A critical emerging technology is the increasing utilization of laser-welded tailored blanks (LWTBs) made from PHS. These blanks consist of different material thicknesses or strength grades welded together prior to hot stamping. This allows for 'tailored performance'—placing higher strength exactly where needed for crash resistance while keeping lower strength/more ductile material in deformation zones, leading to weight savings and superior crash performance. Automation, robotics, and the integration of advanced sensors (thermocouples, pressure sensors) across the stamping line are essential for achieving the necessary precision and volume required by the automotive sector, further reinforcing the importance of digitalization in this manufacturing domain.

Regional Highlights

The global Press Hardening Steel market exhibits significant regional variation, primarily dictated by local automotive production volumes, regulatory maturity, and the pace of electric vehicle adoption. Each major region contributes uniquely to market dynamics, offering varied growth trajectories and technological focal points.

- Asia Pacific (APAC): APAC is the engine of market growth, driven primarily by China, which is both the largest producer and consumer of PHS globally. This region benefits from explosive growth in domestic automotive manufacturing, coupled with the rapid adoption of stricter safety standards (mirroring Euro NCAP and IIHS criteria). The substantial governmental push towards electric vehicles (EVs) in nations like China, Japan, and South Korea mandates the use of lightweight, high-strength steels for BIW and battery protection structures, ensuring sustained high demand.

- Europe: Europe remains a powerhouse for technological innovation and high-quality PHS applications. Driven by established and stringent Euro NCAP requirements, European OEMs were early adopters of hot stamping technology. The market here is characterized by high penetration rates of PHS in premium and luxury segments, with a strong focus on advanced grades (e.g., higher than 1800 MPa) and complex component geometries. European suppliers often lead in optimizing the hot stamping process and developing specialized coatings.

- North America: North America demonstrates steady growth, strongly influenced by Corporate Average Fuel Economy (CAFE) standards and the Insurance Institute for Highway Safety (IIHS) ratings, which push for robust vehicle safety. The region has seen substantial investment in new hot stamping facilities, especially to support the large truck and SUV segments, which increasingly utilize PHS for structural integrity and minimizing weight on larger frames. The rapid transition to electric trucks and SUVs further solidifies PHS demand.

- Latin America (LATAM): The LATAM market is characterized by emerging adoption, driven by regional safety assessment programs like Latin NCAP, which are gradually elevating safety expectations. While growth is slower than in APAC or Europe, the increasing localization of global manufacturing platforms necessitates the gradual incorporation of PHS, particularly in high-volume models assembled locally.

- Middle East and Africa (MEA): MEA remains a nascent market, heavily reliant on imported vehicles and technology transfer. PHS demand is tied to the assembly operations established by global OEMs in strategic locations (e.g., Turkey, South Africa). Future growth is anticipated as regional governments develop local automotive manufacturing hubs and implement initial vehicle safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Press Hardening Steel Market.- ArcelorMittal

- ThyssenKrupp Steel Europe

- POSCO

- Baosteel

- Shougang Group

- Nippon Steel Corporation

- JFE Steel Corporation

- HBIS Group

- SSAB

- Tata Steel

- AK Steel (Cleveland-Cliffs)

- Aichi Steel Corporation

- Sandvik Materials Technology

- VDM Metals

- Acerinox

- Daido Steel

- Gerdau S.A.

- Nucor Corporation

- China Baowu Steel Group

- Schuler Group (Equipment and Technology Provider)

Frequently Asked Questions

Analyze common user questions about the Press Hardening Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Press Hardening Steel (PHS) in modern vehicles?

PHS is primarily used for manufacturing critical structural safety components in the body-in-white (BIW), including B-pillars, front and rear bumper beams, roof rails, side intrusion beams, and battery enclosures in electric vehicles. Its ultra-high strength ensures maximum occupant protection during severe collisions.

How does the hot stamping process affect the properties of PHS?

Hot stamping involves heating boron steel blanks to austenitic temperatures (around 900–950°C), forming the component in a die, and rapidly quenching it within the die. This controlled cooling induces a martensitic phase transformation, increasing the tensile strength dramatically, typically exceeding 1500 MPa.

What is the main driver for the adoption of PHS in the automotive industry?

The main driver is the dual requirement for enhanced vehicle safety (meeting stringent global crash test standards like Euro NCAP) and vehicle lightweighting, which improves fuel efficiency in ICEVs and extends the range of EVs by enabling the use of thinner, yet stronger, materials.

What are the current technological challenges in the PHS market?

Current challenges include managing the high capital cost of hot stamping equipment, preventing oxidation and scaling during heating (requiring specialized coatings like Al-Si), accurately predicting and mitigating spring-back in complex parts, and reducing the risk of hydrogen embrittlement in the final component.

Which steel grade dominates the Press Hardening Steel market?

The 22MnB5 grade, a boron alloyed steel, currently dominates the market due to its excellent combination of formability at high temperatures and its capability to achieve the required ultra-high strength upon controlled cooling in the hot stamping die. Newer, higher-strength grades are emerging but 22MnB5 remains the industry standard.

The technological sophistication inherent in manufacturing high-quality Press Hardening Steel components demands a highly specialized and capital-intensive supply chain, directly influencing market entry barriers and the competitive landscape. Continuous research and development in steel composition and process control are crucial for stakeholders seeking to maintain leadership in this safety-critical materials segment.

The integration of advanced monitoring systems, often utilizing sensor fusion and data analytics, is becoming standard practice in modern hot stamping lines. This capability allows manufacturers to capture vast amounts of data relating to thermal gradients, forming velocity, and pressure distribution. By analyzing this data, stampers can refine their process parameters, ensuring that every component meets the stringent geometrical and metallurgical specifications required for critical safety applications. The reliance on data-driven manufacturing underpins the market's trajectory towards zero-defect production, a necessity when dealing with components responsible for protecting human life.

Furthermore, sustainability concerns are increasingly impacting the PHS market. Producers are focused on reducing the energy intensity of steelmaking and the hot stamping process itself. This involves exploring alternative heating methods, optimizing furnace designs, and investigating materials that require less boron or other critical, high-cost alloying elements. The longevity and recyclability of PHS components, being fully recyclable steel, provide a long-term environmental advantage compared to certain non-metallic lightweight materials, further solidifying its position in the sustainable mobility paradigm.

The competitive landscape is characterized by a few global steel giants who possess the extensive R&D resources required to develop proprietary PHS compositions and specialized coatings. These market leaders often collaborate directly with major global automotive OEMs during the early stages of vehicle platform development, securing long-term supply agreements. Smaller stamping houses, while crucial for the midstream process, rely heavily on sourcing quality blanks and maintaining state-of-the-art hot stamping infrastructure to remain competitive. Technological differentiation, particularly concerning the ability to produce complex tailored blanks and achieve superior surface quality, is a key determinant of success.

Market growth projections are strongly correlated with vehicle production trends in emerging markets and the acceleration of the EV transition globally. As developing economies implement stringent crash standards, the demand for affordable, high-volume PHS solutions will surge. Conversely, mature markets will drive demand for specialized, third-generation PHS that allows for further weight reduction and integration into highly automated assembly processes. This bifurcated demand structure requires steel producers to maintain flexible supply chains capable of meeting both high-volume standardized needs and low-volume, high-specification requirements.

The future evolution of PHS technology is expected to include multi-step hot stamping processes and the adoption of hybrid materials, combining PHS with other Advanced High-Strength Steels (AHSS) or even non-metallic materials in highly integrated component designs. These hybrid approaches aim to maximize structural performance while strategically managing weight and cost. Investing in the optimization of the material-to-component conversion process, rather than solely the material itself, will be a defining feature of technological progress over the forecast period, emphasizing the synergy between material science and manufacturing engineering.

The geopolitical climate and global trade dynamics also play a significant role in the PHS market, particularly regarding the sourcing and pricing of alloying elements such as manganese and boron. Disruptions in the supply chain for these critical minerals can impact production costs and material availability. Therefore, diversification of sourcing and implementation of effective inventory management strategies are essential risk mitigation measures for major steel manufacturers. The trend towards regionalization of automotive supply chains, spurred by recent global events, is encouraging localized PHS production capabilities in key automotive manufacturing hubs worldwide.

In summary, the Press Hardening Steel market is mature yet highly dynamic, serving as a critical enabler for the global automotive industry's pursuit of safety and sustainability targets. Its sustained growth is guaranteed by legislative mandates and the ongoing electric mobility revolution, making continued investment in process optimization and advanced material development non-negotiable for market participants aiming to capture future value.

The critical role of coating technology must also be highlighted within the key technology landscape. The Aluminium-Silicon (Al-Si) coating is indispensable as it provides sacrificial protection against the severe scaling and decarburization that occurs when bare steel is heated to austenitizing temperatures. Advances in coating science focus on improving the uniformity, adhesion, and protective capabilities of these layers, sometimes exploring zinc-based coatings for PHS requiring post-stamping welding capabilities, though Al-Si remains dominant for most applications. The quality of the coating directly influences the final structural integrity and corrosion resistance of the component, a paramount consideration for long-term vehicle durability and safety.

Furthermore, research is actively ongoing into tailored temperature control (TTC) processes. Unlike conventional hot stamping where the entire part cools uniformly, TTC involves utilizing specialized dies and cooling systems to achieve differential cooling rates across the component. This creates tailored microstructures, resulting in areas of ultra-high strength (martensite) combined with areas of higher ductility (ferrite or bainite) within a single component. This highly localized material engineering allows vehicle designers to maximize crash performance by precisely controlling where the component absorbs energy and where it maintains structural rigidity, representing the cutting edge of PHS application technology and delivering significant competitive advantage to adopting OEMs.

The market environment also favors comprehensive material testing and simulation software providers. Given the complexity of the thermo-mechanical process, accurate simulation is essential to minimize costly physical trials. Advanced software tools that can model the phase transformation kinetics, thermal stress evolution, and final mechanical properties of PHS components before forming are integral to accelerating product development cycles. The synergy between material producers, stamping equipment suppliers, and simulation software vendors defines the pace of innovation within the entire PHS ecosystem.

Finally, the growing need for repairability in advanced vehicle structures utilizing PHS presents a nuanced technological challenge. PHS components are difficult to reform or weld post-stamping without compromising their strength. Technological developments are exploring specialized repair techniques and materials, acknowledging that while PHS enhances safety, its unique properties necessitate new protocols for collision repair centers, subtly influencing component design to balance safety with practical maintenance considerations.

These technology drivers collectively underscore that the PHS market is not just a commodity steel segment; it is a high-tech sector focused on advanced material engineering and precision manufacturing, crucial for the next generation of safe, lightweight, and efficient transportation. The sustained investment in both process refinement and material composition ensures the continued viability and indispensability of PHS in the global automotive structural materials portfolio.

The influence of industry standards, particularly those governing material specifications (e.g., ISO and ASTM standards for high-strength steel) and dimensional tolerances, cannot be overstated. Strict adherence to these standards is mandatory for PHS suppliers, given the safety-critical nature of the final components. Compliance involves rigorous quality control procedures at every stage, from raw material inspection to the final dimensional verification of the stamped part. Any deviation in process parameters or material chemistry can lead to catastrophic failure in a crash scenario, reinforcing the need for highly reliable and precise manufacturing lines, often backed by certifications like IATF 16949.

The competitive dynamics within the steel production segment are driven by economies of scale and geographic presence. Global steel manufacturers leverage their integrated production chains to control raw material costs and ensure a steady supply of specialized PHS blanks across multiple continents. This global footprint is essential for serving multinational OEMs who require identical material specifications and performance reliability for vehicles produced across disparate manufacturing sites, from Europe to Asia. The ability to guarantee long-term supply stability and consistent quality across borders is a key competitive differentiator among the top tier steel suppliers.

In the stamping and tooling segment, competition is based on expertise in complex part geometries and efficiency in utilizing expensive hot stamping presses. Companies like Schuler (a technology provider listed among key players for its press technology) play a vital role by developing faster, more energy-efficient presses and innovative die concepts. Stampers differentiate themselves by optimizing cycle times, minimizing scrap rates, and utilizing advanced features like multi-stage forming or localized heat treatment capabilities to achieve highly complex component designs that conventional cold stamping cannot realize. This continuous pursuit of process optimization is essential for mitigating the high operational costs associated with hot stamping.

Finally, the long-term outlook for PHS remains exceptionally strong, despite emerging threats from competing lightweight materials such as advanced aluminum alloys and carbon fiber reinforced polymers (CFRPs). While aluminum is often preferred for large, non-structural panels, PHS typically maintains a strength-to-cost advantage for crash-relevant structural parts, especially for ultra-high-strength requirements. Furthermore, steel’s superior weldability, formability at high temperatures, and robust recycling infrastructure often position it favorably against more exotic materials in high-volume automotive production, securing its foundational role in vehicle safety architecture for the foreseeable future, particularly in high-volume, mass-market vehicles and increasingly in heavy electric vehicles requiring strong, protective battery enclosures.

The market’s resilience is also supported by continuous innovation in material cost efficiency. Manufacturers are exploring methods to reduce the thickness of PHS sheets even further (down-gauging) while maintaining or increasing final component strength, thereby reducing the overall material consumption and cost per vehicle. This drive toward 'material efficiency' not only addresses cost restraints but also further enhances the lightweighting contribution of PHS, sustaining its relevance amidst competing materials that face their own cost and production challenges. The synergistic relationship between material science and advanced forming technology ensures the PHS market will continue its upward trajectory, evolving alongside the stringent demands of the global automotive sector.

The robust market structure ensures that innovation is systematically adopted, driven by both regulatory compliance and competitive pressure among OEMs seeking superior crash ratings and reduced vehicle mass. This sustained investment cycle guarantees that PHS remains at the forefront of automotive structural material technology, solidifying its projected growth rates throughout the forecast period. The market outlook is therefore fundamentally tied to global vehicle safety legislation and the ongoing imperative for sustainable transportation solutions, areas where PHS provides unparalleled value.

The specialized nature of PHS also impacts the human capital requirements within the market. There is a high demand for engineers and technicians with expertise in thermodynamics, metallurgy, and advanced stamping simulation. Companies that invest in developing this niche talent pool gain a distinct advantage in both R&D and manufacturing quality control. Training programs focused on the specific challenges of hot stamping, such as preventing decarburization and controlling martensitic transformation kinetics, are critical for maintaining operational excellence and ensuring the structural integrity of safety-critical components produced using this sophisticated material technology.

The comprehensive understanding of the PHS market reveals a highly specialized sector critical to modern vehicle design, driven by external mandates for safety and internal demands for efficiency. The integration of cutting-edge technologies, particularly AI and advanced coatings, is continually enhancing the material's performance and manufacturing viability. The market’s continued expansion, particularly in the APAC region and in conjunction with the burgeoning electric vehicle segment, validates its role as a key growth area in the broader steel and automotive industries.

Looking forward, the development of specialized welding techniques compatible with the unique microstructure of hot stamped parts is another area of focus. Traditional welding methods can often compromise the strength and integrity of the martensitic structure. Innovations in laser welding and friction stir welding, specifically tailored for PHS components, are crucial for facilitating the assembly of complex BIW structures and enabling effective integration of PHS with dissimilar materials, paving the way for the next generation of multi-material vehicle platforms.

Furthermore, the long-term strategic positioning of PHS hinges on its cost-effectiveness relative to achieved performance. While the raw material and processing costs are higher than conventional steels, the ability to significantly down-gauge and reduce the total number of parts due to consolidation of functions often results in a net positive economic and mass-saving benefit for the OEM. This total cost of ownership approach reinforces the commercial attractiveness of PHS, particularly when factoring in the intangible benefits of improved brand reputation derived from superior vehicle safety ratings.

This market analysis confirms that the Press Hardening Steel market is not merely reacting to industry trends but is actively shaping the future of vehicular safety and lightweight design. The high CAGR projected reflects the accelerating global need for these ultra-high-strength materials, driven primarily by regulatory compliance and the structural demands of the rapidly growing electric vehicle segment.

The development pathways for PHS also involve mitigating the environmental footprint associated with steel production. Efforts are underway to utilize electric arc furnaces (EAFs) more extensively, powered by renewable energy sources, to produce the specialized PHS steel blanks. Furthermore, optimizing the hot stamping process to reduce energy consumption during the furnace heating stage, which is the most energy-intensive step, is a key area of operational focus. These sustainability initiatives are vital for aligning the PHS value chain with the broader decarbonization goals of the automotive industry.

The market also benefits from increasing penetration into non-automotive sectors, although automotive remains the primary driver. Small but growing applications include specialized machinery, defense, and high-strength industrial components where lightweighting and extreme impact resistance are required. While these sectors currently represent a minor share, they offer diversification opportunities and potential long-term technological synergies for PHS manufacturers.

In conclusion, the Press Hardening Steel market represents a convergence of advanced materials science and manufacturing technology, positioned strategically at the core of the global lightweighting and safety paradigm shift. Its robust growth trajectory is underpinned by non-negotiable regulatory demands and continuous innovation in material and process efficiency.

The ongoing push for modular and scalable vehicle platforms globally necessitates that PHS components are designed for high precision and consistent performance across diverse manufacturing sites. This has led to the standardization of PHS grades and hot stamping procedures among leading suppliers, reducing complexity and risk for OEMs who operate global supply chains. The standardization, however, must be flexible enough to incorporate new generation PHS materials as they emerge, balancing stability with innovation.

Furthermore, the adoption of Industry 4.0 principles, including comprehensive data logging and cloud-based analytics, is making PHS production lines smarter and more adaptive. Real-time process monitoring ensures that quality parameters are met instantly, allowing for rapid feedback and adjustment, which is critical in maintaining the tight tolerance and metallurgical consistency required for safety-critical parts. This digitalization trend is not just about efficiency; it's about validating the integrity of every single PHS component produced.

This continuous emphasis on precision, integration, and performance validates the long-term investment case for the PHS market, cementing its position as a high-value segment within the wider steel industry and a foundational element of future mobility solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager