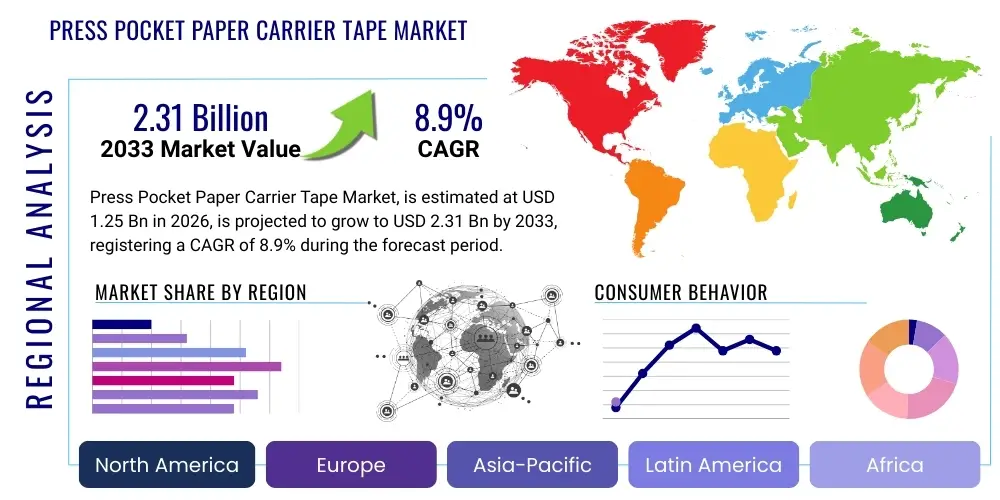

Press Pocket Paper Carrier Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434843 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Press Pocket Paper Carrier Tape Market Size

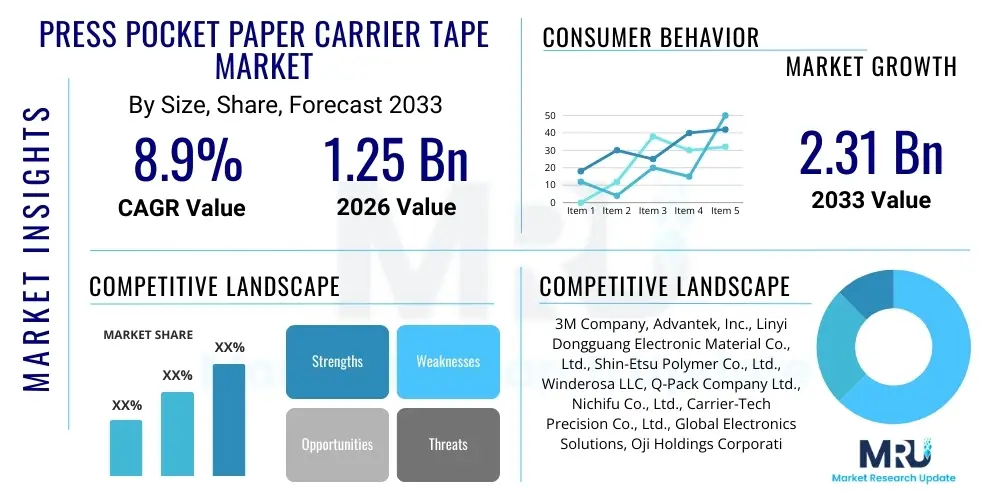

The Press Pocket Paper Carrier Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.31 Billion by the end of the forecast period in 2033. This growth is primarily fueled by the accelerating demand for miniaturized electronic components, particularly in consumer electronics and automotive sectors, where robust, cost-effective, and sustainable packaging solutions are increasingly necessary for automated surface mount technology (SMT) processes.

Press Pocket Paper Carrier Tape Market introduction

The Press Pocket Paper Carrier Tape Market encompasses specialized packaging materials used primarily for transporting and handling surface mount devices (SMDs) and sensitive electronic components during the assembly process. These tapes, constructed from specific paper materials often reinforced or treated for anti-static properties, utilize mechanical pressing techniques to form precise pockets (the "press pocket" method) rather than thermoforming, offering superior component protection and consistency. Major applications include the packaging of resistors, capacitors, inductors, diodes, and microcontrollers used extensively across consumer electronics, telecommunications, and automotive control units. The primary benefits of paper carrier tapes include their cost-effectiveness, environmental sustainability compared to traditional plastic materials, and excellent handling characteristics crucial for high-speed pick-and-place machines, driving market expansion parallel to global electronic manufacturing output and the transition toward environmentally conscious supply chains.

Press Pocket Paper Carrier Tape Market Executive Summary

The global Press Pocket Paper Carrier Tape Market is defined by intense competition and rapid technological evolution aimed at enhancing dimensional stability and anti-static performance, essential for next-generation component handling. Business trends indicate a strong move toward customization, driven by the varying sizes and thicknesses of SMDs, requiring manufacturers to invest heavily in precision tooling and materials science. Regionally, the Asia Pacific (APAC) dominates the market, largely due to its unparalleled concentration of electronics manufacturing hubs in countries like China, South Korea, and Taiwan, which account for the majority of global electronic component production and consumption of carrier tape materials. Segment trends highlight the growing importance of ultra-thin paper tapes capable of accommodating miniature components (01005 and smaller), while the end-user segment is increasingly favoring sustainable, biodegradable solutions, pushing R&D towards specialized coated papers and bio-based adhesives compliant with stringent environmental regulations across Europe and North America.

AI Impact Analysis on Press Pocket Paper Carrier Tape Market

Common user questions regarding AI's influence center around improving manufacturing precision, automating quality control, and optimizing supply chain logistics for high-volume carrier tape production. Users are particularly concerned with how AI can mitigate defects related to pocket dimensional variance and material inconsistency, issues critical to component feeding accuracy in SMT lines. The key themes revolve around predictive maintenance for complex die-cutting machinery, real-time defect detection using machine vision integrated with AI algorithms, and optimizing inventory management based on fluctuating global demand for specific component sizes packaged in the tapes. Expectations suggest that AI integration will significantly reduce material waste and lead times, offering a competitive advantage to manufacturers adopting smart factory initiatives.

AI's primary impact on the Press Pocket Paper Carrier Tape Market lies in its capacity to revolutionize manufacturing efficiency and product quality. Machine learning algorithms are being deployed to analyze sensor data from the production line—such as tension, temperature, and cutting force—to predict potential failures in the forming process before they occur. This predictive maintenance minimizes downtime associated with intricate tooling adjustments required for precision pocket formation. Furthermore, the enhanced accuracy provided by AI-driven visual inspection systems allows for 100% defect screening at speeds far exceeding human capability, ensuring that every meter of carrier tape meets stringent EIA (Electronic Industries Alliance) standards for dimensional accuracy and component registration.

Beyond manufacturing, AI contributes significantly to the strategic planning and inventory management of carrier tape suppliers. Given the vast array of component sizes and specifications, optimizing stock levels and predicting demand for various tape widths and materials is complex. AI utilizes historical sales data, seasonal trends, and forward-looking economic indicators (such as projections for 5G device production or automotive electrification rates) to create highly accurate demand forecasts. This allows suppliers to streamline raw material procurement, particularly specialized papers and anti-static coatings, thereby reducing carrying costs and improving responsiveness to sudden shifts in the demanding electronics manufacturing landscape, ultimately stabilizing the cost structure of the end product.

- Enhanced Automated Optical Inspection (AOI) utilizing deep learning for micro-defect detection in pocket shape and size.

- Predictive maintenance implementation on high-speed die-cutting and pressing machinery, maximizing uptime and tooling lifespan.

- Optimization of paper material usage and reduction of scrap rates through real-time AI feedback loops integrated into converting lines.

- Demand forecasting and supply chain optimization using machine learning to manage highly diversified SKUs (Stock Keeping Units) based on component proliferation.

- Automated process parameter adjustments (e.g., press pressure and speed) to ensure consistent anti-static and dimensional tolerances across long production runs.

DRO & Impact Forces Of Press Pocket Paper Carrier Tape Market

The Press Pocket Paper Carrier Tape Market is shaped by the ongoing rapid expansion of electronic device manufacturing (Driver) countered by the limitations posed by paper material robustness and environmental concerns regarding specialized coatings (Restraint). Significant opportunities arise from the global push towards sustainable packaging solutions and the subsequent need for biodegradable carrier materials, opening avenues for innovative bio-based paper tape formulations. These factors, alongside the pervasive trend of electronic component miniaturization requiring extreme precision in pocket dimensions, create powerful impact forces that necessitate continuous investment in specialized processing equipment and material science R&D among market participants.

Major market drivers include the persistent growth of the semiconductor industry, specifically the increasing adoption of surface mount technology (SMT) across emerging applications such as IoT, 5G infrastructure deployment, and advanced driver-assistance systems (ADAS) in the automotive sector. Every electronic component needs to be reliably packaged and delivered to the pick-and-place machine, making carrier tapes an indispensable element of the assembly ecosystem. Furthermore, the inherent cost advantage and environmental footprint reduction offered by paper tapes compared to equivalent polycarbonate or polyester tapes provide a substantial long-term driver, especially as environmental, social, and governance (ESG) factors become central to corporate procurement strategies globally. This continuous high-volume demand stabilizes the market and encourages capacity expansion.

Conversely, significant restraints hinder market growth. The primary constraint involves the material limitations inherent to paper, particularly its susceptibility to moisture absorption and lower overall mechanical strength compared to plastic alternatives. Maintaining tight dimensional tolerances (crucial for micro-components) under varying temperature and humidity conditions remains a challenge that requires specialized lamination and coating processes, often increasing manufacturing complexity and cost. Additionally, the increasing complexity of electronic components, such as bare dies or highly sensitive sensors, sometimes necessitates the superior protection and antistatic performance of embossed plastic tapes, potentially limiting the addressable market for paper solutions, especially in high-reliability applications where failure is costly.

The most compelling opportunities stem from sustainable innovation and regional diversification. The global regulatory pressure to reduce plastic waste is creating an urgent need for fully compostable or recyclable carrier tapes, presenting a significant opportunity for materials scientists to develop advanced cellulose-based products with inherent anti-static properties, minimizing the need for non-biodegradable conductive coatings. Geographically, while APAC dominates production, there is a growing opportunity to establish localized manufacturing bases in North America and Europe. This would shorten supply chains, reduce logistics costs, and enhance responsiveness to regional customers focused on reducing supply chain vulnerability and lead times, particularly in niche high-reliability markets.

- Drivers:

- Rapid expansion of global electronic component manufacturing, fueled by IoT and 5G deployment.

- Strong industry preference for environmentally sustainable and cost-effective packaging solutions.

- Increasing adoption of high-speed SMT assembly requiring reliable component presentation.

- Restraints:

- Susceptibility of paper materials to environmental factors (moisture, temperature variation).

- Limitations in mechanical strength compared to rigid plastic carrier tapes for heavy or complex components.

- High initial investment and maintenance costs associated with precision die-cutting and pressing machinery.

- Opportunities:

- Development and commercialization of fully biodegradable and compostable paper carrier tape formulations.

- Expansion into niche markets requiring specialized anti-static or high-temperature paper solutions.

- Geographic localization of production closer to European and North American electronics manufacturers.

- Impact Forces:

- Bargaining Power of Buyers: High, due to global competition and standardization (EIA requirements).

- Bargaining Power of Suppliers: Moderate to High, driven by the specialized nature of raw materials (high-purity paper, advanced coatings).

- Threat of Substitutes: Moderate, primarily from thermoformed plastic carrier tapes and matrix trays.

- Threat of New Entrants: Low to Moderate, due to high capital investment and technical expertise required for precision manufacturing.

- Industry Rivalry: High, characterized by pricing pressure and continuous innovation in material performance.

Segmentation Analysis

The Press Pocket Paper Carrier Tape Market is segmented based on critical factors including the material type, the width of the tape (which correlates directly to component size), the type of component packaged, and the primary application industry. Segmentation by tape width is crucial as it reflects the growing trend toward miniaturization, necessitating extremely narrow tapes with ultra-precision pocket forming capabilities. Application segmentation, particularly between consumer electronics and high-reliability sectors like automotive and medical, dictates the performance requirements concerning anti-static properties and thermal stability, influencing material selection and overall pricing structure across the market.

- By Tape Width:

- 8mm

- 12mm

- 16mm

- 24mm and Above

- By Component Type:

- Resistors and Capacitors

- Diodes and Transistors

- Inductors and Filters

- Integrated Circuits (ICs) and Micro-components

- By Application:

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive Electronics (ECUs, ADAS Components)

- Telecommunications (5G Base Stations, Network Hardware)

- Industrial and Medical Devices

- Aerospace and Defense

- By Material/Coating:

- Conductive (Anti-Static) Paper Tape

- Non-Conductive Paper Tape

- Bio-based and Sustainable Paper Tape

Value Chain Analysis For Press Pocket Paper Carrier Tape Market

The value chain for the Press Pocket Paper Carrier Tape Market begins with highly specialized upstream suppliers providing high-density paper stock and proprietary coatings, moving through the complex manufacturing and conversion stage, and culminating in distribution to global electronics assembly houses. Upstream analysis focuses on securing raw materials that offer the necessary tensile strength, dimensional consistency, and compatibility with conductive treatments required for high-speed pressing. The downstream segment is highly critical, involving direct sales or specialized channel partners who integrate the tapes into the customer’s automated SMT lines, often requiring technical support and customization services, emphasizing the importance of strong customer relationships and technical expertise throughout the process.

In the upstream segment, the quality of the raw material dictates the final product performance. Specialized manufacturers procure specific grades of cellulose fibers and advanced composite papers, often treated with thermal stabilizers and conductive agents (e.g., carbon black or specialized polymers) to ensure anti-static performance required for handling sensitive components. Suppliers must maintain rigorous quality control to ensure uniform thickness and density, which are paramount for precision die-cutting and consistent pocket formation via the press method. Securing stable, high-quality, and ethically sourced material inputs is a major competitive differentiator, especially concerning sustainable paper grades and specialized anti-static material suppliers.

The distribution channel for paper carrier tapes is bifurcated into direct sales to large, multinational Original Equipment Manufacturers (OEMs) and indirect sales through specialized technical distributors and fulfillment houses. Direct channels are preferred for high-volume, long-term contracts with tier-one electronics assemblers who require specific, customized tape specifications and technical integration support. Indirect channels, often utilizing regional distributors, cater to smaller or mid-sized electronics manufacturers, providing localized inventory management, faster lead times, and bundled supply solutions (tapes, reels, cover tape). Effective logistics, given the global nature of electronics production, require robust warehousing and supply chain synchronization to minimize inventory gaps at high-volume assembly factories.

Press Pocket Paper Carrier Tape Market Potential Customers

The primary customers and end-users of Press Pocket Paper Carrier Tapes are high-volume electronics contract manufacturers and component assemblers who utilize automated Surface Mount Technology (SMT) processes to populate Printed Circuit Boards (PCBs). These customers operate sophisticated pick-and-place machines that rely entirely on the dimensional precision and consistent feed of the carrier tape to ensure operational efficiency. Key buyer segments include major players in the consumer electronics space (e.g., manufacturers of smartphones and laptops), the automotive supply chain (Tier 1 suppliers producing ECUs and sensors), and large-scale telecommunications equipment producers requiring robust packaging for network components.

These buyers prioritize three main criteria when selecting a supplier: tape dimensional accuracy (critical for minimizing pick-and-place errors), anti-static performance (essential to prevent ESD damage to sensitive micro-components), and cost-efficiency. Given the sheer volume of carrier tape consumed—often millions of meters monthly by a single large factory—even marginal price differences translate into substantial cost savings. Furthermore, increasing regulatory requirements related to environmental impact are pushing OEMs to mandate the use of recyclable or sustainable packaging materials, making the eco-friendly profile of paper tapes highly attractive to leading global technology companies committed to reducing their ecological footprint across their supply chain.

Other significant buyers include specialized manufacturing companies in the medical device sector (e.g., pacemakers, diagnostic equipment), where stringent quality control and high reliability necessitate premium carrier tape performance, especially concerning cleanliness and particle contamination. The industrial sector, covering areas such as power management systems and factory automation controllers, also represents a growing customer base. These applications often require carrier tapes capable of handling components subject to higher operational temperatures, thereby influencing the technical specification requirements related to the thermal stability of the paper material and its adhesive components, demanding niche product offerings from tape manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.31 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Advantek, Inc., Linyi Dongguang Electronic Material Co., Ltd., Shin-Etsu Polymer Co., Ltd., Winderosa LLC, Q-Pack Company Ltd., Nichifu Co., Ltd., Carrier-Tech Precision Co., Ltd., Global Electronics Solutions, Oji Holdings Corporation, Mitsubishi Paper Mills Ltd., Laser Tek, ACL Staticide Inc., Teknek, Shenzhen Huamei Technology Co., Ltd., P.K. Industries, Ltd., Coroplast Tape Corporation, Pioneer Engineering Co., Ltd., Suzhou Sunli Packaging Co., Ltd., Shanghai Jintao Electronic Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Press Pocket Paper Carrier Tape Market Key Technology Landscape

The core technology underpinning the Press Pocket Paper Carrier Tape Market is precision rotary die-cutting combined with specialized material handling and proprietary coating methods. Unlike thermoformed plastic tapes, press pocket tapes rely on mechanical deformation of multi-layered paper composite materials to create consistent pockets without heat, demanding extremely high precision in tooling to meet the micron-level tolerances required for modern components, particularly 0201 or 01005 chips. Technological advancements are focused on developing closed-loop control systems for the pressing process to ensure pocket depth uniformity and reducing friction between the tape material and components, thereby enhancing reliability during high-speed feeding on SMT lines.

A significant area of technological focus involves the material science of the paper substrate and its functional coatings. Manufacturers are increasingly utilizing specialized paper laminates composed of multiple layers to achieve the required mechanical strength while maintaining flexibility. The application of highly effective, permanent anti-static coatings is critical; these coatings must resist flaking or migration, ensuring Electrostatic Discharge (ESD) protection throughout the tape's lifecycle, from manufacturing to end-user assembly. Innovations in conductive polymers and bio-based conductive agents are key trends, allowing companies to meet stringent environmental goals without compromising essential electrical safety characteristics demanded by sensitive microelectronic devices.

Furthermore, technology related to the cover tape and the sealing mechanism is integral to the overall system performance. The sealing process, typically heat-activated or pressure-sensitive, must be engineered to provide secure component retention during transit while allowing for consistent, low-force peel removal at the SMT machine. Technological improvements involve optimizing the adhesive formulation and release characteristics of the cover tape to prevent component displacement (pop-out) or excessive force application during peeling, which could disrupt the automated assembly process. The industry is also exploring advanced monitoring technologies, such as integrated sensors within the production line, to ensure compliance with EIA-481 standards for dimensional and conductive properties.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by the massive concentration of electronics manufacturing facilities in China, Taiwan, South Korea, and Japan. APAC serves as both the largest producer and consumer of electronic components, thus generating the highest demand for press pocket paper carrier tapes. The rapid expansion of 5G infrastructure and consumer electronics production cements its leading position.

- North America: Characterized by a focus on high-reliability applications, particularly in aerospace, defense, and high-end computing. Demand is stable and driven by stringent quality requirements and a strong push toward sustainable packaging alternatives, favoring suppliers who can demonstrate superior materials compliance and strong domestic supply chains.

- Europe: The market is influenced heavily by environmental regulations (e.g., REACH, RoHS) and automotive electronics growth. European manufacturers are rapidly adopting paper-based tapes to comply with sustainability mandates, creating strong demand for innovative, bio-degradable, and highly reliable paper carrier tape solutions, particularly in Germany and Central Europe.

- Latin America (LATAM): Represents an emerging market, primarily driven by the expansion of regional electronics assembly operations and localized manufacturing aimed at domestic consumer markets. Growth is moderate but accelerating, focusing mainly on cost-effective, high-volume tape solutions for basic consumer goods and automotive aftermarket components.

- Middle East and Africa (MEA): Currently holds the smallest market share but shows potential growth tied to government initiatives aimed at digital transformation, particularly in the telecommunications and infrastructure sectors in the UAE and Saudi Arabia. Market activity is heavily dependent on imports and strategic regional logistics hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Press Pocket Paper Carrier Tape Market.- 3M Company

- Advantek, Inc.

- Linyi Dongguang Electronic Material Co., Ltd.

- Shin-Etsu Polymer Co., Ltd.

- Winderosa LLC

- Q-Pack Company Ltd.

- Nichifu Co., Ltd.

- Carrier-Tech Precision Co., Ltd.

- Global Electronics Solutions

- Oji Holdings Corporation

- Mitsubishi Paper Mills Ltd.

- Laser Tek

- ACL Staticide Inc.

- Teknek

- Shenzhen Huamei Technology Co., Ltd.

- P.K. Industries, Ltd.

- Coroplast Tape Corporation

- Pioneer Engineering Co., Ltd.

- Suzhou Sunli Packaging Co., Ltd.

- Shanghai Jintao Electronic Material Co., Ltd.

- ITW ECPS

- Mitsui Chemicals, Inc.

- Sekisui Chemical Co., Ltd.

- Taping Solutions Ltd.

- Pro-Pack Materials Pte Ltd

- Kingmax Technology Co., Ltd.

- Chongqing Fuyue Electronics Co., Ltd.

- Yee Hong Paper Products Co., Ltd.

- Shenzhen Keji New Material Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Press Pocket Paper Carrier Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between press pocket and embossed carrier tapes?

Press pocket carrier tapes utilize a mechanical die-cutting and pressing process on multi-layered paper materials to form component cavities. In contrast, embossed tapes are created by heating and molding thermoplastic materials (like polycarbonate or PET) to form pockets. Press pocket tapes are generally more sustainable and cost-effective, particularly for smaller, passive components.

How does the market ensure the anti-static performance of paper carrier tapes?

Anti-static performance is achieved by treating the paper substrate with specialized permanent conductive or static-dissipative coatings, often involving carbon-based fillers or advanced polymer layers. These treatments are essential to meet stringent Electrostatic Discharge (ESD) protection requirements mandated by the electronics industry (EIA standards).

Which application segment drives the highest demand for these tapes?

The consumer electronics application segment, encompassing high-volume production of smartphones, tablets, and wearable devices, drives the highest overall demand due to the sheer volume and complexity of passive and active components requiring precise, automated packaging solutions for Surface Mount Technology (SMT) assembly.

What are the main material limitations restricting the use of paper carrier tapes?

The principal material limitations include lower mechanical strength and higher susceptibility to dimensional change due to moisture absorption compared to plastic alternatives. These factors can limit their suitability for larger, heavier components or applications requiring extremely high thermal stability during reflow soldering processes.

What is the projected growth trajectory for sustainable, bio-based paper carrier tapes?

The growth trajectory for bio-based and sustainable paper carrier tapes is projected to significantly outpace the overall market average, driven by robust corporate sustainability commitments, increasingly strict global plastic waste regulations, and technological advancements that enhance the performance parity between eco-friendly and traditional tapes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager