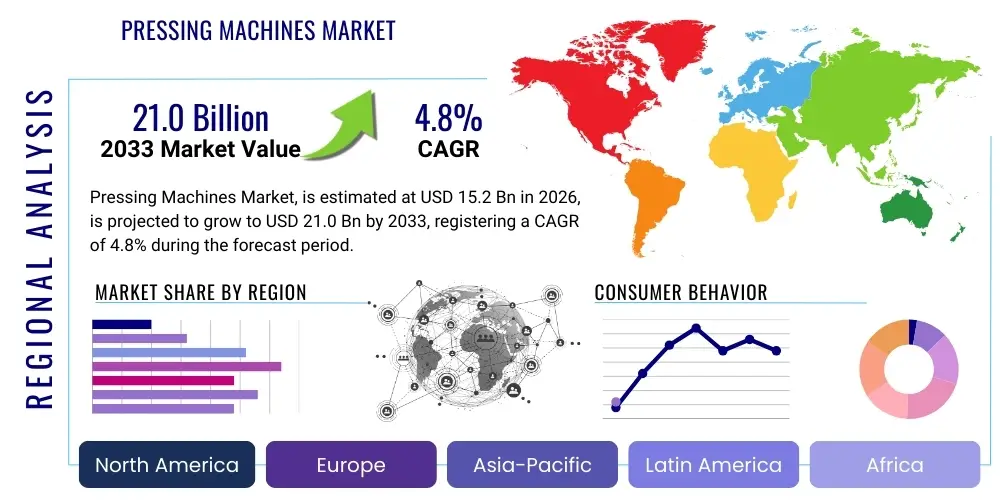

Pressing Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435346 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pressing Machines Market Size

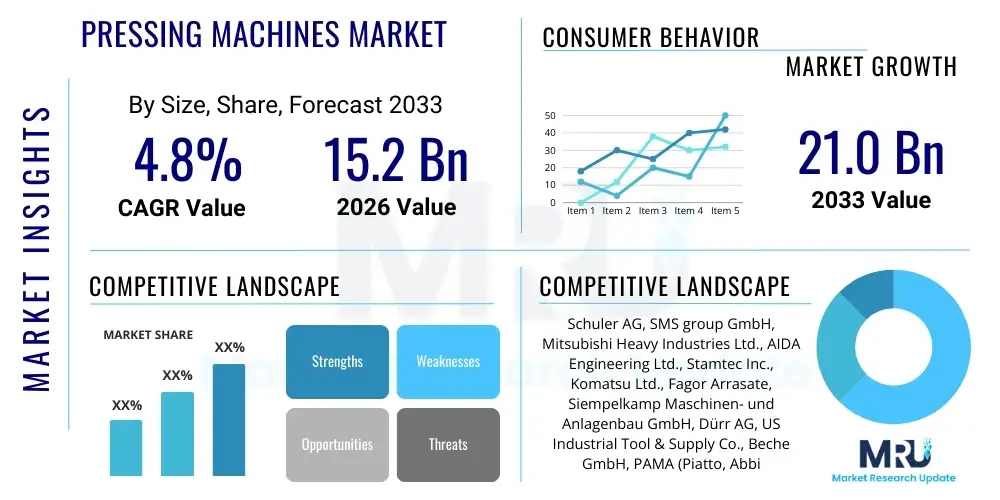

The Pressing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033.

Pressing Machines Market introduction

The Pressing Machines Market encompasses the global manufacturing and distribution of specialized machinery designed to apply significant force for material deformation, cutting, or shaping processes. These essential industrial tools are fundamental to sectors ranging from automotive and aerospace to consumer electronics and heavy machinery production. Pressing machines are critical in high-volume, precision manufacturing environments where repeatability and material integrity are paramount. They include hydraulic presses, mechanical presses, servo presses, and specialized forging equipment, each tailored for specific force applications and speed requirements, driving efficiency across global production lines.

Product descriptions within this market span a broad spectrum, categorized generally by their power source and application methodology. Hydraulic presses utilize fluid pressure to generate force, offering high tonnage capabilities and precise control over the stroke, making them ideal for deep drawing and complex forming. Mechanical presses use flywheels and eccentric gears, prioritizing high speed and short cycles for stamping and blanking operations. The growing prevalence of servo-mechanical presses, integrating electric servo motors, provides the benefits of both—speed, high efficiency, and programmable control—allowing manufacturers unprecedented flexibility in optimizing press cycles for different materials and product specifications.

Major applications of pressing machines are heavily concentrated in the transportation industry, particularly in manufacturing vehicle body panels, structural components, and engine parts. Beyond automotive, these machines are indispensable in producing white goods (refrigerators, washers), electrical components (connectors, terminals), and construction materials (metal sheets, pipe fittings). The driving factors supporting market growth include the global trend toward lightweighting in vehicles and aircraft, necessitating advanced forming processes for high-strength steel, aluminum alloys, and composite materials. Furthermore, the push for automated manufacturing and the integration of Industry 4.0 standards necessitate replacing older, less efficient machines with modern, highly controlled servo and hydraulic systems.

Pressing Machines Market Executive Summary

The Pressing Machines Market is currently defined by significant shifts toward digitization and enhanced operational efficiency, summarized by the robust adoption of servo technology. Business trends indicate a strong move away from traditional mechanical presses, particularly in high-mix, low-volume manufacturing environments where flexibility is crucial. Leading manufacturers are investing heavily in connectivity, offering solutions that integrate pressing machines directly into centralized manufacturing execution systems (MES) for real-time performance monitoring and predictive maintenance. This focus on maximizing uptime and optimizing energy consumption is dictating purchasing decisions globally, favoring equipment providers that can deliver integrated automation packages, including robotic material handling systems and advanced quality control sensors.

Regionally, the market dynamics are polarized. Asia Pacific (APAC) remains the largest consumption hub, driven by massive automotive production capacity and expanding electronics manufacturing in China, India, and Southeast Asian nations. This region is characterized by both high-volume stamping demands and an increasing requirement for precision forming equipment used in electric vehicle (EV) battery casing production. Conversely, North America and Europe emphasize technological upgrade cycles, driven by strict regulatory standards for worker safety, environmental impact, and the need to process advanced materials used in high-end aerospace and defense applications. These mature markets prioritize retrofitting existing hydraulic and mechanical presses with modern control systems to extend asset life while enhancing precision.

Segmentation trends highlight the increasing dominance of the Hydraulic and Servo Press segments. The hydraulic segment maintains strength due to its cost-effectiveness in very high tonnage applications (e.g., deep drawing, forging). However, the Servo Press segment is experiencing the fastest growth, primarily because of its unparalleled versatility, superior energy efficiency compared to traditional mechanical presses, and precise stroke control capability which is essential for processing new composite and high-strength materials. Furthermore, the market for large-tonnage presses (over 1000 tons) is witnessing robust demand from the aerospace and heavy construction machinery sectors, while smaller precision presses are expanding within the medical device and micro-electronics manufacturing domains.

AI Impact Analysis on Pressing Machines Market

User inquiries regarding AI in the pressing machines sector commonly revolve around optimizing process parameters, predicting equipment failure, and achieving 'lights-out' manufacturing capabilities. Users are keen to understand how AI-driven analysis of stamping force, temperature, and vibration data can lead to zero-defect production and extended die life. The core concerns center on the complexity of integrating AI algorithms with legacy press controls and the necessary data infrastructure required to feed machine learning models effectively. Expectations are high, anticipating that AI will move beyond simple condition monitoring to truly autonomous process adjustment, ensuring consistent material yield and optimizing energy use across large fleets of machinery.

- AI enables predictive maintenance algorithms, reducing unexpected downtime by anticipating component failure based on vibrational and thermal signatures.

- Optimized stamping parameters using machine learning models to minimize material spring-back and defects in complex geometries.

- Real-time quality control implemented through AI-powered vision systems, verifying component geometry immediately after pressing.

- Autonomous process adjustment, where AI dynamically modifies ram speed and tonnage based on real-time material properties or temperature variations.

- Enhanced energy management, using AI to schedule press cycles and optimize motor usage, especially in servo-driven machines.

- Accelerated design and simulation of new tooling and press sequences through AI-assisted digital twins, significantly reducing prototyping time.

DRO & Impact Forces Of Pressing Machines Market

The market for pressing machines is influenced by a confluence of driving factors, operational restraints, and substantial growth opportunities. Key drivers include the revitalization of the global automotive sector, particularly the massive capital investments flowing into electric vehicle (EV) production, which requires specialized battery housing and lighter chassis components demanding precision forming. Furthermore, the mandate for higher productivity coupled with energy efficiency in manufacturing encourages widespread adoption of advanced, integrated servo press technologies over older hydraulic or mechanical systems. Rapid industrialization in emerging economies like India and Vietnam also fuels baseline demand for various press types across multiple manufacturing sectors.

However, significant restraints impede faster market expansion. The high initial capital investment associated with large-tonnage, technologically sophisticated presses presents a considerable barrier, especially for small and medium enterprises (SMEs). Additionally, the operational lifespan of existing hydraulic and mechanical presses is long, leading to extended replacement cycles. Skilled labor shortages, particularly in programming, maintaining, and troubleshooting complex CNC and servo-driven presses, pose a continuous challenge, restricting the speed at which advanced technology can be deployed effectively. Supply chain volatility, particularly regarding specialized electronic components and large steel castings necessary for press construction, can delay delivery timelines.

Opportunities for growth are abundant, primarily centered around technological innovation and geographic expansion. The increasing demand for composite forming presses (used in aerospace and wind energy) represents a niche, high-value opportunity. Furthermore, the focus on remanufacturing and retrofitting older machines with modern control packages offers a significant service-based revenue stream for key players. The push towards Industry 4.0 integration—leveraging IoT sensors, data analytics, and cloud connectivity to maximize press effectiveness—provides a strong competitive differentiator. Impact forces, such as global trade policies affecting raw material costs (steel, aluminum) and regional automotive production mandates, exert direct pressure on capital expenditure decisions within the target industries.

- Drivers (D): Global expansion of EV manufacturing; Demand for lightweighting components in aerospace and automotive; Emphasis on automated and energy-efficient manufacturing processes (Industry 4.0).

- Restraints (R): High upfront capital expenditure; Long operational lifecycle of legacy equipment; Shortage of highly skilled maintenance and programming technicians.

- Opportunities (O): Growth in specialized composite forming; Retrofitting and modernization services for existing press infrastructure; Expansion into emerging high-growth manufacturing hubs in Southeast Asia and Latin America.

- Impact Forces: Raw material price volatility (steel, aluminum); Geopolitical trade disputes influencing manufacturing location; Stricter governmental regulations concerning noise and environmental emissions.

Segmentation Analysis

The Pressing Machines Market is segmented based on technology, tonnage capacity, application, and end-user industry, offering a granular view of specific market dynamics and growth pockets. Technology segmentation remains crucial, distinguishing between traditional mechanical systems, powerful hydraulic systems, and the increasingly dominant servo-driven presses. Tonnage capacity segmentation reflects the scale of operations, ranging from small precision presses used in electronics to massive forging presses exceeding 50,000 tons. The market’s health is deeply tied to the end-user industry segment, with the automotive sector acting as the primary consumer, followed by aerospace, general manufacturing, and construction sectors.

- By Technology:

- Mechanical Presses

- Hydraulic Presses

- Servo Presses

- Pneumatic Presses

- Hybrid Presses

- By Tonnage Capacity:

- < 100 Tons

- 100–500 Tons

- 501–1000 Tons

- > 1000 Tons

- By Application:

- Stamping and Blanking

- Deep Drawing

- Forging

- Bending and Forming

- Assembly

- Pouch Cell Forming (for batteries)

- By End-User Industry:

- Automotive and Transportation

- Aerospace and Defense

- General Manufacturing

- Electrical and Electronics

- Construction and Heavy Machinery

- Consumer Goods and Appliances

Value Chain Analysis For Pressing Machines Market

The value chain for pressing machines begins with upstream activities focused on raw material sourcing and component manufacturing. This stage involves securing high-quality, large-scale steel and specialized castings for machine frames, precision components such as cylinders, pumps, and valves for hydraulic systems, and complex electronics, motors, and drives for servo systems. Supplier relationships in this segment are critical, as the quality and delivery timelines of large, custom-fabricated components directly impact the final machine's performance and time-to-market. Expertise in metallurgy and casting processes provides a significant competitive advantage to upstream suppliers, ensuring the durability and rigidity required for high-tonnage applications.

The manufacturing stage involves the assembly, integration, and testing of the pressing machinery. Key Original Equipment Manufacturers (OEMs) focus on designing proprietary control systems (CNC/PLC), integrating safety features, and applying sophisticated software for operational optimization and connectivity (Industry 4.0 features). Distribution channels play a vital role in reaching end-users globally. Direct distribution, often through the OEM's dedicated sales force, is prevalent for highly customized or extremely large-tonnage presses, allowing for detailed technical consultation and customized installation services. Indirect channels, involving authorized distributors, regional agents, and system integrators, handle standard product lines and provide local sales support, maintenance, and spare parts management, particularly effective in geographically fragmented markets.

Downstream activities encompass installation, commissioning, after-sales service, and modernization. Since pressing machines are major capital assets with multi-decade lifecycles, maintenance contracts, parts supply, and technical training represent crucial, high-margin revenue streams. A growing trend is the market for refurbishing or retrofitting older presses with modern control units, dramatically extending their operational life and improving energy efficiency without requiring complete asset replacement. End-users’ decisions are often influenced not just by the machine's initial cost, but by the long-term cost of ownership, including energy consumption, maintenance predictability, and the availability of local technical support, making robust downstream services a key differentiator.

Pressing Machines Market Potential Customers

Potential customers for pressing machines primarily consist of large-scale industrial manufacturing enterprises seeking high-precision, high-volume production capabilities across diverse sectors. The most significant end-users are Tier 1 and Tier 2 suppliers within the global automotive supply chain, requiring presses for stamping body panels, forming chassis components, and increasingly, manufacturing complex battery housings for electric vehicles. These customers prioritize high-speed, reliable equipment capable of achieving tight tolerances with advanced materials like high-strength low-alloy (HSLA) steel and specialized aluminum alloys to meet lightweighting objectives.

Beyond the automotive industry, significant demand originates from the aerospace and defense sectors, which utilize large, often specialized, hydraulic or hot-forming presses for manufacturing critical structural components from titanium, nickel alloys, and advanced composites. These buyers require exceptionally high tonnage capabilities and rigorous certification processes, making reliability and compliance essential purchasing criteria. Furthermore, the general manufacturing segment, including producers of domestic appliances (white goods), HVAC systems, and construction equipment, consistently requires mid-range tonnage presses for forming enclosures, casings, and specialized fittings, focusing on durability and ease of maintenance.

The emerging high-growth customer segment includes manufacturers of lithium-ion batteries and consumer electronics. Battery manufacturers require highly precise presses for pouch cell formation and battery casing production, demanding clean-room compatible, highly automated systems. Electronics producers utilize smaller, high-speed pneumatic and mechanical presses for micro-stamping connectors, terminals, and intricate components. These customers emphasize high throughput, minimal operational footprint, and seamless integration with complex automation lines, driving demand for precision servo presses with advanced control capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler AG, SMS group GmbH, Mitsubishi Heavy Industries Ltd., AIDA Engineering Ltd., Stamtec Inc., Komatsu Ltd., Fagor Arrasate, Siempelkamp Maschinen- und Anlagenbau GmbH, Dürr AG, US Industrial Tool & Supply Co., Beche GmbH, PAMA (Piatto, Abbiategrasso & Morando), Qingdao Beite Machinery Manufacturing Co., Ltd., China National Machinery Industry Corporation (Sinomach), Heilbronn Pressen GmbH, AP&T AB, Verson Press, Chin Fong Machine Industrial Co., Ltd., Santec Exim Private Ltd., Nidec Press & Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pressing Machines Market Key Technology Landscape

The current technology landscape in the Pressing Machines Market is dominated by the migration towards smart, digitally integrated systems, emphasizing the convergence of high-force capability with precision control. Servo press technology represents the most significant paradigm shift, offering manufacturers unparalleled flexibility. Unlike traditional presses where speed and force are fixed or limited by mechanical linkage, servo presses allow the programmable control of the slide motion profile, enabling optimal velocity curves tailored to the material being formed. This capability significantly improves part quality, reduces noise and vibration, and facilitates significant energy savings by only drawing power when required, setting the standard for modern industrial press systems across high-end automotive stamping and advanced forming applications.

A secondary critical technological trend involves advancements in automation and material handling integrated directly into the press cell. High-speed transfer systems, often robotic or gantry-based, minimize cycle times between stamping stages. Furthermore, the incorporation of advanced sensing technology—including in-die force sensors, acoustic emission monitors, and real-time vision systems—is becoming standard. These sensors feed data directly into the press control unit, enabling instantaneous feedback loops and preventative quality control. This integration not only boosts throughput but also plays a vital role in enabling predictive maintenance programs, moving the market closer to 'zero-downtime' manufacturing environments sought by large Tier 1 suppliers.

The third major technological focus area is the development of specialized presses for novel materials and applications, particularly within the energy and aerospace sectors. Hot stamping technology, using presses capable of handling materials at high temperatures, is crucial for producing ultra-high-strength steel components for vehicle safety structures. Similarly, hydraulic presses designed specifically for composite molding (e.g., carbon fiber reinforced plastics) are growing in importance, requiring highly uniform pressure distribution and precise temperature management. Manufacturers are increasingly utilizing digital twin technology and advanced simulation software (FEA) to virtually optimize press designs and tooling, cutting down development time and enhancing the efficiency of physical machinery before production commences, solidifying the importance of software in hardware manufacturing.

Regional Highlights

The Asia Pacific (APAC) region stands out as the global powerhouse for the Pressing Machines Market, largely attributable to the massive scale of manufacturing operations in China, which serves as both the world's largest consumer and producer of pressing equipment. The demand in APAC is robustly driven by the burgeoning electric vehicle ecosystem, general infrastructure expansion, and a relentless focus on increasing localized manufacturing capacity. Countries like India, with its rapidly expanding automotive sector and governmental initiatives promoting domestic production, and Southeast Asian nations, acting as assembly hubs, are driving substantial investments in both new, large-scale press lines and smaller, high-precision electronic stamping equipment, ensuring APAC's continued market dominance.

North America and Europe represent mature markets characterized by sophisticated technology adoption and an emphasis on upgrading existing fleets rather than solely building new capacity. These regions are primarily focused on high-mix, low-volume production of specialized components, particularly in the aerospace, defense, and premium automotive segments. North American and European manufacturers readily adopt high-cost, high-efficiency servo presses and specialized forming equipment for handling high-strength, difficult-to-form alloys. Regulatory standards regarding workplace safety, energy consumption, and environmental accountability also drive sustained demand for advanced machinery that offers better performance metrics and superior data reporting capabilities, accelerating the replacement cycle for older, less compliant assets.

Latin America and the Middle East & Africa (MEA) are emerging markets showing gradual but steady growth, heavily influenced by localized resource extraction and construction needs. Latin America, particularly Mexico and Brazil, benefits from proximity to the U.S. automotive supply chain, generating consistent demand for mid-to-large tonnage mechanical and hydraulic presses. The MEA region's growth is often sporadic, linked to specific governmental infrastructure projects and attempts to diversify economic bases away from oil, leading to targeted investments in metal forming and light manufacturing. These regions typically seek robust, reliable hydraulic machinery that offers a favorable balance between initial cost and operational durability under varying industrial conditions.

- Asia Pacific (APAC): Dominant market share; driven by large-scale automotive production (especially EV components), electronics manufacturing, and robust capital expenditure in China and India.

- North America: Focus on technological sophistication; high adoption rates of servo presses for aerospace and defense manufacturing; strong emphasis on automation and regulatory compliance.

- Europe: Leading in technological innovation and specialized forming (hot stamping, hydroforming); demand fueled by premium automotive sector and stringent environmental standards.

- Latin America (LATAM): Growth linked to regional automotive hubs (Mexico, Brazil) and infrastructure projects; preference for reliable hydraulic and mechanical solutions.

- Middle East & Africa (MEA): Emerging market; demand correlated with localized construction, metal fabrication, and economic diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pressing Machines Market.- Schuler AG

- SMS group GmbH

- Mitsubishi Heavy Industries Ltd.

- AIDA Engineering Ltd.

- Stamtec Inc.

- Komatsu Ltd.

- Fagor Arrasate

- Siempelkamp Maschinen- und Anlagenbau GmbH

- Dürr AG

- US Industrial Tool & Supply Co.

- Beche GmbH

- PAMA (Piatto, Abbiategrasso & Morando)

- Qingdao Beite Machinery Manufacturing Co., Ltd.

- China National Machinery Industry Corporation (Sinomach)

- Heilbronn Pressen GmbH

- AP&T AB

- Verson Press

- Chin Fong Machine Industrial Co., Ltd.

- Santec Exim Private Ltd.

- Nidec Press & Automation

Frequently Asked Questions

Analyze common user questions about the Pressing Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of servo pressing machines?

The primary factor is the ability of servo presses to offer unparalleled flexibility and precise control over the slide motion profile, which significantly optimizes the forming process for complex and lightweight materials (like aluminum and advanced high-strength steels). This precision leads to higher part quality, reduced material waste (spring-back), and substantial energy savings compared to traditional mechanical and hydraulic presses.

How does the shift to Electric Vehicle (EV) manufacturing impact the demand for pressing machines?

The EV shift dramatically increases demand for specialized pressing equipment, particularly for high-tonnage hydraulic presses for forging heavy suspension components and precision servo presses required for forming intricate battery casings, modules, and delicate battery cells. EV manufacturing prioritizes lightweighting and requires new stamping methodologies to handle specific battery metals.

What are the key differences between mechanical and hydraulic presses in modern manufacturing?

Mechanical presses are typically faster, ideal for high-speed, shallow-draw stamping and blanking operations, but offer less force adjustability during the stroke. Hydraulic presses provide maximum force anywhere in the stroke, offering high tonnage capacity and superior control for deep drawing and forming thick materials, though they are generally slower than mechanical counterparts for simple operations.

Which geographical region holds the largest market share in the global pressing machines industry?

The Asia Pacific (APAC) region, driven primarily by manufacturing powerhouse China, holds the largest market share. This dominance is due to immense capital investment in automotive production, heavy machinery manufacturing, and the rapid expansion of the consumer electronics sector, necessitating high volumes of both standard and advanced pressing equipment.

What role does Industry 4.0 integration play in the long-term viability of pressing machine investments?

Industry 4.0 integration is crucial as it ensures long-term viability by enabling connectivity, data analytics, and real-time monitoring. Modern presses equipped with IoT sensors facilitate predictive maintenance, optimize energy consumption, and integrate seamlessly with factory-wide Manufacturing Execution Systems (MES), maximizing uptime and ensuring higher overall equipment effectiveness (OEE).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager