Pressure Indicating Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437880 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pressure Indicating Film Market Size

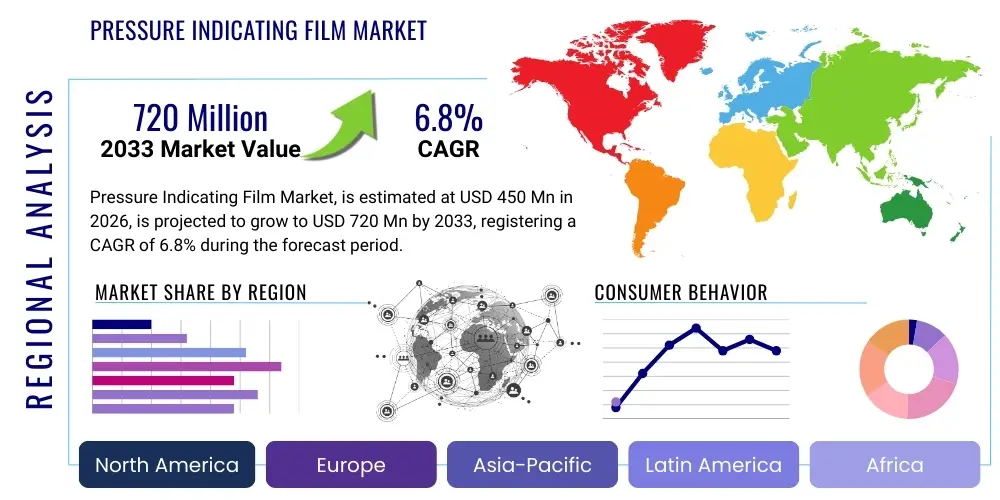

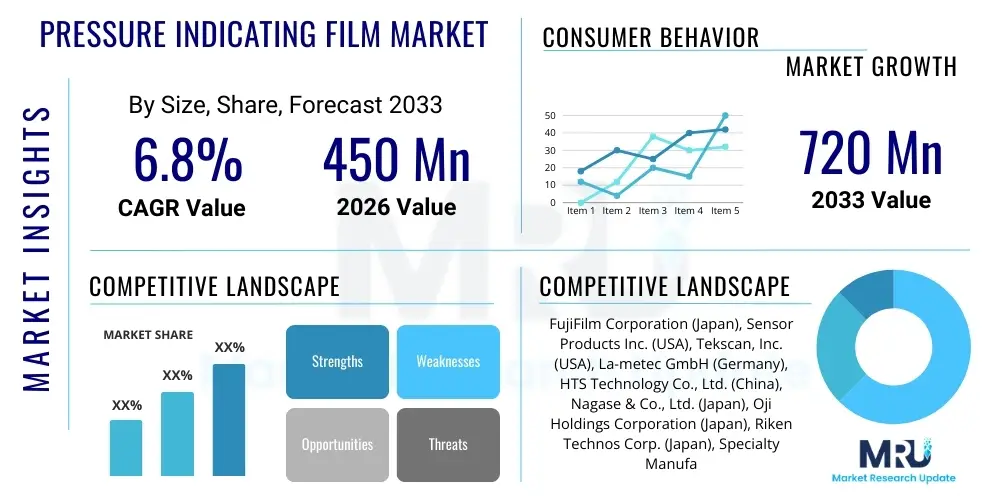

The Pressure Indicating Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Pressure Indicating Film Market introduction

Pressure Indicating Film, often referred to by brand names such as Fuji Prescale, is a specialized thin substrate designed to visualize and quantify pressure distribution and magnitude across contact surfaces. This unique material contains micro-encapsulated dyes that rupture and react with a developing layer upon application of pressure, resulting in an immediate and permanent color change whose intensity directly correlates with the applied force. The inherent simplicity, non-intrusiveness, and immediate feedback provided by these films make them indispensable tools across numerous industries requiring high-precision contact analysis.

The core utility of pressure indicating films lies in optimizing industrial processes, enhancing product quality control, and ensuring mechanical integrity. Major applications span critical sectors, including manufacturing quality assurance (checking bolt fastening, gasket sealing), automotive engineering (tire contact patches, engine component seating), electronics manufacturing (semiconductor wafer handling, screen lamination), and biomedical research (foot pressure mapping, prosthetics alignment). The films serve as a robust alternative or complement to electronic pressure sensors, particularly in environments where complex geometries or transient, high-resolution mapping is required.

Key benefits driving market adoption include their high spatial resolution, ease of use (requiring no complex electronic readout equipment), instantaneous visualization of pressure abnormalities (such as hot spots or uneven distributions), and cost-effectiveness for localized testing. Driving factors encompass stringent quality control regulations in high-tech manufacturing, the continuous push for miniaturization and precision in electronic devices, and increasing research and development activities focused on optimizing mechanical interfaces and material science across sectors like aerospace and medical device production.

Pressure Indicating Film Market Executive Summary

The Pressure Indicating Film Market is experiencing robust growth driven primarily by escalating demand from the automotive and electronics sectors, which rely heavily on precise contact pressure verification for component reliability and assembly quality. Business trends indicate a shift towards highly customized films capable of measuring ultra-low or ultra-high pressure ranges, addressing niche applications in advanced materials testing and specialized medical diagnostics. Furthermore, leading manufacturers are focusing on developing digital integration solutions, allowing film results to be quickly digitized, analyzed using proprietary software, and integrated into existing quality management systems, thereby improving efficiency and reducing reliance solely on visual interpretation.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption and future growth potential, fueled by massive expansion in electronics manufacturing, automotive production, and a high concentration of sophisticated R&D centers in countries like China, Japan, and South Korea. North America and Europe remain mature markets characterized by high technology adoption and strong regulatory oversight, driving consistent demand for premium, high-resolution films used in aerospace and medical device quality assurance. The Middle East and Africa (MEA) and Latin America (LATAM) show moderate growth, primarily tied to local infrastructure development and localized manufacturing initiatives requiring basic quality control tools.

Segment trends highlight the dominance of low-pressure films (crucial for battery cell assembly and display lamination) and medium-pressure films (essential for gasket and clamp testing) in terms of volume. However, the high-pressure film segment is projected to exhibit the highest CAGR, spurred by demand from heavy industrial machinery, hydraulic systems, and advanced material compression testing. End-user analysis confirms that manufacturing companies, particularly those involved in high-stakes assembly (e.g., aerospace and medical), represent the most significant revenue stream, while academic and independent testing laboratories contribute substantially to the adoption of specialized and customized film types.

AI Impact Analysis on Pressure Indicating Film Market

Common user questions regarding AI's impact typically revolve around how AI can enhance the interpretation, digitalization, and predictive maintenance capabilities associated with pressure mapping. Users frequently ask if AI can automate the complex process of color density analysis, convert film results into quantitative data more accurately than traditional scanning methods, and ultimately predict component failure based on visualized pressure patterns. The consensus expectation is that AI will transform the traditionally qualitative nature of film analysis into a highly quantitative and integrated data stream, leading to faster throughput and reduced subjective error in quality control departments. The key themes are automation, predictive insights, and seamless integration of analog film data into digital manufacturing workflows.

- AI algorithms accelerate the digitization and quantitative interpretation of pressure film color density, converting subjective visualization into objective numerical data.

- Machine learning models are used to identify complex pressure signatures, anomalies, and potential failure points that might be overlooked by human inspection, particularly in large-scale testing operations.

- AI-powered software integration enables real-time comparison of visualized pressure maps against ideal or reference standards, immediately flagging deviations in manufacturing assembly lines.

- Predictive maintenance applications utilize historical pressure film data, combined with operational sensor data, to forecast equipment wear, gasket degradation, and sealing failures before they occur.

- Enhanced AEO/GEO strategies will rely on AI to generate optimized content detailing the quantifiable benefits of digital pressure analysis systems, targeting engineers searching for "automated pressure verification" or "non-contact force measurement quantification."

DRO & Impact Forces Of Pressure Indicating Film Market

The market dynamics for Pressure Indicating Film are shaped by a complex interplay of factors including stringent quality requirements in manufacturing (Driving Factor), the high initial cost and need for proprietary densitometers for precise quantitative analysis (Restraint), and the expanding applications in emerging sectors like electric vehicle battery manufacturing and advanced robotics (Opportunity). The impact forces, characterized by the pace of technological change and the growing penetration of competitive electronic sensing technologies, mandate continuous product innovation to maintain market relevance.

The primary driver is the accelerating trend toward zero-defect manufacturing, particularly in aerospace, medical devices, and high-performance electronics, where catastrophic failure can result from minor pressure inconsistencies. This strict requirement necessitates highly reliable, verifiable, and precise methods for evaluating surface contact dynamics, which pressure films excel at visualizing instantly. Furthermore, the inherent simplicity and portability of the film system allow for quick, on-site diagnostics and verification across diverse geographical locations without extensive setup or calibration, facilitating global supply chain quality management. These driving factors ensure a stable baseline demand across industrial sectors committed to meticulous quality assurance protocols.

Key restraints include the consumable nature of the product, generating recurring operational costs, and the technical challenge associated with obtaining truly quantitative results without dedicated high-precision scanning equipment, which adds to the total cost of ownership. Opportunities are significantly expanding through advancements in film material science, allowing for use in extreme temperature or chemically challenging environments. Moreover, the massive global expansion of battery technology for electric vehicles (EVs) and energy storage systems presents a lucrative niche, as precise pressure mapping is critical for optimizing battery cell lamination and preventing internal short circuits, demanding films specifically calibrated for low-to-medium range pressure analysis in controlled environments. The market will see pressure from electronic sensor arrays (Impact Force) which offer continuous, real-time measurement, compelling film manufacturers to focus on applications demanding ultra-high resolution and geometric adaptability where electronic sensors struggle.

Segmentation Analysis

The Pressure Indicating Film market is segmented based on several critical parameters including the type of pressure range measured, the physical form factor, the specific measurement range capacity, and the target end-use application. Understanding these segments is crucial for manufacturers to tailor their product offerings and marketing strategies, ensuring optimal penetration into diverse industrial and research niches. The breadth of applications, ranging from testing the uniformity of roller pressure in printing presses to verifying the contact of semiconductor components, requires a highly specialized portfolio of films, driving segmentation complexity. Each segment addresses unique technical requirements concerning thickness, sensitivity, and resistance to environmental factors, reflecting the highly customized nature of contact pressure measurement needs across various engineering disciplines.

The dominant segmentation criteria often revolve around the pressure sensitivity, which determines the target application. For instance, films designed for low pressure (down to 0.05 MPa) are utilized extensively in semiconductor and display manufacturing, where minimal force applications are paramount, while high-pressure films (up to 300 MPa) are essential for heavy forging, composite curing, and structural engineering tests. Segmentation by application helps stakeholders identify high-growth areas; currently, the automotive sector remains a major segment due to continuous requirements for verifying engine components, braking systems, and crash test integrity. Further analysis includes regional segmentation, reflecting the concentration of advanced manufacturing capabilities, such as the high demand for specialized electronics films in Asia Pacific compared to the dominance of aerospace and defense applications in North America.

- By Pressure Range:

- Ultra-Low Pressure Films (0.05 – 0.5 MPa)

- Low Pressure Films (0.5 – 2.5 MPa)

- Medium Pressure Films (2.5 – 10 MPa)

- High Pressure Films (10 – 50 MPa)

- Ultra-High Pressure Films (50 MPa and Above)

- By Application:

- Industrial Manufacturing (Gasket/Sealing, Roller Calibration, Clamp Force)

- Automotive Engineering (Tire Contact, Engine Head Seating, Brake Systems)

- Electronics and Displays (Semiconductor Processing, LCD/OLED Lamination, Connector Contact)

- Medical and Healthcare (Prosthetics Alignment, Foot Pressure Analysis, Surgical Tool Calibration)

- Aerospace and Defense (Composite Curing, Structural Testing)

- Research & Development and Education

- By End-User:

- Manufacturing Companies

- Testing and Certification Laboratories

- Research Institutions and Universities

- Medical Device Manufacturers

Value Chain Analysis For Pressure Indicating Film Market

The value chain for the Pressure Indicating Film market begins with specialized raw material procurement and complex film manufacturing, moves through distribution, and culminates in the final application by end-users. Upstream activities involve sourcing high-quality, specialized polymers and proprietary micro-encapsulated dyes and chemical reagents that are crucial for the film's pressure-sensitive reaction. Film manufacturers invest heavily in R&D and sophisticated coating technology to ensure uniformity, sensitivity, and accuracy across various pressure ranges, acting as the primary value addition stage. The proprietary nature of the chemical formulation and coating process provides significant barriers to entry and determines the competitive advantage of major players in the market.

Midstream activities primarily encompass distribution channels, which are segmented into direct sales, specialized industrial distributors, and scientific supply houses. Due to the technical nature of the product and the need for application support, direct sales teams often handle high-volume B2B relationships with major manufacturing corporations, providing technical expertise and calibration support. Indirect channels, such as regional distributors, are crucial for reaching smaller R&D labs and geographically dispersed clients. The film often requires specialized reading equipment (densitometers or proprietary scanners), which may be sold separately or bundled, adding complexity to the distribution process.

Downstream activities involve the end-user application across diverse industries. The film itself is a consumable product, creating consistent demand. The value proposition at this stage is enhanced through complementary digital scanning software and analytical tools that convert the visual output into quantifiable engineering data (force per unit area). The efficiency of the film's utilization is often dependent on the integration into the client's quality assurance workflow. Successful market players focus on creating integrated solutions, linking the analog measurement of the film to digital quality records, thus optimizing the entire value chain from material sourcing to final data interpretation and reporting.

Pressure Indicating Film Market Potential Customers

Potential customers for Pressure Indicating Film are predominantly entities that require meticulous analysis and verification of contact force, pressure distribution, or sealing integrity within their product assembly, manufacturing processes, or research activities. The customer base is highly technical and specialized, prioritizing accuracy, reliability, and ease of data interpretation. The largest segment of buyers consists of quality assurance and R&D departments within large-scale manufacturing enterprises across multiple high-precision sectors where failure to control pressure can lead to significant financial losses or safety hazards, such as the aerospace or medical device industries.

Specific end-users/buyers include process engineers in semiconductor fabrication plants who use the films to verify the uniformity of wafer gripping and lamination presses; mechanical engineers in the automotive industry using them to assess engine head sealing forces and optimize brake pad contact; and biomedical researchers utilizing the films for biomechanical studies, assessing joint pressure, or designing custom prosthetics. Furthermore, independent testing and certification laboratories, which handle outsourced quality verification for smaller firms, represent a key institutional buyer group due to their need for versatile, reliable, and standardized pressure measurement tools that meet various industry regulatory requirements.

The market also targets educational institutions and material science research centers that use pressure films as a fundamental, visually intuitive tool for teaching and investigating material compression behavior, surface dynamics, and impact studies. Sales strategies must address both the procurement specialists (focused on consumables cost and supply reliability) and the technical end-users (focused on resolution, accuracy, and compatibility with existing testing protocols, including digital integration capabilities). The sustained nature of demand comes from the film’s necessity as a recurring operational expenditure in quality control settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FujiFilm Corporation (Japan), Sensor Products Inc. (USA), Tekscan, Inc. (USA), La-metec GmbH (Germany), HTS Technology Co., Ltd. (China), Nagase & Co., Ltd. (Japan), Oji Holdings Corporation (Japan), Riken Technos Corp. (Japan), Specialty Manufacturing Inc. (USA), VDI (Germany), Sigma Corporation (Japan), Industrial Physics (USA), Thin Film Sensors LLC (USA), Nitto Denko Corporation (Japan), Chemence (USA), Nitta Corporation (Japan), 3M Company (USA), Avery Dennison Corporation (USA), Dai Nippon Printing Co., Ltd. (Japan), Showa Denko K.K. (Japan) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pressure Indicating Film Market Key Technology Landscape

The technology underpinning the Pressure Indicating Film market relies fundamentally on micro-encapsulation and chromogenic chemistry, where specialized micro-capsules containing dye material are precisely coated onto a thin polyester or Mylar film substrate. When external force is applied, these capsules rupture in direct proportion to the magnitude of the pressure, releasing the dye to react with a developer layer, producing an immediate color change. Advancements in this core technology focus on improving spatial resolution (finer dye particles), expanding the usable pressure measurement range (especially into the ultra-low and ultra-high spectrums), and enhancing resistance to environmental factors such as humidity and temperature variations which can affect film accuracy.

A significant shift in the technological landscape is the convergence of analog film data capture with digital quantitative analysis tools. Key technologies include high-resolution proprietary densitometers and specialized scanners that precisely measure the optical density of the color change on the film. These scanners are paired with advanced software incorporating algorithms (increasingly AI-enhanced) to convert the visual density reading into engineering units (e.g., MPa or PSI) with improved accuracy, repeatability, and speed. This digitalization effort is crucial for integrating film-based testing into modern industrial quality management systems (QMS), allowing for automated reporting and data archiving.

Further innovation is evident in the development of specialized film types tailored for unique constraints, such as films optimized for vacuum environments, high-temperature presses (used in composite curing), or films with inherent anti-static properties for use in sensitive electronics manufacturing. Material scientists are continually refining the uniformity of the coating layer and the compressibility of the substrate to minimize measurement error. The emphasis moving forward is on making the films not just indicators, but high-precision metrology tools fully compatible with Industry 4.0 data requirements, demanding seamless integration between the physical product and the digital analysis ecosystem.

Regional Highlights

- North America (NA): NA is characterized by high demand for premium, specialized pressure indicating films, driven largely by rigorous quality standards in the aerospace, defense, and high-end medical device manufacturing sectors. Companies in this region prioritize digital integration and precise quantitative analysis tools. The mature industrial base and significant R&D spending ensure consistent, high-value adoption, particularly for films designed to test advanced composite materials and complex mechanical assemblies. The US and Canada maintain a leadership position in developing the accompanying scanning and analytical software.

- Europe: The European market demonstrates strong demand, primarily fueled by the robust automotive sector (Germany, France) and stringent industrial safety regulations. The adoption is also high in precision engineering and machinery manufacturing, where calibration of rollers and presses is critical for operational efficiency. Environmental and regulatory pressures promote the use of films in sealing applications (gaskets, flanges) to prevent leakage. Regional growth is steady, focusing on integrating pressure mapping results directly into European quality norms (e.g., ISO certifications).

- Asia Pacific (APAC): APAC is the fastest-growing and largest consuming market globally, dominated by mass manufacturing centers in China, Japan, South Korea, and Taiwan. This region's growth is exponentially driven by the burgeoning electronics industry (smartphones, displays, semiconductors), where low-pressure films are essential for delicate lamination and contact testing. Furthermore, significant investment in EV battery production and massive infrastructure projects increase the demand for medium and high-pressure films for structural and material testing. Cost-efficiency and bulk purchasing are key characteristics of this market segment.

- Latin America (LATAM): The LATAM market represents an emerging segment, with demand primarily originating from localized automotive assembly, construction, and basic industrial manufacturing operations in countries like Brazil and Mexico. Adoption often favors mid-range pressure films and simpler visual analysis methods over complex, fully digitized solutions due to budget constraints and varying levels of industrial technological maturity. Growth is tied closely to foreign direct investment in manufacturing capacity.

- Middle East and Africa (MEA): MEA shows moderate, concentrated growth driven by oil and gas operations and emerging infrastructure development. Pressure indicating films are used extensively for pipeline joint integrity testing, valve sealing verification, and quality control in specialized regional manufacturing hubs. The adoption rate is selective, focusing mainly on high-reliability industrial applications where leakage or structural failure poses major safety risks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pressure Indicating Film Market.- FujiFilm Corporation (Japan)

- Sensor Products Inc. (USA)

- Tekscan, Inc. (USA)

- La-metec GmbH (Germany)

- HTS Technology Co., Ltd. (China)

- Nagase & Co., Ltd. (Japan)

- Oji Holdings Corporation (Japan)

- Riken Technos Corp. (Japan)

- Specialty Manufacturing Inc. (USA)

- VDI (Germany)

- Sigma Corporation (Japan)

- Industrial Physics (USA)

- Thin Film Sensors LLC (USA)

- Nitto Denko Corporation (Japan)

- Chemence (USA)

- Nitta Corporation (Japan)

- 3M Company (USA)

- Avery Dennison Corporation (USA)

- Dai Nippon Printing Co., Ltd. (Japan)

- Showa Denko K.K. (Japan)

Frequently Asked Questions

Analyze common user questions about the Pressure Indicating Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism by which pressure indicating films quantify force?

The film utilizes micro-encapsulated dye technology. When mechanical force is applied, the capsules rupture, releasing a dye that reacts with a developer layer on the adjacent film sheet. The resulting color density (intensity) is directly proportional to the applied pressure, enabling qualitative visualization and quantitative measurement via densitometry.

How do low-pressure films differ from high-pressure films in application?

Low-pressure films (typically 0.05 to 2.5 MPa) are extremely sensitive and used for delicate applications like semiconductor lamination, display panel bonding, or battery cell contact uniformity. High-pressure films (10 MPa and above) are robust, used in heavy industry for structural testing, composite curing, or measuring force in hydraulic presses and heavy mechanical joints.

Is quantitative analysis of pressure film possible without proprietary scanning equipment?

While the film provides immediate qualitative visualization (visual hot spots), achieving precise, repeatable quantitative analysis (measurement in engineering units like MPa) requires a high-resolution densitometer or dedicated scanning system. These specialized tools accurately measure the optical density of the color change across the film surface, reducing subjective interpretation.

What role does the automotive sector play in the growth of the Pressure Indicating Film market?

The automotive sector is a critical growth driver, utilizing these films extensively for quality control in critical assemblies. Applications include verifying the seating uniformity of engine head gaskets, analyzing tire contact patches, ensuring the integrity of braking systems, and optimizing force distribution in electric vehicle battery pack assembly processes.

Which geographic region exhibits the highest growth rate for pressure indicating films and why?

The Asia Pacific (APAC) region displays the highest growth rate. This is primarily attributed to the massive scale of electronics manufacturing (semiconductors, displays) and the rapid expansion of the Electric Vehicle (EV) supply chain, both of which require precise, reliable, and high-volume pressure verification methods in their manufacturing lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager