Pressure Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434540 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Pressure Pipe Market Size

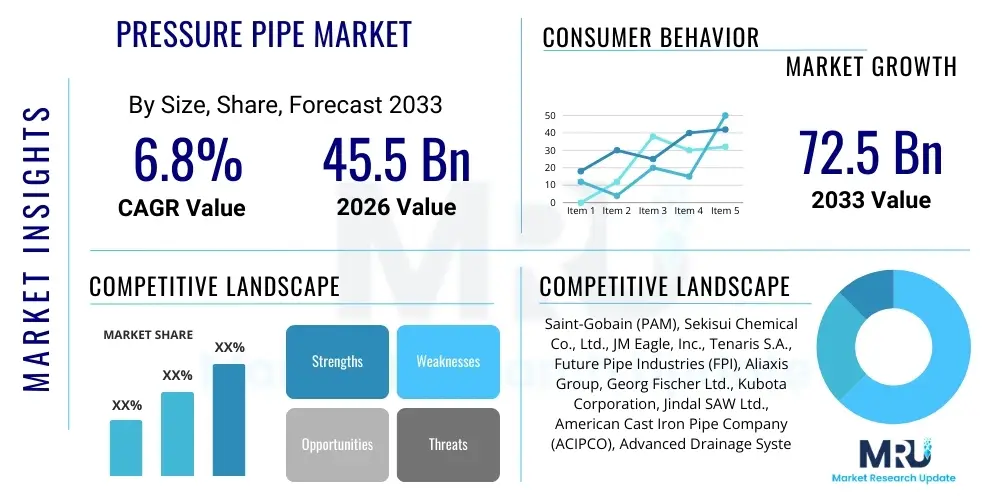

The Pressure Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 72.5 Billion by the end of the forecast period in 2033.

Pressure Pipe Market introduction

The Pressure Pipe Market encompasses the manufacturing, distribution, and utilization of pipes designed to transport fluids or gases under significant internal pressure. These critical infrastructure components are essential for maintaining public health, supporting industrial operations, and ensuring energy security worldwide. Products range widely, spanning materials such as polyvinyl chloride (PVC), high-density polyethylene (HDPE), ductile iron, reinforced concrete, and various grades of steel, each selected based on required pressure rating, chemical resistance, cost-effectiveness, and expected service life. The market is heavily influenced by stringent regulatory standards concerning public safety and environmental protection, particularly in potable water and wastewater management sectors.

Major applications of pressure pipes include municipal water distribution networks, bulk water transmission, sewage force mains, irrigation systems, industrial processing lines, and oil and gas transportation pipelines. In municipal settings, the primary benefit is the reliable delivery of clean water from treatment plants to end-users, requiring pipes that can withstand high hydrostatic forces and resist corrosion. For industrial applications, pipes must handle extreme temperatures and corrosive substances. The long operational lifespan and minimal maintenance requirements of modern pressure piping solutions, driven by advancements in material science like cross-linked polyethylene (PEX) and molecularly oriented PVC (PVC-O), contribute significantly to their market adoption.

Key driving factors accelerating market growth include rapid global urbanization, which necessitates expanding municipal water and sanitation infrastructure, and the massive ongoing efforts in developed economies to replace aging, leak-prone pipelines (often cast iron or asbestos cement). Additionally, increasing governmental investments in sustainable water management, aimed at reducing non-revenue water (NRW) losses, fuel demand for durable, leak-tight piping materials such as HDPE and ductile iron. The rising need for energy infrastructure, especially in emerging economies, further drives demand for high-pressure steel pipes used in hydrocarbon transport, solidifying the critical role of this market segment within global infrastructure development.

Pressure Pipe Market Executive Summary

The Pressure Pipe Market trajectory is defined by a convergence of sustainability mandates, technological innovation in materials, and large-scale infrastructure renewal initiatives. Business trends indicate a shift towards plastic pipes (PVC and HDPE) due to their excellent corrosion resistance, lower installation costs, and flexibility, especially in water utilities. However, ductile iron and steel maintain dominance in large-diameter, high-pressure, or structurally sensitive applications like major transmission mains and specialized oil and gas lines. Market competition is intensifying, driven by multinational corporations focusing on vertical integration and acquiring specialized regional manufacturers to optimize supply chain resilience and expand geographical reach, particularly into fast-growing regions like the Asia Pacific.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented infrastructure development, large-scale public sanitation projects in countries like India and China, and booming industrialization. North America and Europe are characterized less by expansion and more by replacement and rehabilitation efforts, focusing on smart pipe systems integration and addressing aging water infrastructure crises. Furthermore, the Middle East and Africa (MEA) exhibit strong demand, particularly for large diameter desalination transmission pipes and energy pipelines, driven by high oil and gas investments and severe water scarcity challenges requiring robust transfer systems.

Segment trends reveal that the water and wastewater application segment consistently holds the largest market share, directly linked to municipal population growth and mandated environmental regulations requiring efficient waste disposal. Material-wise, the plastic segment is expanding fastest due to continuous material improvements enhancing pressure capabilities and longevity. Within the type segment, buried installation pipes account for the majority of installations, emphasizing the ongoing focus on large-scale distribution networks. Key strategic priorities for market participants include developing materials with enhanced resistance to chemical degradation and implementing advanced manufacturing techniques to improve pipe joint integrity and installation speed, directly addressing common failure points in existing networks.

AI Impact Analysis on Pressure Pipe Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Pressure Pipe Market centers predominantly on how AI can enhance operational efficiency, minimize catastrophic failures, and extend the asset lifespan of vast pipe networks. Users frequently inquire about the feasibility of AI-driven predictive maintenance schedules, automated leak detection using sensor data, and optimizing pipeline routing and design for complex urban environments. The core themes revolve around transitioning from reactive maintenance to proactive asset management, maximizing return on investment in new infrastructure, and leveraging large datasets generated by Supervisory Control and Data Acquisition (SCADA) systems and IoT sensors for real-time risk assessment. Expectations are high that AI will significantly reduce non-revenue water losses and improve the accuracy of infrastructure integrity monitoring.

- Predictive Maintenance: AI algorithms analyze historical performance data, material stress readings, and environmental factors (e.g., soil stability, temperature fluctuations) to predict potential pipe failures before they occur, allowing for timely, targeted repairs.

- Automated Leak Detection: Utilizing machine learning to process acoustic sensors, pressure variations, and flow data in real-time to pinpoint the exact location of leaks, drastically reducing search time and water loss.

- Optimized Design and Installation: AI tools process vast geographical and subterranean data to optimize pipe routing, minimize excavation complexities, and select the most cost-effective and structurally appropriate pipe material for specific environmental conditions.

- Infrastructure Digital Twins: Creation of comprehensive digital models of entire pipe networks, powered by AI, enabling simulation of various stress scenarios, operational changes, and the impact of extreme weather events.

- Enhanced Security and Monitoring: AI provides advanced anomaly detection for unauthorized tapping, pipeline intrusion, or security breaches, particularly crucial for high-value oil and gas pipelines.

DRO & Impact Forces Of Pressure Pipe Market

The dynamics of the Pressure Pipe Market are shaped by a strong interplay between infrastructure needs (Drivers), high capital expenditure (Restraints), and the transition towards smart water systems (Opportunities). Drivers include aggressive global urbanization requiring immediate infrastructure build-out, the critical need for replacing aging infrastructure in mature economies to prevent failures, and governmental regulations mandating improved water quality and reduction of non-revenue water. Restraints typically involve the significant initial capital investment required for large-scale pipeline projects, lengthy regulatory approval processes, and volatility in raw material prices, particularly steel and polymer resins, which directly impacts manufacturing costs and project budgeting.

Opportunities for growth are concentrated in adopting trenchless technologies (e.g., horizontal directional drilling, pipe bursting) that minimize disruption and reduce installation costs in dense urban areas, the increasing implementation of smart sensors and IoT devices integrated into pipe networks for enhanced monitoring, and the development of new high-performance, sustainable materials like bio-based or recycled polymers. Impact Forces are primarily driven by macro-economic factors such as global interest rates affecting infrastructure financing, strict environmental and safety regulations defining material standards (e.g., lead-free requirements), and technological advancements in jointing methods that ensure long-term hydraulic integrity.

The balance of these forces creates a highly competitive environment where product innovation and project execution capabilities are paramount. The market leans towards long-term resilience, favoring manufacturers who can provide certified, durable products integrated with digital solutions. The pressure to reduce environmental impact also acts as a powerful force, pushing the industry towards energy-efficient manufacturing processes and materials that minimize lifecycle carbon footprint, ultimately stabilizing demand by linking infrastructure replacement directly to sustainability goals.

Segmentation Analysis

The Pressure Pipe Market is comprehensively segmented based on material type, application, type of installation, and diameter range, allowing for granular analysis of demand patterns across different infrastructure needs. Understanding these segments is crucial as material selection often dictates project feasibility, longevity, and cost structure. The application segmentation, particularly differentiating between municipal water utilities, industrial use, and oil & gas transport, reveals distinct performance requirements and regulatory landscapes. Market players must tailor their offerings—whether high-pressure steel pipes for energy or corrosion-resistant plastic pipes for sanitation—to effectively address these varied segmental demands and capitalize on targeted growth pockets within the global market.

- By Material:

- Ductile Iron Pipe (DIP)

- Plastic Pipe (PVC, HDPE, MDPE, PEX, ABS, PP)

- Steel Pipe (Carbon Steel, Stainless Steel)

- Concrete Pipe (PCCP, RCRP)

- Others (Fiberglass, Clay)

- By Application:

- Water Supply and Distribution (Potable Water)

- Wastewater and Sewage (Force Mains)

- Oil and Gas (Transmission and Distribution)

- Industrial Applications (Chemical Processing, Mining)

- Agriculture (Irrigation Systems)

- By Installation Type:

- Buried Installation

- Above-Ground Installation

- By Diameter:

- Small Diameter (Up to 18 inches)

- Medium Diameter (18 to 48 inches)

- Large Diameter (Above 48 inches)

Value Chain Analysis For Pressure Pipe Market

The value chain for the Pressure Pipe Market begins with complex upstream activities, including the extraction and processing of raw materials such as iron ore, scrap steel, crude oil derivatives for plastics (resins and polymers), and cement/aggregates for concrete pipes. Efficiency and stability at this stage are paramount, as raw material costs constitute a significant portion of the final product price. Key upstream players are major commodity producers and specialized chemical manufacturers supplying high-grade resins like polyethylene and PVC compounds. Suppliers must adhere to stringent quality control standards as the integrity of the raw materials directly impacts the pressure rating and corrosion resistance of the final pipe product. Price fluctuations in key commodities, particularly steel and petrochemicals, introduce significant cost variability and inventory management challenges across the value chain.

The midstream focuses on manufacturing and fabrication, where companies transform raw materials into finished pressure pipes and fittings using processes like extrusion, centrifugal casting, rolling, and welding. This stage involves complex engineering to meet specific international standards (e.g., AWWA, ISO, ASTM) regarding pressure capacity, wall thickness, and joint mechanisms. Distribution channels are varied, incorporating direct sales for major infrastructure projects (often requiring bespoke solutions and detailed engineering support) and indirect channels utilizing regional distributors, specialized wholesalers, and construction material retailers for smaller projects and maintenance needs. Effective logistics management is critical due to the large, bulky, and heavy nature of pressure pipes, requiring specialized transportation and warehousing infrastructure.

Downstream activities center on installation, integration, and final operation. This stage involves civil engineering firms, specialized pipe laying contractors, and utility operators who manage the pipelines throughout their service life. Direct distribution is common for large municipal tenders or energy pipeline projects where manufacturers work closely with Engineering, Procurement, and Construction (EPC) companies. Indirect distribution through specialized regional suppliers helps contractors access standard fittings and smaller-diameter pipes quickly for routine repairs and smaller utility extensions. The value chain concludes with maintenance and end-of-life considerations, increasingly involving smart monitoring integration and eventual rehabilitation or recycling, reinforcing the market’s move toward a circular economy model, especially for plastic and metal pipes.

Pressure Pipe Market Potential Customers

The primary consumers of pressure pipes are large-scale governmental and private entities managing extensive fluid transport networks, driven by public necessity and industrial demands. Municipal water and wastewater utilities represent the largest segment of potential customers, relying on pressure pipes for potable water transmission and sewage force mains. These organizations prioritize long-term durability, compliance with public health standards, and cost-effectiveness over a 50-to-100-year lifecycle, often leading them to choose ductile iron, PVC, or HDPE depending on the required diameter and soil conditions. Procurement is typically managed through competitive bidding processes linked to substantial, multi-year infrastructure development plans or federally funded rehabilitation programs.

Another major segment includes the Oil and Gas sector, which demands extremely high-pressure, corrosion-resistant steel pipes for upstream, midstream (pipeline transport), and downstream operations. Customers here are major national and international energy companies who require pipes that meet strict safety standards (e.g., API specifications) and can handle volatile or corrosive hydrocarbons over vast geographical distances. Their purchasing decisions are heavily influenced by geopolitical stability, energy demand forecasts, and massive capital investment cycles in new field development and intercontinental transport corridors.

Furthermore, the industrial and agricultural sectors are significant end-users. Industrial customers, including chemical manufacturing plants, power generation facilities, and mining operations, require specialized pressure pipes capable of withstanding extreme thermal cycles and chemical aggression. Agricultural customers primarily use medium- and low-pressure plastic pipes (PVC, HDPE) for large-scale irrigation systems and water conveyance, with purchasing decisions often influenced by governmental subsidies for water-efficient farming practices and the drive for increased crop yields in arid and semi-arid regions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 72.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain (PAM), Sekisui Chemical Co., Ltd., JM Eagle, Inc., Tenaris S.A., Future Pipe Industries (FPI), Aliaxis Group, Georg Fischer Ltd., Kubota Corporation, Jindal SAW Ltd., American Cast Iron Pipe Company (ACIPCO), Advanced Drainage Systems (ADS), China Lesso Group Holdings Ltd., Northwest Pipe Company, Mueller Water Products, McWane, Inc., Saudi Arabian Amiantit Company, Welspun Corp Ltd., Uponor Corporation, Pipelife International GmbH, NAPCO Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pressure Pipe Market Key Technology Landscape

The technological landscape of the Pressure Pipe Market is rapidly evolving, moving beyond traditional material science to integrate smart infrastructure solutions and advanced installation methodologies. A crucial technological advancement involves the refinement of plastic materials, specifically Molecularly Oriented PVC (PVC-O) and High-Performance Polyethylene (HPPE). PVC-O pipes offer significantly higher tensile strength and fatigue resistance compared to standard PVC, allowing for thinner walls, reduced material usage, and consequently lower transportation costs, while maintaining superior pressure capabilities. Similarly, HPPE formulations are optimizing chemical and abrasion resistance, making them preferred for challenging applications like mining slurry transport and aggressive wastewater environments. These material innovations are directly addressing the utility demand for longer service life and reduced non-revenue water (NRW) losses.

Furthermore, digital transformation is deeply embedding into the lifecycle of pressure pipes through the proliferation of Internet of Things (IoT) sensors and smart monitoring systems. Technologies such as fiber optic sensing integrated directly into the pipe wall, acoustic leak detection devices, and pressure transducers enable real-time condition assessment and anomaly detection. This transition supports predictive maintenance models, allowing utilities to precisely locate impending failures or leaks before major damage occurs, dramatically improving operational efficiency. The data gathered is increasingly fed into AI platforms (as discussed previously) to optimize operational pressure settings and forecast infrastructure needs, turning passive pipe networks into actively managed, data-rich assets.

Installation technology represents another major area of innovation. Trenchless technologies, including Horizontal Directional Drilling (HDD) and pipe bursting, are essential for infrastructure development in highly congested urban areas. These methods significantly reduce construction time, minimize surface disruption, and lower overall project costs by avoiding extensive excavation. Additionally, new jointing technologies, such as electrofusion for plastics and specialized mechanical joints for ductile iron, are enhancing the hydraulic integrity and speed of assembly, ensuring leak-free connections under high operational pressures, thereby contributing to the overall reliability and sustainability of new pipe installations globally.

Regional Highlights

The global Pressure Pipe Market exhibits distinct dynamics across key geographical regions, influenced by varying stages of economic development, regulatory frameworks, and infrastructure investment priorities.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by massive urbanization and industrial expansion, particularly in China, India, and Southeast Asian nations. Demand is high for both municipal water infrastructure expansion and new industrial pipeline projects. Governments are heavily investing in extending access to clean water and modern sanitation, creating substantial opportunities for plastic and ductile iron pipe manufacturers.

- North America: Characterized by a mature but aging infrastructure, the North American market is dominated by replacement and rehabilitation projects. The focus is strongly on upgrading existing networks to reduce substantial non-revenue water losses and improve system resiliency against extreme weather. High demand exists for high-performance materials (HDPE, PVC-O) and smart monitoring systems integration.

- Europe: Similar to North America, Europe's market centers on maintenance, replacement, and strict compliance with EU water quality directives. Western European nations prioritize sustainable solutions, including material recycling and the use of advanced composite materials. Central and Eastern Europe present growth opportunities as they modernize their legacy Soviet-era infrastructure using EU structural funds.

- Middle East and Africa (MEA): This region experiences robust demand driven by significant investments in the oil and gas industry, requiring high-specification steel pipelines. Additionally, severe water scarcity mandates investment in large-scale desalination and bulk water conveyance projects, boosting the requirement for large-diameter concrete and ductile iron pipes resistant to harsh environmental conditions.

- Latin America: Market growth is moderate but steady, fueled by ongoing efforts to improve coverage of water and sanitation services, especially in rapidly growing urban centers like Brazil and Mexico. The reliance on public sector funding means market fluctuations are often tied to national economic stability and government spending on essential utilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pressure Pipe Market.- Saint-Gobain (PAM)

- Sekisui Chemical Co., Ltd.

- JM Eagle, Inc.

- Tenaris S.A.

- Future Pipe Industries (FPI)

- Aliaxis Group

- Georg Fischer Ltd.

- Kubota Corporation

- Jindal SAW Ltd.

- American Cast Iron Pipe Company (ACIPCO)

- Advanced Drainage Systems (ADS)

- China Lesso Group Holdings Ltd.

- Northwest Pipe Company

- Mueller Water Products

- McWane, Inc.

- Saudi Arabian Amiantit Company

- Welspun Corp Ltd.

- Uponor Corporation

- Pipelife International GmbH

- NAPCO Inc.

- Westlake Chemical Corporation

- Trelleborg AB

- Aalberts NV (Henco Industries)

- Gassco AS

- Chevron Phillips Chemical Company LP

- Arkema S.A.

- Borealis AG

- Solvay S.A.

- Hanwha Solutions

- C-PLAST Group

- Viega GmbH & Co. KG

- Polyplastic Group

- Tatsuno Corporation

- Wavin B.V.

Frequently Asked Questions

Analyze common user questions about the Pressure Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials dominate the Pressure Pipe Market, and what are their primary applications?

The market is dominated by plastic pipes (PVC and HDPE), favored for municipal water distribution and sewage due to their excellent corrosion resistance and lower installation cost. Ductile Iron and Steel pipes are essential for large-diameter transmission mains and high-pressure industrial or oil/gas applications where superior structural strength and pressure rating are mandatory. Concrete pipes are typically used for very large diameter water conveyance projects.

How significant is the role of aging infrastructure replacement in driving market growth?

Aging infrastructure replacement, particularly in North America and Europe, is a major driver, representing a multi-billion dollar opportunity. Many existing networks (often 50 to 100 years old) are made of materials like cast iron or asbestos cement, suffering from high rates of breakage and leakage (non-revenue water). The necessity to replace these failing systems with modern, durable materials like HDPE and PVC-O underpins consistent demand growth in mature markets.

What are the key technological advancements affecting pipe installation and monitoring?

Key advancements include the widespread adoption of trenchless technologies (e.g., HDD and pipe bursting) which minimize environmental and traffic disruption during installation in densely populated areas. Furthermore, the integration of IoT sensors, fiber optics, and AI-driven monitoring systems is transforming pipes into smart assets, enabling predictive maintenance, real-time leak detection, and significant reductions in operational costs for utility providers.

Which geographical region offers the highest growth potential for pressure pipe manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential, primarily due to unprecedented levels of investment in new infrastructure to support rapid urbanization and industrialization. Countries like China and India are undertaking massive municipal water and sanitation projects, coupled with robust development in industrial and energy sectors, driving high demand for all material types of pressure pipes.

What impact does raw material price volatility have on the Pressure Pipe Market?

Raw material price volatility, especially concerning steel and polymer resins (derived from crude oil), significantly impacts the market. Manufacturers face challenges in maintaining stable pricing and margins, leading to increased pressure to secure long-term supply contracts or implement hedging strategies. This volatility encourages innovation in material efficiency, such as the development of PVC-O, which uses less material while achieving higher performance ratings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager