Price Comparison Websites Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432807 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Price Comparison Websites Market Size

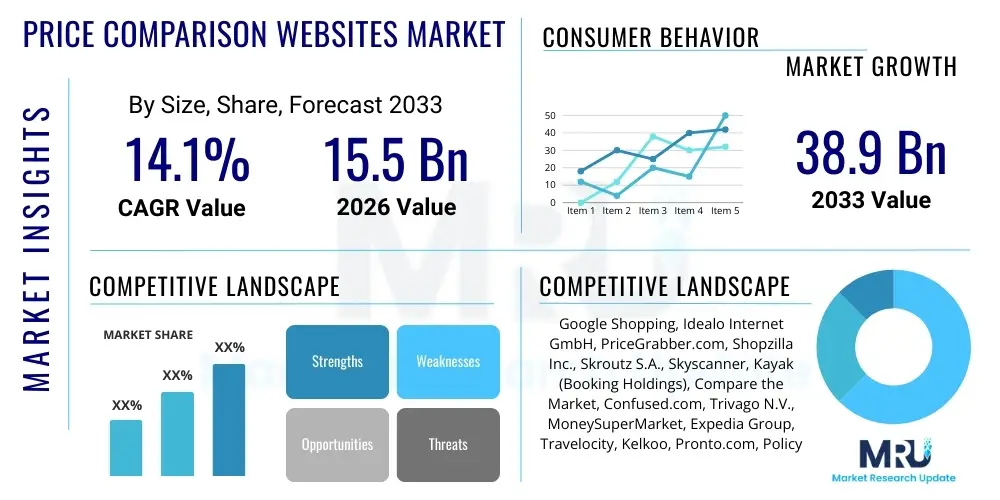

The Price Comparison Websites Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.1% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $38.9 Billion by the end of the forecast period in 2033.

Price Comparison Websites Market introduction

The Price Comparison Websites (PCW) Market encompasses online platforms and applications that aggregate pricing and product information from various retailers, service providers, and brands, allowing consumers to efficiently compare offerings before making a purchase decision. These platforms primarily serve sectors heavily reliant on digital sales, including e-commerce, travel (flights, hotels), finance (insurance, loans), electronics, and utilities. The core product offered is transparency and convenience, reducing the cognitive load on consumers by centralizing competitive data. PCWs act as crucial digital intermediaries, driving traffic and qualified leads to participating merchants while optimizing consumer spending through informed choices. The sophistication of these sites is constantly evolving, moving beyond simple static price feeds to incorporating dynamic real-time inventory checks, personalized recommendation engines, and user-generated reviews to enhance decision quality.

Major applications of PCWs span across both consumer goods and complex service procurement. In the retail sector, platforms like Google Shopping, Idealo, and PriceGrabber dominate, helping users find the best deals on physical products. Conversely, specialized sectors, such as insurance comparison (e.g., Confused.com, Policybazaar) and travel aggregators (e.g., Skyscanner, Kayak), utilize advanced algorithms to compare variable pricing structures, coverage details, and booking flexibility. The increasing adoption of mobile shopping and the persistent growth of global e-commerce have fundamentally solidified the necessity of PCWs. Consumers are habitually researching purchases across multiple channels, making comparative data aggregation an indispensable tool in the modern buying journey. The ability of these platforms to offer broad market visibility drives their essential role in the digital ecosystem.

Key driving factors accelerating the market’s expansion include the global increase in internet penetration, especially in developing economies, coupled with heightened consumer focus on value optimization and budget management. Regulatory frameworks promoting digital transparency, particularly in financial and utility services, also mandate easier access to comparative data, thereby stimulating the development of compliant and comprehensive comparison tools. Furthermore, merchants increasingly view PCWs not merely as advertising channels but as crucial components of their digital marketing mix, recognizing their efficiency in generating high-conversion traffic. Technological advancements in data scraping, machine learning for personalized pricing insights, and robust cybersecurity protocols are also propelling platform reliability and user trust, assuring sustained market momentum.

- Product Description: Aggregation platforms providing centralized, comparative pricing and product data across diverse retail and service sectors.

- Major Applications: E-commerce retail, travel and hospitality, financial services (insurance, loans), utilities, and consumer electronics.

- Benefits: Enhanced consumer transparency, optimized spending, increased efficiency in product research, and high-quality lead generation for merchants.

- Driving Factors: Exponential growth of e-commerce, increasing consumer demand for price transparency, regulatory support for comparison tools, and mobile shopping adoption.

Price Comparison Websites Market Executive Summary

The Price Comparison Websites (PCW) market is characterized by intense technological competition and rapid consolidation, driven primarily by the integration of AI-powered recommendation systems and seamless cross-platform functionality. Business trends indicate a strong movement away from general comparison sites towards highly specialized vertical comparison platforms, focusing on niche, high-value sectors like specialized insurance, B2B procurement, and complex financial derivatives. Major players are strategically acquiring smaller, regional platforms or technology startups to quickly integrate advanced features like dynamic real-time pricing and subscription management comparisons. Furthermore, the reliance on affiliate marketing models is stabilizing, with many platforms exploring alternative monetization strategies, including premium data services for retailers and enhanced direct booking options, aiming to capture higher margins throughout the transaction funnel.

Regionally, the market dynamics exhibit significant divergence. North America and Europe maintain dominance, characterized by mature e-commerce infrastructure, high digital literacy, and stringent consumer protection regulations which favor transparent comparison tools. However, the Asia Pacific (APAC) region is demonstrating the most explosive growth trajectory, fueled by rapidly expanding middle-class populations, accelerated mobile internet adoption (M-commerce), and the proliferation of local, specialized super-apps that integrate comparison services seamlessly within their ecosystems. In APAC, localization of comparison criteria, including factoring in varying logistics costs and cultural preferences, is key to market penetration. Meanwhile, Latin America and MEA are emerging as crucial growth frontiers, driven by increasing consumer awareness of global pricing standards and significant foreign investment in digital infrastructure.

Segment trends reveal that comparison services for Financial Products (Insurance and Loans) continue to hold the largest market share due to the complexity and high monetary value of these purchases, necessitating detailed comparison beyond simple price points. Conversely, the Software and Digital Services comparison segment is experiencing the highest CAGR, spurred by the surge in subscription economies (SaaS, streaming, gaming). Consumers are actively seeking tools to manage and optimize their recurring digital expenditures. Infrastructure deployment trends show a strong preference for Cloud-Based solutions over on-premise deployments, owing to the scalability, real-time data processing capabilities, and reduced operational overhead that cloud environments offer, essential for managing vast, constantly updating pricing databases.

- Business Trends: Shift towards vertical specialization, consolidation via M&A activity, exploration of non-affiliate monetization models, and strong focus on real-time data integrity.

- Regional Trends: APAC exhibiting fastest growth due to M-commerce surge; North America and Europe maintaining technological and regulatory maturity.

- Segments Trends: Financial Services dominating revenue; Software/Digital Services showing the fastest CAGR; Cloud deployment preferred for scalability.

AI Impact Analysis on Price Comparison Websites Market

Users frequently inquire about how Artificial Intelligence (AI) can move price comparison beyond simple numerical listings, focusing heavily on issues of personalization, predictive pricing, and fraud detection. Key themes revolve around the ability of AI to filter noise, interpret nuanced product differences (like insurance policy clauses or complex utility tariffs), and anticipate future price volatility, allowing users to time their purchases optimally. Consumers are also concerned about the ethics of personalized pricing based on their data profile, simultaneously expecting AI to enhance security and prevent fraudulent pricing practices by less reputable retailers. These expectations consolidate into a strong demand for 'smart comparison' tools that deliver actionable insights rather than raw data dumps, fundamentally transforming the role of the PCW from a data aggregator to a personalized purchasing advisor.

The integration of advanced AI technologies, particularly Machine Learning (ML) and Natural Language Processing (NLP), is fundamentally restructuring the competitive landscape of the Price Comparison Websites market. ML algorithms are now critical for handling the massive scale and velocity of pricing data ingestion, improving the accuracy of product mapping across disparate retailer catalogs, and detecting temporary or misleading price fluctuations. Furthermore, AI enables hyper-personalization, allowing comparison platforms to recommend products or services not just based on the lowest price, but on criteria uniquely relevant to the user’s established purchasing history, stated preferences (e.g., sustainability scores, delivery speed preferences), or previous platform interactions. This shift from one-size-fits-all sorting to individualized recommendations is a major differentiator in attracting and retaining sophisticated users.

In addition to consumer-facing enhancements, AI significantly impacts the operational efficiency and business models of PCWs. AI-driven sentiment analysis, utilizing NLP to scan millions of product reviews and forum discussions, provides instant quality scores and reputation metrics, adding a vital non-price dimension to the comparison. Predictive analytics allow platforms to forecast shifts in supply chain costs or seasonal demand, enabling them to offer predictive alerts to users—a service particularly valuable in volatile markets like travel and electronics. For the affiliate business model, AI optimizes click-through rates by ensuring that the comparison results are maximally relevant and timely, thereby improving the conversion rate for partner retailers and maximizing commission revenue for the platform itself. This continuous algorithmic refinement ensures the PCW maintains a competitive edge against search engines and direct retailer sites.

- AI-driven Personalization: Leveraging ML to offer unique product recommendations based on individual user behavior and preferences, rather than relying solely on generalized lowest price metrics.

- Predictive Pricing: Utilizing time-series analysis and forecasting models to alert users to optimal buying windows by anticipating future price increases or decreases in volatile sectors like air travel.

- Enhanced Data Integrity: Employing computer vision and advanced data parsing algorithms to accurately map complex product variations and detect pricing anomalies or fraudulent listings.

- Sentiment Analysis Integration: Analyzing user reviews and social media data via NLP to incorporate real-time quality and reputation scores into the comparison criteria.

- Automated Content Generation: Generating dynamic, AEO-optimized comparison summaries and review snippets tailored to search intent, improving organic visibility.

DRO & Impact Forces Of Price Comparison Websites Market

The Price Comparison Websites market is highly influenced by a dynamic set of driving factors (D), inherent restraints (R), and compelling opportunities (O), which collectively shape the market’s trajectory and define the competitive landscape. A primary driver is the accelerating consumer preference for digital transparency and convenience, directly tied to the exponential growth of global e-commerce. As shoppers face an overwhelming selection of products and pricing variations online, PCWs offer a necessary simplification mechanism. However, significant restraints challenge sustained growth, most notably the fierce competition from large search engine giants (like Google Shopping), which can leverage their dominant position in search results to preference their own comparison tools, potentially restricting organic traffic flow to independent PCWs. Furthermore, maintaining real-time accuracy and comprehensive coverage across millions of SKUs is a persistent technological and logistical hurdle, requiring substantial investment in scalable infrastructure.

Opportunities for market expansion are abundant, particularly through vertical specialization and geographical penetration into emerging markets. Focusing on complex, high-margin sectors such as B2B service comparisons, intricate healthcare plans, or sustainable product sourcing allows PCWs to differentiate themselves beyond simple retail pricing. The advent of open banking regulations presents a significant opportunity for fintech-focused comparison sites to access richer, transaction-level data, enabling highly customized financial product recommendations. Exploiting these niches can create defensible market positions insulated from broad e-commerce competition. Additionally, strategic partnerships with influencers and content creators can significantly enhance trust and customer acquisition in new demographics, leveraging social proof alongside data transparency.

The impact forces within this sector are predominantly shaped by technological innovation and regulatory pressure. The high impact force of technological disruption is evident through the continuous need to integrate AI for better data management and personalized insights; platforms failing to adopt these advanced capabilities risk rapid obsolescence. Regulatory impact forces, particularly those related to data privacy (GDPR, CCPA) and mandated pricing transparency in regulated industries, can either restrict operations or provide significant advantages, depending on a company’s compliance readiness and ability to leverage new data streams responsibly. Overall, market success hinges on the agility to rapidly respond to these forces, balancing aggressive technological advancement (Driver) against stringent data integrity requirements (Restraint and Opportunity), ensuring sustained consumer trust (Impact Force).

- Drivers: Accelerated e-commerce adoption; rising consumer demand for value optimization; widespread adoption of mobile internet shopping; regulatory push for digital transparency.

- Restraints: Intense competition from search engine aggregators; challenges in maintaining real-time pricing accuracy and comprehensive coverage; retailer reluctance to share proprietary data feeds.

- Opportunities: Expansion into specialized vertical markets (e.g., B2B, sustainability); leveraging Open Banking APIs for personalized financial comparisons; integration of voice search and conversational commerce capabilities.

- Impact Forces: High reliance on affiliate marketing models; significant impact of AI/ML technology adoption on operational efficiency; regulatory compliance risks concerning data privacy and advertising standards.

Segmentation Analysis

The Price Comparison Websites market is structurally segmented across multiple dimensions, including the type of offering compared, the deployment model used by the platform, the monetization strategy employed, and the geographical reach. This diverse segmentation reflects the varied consumer needs and the wide array of industries that utilize comparison tools. Understanding these segments is critical for strategic market positioning, as platforms must choose whether to pursue broad, horizontal coverage (like general retail) or narrow, deep vertical expertise (like utility or insurance comparison). The complexity of data required often dictates the best-fit technological deployment, with cloud services dominating due to scalability requirements for handling vast, real-time data feeds across different verticals.

From an offering standpoint, the market is primarily divided into product comparison (tangible goods like electronics and clothing) and service comparison (intangibles like insurance, loans, utility tariffs, and travel bookings). Service comparison segments typically command higher average revenues due to the high conversion value and the complexity of the data, which makes the PCW's contribution more indispensable to the consumer. In contrast, deployment models distinguish between the modern, scalable Cloud-Based solutions and legacy On-Premise systems. Cloud solutions are increasingly preferred as they facilitate real-time updates and integration with retailer APIs globally, meeting the demanding performance requirements of dynamic pricing environments. Monetization strategies further define market competition, primarily relying on Cost-Per-Click (CPC) affiliate fees or Cost-Per-Acquisition (CPA) commission models, though many platforms are diversifying revenue through premium subscription features or data analytics sales to merchants.

Geographical segmentation reveals that market maturity strongly correlates with digital infrastructure investment and consumer behavior. While mature markets like North America and Europe prioritize sophisticated features like predictive pricing and personalized recommendations, emerging markets in APAC and Latin America are focused on basic accessibility, mobile optimization, and localization of product data. The ongoing specialization within the comparison market is driving growth in sub-segments, such as comparing software subscriptions (SaaS) or sustainable and ethically sourced products, indicating a maturation of consumer values beyond mere price considerations. This continuous vertical differentiation ensures resilience against commoditization and strengthens the competitive position of niche players.

- By Offering Type:

- Product Comparison (Electronics, Apparel, Home Goods)

- Service Comparison (Insurance, Finance, Travel, Utilities)

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Monetization Model:

- Cost-Per-Click (CPC)

- Cost-Per-Acquisition (CPA) / Commission

- Subscription/Premium Data Services

- By End-User:

- Individual Consumers (B2C)

- Small and Medium Enterprises (SMEs)

- Large Enterprises (B2B Procurement)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Price Comparison Websites Market

The value chain for the Price Comparison Websites market begins with the Upstream activities centered around data acquisition and processing. This involves sophisticated data scraping, API integration with thousands of retailers and service providers, and robust data cleansing procedures to ensure comparability and accuracy. Key upstream participants include specialized data providers, large retail platforms offering API access, and technology vendors providing machine learning tools necessary for handling the complexity of unstructured and semi-structured pricing data. The efficiency and reliability of these upstream processes are paramount, as the platform's utility is entirely dependent on the breadth and real-time nature of its aggregated information. Weakness in the upstream phase leads directly to user distrust and competitive disadvantage.

The core midstream activity involves the actual comparison engine and platform maintenance. This stage includes algorithmic development for search ranking, personalization, user interface (UI/UX) design for optimal comparison presentation, and the computational infrastructure (mostly cloud-based) required to deliver instantaneous results. PCWs create value here by transforming raw, siloed price data into actionable market intelligence for the consumer. Distribution Channel management forms a crucial part of the value delivery, encompassing both Direct and Indirect methods. Direct distribution occurs when users navigate straight to the PCW website or app. Indirect distribution is managed primarily through search engine optimization (SEO/AEO), paid search advertising (PPC), social media channels, and strategic partnerships with content publishers and financial bloggers who drive targeted traffic to the comparison tool.

Downstream activities focus on conversion and monetization. Once the user selects an option, they are seamlessly redirected to the merchant’s website—the critical conversion point where the PCW earns its affiliate commission (CPC or CPA). Effective downstream execution requires strong contractual relationships with merchants, accurate tracking mechanisms, and continuous optimization of the referral process to minimize drop-offs. The long-term value chain concludes with feedback loops, where user interactions, conversion data, and merchant feedback are analyzed, often using AI, to refine the upstream data acquisition and midstream ranking algorithms. This continuous refinement cycle is what sustains the competitive advantage of leading comparison platforms by ensuring maximum relevance for both consumers and merchants.

Price Comparison Websites Market Potential Customers

Potential customers for Price Comparison Websites are highly diverse, spanning individual consumers seeking better deals, small businesses procuring office supplies or financial services, and large enterprises optimizing complex logistics contracts. The primary end-user segment is the B2C consumer, characterized by digital literacy and a strong inclination towards value shopping across high-frequency purchase categories like electronics, apparel, and travel. These customers utilize PCWs to reduce research time and ensure they are securing the lowest available price or the most optimal service package tailored to their specific needs. Demographic shifts, particularly the purchasing power of Millennials and Gen Z, who rely heavily on mobile devices for research, continue to expand this base, demanding mobile-first, intuitive comparison experiences.

Beyond the B2C sector, Small and Medium Enterprises (SMEs) represent a rapidly growing customer segment, especially for B2B-focused comparison sites. SMEs frequently use these platforms to compare business-critical services such, as cloud hosting providers, commercial insurance policies, utility rates, and specialized financial products (e.g., small business loans). For these enterprises, PCWs significantly streamline procurement processes, offering cost savings and ensuring compliance, often filling a void where dedicated internal procurement teams are limited. The value proposition here shifts from simple price savings to optimizing operational expenditure and reducing administrative burden, making the aggregated data an essential business intelligence tool.

Furthermore, large enterprises are increasingly using specialized B2B price intelligence and comparison services, often delivered as white-label solutions, to track competitor pricing or optimize their internal supplier contracts for complex components or services. These buyers require highly customized, real-time data feeds, often incorporating global supply chain variations and bulk pricing negotiations. For PCW providers, understanding these varying needs—from a consumer checking the price of a single gadget to an enterprise comparing global logistics contracts—is vital for tailoring platform features, data complexity, and monetization strategies to capture value across all potential customer strata.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $38.9 Billion |

| Growth Rate | 14.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google Shopping, Idealo Internet GmbH, PriceGrabber.com, Shopzilla Inc., Skroutz S.A., Skyscanner, Kayak (Booking Holdings), Compare the Market, Confused.com, Trivago N.V., MoneySuperMarket, Expedia Group, Travelocity, Kelkoo, Pronto.com, Policybazaar, LendingTree, NerdWallet, PriceRunner, Nextag. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Price Comparison Websites Market Key Technology Landscape

The technological landscape of the Price Comparison Websites market is defined by a relentless pursuit of speed, accuracy, and personalization, necessitating the deployment of cutting-edge data management and analytical tools. At the foundational level, advanced web crawling and API integration technologies are essential for data acquisition, enabling platforms to ingest structured and unstructured pricing data from thousands of sources efficiently and in real-time. Crucially, Big Data platforms, typically built on distributed computing frameworks, are required to manage the immense volume and high velocity of pricing updates. The shift to Cloud-Native architectures (utilizing AWS, Azure, or GCP) has become standard practice, providing the elasticity and scalability necessary to handle peak comparison traffic and continuously update the product catalog without performance degradation.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful technologies currently shaping the market. ML algorithms are deployed extensively for data cleansing and harmonization, critical tasks where variations in product descriptions (e.g., color, model number, specifications) across different retailers must be accurately mapped and matched for a valid comparison. Furthermore, recommendation engines utilize ML to personalize search results, going beyond simple price sorting to incorporate user-specific variables such as loyalty status, preferred shipping speeds, and historical brand affiliations. Natural Language Processing (NLP) is also integrated to analyze product reviews and specifications, adding qualitative, non-price metrics to the comparison score, significantly enhancing the depth of the insight provided to the consumer.

Beyond data processing, the user interaction layer relies heavily on sophisticated front-end technologies and performance optimization techniques. Progressive Web Apps (PWAs) and highly responsive mobile designs ensure fast loading times and a seamless user experience across all devices, crucial for capturing M-commerce traffic. Security technology is also paramount, utilizing robust encryption, secure socket layer (SSL) protocols, and advanced fraud detection systems to protect user data and ensure the legitimacy of listed prices, maintaining consumer trust. Emerging technologies, such as blockchain, are also being explored, primarily to potentially verify product authenticity and stabilize pricing data integrity across complex international supply chains, promising a new layer of trust and transparency in comparison services.

Regional Highlights

Regional dynamics within the Price Comparison Websites market demonstrate a clear division between mature and high-growth zones. North America holds a substantial market share, driven by a highly mature e-commerce ecosystem, high consumer spending, and the presence of major global tech players and sophisticated financial comparison platforms. Consumer behavior in this region is characterized by high digital literacy and the expectation of advanced features like predictive analytics and complex personalization. Robust regulatory frameworks, particularly concerning financial product transparency, further accelerate the adoption of comparison tools. The market here is highly competitive, necessitating constant technological investment to maintain differentiation and visibility against integrated solutions offered by major search engines.

Europe represents another cornerstone of the market, particularly led by countries such as the UK, Germany, and France, where specialized vertical comparison sites (especially for insurance, utilities, and travel) are deeply entrenched in consumer habits. The European market is heavily influenced by the General Data Protection Regulation (GDPR), which mandates careful handling of user data but simultaneously fosters consumer trust in compliant platforms. The drive toward seamless cross-border e-commerce within the European Union mandates comparison platforms to effectively handle multiple currencies, varying tax structures (VAT), and complex cross-country logistics comparisons. Success in Europe relies heavily on localization and strict adherence to diverse national advertising and consumer protection laws.

The Asia Pacific (APAC) region is projected to register the fastest CAGR during the forecast period. This growth is attributed to massive population bases, rapidly increasing middle-class disposable income, accelerated internet penetration—particularly mobile internet access—and lower barriers to entry for digital services. China, India, and Southeast Asian nations are key growth drivers, characterized by a preference for super-apps that bundle comparison services with messaging, payments, and commerce functionalities. Price sensitivity among APAC consumers is generally higher, making transparent comparison tools indispensable. Market strategy in APAC requires deep partnership with local e-commerce giants and optimization for mobile commerce, often prioritizing speed and integration over complex graphical data visualization.

- North America: Market maturity, high technology adoption (AI/ML), dominance in financial comparison verticals, and robust regulatory environment.

- Europe: Strong presence of specialized vertical sites (insurance/utilities), high regulatory compliance (GDPR), and complex cross-border e-commerce requirements.

- Asia Pacific (APAC): Highest growth rate driven by mobile commerce (M-commerce), massive consumer base, integration with super-apps, and strong price sensitivity.

- Latin America: Emerging market potential, rising digital adoption, focus on basic e-commerce comparisons, and growing foreign investment in digital infrastructure.

- Middle East & Africa (MEA): Growth fueled by increasing internet penetration and government initiatives aimed at digital transformation and enhanced consumer services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Price Comparison Websites Market.- Google Shopping

- Idealo Internet GmbH

- PriceGrabber.com

- Shopzilla Inc.

- Skroutz S.A.

- Skyscanner

- Kayak (Booking Holdings)

- Compare the Market

- Confused.com

- Trivago N.V.

- MoneySuperMarket

- Expedia Group

- Travelocity

- Kelkoo

- Pronto.com

- Policybazaar

- LendingTree

- NerdWallet

- PriceRunner

- Nextag

Frequently Asked Questions

Analyze common user questions about the Price Comparison Websites market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Price Comparison Websites market?

The Price Comparison Websites Market is projected to exhibit a CAGR of 14.1% between 2026 and 2033, driven primarily by accelerated global e-commerce growth and increasing consumer demand for transactional transparency.

How is Artificial Intelligence (AI) transforming the functionality of Price Comparison Websites?

AI is transforming PCWs by enabling hyper-personalization, allowing platforms to offer predictive pricing alerts, accurately harmonize complex product data across multiple merchants, and integrate non-price factors like sentiment analysis into comparison results, enhancing overall decision quality.

Which geographical region is expected to lead the market growth in the coming years?

The Asia Pacific (APAC) region is forecast to demonstrate the highest growth rate, fueled by rapid mobile internet adoption, a substantial increase in middle-class consumers, and the integration of comparison features within regional super-apps.

What are the primary monetization models used by Price Comparison Websites?

The primary monetization strategies include Cost-Per-Click (CPC) fees paid by retailers for referred traffic, Cost-Per-Acquisition (CPA) commissions for successful sales, and increasingly, premium subscription tiers offering enhanced data analytics or ad-free experiences.

What is the greatest restraint affecting the competitive landscape of the PCW market?

The most significant restraint is intense competition from major search engine aggregators, such as Google Shopping, which can leverage their dominant position in search results to potentially limit organic visibility and traffic flow for independent, specialized Price Comparison Websites.

Do PCWs primarily compare tangible products or complex services?

PCWs compare both. While tangible products (electronics, apparel) drive high volume, complex service comparisons (insurance, loans, utilities) often command higher revenue share due to the necessity for detailed analysis beyond simple pricing, driving specialization within the market.

How does the shift to cloud deployment benefit PCW providers?

Cloud deployment models provide essential benefits such as massive scalability, necessary for managing billions of data points, real-time data processing capabilities for instantaneous price updates, and reduced infrastructure overhead compared to traditional on-premise solutions.

What role do regulatory frameworks play in the PCW market, specifically in Europe?

Regulations like GDPR and consumer protection laws enforce digital transparency, compelling PCWs to ensure data accuracy and privacy. In Europe, these regulations are crucial, mandating detailed comparative disclosure, particularly for financial and utility sectors, thereby strengthening consumer reliance on compliant platforms.

Are PCWs moving towards general or vertical specialization?

The overarching trend indicates a strategic move towards vertical specialization. Platforms are increasingly focusing on niche, high-value sectors (e.g., specialized insurance, B2B software, sustainable products) to differentiate their offerings and avoid direct commoditization against large, general retail aggregators.

How important is mobile optimization for comparison websites?

Mobile optimization is critically important, particularly in high-growth regions like APAC, where mobile commerce (M-commerce) dominates consumer transactions. Platforms must prioritize fast loading speeds, intuitive mobile UI/UX, and PWA capabilities to capture this substantial traffic segment.

What is the key technological challenge in maintaining accurate comparisons?

The key technological challenge lies in data harmonization and real-time accuracy. Disparities in product naming, specifications, and pricing feed formats across thousands of global retailers require continuous, sophisticated ML algorithms to correctly map and compare diverse items accurately.

Beyond price, what factors are increasingly compared by these websites?

Modern PCWs compare critical non-price factors including retailer reputation (via sentiment analysis), delivery speed and costs, warranty details, sustainability ratings, customer reviews, and personalized criteria based on user preference history.

Who are the main potential B2B customers for comparison platforms?

Main B2B potential customers include Small and Medium Enterprises (SMEs) seeking optimized procurement for operational services (cloud hosting, utilities), and large corporations requiring specialized price intelligence and supplier contract comparison tools.

How does the value chain capture value at the downstream level?

Downstream value capture occurs primarily through affiliate commissions (CPC or CPA) earned when a user clicks through the comparison site and successfully converts (purchases or signs up) on the merchant's website, relying heavily on seamless referral tracking and high conversion rates.

What is the current estimated market size of the Price Comparison Websites sector?

The Price Comparison Websites market size was estimated at $15.5 Billion in the base year 2026, reflecting robust global digital commerce activity and consumer demand for price transparency tools.

In the segment analysis, which deployment model is most favored and why?

The Cloud-Based deployment model is most favored due to its inherent ability to provide the necessary scalability and flexibility required to process vast, constantly changing pricing datasets in real time, supporting global operations efficiently.

How do PCWs mitigate the risk of fraudulent or misleading pricing?

Leading PCWs utilize AI-driven algorithms to actively monitor and detect sudden, anomalous price fluctuations or discrepancies between advertised prices and checkout prices, flagging or filtering out potentially fraudulent or misleading retailer listings to maintain user trust.

What is the significance of Open Banking APIs for financial comparison sites?

Open Banking APIs allow financial comparison sites to access permissioned user transaction data, enabling highly accurate, personalized financial product recommendations (e.g., loans, credit cards) tailored precisely to an individual's spending and financial history.

Which factors contribute to North America’s current market dominance?

North America's market dominance is sustained by its mature digital infrastructure, high consumer spending power, significant investment in comparative financial technologies, and the strong operational presence of global technology market leaders.

What is the primary role of Natural Language Processing (NLP) in this market?

NLP is utilized to perform sentiment analysis on millions of product reviews and descriptions, allowing PCWs to extract non-numeric qualitative data, such as product reliability and customer satisfaction, and integrate it into the overall comparison score.

How are PCWs diversifying revenue beyond standard affiliate models?

Revenue diversification includes offering premium data analytics services to retailers, selling advanced market intelligence reports, and implementing subscription tiers for users who desire enhanced features like real-time stock alerts or advanced price tracking tools.

What impact does the growth of the subscription economy have on the PCW market?

The growth of the subscription economy (SaaS, streaming) creates a high-growth niche for PCWs specialized in comparing and managing recurring digital expenditures, helping consumers optimize costs and track numerous subscription services efficiently.

Why is data integrity considered a critical impact force?

Data integrity is critical because the entire value proposition of a PCW rests on the accuracy and real-time nature of its pricing data; any failure in integrity quickly erodes consumer trust and renders the comparison service unreliable and obsolete.

What role do specialized technology vendors play in the upstream value chain?

Specialized technology vendors provide crucial upstream support, offering advanced machine learning tools and specialized data parsing solutions necessary to acquire, clean, and structure the massive influx of diverse pricing and product information from various retailer sources.

How do PCWs maintain relevance against direct retail websites?

PCWs maintain relevance by offering market breadth and transparency that no single retailer can provide. They save consumers significant research time by consolidating offers from thousands of sources, providing comparative context, and integrating non-price quality metrics.

What are the key technological factors driving increased user engagement?

Increased user engagement is driven by highly personalized interfaces, intuitive mobile design, integration of conversational AI for search, and the speed and reliability of real-time data delivery, providing instant value and convenience to the user.

Why are financial comparison platforms considered the largest revenue segment?

Financial comparison platforms are the largest segment because financial products (insurance, loans) involve high monetary value, significant complexity, and high barriers to manual comparison, making the specialized aggregator service indispensable for consumers seeking optimal terms.

How does search engine optimization (SEO) relate to the distribution strategy of PCWs?

SEO/AEO is a vital indirect distribution channel, ensuring that PCW content (comparison results, reviews, guides) ranks highly for relevant transactional and informational queries, driving crucial organic traffic and reducing reliance on costly paid advertising channels.

What is the difference between a horizontal and a vertical comparison platform?

A horizontal platform compares a wide range of goods across many sectors (e.g., general retail), while a vertical platform specializes deeply in a single, complex sector, such as only insurance or only flights, offering greater depth of data and expertise within that niche.

How are PCWs addressing sustainability and ethical consumerism?

PCWs are integrating filters and metrics that compare products based on sustainability scores, ethical sourcing, carbon footprint, and corporate responsibility ratings, catering to a growing segment of consumers whose purchasing decisions are driven by values beyond price.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Price Comparison Websites (PCW) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Price Comparison Websites (PCWs) Market Statistics 2025 Analysis By Application (Customers, Retailers), By Type (Retail Products, Electronic Products), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Price Comparison Websites (PCW) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Motor Insurance, Home Insurance, Travel Insurance, Gas, Electricity), By Application (Insurance, Energy, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Price Comparison Websites (PCWS) for Insurance Industry Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Car Insurance, Home buildings Insurance, Travel insurance, Private Medical Insurance, Others), By Application (Organization, Individuals), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager