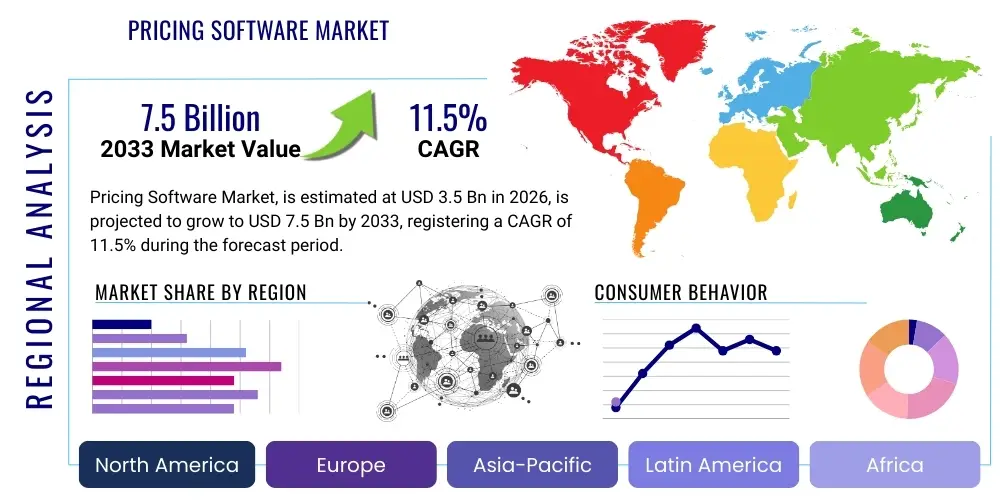

Pricing Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436389 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pricing Software Market Size

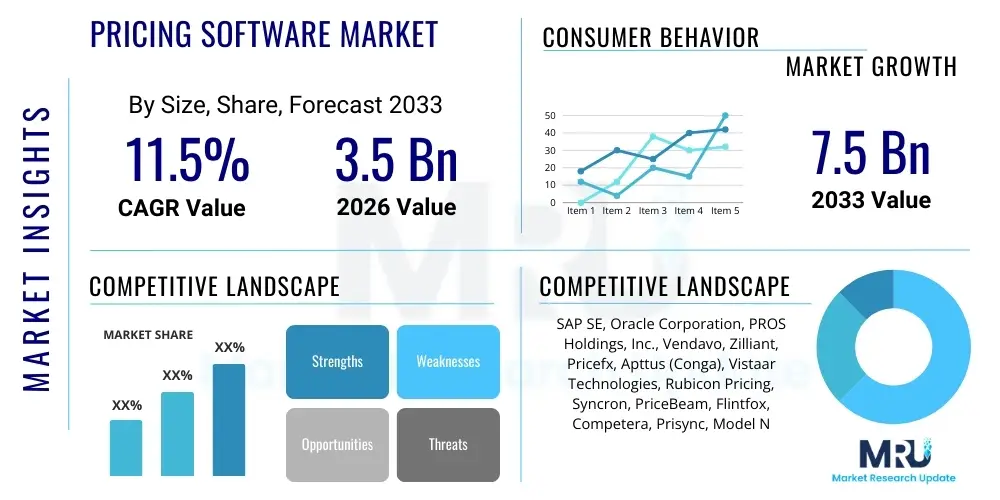

The Pricing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Pricing Software Market introduction

The Pricing Software Market encompasses sophisticated technological solutions designed to help businesses determine optimal product or service prices based on rigorous analysis of market dynamics, competitor actions, cost structures, and customer willingness to pay. These solutions transition enterprises from rudimentary, cost-plus pricing methods to highly dynamic, value-based, and data-driven strategies. Key components of this software include price optimization engines, quotation management systems (CPQ), and strategic pricing intelligence modules. The integration of advanced analytics and predictive modeling capabilities enables organizations across various sectors, particularly retail, e-commerce, manufacturing, and financial services, to enhance profitability and market penetration.

The primary applications of pricing software span across various critical business processes, including setting initial list prices, managing promotional and markdown pricing, handling contractual and discount structures, and executing real-time dynamic pricing strategies, particularly in fast-moving consumer goods and digital marketplaces. This technology delivers substantial benefits by mitigating revenue leakage, drastically improving pricing accuracy, speeding up time-to-value for new products, and ensuring price consistency across multiple sales channels. Furthermore, in environments characterized by volatile supply chains and fluctuating input costs, pricing software provides the agility required to maintain healthy margins without sacrificing competitive advantage.

Driving factors underpinning the robust growth of this market include the increasing complexity of modern pricing models, necessitated by globalized supply chains and the proliferation of digital sales channels. The rapid growth of e-commerce requires algorithmic and dynamic pricing solutions that can respond instantly to changes in inventory and competitive pricing data. Moreover, the pervasive emphasis on maximizing shareholder value and achieving precise revenue predictability is compelling chief financial officers and sales leaders to invest heavily in specialized pricing intelligence tools that offer prescriptive insights rather than mere descriptive data analysis.

- Product Description: Specialized tools for calculating optimal prices based on internal data (cost, inventory) and external factors (demand, competition).

- Major Applications: Dynamic pricing, promotional management, contract pricing, and CPQ (Configure, Price, Quote).

- Benefits: Increased margin realization, reduction in pricing errors, enhanced pricing transparency, and faster reaction to market shifts.

- Driving factors: E-commerce penetration, complexity of multi-channel distribution, demand for margin protection, and AI integration for optimization.

Pricing Software Market Executive Summary

The Pricing Software Market is experiencing a rapid evolution driven by technological convergence, primarily the blending of predictive analytics with machine learning algorithms to enable autonomous pricing decisions. Current business trends indicate a strong movement away from perpetual licensing models towards Software as a Service (SaaS) subscription-based deployments, which lowers the barrier to entry, particularly for Small and Medium-sized Enterprises (SMEs). Key enterprises are focusing on integrating pricing solutions seamlessly with existing ERP, CRM, and inventory management systems, demanding platform compatibility and robust API connectivity. Furthermore, the imperative for price transparency and regulatory compliance across international markets is influencing feature development, compelling vendors to provide audit trails and justification mechanisms for algorithmic pricing outputs.

Regionally, North America maintains the largest market share, characterized by high digital adoption rates and a significant presence of large enterprises in retail and manufacturing that were early adopters of pricing optimization technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by the explosive growth of e-commerce in countries like China and India, coupled with increasing investments in digital infrastructure and the modernization of traditional retail supply chains. Europe is showing consistent growth, driven by stringent data privacy regulations that necessitate localized and compliant pricing strategies, alongside strong demand from the automotive and heavy machinery sectors for efficient aftermarket parts pricing solutions.

Segmentation trends reveal that the deployment type segment is heavily skewed toward cloud-based solutions, capitalizing on scalability, rapid deployment, and reduced operational overhead compared to on-premise installations. Among organizational sizes, large enterprises currently account for the majority revenue, due to their intricate product portfolios and established budgetary capabilities for specialized software. Nonetheless, the SME segment is anticipated to witness accelerated adoption, driven by the increasing availability of affordable, specialized, and highly user-friendly SaaS pricing tools tailored to simpler operational requirements. Functionally, price optimization remains the most critical application segment, directly translating into tangible revenue gains for end-users, while CPQ solutions are growing due to the need for streamlined sales processes.

AI Impact Analysis on Pricing Software Market

Common user questions regarding AI's influence in the Pricing Software Market frequently center on the feasibility of fully autonomous pricing, the reliability of AI predictions under economic volatility, and the ethical implications of algorithmic bias. Users are concerned about the "black box" nature of complex machine learning models, demanding greater interpretability (Explainable AI or XAI) to justify price changes to stakeholders and regulators. They also inquire heavily about how AI handles novel product launches where historical sales data is absent, and how fast AI models can react to unprecedented competitive maneuvers or unforeseen supply chain disruptions. The consensus expectation is that AI will move pricing from predictive modeling to prescriptive optimization, handling massive datasets in real-time, but concerns about data governance and the required talent pool for model maintenance remain prevalent.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the pricing software ecosystem, shifting the focus from backward-looking historical analysis to sophisticated, forward-looking prescriptive decision-making. AI algorithms, particularly deep learning models, excel at processing the vast quantities of structured and unstructured data—including sentiment analysis from social media, competitive price scrapes, and geo-specific demand signals—that traditional statistical methods struggled to handle effectively. This capability allows pricing software to move beyond simple segmentation and historical trends to simulate millions of potential price points and assess their cumulative impact on total revenue, profit margin, and inventory turnover, vastly increasing the precision and speed of optimization.

Furthermore, AI is democratizing high-level pricing strategy, making advanced optimization techniques accessible to businesses of all sizes, rather than just large corporations with dedicated analytics teams. Generative AI tools are starting to assist in generating compelling pricing narratives and contract proposals, while ML-driven anomaly detection is crucial for identifying pricing errors or potential revenue leakage caused by incorrect discount applications. This technological shift is driving market growth by offering demonstrable Return on Investment (ROI) through improved conversion rates and reduced time spent by analysts on routine data manipulation, thereby solidifying pricing software's status as a mission-critical revenue management tool.

- Enhanced Optimization: AI models perform multivariate analysis for optimal price setting, considering elasticity and cross-product effects.

- Dynamic Real-Time Adjustments: Enables true dynamic pricing by instantly reacting to inventory levels, competitor changes, and micro-market demand shifts.

- Demand Forecasting Accuracy: Machine learning significantly improves the accuracy of demand forecasts, minimizing stock-outs and maximizing revenue potential during peak periods.

- Explainable AI (XAI): Increasing integration of XAI features to provide transparency and auditability for algorithmic pricing decisions.

- Automation of Workflow: Automates data ingestion, cleaning, and model retraining, reducing manual intervention and increasing operational efficiency.

DRO & Impact Forces Of Pricing Software Market

The Pricing Software Market is driven by the urgent corporate need to optimize profitability amidst complex market conditions, while simultaneously being restrained by technological implementation hurdles and organizational resistance to change. Significant opportunities lie in expanding market penetration into underserved verticals and adopting niche, specialized pricing solutions for unique business models, such as subscription services. These forces collectively shape the competitive landscape and dictate the pace and direction of technological innovation, influencing vendor strategic priorities toward greater automation and specialized functionality. The net impact of these forces is a positive market trajectory, favoring sophisticated cloud-based offerings that integrate seamlessly into enterprise workflows.

Key drivers include the intense global competitive pressure compelling businesses to move from intuition-based pricing to scientific, data-driven methodologies, ensuring competitive advantage without engaging in costly price wars. The shift towards e-commerce and multi-channel retailing mandates the utilization of dynamic pricing tools capable of handling vast product catalogs and variable demand patterns across disparate sales environments. Moreover, the availability of big data analytics tools and cloud infrastructure provides the necessary processing power and scalability for running complex pricing algorithms, thereby fueling technological feasibility and widespread adoption across diverse industries.

However, the market faces notable restraints, chiefly the complexity and high initial cost associated with integrating sophisticated pricing software with legacy Enterprise Resource Planning (ERP) systems, which can often be cumbersome and data-inconsistent. Organizational resistance, driven by fear of algorithmic error or displacement of existing pricing analysts, poses a significant cultural challenge to successful implementation. Opportunities abound in the burgeoning mid-market segment (SMEs), which is increasingly recognizing the competitive necessity of pricing tools but requires lower cost, faster deployment, and simplified user interfaces. Furthermore, the potential for using pricing software to manage complex global tariffs and trade agreements presents a high-value, untapped opportunity for vendors offering specialized international pricing compliance features.

- Drivers: Demand for margin optimization, proliferation of sales channels (omnichannel commerce), advancement in AI/ML capabilities, and intense competitive pressures.

- Restraints: High cost of implementation and integration with legacy systems, organizational resistance to adopting algorithmic decision-making, and concerns over data security and privacy compliance.

- Opportunity: Expansion into the SME sector, development of specialized pricing solutions for usage-based and subscription models (XaaS), and geographical expansion into high-growth APAC markets.

- Impact Forces: High impact is generated by technological advances (AI/ML), while medium-level impact stems from economic instability which heightens the need for margin protection, and low-level impact from regulatory changes that primarily affect specific regional implementations.

Value Chain Analysis For Pricing Software Market

The value chain for the Pricing Software Market begins with upstream activities focused on foundational technological components and data acquisition, moving through core platform development and rigorous testing, before culminating in downstream activities related to deployment, customization, and continuous customer support. Upstream contributors include data providers (market intelligence, competitor scraping services), cloud infrastructure vendors (AWS, Azure, GCP), and specialized AI/ML model developers. The integrity and richness of the input data are paramount, as the accuracy and effectiveness of the final pricing recommendations are directly contingent upon the quality of the data ingested by the optimization engine. Strategic partnerships at this stage ensure continuous access to high-fidelity, real-time market information.

Midstream activities involve the core software vendors who build and maintain the proprietary algorithms and user interfaces. This phase includes continuous product development, integrating features such as CPQ functionality, rebate management modules, and predictive analytics dashboards. Significant investment is allocated to cybersecurity and data compliance protocols, particularly regarding customer and transactional data. The development process emphasizes modularity and scalability, enabling customized deployments across different industry verticals, such as fine-tuning elasticity models for pharmaceutical versus retail environments. Core vendors also focus on interoperability, ensuring seamless integration with common CRM, ERP, and BI tools used by clients.

Downstream activities center on reaching the end-user and ensuring maximum value realization. The distribution channel is predominantly direct, especially for large enterprise contracts requiring extensive consultation and customized implementation services. However, indirect channels, including system integrators (SIs) and value-added resellers (VARs), play a crucial role in reaching the SME segment and providing regional expertise. Post-sales support, consulting services, and dedicated customer success teams are essential for adoption, continuous optimization, and managing organizational change. The success of the downstream phase is measured by client ROI, retention rates, and the ability of the software to adapt to the client's evolving competitive landscape.

Pricing Software Market Potential Customers

The potential customer base for pricing software is exceptionally broad, spanning any enterprise that manages a complex catalog of products or services and operates within a competitive market structure where profitability is closely tied to optimal pricing strategy. The primary end-users, or buyers, of these solutions are typically large enterprises and, increasingly, mid-market companies in sectors characterized by high transaction volumes, significant product variability, and rapidly changing input costs. Key organizational stakeholders involved in the purchasing decision often include Chief Revenue Officers (CROs), Chief Financial Officers (CFOs), VP of Sales, and dedicated Pricing Directors, highlighting the strategic importance of the software to multiple executive functions.

Traditionally, retail and e-commerce companies have been the most aggressive adopters, leveraging dynamic pricing engines to maximize daily revenue based on real-time competitor movements and fluctuating online demand elasticity. Manufacturing firms, especially those dealing with industrial components, MRO (Maintenance, Repair, and Operations) parts, or complex bill-of-materials, represent a substantial segment requiring sophisticated cost-plus and value-based pricing tools, often embedded within CPQ workflows. Beyond these core segments, the financial services sector utilizes pricing software for optimizing interest rates and loan products, while the software industry relies heavily on it for structuring complex subscription tiers and usage-based pricing models.

The burgeoning potential customer segment lies within the Small and Medium-sized Enterprises (SMEs). While historically priced out of enterprise-grade solutions, SMEs are now rapidly adopting specialized, lightweight SaaS versions that offer core optimization features without the implementation complexity or high capital expenditure. These smaller firms benefit immediately from algorithmic pricing as it levels the playing field against larger competitors. Furthermore, highly regulated industries such as healthcare and pharmaceuticals are beginning to increase adoption to ensure compliance and manage complex reimbursement structures, signaling a diversification of the end-user base and continuous market expansion across niche verticals globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, PROS Holdings, Inc., Vendavo, Zilliant, Pricefx, Apttus (Conga), Vistaar Technologies, Rubicon Pricing, Syncron, PriceBeam, Flintfox, Competera, Prisync, Model N |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pricing Software Market Key Technology Landscape

The technology landscape of the Pricing Software Market is rapidly converging around intelligent automation, driven primarily by the utilization of sophisticated cloud architectures and advancements in data science methodologies. Modern pricing platforms are built upon scalable microservices architectures hosted on public clouds, offering unparalleled elasticity required to handle peak transaction loads, such as during holiday shopping seasons or promotional periods. A foundational technology is the robust data ingestion pipeline, which uses ETL (Extract, Transform, Load) or ELT processes to consolidate disparate data sources—including competitive data scraped via APIs, CRM sales history, and supply chain cost data—into a unified data lake or data warehouse. This unified data layer is essential for training and running complex algorithmic models that require massive computational power, which cloud environments provide efficiently.

The core technological differentiator among leading vendors is the sophistication and variety of their proprietary optimization algorithms. Key technologies here include predictive analytics for demand forecasting, leveraging time series analysis and machine learning models (like Random Forests or Gradient Boosting) to estimate price elasticity of demand across various customer segments and geographies. Prescriptive analytics takes this a step further, using reinforcement learning (RL) techniques, which allows the pricing engine to iteratively test and learn optimal pricing strategies in a simulated market environment before deployment, minimizing risk and maximizing profit objectives. Furthermore, the integration of advanced visualization tools, particularly interactive dashboards and simulation sandboxes, helps users understand and trust the algorithmic recommendations, addressing the common "black box" concern through enhanced data transparency.

Emerging technologies are also shaping the market trajectory. Blockchain technology is being explored to create secure, immutable records of contractual pricing and rebate agreements, enhancing transparency and reducing disputes in complex B2B transactions. The continued evolution of natural language processing (NLP) is enabling more sophisticated CPQ capabilities, allowing sales representatives to generate highly customized quotes and contracts based on textual inputs and complex rulesets more efficiently. Finally, the shift toward hyper-personalization necessitates robust identity resolution technologies and secure data matching to ensure that individualized pricing offers are compliant and effectively targeted, positioning the technology at the intersection of marketing, sales, and financial operations management.

Regional Highlights

North America is the dominant force in the global Pricing Software Market, primarily due to the large concentration of technology vendors, the early adoption of advanced digital solutions, and the presence of numerous large retail and manufacturing conglomerates with complex pricing requirements. The region benefits from a highly mature e-commerce ecosystem that inherently demands dynamic and algorithmic pricing capabilities to remain competitive. Moreover, significant investment in enterprise software and robust regulatory environments that encourage data-driven decision-making contribute to the high market valuation. The U.S., in particular, acts as a pivotal hub for innovation, often setting the global standard for pricing optimization feature sets and integration capabilities.

Europe represents a substantial and steadily growing market, characterized by strong demand from highly regulated sectors such as automotive, pharmaceuticals, and financial services. The region's growth is often influenced by the necessity of adhering to specific pan-European and national regulations, including GDPR, which mandates careful handling and utilization of pricing data. Adoption is robust across both Western European economies, where sophisticated B2B pricing challenges exist, and increasingly in Eastern Europe, where market digitization is accelerating. Key drivers include manufacturers seeking to optimize aftermarket services pricing and retailers navigating cross-border VAT complexities, requiring granular localization capabilities in their software solutions.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, driven by rapidly expanding internet penetration, the explosive growth of mobile commerce, and increasing digital transformation initiatives across industries in emerging economies like India, Southeast Asia, and China. While adoption lags slightly behind North America in terms of overall maturity, the sheer volume of potential customers and the highly competitive nature of local markets are compelling businesses to quickly implement automated pricing tools. Government initiatives supporting digital infrastructure and the modernization of manufacturing supply chains further catalyze investment in optimization technologies throughout the region, focusing on competitive intelligence and volume-based pricing optimization.

- North America: Market leader due to high enterprise digital maturity, high penetration in retail/e-commerce, and the presence of major technology providers.

- Europe: Strong growth driven by regulatory compliance needs (e.g., GDPR) and demand from specialized B2B sectors like manufacturing and automotive aftermarket services.

- Asia Pacific (APAC): Fastest growing region, fueled by massive e-commerce expansion, urbanization, and rapid digital transformation across emerging economies.

- Latin America (LATAM): Emerging market focusing on basic cost-plus and promotional pricing optimization, with adoption concentrated in large metropolitan areas and key retail hubs.

- Middle East & Africa (MEA): Limited adoption, primarily focused on large oil & gas operations and retail chains in the Gulf Cooperation Council (GCC) nations, driven by optimization of complex contractual pricing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pricing Software Market.- SAP SE

- Oracle Corporation

- PROS Holdings, Inc.

- Vendavo

- Zilliant

- Pricefx

- Apttus (Conga)

- Vistaar Technologies

- Rubicon Pricing

- Syncron

- PriceBeam

- Flintfox

- Competera

- Prisync

- Model N

- Icertis

- Infor

- Logility, Inc.

- Tacton Systems

- Axia Price

- E-Smarter Pricing

- Pricing Solutions

Frequently Asked Questions

Analyze common user questions about the Pricing Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of dynamic pricing software?

The primary driver is the intense competition and complexity introduced by omnichannel commerce and e-commerce platforms. Businesses require real-time algorithmic tools to instantly adjust prices based on supply, demand, and competitor actions to maximize margin realization and maintain price consistency across channels.

How does AI contribute to pricing optimization beyond traditional methods?

AI, specifically machine learning and reinforcement learning, moves pricing from reactive prediction to proactive prescription. AI models analyze significantly more variables (including unstructured data) and simulate millions of outcomes to suggest the most profitable price point automatically, adapting continuously without human intervention.

What are the main implementation challenges for large enterprises adopting pricing software?

The main challenges involve integrating the new software seamlessly with fragmented or outdated legacy ERP and CRM systems. Data quality, consistency, and the organizational resistance to shifting pricing authority from human analysts to algorithmic control also present significant hurdles during deployment.

Is the Pricing Software Market dominated by cloud-based or on-premise solutions?

The market is overwhelmingly dominated by cloud-based (SaaS) solutions. Cloud deployment offers superior scalability, faster time-to-value, lower initial capital expenditure, and the necessary computational power required to run modern, complex AI-driven optimization algorithms efficiently and reliably.

Which industry vertical is projected to show the highest growth rate in pricing software adoption?

The Retail and E-commerce segment is projected to show the highest absolute adoption volume, but the Manufacturing industry is forecast to accelerate rapidly, driven by the increasing need to optimize aftermarket parts pricing and manage highly complex, configured B2B contractual pricing efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager