Print On Demand Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431805 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Print On Demand Software Market Size

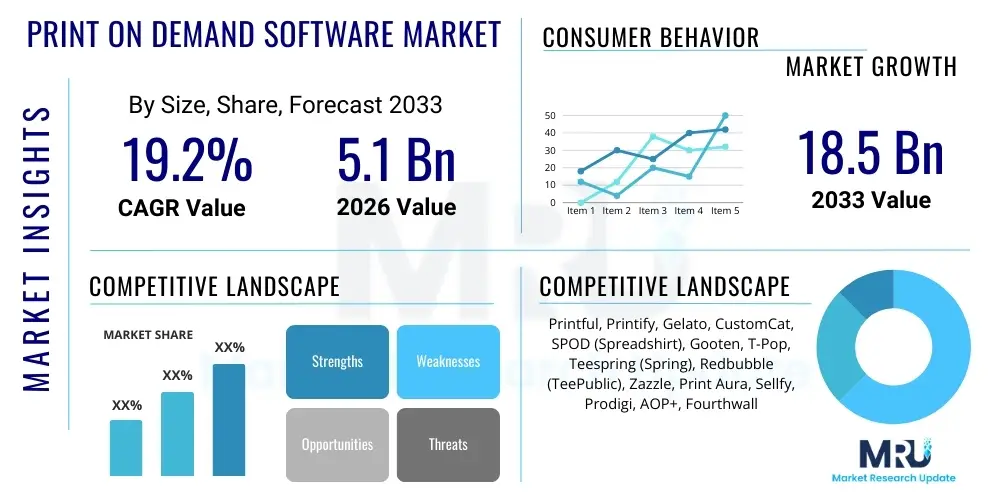

The Print On Demand Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.2% between 2026 and 2033. The market is estimated at $5.1 Billion in 2026 and is projected to reach $18.5 Billion by the end of the forecast period in 2033.

Print On Demand Software Market introduction

The Print On Demand (POD) Software Market encompasses integrated platforms and applications that facilitate the creation, customization, and fulfillment of products on a per-order basis without requiring upfront inventory investment. These robust software solutions act as middleware, connecting e-commerce storefronts (such as Shopify, WooCommerce, and Etsy) with a global network of printing and manufacturing service providers. The core offering includes design tools, order routing, automated fulfillment, inventory management, and integrated payment processing, allowing entrepreneurs, artists, and established brands to launch custom merchandise lines rapidly and efficiently. This operational model minimizes financial risk associated with unsold inventory and significantly lowers the barrier to entry for establishing a product-based e-commerce business, driving widespread adoption across various customer segments seeking personalized products.

The primary applications of POD software span a vast range of customizable products, including apparel (T-shirts, hoodies), home decor (mugs, canvas prints), accessories (phone cases, bags), and stationery. The driving factors behind the market's robust expansion are multifold, heavily influenced by the global surge in e-commerce penetration, particularly in emerging economies, and the growing consumer preference for personalized and unique products over mass-produced goods. Furthermore, the increasing sophistication of integration capabilities, such as advanced API connectivity and seamless synchronization with major marketplace platforms, enhances operational efficiency for users, solidifying POD software as an indispensable tool in the modern digital commerce ecosystem.

Key benefits derived from utilizing POD software include streamlined logistics, automated order management, and scalability without capital expenditure on production equipment or warehouse facilities. These platforms handle complex tasks such as localized production routing, ensuring orders are fulfilled by the nearest optimal print facility to minimize shipping times and costs, thereby improving the overall customer experience. The democratization of design and manufacturing capabilities, facilitated by user-friendly interfaces and robust backend infrastructure, continues to attract a diverse user base, ranging from individual content creators monetizing their audience to large corporations seeking flexible and localized merchandise solutions.

Print On Demand Software Market Executive Summary

The Print On Demand Software Market is characterized by intense technological innovation, focusing heavily on enhancing user experience through advanced design customization tools and deep integration capabilities across multiple sales channels. Current business trends indicate a significant shift towards vertical integration, where major POD platform providers are investing in optimizing their logistics networks and forging exclusive partnerships with fulfillment centers to ensure higher quality control and faster turnaround times. Furthermore, the competitive landscape is evolving beyond simple fulfillment to encompass value-added services such as advanced mock-up generators, intellectual property protection tools, and embedded marketing analytics, positioning these platforms as comprehensive business enablement suites rather than mere operational software. The adoption of subscription-based models offering tiered services is also gaining traction, catering to varying needs from nascent startups to high-volume enterprise clients.

Regionally, North America and Europe remain the dominant markets, attributed to high disposable income, mature e-commerce infrastructure, and a strong culture of digital entrepreneurship. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by the burgeoning middle class in countries like India and China, coupled with rapid mobile commerce adoption and increasing demand for personalized gifting and fashion items. Key regional trends include localized content integration and the necessity for POD platforms to support region-specific payment methods and shipping carriers. Market players are strategically expanding their global printer networks, focusing on decentralized production to mitigate geopolitical risks and optimize local delivery efficiencies, crucial for maintaining competitiveness in international markets.

Segmentation trends highlight the increasing demand for advanced software capabilities within the Enterprise segment, requiring complex API integrations, multi-store management features, and robust security protocols. By deployment type, the Cloud-based segment dominates due to its inherent scalability, low maintenance overhead, and accessibility, catering perfectly to the agile needs of e-commerce ventures. Product category segmentation reveals substantial growth in the Home Decor and Accessories sectors, moving beyond traditional apparel. The integration of Artificial Intelligence (AI) for automating design recommendations, personalized product placement, and enhanced quality assurance is defining the leading edge of segment innovation, driving higher conversion rates and reducing error margins in the fulfillment process.

AI Impact Analysis on Print On Demand Software Market

Common user questions regarding the impact of AI on the Print On Demand Software Market typically revolve around whether AI will automate creative jobs, how it can improve supply chain efficiency, and what tools are available for automatic design generation and personalization. Users frequently inquire about the accuracy of AI-driven mock-ups, the ethical implications of using generative AI for art, and how platform providers are leveraging machine learning to predict consumer trends and optimize inventory pre-positioning (even in a zero-inventory model, predicting material needs is crucial). The key themes emerging from this analysis center on operational efficiency gains, hyper-personalization capabilities, and the potential disruption of traditional graphic design workflows. Users expect AI to seamlessly handle repetitive tasks, allowing creators to focus solely on conceptualization and brand strategy, while demanding transparent and ethical AI usage guidelines from major platforms.

The practical application of Artificial Intelligence within the POD ecosystem is profoundly transforming both the front-end user experience and the back-end fulfillment operations. On the consumer-facing side, AI algorithms analyze vast datasets of consumer purchasing behaviors, seasonal trends, and demographic information to offer highly personalized product recommendations and suggest optimal design elements, colors, and placements that maximize conversion potential. This hyper-personalization capability, extending beyond simple name personalization, involves dynamic content generation based on individual browsing history, significantly enhancing customer engagement and reducing decision fatigue. Furthermore, AI-powered image processing tools can automatically verify design resolution, check for common printing errors, and adjust image parameters for various product dimensions, drastically minimizing fulfillment errors before production begins.

Operationally, AI and machine learning models are central to optimizing the complex global network of print partners. These systems utilize predictive analytics to dynamically route incoming orders to the most efficient facility based on real-time factors like raw material availability, machine downtime, current production queues, shipping costs, and customer location, ensuring the fastest and most cost-effective fulfillment path. This smart routing minimizes logistics friction and optimizes the utilization rate of printing assets across the network. Additionally, AI is being deployed in quality control through computer vision systems that inspect printed products for defects immediately post-production, offering a level of consistency and scalability in quality assurance that manual inspection cannot match, thereby substantially reducing returns and maintaining brand integrity across decentralized manufacturing locations.

- AI-driven design generation and variant suggestion based on trend prediction.

- Predictive analytics for optimal print partner selection and order routing to minimize delivery time and cost.

- Automated quality control via computer vision to detect printing defects in real-time.

- Hyper-personalization engines recommending products based on individual shopper data and history.

- Enhanced mock-up generation utilizing machine learning to create realistic 3D product visualizations.

- Optimization of pricing strategies and discount recommendations based on real-time market elasticity.

DRO & Impact Forces Of Print On Demand Software Market

The Print On Demand Software Market is principally driven by the rapid expansion of the global e-commerce sector and the democratization of entrepreneurship, catalyzed by low barriers to entry. However, the market faces significant restraints, primarily stemming from the complexity of managing a fragmented global supply chain and the challenges associated with ensuring consistent product quality across various fulfillment partners operating disparate machinery. Opportunities for growth are abundant in emerging markets, through niche specialization (e.g., sustainable POD, intellectual property management), and through the integration of cutting-edge technologies like 3D printing and blockchain for supply chain transparency. These elements—Drivers, Restraints, and Opportunities—collectively shape the Impact Forces, which dictate competitive intensity, the threat of substitution, and the bargaining power dynamics within the value chain.

The primary drivers include the inherent flexibility of the POD model, which mitigates inventory risk for businesses, making it highly attractive to micro-enterprises, small and medium-sized enterprises (SMEs), and content creators seeking monetization streams. The global shift toward customization and personalization across consumer goods further reinforces demand for robust POD software capable of handling intricate design variations efficiently. Conversely, the market is constrained by intense price competition among software providers, pressure to maintain low fulfillment costs, and potential intellectual property infringement issues that necessitate sophisticated watermarking and design protection mechanisms. Furthermore, dependency on third-party logistics and fluctuating material costs (especially cotton and specialized inks) pose persistent challenges to stable operational margins for fulfillment networks, which in turn affect the software providers.

Impact forces, derived from these DRO elements, emphasize high rivalry among existing competitors, as differentiation often relies on minor variations in platform features, API sophistication, and the sheer breadth and quality of the global fulfillment network. The bargaining power of customers (e-commerce entrepreneurs) is moderately high due to the low switching costs between competing platforms like Printful, Printify, and Gelato. The threat of new entrants remains medium; while launching a simple POD integration is easy, establishing a high-quality, globally distributed fulfillment network necessary for scale represents a significant capital and logistical barrier. The most compelling opportunities lie in addressing the demand for environmentally friendly production methods and utilizing blockchain technology to create transparent, ethical sourcing and production records, appealing to the rapidly growing segment of conscious consumers.

Segmentation Analysis

The Print On Demand Software Market is extensively segmented based on criteria such as Deployment Type, Product Type, End-User, and Application, each reflecting unique growth drivers and competitive landscapes. Analyzing these segments provides a granular view of market dynamics, revealing where investment is concentrating and which user needs are currently unmet. The foundational segmentation is pivotal for understanding market adoption, with Cloud-based solutions dominating due to their inherent elasticity and accessibility, essential characteristics for scaling e-commerce operations. Product type segmentation demonstrates a diversification away from primary apparel offerings toward higher-margin, personalized hard goods and digital products.

Segmentation by End-User distinguishes between Individual Creators/Freelancers, Small and Medium Enterprises (SMEs), and Large Enterprises. SMEs and individual creators represent the largest volume segment, valuing ease of use and low setup costs, while large enterprises require sophisticated API access, dedicated account management, and advanced security certifications. The application segmentation highlights the software's use across apparel, home decor, accessories, and digital art, with the fastest growth observed in niche applications like personalized packaging and specialized industrial printing, often requiring unique software adaptations to handle complex materials and manufacturing processes.

Further analysis within segmentation involves differentiating the software based on integration capabilities—specifically, whether they offer specialized integration for major platforms (e.g., Shopify focus, Etsy focus) or broad, open-source compatibility. This focus on seamless integration across the commerce stack dictates the total addressable market for each software provider. Understanding these nuances allows market participants to tailor their features, pricing strategies, and marketing efforts to the specific pain points and scale requirements of targeted customer groups, ensuring maximum market penetration and client retention in a highly competitive environment.

- By Deployment Type:

- Cloud-based

- On-Premise

- By Product Type:

- Apparel (T-shirts, Hoodies, Sweatshirts)

- Home Decor (Mugs, Canvas Prints, Blankets)

- Accessories (Phone Cases, Jewelry, Bags)

- Stationery and Office Supplies

- Other Personalized Goods

- By End-User:

- Individual Creators and Freelancers (Artists, Influencers)

- Small and Medium Enterprises (SMEs)

- Large Enterprises and Brands

- By Application/Channel:

- E-commerce Store Integrations (Shopify, WooCommerce)

- Marketplace Integrations (Etsy, Amazon)

- Custom API Integrations

Value Chain Analysis For Print On Demand Software Market

The value chain for the Print On Demand Software Market begins with upstream activities focused on software development and infrastructure management, followed by integration and fulfillment, culminating in the downstream interaction with the end consumer. Upstream analysis involves the continuous investment in cloud infrastructure, development of sophisticated design tools (often incorporating AI), and building comprehensive API documentation. Key stakeholders at this stage are cloud providers (AWS, Azure, Google Cloud) and specialized software engineering teams responsible for system scalability and security. The competitiveness of the software platform is fundamentally determined by the quality, reliability, and speed of its backend technological foundation, ensuring low latency and high uptime for mission-critical e-commerce operations.

The middle segment of the value chain is dominated by the management of the fulfillment network, which serves as the core differentiator for most POD software providers. This involves vetting, onboarding, and integrating numerous printing partners globally, ensuring standardized quality control protocols, and maintaining the complex algorithmic system for intelligent order routing. Distribution channels are inherently decentralized, functioning as a network of direct relationships between the software platform and multiple third-party logistics (3PL) providers and print shops. Direct distribution channels involve the user interacting solely with the platform interface, while indirect methods might include integration partners (e.g., e-commerce platform developers) who recommend or embed the POD software within their services.

Downstream activities center on marketing, sales, and customer support directed toward the end-users (e-commerce sellers). Success at this stage relies heavily on providing intuitive user interfaces, extensive educational resources (tutorials, webinars), and responsive technical support tailored to address specific fulfillment and integration issues. Furthermore, the platform's ability to facilitate seamless integration with critical business tools—such as accounting software, marketing platforms, and Customer Relationship Management (CRM) systems—enhances its perceived value. The optimization of the entire chain, from design upload to final delivery confirmation, ensures efficient transaction flow and reduces operational complexity for the e-commerce seller, thereby maximizing the lifetime value of the customer base.

Print On Demand Software Market Potential Customers

The potential customers and primary end-users of Print On Demand Software are highly diverse, spanning individual content creators to large global retail brands. The largest and fastest-growing segment consists of digital artists, social media influencers, YouTube content creators, and bloggers who utilize POD platforms as a simple, risk-free method to monetize their personal brand or audience by selling branded merchandise. For these individuals, the software serves as a complete business solution, handling inventory, manufacturing, and shipping logistics, allowing them to focus entirely on content creation and audience engagement, maximizing passive revenue generation with minimal overhead.

A second major segment comprises Small and Medium Enterprises (SMEs) and specialized niche e-commerce retailers who use POD software to rapidly test product concepts, launch seasonal collections, or offer highly customized product lines without massive initial capital investment. These businesses often require more advanced features, such as bulk order management, dedicated API access for integration with custom inventory systems, and granular control over profit margins and print quality options. For SMEs, the key value proposition is speed to market and the ability to pivot rapidly based on consumer feedback without being constrained by fixed inventory holdings.

The third, and increasingly significant, segment includes Large Enterprises and established retail brands seeking to enhance their personalization offerings or establish localized, rapid fulfillment capabilities in new geographies. Large corporations utilize POD software, often via dedicated enterprise APIs, for corporate gifting, employee uniforms, event merchandise, or to support localized marketing campaigns. They require robust uptime, enterprise-grade security, comprehensive data reporting, and reliable Service Level Agreements (SLAs), focusing heavily on integrating the POD workflow directly into their existing enterprise resource planning (ERP) and supply chain management systems to maintain brand consistency and operational control across a distributed manufacturing model.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.1 Billion |

| Market Forecast in 2033 | $18.5 Billion |

| Growth Rate | 19.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Printful, Printify, Gelato, CustomCat, SPOD (Spreadshirt), Gooten, T-Pop, Teespring (Spring), Redbubble (TeePublic), Zazzle, Print Aura, Sellfy, Prodigi, AOP+, Fourthwall |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Print On Demand Software Market Key Technology Landscape

The technological backbone of the Print On Demand Software Market is built upon robust cloud infrastructure, advanced Application Programming Interfaces (APIs), and sophisticated automation workflows designed for mass customization and decentralized manufacturing. Cloud technology, primarily utilizing microservices architecture, ensures high scalability and reliability, enabling platforms to handle massive fluctuations in order volume, particularly during peak holiday seasons or major marketing events. Essential technological features include real-time order tracking, complex algorithmic routing systems that intelligently match orders to the best-suited printer based on product type, location, and capacity, and integrated secure payment gateways capable of handling multi-currency transactions across a global network of partners and customers, providing a seamless financial reconciliation process.

A critical component of the technological landscape is the quality and stability of the APIs offered by the major software providers. High-fidelity APIs allow e-commerce sellers to deeply integrate the POD functionality directly into their custom storefronts, ERP systems, or mobile applications, moving beyond simple plug-and-play integrations. These APIs facilitate two-way data synchronization, enabling dynamic product creation based on external data inputs, personalized inventory updates, and highly customized shipping rate calculations. Furthermore, advanced rendering technology, often leveraging WebGL and 3D modeling, is used to generate photorealistic mock-ups of customized products, significantly enhancing the visual merchandising aspect and reducing the need for physical samples before launching a product line.

The future technology landscape is heavily invested in automation and machine learning. Beyond AI-driven personalization, key innovations include the implementation of Digital Asset Management (DAM) systems to efficiently manage large volumes of user designs and product mock-ups, ensuring version control and consistency across all sales channels. Furthermore, the adoption of specialized printing technologies, such as Direct-to-Garment (DTG), Direct-to-Film (DTF), and advanced sublimation printing, requires constant software updates and calibration features built into the platform to maintain optimal color profiles and quality standards across the distributed manufacturing chain. Finally, incorporating blockchain technology is being explored to enhance transparency regarding sourcing and ethical production claims, satisfying the growing consumer demand for sustainable and traceable merchandise.

Regional Highlights

The global Print On Demand Software Market exhibits distinct regional dynamics driven by varying levels of e-commerce maturity, consumer spending power, and digital infrastructure readiness. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributable to the region's highly developed e-commerce ecosystem, the strong prevalence of entrepreneurial ventures leveraging platforms like Shopify and Amazon, and high consumer willingness to pay a premium for personalized and niche products. The competitive environment is characterized by sophisticated integration features, rapid deployment of AI tools for trend analysis, and continuous efforts by major players to expand their domestic fulfillment networks to guarantee next-day or two-day delivery options, which are highly valued by the North American consumer base. Regulatory environments, while generally favorable to e-commerce, necessitate robust data privacy compliance (e.g., CCPA compliance) integrated into the software architecture.

Europe represents the second-largest market, marked by significant growth driven by localized linguistic and cultural preferences, necessitating multi-lingual support and geographically tailored fulfillment strategies. Key markets like the UK, Germany, and France show high adoption rates, specifically in the fashion and luxury customization segments. A major regional trend is the heightened focus on sustainability; European consumers and regulations (e.g., EU Green Deal initiatives) are pushing POD software providers to prioritize eco-friendly printing materials, ethical sourcing, and localized production to minimize carbon footprint. This necessitates software features that allow sellers to filter fulfillment based on environmental certifications and transparently communicate the production story to the end buyer. Furthermore, navigating complex cross-border VAT and taxation rules across the EU requires specialized financial reporting features built into the core platform offerings.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. The explosive growth is primarily fueled by massive populations accessing the internet for the first time, rapid mobile commerce adoption, and the emergence of strong regional marketplaces (e.g., Shopee, Lazada). Countries such as India, China, and Southeast Asian nations present enormous untapped potential, requiring POD software providers to establish decentralized, robust print networks to overcome challenging regional logistics and infrastructure disparities. Success in APAC hinges on platform customization for local payment methods (e.g., digital wallets, COD) and integration with regional logistical partners, prioritizing cost-effectiveness alongside speed. The demand in APAC is heavily skewed toward mobile optimization and social commerce integration, as much of the consumer journey occurs on social media platforms and messaging apps.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions experiencing nascent yet promising growth. In LATAM, economic volatility and logistics challenges necessitate highly resilient and localized fulfillment strategies, often requiring partnerships with smaller, specialized carriers. Brazil and Mexico are leading the adoption curve, driven by increasing internet penetration and a rising consumer interest in personalized apparel linked to sports and cultural events. The MEA region, particularly the Gulf Cooperation Council (GCC) states, shows growing demand for personalized luxury goods and high-end home decor, driven by high disposable incomes. Market penetration in MEA is often focused on direct consumer engagement through localized cultural customization and leveraging influencer marketing, requiring software that supports Arabic interfaces and culturally sensitive design approval workflows.

- North America: Market leader due to mature e-commerce infrastructure; focus on speed, API sophistication, and complex B2B solutions.

- Europe: High growth driven by strong demand for sustainable and ethically sourced products; focus on multi-lingual support and VAT compliance.

- Asia Pacific (APAC): Fastest growth rate, driven by mobile commerce and huge consumer base; necessity for decentralized fulfillment networks and regional payment integration.

- Latin America (LATAM): Emerging market, focusing on overcoming logistical challenges; high growth in apparel customization, particularly in Brazil and Mexico.

- Middle East & Africa (MEA): Growing high-end customization segment; requirements for localized language support and secure, reliable cross-border fulfillment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Print On Demand Software Market.- Printful

- Printify

- Gelato

- CustomCat

- SPOD (Spreadshirt)

- Gooten

- T-Pop

- Teespring (Spring)

- Redbubble (TeePublic)

- Zazzle

- Print Aura

- Sellfy

- Prodigi

- AOP+ (All Over Print)

- Fourthwall

- InkedShop

- Calaméo

- TeePublic

- Society6

- Displate

Frequently Asked Questions

Analyze common user questions about the Print On Demand Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between leading Print On Demand software providers like Printful and Printify?

The primary difference lies in their operational models. Printful operates as a vertically integrated service, owning most of its fulfillment centers, ensuring tight quality control and faster, more predictable shipping. Printify, conversely, operates as a marketplace aggregator, connecting users with a vast, decentralized network of third-party print providers globally, offering greater flexibility in pricing and product variety but potentially introducing variability in quality control and shipping times depending on the chosen vendor.

How does Print On Demand software ensure consistent product quality across different global fulfillment locations?

Software providers address quality consistency through standardized production protocols and continuous vetting processes for all fulfillment partners. Leading platforms implement technology solutions, including centralized color profile management systems and AI-powered quality checks, and often conduct regular audits and performance monitoring based on defect rates and customer feedback, ensuring print output adherence to established global standards regardless of the physical location of the printer.

What is the typical profit margin attainable when selling products through Print On Demand software?

Profit margins in the POD market are highly variable, typically ranging between 15% to 40% per item, depending heavily on the base cost of the blank product, the complexity of the design (which affects printing costs), the chosen POD supplier, and the final retail price set by the seller. Optimization of margins requires sellers to leverage bulk discounts offered by the software provider and strategically select fulfillment partners nearest to their target customer base to minimize shipping expenses.

Can Print On Demand software platforms handle large enterprise volumes and B2B orders?

Yes, many major Print On Demand software providers offer dedicated enterprise solutions specifically designed to handle large-volume B2B orders. These enterprise-level offerings include custom API development for seamless integration into existing ERP or inventory systems, dedicated account management, priority fulfillment routing, and specialized security protocols necessary for handling high-value corporate orders and maintaining brand integrity across vast production requirements.

What integrations are essential for effective use of Print On Demand software in e-commerce?

Essential integrations include direct connectivity with major e-commerce platforms such as Shopify, WooCommerce, and Squarespace for seamless storefront synchronization. Crucially, integration with major marketplaces like Etsy and Amazon expands sales channels. Further necessary integrations involve payment gateways (PayPal, Stripe), inventory management systems, and marketing automation tools, all managed through the POD software's central dashboard to streamline all aspects of the e-commerce operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager