Printed Signage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433268 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Printed Signage Market Size

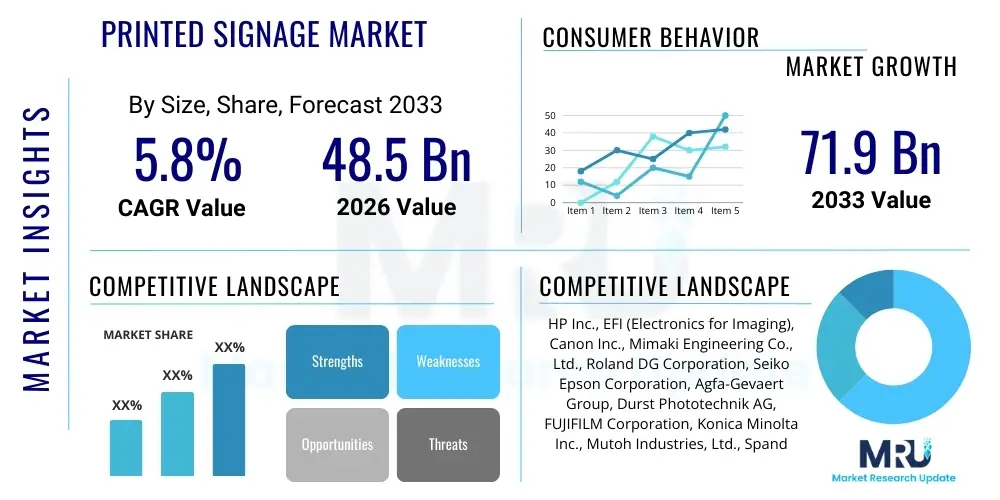

The Printed Signage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 48.5 Billion USD in 2026 and is projected to reach 71.9 Billion USD by the end of the forecast period in 2033.

Printed Signage Market introduction

The Printed Signage Market encompasses the production and deployment of visual communications materials using various wide-format printing technologies. These signs, crucial for branding, navigation, advertising, and regulatory compliance, utilize substrates ranging from flexible materials like vinyl, fabrics, and films to rigid materials such as foam boards, metals, and acrylics. The fundamental product offering includes traditional banners, posters, billboards, point-of-sale displays, vehicle wraps, and specialized architectural graphics. Historically driven by analog processes, the market has undergone a rapid transformation due to the proliferation of high-speed digital printing technologies, enabling faster turnaround times, greater customization, and higher quality output, thus maintaining relevance even amidst the rise of digital displays.

Major applications of printed signage span across diverse commercial sectors, including retail (storefront graphics, promotional displays), corporate environments (wayfinding, branding), transportation (airport and transit station notices), events and exhibitions (booth graphics, backdrops), and construction (safety and regulatory signs). The inherent benefit of printed signage lies in its pervasive visibility, cost-effectiveness for large-scale static campaigns, and resilience in various environmental conditions. Furthermore, advancements in ink technology, particularly UV-curable and latex inks, enhance the durability and eco-friendliness of the final product, addressing growing sustainability concerns among major corporate clients.

The primary driving factors sustaining the market's growth include increased global infrastructure development requiring regulatory and safety signage, the perpetual need for physical retail and corporate branding updates, and the resurgence of large-format outdoor advertising campaigns that benefit from high-resolution digital printing capabilities. Despite competition from dynamic digital displays, printed signage remains essential for cost-sensitive, permanent, and large-format installations where power access or dynamic content changes are not primary requirements. Technological refinements focused on automation, workflow efficiency, and material innovation continue to solidify the market's trajectory.

Printed Signage Market Executive Summary

The Printed Signage Market is characterized by robust resilience fueled by technological integration, specifically the adoption of sophisticated wide-format digital presses offering enhanced speed, quality, and versatility in substrate handling. Business trends indicate a strong shift toward highly personalized and short-run printing demands, pushing print service providers (PSPs) to invest in advanced automation software and finishing equipment. Key consolidation activity is observed among major manufacturers seeking to acquire specialized regional PSPs or technology firms focused on sustainable printing materials and workflow management solutions. This strategic focus is crucial for maintaining competitive edge, particularly as clients increasingly demand streamlined ordering and rapid deployment capabilities across multiple locations.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, significant investments in commercial infrastructure, and expanding retail sectors in emerging economies such as China and India. North America and Europe, though mature, continue to drive innovation, particularly in sustainable materials usage, digital-to-print workflow optimization, and the integration of augmented reality (AR) features onto printed media to create interactive experiences. Regulatory shifts concerning environmental protection and material disposal are impacting European market standards, accelerating the adoption of PVC-free and recyclable substrates across all signage applications.

Segment trends reveal that the digital printing technology segment dominates the market due to its flexibility and high productivity suitable for diverse applications. By end-user, the retail and events segment remains the largest consumer, relying heavily on temporary and promotional graphics. Material consumption is shifting towards greener alternatives, benefiting segments focused on fabrics and paper-based rigid boards over traditional vinyl. Furthermore, the increasing complexity of signage projects, requiring integration of lighting and custom fabrication, is driving growth in the services and installation segment, moving PSPs beyond simple printing into full-service visual communication partners.

AI Impact Analysis on Printed Signage Market

Common user questions regarding AI's impact on printed signage revolve primarily around automation potential, the ability of AI to personalize graphic content dynamically before printing, and the potential for AI-driven design optimization to reduce material waste and turnaround time. Users are keen to understand if AI will replace graphic designers or augment their capabilities, focusing on themes like predictive maintenance for printing hardware, intelligent inventory management of substrates, and using machine learning algorithms to analyze real-world campaign performance (e.g., foot traffic relative to sign placement) to optimize future print locations and designs. The core concern centers on efficiency improvements and how AI facilitates better integration between digital marketing insights and physical print execution.

- AI-Driven Design Automation: Utilizes algorithms to automatically generate or modify signage layouts, colors, and textual elements based on brand guidelines, specific location data, and target audience demographics, significantly speeding up the pre-press process.

- Predictive Maintenance: AI systems analyze sensor data from wide-format printers to anticipate equipment failures, schedule maintenance proactively, and minimize downtime, optimizing the operational efficiency of printing facilities.

- Intelligent Inventory Management: Machine learning models forecast demand for specific inks, substrates, and supplies, ensuring optimal stock levels, reducing holding costs, and minimizing disruptions in production chains.

- Personalized Content Generation: AI analyzes customer behavior data gathered from digital touchpoints to create highly individualized, micro-targeted printed signage content for localized marketing campaigns.

- Workflow Optimization: Automated job routing, scheduling, and error detection systems powered by AI reduce manual intervention and potential human errors in complex multi-step printing and finishing workflows.

- Quality Control Enhancement: Vision systems integrated with AI algorithms conduct real-time inspection of printed output, instantly identifying defects, color inconsistencies, or registration errors far faster and more consistently than manual checks.

- Sustainable Printing Optimization: AI models recommend optimal printing settings, substrate utilization, and nesting patterns to minimize waste material and energy consumption during the printing process.

DRO & Impact Forces Of Printed Signage Market

The Printed Signage Market's dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. A key driver is the enduring efficacy of physical advertising in attracting consumer attention in heavily digitalized environments, often leading to higher recall rates for printed static visuals. Furthermore, the continuous technological improvements in digital wide-format printing, offering quicker setup, lower operational costs for short runs, and enhanced print quality, significantly boost market accessibility and versatility. The infrastructural boom globally, particularly in retail, transportation hubs, and commercial real estate, necessitates a large volume of navigational, informational, and promotional printed graphics, providing a sustained demand floor for the industry.

Restraints primarily include the accelerating shift toward digital signage solutions, which offer dynamic content capabilities, remote updates, and lower long-term environmental impact from a materials perspective, making them attractive for high-traffic, rapidly changing environments. Additionally, the fluctuating costs of raw materials, particularly plastics and specialized coatings, alongside increasing supply chain volatility, pose significant operational and pricing challenges for PSPs. Environmental regulations imposing stricter limits on Volatile Organic Compounds (VOCs) and non-recyclable substrates also restrain traditional printing methods, forcing costly material and equipment transitions.

Opportunities reside predominantly in the realm of sustainable innovation, where the development of eco-friendly inks (latex, UV LED) and fully recyclable or compostable substrates (e.g., cardboard, textile) opens new avenues for market penetration, particularly within corporate clients committed to green initiatives. Another significant opportunity lies in the integration of printed signage with digital technologies, such as incorporating QR codes, NFC chips, or AR triggers, transforming static graphics into interactive customer experiences. The push towards industrial automation and IoT integration within printing facilities offers long-term benefits in maximizing throughput, reducing labor dependency, and achieving unprecedented levels of customization. These forces necessitate strategic investment in technology and material science to maintain relevance and capture premium market segments.

Segmentation Analysis

The Printed Signage Market is comprehensively segmented based on technology, material, product type, and end-use application, providing a detailed view of market demand and operational preferences. The market structure reflects a dominant trend towards digital methods, which offer the speed and flexibility necessary to meet modern commercial demands for highly customized, on-demand print jobs. Analyzing these segments helps in identifying niche areas of growth, such as the increasing demand for specialized security signage or the exponential rise of soft signage utilizing textile materials for events and exhibitions, which require lightweight, portable, and reusable graphics. This segmentation ensures stakeholders can tailor their strategies to specific operational needs and material innovation cycles within the industry.

- By Technology:

- Digital Printing (Inkjet, UV-curable, Latex)

- Screen Printing

- Offset Printing

- By Material:

- Fabric/Textile

- Vinyl/Plastic Film

- Paper and Paperboard

- Rigid Substrates (Foam Board, Metal, Acrylic)

- By Product Type:

- Banners and Posters

- Billboards and Display Boards

- Point-of-Sale (POS) Displays

- Vehicle Wraps

- Wall & Floor Graphics

- Others (Flags, Decals, etc.)

- By End-Use Application:

- Retail & Commercial Real Estate

- Events & Exhibitions

- Transportation & Logistics

- Corporate & Industrial

- Government & Public Sector

Value Chain Analysis For Printed Signage Market

The Printed Signage Market value chain begins with upstream activities involving raw material suppliers, primarily manufacturers of inks (pigments, solvents, resins), specialized coatings, and base substrates (PVC, fabric, paper pulp). This upstream segment is characterized by complex global supply chains and price volatility, heavily influencing the final production cost of signage. Suppliers must adhere to increasingly stringent environmental and material safety regulations, particularly concerning VOC content and recyclability. The quality and innovation at this stage directly impact the durability, visual fidelity, and sustainability credentials of the final printed product, making strategic partnerships with key material manufacturers critical for printing service providers (PSPs).

The core midstream activity involves the actual printing and finishing processes, managed by PSPs. This stage encompasses design consultation, pre-press preparation, wide-format printing (utilizing technologies like UV-curable, Latex, and solvent inkjet), and crucial post-press finishing steps such as cutting, laminating, mounting, and fabrication. Investment in highly automated, integrated printing systems is vital here for mass customization and rapid turnaround. Direct distribution involves large corporations or internal departments purchasing from a specific PSP for large, recurring projects. Indirect distribution relies heavily on brokers, graphic design agencies, and specialized trade print networks who manage the project lifecycle for end-clients but outsource the physical printing to specialized facilities.

Downstream activities center on logistics, installation, maintenance, and ultimate disposal or recycling of the signage. The distribution channel is often localized, especially for large, bespoke installations requiring specialized rigging and permits, highlighting the importance of regional service teams. Direct distribution remains strong for highly specialized industrial applications, while indirect channels thrive in the high-volume, promotional retail sector. The growth in the full-service model, where the PSP manages everything from design to installation, streamlines the customer experience and captures greater value across the chain. Analyzing the downstream segment reveals critical opportunities for providing end-of-life management services, particularly crucial in markets demanding circular economy principles.

Printed Signage Market Potential Customers

Potential customers for printed signage are highly diversified across nearly all commercial and public sectors, fundamentally comprising any entity requiring visible, physical communication for branding, information, or navigation. The largest segment remains the retail sector, encompassing chains, independent stores, and shopping centers that require high-impact promotional graphics (banners, window displays, POS materials) that often change seasonally or monthly. These customers demand flexibility, rapid prototyping, and consistent color matching across distributed locations, driving demand for technologically advanced digital printing solutions and standardized workflow platforms offered by major PSPs.

The second major group includes the corporate and events sectors. Corporate entities require permanent branding elements, internal informational displays, and wayfinding signage for large campuses and offices, often prioritizing durability and aesthetic integration with architectural design. The events and exhibitions segment demands temporary, high-volume, and often fabric-based graphics (soft signage), prioritizing ease of transport, quick setup, and reusable materials. These buyers often prioritize partners capable of providing turnkey solutions, including logistics, installation, and dismantling services, seeking efficiency in managing temporary campaigns.

Furthermore, government and public sector bodies, alongside the transportation and logistics industries, represent stable, high-volume consumers of printed signage. These customers typically require regulatory compliance signage, safety warnings, and standardized informational graphics for infrastructure projects, transit systems, and public service announcements. Procurement in this segment is often driven by rigorous standards for material longevity, resistance to environmental factors, and strict adherence to regulatory specifications, favoring PSPs with established certifications and reliable supply chains for specialized, heavy-duty substrates and inks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 48.5 Billion USD |

| Market Forecast in 2033 | 71.9 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HP Inc., EFI (Electronics for Imaging), Canon Inc., Mimaki Engineering Co., Ltd., Roland DG Corporation, Seiko Epson Corporation, Agfa-Gevaert Group, Durst Phototechnik AG, FUJIFILM Corporation, Konica Minolta Inc., Mutoh Industries, Ltd., Spandex AG, GSG (Graphic Solutions Group), 3M Company, Avery Dennison Corporation, Ricoh Company, Ltd., Kornit Digital Ltd., SwissQprint, Landa Digital Printing, Inca Digital Printers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Printed Signage Market Key Technology Landscape

The technological landscape of the Printed Signage Market is rapidly evolving, driven primarily by the maturation of industrial inkjet printing. Key technologies include UV-curable, Latex, and solvent-based inkjet systems. UV-curable technology has gained significant traction due to its ability to print on an extremely wide range of rigid and flexible materials (glass, metal, wood, plastic) without needing long drying times, curing instantly under UV lamps. This versatility makes it ideal for complex, multi-substrate signage projects. Latex printing, championed by major manufacturers, is favored for indoor applications and environmentally sensitive projects, as it uses water-based inks that are odorless and require lower curing temperatures, aligning with sustainability mandates and providing excellent image durability on flexible media like fabrics and vinyl.

Beyond the core printing engines, advanced automation and software integration define modern efficiency. Workflow management systems (WMS) and Management Information Systems (MIS) are crucial for automating job submission, scheduling, nesting (optimizing material usage), and tracking across the entire production floor. These systems leverage cloud computing and APIs to seamlessly integrate with client ordering platforms and fulfillment logistics. Furthermore, high-speed, precision finishing equipment, including automated cutting tables (e.g., CNC cutters, laser cutters) and robotic material handling systems, are essential for eliminating bottlenecks after the printing phase, ensuring that complex shapes and fabricated elements are produced accurately and quickly.

Emerging technologies focus on expanding the utility and sustainability of printed media. Research and development are concentrated on functional inks, such as conductive inks for integrating sensors or basic interactive elements directly onto the substrate, bridging the gap between static print and dynamic functionality. Furthermore, the adoption of web-to-print (W2P) platforms is fundamentally changing customer interaction, enabling remote customization and design proofing, which drives efficiencies and supports the trend towards decentralized, localized printing. This technological convergence ensures that printed signage remains a competitive, high-quality, and increasingly sustainable solution for visual communication needs.

Regional Highlights

- North America: This region represents a mature, high-value market characterized by early adoption of digital printing technologies and high demand for large-format outdoor advertising and premium retail graphics. The focus is heavily on rapid turnaround, high image quality, and robust supply chains to support massive nationwide campaigns. Key countries like the United States and Canada are leading the investment in sustainable substrates and fully automated production workflows.

- Europe: Driven by strict environmental regulations and a strong corporate commitment to sustainability, Europe is a leader in adopting eco-friendly printing practices, including water-based inks and PVC-free materials. The market is fragmented but highly sophisticated, with substantial demand coming from the exhibition, museum, and high-end fashion retail sectors. Germany, the UK, and France are critical innovation hubs focusing on smart print integration (IoT and AR).

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, massive infrastructure projects (transportation networks, commercial towers), and the expansion of organized retail chains, particularly in China, India, and Southeast Asia. The market is characterized by high volume demand and increasing investment in modern digital printing capacity to meet the scaling requirements of a growing consumer base.

- Latin America: This region exhibits significant growth potential, although market maturity varies. Economic stability improvements are driving increased investment in local advertising and infrastructure development, boosting demand for cost-effective, durable printed signage, particularly banners, billboards, and point-of-sale materials. Brazil and Mexico are the dominant markets, focusing on leveraging digital printing for flexible campaign execution.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states, driven by major real estate, tourism, and large-scale event projects (e.g., Expo, World Cup hosting). The demand is skewed towards high-durability outdoor signage designed to withstand extreme climatic conditions, alongside premium graphics for luxury retail and hospitality sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Printed Signage Market.- HP Inc.

- EFI (Electronics for Imaging)

- Canon Inc.

- Mimaki Engineering Co., Ltd.

- Roland DG Corporation

- Seiko Epson Corporation

- Agfa-Gevaert Group

- Durst Phototechnik AG

- FUJIFILM Corporation

- Konica Minolta Inc.

- Mutoh Industries, Ltd.

- Spandex AG

- GSG (Graphic Solutions Group)

- 3M Company

- Avery Dennison Corporation

- Ricoh Company, Ltd.

- Kornit Digital Ltd.

- SwissQprint

- Landa Digital Printing

- Inca Digital Printers

Frequently Asked Questions

Analyze common user questions about the Printed Signage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Printed Signage Market?

Market growth is primarily driven by global retail expansion and infrastructural development, coupled with continuous advancements in wide-format digital printing technology, which enables faster, higher-quality, and more customizable print jobs, sustaining the demand for physical advertising and navigational aids.

How is sustainability impacting material choices within printed signage?

Sustainability is a major trend, driving a significant shift away from traditional solvent-based printing and PVC substrates towards eco-friendly alternatives. This includes using water-based Latex and UV LED inks, coupled with recyclable materials such as fabrics, paperboard, and PVC-free vinyl alternatives, particularly in environmentally conscious regions like Europe.

What is the main difference between digital and screen printing in this market?

Digital printing (inkjet, UV) offers superior flexibility for short runs, variable data printing, and rapid turnaround with high color fidelity, dominating promotional and customized jobs. Screen printing, while slower, remains highly cost-effective and durable for very large volume runs requiring specific, opaque color applications, often used for industrial or long-term outdoor signage.

How does the rise of AI affect the role of Printing Service Providers (PSPs)?

AI enhances the PSP role by automating design elements, optimizing production schedules, and improving quality control through vision systems, leading to higher efficiency and reduced material waste. PSPs are evolving into full-service visual communication partners, using AI insights to better integrate physical print campaigns with digital marketing strategies.

Which end-user segment utilizes the largest volume of printed signage globally?

The Retail and Commercial Real Estate segment utilizes the largest volume of printed signage. This demand is driven by constant requirements for point-of-sale displays, seasonal promotional banners, window graphics, and general storefront branding to attract consumer attention and drive in-store traffic.

What major challenge is faced by manufacturers in the Printed Signage supply chain?

A major challenge is the volatility and complexity of the raw material supply chain. Fluctuations in the cost and availability of petroleum-derived plastics (for vinyl) and specialized chemical components for high-performance inks introduce significant cost variability and potential disruption to production timelines.

What are the key technological advancements expected to shape the market in the forecast period?

Key advancements include further integration of automation hardware and software, maturation of highly efficient UV LED curing systems, and the commercial viability of functional inks (e.g., conductive inks) that enable printed materials to incorporate basic interactive or sensing capabilities without complex electronics.

Why is the Asia Pacific region showing the highest growth rate?

The high growth in APAC is attributable to rapid economic development, massive state-funded infrastructure projects (e.g., new transit lines, government buildings), and significant expansion of organized international retail brands seeking to establish a strong physical presence across emerging markets in the region.

What is the significance of wide-format printing in this industry?

Wide-format printing is foundational to the printed signage industry, referring to printers capable of handling substrates 18 inches or wider. This technology allows for the creation of necessary large-scale products like billboards, vehicle wraps, and building banners, which traditional printing methods cannot accommodate, making it essential for high-visibility advertising.

How do vehicle wraps contribute to the Printed Signage Market?

Vehicle wraps are a crucial, high-growth segment, leveraging specialized vinyl films and digital printing. They provide cost-effective, mobile advertising that offers excellent visibility. Technological improvements in vinyl durability and ease of installation and removal have made them increasingly popular for corporate fleet branding and promotional campaigns.

What is Answer Engine Optimization (AEO) and its relevance to printed signage marketing?

AEO involves structuring digital content to directly answer user queries, ensuring high visibility in search results and AI-driven summary snippets. For printed signage firms, AEO-optimized content helps potential clients quickly find information on material comparisons, installation standards, and technical specifications, streamlining the procurement process.

What challenges do complex, multi-site retail customers pose to PSPs?

Complex retail customers require PSPs to manage large volumes of orders with variable content (localized promotions), strict brand color consistency across different printing technologies, and highly distributed fulfillment logistics. This necessitates robust workflow management systems and centralized quality control to ensure campaign uniformity nationwide.

In which sector is the demand for soft signage (textile/fabric) most prevalent?

Soft signage is most prevalent in the Events and Exhibitions sector, as well as high-end Retail. Fabric graphics are favored because they are lightweight, easier to transport, reusable, machine-washable, and often perceived as having a more premium, seamless aesthetic compared to rigid or traditional vinyl banners.

What role does lamination play in maximizing signage durability?

Lamination involves applying a protective film over the printed graphics. This process significantly increases the signage’s lifespan, protecting it from UV degradation, abrasion, moisture, and chemical exposure. It is essential for long-term outdoor applications, floor graphics, and vehicle wraps.

How are environmental regulations in Europe specifically impacting ink technology?

European regulations, particularly those concerning VOC emissions and air quality, are driving manufacturers to prioritize low-VOC alternatives. This has accelerated the shift away from conventional solvent inks towards water-based latex, eco-solvent, and UV LED inks, which offer compliance without sacrificing performance or print quality.

What is the definition of Point-of-Sale (POS) signage and its marketing function?

POS signage includes graphics placed near or at the final purchase location (e.g., checkout counter, display shelf). Its primary marketing function is to influence impulsive buying decisions, highlight special promotions, and provide immediate product information right before the transaction is completed.

How does automation benefit the finishing stage of printed signage production?

Automation in finishing, utilizing high-speed digital cutting tables and robotic handlers, ensures precise, complex cuts and routing required for customized shapes (die-cutting) far faster than manual processes. This reduces post-press labor costs, minimizes finishing errors, and accelerates the entire production cycle.

What is the current market trend regarding the choice between rigid and flexible substrates?

While flexible substrates (vinyl, fabric) dominate due to their use in high-volume banners and wraps, the demand for rigid substrates (acrylic, foam board) is rising significantly. This is driven by corporate and architectural applications requiring durable, premium-looking, and structurally sound interior and exterior displays.

How is the concept of Augmented Reality (AR) being applied to printed signage?

AR is integrated by placing scannable markers (like QR codes or visual triggers) on static signs. When scanned via a smartphone app, the sign triggers an overlay of digital content, transforming a static billboard or poster into an interactive experience that bridges the physical and digital promotional worlds.

What are the implications of high-resolution printing for the billboard segment?

High-resolution digital printing allows for complex, photographic-quality imagery on large billboards, improving visual impact and brand messaging effectiveness. It also enables quicker content changes, allowing advertisers to run more localized or time-sensitive campaigns previously restricted by the slower, costly traditional paste-up methods.

Describe the primary characteristics of UV-curable ink technology.

UV-curable inks dry instantly when exposed to UV light, eliminating drying time and allowing printing on non-porous materials like glass or metal. They offer high resistance to fading, scratching, and weather, making them highly favored for durable outdoor and industrial signage applications.

What challenges do PSPs face regarding equipment capital expenditure?

PSPs face substantial capital expenditure challenges due to the high cost of modern wide-format digital presses, finishing automation equipment, and the necessary specialized software. The rapid obsolescence of digital technology requires continuous investment to maintain a competitive edge and meet escalating demand for speed and quality.

How does the transportation sector utilize printed signage?

The transportation sector uses printed signage extensively for navigational aids (airports, subway systems, roads), safety and regulatory notices, and vehicle graphics (bus wraps, taxi decals). Durability, clarity, and compliance with strict standards are paramount for these applications.

What is the definition of a full-service visual communication partner in this market?

A full-service partner goes beyond mere printing, offering end-to-end solutions including strategic design consultation, material sourcing, pre-press optimization, high-quality printing, logistics management, professional installation, and sometimes, maintenance and removal services, simplifying the project for the end-client.

Why is localized printing gaining importance globally?

Localized printing minimizes shipping costs, reduces environmental impact related to transport, and allows for extremely fast fulfillment of market-specific or hyper-local advertising campaigns. Web-to-print technologies facilitate this trend by enabling corporate headquarters to manage distributed print orders easily.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager