Privacy as a Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437247 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Privacy as a Service Market Size

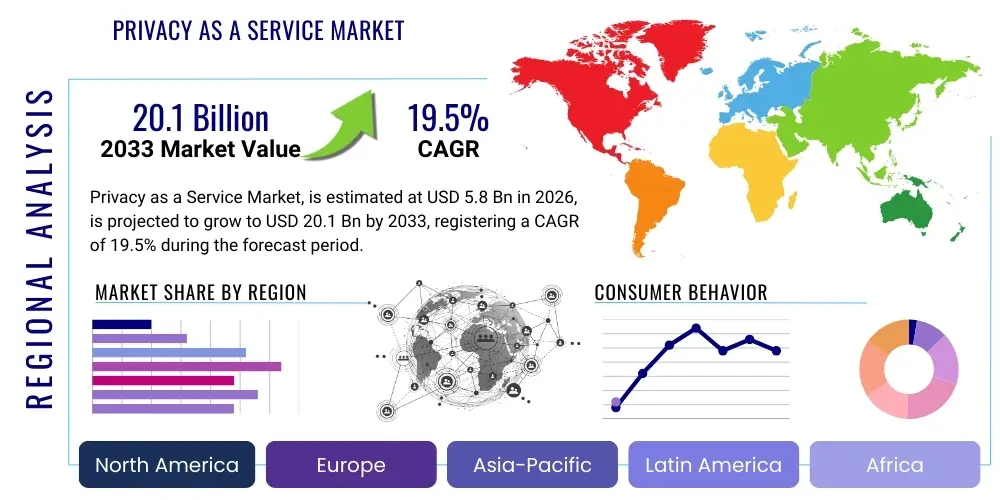

The Privacy as a Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 20.1 Billion by the end of the forecast period in 2033.

Privacy as a Service Market introduction

The Privacy as a Service (PaaS) market encompasses a specialized suite of cloud-delivered solutions designed to help organizations manage, protect, and govern sensitive data, ensuring compliance with an increasingly complex global regulatory landscape, such as GDPR, CCPA, HIPAA, and emerging regional data sovereignty mandates. This market is fundamentally driven by the need for automated compliance management, data anonymization, pseudonymization, and secure data sharing across disparate business units and third-party ecosystems. PaaS solutions provide organizations, particularly those lacking extensive internal data protection teams, with scalable, cost-effective methods to achieve ‘privacy by design’ principles, addressing risks associated with data breaches, regulatory fines, and reputational damage. The core product offering spans governance tools, data mapping solutions, consent management platforms, and robust data subject access request (DSAR) fulfillment systems, transforming compliance from a manual, reactive task into an integrated, proactive operational function.

Major applications of Privacy as a Service span diverse industrial verticals, including Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, IT and Telecommunication, Retail, and Government sectors, each facing unique requirements for consumer data protection and cross-border data transfer limitations. For instance, in BFSI, PaaS facilitates compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations while safeguarding transaction data, whereas in Healthcare, it is critical for managing Protected Health Information (PHI) under strict rules like HIPAA and HITECH. The primary benefits realized by adopting these services include enhanced operational efficiency due to automation of compliance workflows, minimized legal and financial exposure through proactive risk mitigation, and importantly, increased customer trust derived from transparent and ethical data handling practices. As data volumes explode and regulatory complexity intensifies, PaaS transitions from a niche compliance tool to an essential component of enterprise digital transformation strategy, providing the necessary infrastructure to handle data securely in cloud and hybrid environments, thereby maintaining operational continuity and market competitiveness.

Driving factors propelling the expansion of the PaaS market include the relentless globalization of business operations, necessitating standardized approaches to cross-border data transfers, and the rapid adoption of cloud computing, which introduces new vulnerabilities and compliance challenges related to data residency and third-party risk management. Furthermore, the increasing frequency and severity of large-scale data breaches have heightened executive awareness regarding the critical need for robust data protection mechanisms, fueling investment in preventive PaaS tools. Regulatory bodies globally are imposing stricter penalties for non-compliance, making the cost of ignoring privacy mandates significantly higher than the investment required for effective PaaS deployment. This regulatory pressure, coupled with growing consumer activism regarding personal data rights and algorithmic transparency, ensures sustained demand for comprehensive, scalable, and technically advanced privacy management services that leverage artificial intelligence and machine learning to automate complex tasks like data classification and risk assessment, making them viable solutions for enterprises of all sizes.

Privacy as a Service Market Executive Summary

The global Privacy as a Service (PaaS) market is experiencing robust acceleration, characterized by significant business trends focused on integration, automation, and specialized regulatory compliance. Key business trends indicate a shift towards unified privacy platforms that integrate consent management, data discovery, and DSAR fulfillment into single, streamlined interfaces, optimizing enterprise governance workflows. Mergers and acquisitions are frequent, with established cybersecurity firms acquiring niche privacy technology providers to bolster their PaaS portfolios, particularly in areas like synthetic data generation and privacy-enhancing technologies (PETs). Furthermore, the subscription model inherent to PaaS facilitates predictable revenue streams for vendors and allows businesses to scale their privacy compliance efforts dynamically without heavy capital expenditure. Technological innovation is centered on leveraging machine learning to automate data mapping across fragmented environments and improve the accuracy of risk scoring, allowing privacy teams to prioritize remediation efforts effectively. This market is demonstrating resilience against economic fluctuations, as privacy compliance remains a mandatory, non-discretionary expenditure for regulated industries.

Regionally, North America maintains market dominance, primarily due to the stringent enforcement of HIPAA, the dynamism of the U.S. consumer privacy landscape (e.g., CCPA, CPRA), and the high concentration of major technology providers and data-intensive multinational corporations based in the region. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by the introduction and maturation of comprehensive privacy laws such as China’s Personal Information Protection Law (PIPL) and the various regulations across ASEAN nations, coupled with rapid digitalization and cloud adoption across economies like India, Australia, and Singapore. Europe, already a mature PaaS market driven by the pervasive mandate of GDPR, shows sustained, steady growth focused on operationalizing cross-border data transfer mechanisms, particularly post-Schrems II, and managing the increasing complexity of data residency requirements imposed by EU member states. These regional trends underscore the global nature of privacy challenges, requiring PaaS solutions capable of handling diverse jurisdictional demands simultaneously, driving demand for multi-tenant and geographically distributed service architectures.

Segment trends highlight the critical growth within the Data Governance and Accountability segment, which includes core services like data mapping and record of processing activities (RoPA), reflecting the foundational compliance needs of most enterprises under GDPR and similar frameworks. The Services component, specifically Consulting and Managed Services, is expanding rapidly as organizations seek expert assistance not only in implementing complex PaaS platforms but also in defining privacy strategies and handling regulatory audits, a trend particularly prominent among small and medium-sized enterprises (SMEs) that lack specialized in-house legal and compliance expertise. Furthermore, the market is seeing increased adoption of vertical-specific PaaS offerings, such as those tailored for clinical trial data management in life sciences or transaction monitoring in fintech. The shift from purely defensive (e.g., breach response) to proactive and strategic privacy initiatives (e.g., differential privacy for analytics) further defines the current market trajectory, indicating a maturation in how businesses view and utilize privacy technologies—moving beyond mere compliance to competitive differentiation.

AI Impact Analysis on Privacy as a Service Market

User queries regarding the impact of Artificial Intelligence (AI) on Privacy as a Service (PaaS) market frequently center on two opposing themes: how AI enhances privacy protection and how AI itself introduces new privacy risks. Common questions revolve around the effectiveness of AI in automating DSAR processing, classifying sensitive data at scale, and identifying compliance gaps (the positive impact). Conversely, users often express concerns about 'algorithmic bias,' the privacy implications of training data used by AI models, and the need for explainable AI (XAI) within privacy solutions, especially when those solutions make critical compliance decisions. The primary user expectation is that PaaS vendors must not only incorporate AI to manage existing privacy challenges efficiently but also provide robust tools to ensure that the AI systems utilized—both their own and those deployed by clients—adhere strictly to privacy principles and evolving AI governance frameworks, such as the EU AI Act.

The integration of AI, specifically Machine Learning (ML) and Natural Language Processing (NLP), is revolutionizing the PaaS sector by dramatically improving the scalability and efficiency of key compliance functions. AI algorithms are now critical for automatically discovering and categorizing personal data across vast, unstructured data lakes and legacy systems, a task that is nearly impossible manually in modern hyper-scaled environments. For instance, NLP is used to interpret and categorize complex contractual clauses related to data sharing and privacy notices, ensuring consistency and adherence to legal requirements across global operations. This automation substantially reduces the operational overhead associated with managing millions of data subjects and complex consent settings. Moreover, AI enables predictive risk modeling, allowing organizations to anticipate potential data leakage points or policy violations before they escalate into regulatory incidents, fundamentally shifting the paradigm of privacy management from reactive reporting to proactive operational security.

However, the deployment of AI within the PaaS market also presents significant challenges that drive demand for specialized services focused on privacy-enhancing technologies (PETs). A major concern is ensuring that the algorithms used for data analysis and protection do not inadvertently expose sensitive information or lead to re-identification risks, particularly in contexts involving large datasets for research or marketing. This has spurred demand for differential privacy, federated learning, and homomorphic encryption capabilities offered through PaaS platforms, ensuring data utility is preserved while rigorous privacy safeguards are maintained. Furthermore, PaaS vendors are increasingly pressured to provide tools that audit the privacy implications of client-deployed AI systems, helping organizations manage the ethical and legal risks associated with large language models (LLMs) and deep learning applications, thereby broadening the scope of PaaS to include AI governance alongside traditional data privacy management.

- AI-driven Data Discovery and Classification: Automated identification of personal data elements (PII) across structured and unstructured data sources, enhancing compliance mapping accuracy.

- Automated DSAR Fulfillment: Use of NLP and ML to automatically locate, retrieve, redact, and deliver user data in response to access and deletion requests, drastically reducing fulfillment time.

- Privacy Enhancing Technologies (PETs): Increased adoption of differential privacy and synthetic data generation, often integrated into PaaS solutions, to enable data utility while preserving individual privacy.

- Algorithmic Transparency and Governance: PaaS platforms now include modules dedicated to auditing and documenting the decision-making processes of client-deployed AI systems for privacy compliance and bias mitigation.

- Predictive Risk Modeling: Utilization of ML to analyze vast streams of compliance data to predict and flag high-risk operational areas or policy violations before they result in breaches or fines.

DRO & Impact Forces Of Privacy as a Service Market

The Privacy as a Service (PaaS) market is primarily propelled by stringent global regulatory mandates, which act as the dominant driver, creating non-negotiable demand for sophisticated compliance tools. Restraints largely center on organizational inertia, the high initial complexity of integrating these solutions into heterogeneous IT environments, and persistent skill gaps within enterprises regarding modern privacy engineering. Opportunities lie in leveraging emerging technologies, such as blockchain for immutable consent records and PETs for secure data sharing, alongside targeting the vast market of Small and Medium-sized Enterprises (SMEs) that are increasingly subject to global regulations but lack in-house expertise. These dynamics create a powerful impact force where regulatory compliance expenditure is mandated, forcing rapid technological adoption and standardization, ultimately defining the market's accelerated growth trajectory and influencing vendor consolidation towards comprehensive, integrated platforms capable of addressing multi-jurisdictional compliance demands seamlessly and efficiently.

Drivers: The market’s momentum is fundamentally anchored by the proliferation and geographic expansion of strict privacy regulations, spearheaded by the European Union’s General Data Protection Regulation (GDPR), which set a global benchmark for data subject rights and accountability. The subsequent adoption of similar comprehensive laws, including Brazil's LGPD, California’s CCPA/CPRA, and evolving federal legislation, ensures a continuous and escalating need for automated compliance infrastructure. Beyond regulation, the rapid shift towards multi-cloud and hybrid cloud architectures introduces unprecedented complexity in data residency and sovereignty requirements, making manual tracking unsustainable. PaaS solutions provide the necessary visibility and control layers to manage data across these fragmented landscapes effectively, ensuring compliance without hindering digital transformation initiatives. Furthermore, the exponential growth in consumer awareness regarding data rights and the potential for substantial regulatory fines (often percentage-based on global revenue) elevate privacy protection from an IT function to a critical boardroom agenda, driving significant and sustained investment in PaaS solutions designed to mitigate existential business risk.

Restraints: Despite strong drivers, the PaaS market faces several structural and operational constraints. One major restraint is the organizational challenge of integrating PaaS platforms with existing, often legacy, IT infrastructure. Data fragmentation across various internal systems, databases, and third-party SaaS tools makes achieving a unified view of data lineage and sensitive data location extremely difficult, leading to protracted and costly implementation cycles. Furthermore, the lack of standardization across global privacy laws—despite their common intent—forces PaaS vendors to develop highly customizable, complex features, increasing development and deployment costs. Another significant restraint is the persistent shortage of skilled privacy professionals and privacy engineers capable of effectively deploying, managing, and optimizing these sophisticated platforms. Enterprises often struggle to bridge the gap between legal compliance requirements and the technical implementation provided by the service, leading to underutilized capabilities and reliance on expensive external consulting, thereby increasing the total cost of ownership (TCO) for comprehensive PaaS adoption.

Opportunities: Significant market opportunities are concentrated in three key areas. Firstly, the demand for privacy-enhancing technologies (PETs), such as secure multi-party computation (MPC) and homomorphic encryption, is creating a new premium segment within PaaS, enabling organizations to conduct collaborative analytics on sensitive data without exposure, unlocking significant value in healthcare research and financial crime analysis. Secondly, the enormous, relatively untapped market of Small and Medium-sized Enterprises (SMEs) presents a major growth opportunity. SMEs, while often lacking dedicated privacy officers, are increasingly subject to regulatory scrutiny due to their supply chain involvement with larger corporations. Tailored, easily deployable, and cost-effective modular PaaS offerings optimized for this segment are poised for rapid adoption. Lastly, the convergence of privacy management with broader enterprise governance, risk, and compliance (GRC) platforms allows PaaS vendors to expand their footprint, positioning privacy management not just as a compliance function but as an integrated risk intelligence capability, driving higher average contract values and broader platform utilization across enterprise functions.

Segmentation Analysis

The Privacy as a Service market is comprehensively segmented based on the component, deployment type, organization size, and vertical application, reflecting the diverse needs and operational structures of client organizations. Component segmentation typically divides the market into Solutions (software platforms, tools, and applications) and Services (consulting, managed, integration, and training), with the Services segment often showing higher short-term growth due to the complexity of initial implementation and the ongoing need for expert regulatory interpretation. Deployment segmentation distinguishes between Cloud and On-Premise models, reflecting the overwhelming preference for cloud-based PaaS due to its scalability and rapid deployment capabilities, especially for global compliance mandates. Organization size separates Large Enterprises from SMEs, acknowledging the specialized, often modular requirements of smaller entities that prioritize TCO and simplicity. Vertical segmentation highlights the industry-specific compliance demands, such as stringent data security in Healthcare and robust transaction privacy in BFSI, dictating the feature sets and regulatory focus of the solutions provided.

The Solutions segment is further refined into core functional areas, including Consent Management Platforms (CMPs), Data Subject Access Request (DSAR) Management Systems, Data Mapping and Discovery Tools, and Privacy Impact Assessment (PIA)/Data Protection Impact Assessment (DPIA) tools. The growth in DSAR management is particularly notable, driven by the operational challenge of fulfilling requests within legal deadlines, making automated solutions essential for large organizations. The Services segment, encompassing Managed Privacy Services, is vital for maintaining compliance efficacy over time, particularly as regulatory updates are frequent and require continuous adaptation of policies and technical configurations. Organizations increasingly outsource the day-to-day monitoring and reporting aspects of privacy compliance to specialized PaaS providers, allowing internal teams to focus on core business strategy rather than routine compliance operations. This dynamic ensures that both the technology platform (Solutions) and the expertise required to run it (Services) are critical and mutually reinforcing elements of the market ecosystem, ensuring holistic coverage.

From an end-user perspective, the BFSI and Healthcare sectors remain the largest consumers of PaaS, given their highly sensitive data profiles and historically strict regulatory oversight. However, the Retail and E-commerce segment is experiencing accelerated adoption due to high volumes of consumer interaction, complex digital marketing practices, and the need to manage granular consent across multiple channels for personalized services. The convergence of privacy and marketing technology (martech) is driving demand for PaaS tools that ensure marketing personalization activities remain compliant with global consumer consent rules. Ultimately, the segmentation analysis reveals a market moving toward specialized, highly customizable, and integrated platforms that can cater not only to generic regulatory mandates but also to the unique operational constraints and specific data privacy needs of individual industry verticals and enterprise sizes, maximizing compliance efficacy while minimizing operational disruption across the value chain.

- Component:

- Solutions (Platforms and Software)

- Services (Consulting, Managed Services, Integration and Implementation)

- Deployment Type:

- Cloud (Public, Private, Hybrid)

- On-Premise

- Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Application/Functionality:

- Consent Management

- Data Subject Access Request (DSAR) Management

- Data Mapping and Discovery

- Audit, Reporting, and Risk Assessment (PIA/DPIA)

- Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunication

- Healthcare and Life Sciences

- Government and Public Sector

- Retail and E-commerce

- Others (Manufacturing, Media and Entertainment)

Value Chain Analysis For Privacy as a Service Market

The Value Chain for the Privacy as a Service market begins with the upstream activities dominated by core technology providers and specialized data privacy vendors focused on developing proprietary algorithms, privacy-enhancing technologies (PETs), and foundational security architectures. This stage involves significant investment in research and development to address complex cryptographic and data governance challenges, resulting in core software modules for data masking, tokenization, and automated discovery. Key upstream partners include major cloud infrastructure providers (AWS, Azure, Google Cloud) that offer the underlying secure environments, and niche AI/ML firms specializing in data classification and algorithmic fairness tools. Success in this stage is defined by innovation, API standardization, and the ability to integrate seamlessly with diverse enterprise IT landscapes, forming the fundamental technological backbone upon which all PaaS offerings are built, ensuring both data utility and stringent regulatory adherence.

The midstream segment involves the actual delivery and integration of the PaaS solutions. This stage is dominated by specialized PaaS providers (both pure-play privacy companies and large enterprise software vendors) who bundle the upstream technologies into marketable, compliance-focused platforms. Activities here include platform development, customized deployment, continuous maintenance, and managed services. Crucially, system integrators and IT consulting firms play a pivotal role, acting as the primary distribution channel, providing implementation expertise, customization for vertical-specific regulatory needs, and ongoing governance support. These midstream players focus on optimizing user experience, ensuring interoperability between the PaaS platform and the client's existing GRC and security tools, and providing rapid response to evolving regulatory requirements, translating complex legal text into actionable technical configurations and audit trails.

Downstream activities center on the end-user adoption and consumption of the service. This involves the direct and indirect distribution channels through which the services reach the potential customers. Direct channels include vendor sales teams targeting large enterprises with complex, custom deployment needs. Indirect channels, which are increasingly vital, leverage cloud marketplaces, Managed Service Providers (MSPs), and Value-Added Resellers (VARs) to target SMEs and broader geographical markets efficiently. The downstream value is realized through continuous service consumption, including ongoing DSAR fulfillment, automated risk assessments, and compliance reporting. Customer feedback from the downstream market is critical for the upstream and midstream players to adapt their products, focusing on ease of use, cost efficiency, and specific regional compliance gaps. Ultimately, the effectiveness of the entire chain is measured by the end-user’s ability to demonstrate auditable, sustained, and holistic compliance with global privacy mandates.

Privacy as a Service Market Potential Customers

The primary consumers and potential buyers of Privacy as a Service solutions are organizations operating in highly regulated industries or those that process substantial volumes of sensitive personal data, regardless of their geographical location. End-users fall broadly into two categories: large, multinational corporations that face complex, multi-jurisdictional compliance challenges (e.g., needing to comply with GDPR, CCPA, and PIPL simultaneously), and Small and Medium-sized Enterprises (SMEs) that require outsourced expertise to navigate compliance mandates efficiently without the internal resources of a dedicated Chief Privacy Officer (CPO) and legal team. Across all sectors, the primary buyer persona often sits within the C-suite (CISO, CPO, CIO) or the Legal and Compliance Departments, driven by risk mitigation, operational efficiency, and the necessity to maintain business continuity in the face of escalating regulatory scrutiny and the threat of severe financial penalties, making PaaS procurement a strategic business investment.

Within specific verticals, the Banking, Financial Services, and Insurance (BFSI) sector represents a critical customer base, requiring PaaS for managing transaction data privacy, KYC processes, and preventing fraudulent activities while adhering to regional financial services regulations. In this sector, PaaS is essential for maintaining customer trust and meeting stringent data sovereignty rules. Similarly, the Healthcare and Life Sciences sector is a high-demand market, driven by the absolute necessity of protecting Protected Health Information (PHI) under laws like HIPAA (US) and similar standards globally. PaaS solutions specializing in pseudonymization and secure data collaboration for clinical research are highly valued by pharmaceutical companies and healthcare providers, enabling innovation while guaranteeing patient confidentiality, a requirement which translates into complex data masking needs.

Furthermore, the IT and Telecommunication industry, along with Retail and E-commerce, constitute rapidly expanding customer segments. IT companies and Telcos, due to their role as primary data handlers and cloud service providers, must implement PaaS to manage vast troves of metadata, communication records, and ensure vendor compliance throughout their complex supply chains. Retail and E-commerce companies rely heavily on personalized marketing and customer loyalty programs, making consent management and DSAR fulfillment crucial for maintaining consumer relationships and avoiding regulatory backlash related to targeted advertising practices. These companies seek PaaS solutions that integrate seamlessly with Customer Relationship Management (CRM) and marketing automation systems, ensuring that every customer interaction, from initial consent to eventual data deletion, is fully documented, auditable, and compliant with global opt-in/opt-out mandates, thereby making the technology critical to their commercial viability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 20.1 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Oracle, AWS, Google Cloud, Cisco Systems, HPE, Capgemini, Deloitte, KPMG, PwC, Informatica, OneTrust, TrustArc, BigID, Securiti.ai, Privitar, Nymity, DataGrail, Osano. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Privacy as a Service Market Key Technology Landscape

The technological underpinnings of the Privacy as a Service market are defined by a fusion of advanced cryptographic methods, artificial intelligence, and robust cloud infrastructure designed to manage data lifecycle compliance seamlessly. Core technology revolves around Privacy Enhancing Technologies (PETs), including advanced data masking, tokenization, and dynamic pseudonymization techniques, which allow organizations to minimize the exposure of raw PII while preserving data integrity and utility for analytical purposes. Tokenization replaces sensitive data with non-sensitive substitutes (tokens) that maintain all necessary information about the data without compromising the original values, a particularly critical capability in high-volume environments like credit card processing and clinical research. Furthermore, the adoption of specialized data encryption methods, such as homomorphic encryption, which allows computation on encrypted data, is transitioning from niche academic use to commercial PaaS offerings, dramatically increasing the secure data sharing capabilities within the platform.

Artificial Intelligence (AI) and Machine Learning (ML) are central to scaling the functionality of PaaS platforms, moving beyond simple rule-based compliance. AI algorithms are essential for automated data discovery and classification, accurately identifying PII, sensitive personal information (SPI), and various categories of regulated data across petabytes of unstructured content stored in diverse repositories. Machine learning models are also heavily utilized in continuous monitoring and risk assessment, analyzing usage patterns and access logs to detect potential policy violations or unauthorized data access in real-time, providing predictive insights into potential compliance breaches. Natural Language Processing (NLP) specifically streamlines the processing of Data Subject Access Requests (DSARs) by automatically parsing complex requests and identifying relevant information across documents, transforming a historically manual, labor-intensive process into a highly automated, auditable function, which is critical for meeting strict regulatory deadlines.

Infrastructure technologies, particularly the reliance on secure, scalable cloud architecture, are fundamental to PaaS delivery. Most PaaS solutions leverage the hyper-scalability and global distribution networks of major cloud providers, offering capabilities for data residency management and ensuring that data processing adheres to specific geographical sovereignty requirements. This is often supported by integrated blockchain or distributed ledger technology (DLT) for creating immutable, auditable records of consent and data processing activities. DLT provides an unalterable trail necessary for demonstrating accountability and transparency to regulatory bodies and consumers alike. The convergence of these technologies—advanced cryptography for protection, AI/ML for automation, and secure cloud/DLT for delivery and auditability—defines the competitive edge in the PaaS landscape, enabling vendors to offer comprehensive, future-proof compliance solutions.

Regional Highlights

- North America (United States and Canada): North America currently dominates the global PaaS market in terms of market size and technological innovation, primarily driven by the presence of major technology giants, a high rate of digital transformation, and the robust venture capital investment fueling specialized privacy tech startups. The U.S. market is characterized by a fragmented but powerful regulatory landscape, including state laws like the CCPA/CPRA, which necessitate flexible and geographically granular PaaS solutions. High demand exists in the financial services and healthcare sectors due to stringent federal regulations (HIPAA, GLBA). Canada's focus on modernizing its privacy framework (e.g., proposed CPPA) also contributes to sustained, sophisticated demand for enterprise-level privacy governance platforms, emphasizing automated cross-border data management between the US and Canada.

- Europe (Germany, UK, France, and Rest of Europe): Europe represents the most mature and regulatory-driven PaaS market, with growth sustained by the ongoing enforcement and interpretation of the GDPR. European companies require PaaS solutions that offer precise control over data residency, data processing agreements (DPAs), and explicit consent management that adheres strictly to Article 6 and Article 9 stipulations of GDPR. Post-Brexit, the UK maintains a strong independent regulatory position (UK GDPR), ensuring continued localized demand for PaaS. The market is particularly focused on operationalizing complex international data transfers (IDTs), especially following key legal rulings like Schrems II, requiring vendors to provide robust mechanisms like standard contractual clauses (SCCs) management tools and transfer risk assessments integrated into their platforms, driving adoption in areas beyond core compliance.

- Asia Pacific (APAC) (China, India, Japan, South Korea, Australia): APAC is the fastest-growing region for PaaS adoption, spurred by rapid digitalization, massive data creation volumes, and the introduction of new, stringent regulations such as China’s Personal Information Protection Law (PIPL) and South Korea’s Personal Information Protection Act. The challenge in APAC is managing the sheer heterogeneity of data protection laws and cultural differences across the region, necessitating highly flexible and multilingual PaaS deployments. Key drivers include rapid cloud adoption across financial and government sectors in Australia and Singapore, and massive consumer data handling by e-commerce and telecom players in India and China. The market growth here is driven less by mature enforcement and more by foundational infrastructure build-out and preventative compliance investment.

- Latin America (LATAM) (Brazil, Mexico, Argentina): The LATAM market is accelerating, largely influenced by Brazil's LGPD, which mirrors the structure and scope of GDPR. Demand is concentrated in the BFSI sector and government institutions seeking compliance frameworks to mitigate increasing risks. Challenges include lower overall enterprise spending on IT security and variable enforcement maturity across countries, although the trend is strongly positive toward compliance maturation. PaaS vendors focus on providing localized language support and cloud-based solutions accessible to SMEs, leveraging the widespread cloud adoption in major economies like Brazil and Mexico.

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa): The MEA market is niche but growing, driven by national data sovereignty initiatives and increasing foreign direct investment, which mandates adherence to global standards (like GDPR compliance for subsidiaries). Countries such as the UAE and Saudi Arabia are establishing sophisticated digital privacy frameworks to support smart city initiatives and secure cross-border transactions. PaaS solutions here are typically focused on foundational data discovery, risk assessment, and meeting data residency mandates, with government and energy sectors being primary customers, necessitating robust, often private cloud-based, solutions to secure critical infrastructure information and citizen data.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Privacy as a Service Market.- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Amazon Web Services (AWS)

- Google Cloud Platform

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Capgemini SE

- Deloitte Touche Tohmatsu Limited

- KPMG International

- PricewaterhouseCoopers (PwC)

- Informatica LLC

- OneTrust, LLC

- TrustArc, Inc.

- BigID, Inc.

- Securiti.ai

- Privitar Limited

- Nymity Inc. (Acquired by OneTrust)

- DataGrail, Inc.

- Osano, Inc.

- SailPoint Technologies Holdings, Inc.

- Micro Focus International plc

- Varonis Systems, Inc.

- WireWheel, Inc.

- Exterro, Inc.

- Protegrity, Inc.

- Immuta

- Collibra N.V.

- SAS Institute Inc.

- Alteryx, Inc.

Frequently Asked Questions

Analyze common user questions about the Privacy as a Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Privacy as a Service (PaaS) and how does it differ from traditional data security?

Privacy as a Service (PaaS) is a cloud-based delivery model offering automated tools and expertise for managing privacy compliance (e.g., GDPR, CCPA). Unlike traditional data security, which focuses on preventing unauthorized access (confidentiality and integrity), PaaS specifically addresses data governance, consent management, regulatory reporting, and upholding data subject rights throughout the entire data lifecycle, ensuring accountability and legal adherence rather than just perimeter defense.

Which regulatory frameworks are the primary drivers for PaaS adoption globally?

The primary global drivers are the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), along with its update, CPRA. These mandates set high standards for accountability, data subject rights (like DSARs), and consent requirements, forcing multinational organizations to adopt scalable PaaS solutions to manage cross-jurisdictional complexity and avoid significant percentage-based financial penalties for non-compliance.

How does the integration of AI impact the cost efficiency and functionality of PaaS platforms?

AI significantly enhances PaaS efficiency by automating labor-intensive tasks such as data discovery, classification of sensitive information, and fulfillment of Data Subject Access Requests (DSARs). This automation drastically reduces the human capital required for routine compliance operations, thereby lowering the total cost of ownership (TCO) and enabling organizations to scale their privacy programs quickly and accurately across large, fragmented datasets, moving towards proactive risk mitigation.

What are Privacy Enhancing Technologies (PETs) and why are they crucial in modern PaaS offerings?

Privacy Enhancing Technologies (PETs) are critical cryptographic and statistical tools (such as differential privacy, homomorphic encryption, and secure multi-party computation) integrated into PaaS. They are crucial because they allow organizations to analyze, process, and share data for business intelligence, research, or collaboration purposes while mathematically guaranteeing that the underlying personal identifiable information (PII) remains protected and cannot be reverse-engineered, balancing data utility with maximum privacy protection.

What is the significance of the shift from On-Premise to Cloud deployment for PaaS solutions?

The shift to Cloud deployment is significant because it provides the necessary agility, scalability, and geographic distribution required to address global compliance mandates effectively, especially data residency requirements. Cloud PaaS offers faster time-to-value, lower upfront investment, and facilitates continuous regulatory updates and data mapping across multi-cloud environments, making it the preferred model for enterprises dealing with exponential data growth and complex cross-border data transfer rules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager