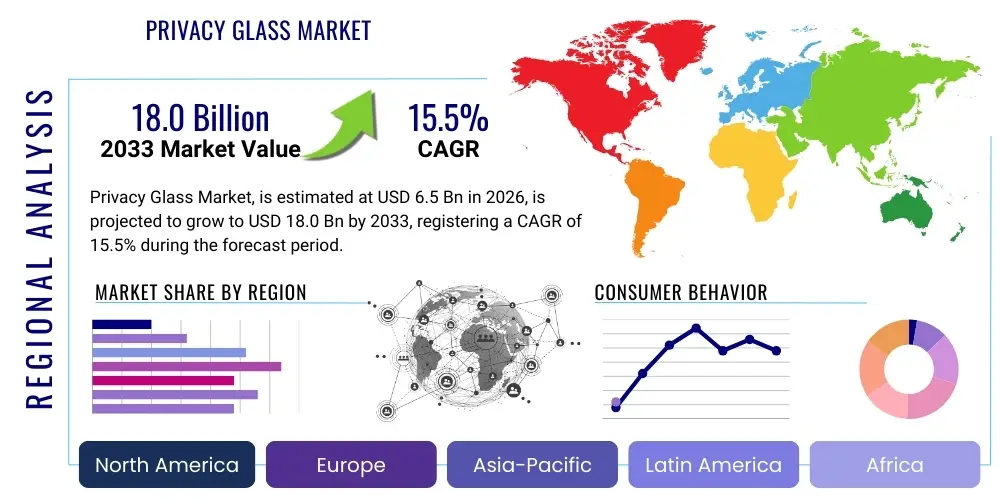

Privacy Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438070 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Privacy Glass Market Size

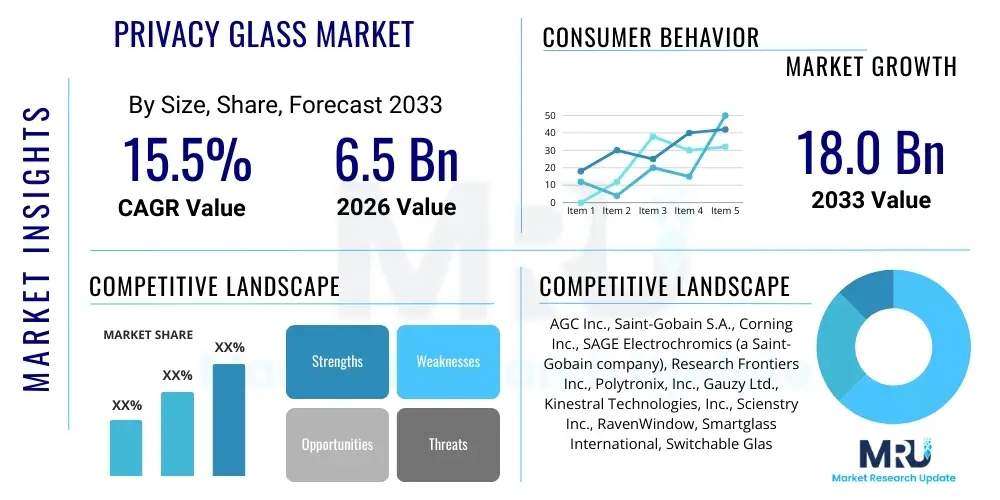

The Privacy Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 6.5 billion in 2026 and is projected to reach USD 18.0 billion by the end of the forecast period in 2033.

Privacy Glass Market introduction

The Privacy Glass Market, often referred to as the Smart Glass or Switchable Glass Market, encompasses advanced glazing technologies that modulate light transmission, heat, and opacity on demand. These innovative materials transition from clear to opaque (or vice versa) instantly through electrical currents, offering dynamic control over privacy and solar heat gain. The core product categories include Polymer Dispersed Liquid Crystal (PDLC), Suspended Particle Devices (SPD), and Electrochromic (EC) technologies, each utilizing different mechanisms to achieve variable light and transparency states. Privacy glass is rapidly replacing traditional blinds and static windows, providing superior aesthetics, hygiene, and immediate adaptability to environmental conditions and user requirements.

Major applications for privacy glass span across architectural, automotive, and aerospace sectors. In the architectural space, it is widely adopted in commercial buildings, healthcare facilities, and modern residential structures for interior partitions, exterior façades, and specialized applications such as projection screens. The automotive industry utilizes it for panoramic roofs and side windows to manage glare, temperature, and passenger privacy, significantly improving cabin comfort and reducing the load on air conditioning systems. Similarly, aerospace applications leverage smart glass technology in cabin windows to enhance passenger experience and optimize solar attenuation at high altitudes, adhering to stringent safety and operational requirements.

The primary benefit driving market adoption is enhanced energy efficiency. By dynamically managing solar heat penetration, privacy glass minimizes dependence on HVAC systems, leading to substantial reductions in energy consumption and operational costs for building owners. Furthermore, the technology offers unparalleled aesthetic flexibility and architectural design freedom, promoting sleek, minimalistic interiors and maximizing natural light when privacy is not required. Regulatory mandates focusing on green building standards and increasing consumer awareness regarding sustainable materials are acting as crucial driving factors accelerating the integration of privacy glass solutions globally.

Privacy Glass Market Executive Summary

The Privacy Glass Market exhibits robust growth driven by accelerating demand from the building and construction sector, particularly in high-rise commercial structures and advanced healthcare facilities prioritizing dynamic environmental control. Current business trends indicate a strong focus on enhancing the integration of smart glass with building management systems (BMS) and IoT platforms, moving beyond simple on/off switching to predictive light management based on external weather conditions and internal occupancy patterns. Furthermore, manufacturers are investing heavily in improving the film application process and reducing manufacturing costs associated with Electrochromic and SPD films, aiming to achieve price parity with high-end conventional glass solutions and expand market accessibility across the mid-range segment.

Regionally, Asia Pacific (APAC) is poised to become the fastest-growing market, primarily fueled by rapid urbanization, significant investments in smart city infrastructure, and supportive government policies promoting energy-efficient construction, particularly in developing economies such as China and India. North America and Europe, however, maintain market leadership in terms of technology adoption and revenue, driven by stringent energy efficiency regulations like the European Union's Energy Performance of Buildings Directive (EPBD) and a high penetration rate of sophisticated smart home technologies. These established regions focus on premium, high-performance solutions for retrofit projects and luxury new construction, emphasizing aesthetics and long-term operational savings.

Segment trends reveal that the Electrochromic technology segment is projected to experience the highest revenue growth due to its superior dimming capabilities, lower power consumption once activated, and ability to manage both light and heat effectively without becoming entirely opaque. While PDLC remains dominant in interior partitioning due to its instantaneous switching and high visual clarity in the transparent state, the shift towards large-scale architectural façades favors Electrochromic solutions for managing solar glare and heat load. The automotive segment is also critical, with luxury vehicle manufacturers increasingly standardizing privacy glass in sunroofs and windows, creating a stable, high-value demand segment.

AI Impact Analysis on Privacy Glass Market

User queries regarding the impact of Artificial Intelligence (AI) on the Privacy Glass Market frequently center on how AI enhances energy management, streamlines manufacturing processes, and facilitates seamless integration into smart ecosystems. Users are keen to understand if AI can move smart glass beyond simple user-controlled switching towards truly predictive and autonomous operation. Key themes revolve around optimizing solar heat gain based on real-time weather forecasts, achieving maximum natural lighting while minimizing glare, and using machine learning algorithms to personalize privacy settings based on individual occupant preferences and behavioral patterns. Concerns often include data privacy associated with integrated sensors and the complexity of implementing AI-driven control systems in existing building infrastructure.

The application of AI is revolutionizing the efficiency and functionality of privacy glass. AI-powered Building Management Systems (BMS) utilize neural networks to analyze vast datasets—including external solar irradiance, internal temperature, occupancy levels, and time of day—to instantaneously and autonomously adjust the transparency of façade smart glass. This predictive adjustment ensures optimal thermal performance and visual comfort without manual intervention, substantially maximizing energy savings beyond what traditional smart glass switching offers. AI algorithms can detect subtle shifts in the environment and proactively adjust the glass state, minimizing thermal discomfort before occupants even notice the change, thereby delivering a superior indoor experience.

Furthermore, AI significantly impacts the manufacturing and quality control phases of complex smart glass products like SPD and EC films. Machine vision systems integrated with AI algorithms can rapidly identify micro-defects or inconsistencies in the coating layers during production, ensuring higher product quality and reducing material waste. Predictive maintenance models analyze sensor data from manufacturing equipment to forecast potential failures, minimizing downtime and optimizing production efficiency. This AI-driven precision in manufacturing is essential for scaling up production and addressing the high precision requirements necessary for large-area architectural applications, ultimately driving down overall unit costs.

- AI optimizes smart glass transparency settings autonomously based on weather, solar angle, and occupancy.

- Machine learning algorithms enable personalized privacy control tailored to individual user behavior and time-of-day preferences.

- AI integration enhances Building Management Systems (BMS) for centralized, energy-optimized thermal and lighting management.

- Predictive maintenance driven by AI improves manufacturing yield and reduces operational costs for smart film production lines.

- AI algorithms analyze energy consumption patterns to demonstrate and quantify the precise return on investment (ROI) of dynamic glazing.

- Integration with voice assistants and smart home platforms is facilitated by AI for intuitive, conversational control over privacy settings.

DRO & Impact Forces Of Privacy Glass Market

The dynamics of the Privacy Glass Market are shaped by powerful drivers, significant restraints, and emerging opportunities that collectively determine its trajectory. The primary driver is the accelerating focus on sustainable building practices and energy efficiency mandates imposed by governments worldwide, necessitating dynamic solar control solutions. Restraints largely involve the high initial capital investment required for installation, especially for advanced Electrochromic technology, and the complexity associated with integrating these systems into existing building infrastructures. Opportunities arise from technological advancements leading to faster switching speeds and reduced material costs, alongside the burgeoning demand from the Electric Vehicle (EV) and specialized transportation sectors seeking superior thermal management and passenger amenities. These forces create a compelling but challenging environment, requiring continuous innovation to overcome cost barriers and maximize adoption benefits.

Key drivers include the global mandate for green buildings, where smart glass technology offers measurable reductions in HVAC energy load, directly impacting building certification scores like LEED and BREEAM. The growing utilization of glass in modern architectural design—moving towards large, expansive façades—naturally increases the demand for dynamic light control to mitigate intense solar gain while preserving views. Furthermore, the enhanced privacy and security benefits offered by instantly switchable opacity are highly valued in critical environments such as financial institutions, governmental buildings, and healthcare procedure rooms, solidifying its adoption in high-specification projects globally.

Despite strong drivers, the high complexity and cost structure pose significant constraints. The cost of raw materials, specifically proprietary chemical coatings and specialized lamination processes required for EC and SPD films, remains elevated compared to traditional insulated glass units (IGUs). Consumers and developers also exhibit hesitation due to long lead times for specialized smart glass units and the perceived complexity of maintaining interconnected electronic glazing systems. However, the opportunity landscape is expanding dramatically through advancements in flexible film technology, which allows for retrofit applications on existing windows, significantly expanding the market addressable size beyond new construction. The integration of privacy glass with augmented reality (AR) displays and specialized projection surfaces also opens new, high-value avenues in retail, entertainment, and professional settings.

Segmentation Analysis

The Privacy Glass Market is meticulously segmented across technology type, application, and end-use sector, providing a multi-dimensional view of market penetration and growth opportunities. Understanding these segments is crucial for manufacturers to tailor their product offerings and strategic focus. Technology segmentation, covering PDLC, SPD, and EC, reveals differing performance metrics and ideal use cases, influencing which segments dominate in architectural versus automotive environments. Application segmentation highlights the critical roles the technology plays in managing climate and privacy across transport and stationary infrastructure, while end-use segmentation determines the scale and volume required, distinguishing between high-volume commercial projects and customized residential installations.

The market is predominantly segmented by the core operational mechanism of the smart material. Polymer Dispersed Liquid Crystal (PDLC) technology is favored for instant, high-contrast privacy in interior spaces due to its rapid transition time and high opacity when switched off. Electrochromic (EC) technology is gaining traction for large exterior façades due to its ability to modulate light gradually and manage solar heat gain effectively over extended periods, consuming less power after the initial state change. Suspended Particle Device (SPD) technology offers exceptional control over light dimming and is highly valued in luxury automotive and aerospace applications for its speed and customizable shading levels. The distinct characteristics of each technology dictate its market share and growth potential within specific verticals, such as EC dominating solar control and PDLC leading interior privacy solutions.

- By Technology

- Electrochromic (EC)

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Device (SPD)

- Thermochromic

- Photochromic

- By Application

- Architectural (Residential, Commercial, Healthcare, Institutional)

- Automotive (Sunroofs, Side Windows, Rear Windows)

- Aerospace (Cabin Windows, Partitions)

- Marine

- Retail Display

- By End-User

- Construction and Real Estate Developers

- Automotive OEMs

- Aerospace Manufacturers

- Specialty Vehicle Builders

- Interior Designers and Architects

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Privacy Glass Market

The value chain for the Privacy Glass Market is complex, beginning with the sourcing of highly specialized chemical compounds and intricate electronic components, extending through specialized manufacturing, and culminating in highly technical distribution and installation. Upstream analysis focuses on the procurement of sensitive materials, including proprietary polymers, liquid crystals, electrochromic gels, and specialized conductive coatings (TCOs). The quality and stability of these raw materials directly influence the performance, longevity, and switching speed of the final smart glass product. Key activities at this stage include R&D for material stability and cost reduction, often performed in close collaboration with chemical suppliers.

Midstream activities involve sophisticated manufacturing processes. Unlike standard glass production, privacy glass requires high-precision application of active materials onto glass or film substrates, followed by lamination into insulated glass units (IGUs) or direct lamination onto existing windows (for retrofit films). This stage is capital-intensive, requiring cleanroom environments and precise electrical integration. Downstream activities focus on reaching the market. Due to the high-value and technical nature of the product, distribution channels often bypass standard retail, relying instead on specialized glass fabricators, certified system integrators, and direct sales teams targeting major architectural and automotive Original Equipment Manufacturers (OEMs).

The distribution network is characterized by both direct and indirect channels. Direct channels are crucial for large-scale, customized projects, where manufacturers work closely with architects and engineering firms from the design phase to ensure seamless integration into complex building envelopes. Indirect channels involve specialized authorized dealers and installers who possess the technical expertise to handle the electrical wiring and installation complexities associated with smart glazing. The installation phase itself is a critical part of the value chain, as improper installation can compromise the electrical integrity and sealing of the smart glass unit, making certified installation training a significant focus area for market players.

Privacy Glass Market Potential Customers

Potential customers for the Privacy Glass Market are highly diversified but share a common need for dynamic control over light, heat, and visual privacy, often driven by high sustainability or aesthetic requirements. The primary customer segment includes architectural firms and commercial real estate developers who are designing premium office buildings, hotels, and luxury retail spaces. These entities seek innovative façade solutions that meet stringent energy codes while offering tenants superior comfort and modern design aesthetics. The move towards flexible, adaptable workspaces also drives demand for PDLC in internal partitions, allowing rapid reconfiguration of meeting spaces and collaborative zones.

Another major customer segment consists of global automotive OEMs, particularly those in the luxury, premium, and electric vehicle (EV) sectors. These manufacturers utilize smart glass to enhance passenger comfort, manage cabin temperature efficiently (reducing battery consumption in EVs), and provide sophisticated privacy features in panoramic roofs and side windows. The aerospace industry, specifically aircraft manufacturers and airline operators, represents a high-value niche customer base, requiring certified smart windows that reduce operational costs related to window maintenance and enhance the passenger flight experience by minimizing glare and maximizing views on demand.

Furthermore, specialized institutional buyers form a crucial customer base. Healthcare facilities, including hospitals and laboratories, use privacy glass for patient rooms and operating theaters to maintain hygienic conditions (replacing blinds) and ensure instant privacy during medical procedures. Government and security agencies also utilize smart glass for confidential meeting rooms and observation decks where immediate, reliable opacity is paramount. These customers prioritize reliability, technical specifications, and compliance with industry-specific standards over general cost considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 18.0 Billion |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Saint-Gobain S.A., Corning Inc., SAGE Electrochromics (a Saint-Gobain company), Research Frontiers Inc., Polytronix, Inc., Gauzy Ltd., Kinestral Technologies, Inc., Scienstry Inc., RavenWindow, Smartglass International, Switchable Glass, E-Glass, Glass Apps, Shenzhen Kaisheng Industrial Co. Ltd., Variopto GmbH, Gentex Corporation, Vision Systems, P D L C Solutions, Inc., Pleotint LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Privacy Glass Market Key Technology Landscape

The technological landscape of the Privacy Glass Market is dominated by three principal technologies: Polymer Dispersed Liquid Crystal (PDLC), Suspended Particle Devices (SPD), and Electrochromic (EC) technology. PDLC relies on an electric field to align liquid crystal droplets suspended in a polymer matrix. When the field is off, the droplets scatter light, rendering the glass opaque; when on, the crystals align, making the glass transparent. This technology is prized for its near-instantaneous switching capability (milliseconds) and is ideally suited for interior privacy applications such as office partitions and residential bathrooms where rapid, high-contrast privacy is necessary.

Electrochromic technology, conversely, involves electrically controlled darkening based on chemical reactions triggered by voltage. Ions transfer between layers, causing the material to absorb light gradually, transitioning from clear to deeply tinted. EC glass excels in solar control for large exterior façades and skylights because it effectively manages both visible light and radiant heat, consumes very little power to maintain a tint state, and offers a smooth, variable dimming effect. However, the switching time for EC glass is typically measured in minutes, making it less suitable for applications requiring instant privacy, but optimal for long-term thermal management in architectural settings.

Suspended Particle Device (SPD) technology utilizes minute light-absorbing particles suspended within a film laminated between two sheets of glass. Applying voltage causes the particles to align, allowing light to pass; removing the voltage causes them to disorganize, blocking light. SPD technology offers a high degree of control over light and glare, can switch rapidly, and provides excellent shading characteristics. Due to its superior performance in variable dimming and rapid response, SPD is often the technology of choice in high-end automotive sunroofs and aerospace windows, where premium performance and passenger comfort justify the higher associated costs.

Regional Highlights

- North America: This region is a leading adopter of smart glass, driven by rigorous energy efficiency codes in states like California and a high concentration of sophisticated commercial real estate developments. The demand is particularly strong in the corporate and technology sectors for dynamic partitioning and sustainable facade solutions. High consumer disposable income also supports the robust integration of smart glass into premium residential construction and luxury automotive manufacturing based in the U.S. and Canada.

- Europe: Europe exhibits substantial growth, primarily catalyzed by the European Union's stringent environmental legislation and ambitious carbon neutrality targets. Regulations promoting near-zero energy buildings (NZEB) significantly boost the uptake of energy-saving technologies like Electrochromic glass. Germany, the UK, and France are key markets, focusing heavily on retrofit projects for existing building stock to improve overall energy performance and compliance.

- Asia Pacific (APAC): APAC is expected to demonstrate the highest CAGR, driven by explosive urbanization and massive infrastructure investments, particularly in China, India, and Southeast Asia. The region’s focus on constructing smart cities and modern commercial hubs creates a vast potential market. While cost sensitivity is a factor, the sheer volume of new construction projects allows for rapid market scaling, with PDLC film dominating interior applications initially due to its relatively lower cost structure.

- Latin America (LATAM): Growth in LATAM is more moderate but steady, centered around major economic hubs like Brazil and Mexico. The market is primarily application-driven, focusing on high-end commercial projects, banking facilities, and hospitality sectors seeking enhanced security and unique aesthetic features. Regulatory support for energy efficiency is gradually increasing, which is expected to provide future momentum.

- Middle East and Africa (MEA): This region offers significant opportunities due to extreme climatic conditions, making solar heat management critical for indoor comfort and efficiency. Major construction projects in the UAE and Saudi Arabia (e.g., NEOM project) are integrating advanced smart glass solutions to mitigate intense solar gain, driving demand for high-performance EC and SPD technologies. High-value infrastructure projects compensate for relatively lower volume compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Privacy Glass Market.- AGC Inc.

- Saint-Gobain S.A.

- Corning Inc.

- SAGE Electrochromics (a Saint-Gobain company)

- Research Frontiers Inc.

- Polytronix, Inc.

- Gauzy Ltd.

- Kinestral Technologies, Inc.

- Scienstry Inc.

- RavenWindow

- Smartglass International

- Switchable Glass

- E-Glass

- Glass Apps

- Shenzhen Kaisheng Industrial Co. Ltd.

- Variopto GmbH

- Gentex Corporation

- Vision Systems

- P D L C Solutions, Inc.

- Pleotint LLC.

Frequently Asked Questions

Analyze common user questions about the Privacy Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between PDLC and Electrochromic privacy glass?

PDLC (Polymer Dispersed Liquid Crystal) provides instant switching between transparent and opaque states, ideal for interior privacy needs, but primarily controls light scattering. Electrochromic (EC) glass transitions slowly (minutes), manages solar heat gain more effectively by tinting, and is preferred for large exterior architectural facades for energy savings.

How does privacy glass contribute to energy efficiency in commercial buildings?

Privacy glass, particularly Electrochromic technology, dynamically modulates the amount of solar radiation entering a building. By reducing solar heat gain during peak sun hours, it significantly decreases the load on Heating, Ventilation, and Air Conditioning (HVAC) systems, leading to substantial energy savings and reduced operating costs.

Is privacy glass suitable for outdoor applications in extreme weather conditions?

Yes, modern privacy glass is manufactured as Insulated Glass Units (IGUs) with integrated smart films, designed to withstand external weather conditions including extreme heat, cold, and UV exposure. High-performance EC and SPD glasses are specifically engineered for robust exterior architectural and automotive use.

What is the typical lifespan and maintenance requirement for smart glass products?

The typical lifespan of high-quality smart glass units (EC or PDLC) is often comparable to standard architectural glass, generally exceeding 20 years. Maintenance requirements are minimal, primarily limited to standard glass cleaning, as the electrical components are safely sealed within the laminated layers, preventing exposure to moisture or damage.

What is the main barrier preventing mass adoption of privacy glass in residential markets?

The main barrier is the high initial capital investment required compared to traditional glazing options. While operational energy savings provide a long-term return on investment (ROI), the upfront cost, coupled with specialized installation complexity, often deters widespread adoption in the general residential construction sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electric Privacy Glass Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Privacy Glass Market Size Report By Type (Electrochromic, Thermochromic, SPD, PDLC), By Application (Transportation, Electronics, Architecture, Solar Power Generation, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Privacy Glass Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stationary Type, Mobile Type), By Application (Transportation, Electronics, Architecture, Solar Power Generation, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager