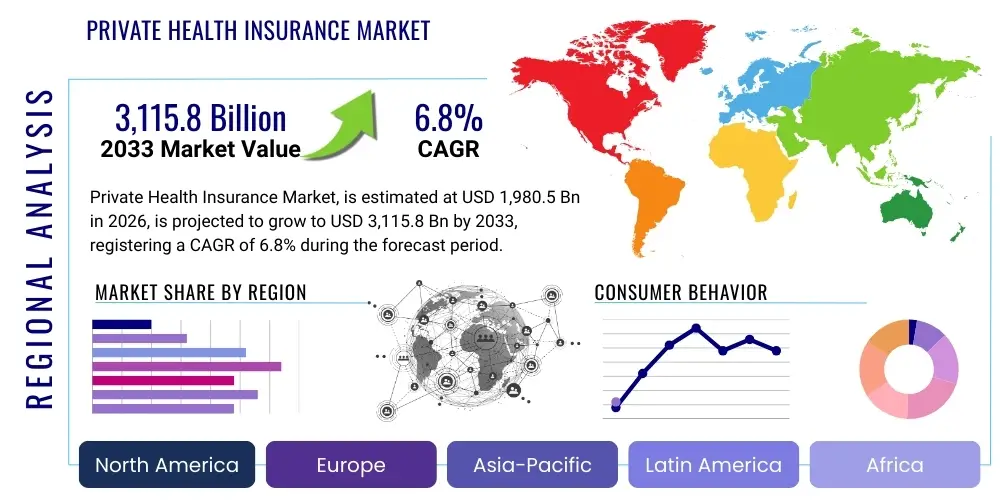

Private Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437206 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Private Health Insurance Market Size

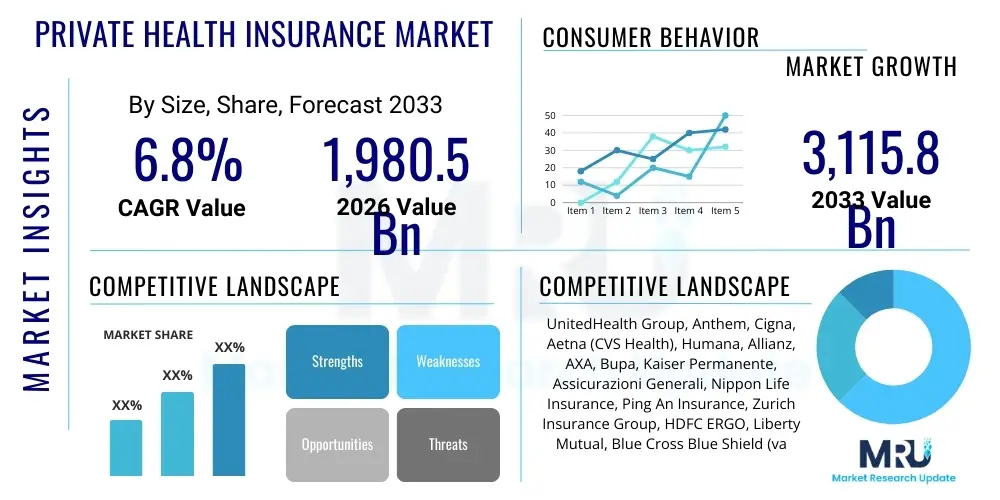

The Private Health Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,980.5 Billion in 2026 and is projected to reach USD 3,115.8 Billion by the end of the forecast period in 2033.

Private Health Insurance Market introduction

The Private Health Insurance market encompasses various insurance products purchased by individuals or groups to cover medical, surgical, and prescription drug expenses, serving as a supplementary or primary mechanism for healthcare financing outside of state-funded systems. These plans are crucial in industrialized economies, addressing the increasing burden of out-of-pocket medical costs and the demand for specialized, timely care. The product spectrum is vast, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point-of-Service (POS) plans, each offering different levels of flexibility and cost structures to meet diverse consumer needs.

Major applications of private health insurance span routine preventative care, management of chronic illnesses, emergency medical services, and specialized treatments, often offering benefits superior to or faster access than public options. Key benefits driving market adoption include enhanced choice of providers, reduced waiting times for elective procedures, financial protection against catastrophic health events, and access to premium drug formularies. This market is fundamentally important for ensuring financial stability for households facing unexpected health crises, thereby acting as a critical pillar of global health infrastructure.

Driving factors propelling market expansion include the global aging population, which necessitates greater healthcare utilization; the rising prevalence of lifestyle diseases such as diabetes and cardiovascular conditions; escalating healthcare delivery costs due to technological advancements in medical equipment and pharmaceuticals; and governmental policies in many regions that encourage private sector participation to alleviate the fiscal pressure on public health systems. Furthermore, economic growth in developing countries leads to increased disposable income, making comprehensive private health coverage attainable and desirable for a larger segment of the populace, fueling demand for specialized, high-quality coverage options.

Private Health Insurance Market Executive Summary

The Private Health Insurance market is defined by rapid technological integration, evolving regulatory frameworks, and intense competitive pressure to optimize operational efficiency and customer experience. Current business trends indicate a significant shift towards digitalization, with leading insurers investing heavily in AI-driven claims processing, telemedicine integration, and personalized risk assessment models. The rise of InsurTech startups is disrupting traditional distribution and administration channels, forcing established players to adopt agile business practices, focusing on consumer-centric products that emphasize wellness and prevention rather than purely reactive coverage models. Mergers and acquisitions remain a crucial strategy for expanding market share and achieving economies of scale in an increasingly consolidated industry landscape.

Regionally, North America maintains its dominance due to high healthcare expenditure and a complex regulatory environment fostering robust private sector involvement, though affordability challenges persist. Asia Pacific (APAC) is emerging as the fastest-growing region, driven by expanding middle classes in countries like China and India, coupled with government initiatives promoting private coverage to manage population health demands. European markets are characterized by diverse public-private mixes, with strong growth observed in supplementary and top-up insurance policies designed to fill gaps left by universal healthcare systems, particularly in areas requiring swift access to specialized services. Latin America and MEA are seeing gradual maturation, fueled by macroeconomic stability and increasing awareness of insurance necessity.

Segment trends reveal a pronounced shift toward managed care organizations (HMOs and PPOs) due to their effectiveness in controlling costs through network restrictions and utilization review. The Group/Employer segment continues to be the largest purchaser, leveraging health plans as a vital employee benefit, while the Individual segment is experiencing growth bolstered by government-supported exchanges and platforms. Furthermore, specialized products targeting the senior demographic, such as Medicare Advantage plans in the U.S. context, represent a critical area of innovation and growth, focusing on comprehensive coverage that integrates health and social care services to address the unique needs of an aging population.

AI Impact Analysis on Private Health Insurance Market

User inquiries regarding AI's influence in Private Health Insurance primarily revolve around efficiency gains, accuracy in risk prediction, ethical concerns related to data privacy, and the potential for job displacement among claims adjusters and administrative staff. Users frequently ask how AI can reduce premiums, if personalized risk scoring based on wearable data is fair, and what safeguards are in place to prevent algorithmic bias in determining coverage or pricing. The core themes center on AI's ability to transform the user experience—from seamless digital enrollment and proactive wellness coaching to accelerated claims resolution—while ensuring transparency and equitable access to care. Expectations are high regarding significant operational cost reductions and the creation of highly individualized insurance products tailored to specific health profiles and behavioral data.

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally restructuring the competitive landscape of the private health insurance sector, moving insurers away from reactive business models toward predictive and preventive frameworks. AI algorithms are now sophisticated enough to analyze vast quantities of clinical, behavioral, and claims data, enabling insurers to perform highly granular risk stratification. This advanced analytical capability allows for precise premium pricing, minimizes adverse selection, and identifies fraudulent activities with higher accuracy than traditional methods. Moreover, AI powers sophisticated chatbots and virtual assistants, providing 24/7 personalized customer support and streamlining initial inquiries, significantly enhancing policyholder satisfaction.

This technological evolution also extends into product development and underwriting. By leveraging predictive modeling, insurers can design dynamic policies that adjust based on real-time health data—often collected through IoT devices and electronic health records. This capability facilitates the creation of "pay-as-you-live" insurance products, promoting healthier behaviors and potentially lowering overall systemic costs. Despite these benefits, implementation requires substantial investment in robust data governance frameworks and cybersecurity measures to comply with stringent healthcare data regulations like HIPAA and GDPR, ensuring consumer trust remains paramount in this data-intensive environment.

- Enhanced Fraud Detection: AI algorithms analyze claims patterns to identify and flag suspicious activities immediately, minimizing revenue leakage.

- Personalized Risk Assessment: Machine learning models utilize behavioral and clinical data for granular underwriting, leading to fairer and more accurate pricing.

- Automated Claims Processing: Natural Language Processing (NLP) accelerates the review and adjudication of complex medical claims, drastically reducing processing times.

- Optimized Customer Engagement: AI-powered chatbots and virtual agents provide instantaneous service, policy information, and guide members through care pathways.

- Predictive Health Interventions: Algorithms identify members at high risk of chronic conditions exacerbation, enabling proactive outreach and preventive care coordination.

- Operational Efficiency: Automation reduces reliance on manual data entry and repetitive administrative tasks, lowering overhead costs significantly.

- Drug Utilization Review: AI helps optimize formularies and detect inappropriate prescription patterns, improving safety and cost-effectiveness.

DRO & Impact Forces Of Private Health Insurance Market

The Private Health Insurance market is simultaneously driven by demographic shifts and technological innovation, while being constrained by pervasive cost pressures and complex regulatory oversight. Key drivers include the global phenomenon of population aging, which consistently increases the demand for comprehensive medical coverage, and the continuous advancement in medical technologies, although these simultaneously push up healthcare costs. Restraints predominantly revolve around the escalating cost of medical care, which impacts affordability and accessibility, leading to public pressure and subsequent stringent governmental regulations aimed at controlling premiums and ensuring minimum coverage standards. Opportunities lie primarily in leveraging digitalization, particularly through InsurTech partnerships and the development of personalized insurance offerings that integrate wellness benefits and utilize real-time health data to optimize pricing and engagement. These forces interact to create a volatile but structurally growing market where operational efficiency and adaptability to digital disruption are crucial for sustained success.

Drivers are strongly influenced by macroeconomic factors and evolving consumer needs. The increasing prevalence of non-communicable diseases (NCDs) requires sustained medical management, making long-term insurance crucial. Furthermore, the rising financial burden of medical treatment pushes middle and upper-income segments globally toward private plans to secure access to specialized procedures and international medical services not readily available or timely under public systems. In emerging markets, rapid urbanization and improved economic standing allow millions to transition from self-payment to formalized insurance coverage, ensuring a steady stream of new policyholders. The regulatory environment, particularly mandates requiring specific levels of coverage or supporting individual exchanges, also acts as a demand driver in certain jurisdictions.

However, market growth is hampered by significant restraints, most notably the 'affordability crisis' in developed economies, where premium increases often outpace wage growth, creating market friction and driving regulatory scrutiny. Regulatory complexity, characterized by frequent changes in coverage mandates, price controls, and capital requirements (like Solvency II in Europe), increases compliance costs for insurers and limits their flexibility in product innovation. The perception of inadequate value or denial of claims also erodes consumer trust. Opportunities, conversely, center on technological solutions: telemedicine expansion, blockchain for secure data management, and predictive analytics for disease management offer pathways to reduce costs, improve outcomes, and create differentiated, value-added services that appeal to younger, digitally native consumers, counteracting traditional market restraints.

Segmentation Analysis

The Private Health Insurance Market is highly fragmented and segmented across multiple dimensions, reflecting the diverse needs of global populations and varied healthcare delivery systems. Analysis by Type reveals a dominance of managed care plans (HMOs and PPOs), which offer cost control benefits to both insurers and policyholders by channeling care through specific networks, a structure favored in large economies like the U.S. Conversely, Indemnity plans, offering maximum freedom of choice, maintain relevance for high-income individuals willing to pay premium prices for flexibility. Understanding these types is crucial as regulatory shifts often dictate which plan structure gains prominence in a given geographic region.

Segmentation by Demographics and Distribution Channel further illustrates market dynamics. The Group/Employer segment represents the bulk of policy enrollment, leveraging scale for better pricing and administrative efficiency. However, the Individual segment, increasingly facilitated by digital platforms and government-mandated marketplaces, is showing the highest growth trajectory, particularly among young adults and freelancers. Distribution remains diversified, relying heavily on traditional agents and brokers for complex sales, but modern distribution is increasingly moving towards direct-to-consumer models facilitated by online sales portals and mobile applications, streamlining the purchasing experience and cutting intermediary costs. The convergence of these channels is essential for maximizing market reach.

The segmentation by Provider demonstrates the growing collaboration between fully private payers and public-private partnerships. In many European and Asian countries, private insurers act as complementary providers, offering coverage for services not fully covered by national schemes (dental, optical, specific specialty care). This hybrid model is becoming increasingly popular, as it balances governmental efforts to ensure basic universal coverage with consumer demand for premium, specialized access. Future growth will be dictated by how effectively insurers can tailor products to specific demographic needs, such as chronic disease management plans or tailored policies for the growing senior population demanding integrated care solutions.

- By Type:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point-of-Service (POS)

- Indemnity/Fee-for-Service

- By Demographics:

- Individual

- Group/Employer (Corporate)

- Senior (e.g., Medicare Advantage, specialized supplemental plans)

- By Provider:

- Private Payers

- Public-Private Partnerships (Complementary/Supplemental)

- By Distribution Channel:

- Direct Sales (Online Platforms, Company Websites)

- Agents and Brokers

- Bancassurance and Affinity Groups

Value Chain Analysis For Private Health Insurance Market

The Value Chain in the Private Health Insurance Market is complex and extends far beyond the core underwriting function, encompassing upstream providers, core insurance operations, and downstream distribution and service delivery. Upstream analysis focuses on critical inputs, primarily data acquisition (health records, demographic statistics, behavioral data) and technology platforms (core administration systems, data analytics tools, AI engines). Key upstream players include healthcare data aggregators, EHR vendors, and specialized InsurTech solution providers. The quality and timeliness of these inputs directly influence the accuracy of risk modeling and the efficiency of product design. Effective management of these upstream resources is crucial for maintaining a competitive edge in pricing and product innovation.

The core segment of the value chain involves product development, underwriting, pricing, and capital management—the intellectual heart of the insurance business. Downstream activities are centered on reaching the end-user and servicing the policy. This involves meticulous distribution through various channels—direct digital platforms, independent agents, and large brokers—followed by post-sales service, claims processing, and utilization review. The efficiency of the claims process and the effectiveness of customer service are paramount, as these directly determine policyholder satisfaction and retention rates. The integration of digital tools across the downstream processes is rapidly becoming the main differentiator in a market where basic coverage packages are often standardized.

Distribution channels are undergoing significant transformation. While direct channels (online portals and mobile apps) offer high speed and low acquisition costs, complex products, particularly group and senior plans, still heavily rely on the expertise of agents and brokers who provide essential consultative services. Furthermore, providers (hospitals and physician groups) play a critical downstream role as they deliver the service that the insurance covers; maintaining strong provider networks and negotiating favorable reimbursement rates are vital for controlling claims costs and ensuring network adequacy. The flow of value is therefore highly interdependent, requiring robust IT infrastructure to manage data exchange between policyholders, insurers, and healthcare providers seamlessly.

Private Health Insurance Market Potential Customers

Potential customers for the Private Health Insurance Market span a broad demographic spectrum, segmented primarily by income level, employment status, and life stage, all united by the need for financial risk mitigation against healthcare expenses. The primary customer base includes large and small businesses purchasing group health insurance plans as part of employee benefits, recognizing that comprehensive health coverage is a key factor in talent attraction and retention. These corporate buyers prioritize plans that offer a balance between cost-effectiveness and network quality, often favoring managed care options like PPOs to offer flexibility while controlling premiums. Their purchasing decisions are heavily influenced by tax incentives and local labor laws.

Another significant segment comprises high-net-worth individuals and families seeking personalized, premium plans that guarantee access to elite medical facilities, specialized treatments, and international healthcare coverage. This cohort prioritizes comprehensive coverage with low deductibles and maximal choice of providers, viewing private insurance as a necessity for maintaining a high quality of life and accessing cutting-edge medicine quickly. In contrast, the growing segment of self-employed individuals, gig workers, and those not covered by employer plans constitute the individual market, often utilizing government or private exchanges to secure coverage, usually focusing on balancing monthly premium costs against adequate catastrophic coverage.

Finally, the senior population represents a critical and rapidly expanding customer segment, particularly in countries with aging demographics. While often supported by government programs (like Medicare in the U.S.), this group frequently requires supplemental private insurance to cover copayments, deductibles, prescription drugs, and long-term care services not fully covered by public schemes. Insurers targeting this demographic must develop specialized products, such as integrated Medicare Advantage plans, that focus heavily on chronic care management, wellness services, and coordination between medical and non-medical social supports, ensuring robust growth potential in this high-demand area.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,980.5 Billion |

| Market Forecast in 2033 | USD 3,115.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UnitedHealth Group, Anthem, Cigna, Aetna (CVS Health), Humana, Allianz, AXA, Bupa, Kaiser Permanente, Assicurazioni Generali, Nippon Life Insurance, Ping An Insurance, Zurich Insurance Group, HDFC ERGO, Liberty Mutual, Blue Cross Blue Shield (various independent plans), Centene Corporation, WellCare Health Plans, Molina Healthcare, Oscar Health, Massachusetts Mutual Life Insurance Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Private Health Insurance Market Key Technology Landscape

The Private Health Insurance market is undergoing a profound digital transformation, primarily driven by InsurTech solutions focused on enhancing efficiency and personalizing customer interactions. The foundational technological backbone involves robust core systems that manage policy administration, billing, and claims, increasingly migrating to cloud-based architectures for scalability and agility. Beyond core systems, advanced data analytics—specifically predictive modeling and big data processing—are essential for actuarial science, enabling insurers to transition from static, historical risk assessment to dynamic, real-time pricing models. This analytical capability is non-negotiable for competitiveness in an era demanding granular understanding of policyholder risk profiles and accurate loss prediction.

A crucial technological area is the integration of digital health and wellness platforms. This includes the use of wearable technologies and mobile apps to gather behavioral data, which is then utilized for incentive programs and personalized risk management. Telemedicine platforms are also deeply integrated, not only offering cost-effective access to routine care but also serving as a gateway for member engagement and preventive health guidance, ultimately reducing high-cost acute interventions. Furthermore, technologies designed for secure data handling, such as blockchain, are being explored to enhance transparency and security in claims documentation and cross-organizational data sharing while ensuring compliance with global privacy regulations like GDPR and CCPA.

Automation technologies, specifically Robotic Process Automation (RPA) and Artificial Intelligence (AI), form the cutting edge of operational improvement. RPA is extensively deployed for repetitive, high-volume tasks such as enrollment verification and data reconciliation, minimizing human error and accelerating workflow. AI and Machine Learning (ML) are strategically used in complex decision-making processes, including automated pre-authorization requests, optimization of provider networks, and sophisticated fraud detection mechanisms. The collective adoption of these technologies allows insurers to drastically reduce administrative costs, refine product offerings, and improve the overall policyholder experience, thereby reshaping the competitive landscape towards efficiency and personalization.

Regional Highlights

Geographic analysis reveals distinct maturity levels and growth trajectories across global private health insurance markets, dictated by local economic stability, regulatory structures, and the maturity of public healthcare systems.

- North America (NA): Represents the largest market share globally, driven primarily by the United States where private insurance is the dominant source of healthcare coverage. High healthcare expenditure, a complex regulatory framework (e.g., Affordable Care Act), and pervasive cost inflation characterize this region. The market here is mature but highly dynamic, focusing intensely on efficiency gains through managed care, integration of digital health technologies, and addressing the persistent challenge of healthcare affordability through plan design innovation.

- Europe: Characterized by a varied mix of supplementary and mandatory private coverage due to established universal public healthcare systems. Western European markets (e.g., Germany, France, UK) focus on selling policies that provide faster access, greater choice of specialists, and superior amenities. Growth is robust in specialized segments like dental, optical, and long-term care, filling gaps left by state systems. Eastern Europe offers high potential due to rising income levels and increasing dissatisfaction with overburdened public systems.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive population bases, rapid urbanization, and rising disposable incomes, particularly in China, India, and Southeast Asia. Governments often encourage private insurance to alleviate pressure on public hospitals, leading to significant investment in local and foreign insurance providers. Demand is focused on critical illness coverage and comprehensive plans that offer international medical access, reflecting a proactive consumer approach to health and financial security.

- Latin America (LATAM): Growth is steady, driven by economic liberalization and the desire for higher quality care not consistently provided by public systems. Markets like Brazil and Mexico are witnessing increased adoption, though regulatory instability and economic fluctuations can impact market stability. Insurers focus on developing tailored corporate wellness programs and expanding digital access in dense urban areas.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) nations, where mandatory health insurance schemes for expatriates and citizens are widely implemented (e.g., UAE, Saudi Arabia). High oil revenues support significant investment in advanced medical infrastructure, driving demand for premium private coverage. The African continent presents immense long-term potential, constrained currently by low penetration rates and infrastructure challenges, but poised for growth as economies mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Private Health Insurance Market.- UnitedHealth Group

- Anthem

- Cigna

- Aetna (CVS Health)

- Humana

- Allianz

- AXA

- Bupa

- Kaiser Permanente

- Assicurazioni Generali

- Nippon Life Insurance

- Ping An Insurance

- Zurich Insurance Group

- HDFC ERGO

- Liberty Mutual

- Blue Cross Blue Shield (various independent plans)

- Centene Corporation

- WellCare Health Plans

- Molina Healthcare

- Oscar Health

- Massachusetts Mutual Life Insurance Company

- Aviva

- MetLife

- Prudential Financial

- Manulife Financial Corporation

Frequently Asked Questions

Analyze common user questions about the Private Health Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Private Health Insurance Market?

The central driver is the escalating cost of healthcare delivery globally, coupled with the aging population demographics and the corresponding rise in chronic disease prevalence. These factors increase the perceived necessity for private financial protection against high medical expenses, particularly for specialized or timely care.

How is technology, specifically AI, changing the way private health insurers operate?

AI is transforming operations by enabling hyper-personalized risk assessment and pricing, automating complex claims adjudication processes, and enhancing fraud detection capabilities. This adoption leads to significant reductions in administrative costs and improvements in policyholder experience and product customization.

Which geographical region holds the largest market share for Private Health Insurance?

North America, particularly the United States, currently dominates the Private Health Insurance market share due to its established reliance on private payers for primary and supplementary coverage and its exceptionally high per capita healthcare spending.

What are the key differences between HMO and PPO plans, the most common types?

HMOs (Health Maintenance Organizations) generally offer lower premiums and out-of-pocket costs but require members to use a strict network of providers and obtain referrals. PPOs (Preferred Provider Organizations) offer greater flexibility, allowing members to see out-of-network providers without referrals, though usually at a higher cost share.

What is the biggest regulatory challenge currently facing private health insurers?

The most significant regulatory challenge involves navigating ever-changing government mandates concerning minimum coverage requirements, controlling premium increases, and complying with stringent data privacy and security laws (such as HIPAA and GDPR) while maintaining profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager