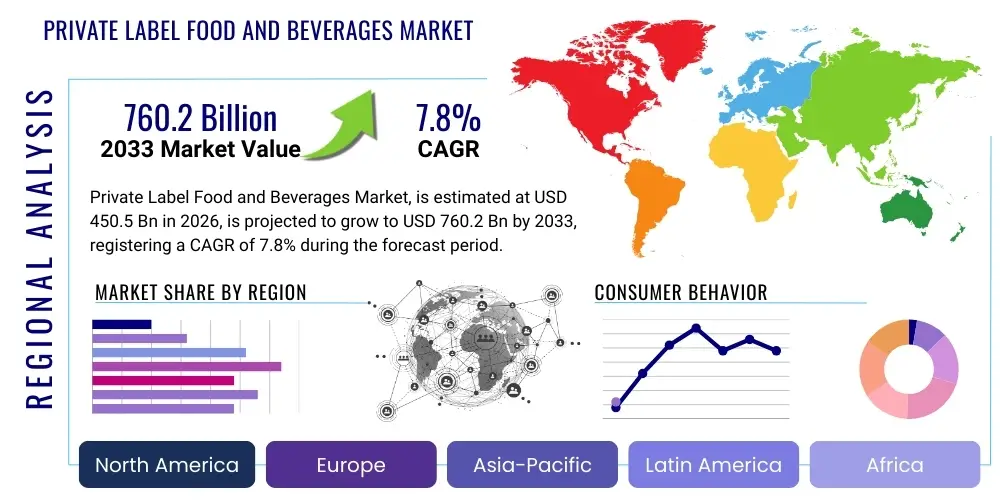

Private Label Food and Beverages Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431404 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Private Label Food and Beverages Market Size

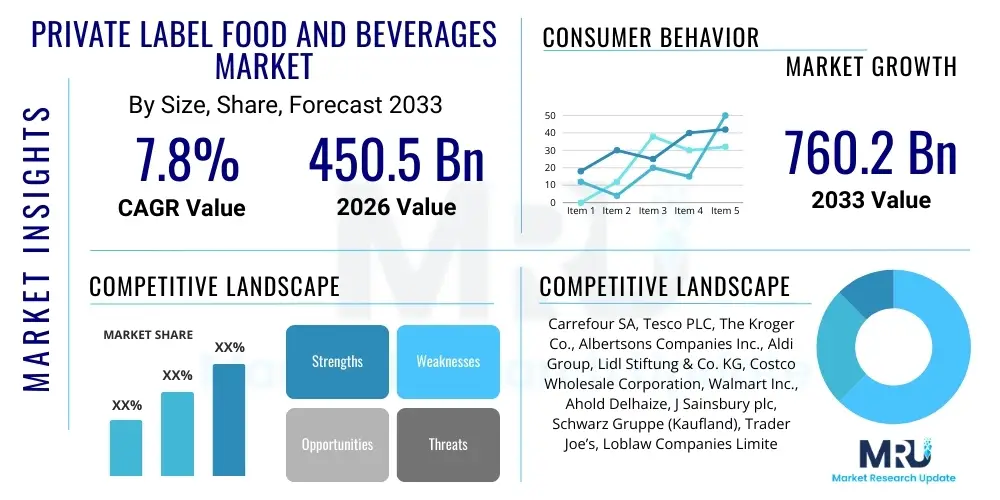

The Private Label Food and Beverages Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 760.2 Billion by the end of the forecast period in 2033.

Private Label Food and Beverages Market introduction

The Private Label Food and Beverages Market encompasses products manufactured or sourced by a retailer or supplier and sold under the retailer’s brand name. These products span a wide spectrum, including packaged foods, fresh produce, dairy, frozen items, and various beverages (non-alcoholic and alcoholic). Unlike national brands, private labels offer retailers enhanced control over pricing, supply chain, and branding, often resulting in higher profit margins and increased consumer loyalty. The core market drivers include growing consumer price sensitivity, rising product quality parity with national brands, and the strategic push by major grocery chains and discounters to differentiate their offerings and capture value-conscious segments.

The primary applications of private label products are found across all retail channels, including supermarkets, hypermarkets, convenience stores, and rapidly expanding e-commerce platforms. Key benefits driving market adoption include cost savings for consumers, greater assortment flexibility for retailers, and the ability for retailers to respond quickly to evolving dietary trends, such as organic, plant-based, and free-from categories. The strategic deployment of tiered private label branding (e.g., value, standard, premium) allows retailers to cater to diverse demographic and economic segments simultaneously, reinforcing their competitive position against manufacturer brands.

Driving factors propelling market expansion include significant investment by retailers in vertical integration and sophisticated supply chain management, enabling better quality control and faster time-to-market. Furthermore, the global economic landscape often favors private labels during periods of inflation or economic uncertainty, as consumers actively seek high-quality, lower-cost alternatives. The perception of private labels has shifted from basic, cheap alternatives to trusted, innovative products, particularly among Millennial and Gen Z shoppers who prioritize value and customized offerings over traditional brand loyalty.

Private Label Food and Beverages Market Executive Summary

The global Private Label Food and Beverages Market is characterized by robust growth, driven primarily by evolving retailer strategies focused on premiumization and category expansion, alongside pervasive consumer demand for value and transparency. Business trends indicate a significant shift from generic "store brands" to sophisticated, differentiated product lines, often mimicking or exceeding the quality benchmarks of national competitors. Retailers are leveraging advanced data analytics and localized sourcing to tailor private label assortments, enhancing their resonance with specific regional preferences and dietary requirements. This focus on differentiation is leading to accelerated market share gains, especially in high-growth segments such as ready-to-eat meals, functional beverages, and specialty organic foods, positioning private labels as key profit centers for major retail chains globally.

Regionally, North America and Europe remain the largest markets, characterized by high private label penetration rates (often exceeding 40% in Western Europe), mature retail infrastructures, and intense competition among discounters and conventional supermarkets. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, propelled by rapid urbanization, the expansion of modern retail formats, and increasing affluence in key economies like China and India, where localized private label offerings are gaining momentum. Emerging markets present substantial untapped potential as traditional wet markets transition toward organized retail, providing essential scaling opportunities for private label portfolios focused on staple and affordable goods.

Segment trends highlight the strong performance of the Private Label Food segment, particularly shelf-stable products and chilled/frozen categories, benefiting from consumer convenience needs and longer shelf lives. Within beverages, private labels are capturing significant share in bottled water, juices, and specialty coffees, demonstrating success through competitive pricing and comparable ingredient quality. The premium private label tier is experiencing disproportionate growth, appealing to affluent consumers seeking gourmet or sustainably sourced products without the attached national brand price premium. Furthermore, the functional food and beverage sub-segment within private label portfolios is seeing significant innovation, reflecting broader consumer health and wellness movements.

AI Impact Analysis on Private Label Food and Beverages Market

Analysis of common user questions regarding AI's influence reveals key themes centered on supply chain optimization, predictive demand forecasting, and personalized product development. Consumers and industry stakeholders frequently ask how AI can enhance the speed of innovation (time-to-market for new private label SKUs), improve quality control (detecting anomalies in raw materials or production batches), and minimize waste through precise inventory management. The central concern revolves around whether AI can democratize access to sophisticated analytics, allowing smaller retailers to compete effectively with industry giants in developing highly targeted private label products. Users anticipate that AI will fundamentally transform how private labels identify white spaces in the market and manage the complexity associated with rapidly diversifying product portfolios across numerous retail locations.

- AI-driven Predictive Demand Forecasting: Utilizes complex algorithms to analyze sales history, seasonal patterns, and external variables (weather, holidays, promotions) to optimize production schedules and inventory levels, substantially reducing stockouts and overstocking of private label goods.

- Automated Quality Control and Inspection: Implementation of machine vision and sensor technology during manufacturing to automatically detect defects, ensuring consistent product quality across private label batches, minimizing recall risks, and maintaining brand trust.

- Supply Chain Optimization and Visibility: AI algorithms enhance logistics planning, route optimization, and supplier performance monitoring, leading to cost reductions in procurement and distribution, which directly translates into competitive pricing for private label items.

- Personalized Product Innovation and Formulation: AI analyzes vast consumer data (search history, loyalty card data, social media trends) to rapidly identify unmet needs and guide R&D toward developing highly localized, successful private label recipes and flavor profiles.

- Dynamic Pricing and Promotion Strategy: Uses real-time data analysis to adjust private label pricing dynamically based on competitor actions, inventory levels, and local demand elasticity, maximizing revenue and market penetration.

DRO & Impact Forces Of Private Label Food and Beverages Market

The Private Label Food and Beverages Market is propelled by compelling drivers, countered by inherent restraints, yet underpinned by substantial opportunities, all influenced by intense internal and external impact forces. Key drivers include accelerating consumer migration toward value-for-money products, enhanced perception of private label quality, and the strategic priority placed by major retailers on maximizing proprietary brand margins. Conversely, the market faces restraints such as persistent logistical complexity, high initial investment required for sophisticated private label manufacturing infrastructure, and the ongoing challenge of maintaining consistent quality control across diverse product categories and manufacturing partners. Overcoming the initial resistance to private label trial among certain demographic segments also remains a constant effort for retailers aiming for deep market penetration.

The primary opportunities lie in the continuous premiumization of private label offerings, especially targeting niche markets such as organic, sustainable, ethical, and functional foods where consumers are willing to pay a slight premium for perceived value and transparency. Geographic expansion into developing Asian and Latin American markets, coupled with leveraging e-commerce and direct-to-consumer models for specialized private label lines, represents significant long-term growth avenues. Furthermore, integrating advanced technologies like blockchain for supply chain transparency and AI for hyper-personalization will define the competitive edge in the coming years, turning private labels into highly data-driven, agile market entities.

Impact forces acting on this market are multifaceted, encompassing intense competitive pressure from national brands that are actively lowering prices or increasing marketing spend to protect market share, and external factors like global commodity price volatility and regulatory shifts regarding food labeling and sustainability standards. The bargaining power of major retailers is extremely high, driving contract manufacturers to stringent cost and quality requirements, constituting a major force shaping the supply side. Customer loyalty, traditionally strong for national brands, is shifting as positive shopping experiences with premium private labels erode that loyalty, significantly impacting brand equity dynamics across the retail landscape.

Segmentation Analysis

The Private Label Food and Beverages Market is highly segmented, allowing for granular analysis based on product type, distribution channel, category, and target consumer tier (value, standard, premium). This segmentation is crucial as retailers utilize different branding and sourcing strategies for staples versus specialty items. The food segment dominates the market share due to the sheer volume and necessity of staple products like dairy, packaged foods, and baked goods. However, the beverage segment, particularly in high-growth areas like functional drinks and ready-to-drink coffee/tea, is gaining traction rapidly as private labels capitalize on convenience trends. Analyzing the market through these lenses provides a clear understanding of where growth capital should be directed for maximum strategic impact and market penetration.

- Product Type:

- Private Label Food (e.g., Bakery, Dairy, Sauces & Condiments, Frozen Foods, Packaged Goods)

- Private Label Beverages (e.g., Bottled Water, Juices, Carbonated Soft Drinks, Coffee & Tea, Alcoholic Beverages)

- Category:

- Staple Products

- Gourmet/Specialty Products

- Functional & Wellness Products (Organic, Gluten-free, Vegan)

- Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Discounters (e.g., Aldi, Lidl)

- Sourcing Type:

- Contract Manufactured

- In-House Manufactured (Retailer owned facilities)

- Tier:

- Value/Economy

- Standard/Mid-tier

- Premium/Gourmet

Value Chain Analysis For Private Label Food and Beverages Market

The value chain for the Private Label Food and Beverages Market starts with complex upstream activities involving raw material procurement, agricultural sourcing, and ingredient processing. Unlike national brands which often rely on proprietary ingredient formulations, private label manufacturers prioritize cost-efficiency and volume sourcing, leading to significant bargaining power over upstream suppliers. Maintaining quality and safety standards while controlling costs at this initial stage is paramount, necessitating rigorous supplier audits and long-term contract agreements. Advances in traceability technology, such as blockchain, are increasingly being integrated to enhance transparency from farm to factory, meeting growing consumer demand for ethical sourcing and food safety assurances in private label offerings.

The midstream involves manufacturing and packaging, where flexibility is key. Private label goods are predominantly produced by third-party contract manufacturers who need the capacity to switch rapidly between producing different retailer brands while maintaining stringent quality specifications. Direct manufacturing by large retailers (in-house facilities) is also a significant component, offering greater control but requiring massive capital investment. Optimization of packaging—focusing on sustainability (recyclable materials) and cost reduction—is a continuous process that directly impacts the final shelf price and consumer appeal of the private label product.

The downstream segment encompasses warehousing, logistics, and distribution channels. The distribution model for private labels is heavily skewed toward direct distribution through the retailer's established network (direct channel), minimizing intermediate costs and maintaining tight control over inventory placement. The growing role of e-commerce necessitates specialized logistics solutions, including temperature-controlled last-mile delivery for perishable private label food items. Indirect distribution remains minor, generally limited to small specialty retailers or third-party marketplaces. Supermarkets, hypermarkets, and discounters constitute the primary point of sale, leveraging shelf placement and in-store marketing (visual merchandising) as critical tools to drive private label penetration and sales velocity.

Private Label Food and Beverages Market Potential Customers

The primary potential customers and end-users of Private Label Food and Beverages are diverse, extending across all consumer demographics, but are generally segmented by their purchase motivation. The largest segment comprises value-conscious households, including large families, budget shoppers, and low-to-middle-income consumers, who prioritize price parity and quality consistency over traditional brand recognition. For these buyers, private label products, especially those in the economy and standard tiers, provide essential cost-saving mechanisms in their weekly grocery spend, ensuring consistent demand regardless of the economic cycle.

A rapidly expanding segment consists of affluent and educated consumers who are drawn to premium and specialty private label offerings. These buyers seek high-quality, specialized products such as organic, free-from, sustainably sourced, or international gourmet items, often at a price point slightly lower than comparable national specialty brands. For this group, the retailer’s brand signifies trust and ethical production standards, rather than merely low cost. Retailers are successfully catering to this segment by investing heavily in high-end packaging, unique ingredient sourcing, and transparent labeling for their premium private label lines.

Furthermore, institutions and the HORECA (Hotel, Restaurant, and Catering) sector represent substantial potential B2B customers. While often purchasing in bulk, institutional buyers prioritize consistency, volume capacity, and competitive tender pricing, making large private label manufacturers highly attractive suppliers for essential ingredients, prepared foods, and high-volume beverages. The growth of quick-service restaurants and institutional food services relying on simplified supply chains further solidifies this customer base for standardized private label formulations designed for commercial use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 760.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carrefour SA, Tesco PLC, The Kroger Co., Albertsons Companies Inc., Aldi Group, Lidl Stiftung & Co. KG, Costco Wholesale Corporation, Walmart Inc., Ahold Delhaize, J Sainsbury plc, Schwarz Gruppe (Kaufland), Trader Joe’s, Loblaw Companies Limited, Edeka Group, Metro AG, Target Corporation, Woolworths Group, Private Label Manufacturers Association (PLMA), Amazon (Whole Foods 365), Sobeys Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Private Label Food and Beverages Market Key Technology Landscape

The technological landscape supporting the Private Label Food and Beverages Market is rapidly evolving, moving beyond traditional manufacturing processes into sophisticated, data-driven operations. A core technological focus is on enhancing the efficiency and agility of the supply chain, essential for managing the wide variety of SKUs inherent in private label portfolios. This includes the implementation of advanced Enterprise Resource Planning (ERP) systems specifically tailored for multi-site and multi-supplier environments, integrating production planning, inventory management, and distribution tracking. Furthermore, the adoption of Internet of Things (IoT) sensors within cold chains and warehousing provides real-time environmental monitoring, drastically reducing spoilage and ensuring the integrity of perishable private label goods from source to shelf.

Another critical area of technological integration is centered on product safety and transparency. Blockchain technology is emerging as a powerful tool, providing immutable, shared records of every step in the supply chain, which is highly valuable for retailers promoting the quality and ethical sourcing of their premium private label lines. This allows consumers to trace the origin of ingredients instantly, building trust and reinforcing the perceived value of the store brand. Simultaneously, sophisticated quality assurance systems utilizing spectral analysis and AI-powered vision systems are embedded in production lines to detect contaminants or variations in product attributes faster and more reliably than manual inspection methods.

Finally, technology is transforming consumer interaction and product development. Retailers are deploying advanced Customer Relationship Management (CRM) and data analytics platforms to mine loyalty program data and online shopping behaviors, enabling granular segmentation and personalized marketing for private label promotions. This data is fed back into the Research & Development pipeline, often utilizing digital twin technology for virtual product testing and faster iteration cycles. This technological ecosystem allows retailers to launch highly localized and trend-responsive private label products, significantly minimizing the risk associated with new product introductions and maintaining a competitive edge over national brand manufacturers who typically require longer innovation timelines.

Regional Highlights

- Europe: Europe maintains the highest private label penetration globally, with Western European countries like Switzerland, Spain, and the UK consistently showing market shares exceeding 45%. The market is mature, highly competitive, and driven by discounters (Aldi, Lidl) and major supermarket chains (Tesco, Carrefour). The focus here is on sustainability, premium organic lines, and ethical sourcing, pushing private label innovation upward in terms of quality and differentiation, especially within chilled foods and specialty beverages.

- North America: The North American market (dominated by the US and Canada) is characterized by massive scale and rapid growth, primarily driven by major retailers like Walmart, Kroger, and Costco, which view private labels as essential strategic assets. The US market is seeing rapid growth in the premium tier (e.g., Whole Foods' 365 brand) and specialized dietary categories (plant-based and functional foods). Retailers are heavily investing in localized manufacturing and advanced supply chain technology to sustain growth momentum and counter rising labor costs.

- Asia Pacific (APAC): APAC represents the highest potential growth region, driven by the expansion of organized retail in populous markets such as China, India, and Southeast Asia. While penetration remains lower than in the West, rapid urbanization, changing lifestyles, and rising middle-class disposable incomes are fueling demand. Private label strategies in APAC focus initially on competitive pricing for staple goods and, subsequently, introducing localized flavors and premium options tailored to urban consumer tastes and smaller household sizes.

- Latin America: This region presents a dynamic market environment where private label growth is strongly correlated with economic volatility. In countries like Brazil and Mexico, consumers are highly sensitive to price fluctuations, leading to strong uptake of value-tier private labels during inflationary periods. Retailers are working on improving distribution efficiency and overcoming infrastructure challenges to maintain product consistency and expand geographical reach.

- Middle East and Africa (MEA): The MEA market is fragmented, with varying degrees of maturity. Growth is concentrated in the GCC countries, driven by high disposable incomes and a strong presence of international hypermarket chains introducing sophisticated private label ranges. In Africa, the market is emerging, focused predominantly on basic packaged foods and essential non-perishables, with significant growth potential tied to increased access to modern retail infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Private Label Food and Beverages Market.- Carrefour SA

- Tesco PLC

- The Kroger Co.

- Albertsons Companies Inc.

- Aldi Group

- Lidl Stiftung & Co. KG

- Costco Wholesale Corporation

- Walmart Inc.

- Ahold Delhaize

- J Sainsbury plc

- Schwarz Gruppe (Kaufland)

- Trader Joe’s

- Loblaw Companies Limited

- Edeka Group

- Metro AG

- Target Corporation

- Woolworths Group

- Amazon (Whole Foods 365)

- Coles Group Limited

- Sobeys Inc.

Frequently Asked Questions

Analyze common user questions about the Private Label Food and Beverages market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift in consumer perception regarding private label quality?

The positive shift is driven by substantial retailer investment in premium ingredient sourcing, advanced manufacturing technologies that ensure product parity with national brands, and strategic branding that segments private labels into distinct quality tiers (value, standard, premium), effectively moving the store brand beyond its budget-only association.

How are private label brands achieving growth in the specialty and functional food categories?

Growth is achieved by leveraging retail data analytics to rapidly identify emerging consumer trends (e.g., keto, plant-based, organic) and contracting specialized manufacturers to quickly develop and launch competitively priced, high-quality private label alternatives that often bypass the slow R&D cycles of major national manufacturers.

Which geographical region holds the highest private label market penetration rate?

Europe, particularly Western European countries such as the UK, Germany, and Switzerland, consistently reports the highest private label penetration rates, frequently exceeding 40% or more of total grocery sales due to strong discount retail presence and established consumer trust in store brands.

What role does e-commerce play in the future expansion of the private label market?

E-commerce is critical for future expansion as it allows retailers to offer a greater assortment of specialized private label SKUs without physical shelf space limitations. Online platforms enable highly targeted marketing and direct consumer feedback loops, facilitating faster product iteration and personalized subscription box offerings for store brands.

What are the key technological challenges facing private label manufacturers?

The primary technological challenges involve maintaining consistent quality across a multitude of contract manufacturing partners globally and implementing complex, integrated supply chain visibility tools (like blockchain) necessary to ensure the traceability and safety standards required for premium private label branding while managing high volume cost efficiencies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager