Probe Station Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440205 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Probe Station Market Size

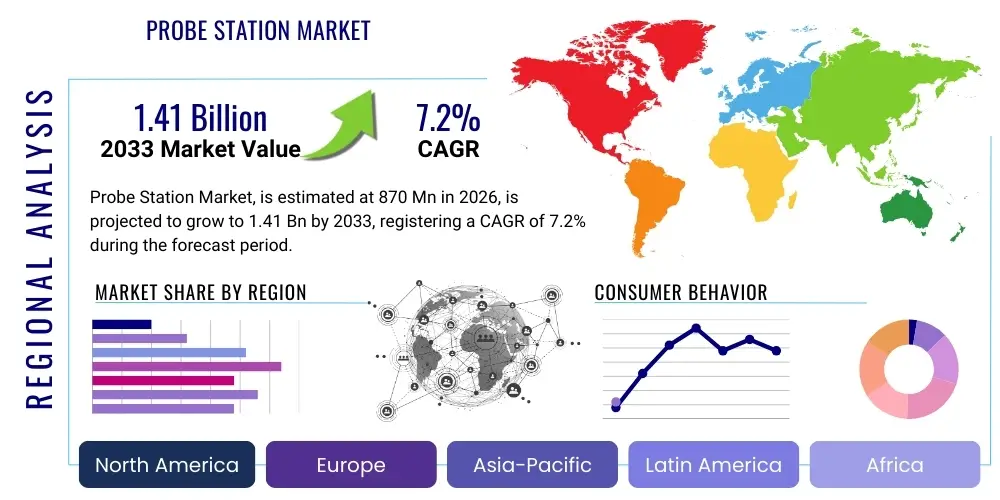

The Probe Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 870 million in 2026 and is projected to reach USD 1.41 billion by the end of the forecast period in 2033.

Probe Station Market introduction

The Probe Station Market encompasses the global industry dedicated to the design, manufacturing, and distribution of specialized test and measurement equipment used for precise electrical, optical, and mechanical characterization of semiconductor devices, wafers, and other microelectronic components. These indispensable systems provide a highly controlled and stable environment, enabling engineers and researchers to perform intricate measurements and analyses from the earliest stages of research and development through to quality control in high-volume production. Their fundamental role lies in ensuring the functionality, reliability, and performance of the microscopic structures that form the backbone of modern electronics, ranging from individual transistors to complex integrated circuits.

A typical probe station assembly comprises several high-precision components working in concert: a robust, vibration-isolated base, a highly accurate wafer chuck or device stage for precise positioning, and a sophisticated microscope system (optical or electron-beam) for visual alignment and inspection. Critically, it includes multiple micro-positioners that precisely manipulate fine-tipped probes to make electrical contact with specific test pads or structures on the device under test. These stations are engineered to accommodate an extensive array of testing requirements, including DC parametric measurements, high-frequency RF and millimeter-wave characterization, optical signal analysis, and measurements under extreme conditions such as cryogenic temperatures or elevated heat, alongside high-power applications. This adaptability is paramount given the accelerating pace of innovation in semiconductor technology and the increasing diversity of device architectures.

The applications for probe stations are broad and diverse, underpinning advancements across numerous critical sectors. They are vital for integrated circuit (IC) manufacturing, where they are used for process monitoring, yield optimization, and failure analysis of logic, memory, and analog circuits. Beyond traditional ICs, probe stations are essential in the development and production of Micro-Electro-Mechanical Systems (MEMS) for sensors and actuators, optoelectronic devices for photonics and communication, and advanced power semiconductor devices crucial for electric vehicles and renewable energy. The benefits derived from probe station utilization are substantial: they facilitate rapid prototyping, enable exhaustive fault diagnosis, minimize design iteration cycles, and ultimately ensure the integrity and performance of components indispensable for cutting-edge technologies like artificial intelligence (AI), 5G and future wireless communication, autonomous driving, and the expansive ecosystem of the Internet of Things (IoT).

Probe Station Market Executive Summary

The global Probe Station Market is currently experiencing robust expansion, driven by an insatiable demand for advanced semiconductor devices across an increasingly digitized world. Business trends within this sector point towards a significant paradigm shift towards enhanced automation, intelligent data integration, and multi-functional capabilities designed to tackle the growing complexity of semiconductor testing. Manufacturers are increasingly focusing on developing systems that not only offer higher throughput and precision but also seamlessly integrate with broader factory automation frameworks, leveraging robotic wafer handling, AI-driven diagnostic tools, and sophisticated software platforms for real-time process monitoring. This strategic pivot is aimed at addressing critical industry challenges such as reducing time-to-market, improving yield rates, and managing the exponential increase in test data generated by next-generation devices, thereby optimizing overall operational efficiency and accelerating innovation cycles for end-users.

From a regional perspective, the Asia Pacific (APAC) market continues its trajectory as the leading revenue generator, primarily due to the dense concentration of global semiconductor manufacturing giants, extensive outsourced semiconductor assembly and test (OSAT) operations, and a burgeoning electronics consumer market in countries such as Taiwan, South Korea, China, and Japan. These economies are heavily invested in expanding their semiconductor fabrication capacities and R&D capabilities, creating a sustained and escalating demand for advanced probe stations. North America and Europe, while having smaller manufacturing footprints, remain crucial markets characterized by significant investments in cutting-edge research, advanced materials science, and niche high-performance computing applications. These regions often drive the demand for highly specialized, custom-engineered probing solutions, particularly in emerging fields like quantum technology and advanced RF communication, showcasing innovation at the forefront of the industry.

Segmentation analysis reveals prominent trends across product types, applications, and end-user industries. Fully automatic probe stations are projected to exhibit the fastest growth, propelled by the semiconductor industry's relentless pursuit of higher throughput, lower operational costs, and reduced human intervention in production environments. Manual and semi-automatic systems, while crucial for research and low-volume prototyping, are seeing a comparatively slower, yet steady, demand. By application, IC manufacturing remains the largest segment, but the rapid expansion of MEMS and optoelectronics sectors, driven by the proliferation of sensors, photonics, and IoT devices, is creating new, high-growth opportunities for specialized probe station configurations. The increasing complexity of advanced packaging technologies, including 3D ICs and chiplets, further necessitates dedicated probing solutions capable of non-destructive and highly precise testing of these intricate and highly integrated components, underscoring a continuous evolution in testing requirements.

AI Impact Analysis on Probe Station Market

The advent of Artificial Intelligence (AI) and Machine Learning (ML) is profoundly transforming the Probe Station Market, moving it beyond traditional deterministic testing methodologies to more intelligent, adaptive, and predictive paradigms. Common user questions and concerns frequently revolve around how AI can enhance test efficiency, automate complex decision-making processes, and extract deeper insights from the vast amounts of data generated during wafer and device characterization. Users are particularly keen on understanding AI's potential to significantly reduce the time required for design debugging, accelerate root cause analysis for device failures, and enable more proactive maintenance of expensive test equipment. The underlying expectation is that AI will empower probe stations to become self-optimizing systems, capable of learning from historical data and adapting test strategies in real-time, thereby maximizing yield and minimizing costly human intervention.

Key themes emerging from market interest in AI integration include its ability to manage the overwhelming data deluge characteristic of advanced semiconductor testing, where terabytes of information can be generated in a single test run. AI algorithms can efficiently sift through this data, identifying subtle correlations, anomalous patterns, and potential manufacturing defects that human operators or conventional statistical methods might miss. This capability directly translates to improved process control and enhanced product reliability. Furthermore, AI is expected to revolutionize predictive maintenance schedules for probe station components, anticipating failures before they occur and optimizing the lifespan of critical parts, leading to substantial cost savings and minimized downtime. The future trajectory suggests AI will be embedded into the core functionalities of probe station software, providing smart diagnostics, automated test plan generation, and intelligent yield prediction, fundamentally altering how semiconductor characterization is performed.

The integration of AI also raises important considerations regarding data governance, cybersecurity, and the need for a skilled workforce capable of developing, deploying, and maintaining AI-powered test solutions. Despite these considerations, the overall sentiment is overwhelmingly positive, recognizing AI as a crucial enabler for navigating the complexities of next-generation semiconductor technologies. By transforming raw measurement data into actionable intelligence, AI-driven probe stations are set to play an even more critical role in accelerating innovation and ensuring the quality of electronic components in an increasingly data-centric world, thereby driving significant market growth and technological differentiation for manufacturers who successfully adopt these advanced capabilities.

- Enhanced automation and autonomous operation: AI algorithms can manage complex test sequences, adapt to varying test conditions, and even self-calibrate systems without manual intervention, boosting efficiency and reducing human error.

- Predictive maintenance and diagnostics: AI analyzes performance data from probe station components to predict potential failures, enabling proactive maintenance, reducing costly downtime, and extending equipment lifespan.

- Real-time anomaly detection and defect classification: Machine learning models can quickly identify subtle defects or deviations in electrical parameters that may indicate manufacturing issues, significantly improving yield management and quality control.

- Optimized test plan generation and adaptive probing: AI can learn from historical test results to suggest optimal test sequences, adapt probing strategies for specific device types, and prioritize tests for faster fault isolation.

- Accelerated data analysis and actionable insights: AI algorithms efficiently process vast amounts of test data, extract meaningful patterns, and provide engineers with immediate, actionable insights for process optimization and design improvements.

- Improved process control and statistical analysis: AI enhances statistical process control by identifying complex correlations in manufacturing data, leading to more robust and stable production processes.

- Advanced root cause analysis for device failures: By correlating test data with design parameters and manufacturing processes, AI can pinpoint the precise reasons for device failures more quickly and accurately than traditional methods.

- Reduced operational costs and increased throughput: Through automation, predictive capabilities, and optimized testing, AI contributes to significant reductions in operational expenditure and a notable increase in the number of devices tested per unit of time.

DRO & Impact Forces Of Probe Station Market

The Probe Station Market is buoyed by several significant drivers that underscore its critical role in the advancement of modern electronics. Foremost among these is the sustained, robust growth of the global semiconductor industry, which continues to innovate at an unprecedented pace. The insatiable demand for integrated circuits (ICs) across an ever-expanding array of applications—including consumer electronics, high-performance computing, automotive systems, industrial automation, and healthcare—directly fuels the need for sophisticated and reliable testing equipment. This is compounded by the relentless drive towards miniaturization, higher transistor densities, and increasing functional integration in semiconductor devices, which necessitates increasingly precise and versatile probe stations for accurate characterization and fault detection at the wafer level. The proliferation of next-generation technologies such as 5G connectivity, Artificial Intelligence (AI) accelerators, the pervasive Internet of Things (IoT), and advanced driver-assistance systems (ADAS) further amplifies this demand, as each new wave of innovation requires rigorous testing of novel materials, device architectures, and complex system-on-chip (SoC) designs, ensuring their performance, reliability, and manufacturability before market deployment.

Despite these powerful growth drivers, the Probe Station Market faces notable restraints that can temper its expansion. A primary constraint is the substantial capital expenditure required for acquiring advanced probe stations, especially fully automated, high-frequency, or cryogenic systems. These high upfront costs can present a significant barrier to entry for smaller companies, startups, or research institutions with limited budgets. The inherent technical complexity of operating, maintaining, and calibrating these highly specialized instruments also necessitates a skilled workforce, contributing to higher operational costs and potentially limiting broader adoption in regions with less developed technical infrastructures. Furthermore, the semiconductor industry is notoriously cyclical, experiencing periods of boom and bust. These fluctuating market conditions can lead to unpredictable investment cycles in capital equipment, impacting sales volumes and revenue streams for probe station manufacturers. Global geopolitical tensions, trade disputes, and supply chain vulnerabilities, as witnessed in recent years, also pose significant risks by disrupting the availability of critical components and increasing lead times, thereby affecting production and delivery schedules for specialized test equipment.

Opportunities for growth within the Probe Station Market are substantial and are emerging from several innovative fronts. The burgeoning fields of quantum computing, advanced photonics, and novel materials research (e.g., 2D materials, wide-bandgap semiconductors like GaN and SiC) are creating a demand for entirely new categories of ultra-low temperature, high-frequency, or specialized optical probing solutions, pushing the boundaries of existing technology. The increasing global focus on energy efficiency and power management in electronic devices is driving the development of power semiconductor devices, which in turn fuels the need for probe stations capable of high-voltage and high-current characterization. Moreover, the growing trend towards custom-built and highly configurable probe solutions tailored to specific research or production needs presents lucrative avenues for manufacturers. Impact forces on the market include the accelerating pace of technological innovation, particularly in measurement science and automation, which continually redefines the performance benchmarks for probe stations. Regulatory standards for electronic device reliability and environmental compliance also influence design and manufacturing processes. Macroeconomic conditions and global trade policies further shape investment landscapes and market accessibility, making these external factors crucial for strategic planning.

Segmentation Analysis

The Probe Station Market is meticulously segmented to provide a granular understanding of its diverse landscape, enabling a precise analysis of technological adoption, application-specific demands, and end-user preferences. These segmentation categories are fundamental tools for market strategists, investors, and manufacturers to identify specific growth vectors, evaluate competitive landscapes, and formulate targeted product development and marketing initiatives. By dissecting the market along dimensions such as product type, automation level, specific application, and the ultimate end-user industry, stakeholders can gain profound insights into the varied requirements that drive demand for different probe station configurations. This detailed breakdown highlights the necessity for versatile solutions that can cater to anything from fundamental academic research to high-volume industrial production, reflecting the broad spectrum of needs within microelectronics testing and characterization.

Further analysis within these segments often delves into specific technical parameters, including the maximum wafer size supported, the range of measurable frequencies (e.g., DC, RF, mmWave), environmental capabilities (e.g., ambient, vacuum, cryogenic), and specialized measurement modes (e.g., optical, high power, thermal). This level of detail allows for an understanding of niche markets and emerging technology drivers. For instance, the escalating demand for 300mm wafer compatibility is a direct reflection of advanced semiconductor manufacturing's push towards larger wafer sizes for economies of scale, while the growth in cryogenic probe stations is intrinsically linked to advancements in quantum computing and low-temperature material science research. Such intricate segmentation is essential for accurately forecasting market trends, identifying unmet needs, and strategically positioning products and services within the complex and rapidly evolving ecosystem of semiconductor test and measurement equipment.

The strategic importance of effective market segmentation cannot be overstated, as it provides a clear roadmap for navigating the competitive landscape. By understanding which segments are experiencing rapid growth, which are mature, and which are emerging, companies can allocate resources more effectively, prioritize research and development efforts, and refine their go-to-market strategies. For example, a probe station manufacturer specializing in high-frequency measurements might primarily target the RF/mmWave application segment within the telecommunications and defense end-user industries. Conversely, a provider of manual probe stations might focus on academic institutions and smaller research labs that prioritize cost-effectiveness and flexibility for experimental setups. This systematic approach to market segmentation ultimately empowers stakeholders to make informed decisions that align with technological trajectories and capitalize on dynamic market opportunities across the global microelectronics value chain.

- By Type: This segment differentiates probe stations based on their operational mechanism and level of human intervention required.

- Manual Probe Station: These require significant operator interaction for positioning probes and wafers; commonly used in R&D and failure analysis for flexibility and cost-effectiveness.

- Semi-Automatic Probe Station: Offers motorized stage and probe manipulation, often with software control for improved precision and repeatability, suitable for small to medium batch testing.

- Fully Automatic Probe Station: Features robotic wafer handling, automatic alignment, and advanced software for unattended, high-throughput testing in production environments.

- By Application: Categorizes probe stations based on their primary use case in the semiconductor lifecycle.

- Wafer Probing: Electrical testing performed on an entire semiconductor wafer before dicing, identifying defective dies to improve yield.

- Die Probing: Testing individual dies after dicing, typically for known good die (KGD) processes or specialized characterization.

- Package Probing: Characterization of semiconductor devices after they have been packaged, often for final functional verification.

- Material Characterization: Used for analyzing the electrical, optical, or thermal properties of new materials, substrates, or thin films in research.

- Failure Analysis: Detailed investigation of defective devices to determine the root cause of failure, crucial for process improvement and reliability.

- By End-User: Identifies the primary industries and organizations that utilize probe stations.

- Semiconductor Manufacturers (Foundries, IDMs): Major users for R&D, process control, and high-volume production testing of ICs.

- Research & Development Institutes: Academic and industrial labs focusing on cutting-edge device physics and materials science.

- OSAT (Outsourced Semiconductor Assembly and Test) Companies: Provide third-party packaging and testing services, requiring versatile, high-throughput systems.

- MEMS Manufacturers: Characterizing micro-electro-mechanical sensors and actuators for automotive, consumer, and industrial applications.

- Optoelectronics Manufacturers: Testing LEDs, lasers, photodiodes, and optical sensors for communication and imaging.

- Universities & Academic Institutions: Educational and research purposes, often requiring flexible and accessible systems for student training and fundamental science.

- Power Electronics Manufacturers: Characterizing high-voltage and high-current devices like MOSFETs, IGBTs, and diodes for electric vehicles and power management.

- By Wafer Size: Differentiates based on the diameter of the semiconductor wafer that the probe station can accommodate.

- 200mm (8-inch): Historically prevalent, still widely used for older processes, MEMS, and niche applications.

- 300mm (12-inch): Dominant in advanced semiconductor manufacturing for high-volume production due to cost efficiency per die.

- Others: Includes smaller sizes (e.g., 150mm/6-inch, 100mm/4-inch) for specialized or legacy devices, and potentially larger next-generation wafer sizes.

- By Measurement Type: Classifies based on the specific electrical or physical parameter being measured.

- DC/Low-Frequency: Standard electrical characterization (e.g., I-V, C-V curves) and low-speed signal measurements.

- RF/mmWave: High-frequency testing for devices in wireless communication (5G, 6G), radar, and high-speed data transmission.

- High Power: Specialized testing for power semiconductor devices, involving high voltage and current capabilities.

- Cryogenic: Measurements performed at extremely low temperatures, crucial for quantum computing and superconductivity research.

- Optical: Utilizing light for characterization, inspection, or interaction with optoelectronic devices.

- High Temperature: Testing devices under elevated thermal conditions to simulate harsh operating environments or for reliability studies.

Value Chain Analysis For Probe Station Market

A comprehensive value chain analysis for the Probe Station Market reveals a complex interplay of specialized entities, from raw material providers to end-users, each contributing essential value to the final product and service offering. The upstream segment is characterized by a reliance on highly specialized component suppliers. These critical partners provide ultra-precision mechanical components, such as sophisticated motion control systems, vibration isolation platforms, and high-accuracy wafer stages that dictate the fundamental stability and positioning capability of the probe station. Optoelectronics suppliers furnish high-resolution microscopes, camera systems, and illumination sources essential for visual alignment and inspection. Moreover, a myriad of electrical component suppliers provide advanced measurement instrumentation (e.g., Source Measure Units, Network Analyzers, signal generators), temperature control units (hot and cold chucks, cryogenic systems), and vacuum technology components for environmental control. Software developers are also crucial upstream players, delivering the operating systems, test program development environments, and data analysis algorithms that empower the probe station's intelligent functions. The integration of these diverse, high-performance components requires deep engineering expertise and rigorous quality control from the probe station manufacturers themselves, ensuring the seamless functionality and precision of the final product.

Further along the value chain, the distribution channels for probe stations are strategically multifaceted, typically involving a combination of direct sales and a network of specialized distributors and sales representatives. Given the high capital cost, inherent technical complexity, and often custom-engineered nature of advanced probe stations, direct sales channels are heavily favored by major manufacturers. This direct engagement allows for close collaboration with customers, enabling in-depth consultations regarding application-specific requirements, customization options, and the provision of comprehensive pre-sales and post-sales technical support, including installation, calibration, training, and ongoing maintenance. This direct model ensures that the nuanced needs of sophisticated end-users, particularly large semiconductor foundries and advanced R&D centers, are met with bespoke solutions and expert guidance. However, indirect channels, through carefully selected authorized distributors and value-added resellers, play a vital role in expanding market reach, particularly in diverse geographical regions where local presence and tailored support are crucial. These partners often possess intimate market knowledge, established customer relationships, and localized technical expertise, effectively complementing the manufacturers' direct sales efforts and servicing smaller customers or niche applications.

The downstream segment of the value chain is dominated by the diverse array of end-users who represent the ultimate consumers of probe station technology. This expansive group includes global semiconductor manufacturers (Integrated Device Manufacturers and Pure-Play Foundries), outsourced semiconductor assembly and test (OSAT) companies, dedicated research and development laboratories, academic institutions, and specialized manufacturers of MEMS, optoelectronics, and power electronics devices. The continuous feedback from these end-users regarding product performance, evolving testing challenges, new device architectures, and emerging research requirements is instrumental in driving innovation and product development cycles for probe station manufacturers. Post-sales services, including technical support, software updates, maintenance contracts, and training programs, constitute a significant and ongoing component of the value proposition, ensuring optimal operation, maximizing uptime, and extending the operational lifespan of these critical instruments. A robust and responsive service network is paramount for customer satisfaction and fostering long-term relationships in this specialized capital equipment market, highlighting that value creation extends far beyond the initial product sale to encompass a complete lifecycle support system.

Probe Station Market Potential Customers

The core customer base for the Probe Station Market comprises entities engaged in the intricate processes of semiconductor device design, fabrication, and characterization. This includes global integrated device manufacturers (IDMs) such as Intel, Samsung, and Micron, which require extensive fleets of probe stations for their end-to-end operations, spanning fundamental research, process development, quality control during high-volume manufacturing, and failure analysis of complex logic, memory, and analog circuits. Similarly, pure-play semiconductor foundries, like TSMC and GlobalFoundries, represent a colossal market segment, as they continuously invest in state-of-the-art probing equipment to ensure the quality, performance, and yield of the billions of chips they produce for fabless companies worldwide. The increasing sophistication and miniaturization of integrated circuits necessitate highly precise, reliable, and often automated testing solutions, making probe stations an indispensable capital investment for these industry behemoths.

Beyond the foundational semiconductor manufacturing sector, the market's reach extends significantly into specialized industries and cutting-edge research environments. Outsourced Semiconductor Assembly and Test (OSAT) companies, providing crucial third-party packaging, assembly, and testing services for a multitude of clients, constitute a vital customer segment. These firms demand highly versatile and high-throughput probe stations capable of accommodating diverse device types and test methodologies. Moreover, manufacturers specializing in Micro-Electro-Mechanical Systems (MEMS)—such as Bosch, STMicroelectronics, and Analog Devices—rely on probe stations for the precise electrical and mechanical characterization of accelerometers, gyroscopes, pressure sensors, and microphones critical for automotive, medical, and consumer electronics applications. The burgeoning optoelectronics sector, encompassing companies developing LEDs, lasers, photodiodes, and optical sensors for data communication, imaging, and sensing, also heavily utilizes probe stations for accurate optical and electrical performance validation.

Furthermore, the academic and research community forms an important, albeit niche, segment of the potential customer base. Universities, government-funded research laboratories, and national institutes are frequent purchasers of probe stations for fundamental materials science research, advanced device physics studies, and the exploration of nascent technologies like quantum computing and novel 2D materials. These institutions often require highly flexible, customizable, and specialized probe stations that can operate under extreme conditions (e.g., cryogenic, high-temperature, vacuum) to support pioneering scientific investigations. Additionally, the growing focus on power efficiency and robust performance in power electronics—driven by sectors like electric vehicles, industrial power management, and renewable energy—means that manufacturers of devices such as MOSFETs, IGBTs, and wide-bandgap semiconductors (SiC, GaN) are increasingly investing in specialized high-power probe stations for critical characterization and reliability testing. This diverse ecosystem of users underscores the broad and indispensable role probe stations play across the entire microelectronics innovation and production landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 870 Million |

| Market Forecast in 2033 | USD 1.41 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FormFactor Inc., Keysight Technologies, Tokyo Electron Limited (TEL), Advantest Corporation, MPI Corporation, Lake Shore Cryotronics, Wentworth Laboratories, SemiProbe, Inc., Accu-Probe, Inc., MicroXact Inc., Suss MicroTec, Qorvo, Optem Inc., Trymax, Micronics Japan Co., Ltd. (MJC), Esatto GmbH, Aetrium Inc., Cohu Inc., Cascade Microtech (now part of FormFactor), Technoprobe S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Probe Station Market Key Technology Landscape

The Probe Station Market is defined by a rapidly evolving and sophisticated technology landscape, continuously adapting to the increasingly complex and stringent demands of advanced semiconductor research, development, and high-volume manufacturing. A paramount area of technological innovation centers around enhancing measurement precision, increasing operational speed, and expanding the versatility of testing environments. The advent and proliferation of 5G, 6G, and radar applications have necessitated significant advancements in high-frequency and millimeter-wave probing capabilities, requiring specialized, low-loss probe tips, meticulously shielded test environments, and integrated high-performance measurement instrumentation to accurately characterize devices operating at extremely high frequencies with minimal signal degradation. Furthermore, the burgeoning fields of quantum computing and advanced material science demand specialized cryogenic and high-temperature probing systems, enabling precise device characterization under extreme thermal conditions that mimic their operational environments or facilitate fundamental physical property investigations, pushing the boundaries of traditional thermal management and measurement stability.

Automation stands as another critical pillar within the modern probe station technology landscape, profoundly influencing efficiency and scalability. Fully automatic probe stations incorporate sophisticated robotic wafer handling systems, advanced pattern recognition software for ultra-precise device alignment, and intelligent control algorithms that enable unattended, high-throughput testing in demanding production settings. This automation not only significantly boosts the number of devices that can be tested per hour but also drastically reduces human error and ensures unparalleled measurement repeatability and consistency across entire wafer batches. Complementing this, the integration of advanced measurement software, frequently enhanced with Artificial Intelligence (AI) and Machine Learning (ML) capabilities, provides powerful tools for sophisticated data analysis, real-time feedback mechanisms, and predictive capabilities. These AI/ML algorithms can discern subtle performance deviations, optimize test parameters dynamically, and accelerate the identification of root causes for device failures, thereby leading to substantial improvements in process optimization and overall yield management for semiconductor manufacturers.

Moreover, the technological landscape is witnessing notable developments in specialized probing techniques. Optical probing, utilizing high-resolution cameras, lasers, and other photonic tools, is gaining traction for non-contact measurements, visual inspection of intricate structures, and the characterization of optoelectronic devices where electrical contact might be impractical or disruptive. Developments in active thermal control systems (hot/cold chucks) provide rapid and precise temperature cycling for reliability testing. The ongoing innovation in probe tip design and materials science is leading to longer-lasting, higher-performance probes capable of making reliable contact with smaller, more delicate test pads. Additionally, the drive towards multi-site probing and parallel testing solutions is further optimizing testing efficiency, allowing for the simultaneous characterization of multiple devices or structures on a single wafer. These continuous technological advancements collectively empower probe stations to meet the ever-increasing complexity and performance demands of the microelectronics industry, solidifying their role as indispensable tools for innovation and quality assurance.

Regional Highlights

- North America: This region stands as a significant innovation hub in the Probe Station Market, driven by substantial investments in cutting-edge semiconductor research and development, particularly in advanced computing (AI, quantum computing), high-performance computing (HPC), and next-generation communication technologies. The presence of major semiconductor design companies, advanced materials research institutions, and prominent universities fosters a robust demand for highly specialized, custom-engineered probe stations that push the boundaries of measurement science. The emphasis here is often on developing solutions for emerging technologies, requiring systems capable of ultra-low temperature, high-frequency, and complex parametric testing, indicating a strong focus on high-value, niche applications rather than pure volume manufacturing. The robust venture capital ecosystem further supports startups and innovative research, ensuring sustained demand for advanced probing solutions.

- Europe: The European Probe Station Market is characterized by a strong focus on industrial electronics, automotive semiconductors, and telecommunications sectors, particularly in countries like Germany, France, and the Netherlands. This drives significant demand for probe stations used in the testing and characterization of power electronics (e.g., SiC, GaN devices for EVs and industrial applications), MEMS sensors, and RF components crucial for 5G infrastructure. Europe boasts a strong R&D ecosystem with numerous research institutes and universities engaged in materials science and microelectronics, fostering both the demand for and the development of advanced probing technologies. The region often prioritizes high reliability, energy efficiency, and functional safety in its electronic components, leading to a consistent need for precise and comprehensive testing equipment to meet stringent industry standards and regulatory requirements.

- Asia Pacific (APAC): The APAC region remains the undisputed global leader in the Probe Station Market, commanding the largest share due to its unparalleled concentration of semiconductor manufacturing, assembly, and test operations. Countries like Taiwan (TSMC, UMC), South Korea (Samsung, SK Hynix), China, and Japan host the majority of the world's semiconductor foundries, IDMs, and outsourced semiconductor assembly and test (OSAT) companies. This dense industrial ecosystem drives massive demand for both high-volume, fully automated probe stations for production lines and advanced semi-automatic systems for process development and quality control. Government initiatives and significant investments aimed at bolstering domestic semiconductor industries further fuel market expansion across the region, making APAC the primary growth engine for the global probe station market, characterized by continuous capacity expansion and technological upgrades.

- Latin America: While currently representing a smaller share of the global Probe Station Market, Latin America is demonstrating promising growth, primarily driven by increasing investments in the localized electronics manufacturing sector, particularly within the automotive and consumer electronics industries. Countries such as Brazil and Mexico are witnessing the establishment of new assembly plants and a growing focus on developing domestic technological capabilities. This trend is leading to a gradual but consistent increase in the demand for essential test and measurement equipment, including probe stations, for quality assurance and process control. The market in this region often seeks cost-effective, versatile, and robust probing solutions that can support diverse manufacturing processes and evolving technological requirements as local industries mature and integrate further into global supply chains, presenting significant untapped potential for market players.

- Middle East and Africa (MEA): The MEA region is at a relatively nascent stage in the Probe Station Market, but it is experiencing gradual expansion fueled by strategic investments in technological infrastructure, the burgeoning telecommunications sector, and national initiatives aimed at diversifying economies away from traditional oil and gas reliance. While large-scale semiconductor manufacturing is limited, there is a growing emphasis on establishing specialized technology parks, fostering innovation hubs, and increasing research activities within universities and scientific institutions. This is creating new, albeit smaller, pockets of demand for probe stations, primarily for academic research, specialized component testing, and quality control in nascent electronics assembly operations. The long-term growth potential in MEA is tied to continued government support for technology adoption, educational advancements, and the gradual development of a more robust local electronics industry ecosystem, making it a region of emerging interest for market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Probe Station Market.- FormFactor Inc.

- Keysight Technologies

- Tokyo Electron Limited (TEL)

- Advantest Corporation

- MPI Corporation

- Lake Shore Cryotronics

- Wentworth Laboratories

- SemiProbe, Inc.

- Accu-Probe, Inc.

- MicroXact Inc.

- Suss MicroTec

- Qorvo

- Optem Inc.

- Trymax

- Micronics Japan Co., Ltd. (MJC)

- Esatto GmbH

- Aetrium Inc.

- Cohu Inc.

- Cascade Microtech (now part of FormFactor)

- Technoprobe S.p.A.

Frequently Asked Questions

What is a probe station, and why is it critically essential in the semiconductor industry?

A probe station is a highly precise test and measurement instrument specifically designed for electrical, optical, and mechanical characterization of semiconductor wafers, individual dies, and packaged devices. It is critically essential in the semiconductor industry because it enables engineers to accurately verify device functionality, measure crucial electrical parameters (e.g., current-voltage, capacitance-voltage), and detect subtle defects at various stages of the manufacturing process and research cycles. This rigorous testing ensures product quality, facilitates process optimization for higher yields, accelerates failure analysis, and ultimately helps bring advanced electronic components to market faster and more reliably, forming the backbone of modern microelectronics development and production.

How is Artificial Intelligence (AI) actively transforming the Probe Station Market and its capabilities?

Artificial Intelligence (AI) is actively transforming the Probe Station Market by integrating advanced automation, enabling predictive maintenance, and revolutionizing data analysis capabilities. AI algorithms empower probe stations to perform complex test sequences autonomously, dynamically optimize measurement parameters in real-time based on historical data, and rapidly detect anomalies or defects. This leads to significantly enhanced test efficiency, reduced operator intervention, and improved yield management. Furthermore, AI-driven systems can anticipate equipment failures, thereby minimizing costly downtime, and provide deeper, actionable insights from vast datasets, making probe stations more intelligent, adaptive, and efficient tools across the entire semiconductor value chain.

What are the primary drivers and key opportunities propelling growth in the Probe Station Market?

The primary drivers propelling growth in the Probe Station Market include the relentless expansion of the global semiconductor industry, fueled by increasing demand for advanced integrated circuits across applications like 5G, AI, IoT, and autonomous vehicles. The continuous drive towards device miniaturization, higher performance, and complex advanced packaging technologies also necessitates sophisticated testing. Key opportunities emerge from burgeoning fields such as quantum computing, photonics, and novel material research requiring specialized probing capabilities. The increasing focus on power electronics and the demand for custom-built, highly configurable test solutions further open lucrative avenues for market expansion and innovation.

Which geographical regions are currently leading in the demand for probe stations, and what factors contribute to their dominance?

The Asia Pacific (APAC) region currently leads in the demand for probe stations, primarily due to its unparalleled concentration of global semiconductor manufacturing hubs, including major foundries and OSAT companies in Taiwan, South Korea, China, and Japan. This extensive industrial ecosystem drives immense demand for both high-volume automated production testing and advanced R&D systems. North America and Europe also maintain significant market shares, driven by strong investments in cutting-edge research, advanced technology development, and high-performance computing, fostering a demand for highly specialized and customized probing solutions for niche, high-value applications.

What are the main types of probe stations available, and what are their diverse applications across industries?

The main types of probe stations available are classified by their automation level: manual, semi-automatic, and fully automatic, each catering to different throughput and precision requirements. Their diverse applications span the entire microelectronics industry, including wafer probing (testing entire wafers), die probing (testing individual chips), package probing (testing finished devices), material characterization (analyzing new substances), and failure analysis (diagnosing defects). These stations are indispensable for semiconductor manufacturers, R&D institutes, OSAT companies, and manufacturers in MEMS, optoelectronics, and power electronics, supporting a wide range of DC, RF/mmWave, optical, high-power, and cryogenic measurements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cryogenic Probe Station Market Statistics 2025 Analysis By Application (Semiconductor, Microelectronics, Opt Electronics), By Type (Automatic Probe station, Semi Automati Probe station, Manual Probe station), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Low Temperature Probe Station Market Statistics 2025 Analysis By Application (Semiconductor, Microelectronics, Opt Electronics, Nanoelectronics), By Type (Automatic Probe station, Semi Automati Probe station, Manual Probe station), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Probe Station Microscope Market Statistics 2025 Analysis By Application (Semiconductor, Microelectronics, Opt Electronics), By Type (Trinocular Microscope, Binocular Microscope), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Probe Station Market Statistics 2025 Analysis By Application (Semiconductor, Microelectronics, Opt Electronics), By Type (Manual Probe Station, Semi Auto Probe Station, Auto Probe Station), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager