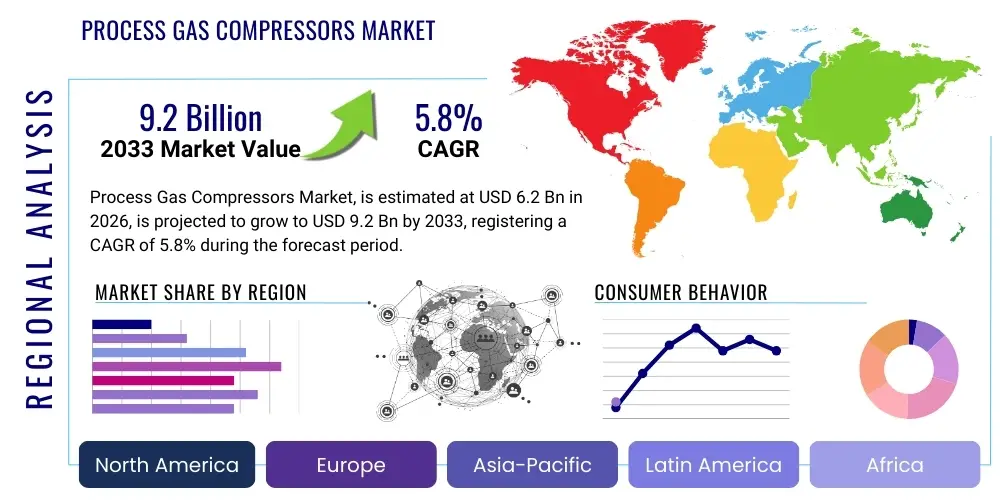

Process Gas Compressors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437440 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Process Gas Compressors Market Size

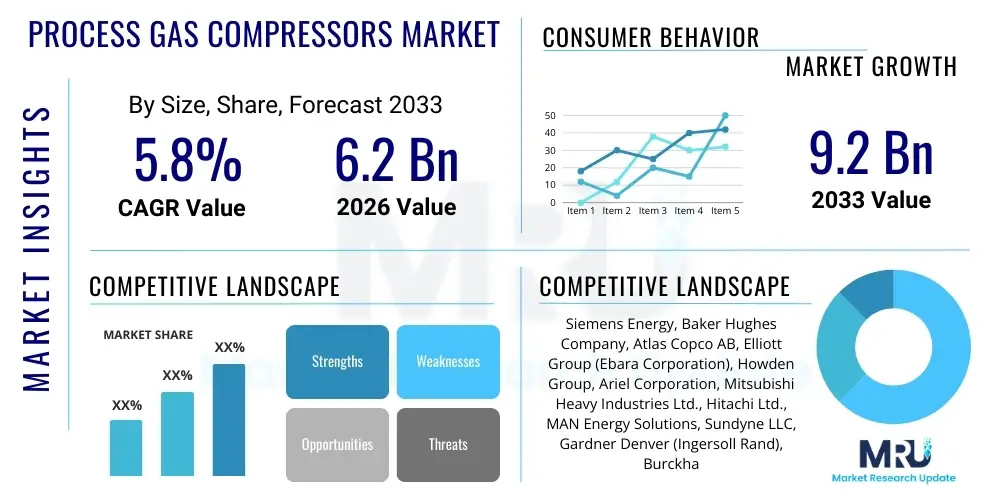

The Process Gas Compressors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $6.2 Billion in 2026 and is projected to reach $9.2 Billion by the end of the forecast period in 2033.

Process Gas Compressors Market introduction

The Process Gas Compressors Market encompasses heavy-duty industrial machinery designed to increase the pressure and density of specialized gases within complex industrial processes, distinct from standard air compressors. These compressors are vital across industries such as oil and gas, petrochemicals, refining, and chemicals, handling highly corrosive, toxic, or flammable gases like natural gas, hydrogen, ammonia, and syngas. Their robust design ensures reliability under severe operating conditions, supporting continuous flow and high-pressure requirements essential for production cycles, gas transportation, and energy transformation.

Process gas compressors are foundational components in capital-intensive projects, serving critical functions such as gas boosting for transportation pipelines (midstream), feedstock preparation (petrochemicals), and gas injection for enhanced oil recovery (EOR). The primary benefit derived from these systems is the maintenance of optimal throughput and reaction conditions, significantly influencing plant efficiency and safety protocols. Furthermore, advancements in materials science and aerodynamic design are continually improving the thermodynamic efficiency and operational lifespan of these critical assets, driving replacement and expansion opportunities globally.

Key applications include natural gas liquefaction (LNG), ammonia and urea synthesis, ethylene production, and hydrogen compression for fuel cell applications and low-carbon energy transition initiatives. Driving factors for market expansion include escalating global energy demand, increased investment in natural gas infrastructure, the proliferation of large-scale chemical manufacturing facilities, and the necessity for carbon capture, utilization, and storage (CCUS) projects, all of which rely heavily on high-performance gas compression technology to operate efficiently and meet stringent environmental regulations.

Process Gas Compressors Market Executive Summary

The Process Gas Compressors Market is experiencing robust growth fueled primarily by substantial investment in the midstream oil and gas sector, particularly the construction of new liquefied natural gas (LNG) terminals and pipeline networks across North America and Asia Pacific. Business trends indicate a strong shift towards optimizing operational expenditure through predictive maintenance powered by Industrial Internet of Things (IIoT) sensors, alongside a growing demand for magnetic bearing technologies in centrifugal compressors to enhance uptime and reduce lubrication requirements. Regulatory pressures concerning methane emissions are also pushing end-users toward zero-leakage, hermetically sealed compressor designs.

Regionally, Asia Pacific leads the market due to massive infrastructure expansion in China and India, focusing on domestic gas distribution and fertilizer production, while North America remains dominant in technological adoption, driven by the shale gas revolution and subsequent investment in petrochemical capacity. Segment trends highlight that reciprocating compressors maintain dominance in high-pressure, low-flow applications like gas gathering and hydrogen compression, but centrifugal compressors are gaining significant traction in high-volume applications such as LNG and large refinery operations, benefiting from efficiency improvements and scalability.

The executive outlook suggests that future market growth will be intrinsically linked to the energy transition, specifically the scaling up of blue and green hydrogen infrastructure and the implementation of large-scale CCUS projects, positioning specialized high-pressure CO2 and H2 compressors as the fastest-growing sub-segments. Market participants are focusing on strategic acquisitions and partnerships to integrate digital service capabilities (asset performance management) alongside core hardware offerings, ensuring comprehensive lifecycle support for complex compression trains.

AI Impact Analysis on Process Gas Compressors Market

User inquiries regarding AI's influence in the Process Gas Compressors Market center predominantly on themes of predictive maintenance efficacy, optimization of energy consumption under variable load conditions, and the potential for autonomous operation. Key concerns revolve around the cybersecurity implications of integrating AI platforms into critical infrastructure and the accuracy of machine learning models trained on highly heterogeneous operational data across diverse gas types and pressures. Users are eagerly seeking quantitative evidence demonstrating how AI reduces unplanned downtime, extends Mean Time Between Failures (MTBF), and improves overall thermodynamic efficiency of complex compression trains.

The implementation of Artificial Intelligence and advanced machine learning algorithms is fundamentally transforming the operational paradigm of process gas compressors from reactive or scheduled maintenance towards prescriptive asset management. AI systems analyze real-time vibration data, temperature gradients, pressure fluctuations, and acoustic emissions, identifying subtle anomalies indicative of impending component failure (e.g., surge events, bearing degradation) long before traditional monitoring systems. This capability significantly enhances asset reliability and safety, minimizing costly shutdowns in high-throughput environments like LNG facilities or synthesis gas plants.

Furthermore, AI is crucial for optimizing the complex control logic required in multi-stage compression systems, particularly in environments with fluctuating demand or feed gas quality, such as refineries. Machine learning models can dynamically adjust anti-surge valves and speed controls to maintain peak efficiency (turndown ratio) while preventing damaging compressor surge, thereby reducing energy wastage and extending the lifespan of mechanical seals and impellers. The adoption of digital twins, powered by AI, allows operators to simulate various operating scenarios and maintenance strategies virtually, de-risking real-world implementations and accelerating performance improvements.

- AI-driven Predictive Maintenance (PdM) reduces unplanned downtime by up to 30%.

- Machine learning optimizes compressor staging and speed control, achieving 3-5% energy efficiency gains.

- Digital Twin technology simulates surge control and variable load scenarios for optimized design.

- Natural Language Processing (NLP) assists technicians in rapidly diagnosing complex operational faults.

- Autonomous control systems are being piloted to manage anti-surge protection and process stability.

- Enhanced cybersecurity measures are necessitated by increased sensor and cloud connectivity.

- AI algorithms assist in optimizing material selection and coating strategies based on corrosion data.

DRO & Impact Forces Of Process Gas Compressors Market

The Process Gas Compressors Market is driven by sustained global energy demand, especially the shift towards cleaner fossil fuels like natural gas, which necessitates extensive compression infrastructure for transportation and processing. Restraints primarily stem from high initial capital expenditure required for large compression trains and the cyclical nature of investment in the volatile oil and gas sector, which can cause project delays. Opportunities are concentrated in emerging low-carbon technologies, particularly hydrogen compression for mobility and power, and specialized CO2 compressors essential for developing Carbon Capture, Utilization, and Storage (CCUS) projects globally, representing a critical diversification pathway for manufacturers.

Impact forces currently governing the market dynamics include the increasing stringency of environmental regulations regarding methane leakage, compelling manufacturers to develop advanced, leak-proof magnetic and dry gas seal systems, thereby accelerating technological obsolescence of older installed bases. Furthermore, geopolitical instability impacting global energy supply chains influences investment decisions in both new exploration and production (E&P) and subsequent midstream processing facilities. The continuous pressure on operational costs drives adoption of high-efficiency, variable-speed drive (VSD) compressors, making energy consumption a primary determinant of purchasing decisions.

Another significant impact force is technological convergence, where integration of advanced monitoring (IIoT), AI, and automation is moving the industry towards 'Compressor-as-a-Service' models, transforming how assets are managed and maintained throughout their lifecycle. This shift requires vendors to invest heavily in software capabilities and digital service infrastructure, changing the competitive landscape from hardware provision to integrated solutions delivery. The need for specialized alloys and materials capable of handling corrosive H2S or wet CO2 streams further influences manufacturing complexity and supply chain resilience.

Segmentation Analysis

The Process Gas Compressors Market is segmented based on critical technical and operational parameters including compressor type, operational stage, application across various industries, and end-use environments. Segmentation by type (Centrifugal, Reciprocating, Screw) reflects trade-offs between flow rate, pressure ratio, and maintenance requirements, catering to the specific needs of processes like LNG liquefaction (high volume, centrifugal) versus ammonia synthesis (high pressure, reciprocating). Analyzing these segments provides a clear view of where capital expenditure is flowing and which technologies are best positioned to capitalize on long-term industrial trends, particularly the energy transition.

The market structure is highly dependent on capital allocation in the heavy industrial sector. For instance, the Oil and Gas application segment, encompassing upstream injection, midstream transport, and downstream processing, remains the largest revenue generator. However, the Chemicals and Petrochemicals segment is exhibiting the fastest growth due to the expansion of large-scale ethylene, methanol, and fertilizer production facilities, demanding highly reliable and efficient compression solutions tailored for harsh chemical environments. Understanding the intersection of these segments is vital for strategic market positioning.

- By Type: Centrifugal Compressors, Reciprocating Compressors, Rotary Screw Compressors, Axial Compressors.

- By Application: Oil and Gas (Upstream, Midstream, Downstream), Chemical and Petrochemical, Power Generation, General Industry, Energy Transition (Hydrogen/CCUS).

- By Operational Stage: Low Pressure, Medium Pressure, High Pressure.

- By Design: Oil-free Compressors, Oil-lubricated Compressors.

Value Chain Analysis For Process Gas Compressors Market

The value chain for process gas compressors begins with upstream activities involving raw material procurement (specialized steel, nickel alloys, complex castings) and core component manufacturing (rotors, impellers, pistons, casing). This stage is highly capital-intensive and requires stringent quality control due to the critical nature of the equipment. Key upstream suppliers include specialized metallurgy firms and advanced bearing/seal manufacturers, who significantly influence the final product's performance and cost structure. Efficiency gains at this stage focus on optimizing machining processes and material flow.

The midstream phase involves Original Equipment Manufacturers (OEMs) who focus on design, system integration, testing, and final assembly of the complex compression trains, often incorporating proprietary aerodynamic designs and sophisticated control systems. Distribution channels are typically direct for large, custom-engineered process compressors, involving extensive bidding, project management, and specialized logistics to deliver equipment to remote industrial sites. For smaller, standardized units, indirect channels via regional distributors or specialized engineering procurement and construction (EPC) firms may be utilized.

Downstream analysis focuses on installation, commissioning, operation, and crucially, long-term aftermarket services (maintenance, repairs, spare parts, and digital monitoring). The high cost and complexity of these assets make the aftermarket segment highly lucrative, often generating higher margins than initial equipment sales. OEMs are increasingly leveraging digitalization and IIoT for remote diagnostics and predictive maintenance, strengthening direct relationships with end-users and capturing greater lifetime value from the installed base, ensuring long-term profitability and customer retention.

Process Gas Compressors Market Potential Customers

Potential customers for process gas compressors are entities engaged in large-scale industrial processes that require precise manipulation and handling of gases under high-pressure conditions. The primary buyers include multinational oil and gas supermajors and National Oil Companies (NOCs) that operate extraction facilities, midstream pipelines, and downstream refining complexes. These customers demand highly customized, robust, and reliable compressors built to withstand continuous operation in extreme environments, often requiring compliance with proprietary corporate engineering standards.

Major end-users also encompass large petrochemical and chemical manufacturers specializing in the production of fertilizers (ammonia, urea), polymers (ethylene, propylene), and industrial gases. For these buyers, gas purity, material compatibility (to resist corrosion), and energy efficiency are paramount, as compression is a significant operational cost component. Furthermore, the emerging energy transition sector, including operators of large-scale hydrogen production and storage facilities, along with developers of CO2 sequestration sites, represents a rapidly expanding customer base seeking highly specialized, often cryogenic, compression solutions.

Finally, Engineering, Procurement, and Construction (EPC) firms act as indirect but influential buyers, specifying and purchasing compression equipment on behalf of the ultimate asset owners. Their procurement decisions are often driven by vendor track record, adherence to project timelines, technological maturity, and total cost of ownership (TCO) assessments. Government-owned utilities and independent power producers (IPPs) are also relevant customers, particularly for applications related to gas turbine fuel supply or specialized industrial waste gas management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.2 Billion |

| Market Forecast in 2033 | $9.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Baker Hughes Company, Atlas Copco AB, Elliott Group (Ebara Corporation), Howden Group, Ariel Corporation, Mitsubishi Heavy Industries Ltd., Hitachi Ltd., MAN Energy Solutions, Sundyne LLC, Gardner Denver (Ingersoll Rand), Burckhardt Compression AG, Doosan Heavy Industries & Construction, Kobelco Compressors, Kaeser Kompressoren SE, Fusheng Industrial Co., Ltd., Shenyang Blower Works Group Co., Ltd., Wuxi Compressor Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Process Gas Compressors Market Key Technology Landscape

The technological landscape of the Process Gas Compressors Market is characterized by continuous innovation aimed at enhancing efficiency, reliability, and adapting to new process demands, notably those related to the energy transition. A core focus is on advanced aerodynamic design, utilizing computational fluid dynamics (CFD) modeling to optimize impeller and diffuser geometry in centrifugal compressors, resulting in wider operating maps and higher isentropic efficiencies. Material science is equally crucial, with manufacturers increasingly utilizing advanced alloys (like stainless steels and titanium) and specialized coatings to resist corrosion and erosion from corrosive feed gases, such as wet CO2 or sour gas (H2S), thereby extending mean time between overhaul (MTBO).

A major disruptive technological trend is the proliferation of oil-free and magnetic bearing technologies, particularly in high-speed centrifugal compressors. Active Magnetic Bearings (AMBs) eliminate the need for lubricating oil systems, reducing maintenance complexity, operational costs, and preventing process gas contamination—a critical requirement in hydrogen and clean gas processes. Furthermore, dry gas seals (DGS) have become standard for preventing process gas leakage into the atmosphere, directly addressing methane emission reduction mandates. These mechanical advancements are driving new performance thresholds in reliability and environmental compliance across the installed base.

Digitization represents the most profound shift, integrating sophisticated sensors, IIoT connectivity, and edge computing capabilities into compression systems. This allows for real-time condition monitoring, remote diagnostics, and the application of AI-powered predictive algorithms. The incorporation of Variable Speed Drives (VSDs) is also standardizing, enabling compressors to adjust rapidly to fluctuating process demands while maximizing energy efficiency across diverse load conditions. The shift towards higher-pressure, multi-stage compression systems for carbon capture and deep gas injection also necessitates breakthroughs in specialized metallurgy and compact, modular skid designs to reduce site footprint and installation time.

Regional Highlights

- North America: North America holds a substantial share of the Process Gas Compressors Market, driven primarily by the high volume of natural gas production stemming from the shale revolution and significant investment in downstream petrochemical expansion along the Gulf Coast. The region is a leader in technological adoption, particularly concerning high-efficiency centrifugal compressors integrated with VSDs and advanced digital monitoring platforms. Growth is further accelerated by regulatory pressures necessitating the replacement of older infrastructure with zero-leakage systems, and substantial early-stage investment into large-scale hydrogen production hubs and associated compression infrastructure in preparation for the energy transition. The midstream sector, focused on gas processing and pipeline transmission, remains the largest consumer.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, characterized by immense capital deployment in energy infrastructure, especially in China, India, and Southeast Asia. This growth is underpinned by rising domestic energy consumption, rapid industrialization, and massive new refinery and petrochemical complex construction projects, driving demand for high-capacity compressors for ethylene, ammonia, and methanol synthesis. Government initiatives supporting domestic natural gas consumption, particularly in India, are spurring pipeline and CNG/LNG terminal construction. The increasing focus on achieving industrial self-sufficiency and reducing reliance on imports makes APAC a key driver of large-scale project commissioning globally, focusing heavily on proven, high-reliability compression solutions.

- Europe: The European market, while mature, is undergoing a profound transformation driven exclusively by decarbonization mandates and the pursuit of energy independence. Demand is intensely focused on specialized compression equipment for low-carbon applications, specifically high-pressure CO2 compressors for large CCUS demonstration projects (e.g., in the North Sea region) and hydrogen compressors vital for blending and storage networks. The market emphasizes efficiency, noise reduction, and adherence to strict EU environmental directives, prioritizing suppliers who can demonstrate superior thermodynamic performance and proven technology in highly specialized gas handling applications. Investment in conventional oil and gas is comparatively lower, shifting capital expenditure almost entirely towards transition technologies.

- Middle East and Africa (MEA): MEA remains a crucial market due to its position as a global hydrocarbon superpower, driving extensive investment in LNG export capacity, gas processing plants, and major downstream diversification projects aimed at chemical production. Countries like Saudi Arabia, Qatar, and the UAE are undertaking megaprojects that require massive, custom-engineered compression trains for gas reinjection (EOR), pipeline boosters, and large-scale liquefaction facilities. The market is characterized by high demand for robust, high-availability equipment designed for harsh desert environments, where reliability and ease of maintenance are critical operational requirements. Investment in high-pressure associated gas compression is consistently high.

- Latin America: Growth in Latin America is tied primarily to the development of deep-water and shale gas reserves, notably the pre-salt basins in Brazil and the Vaca Muerta shale formation in Argentina. This drives demand for compressors in upstream gas gathering and floating LNG (FLNG) applications. Political stability and commodity price fluctuations pose inherent risks, yet long-term investment in national energy security and the modernization of existing refining and petrochemical assets, particularly in Mexico and Brazil, continues to sustain steady demand for specialized reciprocating and centrifugal process gas compressors necessary for maintaining aging infrastructure reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Process Gas Compressors Market.- Siemens Energy

- Baker Hughes Company

- Atlas Copco AB

- Elliott Group (Ebara Corporation)

- Howden Group

- Ariel Corporation

- Mitsubishi Heavy Industries Ltd.

- Hitachi Ltd.

- MAN Energy Solutions

- Sundyne LLC

- Gardner Denver (Ingersoll Rand)

- Burckhardt Compression AG

- Doosan Heavy Industries & Construction

- Kobelco Compressors

- Kaeser Kompressoren SE

- Fusheng Industrial Co., Ltd.

- Shenyang Blower Works Group Co., Ltd.

- Wuxi Compressor Co., Ltd.

- Neuman & Esser Group

Frequently Asked Questions

Analyze common user questions about the Process Gas Compressors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for high-pressure process gas compressors?

The primary drivers are the massive global buildout of Liquefied Natural Gas (LNG) production facilities, the increasing need for Enhanced Oil Recovery (EOR) via gas injection, and the critical growth of Carbon Capture, Utilization, and Storage (CCUS) projects, all requiring specialized high-pressure compression solutions for efficient gas handling and storage.

How is the energy transition impacting the Process Gas Compressors Market?

The energy transition is shifting market focus towards compression equipment designed for green gases. This includes specialized, often high-speed, centrifugal and reciprocating compressors optimized for hydrogen compression (H2) and large-scale CO2 handling, opening significant new revenue streams outside traditional oil and gas applications.

What is the difference between centrifugal and reciprocating process gas compressors in application?

Centrifugal compressors are preferred for high-volume, continuous flow applications requiring lower pressure ratios, such as LNG liquefaction and large petrochemical processes. Reciprocating compressors are ideal for high-pressure, lower-flow applications, such as gas gathering, ammonia synthesis, and high-pressure injection (EOR or hydrogen storage).

What role does digitalization play in the maintenance of complex compression trains?

Digitalization, via IIoT and AI-driven platforms, enables real-time condition monitoring and predictive maintenance (PdM). This allows operators to accurately anticipate and prevent equipment failures (e.g., surge or bearing degradation), thereby maximizing uptime, reducing maintenance costs, and significantly extending the asset's operational life.

Which geographic region currently dominates the global Process Gas Compressors Market in terms of investment?

Asia Pacific (APAC) currently exhibits the fastest growth and highest investment levels, driven by extensive infrastructure development in China and India, focusing on new refinery capacity, petrochemical complexes, and expansion of domestic natural gas transportation networks to meet escalating industrial and residential demand.

What are Active Magnetic Bearings (AMBs) and why are they relevant to process compressors?

AMBs are non-contact bearings that use magnetic levitation to support the rotor shaft. They eliminate the need for traditional oil lubrication systems, preventing gas contamination, reducing mechanical losses, minimizing maintenance, and allowing for higher rotational speeds, crucial for maximizing efficiency in high-speed, oil-free applications like hydrogen compression.

How do stringent environmental regulations influence compressor design?

Regulations, particularly those targeting methane emissions, drive the adoption of highly reliable, leak-proof designs such as advanced dry gas seals (DGS) and hermetically sealed magnetic bearing compressors. Manufacturers must prioritize designs that minimize fugitive emissions to ensure compliance and meet industry sustainability goals.

What is the primary factor restraining market growth in the near term?

The high initial capital expenditure (CAPEX) associated with procuring and installing large, custom-engineered process compression trains acts as a significant restraint, often making project financing complex and sensitive to global commodity price volatility.

Which industrial application segment is expected to see the highest growth rate?

The Energy Transition application segment, specifically specialized compression for Green and Blue Hydrogen production, storage, and mobility, along with high-pressure CO2 compression for Carbon Capture initiatives, is forecasted to demonstrate the most accelerated growth trajectory.

What role do EPC firms play in the purchasing process for process gas compressors?

Engineering, Procurement, and Construction (EPC) firms act as critical intermediaries, responsible for selecting, procuring, integrating, and installing the compressor packages on behalf of the asset owners. Their selection criteria heavily influence vendor choice based on technical specifications, project risk, and delivery timelines.

Why is material selection critical in process gas compressor manufacturing?

Process gases can be corrosive (e.g., sour gas, wet CO2) or extremely flammable. Critical components like impellers and casings must be manufactured from specialized alloys (e.g., stainless steel, nickel alloys) to withstand high pressures, temperatures, and chemical attack, ensuring long-term operational integrity and safety.

How does the shift towards modularization affect compressor deployment?

Modularization, often implemented through containerized or skid-mounted compression packages, accelerates deployment timelines, simplifies installation in remote or challenging locations (like offshore platforms or desert sites), and allows for easier scalability and standardized maintenance protocols, reducing total project costs.

What is the 'Compressor-as-a-Service' model?

This is an emerging business model where the vendor provides the physical compressor asset, along with comprehensive digital monitoring, maintenance, and performance optimization services, charging the end-user based on actual operational output or uptime, shifting the risk and management burden from the owner to the supplier.

How do Variable Speed Drives (VSDs) improve compressor performance?

VSDs allow the compressor motor speed to be dynamically adjusted based on actual process demand, rather than operating at a fixed speed. This dramatically improves energy efficiency during part-load operation, prevents surge conditions, and provides precise control over gas flow and pressure output, maximizing operational flexibility.

What challenges exist in compressing hydrogen gas compared to natural gas?

Hydrogen is highly challenging due to its low molecular weight and propensity to cause hydrogen embrittlement in standard steel alloys. Compression requires specialized sealing systems, non-ferrous materials, multi-stage designs to handle high volumetric flows, and extremely high discharge pressures for storage or pipeline injection.

What is the primary demand segment for Rotary Screw Compressors in this market?

Rotary screw compressors typically serve mid-pressure, lower-flow applications and are heavily utilized in industrial refrigeration (handling gases like ammonia), flare gas recovery systems, and smaller, decentralized gas boosting and processing facilities due to their ruggedness and relatively lower maintenance complexity.

In the Value Chain, why is the aftermarket service segment so important for OEMs?

The aftermarket service segment (spare parts, maintenance, digital services) is crucial because process compressors have a lifespan of 20+ years. Aftermarket revenue is high-margin, stable, and strengthens the long-term relationship between the OEM and the client, generating significant lifetime value beyond the initial equipment sale.

What impact does geopolitical instability have on market trends?

Geopolitical instability, particularly conflicts or sanctions affecting major energy-producing regions, causes price volatility in natural gas and oil. This uncertainty can lead to immediate halts or delays in major capital projects (LNG, pipelines), directly restraining new equipment orders in the short to medium term.

What are the key concerns users have regarding AI integration in critical compressors?

Key concerns include the reliability and accuracy of machine learning models in predicting rare failure events, ensuring the cybersecurity of integrated sensor and control networks, and managing the complexity of data integration across highly proprietary legacy control systems within existing facilities.

How are petrochemical manufacturers utilizing process gas compressors?

Petrochemical manufacturers utilize these compressors extensively for feedstock preparation (e.g., cracking processes), moving synthesis gases (syngas) to reactors, and handling critical gases like ethylene, propylene, and ammonia in the production of plastics, fertilizers, and other base chemicals, demanding high reliability and purity standards.

What is compressor surge and how do modern systems prevent it?

Compressor surge is an unstable flow reversal phenomenon that occurs when the flow rate falls too low for a given pressure ratio, leading to potential catastrophic failure. Modern systems prevent surge using advanced anti-surge control valves, rapid response controllers, and predictive algorithms that constantly monitor the operating point relative to the surge line.

Why is Latin America primarily focused on upstream and offshore compression?

Latin American market activity, particularly in Brazil and Argentina, is focused on monetizing vast deep-water (pre-salt) and shale gas reserves. This necessitates extensive upstream compression for gas gathering and re-injection, as well as specialized, often floating, compression solutions for offshore production and transport.

How does the total cost of ownership (TCO) influence purchasing decisions for gas compressors?

TCO is the dominant financial metric. Since energy consumption accounts for a significant portion of operating costs over the compressor's lifespan, end-users prioritize high-efficiency units (with better isentropic efficiency ratings and VSDs) and designs that minimize maintenance and unplanned downtime, valuing these savings over initial CAPEX.

What specialized requirements exist for compressors used in ammonia synthesis?

Ammonia synthesis requires extremely high-pressure compression (often above 200 bar) for the nitrogen and hydrogen mixture. This application heavily relies on robust, multi-stage reciprocating compressors designed with materials capable of handling the specific gas mixture and maintaining high integrity under continuous, severe operating conditions.

What are the typical end-users classified under the 'General Industry' application segment?

The 'General Industry' segment includes manufacturers in specialized areas such as industrial air separation units (compressing oxygen or nitrogen), food and beverage processing, waste treatment facilities (e.g., biogas compression), and smaller-scale industrial gas handling operations outside of major hydrocarbon or chemical plants.

How is the market addressing the noise pollution issue associated with large compressors?

Market participants address noise pollution through advanced acoustic enclosures, sound-dampening materials, optimized foundation designs, and low-vibration rotor dynamics. The adoption of magnetic bearing technology also contributes to reduced mechanical noise compared to traditional oil-lubricated bearing systems.

What is the significance of the 2026 to 2033 forecast period for this market?

The 2026-2033 period represents a critical phase where major, multi-billion-dollar energy transition projects (CCUS hubs, blue/green hydrogen facilities) will move from planning stages into large-scale execution, driving substantial demand for new, highly specialized compression assets globally.

What is upstream analysis within the context of the Value Chain?

Upstream analysis focuses on the sourcing and supply of raw materials and core components—such as specialized metallurgy, complex castings, and precision machining of rotors and impellers—necessary for the initial manufacturing of the process gas compressor systems.

Why is the midstream oil and gas sector a major growth driver?

The midstream sector, encompassing pipeline transportation, gas processing, and storage, requires high-reliability compressor stations to maintain flow and pressure over long distances. Global expansion of natural gas trading routes, particularly for LNG, directly correlates with substantial midstream compression investments.

What distinguishes an oil-free process gas compressor from an oil-lubricated one?

Oil-free compressors ensure that the process gas never comes into contact with lubricating oil, crucial for maintaining gas purity in sensitive applications (like hydrogen or certain chemical feedstocks). Oil-lubricated compressors, while often more cost-effective for generic use, require external systems to separate the gas from the lubricant.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager