Processed Cheese Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433501 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Processed Cheese Market Size

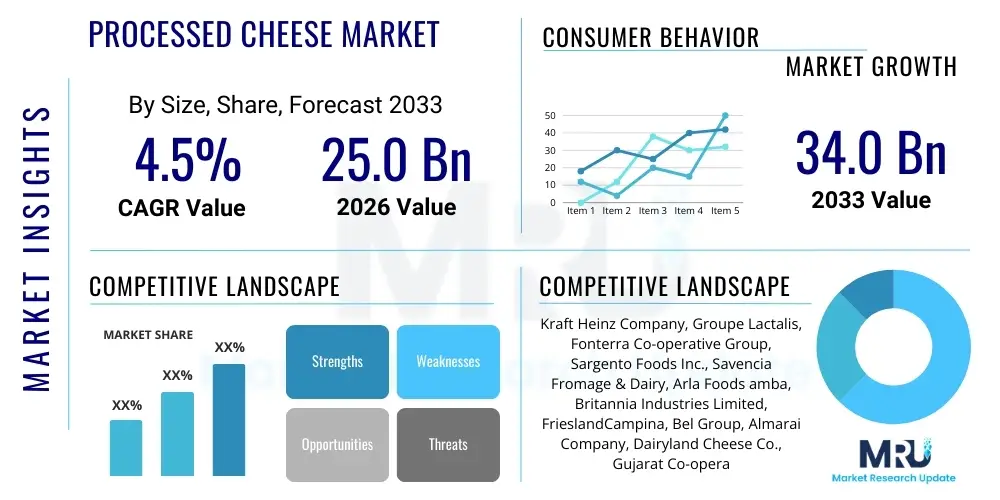

The Processed Cheese Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 25.0 Billion in 2026 and is projected to reach USD 34.0 Billion by the end of the forecast period in 2033.

Processed Cheese Market introduction

The Processed Cheese Market encompasses a sophisticated range of dairy products synthesized from natural cheese, often combined with specific non-dairy components such as emulsifying salts, stabilizers, natural flavorings, and occasionally milk proteins. These ingredients are meticulously formulated and heated to achieve a homogeneous mixture with desirable textural properties, significantly extended shelf life, and superior functional characteristics, particularly enhanced meltability and resistance to oil separation (fatting off). The resulting products—available as individually wrapped slices, versatile spreads, firm blocks, and injectable sauces—cater directly to the escalating global demand for convenient, ready-to-use food solutions across both retail consumption and industrial food manufacturing sectors. The fundamental objective of processed cheese production is to standardize a variable agricultural product (natural cheese), ensuring consistency in quality, flavor, and application performance regardless of seasonal or regional raw material variations. This stability positions processed cheese as an indispensable commodity for large-scale operations, contributing significantly to reducing food preparation time and managing ingredient costs globally.

Product categories within this market are defined rigorously by regulatory bodies, such as the FDA in North America, based on moisture content, milk fat content, and the inclusion criteria for other dairy and non-dairy ingredients. These categories include Process Cheese (higher natural cheese content), Processed Cheese Food, and Processed Cheese Spread (typically higher moisture and lower fat). Major applications span the entire food industry, from direct consumer purchase for use in household meals, sandwiches, and quick snacks, to industrial incorporation into high-volume products like frozen pizzas, ready-to-eat lasagnas, and packaged snack kits. The intrinsic benefits driving market adoption include its long ambient or refrigerated shelf stability compared to natural cheese, crucial for extensive distribution networks; its consistency in culinary applications, particularly ideal for melting on hot surfaces; and its ability to be customized in texture and flavor profile to meet highly specific client demands, such as achieving a precise stretch or non-stick quality. Furthermore, the capacity for product fortification with essential micronutrients like Calcium, Vitamin A, and D makes it a valuable component in nutritional programs targeting deficiency, particularly in developing regions.

Key driving factors underpinning the anticipated market expansion include the sustained, robust growth of the global fast-food ecosystem, which relies heavily on cost-effective and functionally superior cheese slices and blocks for uniformity across franchised locations. Concurrently, the increasing urbanization and resulting shifts in consumer lifestyles toward convenience necessitate products that minimize preparation time, favoring processed cheese spreads for quick breakfasts and packaged snacks. Economic factors, notably rising disposable incomes across Asia Pacific and Latin America, translate directly into higher consumption rates of protein-rich and value-added food items. Technological innovation plays a critical supportive role, specifically advancements in ultra-high-temperature (UHT) processing, aseptic packaging, and the development of natural emulsifiers, which facilitate the production of processed cheese with improved nutritional profiles (e.g., lower sodium, natural coloring) that successfully address prevailing consumer skepticism regarding processed food quality. Navigating regulatory scrutiny and intense competitive pressures from premium natural cheeses remains the critical challenge for sustained, profitable market growth throughout the forecast period.

Processed Cheese Market Executive Summary

The global Processed Cheese Market trajectory is strongly influenced by dynamic business trends emphasizing sustainability, nutritional enhancement, and strategic market penetration into untapped geographies. Leading market participants are actively engaged in vertical integration, securing control over the dairy supply chain to mitigate raw material price volatility and ensure traceability—a growing consumer and regulatory concern. A major strategic pivot involves leveraging advanced food science to produce ‘clean label’ processed cheese, reducing or eliminating synthetic colorings, preservatives, and artificial flavors, aligning the product closer to the consumer perception of natural foods. Furthermore, cross-border mergers and strategic acquisitions are frequently utilized to acquire proprietary technology in stabilization or extend distribution reach, especially targeting localized processing capabilities in high-growth emerging markets to reduce logistical costs and better cater to region-specific flavor preferences. The competitive landscape is characterized by intense price sensitivity in the bulk segment and increasing brand differentiation in the premium retail sector.

Regional consumption patterns show a clear divergence between mature and emerging markets. While North America and Western Europe demonstrate stable, high per capita consumption driven by established foodservice demands, market saturation necessitates innovation primarily focused on product differentiation, such as specialized melting characteristics or reduced-fat formulations. Conversely, the rapid growth engine lies within the Asia Pacific (APAC) region, fueled by unprecedented growth in organized retail and the shift toward Westernized consumption patterns among younger, affluent demographics. This region's demand is characterized by high volume requirements for spreads and economical block formats. Investment in local manufacturing and cold chain infrastructure across APAC is accelerating, transforming the regional supply dynamics. Additionally, stricter enforcement of food safety and labeling standards globally is becoming a significant regulatory trend, compelling all market players to adopt standardized, technologically advanced quality assurance protocols that meet diverse international requirements for imports and local production.

Segmentation analysis underscores the pivotal role of product form, with the pre-sliced category dominating volume due to its unparalleled convenience and suitability for QSR applications. However, the spreads and dips segment is experiencing faster growth in retail, especially as snacking culture proliferates globally, driving demand for innovative flavors and packaging designed for portability and immediate consumption. In terms of distribution, while traditional brick-and-mortar retailers (supermarkets and hypermarkets) remain the foundation of sales, the digital transformation is evident in the exponential rise of e-commerce channels, particularly for specialized or premium imported processed cheese products that require efficient, integrated cold chain logistics to reach consumers directly. Strategic focus areas for manufacturers include developing savory, ethnic-inspired flavor profiles to capture niche markets and developing hybrid products that blend natural cheese attributes with the functional benefits of processed varieties, thereby capturing consumers navigating the perceived gap between health and convenience.

AI Impact Analysis on Processed Cheese Market

Inquiries regarding the practical integration of Artificial Intelligence (AI) and Machine Learning (ML) within the Processed Cheese Market are predominantly focused on elevating operational efficiency, ensuring precise quality conformance, and enabling sophisticated demand forecasting across complex supply chains. Market observers frequently investigate how AI models can predict and counteract the minute chemical and physical changes during the heating and emulsification process that could lead to undesirable texture issues, such as graininess or excessive stickiness. A core concern addressed by AI solutions is managing the inherent variability of raw ingredients—specifically, fluctuations in the protein-to-fat ratio and pH of the natural cheese base—and automatically adjusting blending ratios and thermal parameters in real-time to maintain the target specifications for the final product, minimizing batch rejection rates and optimizing material usage. This level of precision, unattainable through traditional control systems, promises substantial cost savings and superior product consistency, directly impacting global competitiveness.

Beyond manufacturing, AI significantly influences market strategy and supply chain resilience. Predictive maintenance algorithms analyze equipment sensor data to forecast failures in high-value assets (like mixers and continuous cookers) weeks in advance, transitioning factories from reactive repair schedules to proactive maintenance strategies, thus guaranteeing near-zero unplanned downtime—a critical factor in high-volume production environments. Furthermore, AI-powered demand sensing capabilities integrate point-of-sale data, macro-economic indicators, localized weather patterns, and promotional data to generate highly accurate regional and SKU-specific sales forecasts. This enhanced forecasting allows manufacturers to optimize raw material procurement (e.g., dairy solids purchasing contracts) and inventory holding levels, drastically reducing the risk of obsolescence or stock-outs, especially for products with a specific, yet extended, shelf life. This strategic data utilization transforms operational agility and financial performance.

The consumer-facing application of AI is increasingly relevant for personalized product development and marketing. AI algorithms analyze consumer reviews, social media sentiment, and search query data related to cheese preferences, identifying emerging flavor trends (e.g., spicy, smoked, regional herb inclusion) and preferred texture attributes (e.g., firmer slice, spreadable consistency). This deep data insight allows R&D teams to accelerate the creation and testing of innovative processed cheese formulations that are precisely targeted to specific demographic segments, reducing the time-to-market for successful products. Moreover, computer vision systems, a subset of AI, are being deployed on packaging lines for meticulous quality checks, identifying imperfections in wrapping, labeling errors, and ensuring accurate slice weight at speeds far exceeding human capability, securing the brand's reputation for consistency and adherence to stated weight claims, reinforcing customer trust.

- AI-driven optimization of emulsifying salt usage and processing temperatures, ensuring optimal melt characteristics and texture consistency across batches, mitigating the risk of protein precipitation.

- Predictive maintenance analytics applied to homogenizers, cookers, and packaging lines, minimizing unexpected downtime and maximizing continuous production throughput via early fault detection.

- Machine learning algorithms analyzing raw milk and natural cheese quality variations (fat, protein, pH content) to dynamically adjust formulation parameters in real-time, maintaining final product standardization and regulatory compliance.

- AI-enhanced visual inspection systems using high-resolution computer vision for high-speed detection of packaging integrity defects, foreign material contamination, or inaccurate slicing/portioning, bolstering food safety protocols.

- Supply chain optimization through AI forecasting, accurately predicting short-term and seasonal regional demand shifts, and strategically minimizing expensive cold storage logistics costs and product spoilage rates.

- Personalized flavor profiling and ingredient combination suggestion based on localized demographic data, established food pairing preferences, and analysis of competitor product successes and failures.

- Automated compliance monitoring, cross-referencing global ingredient sourcing lists and finished product specifications against regional food safety and labeling regulations instantaneously, reducing legal exposure.

DRO & Impact Forces Of Processed Cheese Market

The Processed Cheese Market operates under significant strategic pressures derived from a delicate balance of inherent market Drivers, systemic Restraints, and attractive Opportunities (DRO). The core Driver remains the irreversible global trend toward food convenience, directly linking market demand to the expansion of urban populations and the widespread availability of convenience foods and snacks. The economic accessibility of processed cheese compared to many natural cheese varieties makes it a primary choice for high-volume consumption segments, particularly institutional buyers and mass-market retail, bolstering sustained volume growth. Furthermore, the functional superiority—specifically, its standardized melt performance and prolonged shelf life—cement its status as the preferred ingredient in commercial kitchens, driving consistent B2B demand. Opportunities abound in emerging economies characterized by improving cold chain infrastructure and increasing integration of organized retail, enabling aggressive market entry and the cultivation of new consumer bases through localized flavor adaptations and affordable product formats like spreads and cubes. Innovation in functional health attributes, such as protein enrichment and the utilization of natural ingredients, presents a clear path to premiumization and segment diversification.

Despite these favorable drivers, the market faces considerable Restraints that necessitate careful strategic navigation. The most formidable challenge is the enduring consumer perception that processed cheese is nutritionally inferior to natural cheese, often associated with higher levels of sodium, saturated fats, and artificial additives. This perception fuels a consumer exodus toward cleaner labels and minimally processed alternatives, forcing costly and continuous reformulation efforts. Economic volatility in the global dairy market, including unpredictable fluctuations in milk powder, butterfat, and natural cheese commodity prices, exerts intense pressure on manufacturing margins, as these raw materials constitute the largest component of production cost. Moreover, competitive intensity is escalating, not only from premium natural cheese suppliers but increasingly from highly innovative plant-based cheese analog manufacturers, which are rapidly closing the gap in texture and melt performance, potentially fragmenting the traditional processed cheese consumer base.

The Impact Forces shaping the market are dynamic and multifaceted. Social forces, particularly the wellness movement and rising consumer demand for ethical sourcing and supply chain transparency, push manufacturers towards detailed labeling and responsible dairy sourcing practices, often incurring higher certification costs. Technological forces focus on refining emulsification techniques to reduce chemical dependence while maintaining superior functional melt, alongside advancements in high-speed, aseptic packaging to enhance shelf stability without reliance on traditional preservatives. Regulatory forces are tightening globally, especially concerning minimum nutritional declarations (e.g., fat and sodium limits) and the acceptable use of food additives, creating regional disparities in product specifications and complex compliance challenges for international players. Economically, the market is exposed to global trade policy shifts and inflationary pressures on energy and logistics, requiring continuous operational efficiency improvements and optimization of distribution channels to maintain competitive pricing and profitability throughout the value chain, ensuring that the market remains responsive to both premiumization and value-seeking consumer cohorts simultaneously.

Segmentation Analysis

The Processed Cheese Market structure is meticulously defined by segmentation across Product Type, Form, Application, Distribution Channel, and Source, allowing for precise market sizing and strategic targeting. The segmentation by Product Type distinguishes between Process Cheese (higher dairy content, closer to natural cheese), Processed Cheese Food, and Processed Cheese Spread, classifications directly impacting regulatory compliance and acceptable pricing tiers. The Process Cheese Food category, offering a balance of consistency, cost-effectiveness, and functional melt properties, typically secures a dominant volume share, particularly in high-volume foodservice applications. Conversely, the rising segment of Processed Cheese Analogs, often dairy-free or containing replacement fats, is gaining traction due to dietary restrictions (lactose intolerance) and the growing popularity of plant-based lifestyles, presenting a crucial area for future innovation and market disruption.

Segmentation by Form is vital as it dictates consumer usage and manufacturing complexity. Slices (individually wrapped or stacked) remain the dominant revenue generator globally, capitalizing on the convenience trend and the massive utilization in sandwiches and burgers. Blocks and loaves are favored in institutional settings and for large household consumption due to lower per-unit cost and versatility for shredding or dicing. The Spread segment, including dips and tub formats, shows significant market velocity, especially in regions where bread and crackers are staple components of breakfast or snacking, requiring continuous flavor innovation to maintain consumer interest. The shift towards single-serve cubes and string forms reflects the industry's response to the highly lucrative on-the-go snacking category, optimizing packaging for portability and perceived portion control.

The Application segmentation rigorously separates B2B and B2C demand. The Foodservice segment (QSRs, hotels, catering) is the most critical driver of volume, demanding stringent specifications for functional performance and assured continuity of supply under competitive pricing structures. The Retail segment covers direct household consumption and is more sensitive to branding, packaging aesthetics, and promotional activities. Meanwhile, the Industrial Application segment—supplying processed cheese components to manufacturers of frozen meals, sauces, and specialized confectionery—requires bulk, custom-formulated product inputs with precise functional attributes, demanding highly specialized B2B relationships and quality assurance protocols tailored to complex industrial processes. Analyzing distribution channels confirms the enduring strength of Supermarkets and Hypermarkets, but the strategic emphasis is shifting toward optimizing logistics and engagement within the explosively expanding Online Retail channel, which mandates investment in secure, temperature-controlled delivery systems to preserve product quality from warehouse to consumer door.

- By Product Type:

- Processed Cheese Food: Largest category by volume due to versatility and cost.

- Processed Cheese Spread: High growth in snacking and breakfast applications, especially in APAC.

- Process Cheese: Closest to natural cheese, commanding a slight premium.

- Processed Cheese Analog/Substitute: Rapidly growing, addressing dietary and ethical demands.

- By Form:

- Slices: Dominant revenue segment; crucial for QSR industry applications globally.

- Blocks: Essential for institutional catering and economical large-format retail sales.

- Spreads: Key driver in emerging markets; highly adaptable to flavor innovation.

- Cubes & Pieces: Growing category focused on children's snacks and convenience packaging.

- Sauces & Dips: Specialized liquid forms for industrial and foodservice applications.

- By Application:

- Foodservice (QSRs, Restaurants, Cafeterias): High volume, demanding strict functional consistency.

- Retail (Household Consumption): Focus on branding, convenience, and diverse product formats.

- Industrial (Baked Goods, Ready Meals, Confectionery): Requires specific bulk formulations for integration into complex manufacturing processes.

- By Distribution Channel:

- Supermarkets & Hypermarkets: Core traditional channel, offering wide shelf visibility.

- Convenience Stores: Important for grab-and-go single-serve processed cheese products.

- Specialty Stores: Niche market for gourmet or imported, high-quality processed cheese.

- Online Retail (E-commerce): Fastest growth rate; requires advanced cold chain integration.

- By Source:

- Dairy-Based Processed Cheese: Traditional market foundation, dependent on dairy commodity prices.

- Plant-Based Processed Cheese: Strategic growth area, leveraging innovations in protein and fat substitutes.

Value Chain Analysis For Processed Cheese Market

The value chain of the Processed Cheese Market begins with meticulous upstream activities focused on securing high-quality, cost-effective raw materials. Upstream procurement involves establishing robust sourcing relationships with dairy farms and cooperatives to guarantee a consistent supply of milk, which is then processed into the primary ingredients: natural cheese base, butterfat, whey protein concentrates, and essential dry components like milk powder. Equally critical is the sourcing of specialized food-grade additives, particularly proprietary blends of emulsifying salts and stabilizers, which are crucial for achieving the desired processed cheese texture and melt attributes. Efficient upstream management involves strategic risk mitigation against commodity price volatility (dairy futures trading) and strict adherence to raw material quality specifications, as variations in the pH or protein structure of the natural cheese base directly compromise the final product's stability, necessitating advanced contractual agreements and traceability systems.

The core midstream phase constitutes manufacturing and packaging, involving capital-intensive processes defined by highly technical chemical engineering. The central operation is the batch or continuous cooking and emulsification process, where ingredients are precisely weighed, blended, rapidly heated (often using direct steam injection), and mechanically mixed under controlled pressure and temperature to create a uniform, pasteurized emulsion. Technological efficiency is crucial here; modern facilities utilize sophisticated PLC (Programmable Logic Controller) systems and continuous flow equipment to minimize energy consumption and maximize throughput speed, especially for high-volume products like slices. Following cooking, the product is hot-filled or extruded into various forms—blocks, slices, or tubs—and rapidly cooled. Quality assurance focuses on verifying physical parameters like moisture level, pH, salt content, and melt characteristics through automated inline sensors, ensuring every batch conforms rigorously to technical specifications required by end-user applications.

The downstream segment covers distribution and market engagement, connecting the manufactured product to end-users via both direct and indirect channels. Direct distribution is vital for large B2B clients (major QSR chains, industrial manufacturers), involving specialized bulk tankers or pallet deliveries requiring negotiated contracts and strict temperature adherence. Indirect distribution relies heavily on complex, multi-tiered logistics networks—spanning large retailers, convenience stores, and the rapidly growing e-commerce sector. The integrity of the cold chain is paramount across all distribution methodologies to preserve shelf life and functional quality. Trade marketing and promotional strategies are tailored to the channel; retail focuses on brand visibility, attractive packaging, and consumer promotions, while foodservice focuses on reliability, volume pricing, and technical support regarding product application. Effective downstream logistics, leveraging advanced warehouse management systems and predictive retail analytics, is crucial for optimizing inventory flow and ensuring product freshness upon arrival, thereby maximizing consumer satisfaction and market presence.

Processed Cheese Market Potential Customers

The consumption landscape for processed cheese is dominated by institutional demand, positioning the global foodservice industry as the most crucial category of potential customers. Quick-Service Restaurants (QSRs) and fast-casual dining establishments represent cornerstone buyers due to their non-negotiable need for cost-effective, high-volume, and perfectly consistent cheese slices or sauces that perform identically across thousands of locations. Processed cheese's ability to maintain structural integrity under heating and its uniform melt profile are non-functional attributes that make it the product of choice, translating into substantial, long-term supply contracts. The purchasing decision for this segment is heavily influenced by quality assurance (HACCP/ISO certification), bulk pricing, and the ability of suppliers to guarantee reliable, global supply chains, often requiring customized slice sizes or specific formulation blends tailored to a franchise’s unique recipes and regulatory market requirements across various geographies.

Secondly, the Retail segment encompasses a broad spectrum of household consumers who purchase processed cheese for daily consumption, driven primarily by convenience and value. This includes busy urban families purchasing blocks or slices for sandwich preparation and meal components, as well as cost-conscious consumers utilizing spreads for breakfast and snacking due to their affordability and extended shelf life. Specific demographic cohorts, such as children and teenagers, drive the demand for portable, fun formats like cheese cubes or string cheese, marketed for lunch boxes and quick snacks. Manufacturers actively seek to capture this segment through strategic shelf placement, engaging packaging design, and extensive promotional activities in supermarkets and convenience stores. The growing health-conscious retail segment, though traditionally skeptical of processed foods, is increasingly receptive to innovative low-fat, low-sodium, and clean-label variants, providing a premium revenue stream.

Finally, the industrial food manufacturing sector represents a significant potential B2B customer base, utilizing processed cheese as a functional ingredient rather than a standalone product. Companies specializing in frozen entrees (e.g., pizzas, ready meals), baked goods (e.g., cheese-filled pastries, biscuits), and snack foods integrate bulk processed cheese specifically for its functional attributes—such as its resistance to weeping or burning during industrial baking/freezing cycles, its ability to blend seamlessly into sauces, and its standardized flavor contribution. These industrial buyers require precise technical specifications, adherence to strict contaminant limits, and often utilize high-tech equipment for integration, demanding suppliers capable of delivering specialized, bulk-packaged products (e.g., shredded, cubed, or pumpable sauces) under continuous supply agreements and highly rigorous quality documentation, making them high-value, albeit highly demanding, long-term clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.0 Billion |

| Market Forecast in 2033 | USD 34.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kraft Heinz Company, Groupe Lactalis, Fonterra Co-operative Group, Sargento Foods Inc., Savencia Fromage & Dairy, Arla Foods amba, Britannia Industries Limited, FrieslandCampina, Bel Group, Almarai Company, Dairyland Cheese Co., Gujarat Co-operative Milk Marketing Federation Ltd. (Amul), Tine SA, Fromageries Bel, Associated Milk Producers Inc. (AMPI), Organic Valley, Schuman Cheese, Schreiber Foods Inc., Bega Cheese Limited, Parag Milk Foods Ltd., Dairy Farmers of America (DFA) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Processed Cheese Market Key Technology Landscape

The technological evolution within the Processed Cheese Market is fundamentally centered on achieving functional superiority, enhancing product safety, and facilitating clean-label production. Advanced emulsification science remains the intellectual core of the sector, focusing on the selection and precise utilization of optimized blends of food-grade phosphates and citrates. These emulsifying salts are critical; they solubilize the cheese proteins, enabling the fat and water phases to mix homogeneously under heat, preventing separation and ensuring the signature smooth, non-stringy melt characteristic required by the foodservice industry. State-of-the-art continuous cooking and blending systems, featuring high-shear mixers and direct steam injection (DSI) or plate heat exchangers, are deployed to rapidly process ingredients at ultra-high temperatures (UHT) for sterilization, followed by immediate flash cooling. This rapid thermal cycle is crucial for inactivating spoilage microorganisms while minimizing the exposure time that could otherwise lead to protein denaturation and flavor degradation, thereby ensuring both maximum shelf stability and optimal flavor retention across various product formats.

Furthermore, packaging technology represents a critical component of market competitiveness and product preservation. Manufacturers are increasingly adopting Modified Atmosphere Packaging (MAP) techniques and utilizing highly engineered, multi-layer barrier films (e.g., EVOH, PVDC) designed to minimize oxygen and light transmission, effectively preserving the flavor and preventing fat oxidation throughout the extended shelf life. Aseptic processing and hot-filling are standard for processed cheese spreads and dips, ensuring that products can be distributed and stored ambiently in regions lacking robust refrigeration infrastructure, significantly expanding market reach into developing countries. In the premium segment, novel packaging solutions are exploring biodegradable or recyclable materials, responding directly to mounting global pressure regarding plastic waste, while still maintaining the rigorous barrier properties necessary for food safety and quality integrity over time.

The integration of digital manufacturing principles, often termed Industry 4.0, is becoming pervasive across the production landscape. This includes deploying sophisticated sensors and IoT (Internet of Things) devices throughout the entire process—from incoming raw material inspection to the final packaging stage—to monitor real-time data on viscosity, texture, pH, and temperature. These centralized data systems feed into sophisticated supervisory control and data acquisition (SCADA) systems, enabling operators to make immediate, precise adjustments to process parameters, thereby minimizing waste, ensuring consistent quality conformance, and maximizing yield. Robotic automation is also increasingly utilized, particularly in the high-speed slicing, stacking, and wrapping of individual processed cheese slices, ensuring hygienic handling, high throughput, and remarkable precision in weight control, which is essential for managing material costs and meeting legally mandated net weight tolerances in highly regulated markets.

Regional Highlights

North America maintains its position as a substantial revenue generator in the Processed Cheese Market, characterized by high maturity and deep integration into the fast-food supply chain. The U.S. consumer exhibits a strong preference for individually wrapped slices and blocks, driven by convenience and established usage patterns (sandwiches, burgers). Innovation in this region is typically concentrated on premiumization, focusing on enhanced nutritional profiles, inclusion of natural coloring agents, and the aggressive development of plant-based cheese substitutes tailored to meet the growing interest in specific diets such as keto or flexitarianism. The market environment is highly competitive, necessitating robust brand marketing and efficient, large-scale supply chain management capable of serving major national retailers and QSR franchises simultaneously and reliably.

Europe represents a nuanced and highly segmented market, with distinct preferences between Western and Eastern Europe. Western Europe exhibits stable, moderate growth, prioritizing high-quality, spreadable processed cheese often consumed for breakfast or snacking, influenced by traditional dairy cultures and strict labeling regulations that favor natural ingredients and reduced chemical additives. Eastern Europe, conversely, is experiencing faster volume growth, propelled by rising discretionary spending and the increasing penetration of multinational food retailers and QSR chains. Regulatory divergence across the continent, particularly post-Brexit and within the EU, requires manufacturers to maintain highly adaptable product specifications and labeling adherence across national borders, increasing operational complexity but simultaneously ensuring stringent quality and safety standards are met.

The Asia Pacific (APAC) region is indisputably the engine of future market growth, expected to record the highest Compound Annual Growth Rate (CAGR) globally. This rapid expansion is directly linked to massive demographic shifts, including rapid urbanization and the entry of millions into the middle class, leading to a profound transformation in dietary habits toward Western-style, processed, and convenient foods. Countries like China and India are seeing unprecedented demand for processed cheese spreads and cubes, favored for their affordability and cultural adaptability into local cuisines. Investment in cold chain infrastructure and local manufacturing capacity is accelerating in key metropolitan areas, essential for supporting the burgeoning retail sector and facilitating the mass distribution required to capitalize on the vast consumer base in this highly diversified region.

Latin America (LAMEA) and the Middle East and Africa (MEA) offer compelling growth opportunities, albeit from a smaller base. In LAMEA, sustained economic improvements in key markets like Brazil and Mexico boost purchasing power, driving demand for affordable, functional processed cheese, particularly for use as versatile cooking ingredients. The focus here is on value and availability through widespread retail and convenience store presence. In MEA, the market is characterized by a strong reliance on imported, branded processed cheese, often favored for its long shelf life suitable for warmer climates and its perceived higher quality. However, increasing local manufacturing capability in Gulf Cooperation Council (GCC) countries and parts of Africa, driven by government incentives and regional trade agreements, is shifting the supply dynamic, concentrating on products that are culturally acceptable and competitively priced against imported alternatives.

- North America (NA): Dominant in value; mature market emphasizing premiumization, reduced-fat/sodium formulations, and high integration with major fast-food supply chains.

- Europe: Stable and highly regulated; Western Europe focuses on high-quality spreads; Eastern Europe exhibits faster growth driven by rising affluence and organized retail penetration.

- Asia Pacific (APAC): Highest CAGR forecast; immense potential driven by massive urbanization, lifestyle changes, and the rapid expansion of QSRs and supermarkets in China and India.

- Latin America (LATAM): Strong potential driven by improved economic stability and increasing consumer adoption of processed, convenient packaged foods; value-driven pricing is key.

- Middle East & Africa (MEA): Growth bolstered by population expansion and reliance on shelf-stable dairy imports; increasing local investment focusing on regionalized production and secure cold-chain distribution solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Processed Cheese Market.- Kraft Heinz Company

- Groupe Lactalis

- Fonterra Co-operative Group

- Sargento Foods Inc.

- Savencia Fromage & Dairy

- Arla Foods amba

- Britannia Industries Limited

- FrieslandCampina

- Bel Group

- Almarai Company

- Dairyland Cheese Co.

- Gujarat Co-operative Milk Marketing Federation Ltd. (Amul)

- Tine SA

- Fromageries Bel

- Associated Milk Producers Inc. (AMPI)

- Organic Valley

- Schuman Cheese

- Schreiber Foods Inc.

- Bega Cheese Limited

- Parag Milk Foods Ltd.

Frequently Asked Questions

Analyze common user questions about the Processed Cheese market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Processed Cheese Market?

The market growth is primarily fueled by the increasing global demand for convenient, ready-to-eat food options, the rapid expansion of the quick-service restaurant (QSR) sector globally which demands consistent product functionality, and rising disposable incomes in emerging economies, enabling greater consumer expenditure on affordable, shelf-stable packaged snacks and meals.

How do manufacturers address consumer concerns regarding high sodium content in processed cheese?

Manufacturers are actively addressing sodium concerns through formulation innovation by utilizing advanced mineral and organic salts (such as potassium chloride or specialty citrates) to replace or reduce sodium chloride and sodium-based emulsifying salts, thereby developing low-sodium and reduced-fat variants without compromising the critical texture, stability, or melt performance required for culinary applications.

Which processed cheese form holds the largest market share globally?

The slice form of processed cheese typically holds the largest market share due to its unparalleled convenience, high integration into standardized global foodservice applications (burgers, sandwiches), and its efficiency in high-speed, automated packaging lines, ensuring broad availability in both retail and institutional settings worldwide.

What is the impact of plant-based diets on the Processed Cheese Market?

The rise of plant-based diets presents a significant commercial opportunity, driving traditional dairy manufacturers to invest heavily in R&D for sophisticated dairy-free processed cheese analogs. These products utilize ingredients like modified starches, nuts, coconut oil, and microbial proteins, positioning the market for necessary growth among vegan, vegetarian, and flexitarian consumer segments seeking ethical and dietary-compliant alternatives.

Which distribution channel is experiencing the fastest growth for processed cheese sales?

Online retail (e-commerce) is experiencing the fastest revenue growth, supported by substantial, ongoing investments in secure cold chain logistics and improved digital consumer engagement. This channel facilitates direct-to-consumer sales, particularly for niche, imported, or premium processed cheese varieties that may not be widely stocked in traditional retail outlets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager